Key Insights

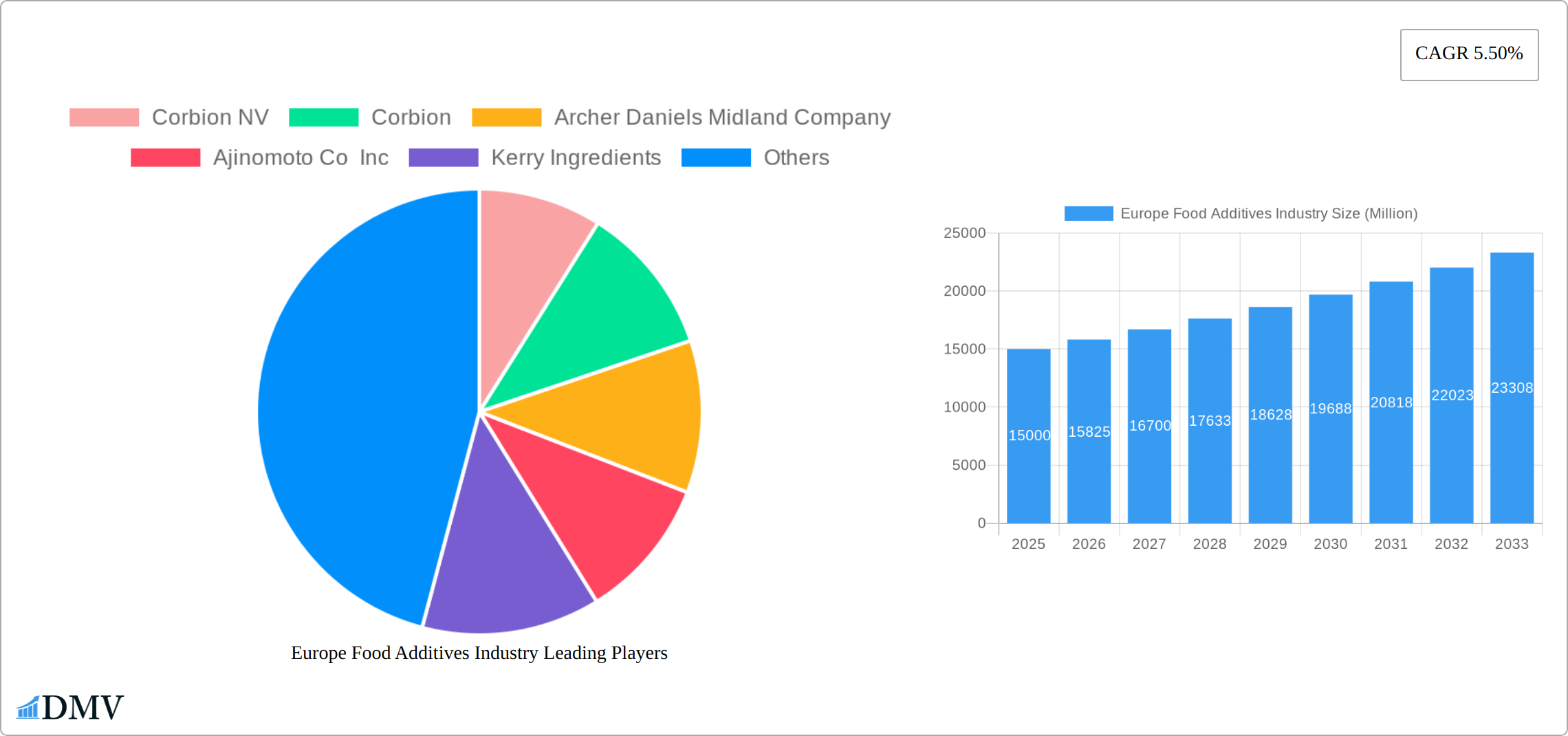

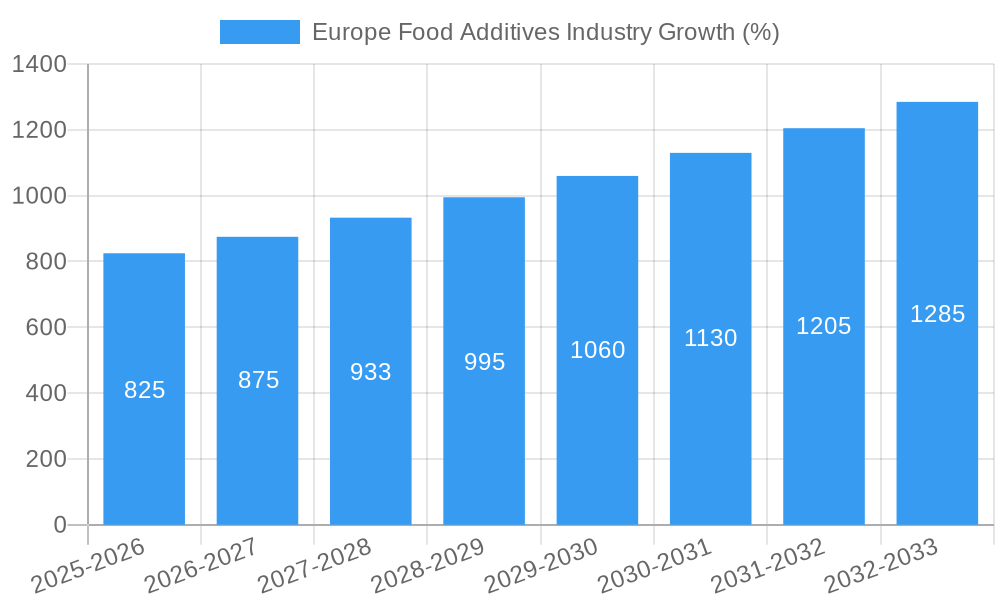

The European food additives market, valued at approximately €15 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.50% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the increasing demand for processed and convenience foods across Europe is a significant catalyst. Consumers' busy lifestyles and preference for ready-to-eat meals are driving the consumption of processed foods, which inherently rely heavily on food additives for preservation, taste enhancement, and improved texture. Secondly, evolving consumer preferences towards healthier and more natural food additives are influencing market trends. This is leading to increased demand for additives derived from natural sources, such as plant-based preservatives and colorants. Finally, stringent food safety regulations in Europe are pushing manufacturers to adopt high-quality, compliant additives, further stimulating market growth. However, growing concerns regarding the potential health impacts of certain additives and increasing consumer awareness of artificial ingredients are acting as restraints, compelling manufacturers to explore and adopt cleaner label initiatives.

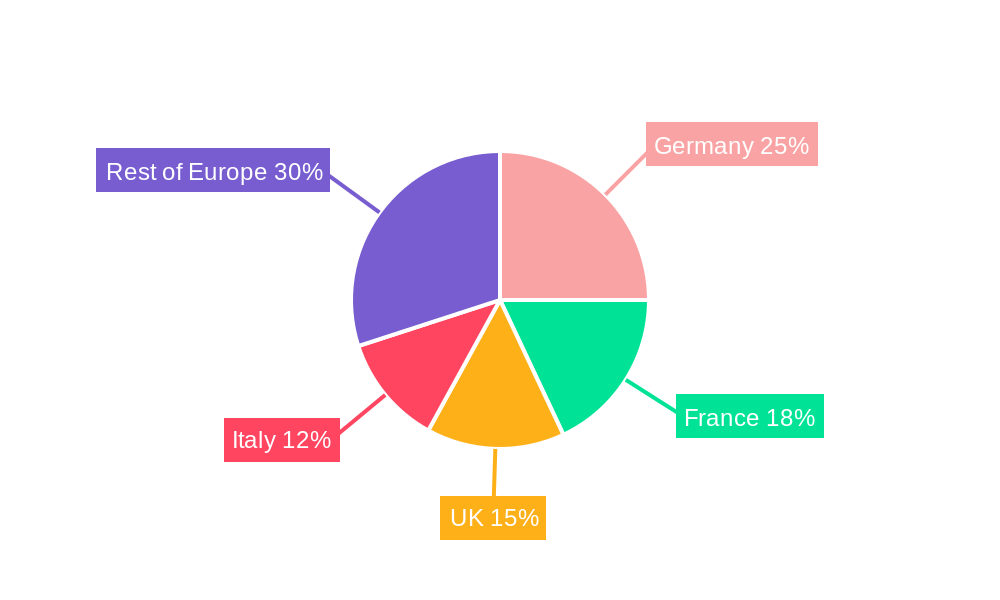

Segment-wise, preservatives, food flavors and enhancers, and food colorants currently hold significant market shares. Preservatives are essential for extending shelf life, while flavors and enhancers cater to consumer preferences for enhanced taste and sensory appeal. Food colorants play a vital role in improving the visual appeal of food products. The leading companies in the European food additives market, including Corbion NV, Archer Daniels Midland Company, Ajinomoto Co Inc, and Kerry Ingredients, are focusing on innovation and strategic partnerships to capture a larger share of the market. They are investing heavily in research and development to create novel additives that cater to evolving consumer demands, particularly those prioritizing natural and functional ingredients. Geographic analysis reveals that Germany, France, the United Kingdom, and Italy are the major contributors to market revenue in Europe, with the Rest of Europe segment showing promising growth potential.

Europe Food Additives Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe food additives industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. Valued at €XX Billion in 2025, the market is poised for significant expansion, reaching €XX Billion by 2033. This in-depth study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period spans from 2025 to 2033, while the historical period encompasses 2019-2024. Key segments analyzed include preservatives, anti-caking agents, enzymes, hydrocolloids, food flavors and enhancers, food colorants, and acidulants. Leading companies such as Corbion NV, Archer Daniels Midland Company, Ajinomoto Co Inc, Kerry Ingredients, Tate & Lyle PLC, BASF SE, Eastman Chemical Company, Cargill Inc, and Associated British Foods PLC are profiled, providing crucial insights into their market strategies and competitive landscape.

Europe Food Additives Industry Market Composition & Trends

This section delves into the intricate dynamics of the European food additives market. We analyze market concentration, revealing the market share distribution among key players. For example, Corbion NV holds an estimated xx% market share in 2025, while Cargill Inc. commands approximately xx%. The report further explores innovation catalysts, pinpointing technological advancements driving market growth. The regulatory landscape, including evolving EU food safety regulations and their impact on market players, is thoroughly examined. A detailed analysis of substitute products and their potential influence on market share is also included. Finally, we investigate end-user profiles, focusing on the food and beverage industry segments most reliant on food additives, and provide a comprehensive overview of recent M&A activities, including deal values (e.g., a recent merger valued at €XX Million).

- Market Concentration: Highlighted through market share analysis of key players.

- Innovation Catalysts: Focus on technological advancements in additive development and production.

- Regulatory Landscape: Analysis of EU regulations impacting the industry.

- Substitute Products: Assessment of alternative ingredients and their market impact.

- End-User Profiles: Detailed breakdown of food and beverage segments utilizing additives.

- M&A Activities: Review of recent mergers and acquisitions with deal values.

Europe Food Additives Industry Industry Evolution

This section provides a detailed account of the European food additives industry's evolution, charting its growth trajectories from 2019 to 2033. We analyze the impact of technological advancements, such as the increasing adoption of bio-based additives and precision fermentation technologies, on market growth. The report explores shifting consumer demands, such as the growing preference for clean-label products and the influence of health and wellness trends on additive consumption. Specific data points, including compound annual growth rates (CAGRs) for various segments and adoption metrics for new technologies, are provided to illustrate the industry's dynamic evolution. The analysis highlights the increasing demand for natural and organic food additives, driving innovation in extraction and processing techniques. Furthermore, changes in consumer preferences towards specific functional properties are explored. Finally, the report analyzes the impact of external factors like economic fluctuations and geopolitical events on the market's trajectory.

Leading Regions, Countries, or Segments in Europe Food Additives Industry

This section identifies the dominant regions, countries, and additive types within the European market. A detailed analysis reveals the key drivers behind this dominance, including investment trends, regulatory support, and consumer preferences.

- Dominant Region: [Specify the dominant region, e.g., Western Europe]

- Dominant Country: [Specify the dominant country, e.g., Germany]

- Dominant Additive Types: Detailed analysis focusing on the factors contributing to the leading segments' success (e.g., Preservatives, driven by increasing demand for shelf-stable products).

Key Drivers (examples):

- Preservatives: Growing demand for extended shelf life in processed foods.

- Anti-caking Agents: Increased use in powdered food products to enhance flowability.

- Enzymes: Rising application in food processing for improved efficiency and quality.

- Hydrocolloids: Growing demand in the dairy and bakery sectors for texture modification.

- Food Flavors and Enhancers: Increased use to cater to evolving consumer taste preferences.

- Food Colorants: Demand driven by consumer preference for visually appealing products.

- Acidulants: Use in various food and beverage products to regulate pH and enhance flavor.

The analysis examines factors such as strong consumer demand, favorable regulatory environments, and significant investments in research and development within each dominant segment and geographic location.

Europe Food Additives Industry Product Innovations

Recent product innovations in the European food additives market are characterized by a strong focus on enhanced functionality, improved stability, and a clear shift towards natural origins. This drive towards cleaner and more sustainable solutions is evident in the development of novel preservatives extending shelf life, plant-based alternatives to synthetic additives, and innovative emulsifiers and stabilizers derived from renewable sources. We detail these cutting-edge formulations, highlighting their unique selling propositions, applications across diverse food categories, and supporting performance data. Case studies of successful product launches illustrate the competitive landscape and the strategies employed by leading companies to capture market share within specific niches. The analysis also explores the application of nanotechnology and other advanced techniques to improve the efficacy and delivery systems of food additives.

Propelling Factors for Europe Food Additives Industry Growth

Several factors contribute to the growth of the European food additives market. These include increasing demand for processed and convenience foods, rising consumer preference for healthier and functional foods (leading to increased demand for certain additives), technological advancements enabling the development of more effective and sustainable additives, and supportive regulatory frameworks that encourage innovation and market expansion.

Obstacles in the Europe Food Additives Industry Market

Despite significant growth potential, the European food additives market faces notable challenges. Stringent regulations governing product approvals and market entry create significant hurdles for new entrants and necessitate substantial investment in compliance. Supply chain disruptions, exacerbated by geopolitical instability and raw material shortages, lead to increased production costs and potential price volatility. Furthermore, intense competition among established players necessitates continuous innovation and effective marketing strategies to maintain market share. The report analyzes the impact of these factors on overall market growth, providing insights into mitigation strategies and potential future scenarios.

Future Opportunities in Europe Food Additives Industry

The future holds significant opportunities for growth. The increasing focus on clean-label products presents a key opportunity for developing and marketing naturally sourced additives. Furthermore, emerging technologies like precision fermentation offer possibilities for creating sustainable and high-performing additives. Expanding into new markets within Europe and leveraging technological innovations to improve efficiency and sustainability will be crucial for future market expansion.

Major Players in the Europe Food Additives Industry Ecosystem

- Corbion NV

- Archer Daniels Midland Company

- Ajinomoto Co Inc

- Kerry Ingredients

- Tate & Lyle PLC

- BASF SE

- Eastman Chemical Company

- Cargill Inc

- Associated British Foods PLC

Key Developments in Europe Food Additives Industry Industry

- [Insert bullet points detailing key developments with year/month, e.g., "January 2023: Launch of a new natural preservative by Corbion NV."]

Strategic Europe Food Additives Industry Market Forecast

The European food additives market is projected to experience robust growth driven by several factors, including the aforementioned technological advancements and a continued rise in demand from the food and beverage industry. The focus on clean-label and sustainable products will continue to shape market trends, creating opportunities for companies that can meet evolving consumer demands and adapt to changing regulations. The market's potential for expansion is significant, particularly in emerging segments like plant-based additives and novel functionalities.

Europe Food Additives Industry Segmentation

-

1. Type

-

1.1. Preservatives

- 1.1.1. Natural Antioxidants

- 1.1.2. Sorbates

- 1.1.3. Benzoates

- 1.1.4. Other Preservatives

-

1.2. Sweeteners

- 1.2.1. Bulk Sweeteners

- 1.2.2. Sucrose

- 1.2.3. Fructose

- 1.2.4. Lactose

- 1.2.5. HFCS

- 1.2.6. Other Sweeteners

-

1.3. Sugar Substitutes

- 1.3.1. Sucralose

- 1.3.2. Xylitol

- 1.3.3. Stevia

- 1.3.4. Aspartame

- 1.3.5. Saccharine

- 1.3.6. Other Sugar Substitutes

-

1.4. Emulsifier

- 1.4.1. Mono- and Diglycerides & Derivatives

- 1.4.2. Lecithin

- 1.4.3. Sorbates Easters

- 1.4.4. Other Emulsifiers

-

1.5. Anti-caking Agents

- 1.5.1. Calcium Compounds

- 1.5.2. Sodium Compounds

- 1.5.3. Silicon Dioxide

- 1.5.4. Other Anti-caking Agents

-

1.6. Enzymes

- 1.6.1. Carbohydrase

- 1.6.2. Protease

- 1.6.3. Lipase

- 1.6.4. Other Enzymes

-

1.7. Hydrocolloids

- 1.7.1. Starch

- 1.7.2. Gelatin Gum

- 1.7.3. Xanthan Gum

- 1.7.4. Other Hydrocolloids

-

1.8. Food Flavors and Enhancers

- 1.8.1. Natural Flavors

- 1.8.2. Synthetic Flavors

- 1.8.3. Flavor Enhancers

-

1.9. Food Colorants

- 1.9.1. Synthetic Food Colorants

- 1.9.2. Natural Food Colorants

- 1.9.3. Other Food Colorants

-

1.10. Acidulants

- 1.10.1. Citric Acid

- 1.10.2. Phosphoric Acid

- 1.10.3. Lactic Acid

- 1.10.4. Other Acidulants

-

1.1. Preservatives

Europe Food Additives Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Russia

- 5. Italy

- 6. Spain

- 7. Rest of Europe

Europe Food Additives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Food Flavors and Enhancers To Hold a Prominent Share In The Food Additives Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Preservatives

- 5.1.1.1. Natural Antioxidants

- 5.1.1.2. Sorbates

- 5.1.1.3. Benzoates

- 5.1.1.4. Other Preservatives

- 5.1.2. Sweeteners

- 5.1.2.1. Bulk Sweeteners

- 5.1.2.2. Sucrose

- 5.1.2.3. Fructose

- 5.1.2.4. Lactose

- 5.1.2.5. HFCS

- 5.1.2.6. Other Sweeteners

- 5.1.3. Sugar Substitutes

- 5.1.3.1. Sucralose

- 5.1.3.2. Xylitol

- 5.1.3.3. Stevia

- 5.1.3.4. Aspartame

- 5.1.3.5. Saccharine

- 5.1.3.6. Other Sugar Substitutes

- 5.1.4. Emulsifier

- 5.1.4.1. Mono- and Diglycerides & Derivatives

- 5.1.4.2. Lecithin

- 5.1.4.3. Sorbates Easters

- 5.1.4.4. Other Emulsifiers

- 5.1.5. Anti-caking Agents

- 5.1.5.1. Calcium Compounds

- 5.1.5.2. Sodium Compounds

- 5.1.5.3. Silicon Dioxide

- 5.1.5.4. Other Anti-caking Agents

- 5.1.6. Enzymes

- 5.1.6.1. Carbohydrase

- 5.1.6.2. Protease

- 5.1.6.3. Lipase

- 5.1.6.4. Other Enzymes

- 5.1.7. Hydrocolloids

- 5.1.7.1. Starch

- 5.1.7.2. Gelatin Gum

- 5.1.7.3. Xanthan Gum

- 5.1.7.4. Other Hydrocolloids

- 5.1.8. Food Flavors and Enhancers

- 5.1.8.1. Natural Flavors

- 5.1.8.2. Synthetic Flavors

- 5.1.8.3. Flavor Enhancers

- 5.1.9. Food Colorants

- 5.1.9.1. Synthetic Food Colorants

- 5.1.9.2. Natural Food Colorants

- 5.1.9.3. Other Food Colorants

- 5.1.10. Acidulants

- 5.1.10.1. Citric Acid

- 5.1.10.2. Phosphoric Acid

- 5.1.10.3. Lactic Acid

- 5.1.10.4. Other Acidulants

- 5.1.1. Preservatives

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. Germany

- 5.2.3. France

- 5.2.4. Russia

- 5.2.5. Italy

- 5.2.6. Spain

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Preservatives

- 6.1.1.1. Natural Antioxidants

- 6.1.1.2. Sorbates

- 6.1.1.3. Benzoates

- 6.1.1.4. Other Preservatives

- 6.1.2. Sweeteners

- 6.1.2.1. Bulk Sweeteners

- 6.1.2.2. Sucrose

- 6.1.2.3. Fructose

- 6.1.2.4. Lactose

- 6.1.2.5. HFCS

- 6.1.2.6. Other Sweeteners

- 6.1.3. Sugar Substitutes

- 6.1.3.1. Sucralose

- 6.1.3.2. Xylitol

- 6.1.3.3. Stevia

- 6.1.3.4. Aspartame

- 6.1.3.5. Saccharine

- 6.1.3.6. Other Sugar Substitutes

- 6.1.4. Emulsifier

- 6.1.4.1. Mono- and Diglycerides & Derivatives

- 6.1.4.2. Lecithin

- 6.1.4.3. Sorbates Easters

- 6.1.4.4. Other Emulsifiers

- 6.1.5. Anti-caking Agents

- 6.1.5.1. Calcium Compounds

- 6.1.5.2. Sodium Compounds

- 6.1.5.3. Silicon Dioxide

- 6.1.5.4. Other Anti-caking Agents

- 6.1.6. Enzymes

- 6.1.6.1. Carbohydrase

- 6.1.6.2. Protease

- 6.1.6.3. Lipase

- 6.1.6.4. Other Enzymes

- 6.1.7. Hydrocolloids

- 6.1.7.1. Starch

- 6.1.7.2. Gelatin Gum

- 6.1.7.3. Xanthan Gum

- 6.1.7.4. Other Hydrocolloids

- 6.1.8. Food Flavors and Enhancers

- 6.1.8.1. Natural Flavors

- 6.1.8.2. Synthetic Flavors

- 6.1.8.3. Flavor Enhancers

- 6.1.9. Food Colorants

- 6.1.9.1. Synthetic Food Colorants

- 6.1.9.2. Natural Food Colorants

- 6.1.9.3. Other Food Colorants

- 6.1.10. Acidulants

- 6.1.10.1. Citric Acid

- 6.1.10.2. Phosphoric Acid

- 6.1.10.3. Lactic Acid

- 6.1.10.4. Other Acidulants

- 6.1.1. Preservatives

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Preservatives

- 7.1.1.1. Natural Antioxidants

- 7.1.1.2. Sorbates

- 7.1.1.3. Benzoates

- 7.1.1.4. Other Preservatives

- 7.1.2. Sweeteners

- 7.1.2.1. Bulk Sweeteners

- 7.1.2.2. Sucrose

- 7.1.2.3. Fructose

- 7.1.2.4. Lactose

- 7.1.2.5. HFCS

- 7.1.2.6. Other Sweeteners

- 7.1.3. Sugar Substitutes

- 7.1.3.1. Sucralose

- 7.1.3.2. Xylitol

- 7.1.3.3. Stevia

- 7.1.3.4. Aspartame

- 7.1.3.5. Saccharine

- 7.1.3.6. Other Sugar Substitutes

- 7.1.4. Emulsifier

- 7.1.4.1. Mono- and Diglycerides & Derivatives

- 7.1.4.2. Lecithin

- 7.1.4.3. Sorbates Easters

- 7.1.4.4. Other Emulsifiers

- 7.1.5. Anti-caking Agents

- 7.1.5.1. Calcium Compounds

- 7.1.5.2. Sodium Compounds

- 7.1.5.3. Silicon Dioxide

- 7.1.5.4. Other Anti-caking Agents

- 7.1.6. Enzymes

- 7.1.6.1. Carbohydrase

- 7.1.6.2. Protease

- 7.1.6.3. Lipase

- 7.1.6.4. Other Enzymes

- 7.1.7. Hydrocolloids

- 7.1.7.1. Starch

- 7.1.7.2. Gelatin Gum

- 7.1.7.3. Xanthan Gum

- 7.1.7.4. Other Hydrocolloids

- 7.1.8. Food Flavors and Enhancers

- 7.1.8.1. Natural Flavors

- 7.1.8.2. Synthetic Flavors

- 7.1.8.3. Flavor Enhancers

- 7.1.9. Food Colorants

- 7.1.9.1. Synthetic Food Colorants

- 7.1.9.2. Natural Food Colorants

- 7.1.9.3. Other Food Colorants

- 7.1.10. Acidulants

- 7.1.10.1. Citric Acid

- 7.1.10.2. Phosphoric Acid

- 7.1.10.3. Lactic Acid

- 7.1.10.4. Other Acidulants

- 7.1.1. Preservatives

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Preservatives

- 8.1.1.1. Natural Antioxidants

- 8.1.1.2. Sorbates

- 8.1.1.3. Benzoates

- 8.1.1.4. Other Preservatives

- 8.1.2. Sweeteners

- 8.1.2.1. Bulk Sweeteners

- 8.1.2.2. Sucrose

- 8.1.2.3. Fructose

- 8.1.2.4. Lactose

- 8.1.2.5. HFCS

- 8.1.2.6. Other Sweeteners

- 8.1.3. Sugar Substitutes

- 8.1.3.1. Sucralose

- 8.1.3.2. Xylitol

- 8.1.3.3. Stevia

- 8.1.3.4. Aspartame

- 8.1.3.5. Saccharine

- 8.1.3.6. Other Sugar Substitutes

- 8.1.4. Emulsifier

- 8.1.4.1. Mono- and Diglycerides & Derivatives

- 8.1.4.2. Lecithin

- 8.1.4.3. Sorbates Easters

- 8.1.4.4. Other Emulsifiers

- 8.1.5. Anti-caking Agents

- 8.1.5.1. Calcium Compounds

- 8.1.5.2. Sodium Compounds

- 8.1.5.3. Silicon Dioxide

- 8.1.5.4. Other Anti-caking Agents

- 8.1.6. Enzymes

- 8.1.6.1. Carbohydrase

- 8.1.6.2. Protease

- 8.1.6.3. Lipase

- 8.1.6.4. Other Enzymes

- 8.1.7. Hydrocolloids

- 8.1.7.1. Starch

- 8.1.7.2. Gelatin Gum

- 8.1.7.3. Xanthan Gum

- 8.1.7.4. Other Hydrocolloids

- 8.1.8. Food Flavors and Enhancers

- 8.1.8.1. Natural Flavors

- 8.1.8.2. Synthetic Flavors

- 8.1.8.3. Flavor Enhancers

- 8.1.9. Food Colorants

- 8.1.9.1. Synthetic Food Colorants

- 8.1.9.2. Natural Food Colorants

- 8.1.9.3. Other Food Colorants

- 8.1.10. Acidulants

- 8.1.10.1. Citric Acid

- 8.1.10.2. Phosphoric Acid

- 8.1.10.3. Lactic Acid

- 8.1.10.4. Other Acidulants

- 8.1.1. Preservatives

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Preservatives

- 9.1.1.1. Natural Antioxidants

- 9.1.1.2. Sorbates

- 9.1.1.3. Benzoates

- 9.1.1.4. Other Preservatives

- 9.1.2. Sweeteners

- 9.1.2.1. Bulk Sweeteners

- 9.1.2.2. Sucrose

- 9.1.2.3. Fructose

- 9.1.2.4. Lactose

- 9.1.2.5. HFCS

- 9.1.2.6. Other Sweeteners

- 9.1.3. Sugar Substitutes

- 9.1.3.1. Sucralose

- 9.1.3.2. Xylitol

- 9.1.3.3. Stevia

- 9.1.3.4. Aspartame

- 9.1.3.5. Saccharine

- 9.1.3.6. Other Sugar Substitutes

- 9.1.4. Emulsifier

- 9.1.4.1. Mono- and Diglycerides & Derivatives

- 9.1.4.2. Lecithin

- 9.1.4.3. Sorbates Easters

- 9.1.4.4. Other Emulsifiers

- 9.1.5. Anti-caking Agents

- 9.1.5.1. Calcium Compounds

- 9.1.5.2. Sodium Compounds

- 9.1.5.3. Silicon Dioxide

- 9.1.5.4. Other Anti-caking Agents

- 9.1.6. Enzymes

- 9.1.6.1. Carbohydrase

- 9.1.6.2. Protease

- 9.1.6.3. Lipase

- 9.1.6.4. Other Enzymes

- 9.1.7. Hydrocolloids

- 9.1.7.1. Starch

- 9.1.7.2. Gelatin Gum

- 9.1.7.3. Xanthan Gum

- 9.1.7.4. Other Hydrocolloids

- 9.1.8. Food Flavors and Enhancers

- 9.1.8.1. Natural Flavors

- 9.1.8.2. Synthetic Flavors

- 9.1.8.3. Flavor Enhancers

- 9.1.9. Food Colorants

- 9.1.9.1. Synthetic Food Colorants

- 9.1.9.2. Natural Food Colorants

- 9.1.9.3. Other Food Colorants

- 9.1.10. Acidulants

- 9.1.10.1. Citric Acid

- 9.1.10.2. Phosphoric Acid

- 9.1.10.3. Lactic Acid

- 9.1.10.4. Other Acidulants

- 9.1.1. Preservatives

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Preservatives

- 10.1.1.1. Natural Antioxidants

- 10.1.1.2. Sorbates

- 10.1.1.3. Benzoates

- 10.1.1.4. Other Preservatives

- 10.1.2. Sweeteners

- 10.1.2.1. Bulk Sweeteners

- 10.1.2.2. Sucrose

- 10.1.2.3. Fructose

- 10.1.2.4. Lactose

- 10.1.2.5. HFCS

- 10.1.2.6. Other Sweeteners

- 10.1.3. Sugar Substitutes

- 10.1.3.1. Sucralose

- 10.1.3.2. Xylitol

- 10.1.3.3. Stevia

- 10.1.3.4. Aspartame

- 10.1.3.5. Saccharine

- 10.1.3.6. Other Sugar Substitutes

- 10.1.4. Emulsifier

- 10.1.4.1. Mono- and Diglycerides & Derivatives

- 10.1.4.2. Lecithin

- 10.1.4.3. Sorbates Easters

- 10.1.4.4. Other Emulsifiers

- 10.1.5. Anti-caking Agents

- 10.1.5.1. Calcium Compounds

- 10.1.5.2. Sodium Compounds

- 10.1.5.3. Silicon Dioxide

- 10.1.5.4. Other Anti-caking Agents

- 10.1.6. Enzymes

- 10.1.6.1. Carbohydrase

- 10.1.6.2. Protease

- 10.1.6.3. Lipase

- 10.1.6.4. Other Enzymes

- 10.1.7. Hydrocolloids

- 10.1.7.1. Starch

- 10.1.7.2. Gelatin Gum

- 10.1.7.3. Xanthan Gum

- 10.1.7.4. Other Hydrocolloids

- 10.1.8. Food Flavors and Enhancers

- 10.1.8.1. Natural Flavors

- 10.1.8.2. Synthetic Flavors

- 10.1.8.3. Flavor Enhancers

- 10.1.9. Food Colorants

- 10.1.9.1. Synthetic Food Colorants

- 10.1.9.2. Natural Food Colorants

- 10.1.9.3. Other Food Colorants

- 10.1.10. Acidulants

- 10.1.10.1. Citric Acid

- 10.1.10.2. Phosphoric Acid

- 10.1.10.3. Lactic Acid

- 10.1.10.4. Other Acidulants

- 10.1.1. Preservatives

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Spain Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Preservatives

- 11.1.1.1. Natural Antioxidants

- 11.1.1.2. Sorbates

- 11.1.1.3. Benzoates

- 11.1.1.4. Other Preservatives

- 11.1.2. Sweeteners

- 11.1.2.1. Bulk Sweeteners

- 11.1.2.2. Sucrose

- 11.1.2.3. Fructose

- 11.1.2.4. Lactose

- 11.1.2.5. HFCS

- 11.1.2.6. Other Sweeteners

- 11.1.3. Sugar Substitutes

- 11.1.3.1. Sucralose

- 11.1.3.2. Xylitol

- 11.1.3.3. Stevia

- 11.1.3.4. Aspartame

- 11.1.3.5. Saccharine

- 11.1.3.6. Other Sugar Substitutes

- 11.1.4. Emulsifier

- 11.1.4.1. Mono- and Diglycerides & Derivatives

- 11.1.4.2. Lecithin

- 11.1.4.3. Sorbates Easters

- 11.1.4.4. Other Emulsifiers

- 11.1.5. Anti-caking Agents

- 11.1.5.1. Calcium Compounds

- 11.1.5.2. Sodium Compounds

- 11.1.5.3. Silicon Dioxide

- 11.1.5.4. Other Anti-caking Agents

- 11.1.6. Enzymes

- 11.1.6.1. Carbohydrase

- 11.1.6.2. Protease

- 11.1.6.3. Lipase

- 11.1.6.4. Other Enzymes

- 11.1.7. Hydrocolloids

- 11.1.7.1. Starch

- 11.1.7.2. Gelatin Gum

- 11.1.7.3. Xanthan Gum

- 11.1.7.4. Other Hydrocolloids

- 11.1.8. Food Flavors and Enhancers

- 11.1.8.1. Natural Flavors

- 11.1.8.2. Synthetic Flavors

- 11.1.8.3. Flavor Enhancers

- 11.1.9. Food Colorants

- 11.1.9.1. Synthetic Food Colorants

- 11.1.9.2. Natural Food Colorants

- 11.1.9.3. Other Food Colorants

- 11.1.10. Acidulants

- 11.1.10.1. Citric Acid

- 11.1.10.2. Phosphoric Acid

- 11.1.10.3. Lactic Acid

- 11.1.10.4. Other Acidulants

- 11.1.1. Preservatives

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Preservatives

- 12.1.1.1. Natural Antioxidants

- 12.1.1.2. Sorbates

- 12.1.1.3. Benzoates

- 12.1.1.4. Other Preservatives

- 12.1.2. Sweeteners

- 12.1.2.1. Bulk Sweeteners

- 12.1.2.2. Sucrose

- 12.1.2.3. Fructose

- 12.1.2.4. Lactose

- 12.1.2.5. HFCS

- 12.1.2.6. Other Sweeteners

- 12.1.3. Sugar Substitutes

- 12.1.3.1. Sucralose

- 12.1.3.2. Xylitol

- 12.1.3.3. Stevia

- 12.1.3.4. Aspartame

- 12.1.3.5. Saccharine

- 12.1.3.6. Other Sugar Substitutes

- 12.1.4. Emulsifier

- 12.1.4.1. Mono- and Diglycerides & Derivatives

- 12.1.4.2. Lecithin

- 12.1.4.3. Sorbates Easters

- 12.1.4.4. Other Emulsifiers

- 12.1.5. Anti-caking Agents

- 12.1.5.1. Calcium Compounds

- 12.1.5.2. Sodium Compounds

- 12.1.5.3. Silicon Dioxide

- 12.1.5.4. Other Anti-caking Agents

- 12.1.6. Enzymes

- 12.1.6.1. Carbohydrase

- 12.1.6.2. Protease

- 12.1.6.3. Lipase

- 12.1.6.4. Other Enzymes

- 12.1.7. Hydrocolloids

- 12.1.7.1. Starch

- 12.1.7.2. Gelatin Gum

- 12.1.7.3. Xanthan Gum

- 12.1.7.4. Other Hydrocolloids

- 12.1.8. Food Flavors and Enhancers

- 12.1.8.1. Natural Flavors

- 12.1.8.2. Synthetic Flavors

- 12.1.8.3. Flavor Enhancers

- 12.1.9. Food Colorants

- 12.1.9.1. Synthetic Food Colorants

- 12.1.9.2. Natural Food Colorants

- 12.1.9.3. Other Food Colorants

- 12.1.10. Acidulants

- 12.1.10.1. Citric Acid

- 12.1.10.2. Phosphoric Acid

- 12.1.10.3. Lactic Acid

- 12.1.10.4. Other Acidulants

- 12.1.1. Preservatives

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Germany Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Food Additives Industry Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Corbion NV

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Corbion

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Archer Daniels Midland Company

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Ajinomoto Co Inc

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Kerry Ingredients

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Tate & Lyle PLC

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 BASF SE

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Eastman Chemical Company

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Cargill Inc

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Associated British Foods PLC

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Corbion NV

List of Figures

- Figure 1: Europe Food Additives Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Food Additives Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Food Additives Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Food Additives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Food Additives Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Food Additives Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Food Additives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Food Additives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Food Additives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Food Additives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Food Additives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Food Additives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Food Additives Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Food Additives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Food Additives Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Food Additives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Europe Food Additives Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Food Additives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Food Additives Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Food Additives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Europe Food Additives Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Food Additives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Europe Food Additives Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Food Additives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Food Additives Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Food Additives Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Europe Food Additives Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Food Additives Industry?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Europe Food Additives Industry?

Key companies in the market include Corbion NV, Corbion, Archer Daniels Midland Company, Ajinomoto Co Inc, Kerry Ingredients, Tate & Lyle PLC, BASF SE, Eastman Chemical Company, Cargill Inc, Associated British Foods PLC.

3. What are the main segments of the Europe Food Additives Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Food Flavors and Enhancers To Hold a Prominent Share In The Food Additives Market.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Food Additives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Food Additives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Food Additives Industry?

To stay informed about further developments, trends, and reports in the Europe Food Additives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence