Key Insights

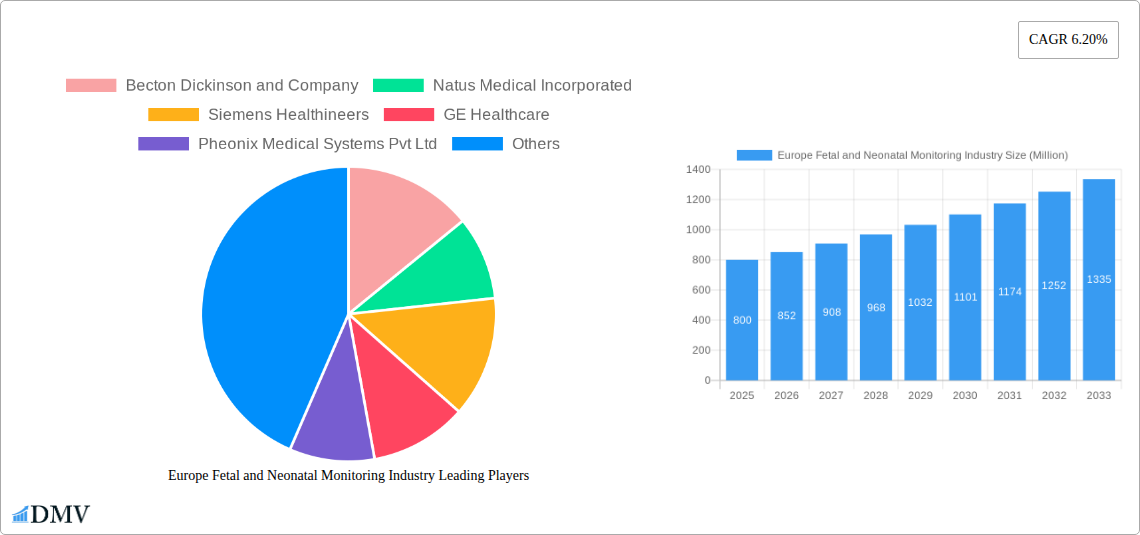

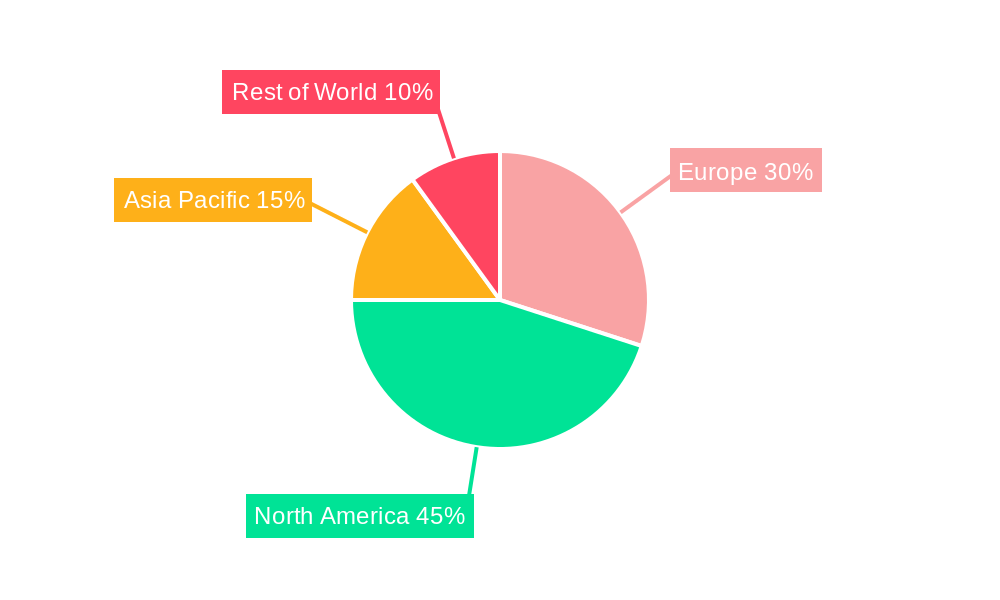

The European fetal and neonatal monitoring market, valued at approximately €800 million in 2025, is projected to experience robust growth, driven by several key factors. Technological advancements, such as the increasing adoption of wireless and remote monitoring systems, are enhancing the efficiency and effectiveness of care, while simultaneously reducing hospital readmissions and improving patient outcomes. The rising prevalence of premature births and low birth weight infants is another significant driver, increasing the demand for advanced monitoring solutions to ensure optimal neonatal care. Furthermore, stringent regulatory frameworks promoting patient safety and the expanding geriatric population contribute to market expansion. The market is segmented by product type (fetal monitoring devices and neonatal monitoring devices) and end-user (hospitals, neonatal care centers, and other end-users), with hospitals currently holding the largest market share. Competition is fierce among established players like Becton Dickinson, Natus Medical, Siemens Healthineers, and GE Healthcare, alongside smaller, specialized companies. Growth will also be fueled by increasing investments in healthcare infrastructure, particularly in emerging European markets, as well as a growing awareness among healthcare professionals regarding the importance of early detection of potential complications.

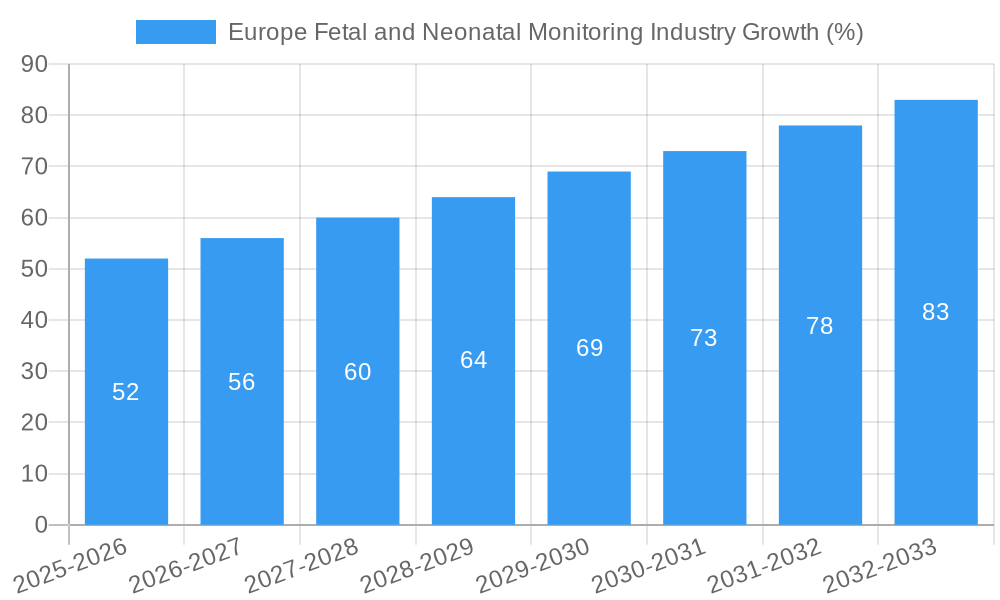

However, market growth faces some challenges. High initial investment costs associated with advanced monitoring equipment may limit adoption in smaller hospitals and clinics, particularly in regions with constrained healthcare budgets. Furthermore, the complexity of these devices and the need for specialized training for healthcare professionals can impede widespread implementation. Despite these restraints, the long-term outlook for the European fetal and neonatal monitoring market remains positive, propelled by sustained technological innovations, increasing healthcare spending, and a growing focus on improving neonatal and maternal health outcomes. The market is expected to maintain a compound annual growth rate (CAGR) of approximately 6.2% from 2025 to 2033, significantly increasing the market size and presenting substantial opportunities for market participants.

This insightful report provides a detailed analysis of the European fetal and neonatal monitoring market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Europe Fetal and Neonatal Monitoring Industry Market Composition & Trends

This section delves into the competitive landscape of the European fetal and neonatal monitoring market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities.

Market Concentration & Competitive Dynamics: The European fetal and neonatal monitoring market exhibits a moderately concentrated structure, with key players such as Becton Dickinson and Company, Natus Medical Incorporated, and Siemens Healthineers holding significant market share. However, the presence of several smaller, specialized companies fosters competition and innovation. The market share distribution in 2025 is estimated as follows: Becton Dickinson and Company (xx%), Natus Medical Incorporated (xx%), Siemens Healthineers (xx%), with the remaining share distributed among other players.

Innovation Catalysts: Continuous technological advancements, particularly in areas like wireless technology, AI-powered analytics, and improved sensor technology, are driving innovation in fetal and neonatal monitoring. Regulatory approvals for new technologies and increasing demand for advanced features further fuel innovation.

Regulatory Landscape: Stringent regulatory requirements in Europe, particularly concerning medical device approvals (e.g., CE marking), influence market dynamics and create a barrier to entry for new players. However, these regulations also ensure high safety and efficacy standards.

Substitute Products & End-User Profiles: While no direct substitutes exist, alternative methods for monitoring fetal and neonatal health influence market penetration. Key end users include hospitals (holding the largest market share at xx%), neonatal care centers (xx%), and other end-users (xx%), with hospitals dominating due to their comprehensive capabilities and patient volume.

M&A Activities: The industry has witnessed several M&A activities in recent years, though the precise deal values are difficult to quantify precisely without access to specific financial disclosures. These activities indicate consolidation within the market and a drive towards greater market share among large players. An example includes [insert example if available, otherwise state "Specific deal values are not publicly available."].

Europe Fetal and Neonatal Monitoring Industry Industry Evolution

This section provides a detailed analysis of the evolution of the European fetal and neonatal monitoring market, focusing on market growth trajectories, technological advancements, and evolving consumer demands over the period from 2019 to 2033.

The market has witnessed consistent growth from 2019 to 2024, with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several factors, including rising birth rates (in specific regions), increasing awareness of the importance of prenatal and postnatal care, and the growing adoption of advanced monitoring technologies. Technological advancements, such as the integration of AI and machine learning, are enhancing the accuracy and efficiency of fetal and neonatal monitoring, leading to improved patient outcomes. The market is also witnessing a shift towards minimally invasive and remote monitoring solutions, driven by consumer demand for greater convenience and less hospital stays. The forecast period (2025-2033) anticipates a CAGR of xx%, driven by ongoing technological improvements, increased healthcare spending, and a rising preference for advanced monitoring techniques across the region. Adoption rates for advanced technologies such as wireless fetal monitoring are increasing steadily, though exact figures are difficult to obtain comprehensively due to variations in data collection across different European healthcare providers.

Leading Regions, Countries, or Segments in Europe Fetal and Neonatal Monitoring Industry

This section identifies the dominant regions, countries, and segments within the European fetal and neonatal monitoring market.

By Product Type:

- Fetal Monitoring Devices: This segment holds the largest market share, driven by the high demand for accurate and reliable fetal monitoring during pregnancy and labor. The adoption of technologically advanced fetal monitors is rising because of increasing awareness about potential complications during pregnancy.

- Neonatal Monitoring Devices: This segment is experiencing significant growth, fueled by the increasing focus on neonatal intensive care and the need for advanced monitoring tools for premature and critically ill newborns.

By End User:

- Hospitals: Hospitals remain the dominant end-user segment, owing to their extensive infrastructure and specialized expertise in handling high-risk pregnancies and neonatal care. Their large volume of patients drives demand for a diverse range of fetal and neonatal monitoring equipment.

- Neonatal Care Centers: Dedicated neonatal care centers are also significant end-users, focusing on specialized care for newborns, driving demand for advanced neonatal monitoring technology.

Key Drivers:

- Increased healthcare spending and investments in healthcare infrastructure in various European nations.

- Favorable regulatory environments supporting the adoption of advanced medical devices.

- Growing awareness among healthcare professionals and expectant parents about the benefits of advanced fetal and neonatal monitoring.

The dominance of specific regions and countries is largely attributed to factors such as healthcare infrastructure development, government policies, and economic prosperity, although providing precise country-level breakdowns here requires additional data. Generally, Western European countries with advanced healthcare systems tend to lead in adoption of advanced technology.

Europe Fetal and Neonatal Monitoring Industry Product Innovations

Recent innovations in fetal and neonatal monitoring include the development of wireless and remote monitoring systems, improving patient comfort and reducing hospital stay. AI-powered analytics are enhancing diagnostic accuracy and providing early warnings of potential complications. Miniaturization of sensors and improved sensor technology are expanding monitoring capabilities and enhancing ease-of-use. These innovations are characterized by improved accuracy, real-time data analysis, and enhanced portability, offering unique selling propositions compared to older monitoring methods.

Propelling Factors for Europe Fetal and Neonatal Monitoring Industry Growth

Several factors are driving the growth of the European fetal and neonatal monitoring market. Technological advancements, such as the development of wireless and remote monitoring systems, are improving the accessibility and convenience of monitoring. Increased healthcare expenditure and government initiatives promoting advanced healthcare technologies are further boosting market growth. Rising awareness among healthcare providers and patients regarding the benefits of early detection and intervention in high-risk pregnancies and neonatal care also fuels market expansion.

Obstacles in the Europe Fetal and Neonatal Monitoring Industry Market

The European fetal and neonatal monitoring market faces several challenges. Strict regulatory requirements for medical device approval can increase development costs and timelines. Supply chain disruptions, particularly in the context of global events, can impact the availability and cost of components. Intense competition among established players and the emergence of new entrants create price pressures. These factors combined can limit market growth to some extent.

Future Opportunities in Europe Fetal and Neonatal Monitoring Industry

Future opportunities lie in the expansion of remote and home-based monitoring solutions, leveraging the growth in telemedicine and remote patient monitoring. The integration of AI and machine learning offers potential for improved diagnostics and personalized care. Developing cost-effective and user-friendly monitoring devices can open up the market to a wider range of healthcare providers and patients. Focusing on underserved regions and developing countries within Europe may also present significant expansion opportunities.

Major Players in the Europe Fetal and Neonatal Monitoring Industry Ecosystem

- Becton Dickinson and Company

- Natus Medical Incorporated

- Siemens Healthineers

- GE Healthcare

- Pheonix Medical Systems Pvt Ltd

- FUJIFILM SonoSite Inc

- CooperSurgical Inc

- Cardinal Health

- Draegerwerk AG & Co KGaA

- Koninklijke Philips NV

- Medtronic Plc

Key Developments in Europe Fetal and Neonatal Monitoring Industry Industry

- May 2021: Raydiants Oximetry received a USD 3 Million grant from the Irish government to develop innovative fetal monitors. This highlights government support for technological advancements in the sector.

- January 2022: Nuvo Group partnered with Charite-Universitatsmedizin Berlin to establish a remote fetal surveillance protocol in Europe. This signifies a shift towards remote monitoring solutions and improved healthcare access.

Strategic Europe Fetal and Neonatal Monitoring Industry Market Forecast

The European fetal and neonatal monitoring market is poised for continued growth, driven by technological advancements, increased healthcare spending, and a growing emphasis on preventative and personalized healthcare. The market's expansion will be fueled by the rising adoption of advanced monitoring technologies, particularly those incorporating AI and remote monitoring capabilities. This will lead to improved patient outcomes, increased efficiency, and expansion into new market segments. The market's future potential is significant, promising substantial returns for investors and stakeholders alike.

Europe Fetal and Neonatal Monitoring Industry Segmentation

-

1. Product Type

-

1.1. Fetal Monitoring Devices

- 1.1.1. Heart Rate Monitors

- 1.1.2. Uterine Contraction Monitor

- 1.1.3. Pulse Oximeters

- 1.1.4. Other Fetal Monitoring Devices

-

1.2. Neonatal Monitoring Devices

- 1.2.1. Cardiac Monitors

- 1.2.2. Capnographs

- 1.2.3. Blood Pressure Monitors

- 1.2.4. Other Neonatal Monitoring Devices

-

1.1. Fetal Monitoring Devices

-

2. End User

- 2.1. Hospitals

- 2.2. Neonatal Care Centers

- 2.3. Other End-users

Europe Fetal and Neonatal Monitoring Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of the Europe

Europe Fetal and Neonatal Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advancing Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Pulse Oximeters Segment is Expected to Hold Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fetal Monitoring Devices

- 5.1.1.1. Heart Rate Monitors

- 5.1.1.2. Uterine Contraction Monitor

- 5.1.1.3. Pulse Oximeters

- 5.1.1.4. Other Fetal Monitoring Devices

- 5.1.2. Neonatal Monitoring Devices

- 5.1.2.1. Cardiac Monitors

- 5.1.2.2. Capnographs

- 5.1.2.3. Blood Pressure Monitors

- 5.1.2.4. Other Neonatal Monitoring Devices

- 5.1.1. Fetal Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Neonatal Care Centers

- 5.2.3. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. Rest of the Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Fetal Monitoring Devices

- 6.1.1.1. Heart Rate Monitors

- 6.1.1.2. Uterine Contraction Monitor

- 6.1.1.3. Pulse Oximeters

- 6.1.1.4. Other Fetal Monitoring Devices

- 6.1.2. Neonatal Monitoring Devices

- 6.1.2.1. Cardiac Monitors

- 6.1.2.2. Capnographs

- 6.1.2.3. Blood Pressure Monitors

- 6.1.2.4. Other Neonatal Monitoring Devices

- 6.1.1. Fetal Monitoring Devices

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Neonatal Care Centers

- 6.2.3. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Fetal Monitoring Devices

- 7.1.1.1. Heart Rate Monitors

- 7.1.1.2. Uterine Contraction Monitor

- 7.1.1.3. Pulse Oximeters

- 7.1.1.4. Other Fetal Monitoring Devices

- 7.1.2. Neonatal Monitoring Devices

- 7.1.2.1. Cardiac Monitors

- 7.1.2.2. Capnographs

- 7.1.2.3. Blood Pressure Monitors

- 7.1.2.4. Other Neonatal Monitoring Devices

- 7.1.1. Fetal Monitoring Devices

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Neonatal Care Centers

- 7.2.3. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Fetal Monitoring Devices

- 8.1.1.1. Heart Rate Monitors

- 8.1.1.2. Uterine Contraction Monitor

- 8.1.1.3. Pulse Oximeters

- 8.1.1.4. Other Fetal Monitoring Devices

- 8.1.2. Neonatal Monitoring Devices

- 8.1.2.1. Cardiac Monitors

- 8.1.2.2. Capnographs

- 8.1.2.3. Blood Pressure Monitors

- 8.1.2.4. Other Neonatal Monitoring Devices

- 8.1.1. Fetal Monitoring Devices

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Neonatal Care Centers

- 8.2.3. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Fetal Monitoring Devices

- 9.1.1.1. Heart Rate Monitors

- 9.1.1.2. Uterine Contraction Monitor

- 9.1.1.3. Pulse Oximeters

- 9.1.1.4. Other Fetal Monitoring Devices

- 9.1.2. Neonatal Monitoring Devices

- 9.1.2.1. Cardiac Monitors

- 9.1.2.2. Capnographs

- 9.1.2.3. Blood Pressure Monitors

- 9.1.2.4. Other Neonatal Monitoring Devices

- 9.1.1. Fetal Monitoring Devices

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Neonatal Care Centers

- 9.2.3. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Fetal Monitoring Devices

- 10.1.1.1. Heart Rate Monitors

- 10.1.1.2. Uterine Contraction Monitor

- 10.1.1.3. Pulse Oximeters

- 10.1.1.4. Other Fetal Monitoring Devices

- 10.1.2. Neonatal Monitoring Devices

- 10.1.2.1. Cardiac Monitors

- 10.1.2.2. Capnographs

- 10.1.2.3. Blood Pressure Monitors

- 10.1.2.4. Other Neonatal Monitoring Devices

- 10.1.1. Fetal Monitoring Devices

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Neonatal Care Centers

- 10.2.3. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of the Europe Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Fetal Monitoring Devices

- 11.1.1.1. Heart Rate Monitors

- 11.1.1.2. Uterine Contraction Monitor

- 11.1.1.3. Pulse Oximeters

- 11.1.1.4. Other Fetal Monitoring Devices

- 11.1.2. Neonatal Monitoring Devices

- 11.1.2.1. Cardiac Monitors

- 11.1.2.2. Capnographs

- 11.1.2.3. Blood Pressure Monitors

- 11.1.2.4. Other Neonatal Monitoring Devices

- 11.1.1. Fetal Monitoring Devices

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Hospitals

- 11.2.2. Neonatal Care Centers

- 11.2.3. Other End-users

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Germany Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Fetal and Neonatal Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Becton Dickinson and Company

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Natus Medical Incorporated

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Siemens Healthineers

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 GE Healthcare

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Pheonix Medical Systems Pvt Ltd

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 FUJIFILM SonoSite Inc

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 CooperSurgical Inc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Cardinal Health *List Not Exhaustive

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Draegerwerk AG & Co KGaA

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Koninklijke Philips NV

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Medtronic Plc

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Europe Fetal and Neonatal Monitoring Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Fetal and Neonatal Monitoring Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Fetal and Neonatal Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Fetal and Neonatal Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Fetal and Neonatal Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Fetal and Neonatal Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Fetal and Neonatal Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Fetal and Neonatal Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Fetal and Neonatal Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 27: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 29: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Europe Fetal and Neonatal Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Fetal and Neonatal Monitoring Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Europe Fetal and Neonatal Monitoring Industry?

Key companies in the market include Becton Dickinson and Company, Natus Medical Incorporated, Siemens Healthineers, GE Healthcare, Pheonix Medical Systems Pvt Ltd, FUJIFILM SonoSite Inc, CooperSurgical Inc, Cardinal Health *List Not Exhaustive, Draegerwerk AG & Co KGaA, Koninklijke Philips NV, Medtronic Plc.

3. What are the main segments of the Europe Fetal and Neonatal Monitoring Industry?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advancing Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Pulse Oximeters Segment is Expected to Hold Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

January 2022: Nuvo Group partnered with Charite- Universitatsmedizin Berlin to establish a remote fetal surveillance protocol for Europe and study predictive analysis to improve health outcomes in the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Fetal and Neonatal Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Fetal and Neonatal Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Fetal and Neonatal Monitoring Industry?

To stay informed about further developments, trends, and reports in the Europe Fetal and Neonatal Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence