Key Insights

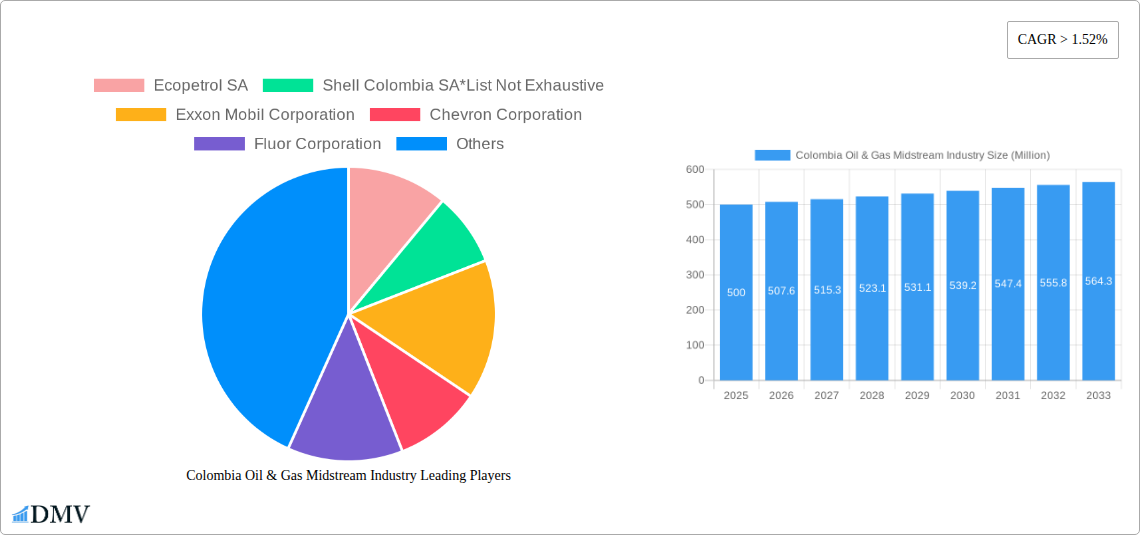

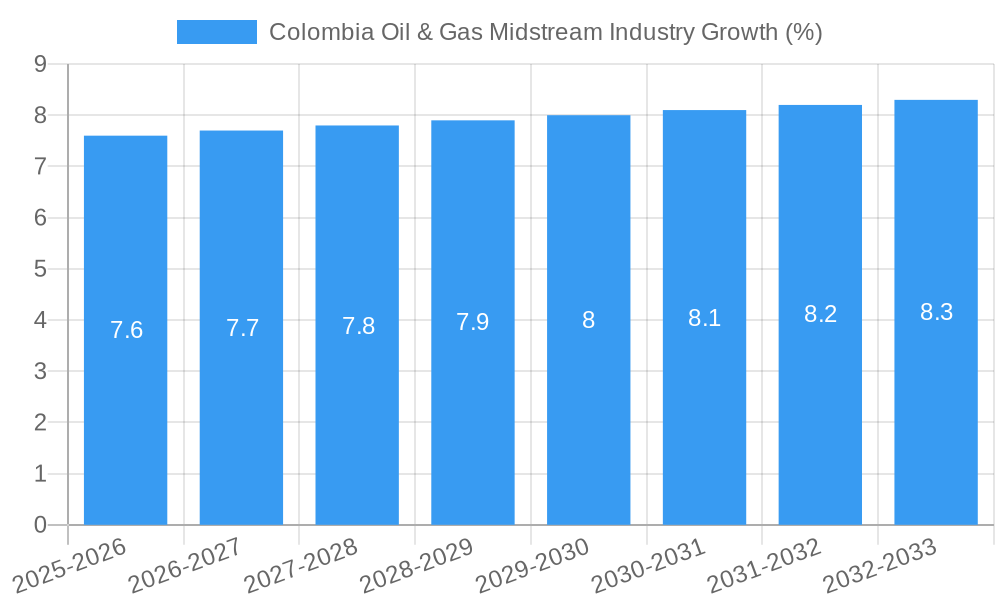

The Colombia Oil & Gas Midstream industry, encompassing LNG terminals, transportation, and storage, presents a promising investment landscape. With a current market size (2025) estimated at $500 million (based on a CAGR of 1.52% and extrapolated from available data), the sector is projected to experience steady growth through 2033. This expansion is driven by increasing domestic oil and gas production, growing energy demand fueled by Colombia's economic development, and ongoing investments in infrastructure modernization. Key trends include the ongoing expansion of LNG terminal capacity to meet export demands, the development of more efficient pipeline networks to enhance transportation capabilities, and the adoption of advanced storage technologies to minimize environmental impact and maximize operational efficiency. However, challenges remain, including the need for continuous investment in infrastructure to support growth, regulatory hurdles surrounding pipeline expansion projects, and fluctuating global energy prices which can impact investment decisions. Major players such as Ecopetrol SA, Shell Colombia SA, Exxon Mobil Corporation, Chevron Corporation, and Fluor Corporation are actively shaping the market's trajectory through strategic investments and operational initiatives.

The segmentation of the market into LNG terminals, transportation, and storage allows for a granular understanding of the industry's dynamics. The LNG terminal segment is expected to witness significant growth driven by increasing global demand for LNG and Colombia's strategic geographical location. The transportation segment, largely reliant on pipelines, is poised for expansion as new infrastructure projects are implemented to improve efficiency and capacity. The storage segment will witness growth reflecting the increasing need to efficiently store and manage growing volumes of oil and gas. Given the country's ambitious energy targets and sustained investment in infrastructure development, the Colombian Oil & Gas Midstream sector is predicted to maintain a healthy growth trajectory for the forecast period, offering attractive opportunities for investors and industry participants alike.

Colombia Oil & Gas Midstream Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Colombian oil and gas midstream industry, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study offers invaluable insights for stakeholders seeking to navigate this dynamic sector. The report incorporates meticulous data analysis, revealing market trends and potential investment opportunities. Key segments explored include LNG terminals, transportation, and storage, with a focus on market size, growth trajectories, and key players such as Ecopetrol SA, Shell Colombia SA, Exxon Mobil Corporation, Chevron Corporation, and Fluor Corporation. This report is essential for investors, industry professionals, and government agencies looking to understand and leverage opportunities within the Colombian oil and gas midstream sector.

Colombia Oil & Gas Midstream Industry Market Composition & Trends

This section evaluates the competitive landscape of Colombia's oil and gas midstream industry, examining market concentration, innovation, regulation, and M&A activity. The analysis reveals the market share distribution amongst key players, highlighting the influence of major companies such as Ecopetrol SA and international giants like Shell Colombia SA.

- Market Concentration: The Colombian midstream market exhibits a moderately concentrated structure, with a few dominant players controlling a significant portion of the market share. Ecopetrol SA holds a substantial share, followed by international players like Shell Colombia SA and Exxon Mobil Corporation. Precise market share figures are unavailable (xx%) for this year, but the report provides a detailed breakdown based on available data.

- Innovation Catalysts: Technological advancements in pipeline infrastructure, storage solutions, and LNG processing are driving efficiency improvements and expanding market capacity.

- Regulatory Landscape: Government regulations play a significant role, influencing investment decisions and operational strategies. The report details the evolving regulatory framework and its impact on market dynamics.

- Substitute Products: While limited direct substitutes exist, alternative energy sources and transportation methods indirectly influence the midstream sector.

- End-User Profiles: The report profiles key end-users, including power generation companies, industrial facilities, and domestic consumers, highlighting their varying needs and demands.

- M&A Activities: The report analyzes significant mergers and acquisitions, noting deal values totaling approximately $XX Million in the period 2019-2024, and projecting further activity in the coming years.

Colombia Oil & Gas Midstream Industry Industry Evolution

This section delves into the evolutionary trajectory of Colombia's oil and gas midstream sector, examining market growth, technological advancements, and shifting consumer demands throughout the study period (2019-2033). The analysis unveils growth rates exceeding xx% annually during the historical period (2019-2024), with a projected slowdown to xx% annually during the forecast period (2025-2033). This moderation is attributed to a combination of factors, including increased competition and the ongoing transition to cleaner energy sources. Technological innovation in areas such as pipeline monitoring and automation has significantly improved operational efficiency and safety. The shift in consumer demand towards cleaner energy sources is also analyzed, along with the implications for the midstream sector.

Leading Regions, Countries, or Segments in Colombia Oil & Gas Midstream Industry

This section identifies the leading regions and segments within the Colombian oil and gas midstream industry.

LNG Terminals: Overview

- Key Drivers: Increased domestic demand for natural gas, coupled with government incentives for LNG infrastructure development, are key drivers in this segment.

- Dominance Factors: The proximity to major consumption centers and access to international shipping routes are key factors contributing to the dominance of specific terminal locations (Specific location details found within the report).

Transportation: Overview

- Key Drivers: Expanding pipeline networks and the development of efficient transportation routes are crucial for this segment. Government initiatives to enhance infrastructure and facilitate private investment play a significant role.

- Dominance Factors: Existing pipeline infrastructure, strategic geographic locations, and access to major production areas contribute to the dominance of certain transportation corridors.

Storage: Overview

- Key Drivers: Growing demand for natural gas and crude oil storage capacity is a major driver.

- Dominance Factors: Strategic geographic location, proximity to production and consumption centers, and the availability of suitable land for storage facilities are crucial factors.

Colombia Oil & Gas Midstream Industry Product Innovations

Recent innovations encompass advanced pipeline monitoring systems, automated control technologies, and improved storage solutions optimized for safety and efficiency. These advancements enhance operational efficiency, reduce environmental impact, and improve security. Specific examples within the report highlight enhanced leak detection systems and the adoption of digital twin technology for real-time monitoring and predictive maintenance.

Propelling Factors for Colombia Oil & Gas Midstream Industry Growth

Several factors contribute to the growth of Colombia's oil and gas midstream sector. These include increasing domestic demand for natural gas fueled by industrial growth and power generation, coupled with government initiatives to improve infrastructure and attract foreign investment. The development of new pipeline projects, such as the Jobo-Medellin pipeline, further enhances the sector's growth.

Obstacles in the Colombia Oil & Gas Midstream Industry Market

Challenges include fluctuating oil and gas prices, the need for further infrastructure development, regulatory hurdles, and potential environmental concerns. Supply chain disruptions due to global events (e.g., the impact of geopolitical instability) also pose a significant obstacle.

Future Opportunities in Colombia Oil & Gas Midstream Industry

Future opportunities include expanding LNG import capacity, improving pipeline infrastructure, and developing new storage facilities to meet rising domestic demand. The exploration of new technologies to minimize environmental impact presents further opportunities for growth.

Major Players in the Colombia Oil & Gas Midstream Industry Ecosystem

- Ecopetrol SA

- Shell Colombia SA

- Exxon Mobil Corporation

- Chevron Corporation

- Fluor Corporation

Key Developments in Colombia Oil & Gas Midstream Industry Industry

- October 2022: Shanghai Engineering and Technology Corp. (SETCO) was awarded a contract to construct a 289-km natural gas pipeline from Canacol Energy Ltd.'s Jobo gas processing plant to Medellin. Initial capacity is projected at 100 MMscfd. This development significantly expands natural gas transportation capacity to a major consumption center.

- May 2022: Construction of the Jobo-Medellin natural gas pipeline commenced, with an anticipated operational date of December 2024, delivering 100 MMscfd of natural gas to Medellin. This project will significantly improve the reliability and efficiency of natural gas supply to a key region of Colombia.

Strategic Colombia Oil & Gas Midstream Industry Market Forecast

The Colombian oil and gas midstream market is poised for sustained growth driven by increasing domestic demand, ongoing infrastructure development, and strategic investments. Opportunities exist in expanding LNG infrastructure, enhancing pipeline networks, and improving storage capacities. The sector's future hinges on balancing economic growth with environmental sustainability and the implementation of robust regulatory frameworks.

Colombia Oil & Gas Midstream Industry Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

-

3. LNG Terminals

-

3.1. Overview

- 3.1.1. Existing Infrastructure

- 3.1.2. Projects in Pipeline

- 3.1.3. Upcoming Projects

-

3.1. Overview

Colombia Oil & Gas Midstream Industry Segmentation By Geography

- 1. Colombia

Colombia Oil & Gas Midstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Pipeline Sector is Likely to Remain Stagnant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.1.1. Existing Infrastructure

- 5.3.1.2. Projects in Pipeline

- 5.3.1.3. Upcoming Projects

- 5.3.1. Overview

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ecopetrol SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shell Colombia SA*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chevron Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fluor Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Ecopetrol SA

List of Figures

- Figure 1: Colombia Oil & Gas Midstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Colombia Oil & Gas Midstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Transportation 2019 & 2032

- Table 3: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Storage 2019 & 2032

- Table 4: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 5: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Transportation 2019 & 2032

- Table 8: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Storage 2019 & 2032

- Table 9: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 10: Colombia Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Oil & Gas Midstream Industry?

The projected CAGR is approximately > 1.52%.

2. Which companies are prominent players in the Colombia Oil & Gas Midstream Industry?

Key companies in the market include Ecopetrol SA, Shell Colombia SA*List Not Exhaustive, Exxon Mobil Corporation, Chevron Corporation, Fluor Corporation.

3. What are the main segments of the Colombia Oil & Gas Midstream Industry?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems.

6. What are the notable trends driving market growth?

Pipeline Sector is Likely to Remain Stagnant.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

October 2022: The construction of a 289-km OD natural gas pipeline from Canacol Energy Ltd's 300-MMscfd Jobo gas processing plant to Medellin, Colombia, was contracted out to Shanghai Engineering and Technology Corp. (SETCO). The pipeline's initial capacity is expected to be 100 MMscfd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Oil & Gas Midstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Oil & Gas Midstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Oil & Gas Midstream Industry?

To stay informed about further developments, trends, and reports in the Colombia Oil & Gas Midstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence