Key Insights

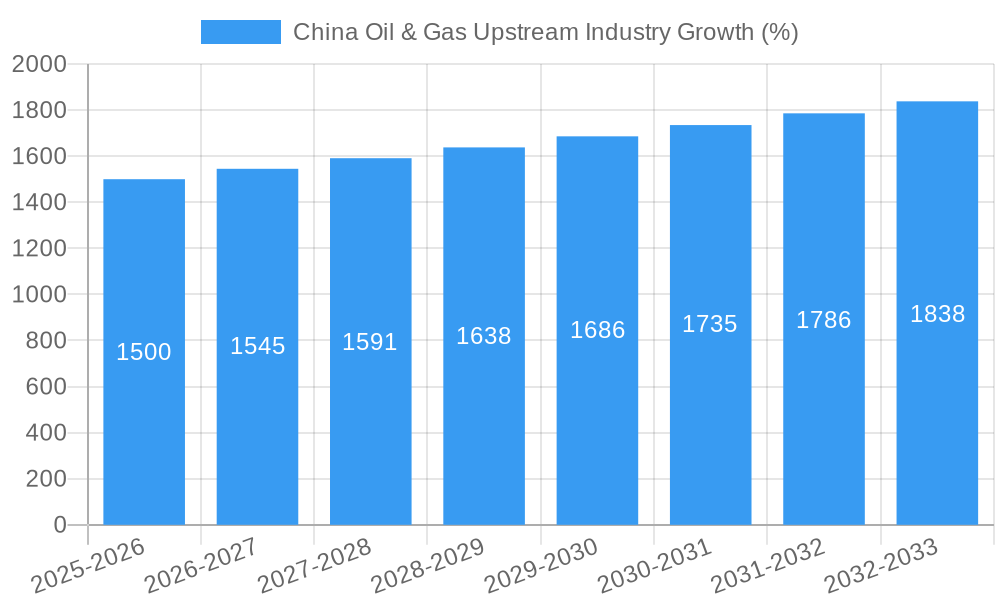

The China oil and gas upstream industry, a significant contributor to the nation's energy security, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. This expansion is driven by several factors. Firstly, China's persistent economic growth fuels an ever-increasing demand for energy, particularly in sectors like transportation, manufacturing, and power generation. Secondly, government initiatives aimed at enhancing domestic energy production and reducing reliance on imports are bolstering investment in exploration and production activities. Technological advancements in unconventional oil and gas extraction, such as shale gas development, are also playing a crucial role in expanding resource availability. Furthermore, strategic partnerships between domestic giants like Sinopec, CNPC, and CNOOC, and international players like ExxonMobil and Chevron, are fostering technological transfer and driving efficiency improvements. While challenges exist, including environmental regulations and the need for sustainable practices, the overall outlook for the sector remains positive. The increasing focus on renewable energy sources, however, presents a potential long-term restraint, requiring the industry to adapt and integrate cleaner energy solutions within its operations.

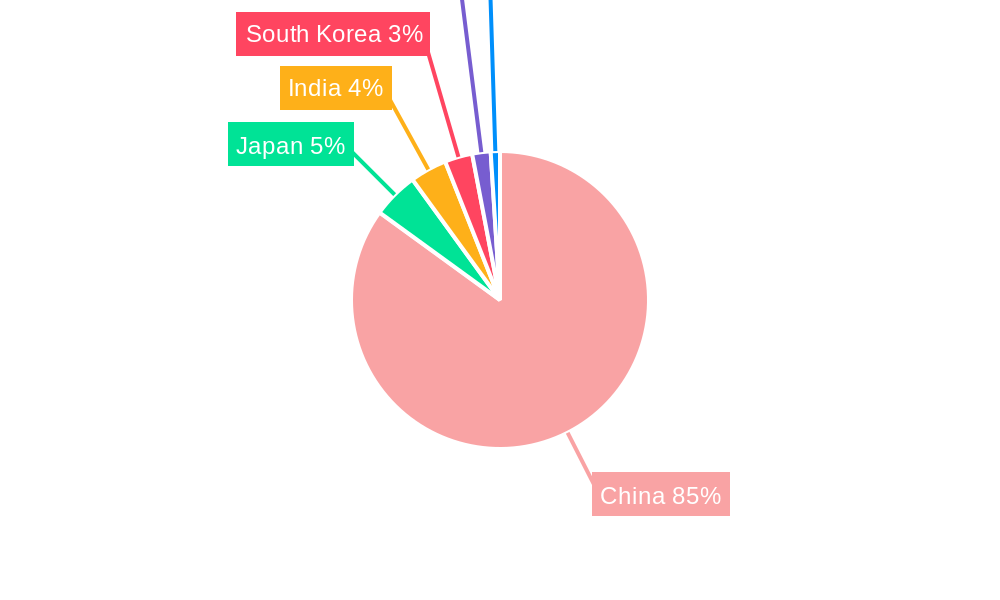

The industry's segmentation, encompassing crude oil, natural gas, and natural gas liquids (NGLs), across exploration, development, and production stages, reflects the diverse nature of operations. The Asia-Pacific region, particularly China, Japan, India, South Korea, and Australia, dominates the market share, with China being the central player due to its massive energy consumption and ongoing investments. Companies are actively pursuing strategies to optimize resource utilization, enhance production efficiency, and navigate the evolving regulatory landscape. This includes investments in advanced technologies, exploration of new reserves, and strategic collaborations to secure a leading position in the global energy market. The forecast period of 2025-2033 is expected to witness significant activity, shaping the future of China's energy landscape. Maintaining a balance between economic growth, energy security, and environmental sustainability will be critical for the industry's long-term success.

China Oil & Gas Upstream Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the China oil & gas upstream industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, leading players, technological advancements, and future growth prospects. The analysis encompasses key segments – Crude Oil, Natural Gas, and Natural Gas Liquids (NGLs) – across exploration, development, and production stages.

China Oil & Gas Upstream Industry Market Composition & Trends

This section delves into the competitive landscape of China's oil & gas upstream sector, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The report analyzes market share distribution amongst key players like China National Petroleum Corporation (CNPC), China National Offshore Oil Corporation (CNOOC), China Petroleum & Chemical Corporation (Sinopec), Chevron Corporation, Exxon Mobil Corporation, BP PLC, Shell PLC, and Yanchang Petroleum International Limited, providing insights into their strategic moves and market influence.

- Market Concentration: The report quantifies market share held by top players, revealing the level of competition and potential for disruption. xx% of the market is controlled by the top 5 players in 2025, with a projected xx% increase/decrease by 2033.

- M&A Activity: Analysis of major M&A deals, including deal values (in Millions) and their impact on market consolidation and technological advancements is included. The total value of M&A transactions in the period 2019-2024 reached approximately xx Million.

- Innovation Catalysts: The report identifies key technological advancements and their influence on exploration techniques, production efficiency, and cost reduction.

- Regulatory Landscape: A comprehensive overview of government policies, regulations, and their impact on investment decisions and operational strategies is presented.

- Substitute Products: Examination of alternative energy sources and their potential impact on the demand for oil and gas is included.

- End-User Profiles: Detailed insights into the major consumers of oil and gas from various sectors, along with consumption patterns and future projections are provided.

China Oil & Gas Upstream Industry Industry Evolution

This section traces the evolutionary path of China's oil & gas upstream industry, exploring market growth trajectories, technological progress, and evolving consumer demands. Utilizing a combination of historical data (2019-2024) and projected figures (2025-2033), the report illustrates the industry’s transformation. Specific data points, including compound annual growth rates (CAGR) for various segments and adoption rates of new technologies will highlight the dynamics of market expansion and technological transformation. Analysis will also cover the increasing focus on environmental sustainability and its influence on industry practices and investments.

Leading Regions, Countries, or Segments in China Oil & Gas Upstream Industry

This section identifies the dominant regions, countries, and segments within China's oil & gas upstream industry. The analysis will focus on the relative performance of Crude Oil, Natural Gas, and Natural Gas Liquids (NGLs) production and exploration across various geographical areas and production stages (Exploration, Development, Production).

Key Drivers:

- Investment Trends: Analysis of capital expenditure in different regions and segments.

- Regulatory Support: Assessment of government policies and incentives influencing regional growth.

- Resource Abundance: Evaluation of the geological potential of different regions.

Dominance Factors: In-depth analysis will explain why certain regions or segments are more successful than others, considering factors such as resource availability, infrastructural development, and government support.

China Oil & Gas Upstream Industry Product Innovations

This section showcases recent product innovations, their applications, and performance benchmarks. The report highlights unique selling propositions (USPs) and technological advancements that are enhancing efficiency, safety, and sustainability within the industry. Examples may include improved drilling technologies, enhanced oil recovery (EOR) methods, and advanced exploration techniques.

Propelling Factors for China Oil & Gas Upstream Industry Growth

This section outlines the key growth drivers, categorized into technological, economic, and regulatory influences. The analysis will focus on how these factors stimulate industry expansion. For instance, technological innovations leading to improved resource extraction efficiency, robust economic growth fueling increased energy demand, and supportive government policies encouraging investment in the sector.

Obstacles in the China Oil & Gas Upstream Industry Market

This section identifies major barriers and constraints hindering market growth. This includes regulatory hurdles (e.g., environmental regulations, licensing complexities), supply chain disruptions (e.g., geopolitical instability, material shortages), and intense competition amongst various players. Quantitative analysis of the impact of these obstacles on market development will be provided.

Future Opportunities in China Oil & Gas Upstream Industry

This section highlights promising avenues for future growth, including new market penetration strategies, technological advancements (e.g., carbon capture, utilization, and storage (CCUS)), and shifts in consumer preferences toward cleaner energy sources. The report underscores the importance of adaptation and innovation in capturing these opportunities.

Major Players in the China Oil & Gas Upstream Industry Ecosystem

- Yanchang Petroleum International Limited

- Exxon Mobil Corporation

- China National Petroleum Corporation (CNPC)

- China National Offshore Oil Corporation (CNOOC)

- Chevron Corporation

- BP PLC

- Shell PLC

- China Petroleum & Chemical Corporation (Sinopec)

Key Developments in China Oil & Gas Upstream Industry Industry

- June 2021: CNPC discovers a new 1-billion-ton super-deep oil and gas area in the Tarim Basin. This discovery significantly boosts China's oil reserves and underscores the potential of deepwater exploration.

- August 2021: PetroChina announces a massive shale oil discovery (1.268 billion tons) at the Gulong prospect in the Songliao Basin, demonstrating the viability of shale oil extraction in China.

- January 2022: Sinopec discovers a new oil and gas area (approximately 100 million tons of reserves) in the Tarim Basin, further enhancing China's energy security and showcasing the ongoing exploration success in the region.

Strategic China Oil & Gas Upstream Industry Market Forecast

The future of China's oil & gas upstream industry is promising, driven by sustained domestic demand, technological breakthroughs, and ongoing exploration activities. Strategic investments in new technologies, coupled with government support and the potential for further large-scale discoveries, are poised to propel market growth and further solidify China's position as a significant player in the global energy landscape. The report projects continued growth in the coming years, with the potential for significant gains in production and reserves.

China Oil & Gas Upstream Industry Segmentation

- 1. Onshore

- 2. Offshore

China Oil & Gas Upstream Industry Segmentation By Geography

- 1. China

China Oil & Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. China China Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan China Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 8. India China Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea China Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan China Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia China Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific China Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Yanchang Petroleum International Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Exxon Mobil Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 China National Petroleum Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 China National Offshore Oil Corporation (CNOOC)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Chevron Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BP PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Shell PLC*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 China Petroleum & Chemical Corporation (Sinopec)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Yanchang Petroleum International Limited

List of Figures

- Figure 1: China Oil & Gas Upstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Oil & Gas Upstream Industry Share (%) by Company 2024

List of Tables

- Table 1: China Oil & Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Oil & Gas Upstream Industry Revenue Million Forecast, by Onshore 2019 & 2032

- Table 3: China Oil & Gas Upstream Industry Revenue Million Forecast, by Offshore 2019 & 2032

- Table 4: China Oil & Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Oil & Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China China Oil & Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan China Oil & Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India China Oil & Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea China Oil & Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan China Oil & Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia China Oil & Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific China Oil & Gas Upstream Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: China Oil & Gas Upstream Industry Revenue Million Forecast, by Onshore 2019 & 2032

- Table 14: China Oil & Gas Upstream Industry Revenue Million Forecast, by Offshore 2019 & 2032

- Table 15: China Oil & Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Oil & Gas Upstream Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the China Oil & Gas Upstream Industry?

Key companies in the market include Yanchang Petroleum International Limited, Exxon Mobil Corporation, China National Petroleum Corporation, China National Offshore Oil Corporation (CNOOC), Chevron Corporation, BP PLC, Shell PLC*List Not Exhaustive, China Petroleum & Chemical Corporation (Sinopec).

3. What are the main segments of the China Oil & Gas Upstream Industry?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand4.; Rsing Investments in the Coal Industry.

6. What are the notable trends driving market growth?

Offshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In January 2022, Sinopec discovered a new oil and gas area with approximately 100 million tons of reserves in the Tarim Basin of northwest China's Xinjiang Uygur Autonomous Region. These latest reserves in Sinopec's Shunbei oil and gas field are estimated to provide 88 million tons of condensate oil and 290 billion cubic meters of natural gas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Oil & Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Oil & Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Oil & Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the China Oil & Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence