Key Insights

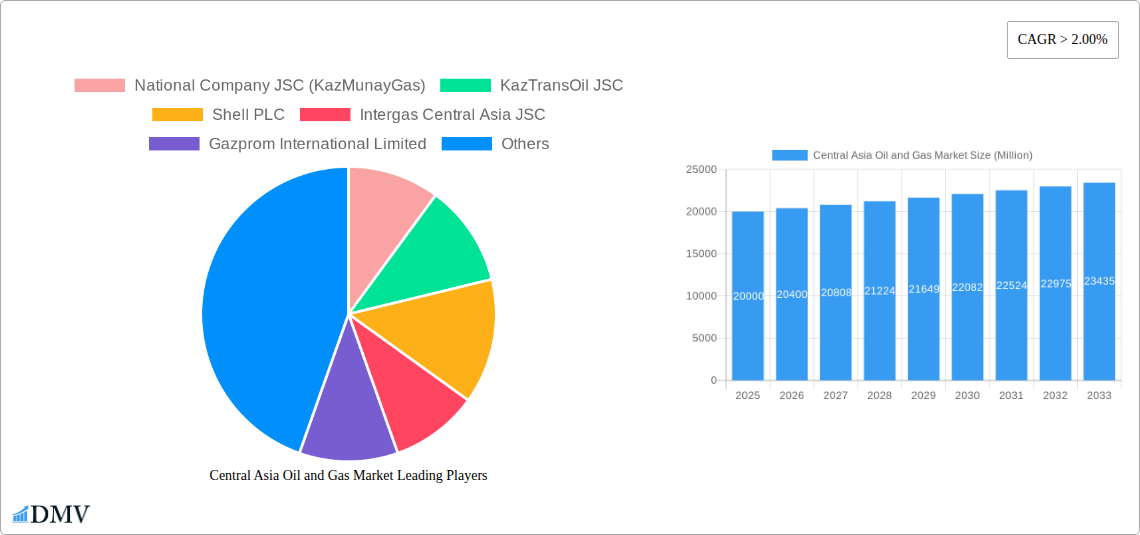

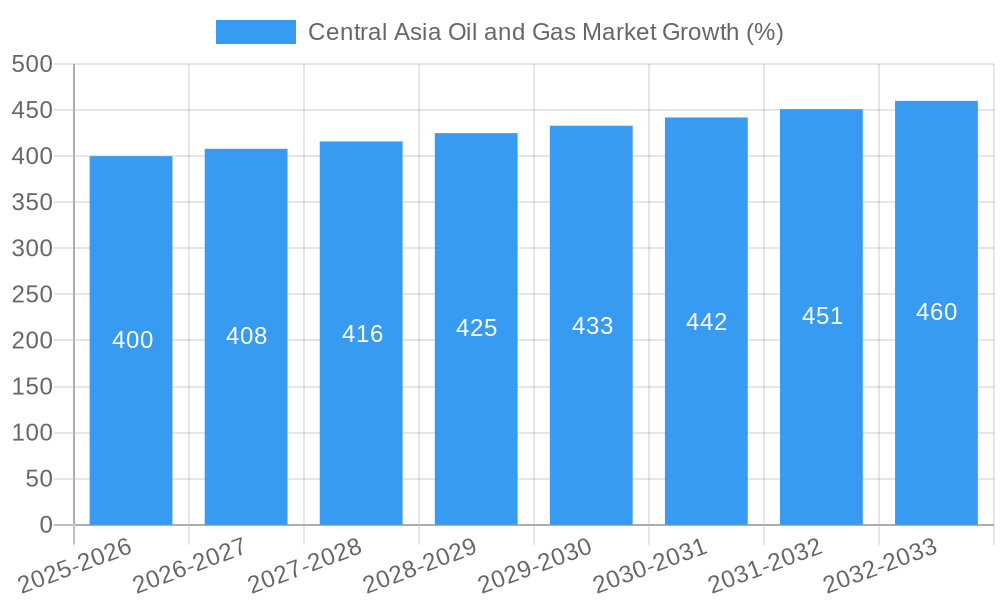

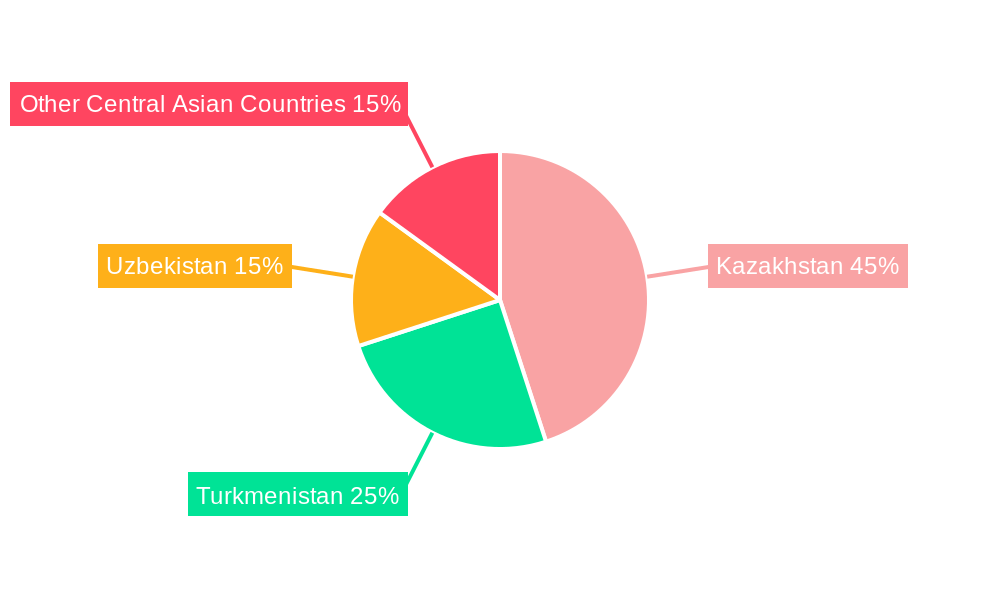

The Central Asian oil and gas market, encompassing countries like Kazakhstan, Turkmenistan, and Uzbekistan, presents a compelling investment landscape characterized by significant growth potential. Driven by increasing global energy demand, particularly from Asia-Pacific nations like China and India, the region's substantial reserves are poised for continued exploitation. A compound annual growth rate (CAGR) exceeding 2% indicates steady expansion, projected to reach a market value significantly exceeding the current estimate within the forecast period (2025-2033). Key drivers include ongoing infrastructure development, increasing foreign direct investment (FDI) in exploration and production, and government initiatives aimed at boosting energy exports. However, geopolitical instability and fluctuating global oil prices represent considerable challenges. Furthermore, the market is segmented into upstream (exploration and production), midstream (transportation and storage), and downstream (refining and distribution) sectors, each experiencing varied growth trajectories influenced by specific regional dynamics and technological advancements. The presence of major international players like Shell and Lukoil alongside national oil companies such as KazMunayGas indicates a competitive yet potentially lucrative environment for both established corporations and emerging market participants.

The forecast period will likely witness a shift towards cleaner energy sources, creating pressure on the industry to adopt more sustainable practices. This will involve integrating renewable energy sources, reducing methane emissions, and improving operational efficiencies. The market’s growth will also be influenced by the extent to which regional governments can successfully attract further FDI, manage resource allocation effectively, and ensure political stability. The success of individual companies hinges on their agility in adapting to changing regulatory landscapes and consumer preferences, as well as their capacity to navigate geopolitical complexities and maintain robust operational safety standards. The strategic location of Central Asia, positioned as a vital link between major energy consumers and producers, ensures its continuing relevance in the global energy market, despite challenges.

Central Asia Oil and Gas Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Central Asia oil and gas market, offering valuable insights for stakeholders seeking to understand the region's evolving energy landscape. Covering the period from 2019 to 2033, with a focus on 2025, this report unravels market dynamics, identifies key players, and forecasts future growth potential. With a meticulous examination of upstream, midstream, and downstream segments, this report is an essential resource for informed decision-making.

Central Asia Oil and Gas Market Composition & Trends

This section delves into the intricate structure of the Central Asia oil and gas market, exploring its concentration levels, innovation drivers, regulatory environment, substitute product influences, end-user behaviors, and merger & acquisition (M&A) activity. The market's competitive landscape is analyzed, revealing the share distribution among key players like National Company JSC (KazMunayGas), KazTransOil JSC, and others. We examine the impact of regulatory changes on market dynamics, as well as the influence of substitute energy sources and technological innovations. Furthermore, the report meticulously details M&A activities, evaluating the deal values and their implications on market consolidation. Expected total M&A deal value for the period 2019-2024 is estimated at $xx Million.

- Market Share Distribution: KazMunayGas holds a significant market share in the upstream sector, with a predicted xx% in 2025. Other players hold smaller, yet impactful shares.

- M&A Activity: Significant M&A activity was observed in the historical period (2019-2024), with an estimated total deal value of $xx Million. This is expected to continue into the forecast period.

- Regulatory Landscape: The regulatory framework significantly impacts investment decisions and market access. Fluctuations in regulatory policies can influence market concentration and investment flows.

- Innovation Catalysts: Technological advancements in exploration, extraction, and processing drive innovation and efficiency improvements across the value chain.

Central Asia Oil and Gas Market Industry Evolution

This section presents a detailed analysis of the Central Asia oil and gas market's growth trajectory, technological advancements, and evolving consumer preferences over the study period (2019-2033). We explore the historical period (2019-2024), analyzing market growth rates, technological adoption rates, and shifts in consumer demands. The report provides specific data points, including year-on-year growth rates and adoption metrics for key technologies. Market growth during the historical period averaged xx% annually, with expectations of xx% annual growth during the forecast period (2025-2033). Factors such as increasing energy demand, geopolitical shifts, and technological innovations shape the market's evolution. The transition towards cleaner energy sources is also explored, along with its impact on the industry.

Leading Regions, Countries, or Segments in Central Asia Oil and Gas Market

This section identifies the leading regions, countries, and segments within the Central Asia oil and gas market. The report examines the dominance of specific sectors (Upstream, Midstream, Downstream) and geographic locations, providing in-depth analysis of the factors contributing to their leadership.

- Upstream: Kazakhstan's robust oil and gas reserves and significant production capacity make it a leading player in the upstream sector.

- Midstream: The development of pipeline infrastructure and transportation networks drives the midstream sector's growth.

- Downstream: The growth of refining and petrochemical industries within the region shapes the downstream sector.

Key Drivers:

- Investment Trends: Significant investments in exploration and production activities fuel growth, particularly in Kazakhstan and Turkmenistan.

- Regulatory Support: Government policies and incentives influence investment decisions and market access.

- Resource Abundance: The abundance of oil and gas reserves in certain areas serves as a key driver for sector dominance.

Central Asia Oil and Gas Market Product Innovations

This section highlights recent product innovations and advancements in oil and gas technologies within Central Asia. These include improved drilling techniques, enhanced oil recovery methods, and innovative pipeline technologies to ensure efficient and safe operation. This section will cover the specific applications and performance metrics of these innovations, emphasizing their unique selling propositions and technological advancements that contribute to efficiency gains, cost reductions, and environmental improvements.

Propelling Factors for Central Asia Oil and Gas Market Growth

Several key factors drive the growth of the Central Asia oil and gas market. These include:

- Technological Advancements: Improvements in exploration and extraction techniques unlock new reserves and increase production efficiency.

- Economic Growth: The region's economic development fuels energy demand, boosting market growth.

- Government Support: Government policies and initiatives foster investment and development in the sector.

Obstacles in the Central Asia Oil and Gas Market

The Central Asia oil and gas market faces several challenges:

- Geopolitical Instability: Regional political uncertainties create investment risks and supply chain disruptions, impacting market stability.

- Infrastructure Limitations: Inadequate infrastructure in some regions hinders efficient production and transportation.

- Environmental Concerns: Growing environmental awareness puts pressure on the industry to adopt sustainable practices.

Future Opportunities in Central Asia Oil and Gas Market

The Central Asia oil and gas market presents several promising opportunities:

- Exploration of New Reserves: Significant untapped reserves offer substantial potential for future growth.

- Technological Innovation: Adoption of advanced technologies boosts efficiency and reduces costs.

- Regional Cooperation: Increased collaboration among regional countries enhances market integration and development.

Major Players in the Central Asia Oil and Gas Market Ecosystem

- National Company JSC (KazMunayGas)

- KazTransOil JSC

- Shell PLC

- Intergas Central Asia JSC

- Gazprom International Limited

- PJSC Lukoil Oil Company

- Chevron Corporation

- JSC Turkmengaz

- National Company QazaqGaz JSC

- Sinopec Oilfield Service Corporation

Key Developments in Central Asia Oil and Gas Market Industry

- August 2022: Kazakhstan announced plans to diversify its crude oil export routes via Azerbaijan, seeking alternatives to Russia-controlled pipelines. This significantly impacted market dynamics, highlighting the geopolitical risks in the region.

- August 2022: Turkmenistan's purchase of drilling pipes from China demonstrates investment in domestic production capacity enhancement.

- June 2022: The MoU between Chevron and KazMunayGas to explore lower-carbon business opportunities signals a shift towards sustainability in the industry.

Strategic Central Asia Oil and Gas Market Forecast

The Central Asia oil and gas market is poised for significant growth driven by rising energy demand, ongoing exploration activities, and technological advancements. Future opportunities lie in diversifying export routes, improving infrastructure, and embracing sustainable practices. The market's potential is substantial, promising significant returns for investors and stakeholders who understand and adapt to the evolving dynamics of the region. The forecast period (2025-2033) anticipates robust growth, driven primarily by exploration in new areas and the implementation of innovative technologies aimed at increasing efficiency and sustainability.

Central Asia Oil and Gas Market Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Geography

- 2.1. Kazakhstan

- 2.2. Tajikistan

- 2.3. Turkmenistan

- 2.4. Rest of Central Asia

Central Asia Oil and Gas Market Segmentation By Geography

- 1. Kazakhstan

- 2. Tajikistan

- 3. Turkmenistan

- 4. Rest of Central Asia

Central Asia Oil and Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Sector to dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Kazakhstan

- 5.2.2. Tajikistan

- 5.2.3. Turkmenistan

- 5.2.4. Rest of Central Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kazakhstan

- 5.3.2. Tajikistan

- 5.3.3. Turkmenistan

- 5.3.4. Rest of Central Asia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Kazakhstan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Kazakhstan

- 6.2.2. Tajikistan

- 6.2.3. Turkmenistan

- 6.2.4. Rest of Central Asia

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Tajikistan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Kazakhstan

- 7.2.2. Tajikistan

- 7.2.3. Turkmenistan

- 7.2.4. Rest of Central Asia

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Turkmenistan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Kazakhstan

- 8.2.2. Tajikistan

- 8.2.3. Turkmenistan

- 8.2.4. Rest of Central Asia

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Rest of Central Asia Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Kazakhstan

- 9.2.2. Tajikistan

- 9.2.3. Turkmenistan

- 9.2.4. Rest of Central Asia

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. China Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 12. India Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Central Asia Oil and Gas Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 National Company JSC (KazMunayGas)

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 KazTransOil JSC

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Shell PLC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Intergas Central Asia JSC

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Gazprom International Limited

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 PJSC Lukoil Oil Company

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Chevron Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 JSC Turkmengaz

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 National Company QazaqGaz JSC

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Sinopec Oilfield Service Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 National Company JSC (KazMunayGas)

List of Figures

- Figure 1: Central Asia Oil and Gas Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Central Asia Oil and Gas Market Share (%) by Company 2024

List of Tables

- Table 1: Central Asia Oil and Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Region 2019 & 2032

- Table 3: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 5: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 7: Central Asia Oil and Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Region 2019 & 2032

- Table 9: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 11: China Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 13: Japan Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 15: India Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 17: South Korea Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 21: Australia Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Central Asia Oil and Gas Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Central Asia Oil and Gas Market Volume (Metric Tonns) Forecast, by Application 2019 & 2032

- Table 25: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 26: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 27: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 29: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 31: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 32: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 33: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 35: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 37: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 38: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 39: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 41: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

- Table 43: Central Asia Oil and Gas Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 44: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Sector 2019 & 2032

- Table 45: Central Asia Oil and Gas Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Geography 2019 & 2032

- Table 47: Central Asia Oil and Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Central Asia Oil and Gas Market Volume Metric Tonns Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central Asia Oil and Gas Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Central Asia Oil and Gas Market?

Key companies in the market include National Company JSC (KazMunayGas), KazTransOil JSC, Shell PLC, Intergas Central Asia JSC, Gazprom International Limited, PJSC Lukoil Oil Company, Chevron Corporation, JSC Turkmengaz, National Company QazaqGaz JSC, Sinopec Oilfield Service Corporation.

3. What are the main segments of the Central Asia Oil and Gas Market?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Upstream Sector to dominate the market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In August 2022, Kazakhstan announced plans to sell some of its crude oil through Azerbaijan's most significant oil pipeline as the nation seeks alternatives to a route Russia threatened to shut. Kazakh oil exports account for more than 1 percent of world supplies, or roughly 1.4 million barrels per day (BPD).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tonns.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central Asia Oil and Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central Asia Oil and Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central Asia Oil and Gas Market?

To stay informed about further developments, trends, and reports in the Central Asia Oil and Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence