Key Insights

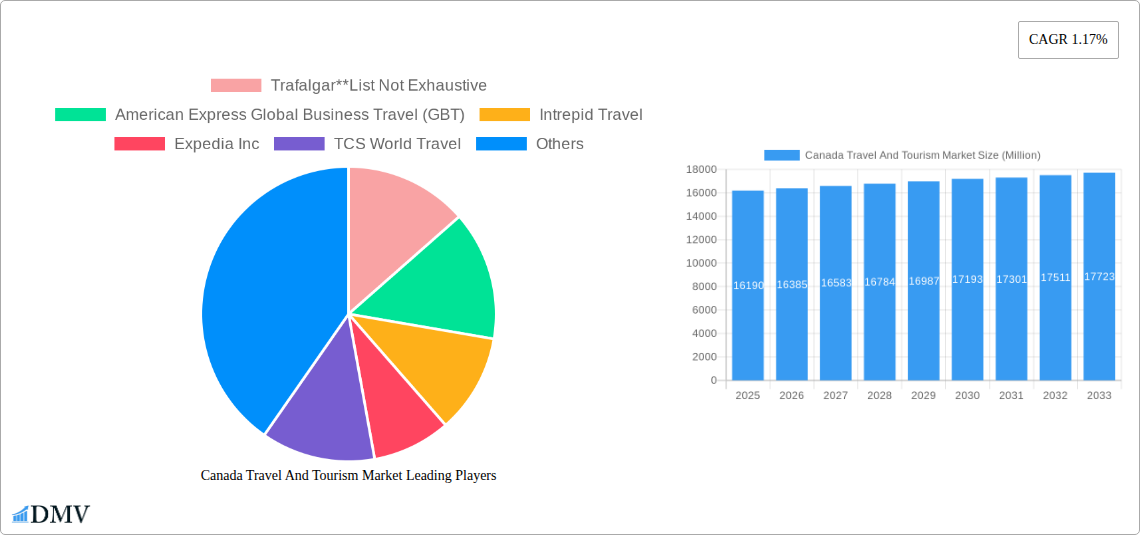

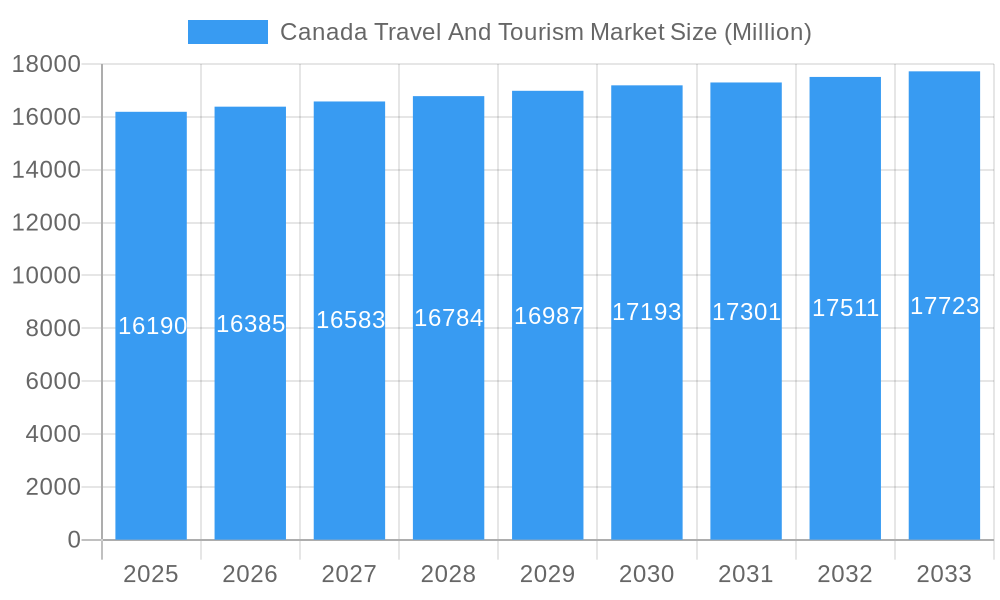

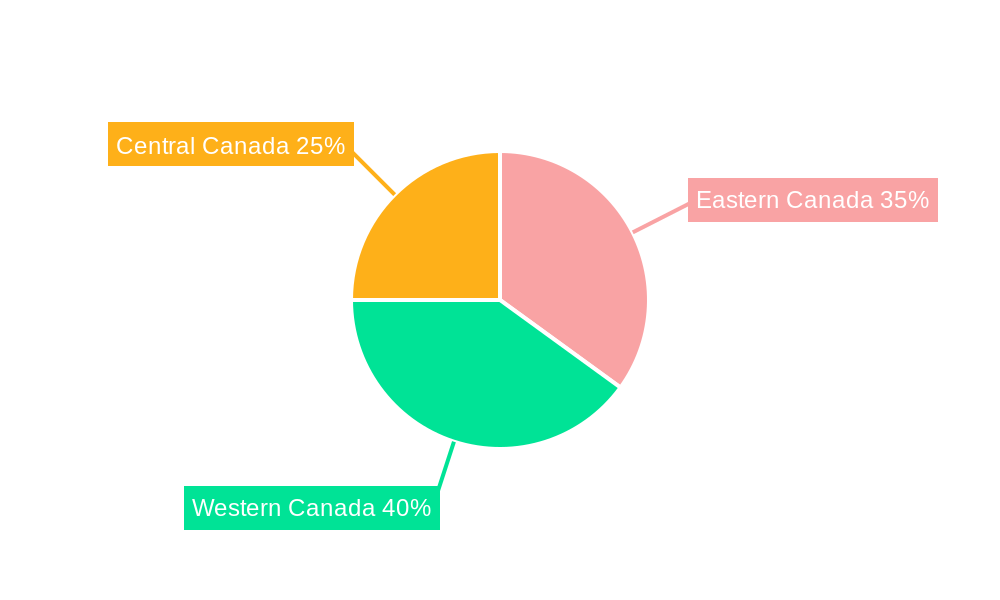

The Canada Travel and Tourism market, valued at $16.19 billion in 2025, exhibits a steady growth trajectory with a Compound Annual Growth Rate (CAGR) of 1.17% from 2025 to 2033. This moderate growth reflects a combination of factors. Drivers include increasing disposable incomes among Canadians, a growing interest in domestic and international travel experiences (particularly leisure and adventure tourism), and government initiatives promoting tourism. Trends show a significant shift towards online booking platforms, mirroring global patterns. While the market benefits from Canada's diverse landscapes and cultural attractions, constraints include seasonality, reliance on international tourism (vulnerable to global economic fluctuations and geopolitical events), and the rising cost of travel. Segmentation reveals a robust leisure travel segment, complemented by significant business and education tourism. The domestic travel market is likely to continue expanding due to the increasing appeal of exploring Canada's diverse regions (Eastern, Western, and Central Canada). The presence of major players like Trafalgar, American Express GBT, and Expedia highlights the market's competitiveness and potential for further consolidation. The forecast period of 2025-2033 suggests continued, albeit gradual, market expansion, driven by sustained economic growth and evolving traveler preferences.

Canada Travel And Tourism Market Market Size (In Billion)

The forecast period will see continued growth in online bookings, alongside a persistent demand for unique and sustainable travel experiences. The market will likely witness increased competition amongst established and emerging players, leading to innovative offerings and competitive pricing. The segment breakdown indicates a diverse market with potential for specialized growth within niche areas like medical and sports tourism. Effective marketing strategies focusing on highlighting Canada's diverse landscapes and unique experiences will be crucial for attracting both domestic and international tourists. The Canadian government's role in supporting sustainable tourism practices and improving infrastructure will further influence market growth during this period. Regional variations in growth are anticipated, with potentially higher growth rates in regions with strong tourism infrastructure and marketing campaigns.

Canada Travel And Tourism Market Company Market Share

Canada Travel and Tourism Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Canada travel and tourism market, encompassing historical data (2019-2024), the current market (2025), and a comprehensive forecast (2025-2033). It delves into market segmentation, key players, growth drivers, challenges, and future opportunities, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The report leverages extensive primary and secondary research to deliver actionable intelligence, empowering informed decision-making. The total market size is estimated at xx Million in 2025.

Canada Travel and Tourism Market Market Composition & Trends

This section offers a granular examination of the Canadian travel and tourism market landscape. We analyze market concentration, identifying key players and their respective market shares. The report explores innovation catalysts, such as technological advancements in booking platforms and sustainable tourism initiatives, and examines the evolving regulatory landscape and its impact on market operations. Substitute products, emerging travel trends, and the shifting profiles of end-users are meticulously analyzed. Furthermore, the report assesses the impact of mergers and acquisitions (M&A) activities, including deal values and their influence on market dynamics. The competitive landscape is examined across various segments, including:

- Market Share Distribution: [Insert data on market share distribution for key players. e.g., Expedia Inc. holds xx% market share, followed by Booking Holdings Inc. with xx%, etc.]

- M&A Activity: [Insert data on M&A activity, e.g., "In 2024, there were xx M&A deals in the Canadian travel and tourism sector totaling xx Million in value."]

- Innovation Catalysts: Growth of sustainable tourism, technological advancements in booking and travel management systems.

- Regulatory Landscape: Federal and provincial regulations affecting tourism operations and consumer protection.

- Substitute Products: Staycations, alternative vacation experiences, and the rise of the “work from anywhere” trend.

- End-User Profiles: Analysis of demographic trends, travel preferences, and spending patterns of various traveler segments (e.g., leisure, business, education).

Canada Travel and Tourism Market Industry Evolution

This section provides a comprehensive overview of the Canada travel and tourism market's evolution from 2019 to 2033. We examine market growth trajectories, charting the impact of external factors like economic fluctuations, global events, and pandemics. The analysis incorporates technological advancements, including the proliferation of online booking platforms, mobile travel apps, and AI-powered travel planning tools. Furthermore, it details shifting consumer demands, highlighting trends such as the increasing preference for sustainable and experiential travel, personalized travel experiences, and the growing importance of safety and hygiene. Specific data points on growth rates and adoption metrics for key technologies will be provided. [Insert paragraph with growth rates and adoption metrics for online booking, sustainable tourism, etc. Example: “Online travel bookings grew by xx% annually from 2020 to 2024, driven by increasing smartphone penetration…”]

Leading Regions, Countries, or Segments in Canada Travel and Tourism Market

This section identifies the dominant regions, countries, and segments within the Canadian travel and tourism market across various categorizations. The analysis considers market size, growth rate, and key drivers for each segment.

By Application:

- International Tourism: [Analysis of international tourist arrivals, spending patterns, and key source markets. Include factors driving growth.]

- Domestic Tourism: [Analysis of domestic travel patterns, popular destinations, and factors influencing domestic tourism growth.]

By Booking:

- Online Bookings: [Analysis of the online booking market, key players, and factors driving online booking growth. Include statistics on online booking penetration.]

- Offline Bookings: [Analysis of the offline booking market, its share, and factors influencing its growth or decline.]

By Type:

- Leisure Travel: [Analysis of leisure travel trends, popular destinations, and factors driving growth.]

- Education Travel: [Analysis of the education travel market, including student travel and educational tours.]

- Business Travel: [Analysis of the business travel market, including corporate travel and MICE (Meetings, Incentives, Conferences, and Exhibitions).]

- Sports Tourism: [Analysis of sports tourism, including events, spectator travel, and participation in sports activities.]

- Medical Tourism: [Analysis of medical tourism trends, including inbound and outbound medical travel.]

- Other Types: [Analysis of niche tourism segments, such as adventure travel, eco-tourism, etc.]

[Insert detailed paragraphs analyzing the dominant segment in each category, including factors driving its dominance, e.g., government initiatives, infrastructure development, and consumer preferences.]

Canada Travel and Tourism Market Product Innovations

Recent years have witnessed significant product innovation within the Canadian travel and tourism sector. This includes advancements in booking platforms offering personalized travel itineraries and integrated services, the rise of sustainable tourism packages promoting eco-friendly practices, and the development of immersive experiences catering to evolving traveler preferences. These innovations leverage technological advancements, such as AI-powered chatbots for customer service and virtual reality tours for destination previews. Unique selling propositions include personalized recommendations, curated experiences, and seamless booking processes.

Propelling Factors for Canada Travel and Tourism Market Growth

Several key factors are driving the growth of the Canada travel and tourism market. Technological advancements, such as improved online booking platforms and mobile apps, have significantly enhanced user experience and accessibility. A robust economy fuels consumer spending on travel and leisure activities. Favorable government policies, such as investment in tourism infrastructure and promotion of sustainable practices, contribute to market growth. Specific examples include the government's investment in Indigenous tourism strategies and the development of new tourism infrastructure in various regions.

Obstacles in the Canada Travel and Tourism Market Market

Despite the positive growth trajectory, the Canadian travel and tourism market faces several challenges. Regulatory hurdles, including visa requirements and environmental regulations, can hinder market expansion. Supply chain disruptions, such as airline cancellations and accommodation shortages, affect tourism operations. Intense competition among travel providers necessitates continuous innovation and strategic differentiation. Furthermore, external factors such as economic downturns and geopolitical instability can significantly impact travel patterns and consumer confidence.

Future Opportunities in Canada Travel and Tourism Market

The future holds significant opportunities for growth in the Canadian travel and tourism market. The increasing popularity of sustainable and experiential tourism presents lucrative prospects for businesses that prioritize eco-friendly practices and immersive experiences. Technological innovations, such as AI-powered personalized travel planning tools and virtual reality experiences, create new revenue streams and enhance customer engagement. Untapped niche markets, like adventure tourism and medical tourism, hold potential for expansion.

Major Players in the Canada Travel and Tourism Market Ecosystem

- Trafalgar

- American Express Global Business Travel (GBT)

- Intrepid Travel

- Expedia Inc

- TCS World Travel

- BCD Travel

- Topdeck Travel Ltd

- Exodus Travels Ltd

- Abercrombie & Kent USA LLC

- Booking Holdings Inc

Key Developments in Canada Travel and Tourism Market Industry

October 2023: The Government of Canada invested USD 500,000 in tourism across British Columbia, supporting the Aboriginal Tourism Association of British Columbia's "Invest in Iconic" tourism strategy with Destination BC. This initiative aims to stimulate local economies and attract new visitors by promoting Indigenous tourism.

October 2022: Sabre and BCD Travel announced a significant technology partnership to drive innovation and growth in corporate travel. This collaboration is expected to increase booking levels for BCD Travel and foster the development of advanced travel solutions within the corporate travel ecosystem.

Strategic Canada Travel and Tourism Market Market Forecast

The Canadian travel and tourism market is poised for continued growth over the forecast period (2025-2033). Key growth catalysts include increasing disposable incomes, technological advancements enhancing travel experiences, and supportive government policies fostering sustainable and responsible tourism. The focus on immersive and personalized travel experiences, coupled with the expansion of niche tourism segments, will further drive market expansion. The rising popularity of sustainable travel practices presents both opportunities and challenges for businesses to adapt and meet evolving consumer expectations.

Canada Travel And Tourism Market Segmentation

-

1. Type

- 1.1. Leisure

- 1.2. Education

- 1.3. Business

- 1.4. Sports

- 1.5. Medical Tourism

- 1.6. Other Types

-

2. Application

- 2.1. International

- 2.2. Domestic

-

3. Booking

- 3.1. Online

- 3.2. Offline

Canada Travel And Tourism Market Segmentation By Geography

- 1. Canada

Canada Travel And Tourism Market Regional Market Share

Geographic Coverage of Canada Travel And Tourism Market

Canada Travel And Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market

- 3.3. Market Restrains

- 3.3.1. Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies

- 3.4. Market Trends

- 3.4.1. Increasing Interest in Multi-Day Tours is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Travel And Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Leisure

- 5.1.2. Education

- 5.1.3. Business

- 5.1.4. Sports

- 5.1.5. Medical Tourism

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. International

- 5.2.2. Domestic

- 5.3. Market Analysis, Insights and Forecast - by Booking

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trafalgar**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 American Express Global Business Travel (GBT)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intrepid Travel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Expedia Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TCS World Travel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BCD Travel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Topdeck Travel Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Exodus Travels Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abercrombie & Kent USA LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Booking Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Trafalgar**List Not Exhaustive

List of Figures

- Figure 1: Canada Travel And Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Travel And Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 4: Canada Travel And Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Canada Travel And Tourism Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Canada Travel And Tourism Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Canada Travel And Tourism Market Revenue Million Forecast, by Booking 2020 & 2033

- Table 8: Canada Travel And Tourism Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Travel And Tourism Market?

The projected CAGR is approximately 1.17%.

2. Which companies are prominent players in the Canada Travel And Tourism Market?

Key companies in the market include Trafalgar**List Not Exhaustive, American Express Global Business Travel (GBT), Intrepid Travel, Expedia Inc, TCS World Travel, BCD Travel, Topdeck Travel Ltd, Exodus Travels Ltd, Abercrombie & Kent USA LLC, Booking Holdings Inc.

3. What are the main segments of the Canada Travel And Tourism Market?

The market segments include Type, Application, Booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Domestic Travel Driving the Market; Growing Tourist Footfall Driving the Market.

6. What are the notable trends driving market growth?

Increasing Interest in Multi-Day Tours is Driving the Market.

7. Are there any restraints impacting market growth?

Restrictions on Purchases of Number of Products; Customs Regulations and Taxation Policies.

8. Can you provide examples of recent developments in the market?

October 2023: The Government of Canada invested in tourism across British Columbia to attract new visitors and stimulate local economies. Funding of USD 500,000 has been provided to the Aboriginal Tourism Association of British Columbia to help Indigenous Tourism BC develop its "Invest in Iconic" tourism strategy with Destination BC to grow the Indigenous tourism sector in British Columbia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Travel And Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Travel And Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Travel And Tourism Market?

To stay informed about further developments, trends, and reports in the Canada Travel And Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence