Key Insights

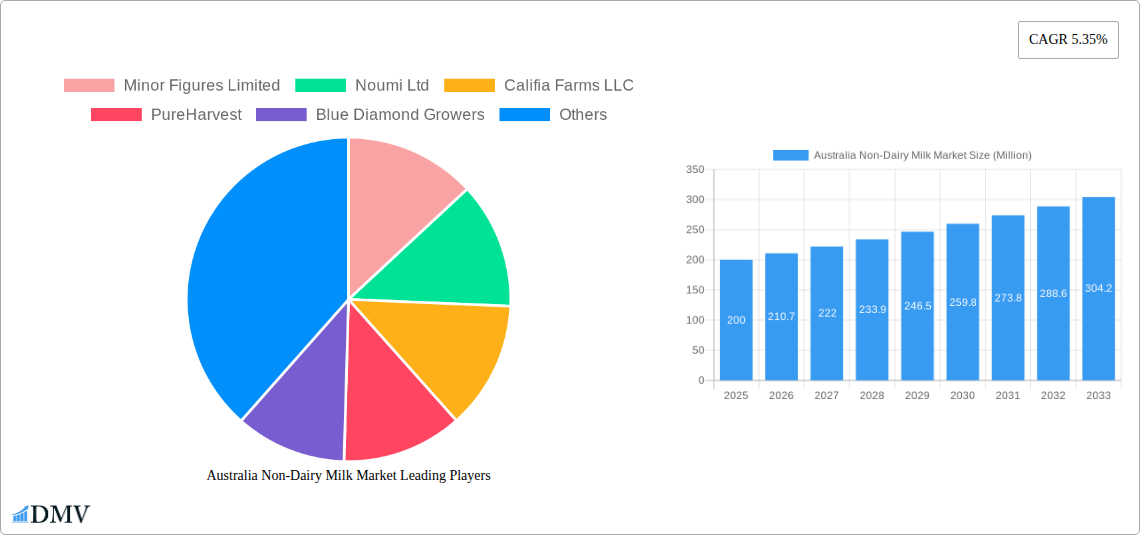

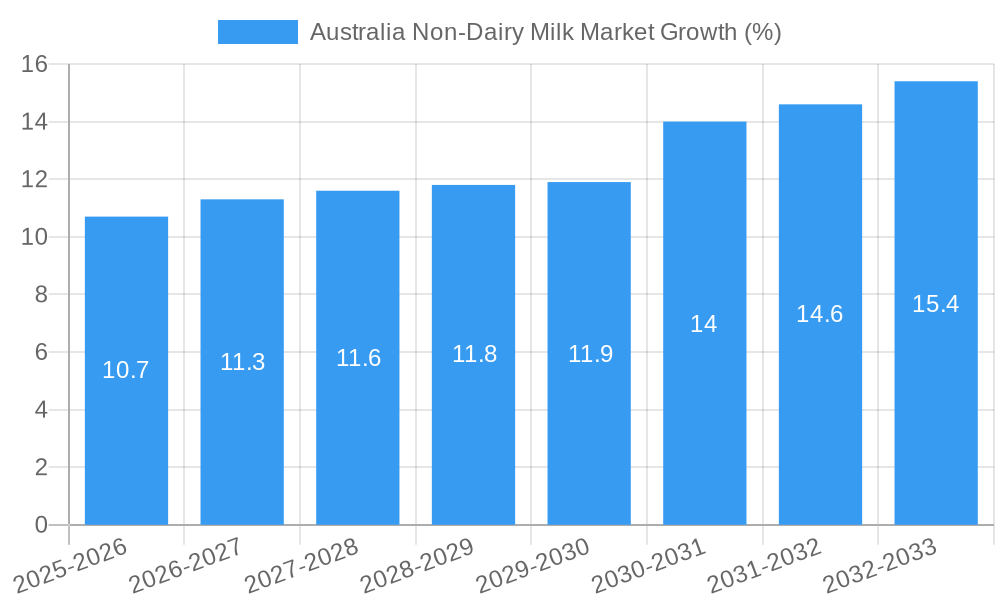

The Australian non-dairy milk market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.35% from 2025 to 2033. This expansion is fueled by several key factors. Rising consumer awareness of health benefits associated with plant-based diets, coupled with increasing concerns regarding lactose intolerance and animal welfare, are driving significant demand for alternatives like almond, soy, oat, and coconut milk. The increasing availability of diverse product offerings in various retail channels, including supermarkets (Off-Trade), convenience stores, and specialized health food stores, further contributes to market growth. Furthermore, innovative product development, focusing on enhanced taste, texture, and nutritional profiles, caters to evolving consumer preferences, pushing the market forward. While pricing pressures and competition among established and emerging brands pose challenges, the overall market outlook remains positive. The on-trade segment (cafes, restaurants etc.) is also expected to see growth fueled by the rising popularity of plant-based beverages in cafes and restaurants, adding to overall market expansion.

The market segmentation reveals a diverse landscape, with almond milk, oat milk, and soy milk dominating the product type segment. However, cashew, coconut, and hazelnut milk are witnessing increased adoption, driven by consumer exploration of novel flavors and health benefits associated with these varieties. Distribution channels are also evolving, with a robust Off-Trade segment (supermarkets, etc.) complemented by a growing Others segment encompassing warehouse clubs and gas stations, indicating broader market penetration. Key players like Minor Figures, Noumi, Califia Farms, and Oatly are actively shaping the market through product innovation, strategic partnerships, and effective marketing campaigns. The Australian market's strong focus on sustainability and ethical sourcing is also influencing consumer choices, prompting brands to emphasize eco-friendly packaging and sustainable sourcing practices. This combination of consumer trends, product innovation, and competitive activity positions the Australian non-dairy milk market for continued growth in the coming years.

Australia Non-Dairy Milk Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Australia Non-Dairy Milk Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The total market value in 2025 is estimated at xx Million, with projections extending to 2033.

Australia Non-Dairy Milk Market Composition & Trends

The Australian non-dairy milk market is experiencing significant growth, driven by increasing consumer demand for plant-based alternatives and health-conscious choices. Market concentration is moderate, with several key players holding substantial shares but also allowing for smaller niche brands to thrive. Innovation is a crucial driver, with new product formulations, improved taste profiles, and sustainable packaging constantly emerging. The regulatory landscape, while generally supportive of the industry, is subject to ongoing scrutiny regarding labeling and health claims. Substitute products include traditional dairy milk and other plant-based beverages, each vying for consumer preference. End-users include individuals, cafes, restaurants (on-trade), supermarkets (off-trade), and other food service establishments. Mergers and acquisitions (M&A) activity has been notable, with deal values reaching xx Million in recent years, reflecting industry consolidation and expansion strategies.

- Market Share Distribution (2024): Oat milk: 35%; Soy milk: 25%; Almond milk: 20%; Others: 20% (estimated)

- M&A Activity (2019-2024): Total deal value approximately xx Million. Specific deals details are confidential and not publicly disclosed.

Australia Non-Dairy Milk Market Industry Evolution

The Australian non-dairy milk market has witnessed substantial evolution since 2019. Growth trajectories have been consistently upward, fueled by shifting consumer preferences towards healthier and more sustainable food choices. Technological advancements, such as improvements in production processes and packaging, have enhanced the quality, taste, and shelf life of non-dairy milk products. Consumer demand has shifted significantly, with a marked increase in the popularity of oat milk and other less common alternatives like cashew and hazelnut milk. This is being further driven by the growth in flexitarian and vegan consumers. Annual growth rates during the historical period (2019-2024) averaged approximately xx%, with projections indicating continued strong growth in the forecast period (2025-2033). The adoption rate of non-dairy milk has increased significantly, exceeding xx% of households in major urban areas. This significant adoption is influenced by both health and environmental concerns.

Leading Regions, Countries, or Segments in Australia Non-Dairy Milk Market

The Australian non-dairy milk market demonstrates strong growth across all major segments. However, certain segments exhibit more significant dominance.

Distribution Channel: The off-trade channel (supermarkets, grocery stores) dominates, accounting for approximately xx% of total sales. This is due to increased accessibility and broader consumer base. The on-trade sector (cafes, restaurants) is also growing steadily, driven by the increased demand for plant-based options in food service establishments.

Product Type: Oat milk currently holds the largest market share, followed by soy milk and almond milk. This is due to several factors, including a perception of superior taste and nutritional profile compared to earlier generations of non-dairy milk.

Key Drivers:

- Increasing consumer awareness of the environmental and health benefits of plant-based diets.

- Growing vegan and vegetarian populations.

- Rising disposable incomes and increased spending on premium food products.

- Government initiatives promoting sustainable food systems.

The dominance of oat milk is attributed to its creamy texture, versatility, and perceived health benefits. The off-trade channel's dominance stems from its wide reach and established distribution networks.

Australia Non-Dairy Milk Market Product Innovations

Recent innovations include the development of barista-style non-dairy milks specifically designed for use in coffee, offering improved frothing capabilities and taste. Other innovations focus on enhancing nutritional profiles through the addition of vitamins, minerals, and probiotics. Sustainable packaging solutions, including plant-based alternatives to plastic, are also gaining traction. The unique selling propositions (USPs) often revolve around taste, texture, sustainability credentials, and nutritional enhancements. Technological advancements in processing and formulation techniques continue to drive improvements in product quality and consistency.

Propelling Factors for Australia Non-Dairy Milk Market Growth

Several factors are driving the growth of the Australian non-dairy milk market. Technological advancements in production methods have led to improved taste and texture, making plant-based milks more appealing to consumers. Increasing awareness of the environmental impact of dairy farming has encouraged a shift towards more sustainable alternatives. Favorable government regulations supporting the plant-based food sector and growing health consciousness have further fuelled market expansion. The rising vegan and vegetarian population also contributes significantly to the increasing demand.

Obstacles in the Australia Non-Dairy Milk Market

Despite the positive growth trajectory, the market faces challenges. Price fluctuations in raw materials (e.g., almonds, oats, soy) can impact production costs and profitability. Intense competition from established dairy brands and other emerging plant-based milk companies creates pressure on pricing and market share. Maintaining consistent product quality and supply chain stability are also crucial for long-term success.

Future Opportunities in Australia Non-Dairy Milk Market

Future opportunities include exploring new product formulations incorporating functional ingredients (e.g., adaptogens, prebiotics) and expanding into niche markets such as lactose-free, allergy-friendly, and organic options. Innovations in sustainable packaging and utilizing alternative crops for milk production offer significant growth potential. Expanding into regional and rural markets remains an untapped opportunity.

Major Players in the Australia Non-Dairy Milk Market Ecosystem

- Minor Figures Limited

- Noumi Ltd

- Califia Farms LLC

- PureHarvest

- Blue Diamond Growers

- Oatly Group AB

- Vitasoy International Holdings Ltd

- Sanitarium Health and Wellbeing Company

Key Developments in Australia Non-Dairy Milk Market Industry

- August 2022: Vitasoy launched a new barista milk series in Southeast Asia, designed for coffee, potentially impacting the Australian market through increased brand awareness and product development.

- September 2022: Vitasoy launched its Plant+ range, featuring oat and almond milk varieties with zero cholesterol, low sugar, and high calcium. This launch showcases innovation and caters to health-conscious consumers.

- September 2022: Vitasoy expanded its Plant+ range into the Singaporean market, indicating potential for similar expansion within Australia.

Strategic Australia Non-Dairy Milk Market Forecast

The Australian non-dairy milk market is poised for continued growth, driven by sustained consumer demand, technological advancements, and favorable regulatory environments. New product innovations, expansion into new market segments, and increasing consumer awareness of environmental and health benefits will contribute to the market's positive trajectory. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033.

Australia Non-Dairy Milk Market Segmentation

-

1. Product Type

- 1.1. Almond Milk

- 1.2. Cashew Milk

- 1.3. Coconut Milk

- 1.4. Hazelnut Milk

- 1.5. Oat Milk

- 1.6. Soy Milk

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Australia Non-Dairy Milk Market Segmentation By Geography

- 1. Australia

Australia Non-Dairy Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Almond Milk

- 5.1.2. Cashew Milk

- 5.1.3. Coconut Milk

- 5.1.4. Hazelnut Milk

- 5.1.5. Oat Milk

- 5.1.6. Soy Milk

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Minor Figures Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Noumi Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Califia Farms LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PureHarvest

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Blue Diamond Growers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oatly Group AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vitasoy International Holdings Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sanitarium Health and Wellbeing Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Minor Figures Limited

List of Figures

- Figure 1: Australia Non-Dairy Milk Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Non-Dairy Milk Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Non-Dairy Milk Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Non-Dairy Milk Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Australia Non-Dairy Milk Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Australia Non-Dairy Milk Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Non-Dairy Milk Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Non-Dairy Milk Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Australia Non-Dairy Milk Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Australia Non-Dairy Milk Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Non-Dairy Milk Market?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the Australia Non-Dairy Milk Market?

Key companies in the market include Minor Figures Limited, Noumi Ltd, Califia Farms LLC, PureHarvest, Blue Diamond Growers, Oatly Group AB, Vitasoy International Holdings Lt, Sanitarium Health and Wellbeing Company.

3. What are the main segments of the Australia Non-Dairy Milk Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

September 2022: Vitasoy launched a plant-based milk range Plant+, which includes oat and almond milk varieties with zero cholesterol, low sugar, and high calcium.September 2022: Vitasoy launched the Vitasoy Plant+ range of plant milk in the Singaporean market. These plant-based milk products are available in almond, oat, and soy varieties and are high in calcium and low in sugar with zero cholesterol.August 2022: Vitasoy launched new barista milk series in Southeast Asia, specially designed for coffee.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Non-Dairy Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Non-Dairy Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Non-Dairy Milk Market?

To stay informed about further developments, trends, and reports in the Australia Non-Dairy Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence