Key Insights

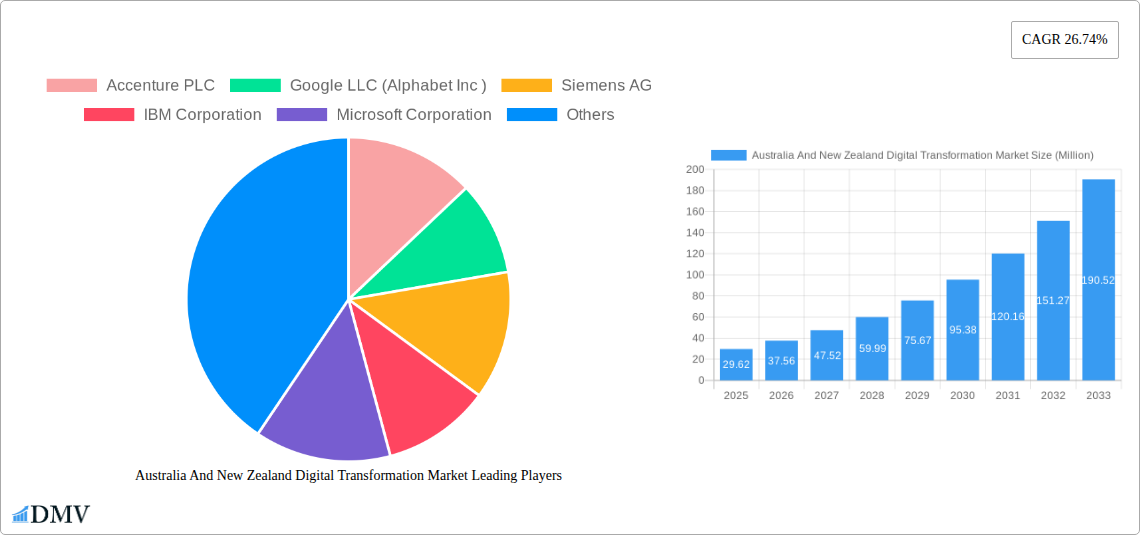

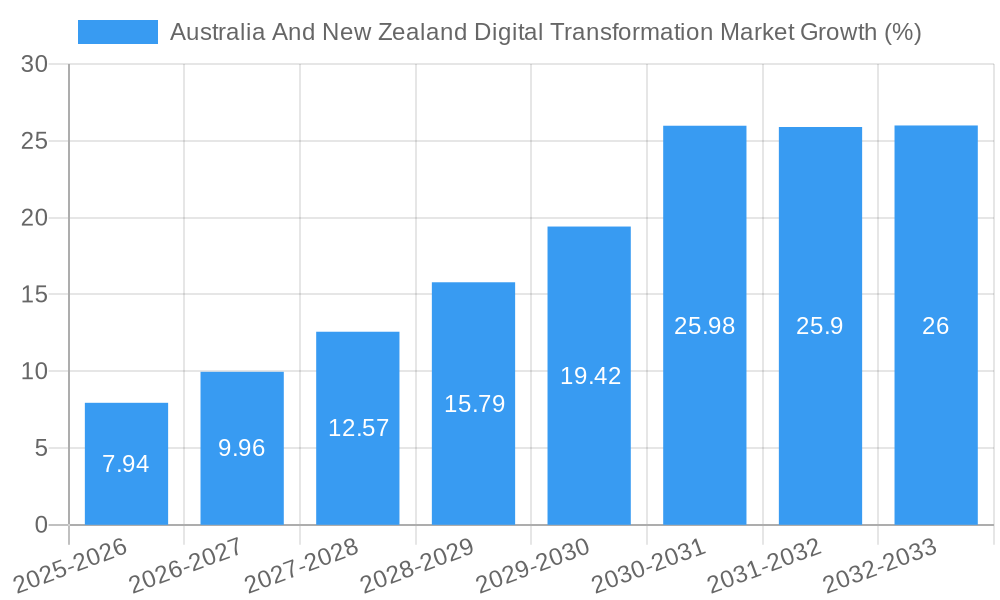

The Australia and New Zealand digital transformation market is experiencing robust growth, projected to reach a market size of $29.62 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 26.74% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing government initiatives promoting digital adoption across various sectors, coupled with the rising need for improved operational efficiency and enhanced customer experiences, are major catalysts. Furthermore, the burgeoning adoption of cloud computing, big data analytics, and artificial intelligence (AI) solutions is significantly accelerating digital transformation across businesses of all sizes. The market is segmented by industry verticals (e.g., finance, healthcare, retail), technology solutions (e.g., cloud services, cybersecurity), and deployment models (e.g., on-premise, cloud). Competitive pressures are high, with major technology players such as Accenture, Google, IBM, Microsoft, and Salesforce actively vying for market share. While the market enjoys significant growth potential, challenges such as cybersecurity concerns, integration complexities, and the skills gap in digital expertise represent key constraints that need careful consideration by businesses and policymakers alike. The forecast period, 2025-2033, promises continued substantial growth, underpinned by ongoing investments in digital infrastructure and a growing appreciation for the strategic importance of digital transformation for business success in the region.

The sustained growth trajectory of the Australia and New Zealand digital transformation market hinges on several factors. The region's strong digital infrastructure development is providing a solid foundation for broader adoption. Government support through funding initiatives and regulatory frameworks also plays a crucial role in facilitating market growth. The increasing penetration of high-speed internet and mobile devices has significantly expanded market access. Moreover, the rise of innovative business models and the adoption of agile methodologies contribute to more effective digital transformation initiatives. However, organizations must also actively manage the risks associated with data security and privacy, addressing workforce skill gaps through targeted training and development programs. A balanced approach, combining technological investments with robust change management strategies, will be crucial for organizations to successfully leverage the transformative power of digital technologies and capitalize on the market's immense growth potential.

Australia and New Zealand Digital Transformation Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Australia and New Zealand digital transformation market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the dynamic opportunities within this burgeoning market. The market is expected to reach xx Million by 2033.

Australia And New Zealand Digital Transformation Market Market Composition & Trends

The Australia and New Zealand digital transformation market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Accenture PLC, Google LLC (Alphabet Inc.), and Microsoft Corporation, among others, are key players shaping the market dynamics. Market share distribution fluctuates based on specific segments and technological advancements, with significant M&A activity influencing the competitive landscape. Deal values have ranged from several Million to hundreds of Million in recent years, driving consolidation and innovation. The regulatory environment, while generally supportive of digital transformation, presents certain compliance challenges. Substitute products and services exert limited competitive pressure, given the unique nature of many digital transformation solutions. End-users span diverse industries, with significant adoption across finance, healthcare, and retail sectors.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Innovation Catalysts: Government initiatives, venture capital investment, and strong R&D spending.

- Regulatory Landscape: Generally supportive but evolving with data privacy and cybersecurity regulations.

- Substitute Products: Limited direct substitutes, with competitive pressures primarily from alternative solution providers.

- End-User Profiles: Diverse, encompassing sectors such as finance, healthcare, retail, and government.

- M&A Activity: Significant activity observed in recent years, with deal values averaging xx Million.

Australia And New Zealand Digital Transformation Market Industry Evolution

The Australian and New Zealand digital transformation market has witnessed robust growth over the historical period (2019-2024), fueled by increasing digital adoption across various industries. Technological advancements, such as cloud computing, artificial intelligence (AI), and the Internet of Things (IoT), have accelerated this transformation. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, driven by factors such as increasing government investments in digital infrastructure, rising consumer demand for digital services, and the growing adoption of digital technologies by businesses of all sizes. The forecast period (2025-2033) anticipates continued growth, driven by the expansion of 5G networks, the increasing adoption of AI and machine learning, and the growth of the cloud computing market. Adoption rates for cloud-based solutions, for example, are projected to increase by xx% annually over the forecast period.

Leading Regions, Countries, or Segments in Australia And New Zealand Digital Transformation Market

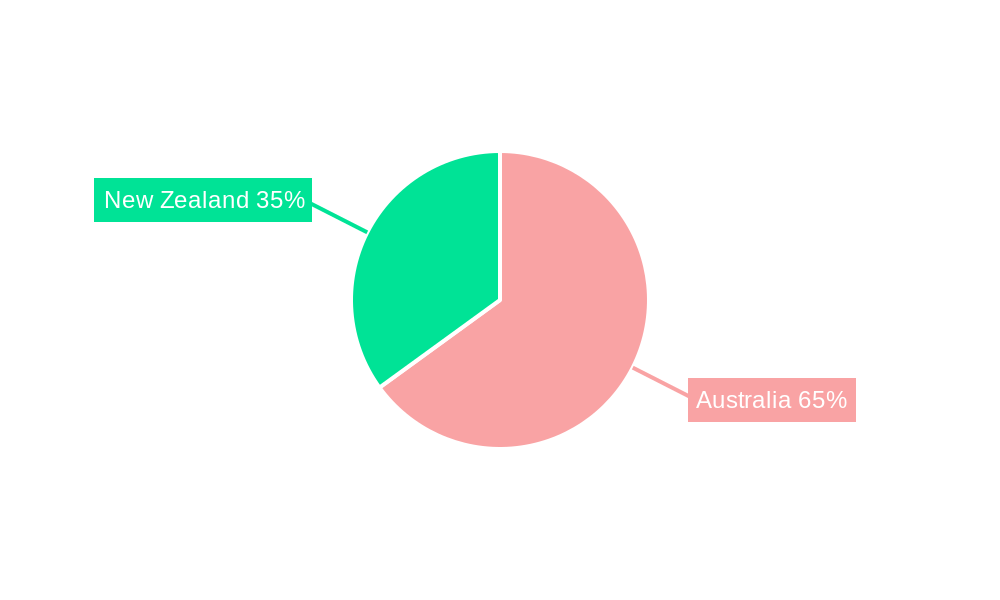

The major metropolitan areas of Sydney, Melbourne, and Auckland are leading regions in the Australia and New Zealand digital transformation market due to high concentrations of technology companies, skilled professionals, and robust digital infrastructure.

- Key Drivers:

- High Investment: Significant government and private sector investment in digital infrastructure and innovation.

- Strong Talent Pool: Availability of skilled professionals in software development, data science, and cybersecurity.

- Supportive Regulatory Environment: Government policies promoting digital adoption and innovation.

- Dominance Factors: These regions benefit from advanced digital infrastructure, a concentrated pool of skilled talent, and robust government support for digital initiatives. This creates a favorable environment for rapid digital transformation adoption across diverse sectors.

Australia And New Zealand Digital Transformation Market Product Innovations

Recent years have seen significant innovation in digital transformation products and services, with a focus on cloud-based solutions, AI-powered analytics, and enhanced cybersecurity measures. The emphasis is on user-friendly interfaces, seamless integration with existing systems, and improved data security. Unique selling propositions often include specific industry-tailored solutions, providing superior value and efficiency gains. For instance, AI-driven predictive analytics is helping businesses optimize operations and make more informed decisions.

Propelling Factors for Australia And New Zealand Digital Transformation Market Growth

The market's growth is driven by several key factors. Increasing government investment in digital infrastructure, a burgeoning startup ecosystem, and rising consumer demand for digital services fuel adoption. The strong emphasis on data analytics and AI, along with a supportive regulatory framework that encourages innovation, further accelerates market growth. The expanding use of cloud computing and the increasing adoption of 5G technology are creating new avenues for growth and innovation.

Obstacles in the Australia And New Zealand Digital Transformation Market Market

Despite the market's growth potential, some significant barriers persist. These include the high cost of implementation and integration of new digital technologies, the shortage of skilled professionals with expertise in emerging technologies, concerns about data security and privacy, and the need for robust cybersecurity measures. Moreover, supply chain disruptions and ongoing global economic uncertainty present further challenges to market growth. These obstacles can potentially restrict market expansion unless effectively addressed.

Future Opportunities in Australia And New Zealand Digital Transformation Market

Significant opportunities exist for growth in the coming years. Expansion into new sectors like agriculture and education offers potential for digital transformation solutions. The development and deployment of advanced technologies, including edge computing, blockchain, and extended reality (XR), will unlock new applications and services. Finally, a stronger focus on sustainability and green technology integration presents a fertile ground for innovative solutions within the digital transformation landscape.

Major Players in the Australia And New Zealand Digital Transformation Market Ecosystem

- Accenture PLC

- Google LLC (Alphabet Inc.)

- Siemens AG

- IBM Corporation

- Microsoft Corporation

- Cognex Corporation

- Hewlett Packard Enterprise

- SAP SE

- EMC Corporation (Dell EMC)

- Oracle Corporation

- Adobe Inc

- Amazon Web Services Inc

- Apple Inc

- Salesforce com Inc

- Cisco Systems Inc

- *List Not Exhaustive

Key Developments in Australia And New Zealand Digital Transformation Market Industry

- June 2024: Tompkins Robotics announced that Primary Sight, a provider of supply chain technology solutions in Australia, became Tompkins Robotics ANZ. This expansion significantly enhances service offerings and global reach.

- May 2024: The state government allocated USD 6 Million to the University of Adelaide's Australian Institute for Machine Learning (AIML). This funding boosts AI capabilities, supporting SME initiatives and attracting top talent.

Strategic Australia And New Zealand Digital Transformation Market Market Forecast

The Australia and New Zealand digital transformation market is poised for continued strong growth throughout the forecast period (2025-2033). Government initiatives, private sector investments, and the increasing adoption of emerging technologies will be primary drivers. The market's potential is vast, with opportunities spanning various industries and applications. This positive outlook reflects a robust and dynamic market ripe for further expansion and innovation.

Australia And New Zealand Digital Transformation Market Segmentation

-

1. Type

-

1.1. Analytic

- 1.1.1. Current

- 1.1.2. Key Grow

- 1.1.3. Use Case Analysis

- 1.1.4. Market Outlook

- 1.2. Extended Reality (XR)

- 1.3. IoT

- 1.4. Industrial Robotics

- 1.5. Blockchain

- 1.6. Additive Manufacturing/3D Printing

- 1.7. Cybersecurity

- 1.8. Cloud and Edge Computing

-

1.9. Others (digital twin, mobility and connectivity)

- 1.9.1. Market B

-

1.1. Analytic

-

2. End-User Industry

-

2.1. Manufacturing

- 2.1.1. Oil, Gas and Utilities

- 2.1.2. Retail & e-commerce

- 2.1.3. Transportation and Logistics

- 2.1.4. Healthcare

- 2.1.5. BFSI

- 2.1.6. Telecom and IT

- 2.1.7. Government and Public Sector

- 2.1.8. Others (Education, Media &

-

2.1. Manufacturing

Australia And New Zealand Digital Transformation Market Segmentation By Geography

- 1. Australia

Australia And New Zealand Digital Transformation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps

- 3.3. Market Restrains

- 3.3.1. Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps

- 3.4. Market Trends

- 3.4.1. The IoT Segment is Expected to Occupy the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia And New Zealand Digital Transformation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analytic

- 5.1.1.1. Current

- 5.1.1.2. Key Grow

- 5.1.1.3. Use Case Analysis

- 5.1.1.4. Market Outlook

- 5.1.2. Extended Reality (XR)

- 5.1.3. IoT

- 5.1.4. Industrial Robotics

- 5.1.5. Blockchain

- 5.1.6. Additive Manufacturing/3D Printing

- 5.1.7. Cybersecurity

- 5.1.8. Cloud and Edge Computing

- 5.1.9. Others (digital twin, mobility and connectivity)

- 5.1.9.1. Market B

- 5.1.1. Analytic

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Manufacturing

- 5.2.1.1. Oil, Gas and Utilities

- 5.2.1.2. Retail & e-commerce

- 5.2.1.3. Transportation and Logistics

- 5.2.1.4. Healthcare

- 5.2.1.5. BFSI

- 5.2.1.6. Telecom and IT

- 5.2.1.7. Government and Public Sector

- 5.2.1.8. Others (Education, Media &

- 5.2.1. Manufacturing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Accenture PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC (Alphabet Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microsoft Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cognex Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hewlett Packard Enterprise

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAP SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EMC Corporation (Dell EMC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oracle Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Adobe Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Amazon Web Services Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Apple Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Salesforce com Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Cisco Systems Inc *List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Accenture PLC

List of Figures

- Figure 1: Australia And New Zealand Digital Transformation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia And New Zealand Digital Transformation Market Share (%) by Company 2024

List of Tables

- Table 1: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 7: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 13: Australia And New Zealand Digital Transformation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Australia And New Zealand Digital Transformation Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia And New Zealand Digital Transformation Market?

The projected CAGR is approximately 26.74%.

2. Which companies are prominent players in the Australia And New Zealand Digital Transformation Market?

Key companies in the market include Accenture PLC, Google LLC (Alphabet Inc ), Siemens AG, IBM Corporation, Microsoft Corporation, Cognex Corporation, Hewlett Packard Enterprise, SAP SE, EMC Corporation (Dell EMC), Oracle Corporation, Adobe Inc, Amazon Web Services Inc, Apple Inc, Salesforce com Inc, Cisco Systems Inc *List Not Exhaustive.

3. What are the main segments of the Australia And New Zealand Digital Transformation Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps.

6. What are the notable trends driving market growth?

The IoT Segment is Expected to Occupy the Largest Market Share.

7. Are there any restraints impacting market growth?

Increase in the adoption of big data analytics and other technologies in Australia And New Zealand; The rapid proliferation of mobile devices and apps.

8. Can you provide examples of recent developments in the market?

June 2024: Tompkins Robotics announced that Primary Sight, a provider of supply chain technology solutions in Australia, became Tompkins Robotics ANZ. Bringing Primary Sight into the Tompkins Robotics organization marked a significant milestone as it continued to expand its global footprint and enhance its service offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia And New Zealand Digital Transformation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia And New Zealand Digital Transformation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia And New Zealand Digital Transformation Market?

To stay informed about further developments, trends, and reports in the Australia And New Zealand Digital Transformation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence