Key Insights

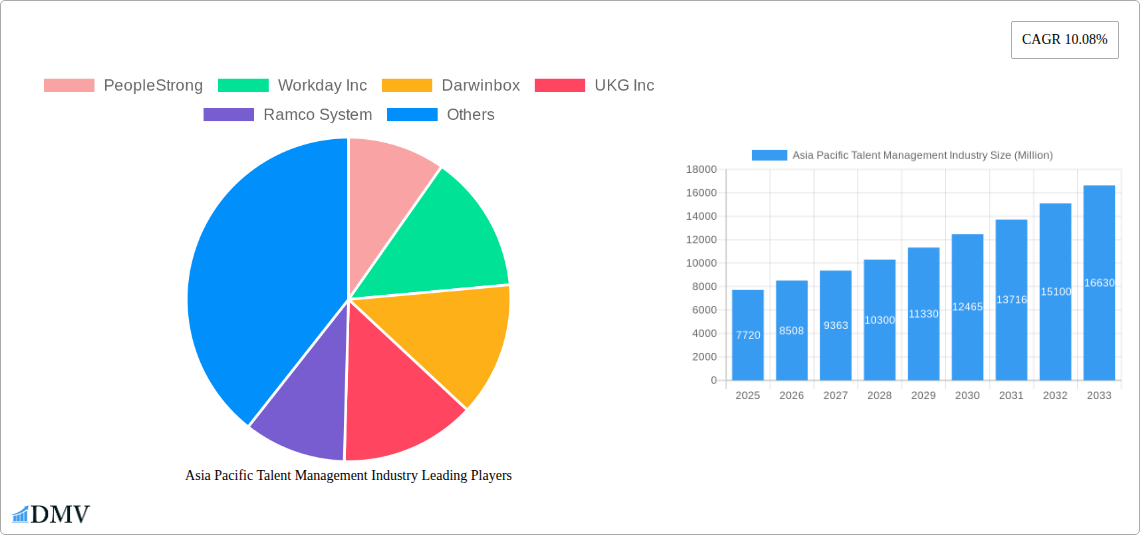

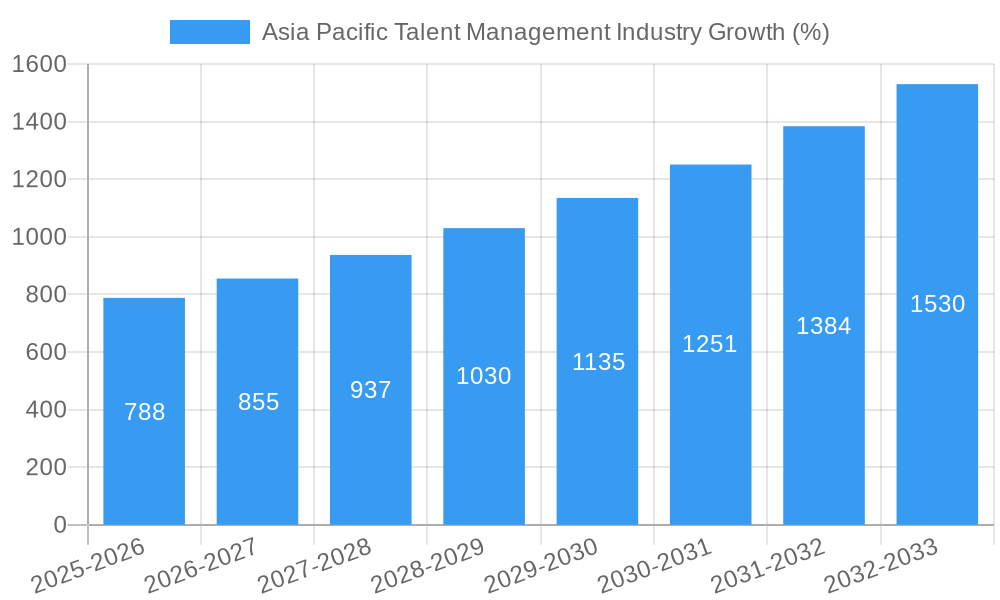

The Asia Pacific talent management market, currently valued at $7.72 billion (2025), is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.08% from 2025 to 2033. This significant expansion is driven by several key factors. Firstly, the increasing adoption of cloud-based solutions offers scalability, cost-effectiveness, and enhanced accessibility for businesses of all sizes across diverse sectors like BFSI, IT & Telecom, and Retail. Secondly, the rising focus on employee experience and engagement is fueling demand for advanced talent management systems that encompass performance management, compensation management, and learning & development modules. The region's burgeoning digital economy and a large, young, tech-savvy workforce further amplify this trend. Finally, stringent government regulations concerning compliance and risk management are compelling organizations to invest in robust eGRC solutions, contributing significantly to market growth. Competition is fierce, with established players like Workday, Oracle, and SAP alongside agile startups like PeopleStrong and Darwinbox vying for market share.

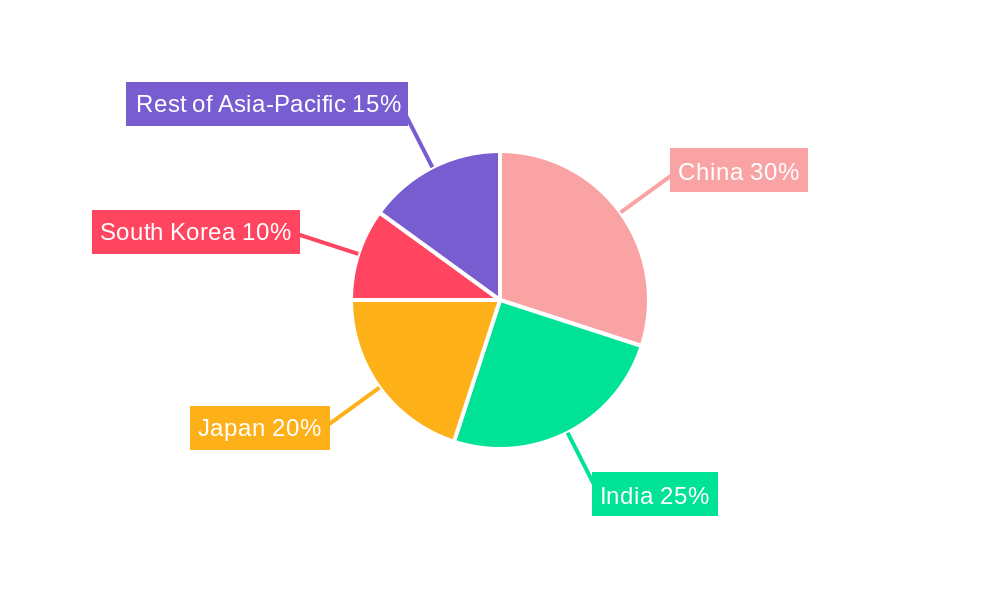

However, the market faces certain challenges. The high initial investment cost of implementing comprehensive talent management systems can be a barrier for smaller companies, especially in less developed economies within the Asia-Pacific region. Furthermore, the integration of legacy systems with new talent management solutions can present technological hurdles. Despite these challenges, the long-term prospects for the Asia-Pacific talent management market remain exceptionally positive, driven by continuous technological advancements, increasing digitization, and the growing need for efficient and effective workforce management strategies. The market segmentation, encompassing various deployment models (cloud, on-premise), application types (compensation, payroll, performance management), and end-user industries, presents significant opportunities for specialized players to cater to the diverse needs of organizations across the region. China, India, Japan, and South Korea are projected to be the key contributors to market growth, given their large and dynamic workforces.

Asia Pacific Talent Management Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific Talent Management industry, offering invaluable insights for stakeholders across the ecosystem. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, key players, and future growth trajectories. The multi-million dollar market is segmented by country (China, Japan, India, South Korea, Singapore, Vietnam, Australia & New Zealand, Philippines, Malaysia), application (Compensation Management, Core HR, Payroll Management, E-learning & E-recruiting, Performance Management, Workforce Management, Enterprise Governance, Risk, and Compliance (eGRC)), deployment (Cloud-based, On-premise), and end-user industry (BFSI, IT & Telecom, Retail, Manufacturing, Healthcare, Government, Others). Leading companies like PeopleStrong, Workday Inc, Darwinbox, UKG Inc, Ramco Systems, Infor, Oracle Corporation, Cornerstone OnDemand, Dayforce, ADP Inc, and SAP SE are profiled, providing a holistic view of this dynamic market.

Asia Pacific Talent Management Industry Market Composition & Trends

The Asia Pacific talent management market is experiencing significant growth, driven by increasing digitalization, evolving workforce demographics, and a growing need for efficient HR solutions. Market concentration is moderate, with a few major players holding substantial shares, while numerous smaller companies cater to niche segments. Innovation is propelled by advancements in AI, machine learning, and cloud computing, leading to the development of sophisticated HCM (Human Capital Management) platforms. Regulatory landscapes vary across countries, impacting data privacy and compliance requirements. Substitute products include legacy on-premise systems and outsourcing solutions, but the market is steadily shifting towards cloud-based solutions. M&A activity is moderately active, with deal values ranging from xx Million to xx Million USD.

- Market Share Distribution: Workday Inc and Oracle Corporation hold a significant portion, estimated at xx% and xx% respectively in 2025. The remaining market share is distributed among other players.

- M&A Deal Values: Recent deals indicate an average value of xx Million USD, although significant variations exist based on the size and scope of acquisitions.

- End-User Profiles: The market is diverse, with a significant presence across various sectors including BFSI, IT & Telecom, and Manufacturing. Large enterprises are driving demand for comprehensive solutions, while SMEs are adopting more modular offerings.

Asia Pacific Talent Management Industry Industry Evolution

The Asia Pacific talent management market has witnessed substantial evolution from 2019 to 2024, exhibiting a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million USD by 2033. The shift from on-premise to cloud-based solutions is a key trend, driven by scalability, cost-effectiveness, and enhanced accessibility. Technological advancements, particularly in AI and machine learning, are leading to improved talent acquisition, performance management, and employee engagement capabilities. The rising demand for personalized employee experiences and the growing need for data-driven decision-making in HR are further shaping the market landscape. Adoption of cloud-based HCM solutions increased from xx% in 2019 to xx% in 2024, indicating a significant shift towards digital transformation within organizations.

Leading Regions, Countries, or Segments in Asia Pacific Talent Management Industry

- By Country: India and China are the leading markets, driven by their large and rapidly growing workforce, increasing investment in technology, and strong economic growth. Japan, South Korea, and Singapore also show significant market potential.

- Key Drivers (India): High demand for skilled labor, growing IT sector, and government initiatives promoting digital transformation.

- Key Drivers (China): Large workforce, increasing focus on employee engagement, and government support for technology adoption.

- By Application: Compensation Management, Payroll Management, and Performance Management are the dominant application segments, representing xx% of the market in 2025. The increasing need for efficient and accurate payroll processing and the focus on improving employee performance are key drivers.

- By Deployment: Cloud-based deployment is the dominant model, capturing a significant share of the market and expected to continue its growth trajectory due to its cost-effectiveness and scalability.

- By End-user Industry: The BFSI and IT & Telecom sectors are the largest contributors, driven by their high demand for skilled professionals and sophisticated HR solutions.

Asia Pacific Talent Management Industry Product Innovations

Recent innovations include AI-powered chatbots for employee support, predictive analytics for talent acquisition, and personalized learning platforms for employee development. These solutions leverage machine learning and AI to provide real-time insights and automation of HR processes. Unique selling propositions often include enhanced user experience, improved data security, and integration with other enterprise applications. The focus is on developing solutions that are flexible, scalable, and easy to implement.

Propelling Factors for Asia Pacific Talent Management Industry Growth

Technological advancements, such as AI and cloud computing, are primary growth catalysts. Strong economic growth across many APAC nations fuels investment in HR technology. Government initiatives promoting digital transformation and favorable regulatory frameworks further contribute to market expansion. Examples include the recent launch of Ramco Payce, leveraging AI and machine learning for improved payroll processing.

Obstacles in the Asia Pacific Talent Management Industry Market

Data security concerns and compliance requirements across different jurisdictions pose significant challenges. Supply chain disruptions, especially regarding hardware and software components, can impact delivery timelines and project costs. Intense competition among established and emerging players results in price pressures and a need for constant innovation.

Future Opportunities in Asia Pacific Talent Management Industry

The increasing adoption of remote work models creates opportunities for solutions supporting hybrid workforces. The growing demand for upskilling and reskilling initiatives opens avenues for personalized learning platforms. Expansion into untapped markets and segments, coupled with the emergence of new technologies, presents significant growth potential.

Major Players in the Asia Pacific Talent Management Industry Ecosystem

- PeopleStrong

- Workday Inc

- Darwinbox

- UKG Inc

- Ramco Systems

- Infor

- Oracle Corporation

- Cornerstone OnDemand

- Dayforce

- ADP Inc

- SAP SE

Key Developments in Asia Pacific Talent Management Industry Industry

- February 2024: Ramco Systems launched Ramco Payce, a platform-based payroll software leveraging AI, machine learning, and data analytics for faster and more accurate payroll processing. This launch strengthens Ramco Systems' position in the market and enhances its competitiveness.

- January 2024: MiHCM launched an AI-powered HR co-pilot, driving the adoption of cloud-based HCM solutions and enhancing real-time AI capabilities in the APAC region. This highlights the increasing importance of AI-driven solutions in the industry.

Strategic Asia Pacific Talent Management Industry Market Forecast

The Asia Pacific talent management market is poised for continued robust growth, driven by technological innovation, economic expansion, and a rising demand for efficient and effective HR solutions. The increasing adoption of cloud-based solutions, coupled with the growing integration of AI and machine learning, will further accelerate market expansion. New opportunities lie in leveraging data analytics for improved talent acquisition and workforce planning, as well as in developing personalized learning and development solutions. The market is expected to witness significant consolidation and further M&A activity as companies strive to enhance their product offerings and expand their market reach.

Asia Pacific Talent Management Industry Segmentation

-

1. Application

- 1.1. Compensation Management

-

1.2. Core HR

- 1.2.1. Payroll Management

- 1.3. E-learning and E-recruiting

- 1.4. Performance Management

- 1.5. Workforce Management

- 1.6. Enterprise Governance, Risk and Compliance (eGRC^)

-

2. Deployment

- 2.1. Cloud-based

- 2.2. On-premise

-

3. End-user Industry

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Retail

- 3.4. Manufacturing

- 3.5. Healthcare

- 3.6. Government

- 3.7. Other End-user Industries

Asia Pacific Talent Management Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Talent Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.08% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Mobile HCM Applications; Increase in Demand for Talent Mobility

- 3.3. Market Restrains

- 3.3.1. Privacy and Security Concerns

- 3.4. Market Trends

- 3.4.1. IT and Telecommunication Sector to be the Largest End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Talent Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Compensation Management

- 5.1.2. Core HR

- 5.1.2.1. Payroll Management

- 5.1.3. E-learning and E-recruiting

- 5.1.4. Performance Management

- 5.1.5. Workforce Management

- 5.1.6. Enterprise Governance, Risk and Compliance (eGRC^)

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud-based

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Retail

- 5.3.4. Manufacturing

- 5.3.5. Healthcare

- 5.3.6. Government

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia Pacific Talent Management Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Talent Management Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Talent Management Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Talent Management Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Talent Management Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Talent Management Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Talent Management Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 PeopleStrong

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Workday Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Darwinbox

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 UKG Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Ramco System

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Infor

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Oracle Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Cornerstone OnDemand

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Dayforce

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 ADP Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 SAP SE

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 PeopleStrong

List of Figures

- Figure 1: Asia Pacific Talent Management Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Talent Management Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Talent Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Talent Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Asia Pacific Talent Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Asia Pacific Talent Management Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Asia Pacific Talent Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Talent Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Talent Management Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Asia Pacific Talent Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 16: Asia Pacific Talent Management Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Asia Pacific Talent Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia Pacific Talent Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Talent Management Industry?

The projected CAGR is approximately 10.08%.

2. Which companies are prominent players in the Asia Pacific Talent Management Industry?

Key companies in the market include PeopleStrong, Workday Inc, Darwinbox, UKG Inc, Ramco System, Infor, Oracle Corporation, Cornerstone OnDemand, Dayforce, ADP Inc, SAP SE.

3. What are the main segments of the Asia Pacific Talent Management Industry?

The market segments include Application, Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Mobile HCM Applications; Increase in Demand for Talent Mobility.

6. What are the notable trends driving market growth?

IT and Telecommunication Sector to be the Largest End-user Industry.

7. Are there any restraints impacting market growth?

Privacy and Security Concerns.

8. Can you provide examples of recent developments in the market?

February 2024: Ramco Systems, a Chennai-based global payroll technology provider, launched Ramco Payce, a platform-based payroll software designed to help businesses manage payroll. Ramco Payce capitalizes on advanced technologies such as artificial intelligence, machine learning, serverless in-memory, and data analytics to help enterprises process payroll faster, effortlessly, and accurately while being easy to use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Talent Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Talent Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Talent Management Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Talent Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence