Key Insights

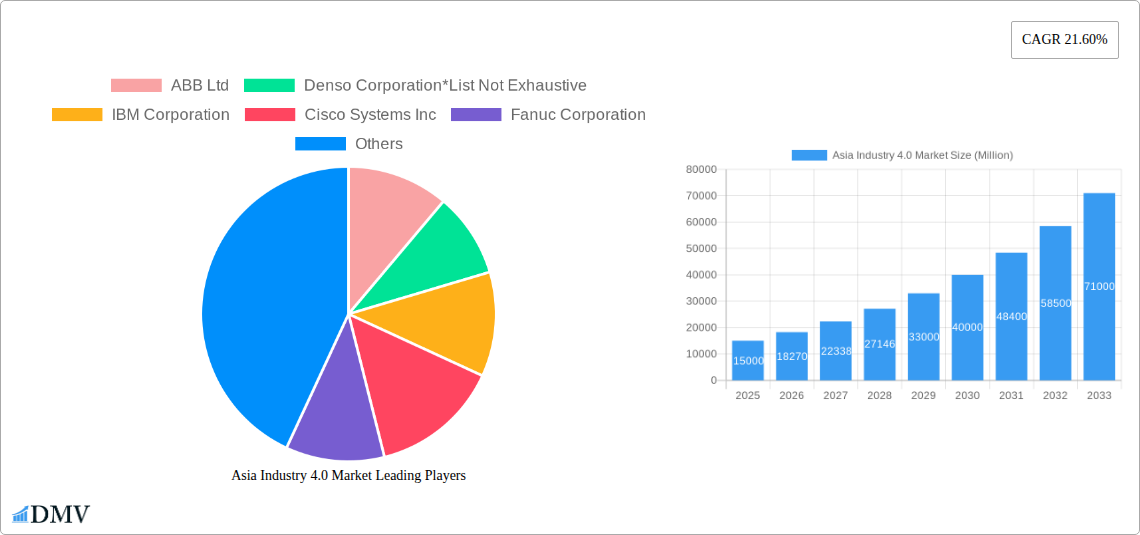

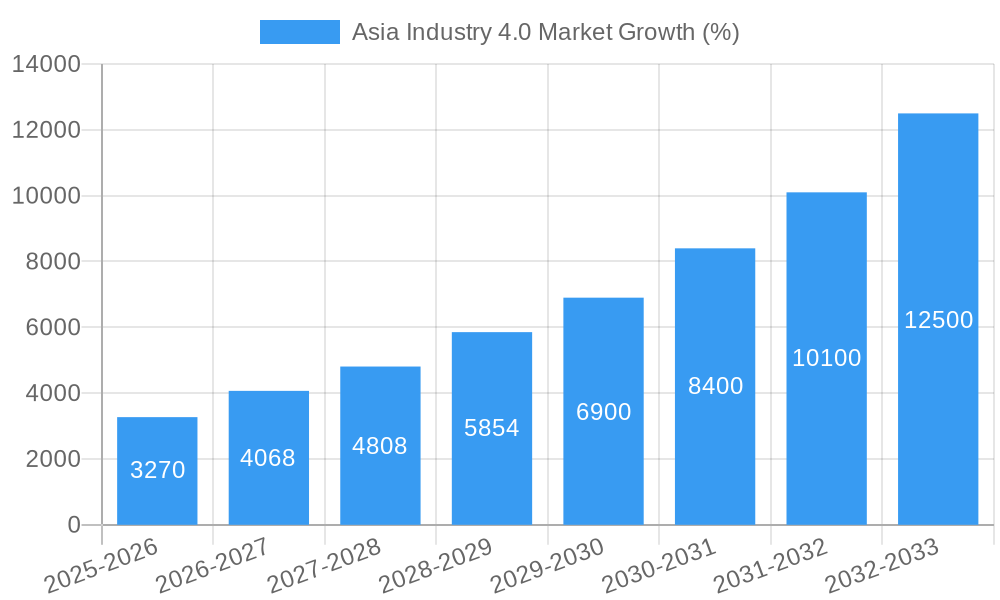

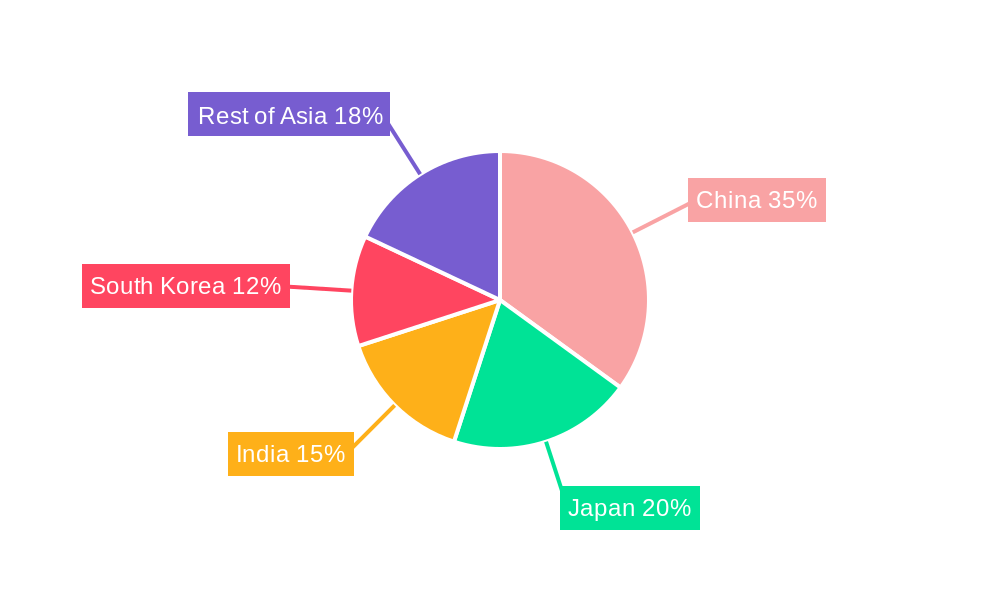

The Asia Industry 4.0 market is experiencing explosive growth, fueled by a confluence of factors. The region's robust manufacturing base, coupled with increasing government initiatives promoting digital transformation and smart manufacturing, is driving significant adoption of technologies like industrial robotics, AI/ML, and IIoT. A CAGR of 21.60% from 2019-2033 indicates a substantial expansion, with the market projected to reach significant value by 2033. China, Japan, South Korea, and India are leading the charge, representing substantial portions of the market share due to their advanced technological infrastructure and large manufacturing sectors. However, challenges remain, including the need for skilled labor to manage and maintain advanced systems, high initial investment costs for implementing Industry 4.0 technologies, and cybersecurity concerns related to data integrity and system vulnerabilities. The manufacturing sector remains the dominant end-user, followed by automotive, electronics, and energy & utilities. The diverse technological landscape, including the increasing adoption of digital twins, extended reality for training and maintenance, and the burgeoning use of 3D printing for customized production, contributes to the market’s dynamism. While the initial focus was on automation through robotics, the current trend shows a clear shift towards data-driven decision-making enabled by AI and advanced analytics, improving efficiency and predictive maintenance.

The continued expansion of the Asia Industry 4.0 market hinges on several crucial factors. Addressing the skills gap through robust training programs and fostering collaboration between academia and industry will be critical. Government support in the form of incentives and regulations facilitating technology adoption will be crucial for market expansion. Overcoming cybersecurity challenges through robust infrastructure and stringent security protocols will instill confidence in businesses adopting these technologies. Furthermore, the seamless integration of Industry 4.0 technologies across different sectors and the development of interoperable systems will enhance efficiency and unlock further growth potential. The market is expected to see continued strong growth, driven by the region's economic development and commitment to technological advancement. However, a realistic assessment should account for potential economic fluctuations and geopolitical factors that might influence the market trajectory.

Asia Industry 4.0 Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia Industry 4.0 market, offering crucial insights for stakeholders seeking to navigate this rapidly evolving landscape. From market size and segmentation to key players and future opportunities, this report offers a 360-degree view of the Asia Industry 4.0 market, covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive primary and secondary research to deliver actionable intelligence, helping businesses make informed decisions and capitalize on emerging trends. The market is projected to reach xx Million by 2033.

Asia Industry 4.0 Market Composition & Trends

This section delves into the intricate structure of the Asia Industry 4.0 market, evaluating its concentration, innovation drivers, regulatory frameworks, and competitive dynamics. We analyze the market share distribution among key players, highlighting the impact of mergers and acquisitions (M&A) activities on market consolidation. The report also examines end-user profiles and the influence of substitute products.

- Market Concentration: The Asia Industry 4.0 market exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share. However, the presence of numerous smaller companies fosters competition and innovation. Market share distribution is analyzed based on revenue and unit sales.

- Innovation Catalysts: Government initiatives promoting digital transformation, substantial R&D investments by leading companies, and a thriving startup ecosystem fuel innovation in the region.

- Regulatory Landscape: Variations in regulatory environments across Asian countries influence market growth. The report details key regulations affecting the adoption of Industry 4.0 technologies.

- Substitute Products: The emergence of alternative technologies may pose challenges to the growth of some segments within the Industry 4.0 market. The report assesses the potential impact of substitute products on market dynamics.

- End-User Profiles: This report profiles key end-user industries, including their adoption rates, technology preferences, and spending patterns.

- M&A Activities: The report analyzes recent M&A activities in the Asia Industry 4.0 market, including deal values and their implications for market consolidation. The total value of M&A deals during the historical period (2019-2024) is estimated at xx Million.

Asia Industry 4.0 Market Industry Evolution

This section traces the evolution of the Asia Industry 4.0 market, examining its growth trajectories, technological advancements, and evolving consumer demands from 2019 to 2024. We analyze the factors driving market growth, including increasing automation needs, the rising adoption of advanced technologies, and supportive government policies. The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) is estimated at xx%, while the projected CAGR for the forecast period (2025-2033) is xx%. Adoption rates of key Industry 4.0 technologies, like Industrial IoT (IIoT) and Artificial Intelligence (AI), are also detailed, showing significant increases year-over-year. The shift towards smart manufacturing and the increasing demand for data-driven decision-making are key drivers for this growth. The report further explores how shifting consumer demands are influencing the development and adoption of Industry 4.0 solutions, particularly regarding sustainability and customization.

Leading Regions, Countries, or Segments in Asia Industry 4.0 Market

This section identifies the leading regions, countries, and segments within the Asia Industry 4.0 market. China, Japan, and South Korea currently dominate the market, driven by robust industrial bases and significant government investments in digital transformation. However, India and other Southeast Asian nations show immense growth potential.

By Country:

- China: Dominates due to its massive manufacturing sector, government support for technological advancements, and a large pool of skilled labor. Key drivers include substantial government investments in infrastructure and technological development.

- South Korea: Strong in electronics and automotive sectors, with a focus on technological innovation and high-quality manufacturing. Government initiatives fostering the development of smart factories contribute to its leading position.

- Japan: A pioneer in robotics and automation, benefiting from a highly developed industrial sector and a strong emphasis on technological research and development. The country's focus on advanced manufacturing and its expertise in automation technologies are key drivers.

- India: A rapidly emerging market with significant growth potential fueled by increasing digitalization and a large pool of IT professionals. Favorable government policies and rising investments in infrastructure are fostering rapid growth.

- Indonesia: Demonstrates strong potential for Industry 4.0 adoption, driven by government initiatives to improve manufacturing competitiveness.

By Technology Type: Industrial Robotics and IIoT currently hold the largest market share, however, AI and ML are experiencing the fastest growth, indicating a major shift toward data-driven decision-making and intelligent automation.

By End-user Industry: The manufacturing sector remains the largest adopter of Industry 4.0 technologies, followed by the automotive and electronics industries.

Asia Industry 4.0 Market Product Innovations

The Asia Industry 4.0 market is characterized by continuous innovation in industrial robotics, AI-powered predictive maintenance, and advanced data analytics platforms. These advancements enable improved operational efficiency, enhanced productivity, and reduced downtime. The integration of cloud computing, edge computing, and blockchain technologies further enhances the capabilities of Industry 4.0 solutions. Companies are focusing on developing user-friendly interfaces, modular systems, and customizable solutions to meet diverse industry needs. Unique selling propositions center around enhanced data security, scalability, and seamless integration with existing infrastructure.

Propelling Factors for Asia Industry 4.0 Market Growth

Several factors fuel the growth of the Asia Industry 4.0 market. Firstly, technological advancements, such as the development of advanced sensors, AI algorithms, and high-speed data networks, are continuously improving the capabilities of Industry 4.0 solutions. Secondly, the significant economic growth across several Asian countries creates substantial demand for improved manufacturing efficiency and productivity. Lastly, government initiatives and favorable regulatory environments are encouraging the adoption of Industry 4.0 technologies. Examples include government subsidies, tax breaks, and specialized industrial zones.

Obstacles in the Asia Industry 4.0 Market

Despite significant growth potential, the Asia Industry 4.0 market faces challenges. These include: the high initial investment costs associated with implementing Industry 4.0 technologies; a lack of skilled workforce proficient in operating and maintaining these advanced technologies; data security and privacy concerns; supply chain disruptions caused by global events; and intense competition among technology providers. These factors can hinder the widespread adoption of Industry 4.0 solutions.

Future Opportunities in Asia Industry 4.0 Market

The Asia Industry 4.0 market presents numerous opportunities. The expanding adoption of 5G networks will enable faster data transmission and real-time control, creating new possibilities for connected manufacturing. The increasing demand for sustainable manufacturing practices will drive the development of eco-friendly Industry 4.0 solutions. Furthermore, the integration of Industry 4.0 technologies into new sectors like healthcare and agriculture will unlock further growth potential.

Major Players in the Asia Industry 4.0 Market Ecosystem

- ABB Ltd

- Denso Corporation

- IBM Corporation

- Cisco Systems Inc

- Fanuc Corporation

- Omron Corporation

- Robert Bosch GmbH

- Yokogawa Electric Corporation

- Mitsubishi Electric

- General Electric Company

- Intel Corporation

- Yaskawa Electric Corporation

Key Developments in Asia Industry 4.0 Market Industry

- June 2022: Yokogawa Electric Corporation launched OpreX asset health insights, a cloud-based plant asset monitoring service leveraging ML and AI for enhanced asset management. This highlights the increasing adoption of cloud-based solutions for real-time asset optimization.

- February 2022: Mitsubishi Electric Corporation received the SAP Japan Customer Award 2021 for its leadership in digital transformation, showcasing successful IT/OT integration through its Industry 4.0 HUB TOKYO initiative. This underscores the importance of collaboration and IT/OT integration for successful Industry 4.0 implementation.

Strategic Asia Industry 4.0 Market Forecast

The Asia Industry 4.0 market is poised for robust growth, driven by technological advancements, increasing digitalization, and supportive government policies. The convergence of various technologies, like AI, IoT, and blockchain, will create innovative solutions for diverse industries. Emerging markets in Southeast Asia will contribute significantly to this growth. The market is expected to experience substantial expansion in the forecast period (2025-2033), fueled by continued investments in automation, digitalization, and technological innovation across various sectors.

Asia Industry 4.0 Market Segmentation

-

1. Technology Type

- 1.1. Industrial Robotics

- 1.2. IIoT

- 1.3. AI and ML

- 1.4. Blockchain

- 1.5. Extended Reality

- 1.6. Digital Twin

- 1.7. 3D Printing

- 1.8. Other Technology Types

-

2. End-user Industry

- 2.1. Manufacturing

- 2.2. Automotive

- 2.3. Oil and Gas

- 2.4. Energy and Utilities

- 2.5. Electronics and Foundry

- 2.6. Food and Beverage

- 2.7. Aerospace and Defense

- 2.8. Other End-user Industries

Asia Industry 4.0 Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Industry 4.0 Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs

- 3.3. Market Restrains

- 3.3.1. Sluggish Adoption of New Technologies

- 3.4. Market Trends

- 3.4.1. Manufacturing Industry to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Industrial Robotics

- 5.1.2. IIoT

- 5.1.3. AI and ML

- 5.1.4. Blockchain

- 5.1.5. Extended Reality

- 5.1.6. Digital Twin

- 5.1.7. 3D Printing

- 5.1.8. Other Technology Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Manufacturing

- 5.2.2. Automotive

- 5.2.3. Oil and Gas

- 5.2.4. Energy and Utilities

- 5.2.5. Electronics and Foundry

- 5.2.6. Food and Beverage

- 5.2.7. Aerospace and Defense

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. China Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Denso Corporation*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IBM Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cisco Systems Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fanuc Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Omron Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Robert Bosch GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yokogawa Electric Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mitsubishi Electric

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 General Electric Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Intel Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Yaskawa Electric Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: Asia Industry 4.0 Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Industry 4.0 Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 3: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 14: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Bangladesh Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Pakistan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Industry 4.0 Market?

The projected CAGR is approximately 21.60%.

2. Which companies are prominent players in the Asia Industry 4.0 Market?

Key companies in the market include ABB Ltd, Denso Corporation*List Not Exhaustive, IBM Corporation, Cisco Systems Inc, Fanuc Corporation, Omron Corporation, Robert Bosch GmbH, Yokogawa Electric Corporation, Mitsubishi Electric, General Electric Company, Intel Corporation, Yaskawa Electric Corporation.

3. What are the main segments of the Asia Industry 4.0 Market?

The market segments include Technology Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs.

6. What are the notable trends driving market growth?

Manufacturing Industry to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Sluggish Adoption of New Technologies.

8. Can you provide examples of recent developments in the market?

June 2022: Yokogawa Electric Corporation released OpreX asset health insights. OpreX is a cloud-based plant asset monitoring service that refines, collects, and aggregates operational technology data from distributed assets. Asset Health Insights Oprex powered by Yokogawa Cloud is equipped with ML and AI analytics capability. As the adoption of Industry 4.0 technologies continues to pace in the region, companies are changing the way they do asset management by introducing cloud-based technologies that can monitor assets from anywhere in the world and optimize their performance in real-time. Driven by customers' focus on integrated, remote, and increasingly autonomous operations, Yokogawa Electric developed Asset Health Insights to make data more visible, integrated, and actionable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Industry 4.0 Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Industry 4.0 Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Industry 4.0 Market?

To stay informed about further developments, trends, and reports in the Asia Industry 4.0 Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence