Key Insights

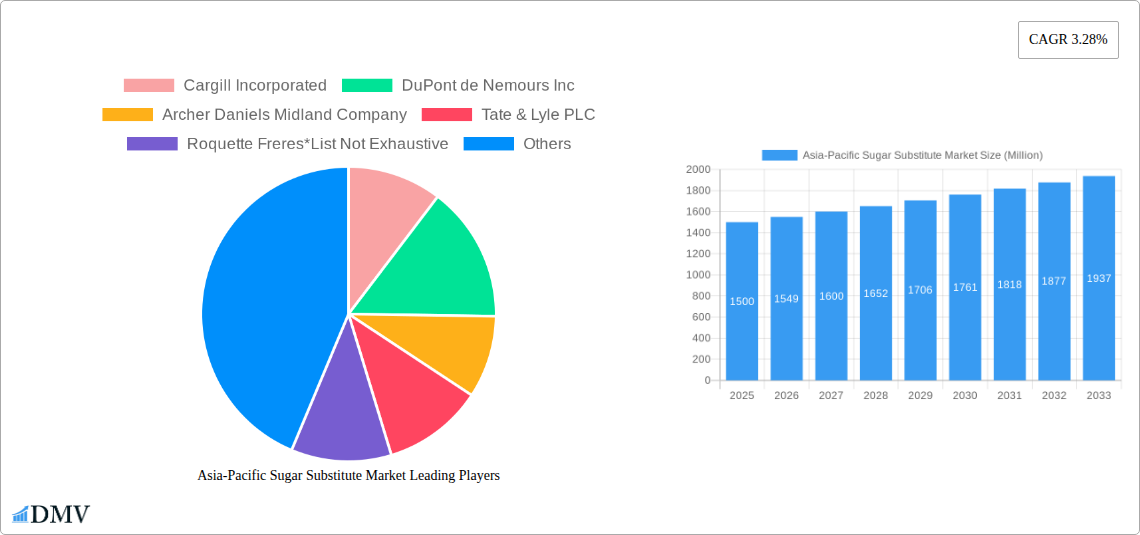

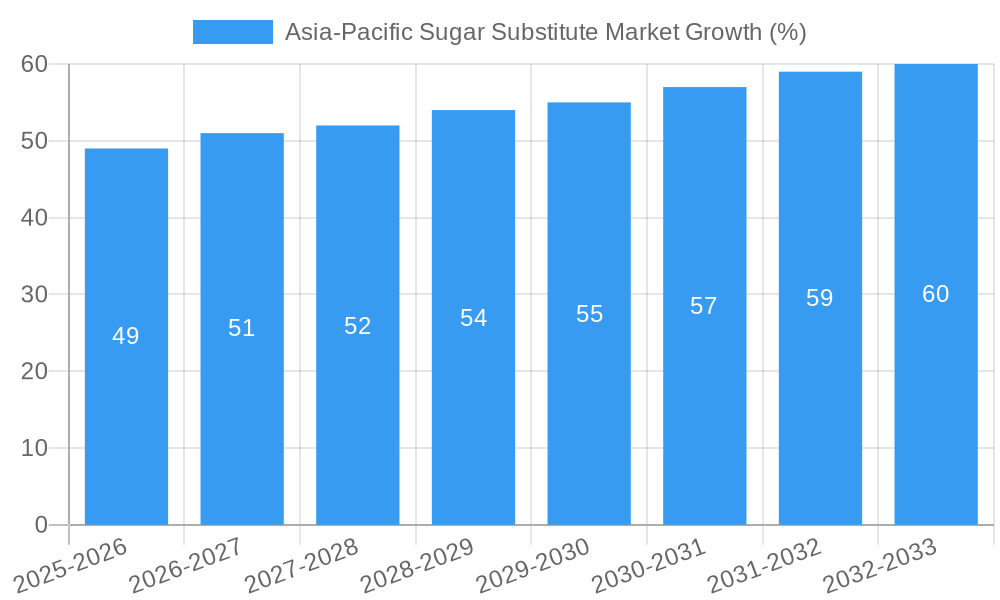

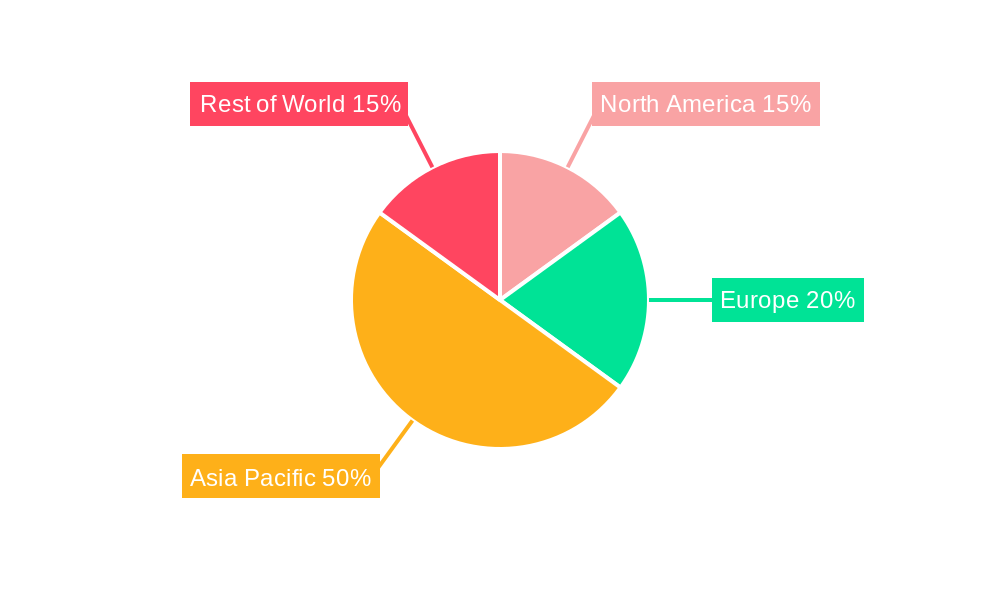

The Asia-Pacific sugar substitute market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing health consciousness, rising prevalence of diabetes, and growing demand for low-calorie food and beverages. The market's Compound Annual Growth Rate (CAGR) of 3.28% from 2025 to 2033 indicates a steady expansion, fueled by the escalating adoption of high-intensity sweeteners like stevia and erythritol in various applications, including food and beverages, dietary supplements, and pharmaceuticals. Significant growth is anticipated from countries like China, India, and Japan, which are witnessing a surge in health-conscious consumers seeking healthier alternatives to traditional sugar. The increasing preference for natural and organic sugar substitutes is also shaping market trends, pushing manufacturers to innovate and offer products that cater to this demand. However, consumer concerns regarding the potential long-term health effects of certain artificial sweeteners and fluctuating raw material prices pose challenges to market growth. Furthermore, the presence of established players like Cargill, DuPont, and Tate & Lyle creates a competitive landscape, driving innovation and price competitiveness.

Segmentation analysis reveals that high-intensity sweeteners are expected to dominate the product type segment, owing to their superior sweetness and lower caloric content compared to other options. Within applications, the food and beverage industry will continue to be a major driver, followed by the expanding dietary supplements and pharmaceuticals sectors. The Asia-Pacific region's burgeoning middle class, coupled with rising disposable incomes, further contributes to the market's expansion potential. While challenges exist, the long-term outlook for the Asia-Pacific sugar substitute market remains positive, reflecting a significant opportunity for manufacturers to capitalize on the growing demand for healthier alternatives to traditional sugar. The market is expected to reach approximately $YY million by 2033 (YY is calculated based on CAGR and 2025 value). Further research into consumer preferences, regulatory landscape, and technological advancements will be crucial for optimizing market strategies and ensuring sustained growth.

Asia-Pacific Sugar Substitute Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific sugar substitute market, offering a comprehensive overview of market dynamics, growth drivers, challenges, and future opportunities. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this rapidly evolving market. The market size in 2025 is estimated at xx Million.

Asia-Pacific Sugar Substitute Market Composition & Trends

This section delves into the competitive landscape of the Asia-Pacific sugar substitute market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We examine the market share distribution among key players, including Cargill Incorporated, DuPont de Nemours Inc, Archer Daniels Midland Company, Tate & Lyle PLC, Roquette Freres, Ajinomoto Inc, PureCircle, and Ingredion Incorporated (list not exhaustive). The report further investigates the impact of M&A activities on market consolidation, analyzing deal values and their strategic implications. The analysis also considers the influence of emerging substitute products and evolving regulatory landscapes on market dynamics. Specific data points on market share and M&A deal values for the historical period (2019-2024) and the forecast period (2025-2033) are included. The analysis will also cover the impact of consumer preference shifts on the adoption rates of different sugar substitutes. We will also assess the various end-user profiles contributing to the market demand within the region, including the roles of food and beverage companies, dietary supplement manufacturers, and pharmaceutical companies in driving market growth.

Asia-Pacific Sugar Substitute Market Industry Evolution

This section provides a detailed analysis of the Asia-Pacific sugar substitute market's evolution from 2019 to 2033. We examine market growth trajectories, technological advancements driving innovation, and evolving consumer preferences. Specific data points on growth rates and adoption metrics for various sugar substitute types (High-Intensity Sweeteners, Low Intensity Sweeteners, High Fructose Syrup, Others) across different application segments (Food and Beverage, Dietary Supplements, Pharmaceuticals, Others) are provided. The analysis will trace the technological advancements that have fueled product innovations and enhanced the functionalities of sugar substitutes. This section also investigates the impact of increasing health consciousness, rising prevalence of diabetes, and changing lifestyles on consumer demand for sugar substitutes. The report will assess the influence of government policies, regulations, and public health campaigns on market growth and adoption rates in different countries within the Asia-Pacific region. The influence of growing disposable incomes, changing dietary habits, and urbanization on the market growth will also be analyzed. We delve into the impact of consumer preference trends towards natural and healthier sweeteners and the implications for market growth.

Leading Regions, Countries, or Segments in Asia-Pacific Sugar Substitute Market

This section identifies the dominant regions, countries, and segments within the Asia-Pacific sugar substitute market. We analyze key drivers for growth in each segment, including investment trends and regulatory support.

- Dominant Segments: Analysis will determine the leading segment based on Product Type (High-Intensity Sweeteners, Low Intensity Sweeteners, High Fructose Syrup, Others) and Application (Food and Beverage, Dietary Supplements, Pharmaceuticals, Others).

- Key Drivers (by segment):

- Investment Trends: Details on investment flows into specific segments.

- Regulatory Support: Analysis of supportive government policies and regulations affecting each segment.

- Dominant Regions/Countries: Identification of leading countries/regions based on market size and growth rates, explaining the factors contributing to their dominance. The analysis will also look at factors that influence demand from different countries, such as differing consumer preferences, regulatory frameworks, economic conditions, and industrial infrastructure.

Asia-Pacific Sugar Substitute Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics in the Asia-Pacific sugar substitute market. We examine unique selling propositions (USPs) and technological advancements driving innovation, such as the development of novel sweeteners with improved taste profiles and functionalities. We will also analyze the expansion of existing products into new applications, as well as the introduction of new product formulations and delivery systems.

Propelling Factors for Asia-Pacific Sugar Substitute Market Growth

The growth of the Asia-Pacific sugar substitute market is propelled by several key factors. Increasing health consciousness among consumers, rising prevalence of diabetes and other health issues, and growing concerns regarding the adverse effects of sugar consumption are driving the demand for healthier alternatives. Furthermore, technological advancements leading to the development of new and improved sugar substitutes with enhanced taste and functionalities contribute to market growth. Government regulations promoting healthier food choices and initiatives supporting the development of the sugar substitute industry also play a vital role. Additionally, the increasing disposable incomes in many parts of Asia-Pacific enable consumers to afford more premium and healthier food options, further boosting market growth.

Obstacles in the Asia-Pacific Sugar Substitute Market

Despite the significant growth potential, the Asia-Pacific sugar substitute market faces several challenges. Stringent regulatory requirements and approval processes can hinder product launches and market expansion. Supply chain disruptions, especially those related to raw material sourcing and transportation, can impact production and availability. Intense competition among established players and emerging entrants creates pricing pressure and requires continuous innovation to maintain market share. Consumer perceptions and acceptance of artificial sweeteners, as well as pricing considerations, can pose challenges.

Future Opportunities in Asia-Pacific Sugar Substitute Market

The Asia-Pacific sugar substitute market presents significant future opportunities. Expansion into untapped markets, particularly in rural areas with increasing consumer awareness, holds immense potential. Development of innovative sugar substitutes with improved taste, texture, and functional properties offers scope for growth. Exploring new applications for sugar substitutes in emerging food and beverage categories, as well as in pharmaceuticals and dietary supplements, can unlock further market potential. Collaborations between industry players and research institutions can facilitate the development of next-generation sugar substitutes.

Major Players in the Asia-Pacific Sugar Substitute Market Ecosystem

- Cargill Incorporated

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Roquette Freres

- Ajinomoto Inc

- PureCircle

- Ingredion Incorporated

Key Developments in Asia-Pacific Sugar Substitute Market Industry

- January 2023: Launch of a new stevia-based sweetener by X company.

- March 2022: Acquisition of Y company by Z company for xx Million.

- June 2021: Introduction of a novel sugar substitute with improved functionalities by A company.

Strategic Asia-Pacific Sugar Substitute Market Forecast

The Asia-Pacific sugar substitute market is poised for sustained growth in the coming years, driven by increasing consumer demand for healthier alternatives, ongoing technological advancements, and supportive regulatory environments. Expanding into new product applications and leveraging market opportunities in emerging economies will further fuel market expansion. The market is expected to witness increased consolidation through mergers and acquisitions, shaping the competitive landscape significantly. The sustained focus on innovation, coupled with expanding consumer awareness, will pave the way for stronger growth throughout the forecast period.

Asia-Pacific Sugar Substitute Market Segmentation

-

1. Product Type

-

1.1. High-Intensity Sweeteners

- 1.1.1. Stevia

- 1.1.2. Aspartame

- 1.1.3. Cyclamate

- 1.1.4. Sucralose

- 1.1.5. Other High Intensity Sweeteners

-

1.2. Low-Intensity Sweeteners

- 1.2.1. Sorbitol

- 1.2.2. Maltitol

- 1.2.3. Xylitol

- 1.2.4. Other Low Intensity Sweeteners

- 1.3. High Fructose Syrup

-

1.1. High-Intensity Sweeteners

-

2. Application

-

2.1. Food and Beverage

- 2.1.1. Bakery

- 2.1.2. Confectionery

- 2.1.3. Dairy

- 2.1.4. Beverages

- 2.1.5. Meat and Seafood

- 2.1.6. Other Food and Beverages

- 2.2. Dietary Supplements

- 2.3. Pharmaceuticals

-

2.1. Food and Beverage

-

3. Geography

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Sugar Substitute Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Sugar Substitute Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Stevia Held the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-Intensity Sweeteners

- 5.1.1.1. Stevia

- 5.1.1.2. Aspartame

- 5.1.1.3. Cyclamate

- 5.1.1.4. Sucralose

- 5.1.1.5. Other High Intensity Sweeteners

- 5.1.2. Low-Intensity Sweeteners

- 5.1.2.1. Sorbitol

- 5.1.2.2. Maltitol

- 5.1.2.3. Xylitol

- 5.1.2.4. Other Low Intensity Sweeteners

- 5.1.3. High Fructose Syrup

- 5.1.1. High-Intensity Sweeteners

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.1.1. Bakery

- 5.2.1.2. Confectionery

- 5.2.1.3. Dairy

- 5.2.1.4. Beverages

- 5.2.1.5. Meat and Seafood

- 5.2.1.6. Other Food and Beverages

- 5.2.2. Dietary Supplements

- 5.2.3. Pharmaceuticals

- 5.2.1. Food and Beverage

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. India Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. High-Intensity Sweeteners

- 6.1.1.1. Stevia

- 6.1.1.2. Aspartame

- 6.1.1.3. Cyclamate

- 6.1.1.4. Sucralose

- 6.1.1.5. Other High Intensity Sweeteners

- 6.1.2. Low-Intensity Sweeteners

- 6.1.2.1. Sorbitol

- 6.1.2.2. Maltitol

- 6.1.2.3. Xylitol

- 6.1.2.4. Other Low Intensity Sweeteners

- 6.1.3. High Fructose Syrup

- 6.1.1. High-Intensity Sweeteners

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.1.1. Bakery

- 6.2.1.2. Confectionery

- 6.2.1.3. Dairy

- 6.2.1.4. Beverages

- 6.2.1.5. Meat and Seafood

- 6.2.1.6. Other Food and Beverages

- 6.2.2. Dietary Supplements

- 6.2.3. Pharmaceuticals

- 6.2.1. Food and Beverage

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. China Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. High-Intensity Sweeteners

- 7.1.1.1. Stevia

- 7.1.1.2. Aspartame

- 7.1.1.3. Cyclamate

- 7.1.1.4. Sucralose

- 7.1.1.5. Other High Intensity Sweeteners

- 7.1.2. Low-Intensity Sweeteners

- 7.1.2.1. Sorbitol

- 7.1.2.2. Maltitol

- 7.1.2.3. Xylitol

- 7.1.2.4. Other Low Intensity Sweeteners

- 7.1.3. High Fructose Syrup

- 7.1.1. High-Intensity Sweeteners

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.1.1. Bakery

- 7.2.1.2. Confectionery

- 7.2.1.3. Dairy

- 7.2.1.4. Beverages

- 7.2.1.5. Meat and Seafood

- 7.2.1.6. Other Food and Beverages

- 7.2.2. Dietary Supplements

- 7.2.3. Pharmaceuticals

- 7.2.1. Food and Beverage

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. India

- 7.3.2. China

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. High-Intensity Sweeteners

- 8.1.1.1. Stevia

- 8.1.1.2. Aspartame

- 8.1.1.3. Cyclamate

- 8.1.1.4. Sucralose

- 8.1.1.5. Other High Intensity Sweeteners

- 8.1.2. Low-Intensity Sweeteners

- 8.1.2.1. Sorbitol

- 8.1.2.2. Maltitol

- 8.1.2.3. Xylitol

- 8.1.2.4. Other Low Intensity Sweeteners

- 8.1.3. High Fructose Syrup

- 8.1.1. High-Intensity Sweeteners

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.1.1. Bakery

- 8.2.1.2. Confectionery

- 8.2.1.3. Dairy

- 8.2.1.4. Beverages

- 8.2.1.5. Meat and Seafood

- 8.2.1.6. Other Food and Beverages

- 8.2.2. Dietary Supplements

- 8.2.3. Pharmaceuticals

- 8.2.1. Food and Beverage

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. India

- 8.3.2. China

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. High-Intensity Sweeteners

- 9.1.1.1. Stevia

- 9.1.1.2. Aspartame

- 9.1.1.3. Cyclamate

- 9.1.1.4. Sucralose

- 9.1.1.5. Other High Intensity Sweeteners

- 9.1.2. Low-Intensity Sweeteners

- 9.1.2.1. Sorbitol

- 9.1.2.2. Maltitol

- 9.1.2.3. Xylitol

- 9.1.2.4. Other Low Intensity Sweeteners

- 9.1.3. High Fructose Syrup

- 9.1.1. High-Intensity Sweeteners

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.1.1. Bakery

- 9.2.1.2. Confectionery

- 9.2.1.3. Dairy

- 9.2.1.4. Beverages

- 9.2.1.5. Meat and Seafood

- 9.2.1.6. Other Food and Beverages

- 9.2.2. Dietary Supplements

- 9.2.3. Pharmaceuticals

- 9.2.1. Food and Beverage

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. India

- 9.3.2. China

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. High-Intensity Sweeteners

- 10.1.1.1. Stevia

- 10.1.1.2. Aspartame

- 10.1.1.3. Cyclamate

- 10.1.1.4. Sucralose

- 10.1.1.5. Other High Intensity Sweeteners

- 10.1.2. Low-Intensity Sweeteners

- 10.1.2.1. Sorbitol

- 10.1.2.2. Maltitol

- 10.1.2.3. Xylitol

- 10.1.2.4. Other Low Intensity Sweeteners

- 10.1.3. High Fructose Syrup

- 10.1.1. High-Intensity Sweeteners

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage

- 10.2.1.1. Bakery

- 10.2.1.2. Confectionery

- 10.2.1.3. Dairy

- 10.2.1.4. Beverages

- 10.2.1.5. Meat and Seafood

- 10.2.1.6. Other Food and Beverages

- 10.2.2. Dietary Supplements

- 10.2.3. Pharmaceuticals

- 10.2.1. Food and Beverage

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. India

- 10.3.2. China

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. China Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific Sugar Substitute Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Cargill Incorporated

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 DuPont de Nemours Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Archer Daniels Midland Company

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Tate & Lyle PLC

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Roquette Freres*List Not Exhaustive

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Ajinomoto Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 PureCircle

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Ingredion Incorporated

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.1 Cargill Incorporated

List of Figures

- Figure 1: Asia-Pacific Sugar Substitute Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Sugar Substitute Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Sugar Substitute Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Sugar Substitute Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Sugar Substitute Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Sugar Substitute Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Sugar Substitute Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Sugar Substitute Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Sugar Substitute Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific Sugar Substitute Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Sugar Substitute Market?

The projected CAGR is approximately 3.28%.

2. Which companies are prominent players in the Asia-Pacific Sugar Substitute Market?

Key companies in the market include Cargill Incorporated, DuPont de Nemours Inc, Archer Daniels Midland Company, Tate & Lyle PLC, Roquette Freres*List Not Exhaustive, Ajinomoto Inc, PureCircle, Ingredion Incorporated.

3. What are the main segments of the Asia-Pacific Sugar Substitute Market?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Stevia Held the Largest Market Share.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Sugar Substitute Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Sugar Substitute Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Sugar Substitute Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Sugar Substitute Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence