Key Insights

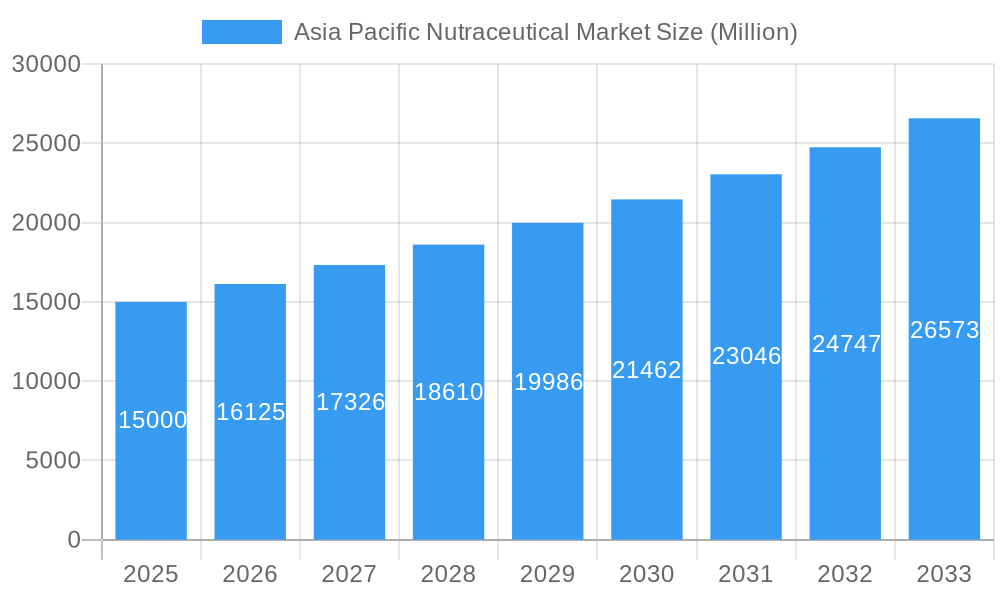

The Asia-Pacific nutraceutical market is poised for substantial growth, projected to expand significantly from $103 billion in 2025. This robust expansion is driven by heightened consumer awareness of preventative healthcare, increasing disposable incomes, and a growing aging demographic, particularly in key markets such as China, Japan, and India. Demand is strong for functional foods and beverages, dietary supplements, and other nutraceutical products aimed at enhancing overall well-being. Key product categories include specialized functional beverages (e.g., for immunity and energy), targeted dietary supplements, and functional foods integrated into daily diets. Distribution is diverse, spanning specialty stores, supermarkets, convenience stores, pharmacies, and a rapidly growing online retail sector. Despite challenges like regulatory complexities and product quality concerns, market expansion is expected to continue, fueled by product innovation and strategic marketing.

Asia Pacific Nutraceutical Market Market Size (In Billion)

The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 7%. Functional beverages and online retail segments are anticipated to lead this growth due to convenience and expanding e-commerce. Regional variations are expected, with China and India potentially exhibiting higher growth rates owing to their large populations and burgeoning middle classes. Intense competition is driving innovation, mergers, and acquisitions as companies strive to enhance market share. Continuous focus on product quality, safety, and regulatory compliance will be paramount for sustained success in this dynamic market.

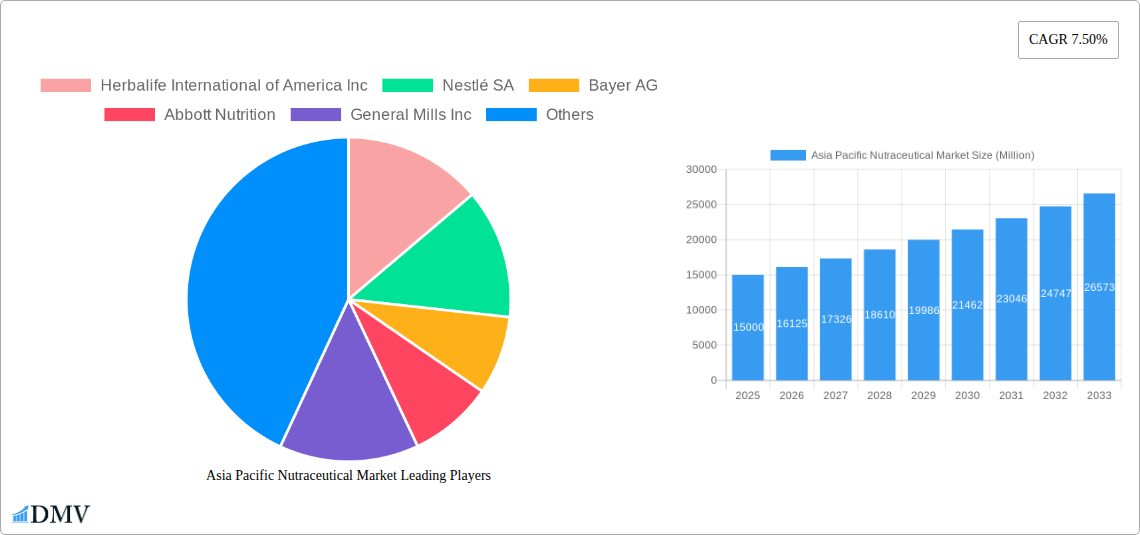

Asia Pacific Nutraceutical Market Company Market Share

Asia Pacific Nutraceutical Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific nutraceutical market, encompassing market size, growth drivers, challenges, and future opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report offers invaluable insights for stakeholders, including manufacturers, distributors, investors, and policymakers, seeking to navigate this dynamic and rapidly expanding market. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Asia Pacific Nutraceutical Market Composition & Trends

The Asia Pacific nutraceutical market is characterized by a moderately fragmented landscape, with several large multinational corporations and numerous smaller regional players competing for market share. Major players like Herbalife International of America Inc, Nestlé SA, Bayer AG, Abbott Nutrition, General Mills Inc, GlaxoSmithKline Plc, PepsiCo Inc, Pure Harvest Smart Farms Ltd, Remedy Drinks, The Kellogg's Company, and Alticor (Amway Corporation) dominate significant segments. However, the market exhibits high potential for new entrants due to increasing consumer health awareness and product innovation.

Market share distribution varies significantly across product types and distribution channels. Dietary supplements command a substantial share, driven by growing health consciousness and rising disposable incomes. Functional beverages are also experiencing rapid growth, propelled by increasing demand for convenient and healthy alternatives.

Mergers and acquisitions (M&A) are increasingly prevalent, with deal values exceeding xx Million in recent years, consolidating market share and driving innovation. Key M&A activities include strategic acquisitions of smaller companies possessing specialized technologies or regional market expertise by larger players. The regulatory landscape varies across the region, influencing product approvals and market access. The presence of substitute products, particularly traditional herbal remedies and homeopathic treatments, presents competitive pressures. End-user profiles are diverse, encompassing health-conscious consumers, athletes, aging populations, and individuals seeking preventative healthcare solutions.

- Market Concentration: Moderately fragmented, dominated by several key players.

- Innovation Catalysts: Growing health awareness, technological advancements, increasing demand for functional foods.

- Regulatory Landscape: Varies across countries, impacting product approvals and market access.

- Substitute Products: Traditional remedies, homeopathic treatments.

- End-User Profiles: Health-conscious individuals, athletes, aging populations.

- M&A Activities: Significant M&A activity, with deal values exceeding xx Million.

Asia Pacific Nutraceutical Market Industry Evolution

The Asia Pacific nutraceutical market has witnessed significant growth over the historical period (2019-2024), driven by a confluence of factors including rising health consciousness, increasing disposable incomes, rapid urbanization, and growing awareness of preventive healthcare. The market has exhibited a CAGR of xx% during this period. Technological advancements in areas such as personalized nutrition and functional food development have further fueled market growth. The emergence of e-commerce platforms has broadened access to nutraceutical products, accelerating market expansion.

Consumer demands are evolving, with a growing preference for natural, organic, and sustainably sourced ingredients. This trend is reflected in the increasing demand for plant-based alternatives, clean label products, and personalized nutrition solutions. The market is also seeing a shift towards proactive health management, with consumers actively seeking ways to improve their overall well-being through nutrition. Growth is projected to be particularly strong in countries with rapidly expanding middle classes and increasing health expenditures. Technological advancements in product formulation, packaging, and delivery systems continue to drive innovation and expand market opportunities. The adoption of innovative technologies like personalized nutrition and precision medicine will propel market growth significantly over the forecast period.

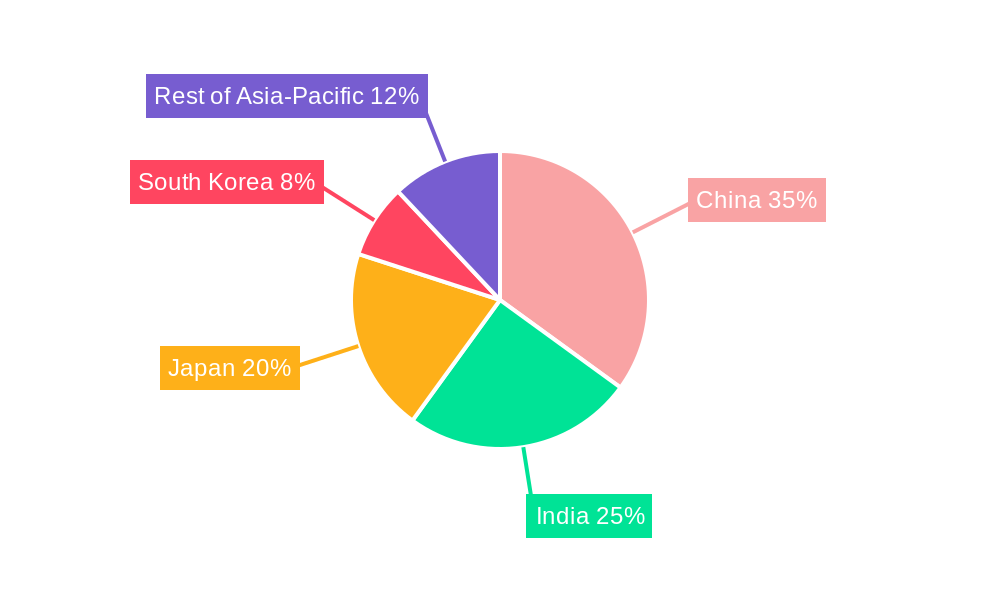

Leading Regions, Countries, or Segments in Asia Pacific Nutraceutical Market

China and India are currently the leading markets in the Asia Pacific nutraceutical market, driven by factors like rising disposable incomes, increased health awareness, and a large and growing population. Other key markets include Australia, Japan, South Korea, and Singapore.

Within the product segments, dietary supplements maintain a substantial market share due to their established presence and wide-ranging applications. However, functional beverages are displaying strong growth potential, fueled by the increasing demand for convenient and healthier alternatives to traditional beverages. Online retail channels are experiencing rapid expansion, offering consumers greater convenience and product selection.

- Key Drivers for Dominance:

- China & India: Large and growing populations, increasing disposable incomes, rising health awareness.

- Dietary Supplements: Established market presence, wide range of applications.

- Functional Beverages: Growing demand for convenient and healthy alternatives.

- Online Retail: Increased convenience, wider product selection.

- Regulatory Support: Government initiatives promoting health and wellness, including investments in research and development.

- Investment Trends: Significant private and public investment in the nutraceutical sector.

The dominance of these regions and segments is underpinned by a combination of factors, including favourable demographic trends, evolving consumer preferences, and supportive regulatory environments.

Asia Pacific Nutraceutical Market Product Innovations

Recent product innovations have focused on enhancing product efficacy, improving taste and texture, and incorporating natural and organic ingredients. For example, the introduction of high-protein iced coffee by Herbalife Nutrition caters to consumers seeking convenient and nutritious alternatives. The launch of plant-based milk alternatives by PureHarvest highlights the growing demand for sustainable and ethically sourced products. Furthermore, the development of personalized nutrition solutions tailored to individual needs and health goals is gaining traction. These innovations demonstrate a clear trend towards consumer-centric product development, emphasizing natural ingredients, enhanced functionality, and personalized solutions.

Propelling Factors for Asia Pacific Nutraceutical Market Growth

Technological advancements in product formulation, delivery systems, and personalized nutrition are key drivers. The rising health consciousness among consumers, fueled by increased awareness of chronic diseases and preventive healthcare, is also propelling market growth. Economic factors, such as rising disposable incomes and increased healthcare spending, are contributing significantly. Finally, supportive regulatory policies in several countries are creating a favorable environment for market expansion.

Obstacles in the Asia Pacific Nutraceutical Market Market

Regulatory hurdles, including varying regulations across countries and stringent approval processes, pose significant challenges. Supply chain disruptions, particularly those related to raw material sourcing and logistics, can impact product availability and cost. Intense competition among existing players, both large multinational corporations and smaller regional companies, also creates pressure on pricing and profitability.

Future Opportunities in Asia Pacific Nutraceutical Market

Expanding into untapped markets within the region, particularly in Southeast Asia, presents significant growth potential. The development of innovative products catering to specific health needs, such as personalized nutrition solutions, offers considerable opportunities. Leveraging digital technologies for personalized marketing and targeted product development will also play a critical role in driving future growth.

Major Players in the Asia Pacific Nutraceutical Market Ecosystem

- Herbalife International of America Inc

- Nestlé SA

- Bayer AG

- Abbott Nutrition

- General Mills Inc

- GlaxoSmithKline Plc

- PepsiCo Inc

- Pure Harvest Smart Farms Ltd

- Remedy Drinks

- The Kellogg's Company

- Alticor (Amway Corporation)

- *List Not Exhaustive

Key Developments in Asia Pacific Nutraceutical Market Industry

- July 2021: Herbalife Nutrition of America Inc. launched high-protein iced coffee in Asia Pacific.

- July 2022: PureHarvest launched four new plant-based alt-milk products in Australia.

- October 2022: Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink in Australia.

Strategic Asia Pacific Nutraceutical Market Forecast

The Asia Pacific nutraceutical market is poised for continued robust growth driven by favourable demographics, rising health awareness, and technological advancements. Emerging opportunities in personalized nutrition, plant-based alternatives, and digital marketing present significant potential for market expansion. The market's future trajectory depends on successfully navigating regulatory landscapes, mitigating supply chain vulnerabilities, and capitalizing on emerging consumer trends.

Asia Pacific Nutraceutical Market Segmentation

-

1. Product Type

-

1.1. Functional Food

- 1.1.1. Cereals

- 1.1.2. Bakery and Confectionery

- 1.1.3. Dairy

- 1.1.4. Snacks

- 1.1.5. Other Functional Foods

-

1.2. Functional Beverages

- 1.2.1. Energy Drinks

- 1.2.2. Sports Drinks

- 1.2.3. Fortified Juice

- 1.2.4. Dairy and Dairy Alternative Beverages

-

1.3. Dietary Supplements

- 1.3.1. Vitamins

- 1.3.2. Minerals

- 1.3.3. Botanicals

- 1.3.4. Enzymes

- 1.3.5. Fatty Acids

- 1.3.6. Proteins

- 1.3.7. Other Dietary Supplements

-

1.1. Functional Food

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Supermarkets/Hypermarkets,

- 2.3. Convenience Stores

- 2.4. Drug Stores/Pharmacies

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

Asia Pacific Nutraceutical Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Nutraceutical Market Regional Market Share

Geographic Coverage of Asia Pacific Nutraceutical Market

Asia Pacific Nutraceutical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Food Safety Regulations

- 3.4. Market Trends

- 3.4.1. Growing Consumption of Functional Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Nutraceutical Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.1.1. Cereals

- 5.1.1.2. Bakery and Confectionery

- 5.1.1.3. Dairy

- 5.1.1.4. Snacks

- 5.1.1.5. Other Functional Foods

- 5.1.2. Functional Beverages

- 5.1.2.1. Energy Drinks

- 5.1.2.2. Sports Drinks

- 5.1.2.3. Fortified Juice

- 5.1.2.4. Dairy and Dairy Alternative Beverages

- 5.1.3. Dietary Supplements

- 5.1.3.1. Vitamins

- 5.1.3.2. Minerals

- 5.1.3.3. Botanicals

- 5.1.3.4. Enzymes

- 5.1.3.5. Fatty Acids

- 5.1.3.6. Proteins

- 5.1.3.7. Other Dietary Supplements

- 5.1.1. Functional Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Supermarkets/Hypermarkets,

- 5.2.3. Convenience Stores

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Herbalife International of America Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestlé SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbott Nutrition

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Mills Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GlaxoSmithKline Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PepsiCo Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pure Harvest Smart Farms Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Remedy Drinks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Kellogg's Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alticor (Amway Corporation)*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Herbalife International of America Inc

List of Figures

- Figure 1: Asia Pacific Nutraceutical Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Nutraceutical Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Nutraceutical Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Nutraceutical Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Nutraceutical Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Asia Pacific Nutraceutical Market?

Key companies in the market include Herbalife International of America Inc, Nestlé SA, Bayer AG, Abbott Nutrition, General Mills Inc, GlaxoSmithKline Plc, PepsiCo Inc, Pure Harvest Smart Farms Ltd, Remedy Drinks, The Kellogg's Company, Alticor (Amway Corporation)*List Not Exhaustive.

3. What are the main segments of the Asia Pacific Nutraceutical Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 103 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages.

6. What are the notable trends driving market growth?

Growing Consumption of Functional Food and Beverages.

7. Are there any restraints impacting market growth?

Stringent Food Safety Regulations.

8. Can you provide examples of recent developments in the market?

October 2022: Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink available at 7-Eleven stores across Australia. Remedy K! CK is available in three fruity flavors - blackberry, lemon-lime, and mango pineapple.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Nutraceutical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Nutraceutical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Nutraceutical Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Nutraceutical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence