Key Insights

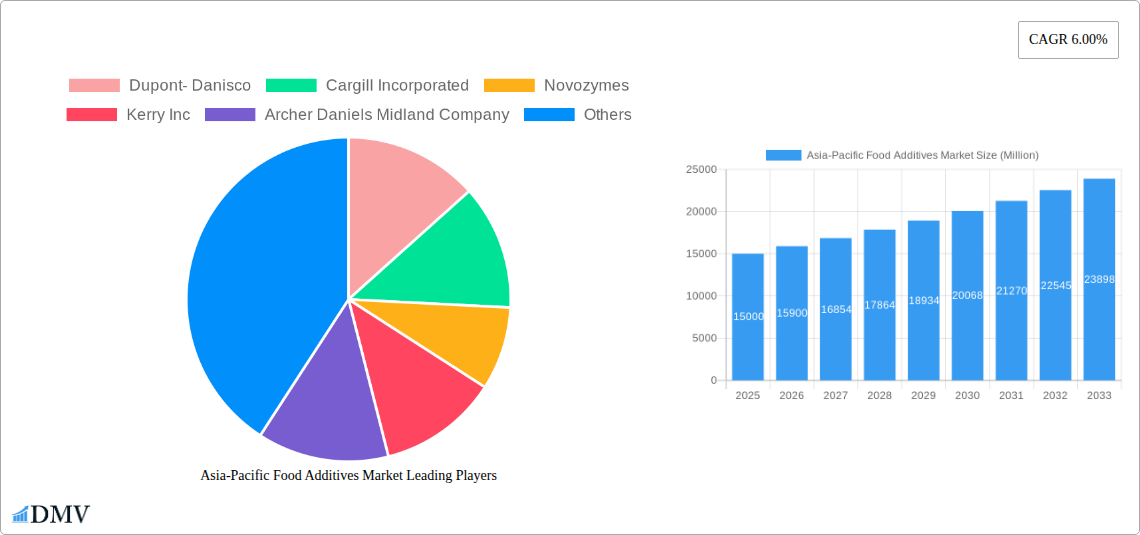

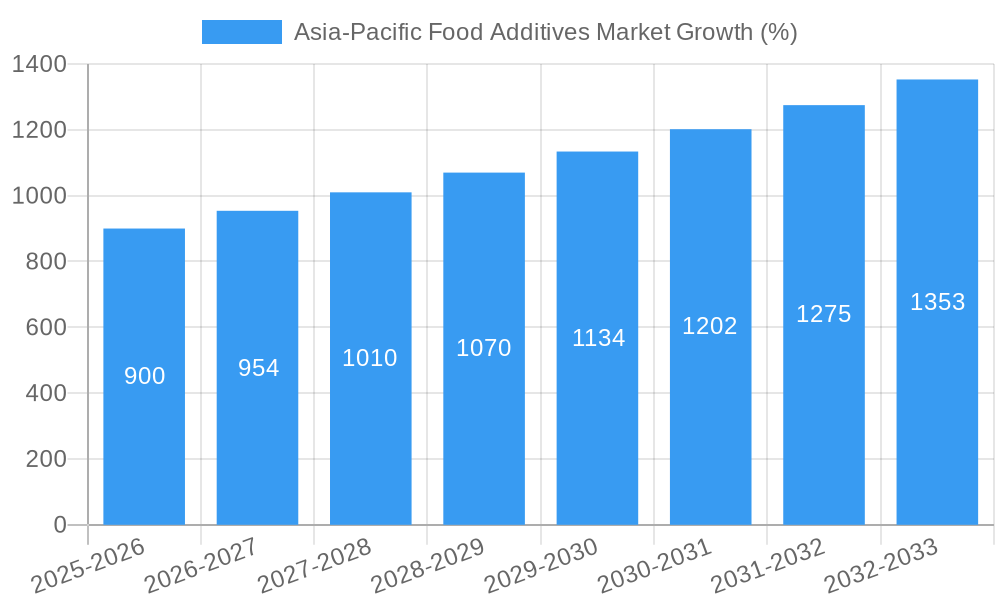

The Asia-Pacific food additives market, currently valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), is projected to experience robust growth, driven by a 6% Compound Annual Growth Rate (CAGR) through 2033. This expansion is fueled by several key factors. Firstly, the region's burgeoning population and rising disposable incomes are leading to increased demand for processed and convenience foods, which heavily rely on food additives for preservation, texture enhancement, and flavor improvement. Secondly, rapid urbanization and changing consumer lifestyles are boosting consumption of ready-to-eat meals and beverages, further driving market growth. The increasing popularity of bakery products, meat and meat products, and dairy products across the region also significantly contributes to the demand for a wide range of food additives. Major players like Dupont-Danisco, Cargill, and Novozymes are strategically investing in research and development to introduce innovative and high-performing food additives, catering to the growing demand for natural and clean-label products.

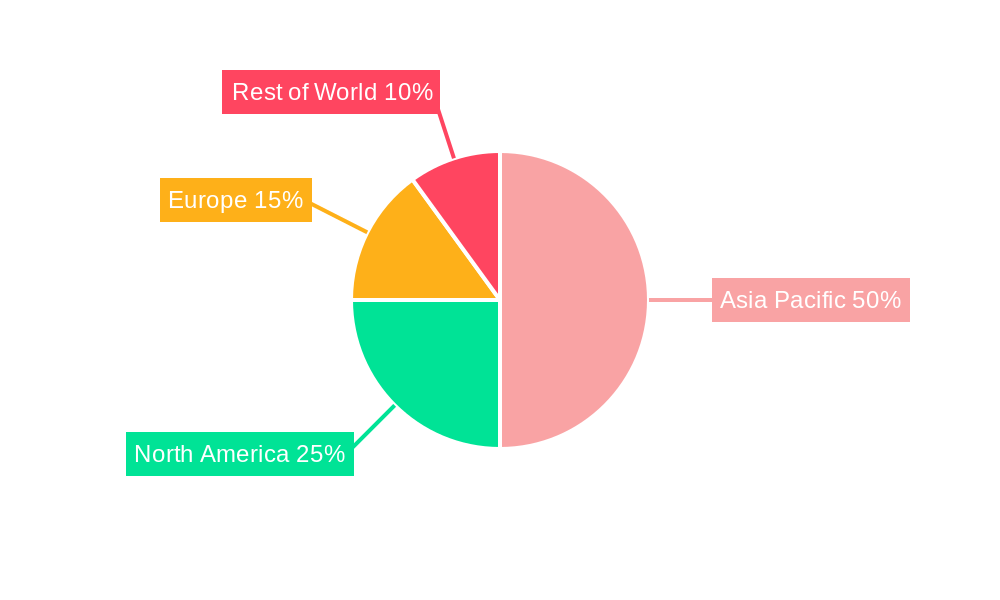

However, the market also faces certain restraints. Stringent government regulations regarding the use of certain food additives, growing consumer awareness about health and safety concerns related to artificial additives, and fluctuating raw material prices pose challenges to market growth. Nevertheless, the dominance of key segments like emulsifiers, preservatives, and sweeteners, coupled with the expanding application across diverse food and beverage categories, is expected to continue driving substantial market growth. Within the Asia-Pacific region, countries like China, India, and Japan are significant contributors, showcasing considerable potential due to their large populations and developing food processing industries. The market segmentation by type (emulsifiers, anti-caking agents, enzymes, etc.) and application (beverages, bakery, dairy, etc.) provides valuable insights for strategic market positioning by key players.

Asia-Pacific Food Additives Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia-Pacific food additives market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a meticulous overview of market trends, leading players, and future growth potential. The market size in 2025 is estimated at xx Million, projecting significant expansion by 2033.

Asia-Pacific Food Additives Market Composition & Trends

This section delves into the intricate structure of the Asia-Pacific food additives market, examining key aspects influencing its trajectory. We analyze market concentration, revealing the dominance of major players like Dupont-Danisco, Cargill Incorporated, and Novozymes. Innovation within the sector is propelled by the rising demand for clean-label products and functional foods. The regulatory landscape, constantly evolving with stricter safety standards, significantly impacts market dynamics. The report also assesses the presence of substitute products and their influence on market share. End-user profiles across various food segments (beverages, bakery, dairy, etc.) are meticulously examined, highlighting their unique requirements and preferences. The analysis encompasses mergers and acquisitions (M&A) activities, including deal values and their impact on market consolidation. For instance, the recent acquisitions in the food stabilizer segment illustrate a trend towards portfolio diversification. Market share distribution is detailed, revealing the competitive intensity within different additive categories. We further discuss the impact of evolving consumer preferences for natural and organic ingredients, driving innovation in product formulations.

Asia-Pacific Food Additives Market Industry Evolution

This section meticulously traces the evolution of the Asia-Pacific food additives market from 2019 to 2024 and projects its future course to 2033. We analyze the market's growth trajectory, highlighting key periods of expansion and contraction. Technological advancements, such as the development of bio-based emulsifiers and novel enzymes, have significantly shaped the industry's landscape. Consumer demands for healthier, more convenient, and sustainable food products are driving innovation and shaping market trends. Specific data points are presented, illustrating growth rates across various segments and the adoption of novel technologies. The increasing demand for clean-label products necessitates the development and adoption of natural and organic food additives, fueling the growth in this niche sector. The section further discusses the influence of emerging economies and evolving consumer preferences on market growth. The market is experiencing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Leading Regions, Countries, or Segments in Asia-Pacific Food Additives Market

This section identifies the leading regions, countries, and segments within the Asia-Pacific food additives market.

Key Drivers:

- Investment Trends: Significant investments in research and development are driving innovation and expanding product portfolios.

- Regulatory Support: Supportive regulatory frameworks are fostering market growth and attracting investments.

- Consumer Preferences: The growing demand for healthier and convenient food products is driving segment growth.

Dominance Factors:

China and India are leading the market due to their massive populations, rapid economic growth, and expanding food processing industries. Within the additive types, emulsifiers and preservatives command the largest market share due to their widespread applications in diverse food products. Similarly, the bakery and beverage industries demonstrate high demand for food additives, contributing significantly to overall market growth. Detailed analysis is provided for each segment, revealing their respective contributions to overall market size and potential for future expansion.

Asia-Pacific Food Additives Market Product Innovations

Recent innovations include bio-based emulsifiers that enhance product stability and texture while offering environmental benefits, along with natural preservatives that cater to growing consumer demand for clean-label products. Advances in enzyme technology have improved food processing efficiency and created opportunities for developing functional foods. These innovations, coupled with improvements in flavor and color technologies, are shaping the future of food additives in the Asia-Pacific region. The development and adoption of these innovative additives are driven by consumer demands for enhanced product quality, longer shelf life, and improved sensory attributes.

Propelling Factors for Asia-Pacific Food Additives Market Growth

Several factors drive the growth of the Asia-Pacific food additives market. Technological advancements, especially in biotechnology and nanotechnology, are contributing to the development of novel and improved additives. The burgeoning food processing industry, particularly in rapidly developing economies, creates significant demand for these products. Favorable regulatory frameworks, including investments in research and development, promote the development of advanced food additives.

Obstacles in the Asia-Pacific Food Additives Market

The Asia-Pacific food additives market faces several challenges, including stringent regulatory requirements that increase compliance costs. Supply chain disruptions due to geopolitical instability and logistical complexities can impact product availability and pricing. Intense competition among existing players and the emergence of new entrants create pressure on market share and pricing. These factors have a measurable impact on overall market growth and profitability.

Future Opportunities in Asia-Pacific Food Additives Market

Emerging opportunities exist in the growing demand for natural and clean-label additives. The development of sustainable and eco-friendly additives is attracting significant interest. Expansion into new markets within the region, coupled with the increased adoption of advanced technologies in the food processing industry, provides ample growth potential.

Major Players in the Asia-Pacific Food Additives Market Ecosystem

- Dupont-Danisco

- Cargill Incorporated

- Novozymes

- Kerry Inc

- Archer Daniels Midland Company

- Corbion NV

- Koninklijke DSM N V

- Tate & Lyle

Key Developments in Asia-Pacific Food Additives Market Industry

- 2022 Q3: Dupont-Danisco invests in bio-based emulsifiers to expand its sustainable product portfolio.

- 2023 Q1: Cargill acquires a food stabilizer manufacturer, strengthening its position in the market.

- 2024 Q2: Novozymes launches a novel enzyme enhancing food texture, improving consumer appeal.

- 2024 Q4: Kerry Inc. introduces a natural food preservative, responding to increasing consumer demand for clean-label products.

Strategic Asia-Pacific Food Additives Market Forecast

The Asia-Pacific food additives market is poised for sustained growth, driven by several factors. The rising demand for processed foods, coupled with technological advancements, creates a favorable environment for expansion. The increasing focus on sustainability and the growing preference for natural ingredients will continue to shape product innovation. The market's future potential is significant, offering attractive opportunities for existing and new players.

Asia-Pacific Food Additives Market Segmentation

-

1. Type

- 1.1. Emulsifiers

- 1.2. Anti-Caking Agents

- 1.3. Enzymes

- 1.4. Hydrocolloids

- 1.5. Acidulants

- 1.6. Preservatives

- 1.7. Sweeteners

- 1.8. Food Flavors

- 1.9. Food Flavor Enhancers

- 1.10. Food Colorants

-

2. Applications

- 2.1. Beverages

- 2.2. Bakery

- 2.3. Meat and Meat Products

- 2.4. Dairy Products

- 2.5. Others

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia Pacific

Asia-Pacific Food Additives Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia-Pacific Food Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Bakery Holds a Great Potential

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Emulsifiers

- 5.1.2. Anti-Caking Agents

- 5.1.3. Enzymes

- 5.1.4. Hydrocolloids

- 5.1.5. Acidulants

- 5.1.6. Preservatives

- 5.1.7. Sweeteners

- 5.1.8. Food Flavors

- 5.1.9. Food Flavor Enhancers

- 5.1.10. Food Colorants

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Beverages

- 5.2.2. Bakery

- 5.2.3. Meat and Meat Products

- 5.2.4. Dairy Products

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Dupont- Danisco

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cargill Incorporated

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Novozymes

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Kerry Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Archer Daniels Midland Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Corbion NV

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Koninklijke DSM N V

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Tate & Lyle

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Dupont- Danisco

List of Figures

- Figure 1: Asia-Pacific Food Additives Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Food Additives Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Food Additives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Food Additives Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific Food Additives Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 4: Asia-Pacific Food Additives Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Food Additives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Food Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Food Additives Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Asia-Pacific Food Additives Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 16: Asia-Pacific Food Additives Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Food Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Asia-Pacific Food Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Food Additives Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Asia-Pacific Food Additives Market?

Key companies in the market include Dupont- Danisco, Cargill Incorporated, Novozymes, Kerry Inc, Archer Daniels Midland Company, Corbion NV, Koninklijke DSM N V , Tate & Lyle.

3. What are the main segments of the Asia-Pacific Food Additives Market?

The market segments include Type, Applications, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Bakery Holds a Great Potential.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Dupont-Danisco invests in bio-based emulsifiers. 2. Cargill acquires food stabilizer manufacturer to expand its portfolio. 3. Novozymes launches a new enzyme for improved food texture. 4. Kerry Inc. develops a natural food preservative to meet consumer demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Food Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Food Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Food Additives Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Food Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence