Key Insights

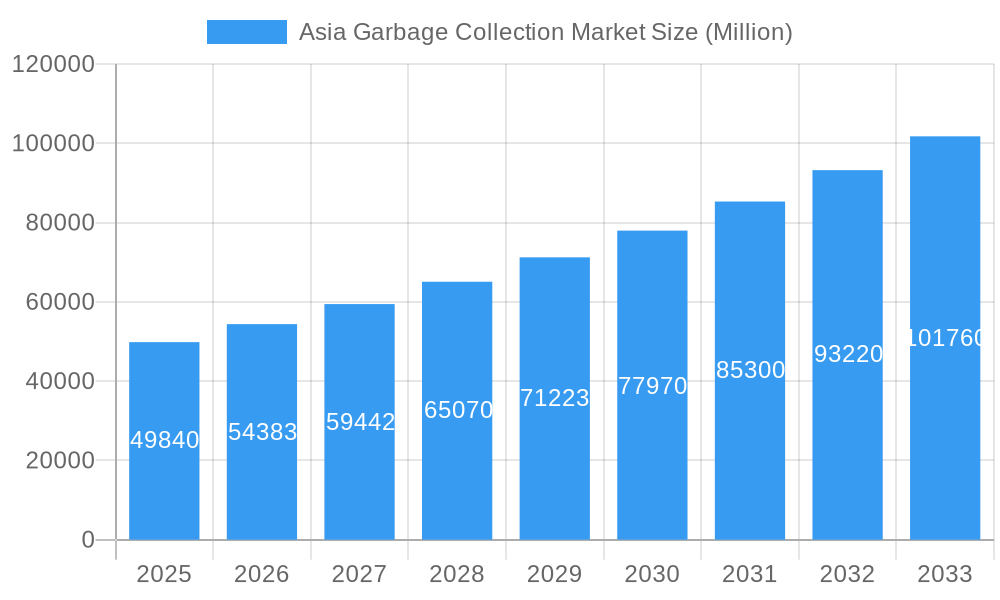

The Asia garbage collection market, valued at $49.84 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.97% from 2025 to 2033. This expansion is fueled by several key factors. Rapid urbanization across the Asia-Pacific region is leading to increased waste generation, necessitating efficient and sustainable waste management solutions. Stringent government regulations aimed at improving environmental standards and reducing pollution are also driving market growth. Furthermore, rising environmental awareness among consumers and businesses is fostering a demand for eco-friendly waste collection and recycling practices. The market is segmented by waste type (hazardous and non-hazardous), collection type (curbside, door-to-door, community programs), end-user (municipal, healthcare, chemical, mining), and product type (disposal and recycling equipment, sorting equipment). Significant growth is expected in segments such as hazardous waste management due to increasing industrialization and stricter regulatory compliance requirements. Similarly, the demand for advanced waste sorting and recycling equipment is anticipated to rise due to growing focus on resource recovery and circular economy principles. China, Japan, and India are expected to remain dominant markets within the region, contributing significantly to the overall market growth. However, other countries in the Asia-Pacific region are also witnessing increasing investment in waste management infrastructure, promising further market expansion.

Asia Garbage Collection Market Market Size (In Billion)

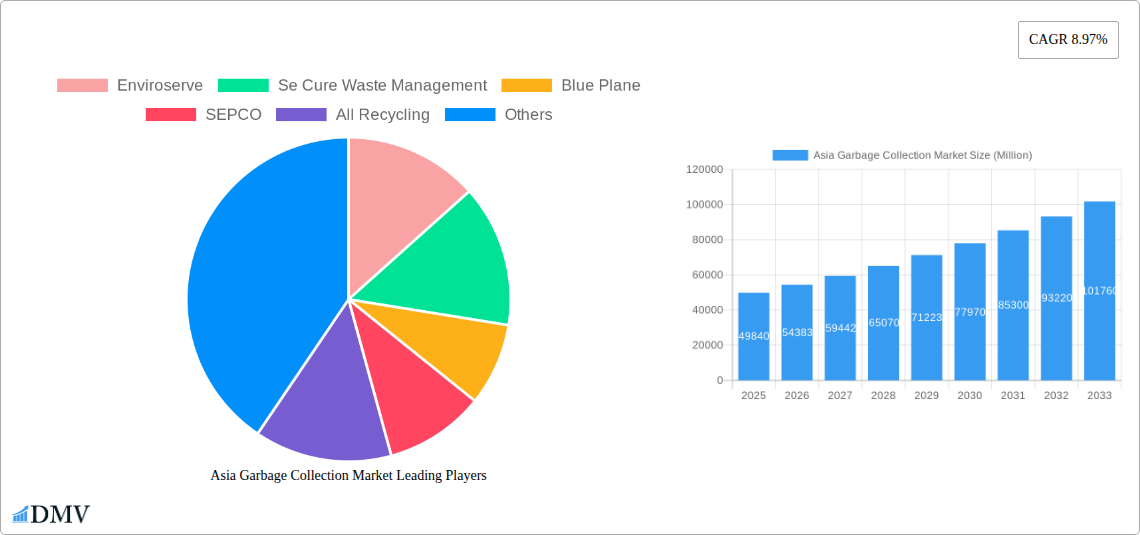

The competitive landscape is characterized by a mix of established international players and regional companies. Key players such as Enviroserve, Se Cure Waste Management, Blue Plane, SEPCO, All Recycling, Cleanco Waste Treatment, Attero, Averda, and Remondis are actively investing in technological advancements and expanding their service portfolios to cater to the growing demand. The market's future growth will depend on continued government support for infrastructure development, technological innovations in waste management techniques, and the successful implementation of public-private partnerships to promote sustainable waste collection practices. Challenges remain, such as the need for improved waste segregation at the source and addressing the issue of informal waste collection, which impacts efficiency and environmental sustainability. However, the overall outlook for the Asia garbage collection market remains positive, driven by a combination of supportive regulatory frameworks, technological advancements, and evolving societal attitudes towards waste management.

Asia Garbage Collection Market Company Market Share

Asia Garbage Collection Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia Garbage Collection Market, offering crucial data and forecasts for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and future opportunities. The market is segmented by waste type (hazardous and non-hazardous), collection type (curbside pickup, door-to-door, community recycling programs), end-user (municipal, healthcare, chemical, mining), region (China, Japan, India, Rest of Asia), and product type (waste disposal equipment, waste recycling, sorting equipment). The report values the market in Millions.

Asia Garbage Collection Market Composition & Trends

The Asia garbage collection market is characterized by a moderately concentrated landscape, with key players such as Enviroserve, Se Cure Waste Management, and Averda holding significant market share. However, the market exhibits considerable dynamism fueled by increasing environmental concerns, stringent government regulations, and technological advancements in waste management solutions. Innovation is driven by the need for efficient and sustainable waste processing, leading to the development of advanced sorting technologies, automated collection systems, and innovative recycling techniques. The regulatory landscape varies across Asian nations, creating both opportunities and challenges for market players. While some countries have implemented comprehensive waste management policies, others lag behind, creating a fragmented market. Substitute products, such as incineration and landfilling, still play a role, though their environmental impact is increasingly scrutinized. The end-user profile is diversifying, with growing demand from the healthcare and chemical sectors driving market expansion. M&A activity is relatively frequent, with deal values ranging from xx Million to xx Million, reflecting industry consolidation and the pursuit of scale and technological capabilities.

- Market Share Distribution (2025): Enviroserve (xx%), Se Cure Waste Management (xx%), Averda (xx%), Others (xx%)

- Average M&A Deal Value (2019-2024): xx Million

- Number of M&A Deals (2019-2024): xx

Asia Garbage Collection Market Industry Evolution

The Asia garbage collection market has experienced substantial growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributable to several factors, including rising urbanization, increasing waste generation, stricter environmental regulations, and growing awareness among consumers regarding sustainable waste management practices. Technological advancements have played a crucial role, with the adoption of smart waste management solutions, such as sensor-based bin monitoring and optimized collection routes, improving efficiency and reducing operational costs. Consumer demands are evolving, with a growing preference for convenient and eco-friendly waste disposal options, further driving market growth. The forecast period (2025-2033) is projected to witness continued expansion, driven by government initiatives promoting circular economy models and investments in advanced waste processing infrastructure. Growth rates are expected to moderate slightly, reaching a CAGR of xx% during this period, due to factors such as market saturation in certain segments and economic fluctuations. Adoption of advanced technologies, such as AI-powered waste sorting, is expected to accelerate, boosting market efficiency and sustainability.

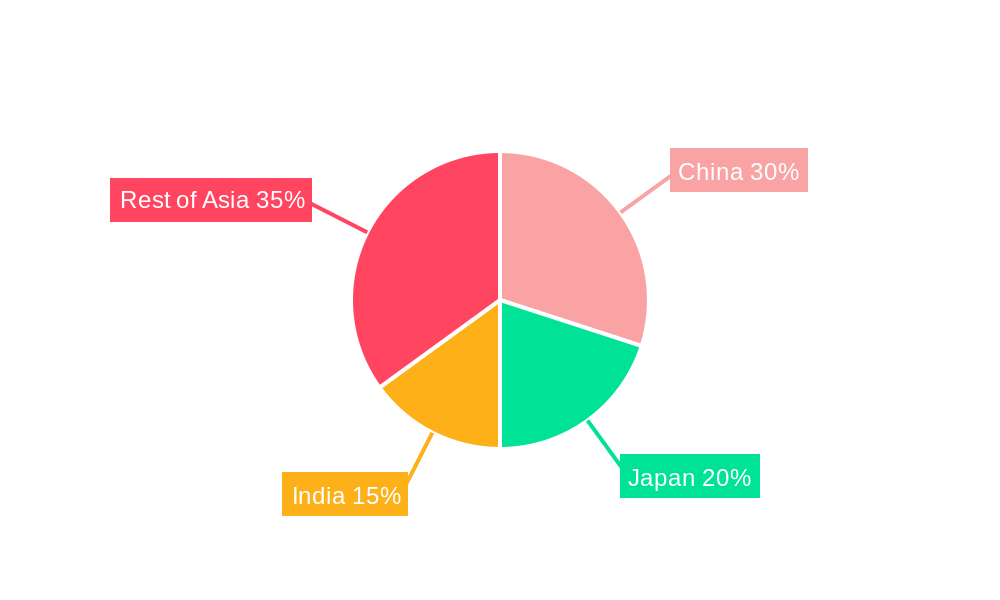

Leading Regions, Countries, or Segments in Asia Garbage Collection Market

By Region: China dominates the Asia garbage collection market due to its vast population, rapid urbanization, and significant investments in waste management infrastructure. Japan follows closely, owing to its advanced waste management technologies and stringent environmental regulations. India is also experiencing rapid growth, driven by increasing government initiatives and rising awareness.

By Waste Type: Non-hazardous waste constitutes the larger segment, driven by high volumes of municipal solid waste. However, the hazardous waste segment is growing rapidly, fueled by stricter regulations and increasing industrial activity.

By Collection Type: Curbside pickup remains the most prevalent collection method, but door-to-door collection is gaining traction, particularly in affluent areas and for specialized waste streams. Community recycling programs are expanding, supported by government initiatives and rising public awareness.

By End User: Municipal waste management accounts for the largest segment, followed by the healthcare and chemical sectors. Mining and other industrial sectors are also emerging as important end users, driven by stringent regulations and the need for responsible waste disposal.

By Product Type: Waste disposal equipment, particularly advanced technologies like incinerators and anaerobic digestion systems, is experiencing high growth. Waste recycling and sorting equipment are also witnessing increased demand, driven by the need for efficient resource recovery.

Key Drivers:

- Significant government investments in waste management infrastructure.

- Stringent environmental regulations and policies.

- Rising consumer awareness and demand for sustainable waste management practices.

- Technological advancements in waste processing and recycling.

Asia Garbage Collection Market Product Innovations

Recent innovations in the Asia garbage collection market include AI-powered waste sorting systems that can accurately identify and sort various waste materials, improving recycling rates and reducing landfill waste. Smart bins with sensors monitor fill levels, optimizing collection routes and reducing operational costs. Autonomous waste collection vehicles are also emerging, improving efficiency and safety. These innovations offer unique selling propositions by enhancing efficiency, reducing environmental impact, and optimizing resource recovery.

Propelling Factors for Asia Garbage Collection Market Growth

Technological advancements, such as AI-powered sorting and autonomous collection vehicles, are significantly improving efficiency and reducing costs. Economic growth in many Asian countries is leading to increased waste generation, driving demand for effective waste management solutions. Stringent government regulations and policies promoting sustainable waste management practices, like extended producer responsibility (EPR) schemes, are further propelling market growth. For example, China's ambitious waste sorting initiatives have created substantial market opportunities.

Obstacles in the Asia Garbage Collection Market

Regulatory inconsistencies across different Asian countries create challenges for companies operating across multiple jurisdictions. Supply chain disruptions, particularly in the procurement of raw materials and specialized equipment, can impact market growth. Intense competition among established players and new entrants can lead to price pressures and reduced profit margins. These factors can collectively impact market growth by hindering expansion plans and increasing operational costs.

Future Opportunities in Asia Garbage Collection Market

Emerging opportunities include the expansion of waste-to-energy projects, the development of advanced recycling technologies for challenging materials like plastics, and the growth of the circular economy. New markets in less developed regions of Asia offer significant potential. Technological advancements in AI and automation will continue to drive innovation and efficiency. The rising demand for sustainable waste management solutions will create further opportunities.

Major Players in the Asia Garbage Collection Market Ecosystem

- Enviroserve

- Se Cure Waste Management

- Blue Plane

- SEPCO

- All Recycling

- Cleanco Waste Treatment

- Attero

- Averda

- Remondis

Key Developments in Asia Garbage Collection Market Industry

September 2023: Project STOP, in collaboration with Regent Ipuk Feliiantiandani and the Banyuwan Provincial Government, inaugurated one of Indonesia's largest Material Recovery Facilities in Songgon Town. This signifies a major leap toward establishing Indonesia as a leader in regency-run circular waste management systems.

March 2023: ALBA Group Asia and VietCycle formed a joint venture to establish Vietnam's largest food-grade PET/HDPE plastic recycling facility, demonstrating a commitment to sustainable and innovative waste management solutions.

Strategic Asia Garbage Collection Market Forecast

The Asia garbage collection market is poised for continued growth, driven by strong urbanization trends, increasing environmental awareness, and supportive government policies. The adoption of innovative technologies and the expansion of circular economy initiatives will further fuel market expansion. New market entrants and strategic partnerships are expected to enhance competition and drive innovation, resulting in a robust and sustainable waste management sector across Asia. The market is projected to reach xx Million by 2033.

Asia Garbage Collection Market Segmentation

-

1. Product Type

- 1.1. Waste Disposal Equipment

- 1.2. Waste Recycling

- 1.3. Sorting Equipment

-

2. Waste Type

- 2.1. Hazardous Waste

- 2.2. Non-Hazardous Waste

-

3. Collection Type

- 3.1. Curbside Pickup

- 3.2. Door-to-door Collection

- 3.3. Community Recycling Programs

-

4. End User

- 4.1. Municipal Waste Management

- 4.2. Healthcare

- 4.3. Chemical

- 4.4. Mining

Asia Garbage Collection Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Garbage Collection Market Regional Market Share

Geographic Coverage of Asia Garbage Collection Market

Asia Garbage Collection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing awareness among consumers4.; Environment concerns and sustainability

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Non Hazardous segment dominating the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Garbage Collection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Waste Disposal Equipment

- 5.1.2. Waste Recycling

- 5.1.3. Sorting Equipment

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Hazardous Waste

- 5.2.2. Non-Hazardous Waste

- 5.3. Market Analysis, Insights and Forecast - by Collection Type

- 5.3.1. Curbside Pickup

- 5.3.2. Door-to-door Collection

- 5.3.3. Community Recycling Programs

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Municipal Waste Management

- 5.4.2. Healthcare

- 5.4.3. Chemical

- 5.4.4. Mining

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Enviroserve

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Se Cure Waste Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blue Plane

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SEPCO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 All Recycling

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cleanco Waste Treatment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Attero

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Averda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Remondis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Enviroserve

List of Figures

- Figure 1: Asia Garbage Collection Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Garbage Collection Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Garbage Collection Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Asia Garbage Collection Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Asia Garbage Collection Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 4: Asia Garbage Collection Market Volume K Tons Forecast, by Waste Type 2020 & 2033

- Table 5: Asia Garbage Collection Market Revenue Million Forecast, by Collection Type 2020 & 2033

- Table 6: Asia Garbage Collection Market Volume K Tons Forecast, by Collection Type 2020 & 2033

- Table 7: Asia Garbage Collection Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Asia Garbage Collection Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 9: Asia Garbage Collection Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Asia Garbage Collection Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 11: Asia Garbage Collection Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Asia Garbage Collection Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 13: Asia Garbage Collection Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 14: Asia Garbage Collection Market Volume K Tons Forecast, by Waste Type 2020 & 2033

- Table 15: Asia Garbage Collection Market Revenue Million Forecast, by Collection Type 2020 & 2033

- Table 16: Asia Garbage Collection Market Volume K Tons Forecast, by Collection Type 2020 & 2033

- Table 17: Asia Garbage Collection Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Asia Garbage Collection Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 19: Asia Garbage Collection Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Asia Garbage Collection Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 21: China Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Japan Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: South Korea Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: India Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Bangladesh Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Bangladesh Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: Pakistan Asia Garbage Collection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Pakistan Asia Garbage Collection Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Garbage Collection Market?

The projected CAGR is approximately 8.97%.

2. Which companies are prominent players in the Asia Garbage Collection Market?

Key companies in the market include Enviroserve, Se Cure Waste Management, Blue Plane, SEPCO, All Recycling, Cleanco Waste Treatment, Attero, Averda, Remondis.

3. What are the main segments of the Asia Garbage Collection Market?

The market segments include Product Type, Waste Type, Collection Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.84 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing awareness among consumers4.; Environment concerns and sustainability.

6. What are the notable trends driving market growth?

Non Hazardous segment dominating the market.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

September 2023: Project STOP, in collaboration with Regent Ipuk Feliiantiandani, inaugurated one of Indonesia's largest Material Recovery Facilities in Songgon Town. This significant milestone, achieved in partnership with the Banyuwan Provincial Government, marks a major stride toward establishing Indonesia as the pioneer in regency-run systems for circular waste management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Garbage Collection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Garbage Collection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Garbage Collection Market?

To stay informed about further developments, trends, and reports in the Asia Garbage Collection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence