Key Insights

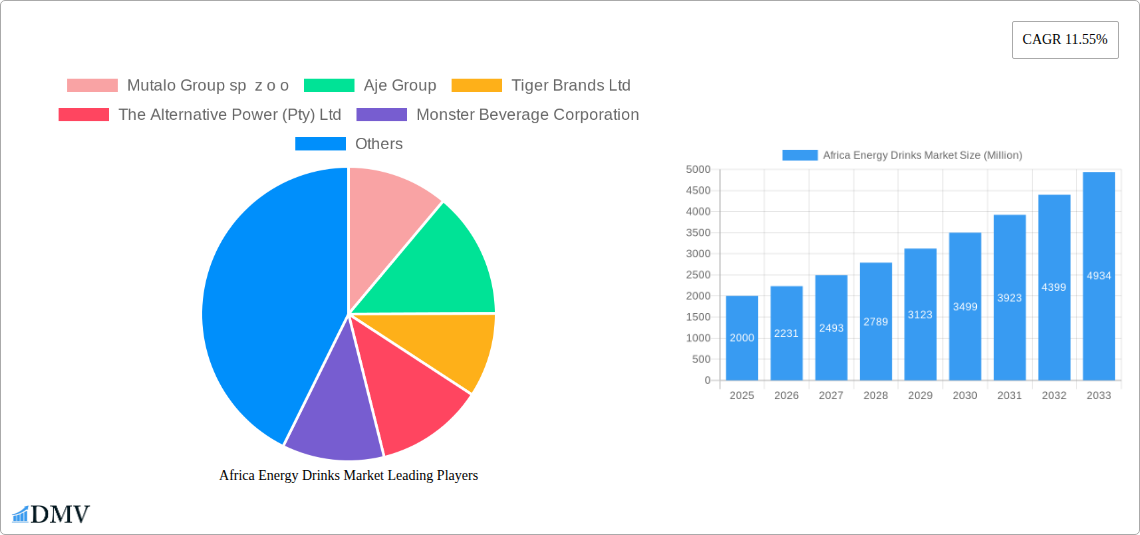

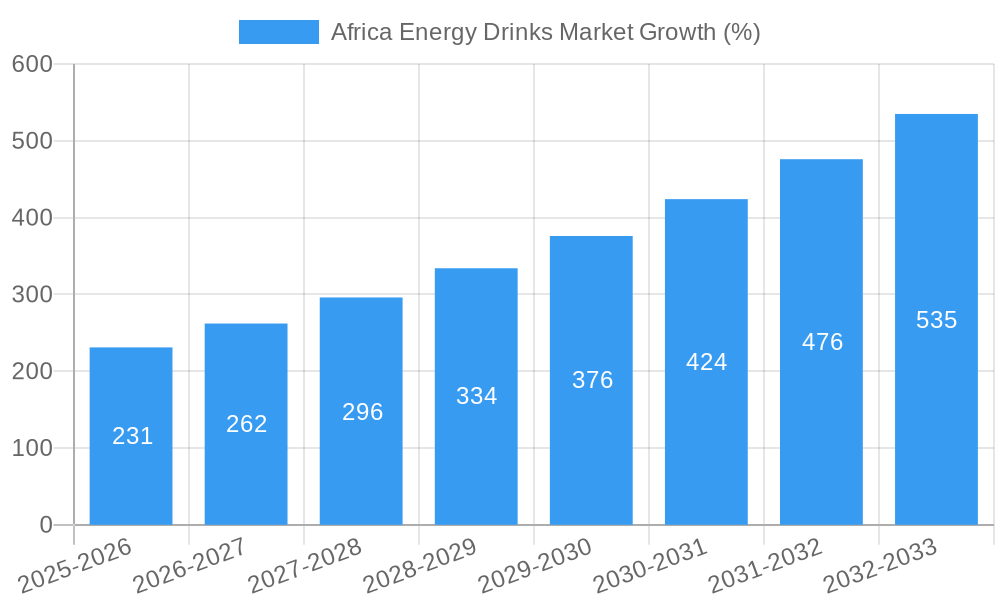

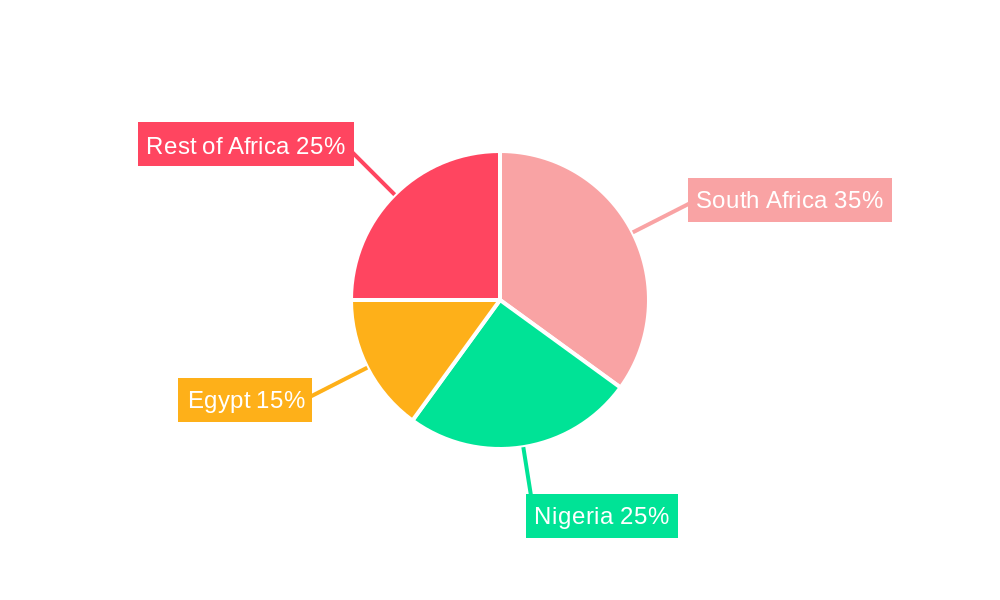

The African energy drink market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.55% from 2025 to 2033. This expansion is fueled by several key factors. A burgeoning young population, increasingly urbanized and with rising disposable incomes, is driving demand for convenient, energy-boosting beverages. The growing adoption of Western lifestyles and the influence of global brands are also contributing to market penetration. Furthermore, innovative product launches, such as sugar-free and natural/organic options, cater to evolving health consciousness, broadening the consumer base beyond traditional energy drink users. The market is segmented by packaging (glass bottles, metal cans, PET bottles), distribution channels (off-trade, on-trade), and drink type (energy shots, natural/organic, sugar-free/low-calorie, traditional, and others). South Africa, Nigeria, and Egypt are currently leading the market, reflecting their larger economies and established beverage industries. However, growth opportunities exist across the continent, particularly in rapidly developing economies.

Despite the positive outlook, the market faces certain challenges. Fluctuations in raw material prices, particularly sugar and other ingredients, can impact profitability. Competition from established beverage companies and the rise of locally produced alternatives exert pressure on market share. Furthermore, regulatory changes concerning sugar content and marketing to younger consumers pose potential obstacles to growth. To capitalize on the opportunities, companies are focusing on product diversification, strategic partnerships, and targeted marketing campaigns to effectively reach the diverse African consumer segments. This includes adapting products to local tastes and preferences while simultaneously focusing on sustainable and ethically sourced ingredients to appeal to the growing eco-conscious demographic. Successful players will be those that effectively navigate these market dynamics, leveraging both established brand recognition and adapting to the unique cultural nuances of the African market.

Africa Energy Drinks Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Africa Energy Drinks Market, projecting robust growth from 2025 to 2033. We delve into market dynamics, competitive landscapes, and future opportunities, offering invaluable insights for stakeholders across the value chain. The report covers a historical period of 2019-2024, uses 2025 as the base and estimated year, and forecasts market trends until 2033. The market is valued at xx Million in 2025 and is expected to reach xx Million by 2033.

Africa Energy Drinks Market Composition & Trends

This section examines the market concentration, highlighting key players such as The Coca-Cola Company, PepsiCo Inc, and Red Bull GmbH, alongside regional players like Mutalo Group sp z o o and Aje Group. We analyze the competitive intensity, market share distribution (with xx% attributed to the top 5 players in 2025), and the impact of mergers and acquisitions (M&A) activities, with estimated M&A deal values totaling xx Million in the period 2019-2024.

- Market Concentration: Analysis of market share held by leading players and emerging competitors.

- Innovation Catalysts: Exploration of factors driving product innovation, including consumer preferences and technological advancements.

- Regulatory Landscape: Assessment of relevant regulations and their impact on market growth.

- Substitute Products: Identification and evaluation of competing beverage categories impacting market share.

- End-User Profiles: Segmentation of consumers based on demographics, preferences, and purchasing behavior.

- M&A Activities: Detailed overview of significant mergers, acquisitions, and joint ventures, including their financial implications and strategic rationale.

Africa Energy Drinks Market Industry Evolution

This section delves into the historical and projected growth trajectories of the African energy drinks market. We analyze the market's evolution, driven by factors such as rising disposable incomes, increasing urbanization, and changing lifestyle trends. We also examine technological advancements in production, packaging, and distribution, alongside the evolving consumer preferences towards healthier options like sugar-free and natural energy drinks. The market experienced a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024, and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). The adoption rate of sugar-free energy drinks is expected to increase by xx% by 2033.

Leading Regions, Countries, or Segments in Africa Energy Drinks Market

This segment pinpoints the leading regions, countries, and segments within the African energy drinks market. South Africa currently holds the largest market share, driven by factors such as a robust economy, high consumer spending, and a well-established distribution network. Nigeria and Egypt are also key markets exhibiting significant growth potential.

Key Drivers:

- South Africa: High disposable incomes, strong consumer demand, and established distribution channels.

- Nigeria: Large population, rapid urbanization, and increasing consumer spending.

- Egypt: Growing middle class, increasing consumption of Westernized products, and favorable regulatory environment.

- Packaging Type: PET bottles dominate due to cost-effectiveness and convenience.

- Distribution Channel: Off-trade channels (retail stores, supermarkets) hold a larger market share compared to on-trade channels.

- Soft Drink Type: Traditional energy drinks command the largest segment, followed by sugar-free/low-calorie options.

Africa Energy Drinks Market Product Innovations

Recent years have witnessed a surge in product innovation within the African energy drinks market. Companies are introducing new flavors, functional ingredients (e.g., added vitamins, antioxidants), and sustainable packaging options to cater to evolving consumer preferences. The introduction of limited-edition flavors, such as those launched by Switch Energy Drink, highlights the focus on creating excitement and capturing market share through novelty. This trend is expected to continue, driving further market growth and product diversification.

Propelling Factors for Africa Energy Drinks Market Growth

The Africa energy drinks market is fueled by several key factors. Rising disposable incomes, particularly amongst younger demographics, contribute to increased consumer spending on discretionary items like energy drinks. Rapid urbanization is also a major driver, with increased exposure to Westernized lifestyles and the associated consumption patterns. Furthermore, favorable government regulations promoting the beverage industry contribute to market expansion.

Obstacles in the Africa Energy Drinks Market Market

The market faces challenges including supply chain disruptions, particularly in transportation and raw material sourcing, which have contributed to increased production costs. Moreover, intense competition from both established multinational corporations and regional players exerts pressure on profit margins. Fluctuating exchange rates also affect the pricing and profitability of imported ingredients.

Future Opportunities in Africa Energy Drinks Market

Untapped market potential exists across numerous African countries. Expansion into less-penetrated regions presents significant opportunities. Innovations in natural and organic energy drinks, catering to health-conscious consumers, also offer lucrative prospects. Finally, exploring sustainable packaging options and improving distribution networks can significantly enhance market reach and profitability.

Major Players in the Africa Energy Drinks Market Ecosystem

- Mutalo Group sp z o o

- Aje Group

- Tiger Brands Ltd

- The Alternative Power (Pty) Ltd

- Monster Beverage Corporation

- PepsiCo Inc

- Mofaya Beverage Company (PTY) Ltd

- S Spitz GmbH

- Suntory Holdings Limited

- Red Bull GmbH

- Halewood International South Africa (Pty) Ltd

- The Coca-Cola Company

Key Developments in Africa Energy Drinks Market Industry

- October 2023: Miss South Africa Natasha Joubert launches a new Berry Queen-flavored energy drink under the MoFaya brand, leveraging celebrity endorsement to enhance brand awareness and drive sales.

- October 2023: Switch Energy Drink introduces three new limited-edition flavors (Sour Worms, Naartjie & Grape, and Kiwi, Mango & Strawberry), aiming to attract consumers through product innovation and excitement.

- September 2023: Switch Energy Drink launches a special limited-edition flavor in celebration of South African Heritage Day, aligning the brand with cultural events and potentially boosting sales during a specific period.

Strategic Africa Energy Drinks Market Market Forecast

The Africa energy drinks market is poised for sustained growth driven by favorable demographic trends, rising disposable incomes, and ongoing product innovation. The focus on healthier options and expansion into new markets will further fuel market expansion. The predicted increase in consumption, coupled with strategic partnerships and effective marketing initiatives, positions the market for a robust future.

Africa Energy Drinks Market Segmentation

-

1. Soft Drink Type

- 1.1. Energy Shots

- 1.2. Natural/Organic Energy Drinks

- 1.3. Sugar-free or Low-calories Energy Drinks

- 1.4. Traditional Energy Drinks

- 1.5. Other Energy Drinks

-

2. Packaging Type

- 2.1. Glass Bottles

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Supermarket/Hypermarket

- 3.1.4. Others

- 3.2. On-trade

-

3.1. Off-trade

Africa Energy Drinks Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Energy Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Energy Shots

- 5.1.2. Natural/Organic Energy Drinks

- 5.1.3. Sugar-free or Low-calories Energy Drinks

- 5.1.4. Traditional Energy Drinks

- 5.1.5. Other Energy Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Glass Bottles

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Supermarket/Hypermarket

- 5.3.1.4. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. South Africa Africa Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Mutalo Group sp z o o

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Aje Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Tiger Brands Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 The Alternative Power (Pty) Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Monster Beverage Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PepsiCo Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mofaya Beverage Company (PTY) Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 S Spitz GmbH

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Suntory Holdings Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Red Bull GmbH

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Halewood International South Africa (Pty) Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 The Coca-Cola Company

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Mutalo Group sp z o o

List of Figures

- Figure 1: Africa Energy Drinks Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Energy Drinks Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Energy Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Energy Drinks Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Africa Energy Drinks Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 4: Africa Energy Drinks Market Volume K Tons Forecast, by Soft Drink Type 2019 & 2032

- Table 5: Africa Energy Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 6: Africa Energy Drinks Market Volume K Tons Forecast, by Packaging Type 2019 & 2032

- Table 7: Africa Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Africa Energy Drinks Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 9: Africa Energy Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Africa Energy Drinks Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Africa Energy Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Africa Energy Drinks Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: South Africa Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Sudan Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Sudan Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Uganda Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Uganda Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Tanzania Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tanzania Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Kenya Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Africa Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Africa Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Africa Energy Drinks Market Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 26: Africa Energy Drinks Market Volume K Tons Forecast, by Soft Drink Type 2019 & 2032

- Table 27: Africa Energy Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 28: Africa Energy Drinks Market Volume K Tons Forecast, by Packaging Type 2019 & 2032

- Table 29: Africa Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 30: Africa Energy Drinks Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 31: Africa Energy Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Africa Energy Drinks Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 33: Nigeria Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Nigeria Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: South Africa Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Egypt Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Egypt Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Kenya Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Kenya Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Ethiopia Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Ethiopia Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Morocco Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Morocco Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Ghana Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Ghana Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Algeria Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Algeria Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Tanzania Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Tanzania Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Ivory Coast Africa Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Ivory Coast Africa Energy Drinks Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Energy Drinks Market?

The projected CAGR is approximately 11.55%.

2. Which companies are prominent players in the Africa Energy Drinks Market?

Key companies in the market include Mutalo Group sp z o o, Aje Group, Tiger Brands Ltd, The Alternative Power (Pty) Ltd, Monster Beverage Corporation, PepsiCo Inc, Mofaya Beverage Company (PTY) Ltd, S Spitz GmbH, Suntory Holdings Limited, Red Bull GmbH, Halewood International South Africa (Pty) Ltd, The Coca-Cola Company.

3. What are the main segments of the Africa Energy Drinks Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

October 2023: Miss South Africa Natasha Joubert has expanded her business venture by collaborating with the MoFaya energy drink business. Joubert has launched the Berry Queen-flavoured energy drink under the MoFaya energy drink brand.October 2023: Switch Energy Drink introduced 3 new flavors in the African region. The three new limited-edition flavors are Sour Worms, Naartjie & Grape, and Kiwi, Mango & Strawberry.September 2023: Switch Energy Drink launched a special limited-edition flavor in celebration of South African Heritage Day. As a brand deeply rooted in the South African spirit, Switch Energy Drink is excited to contribute to the festivities with this special edition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Energy Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Energy Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Energy Drinks Market?

To stay informed about further developments, trends, and reports in the Africa Energy Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence