Key Insights

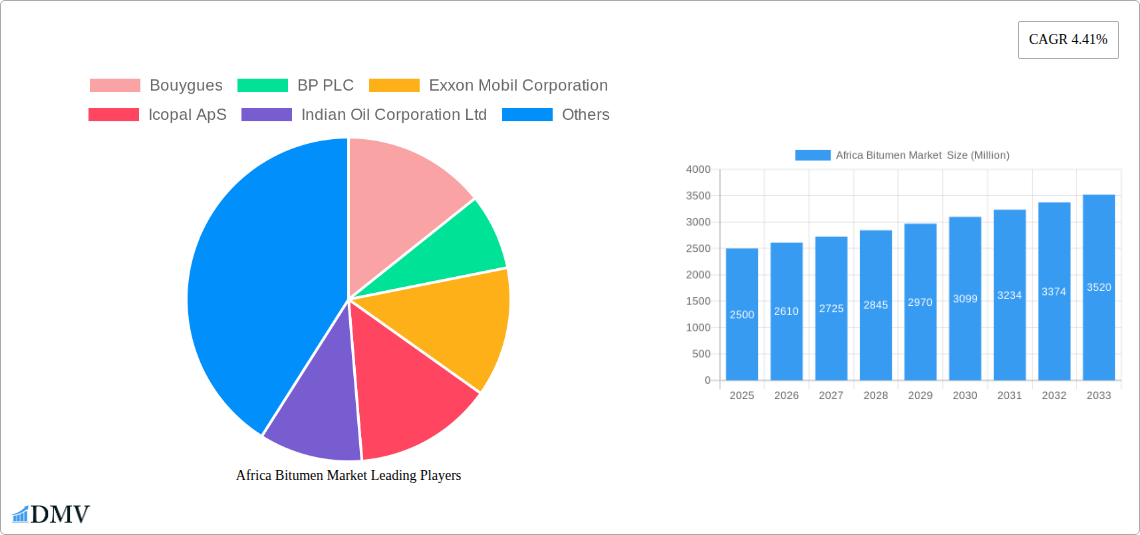

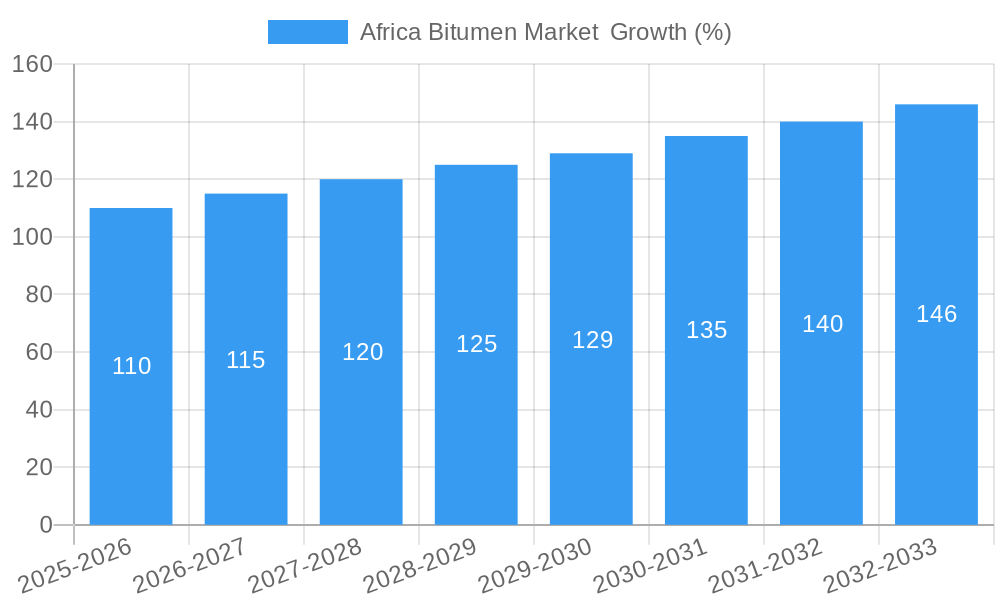

The Africa Bitumen Market, valued at approximately $X billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 4.41% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning infrastructure development across the continent, fueled by increasing urbanization and government investments in roads, bridges, and airports, significantly boosts bitumen demand. Secondly, the rising construction activity in both the residential and commercial sectors further contributes to market growth. The expansion of the oil and gas sector also plays a crucial role, as bitumen is a key component in pipeline construction and maintenance. However, the market faces challenges, including fluctuating crude oil prices which directly impact bitumen pricing, and the occasional inconsistencies in bitumen quality across different sources. Furthermore, environmental concerns regarding the carbon footprint of bitumen production are increasingly prompting exploration of sustainable alternatives, potentially acting as a restraint on market expansion in the long term. Despite these challenges, the overall outlook for the Africa Bitumen Market remains positive due to sustained infrastructure spending and economic growth across various African nations. The market is segmented by application (road construction, roofing, waterproofing, etc.) and by region, with significant variations in growth rates and market shares across different geographic areas, driven by economic disparities and infrastructural development priorities across the continent. Major players like Bouygues, BP PLC, ExxonMobil, and Shell Plc compete in this market, often leveraging their established global supply chains and technical expertise.

The competitive landscape is characterized by a mix of international corporations and local players, each adopting diverse strategies to gain market share. International players benefit from established brand recognition and advanced technologies, while local companies often possess a better understanding of regional requirements and can offer more competitive pricing. Strategic alliances, mergers and acquisitions, and technological innovations are expected to shape the competitive landscape in the coming years. The sustained demand for infrastructure development, coupled with the ongoing efforts to improve transportation networks across Africa, indicates that the bitumen market is well-positioned for continued growth throughout the forecast period. Ongoing research and development into sustainable and environmentally friendly bitumen alternatives might alter the market trajectory in the later years of the forecast.

Africa Bitumen Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Africa Bitumen Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The study covers the period 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. We delve deep into market composition, industry evolution, key players, and future growth prospects, equipping you with the knowledge to make informed strategic decisions. The total market value is projected to reach xx Million by 2033.

Africa Bitumen Market Market Composition & Trends

This section dissects the competitive landscape of the African bitumen market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute materials, end-user preferences, and mergers & acquisitions (M&A) activity. We explore the market share distribution among key players, revealing the dominance of established multinational corporations alongside emerging regional players. The report quantifies M&A deal values, providing a comprehensive overview of strategic investment patterns within the industry.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share, while numerous smaller companies compete in niche segments. Precise market share figures for top players are detailed within the full report.

- Innovation Catalysts: Technological advancements in bitumen modification and sustainable production methods are key drivers of innovation. The increasing demand for high-performance bitumen is fuelling R&D efforts.

- Regulatory Landscape: Government regulations on infrastructure development and environmental standards significantly influence market dynamics. Variations in regulatory frameworks across African nations are analyzed in detail.

- Substitute Products: The emergence of alternative paving materials presents competitive pressures, although bitumen's widespread use and cost-effectiveness remain significant advantages.

- End-User Profiles: The report segments end-users into key sectors including road construction, building & construction, and industrial applications, providing insights into the specific requirements and demands of each sector.

- M&A Activities: The report meticulously documents key M&A activities during the study period, including deal values and the strategic rationale behind each transaction. The total value of M&A transactions between 2019 and 2024 is estimated at xx Million.

Africa Bitumen Market Industry Evolution

This section examines the historical and projected growth trajectory of the African bitumen market. We trace technological advancements, shifting consumer preferences, and evolving market trends, supported by robust data points on growth rates and adoption metrics. The analysis covers the impact of economic fluctuations, infrastructure investments, and evolving construction practices on market growth. Detailed analysis of market growth rate from 2019 to 2024 and its projected growth until 2033 is provided within the report.

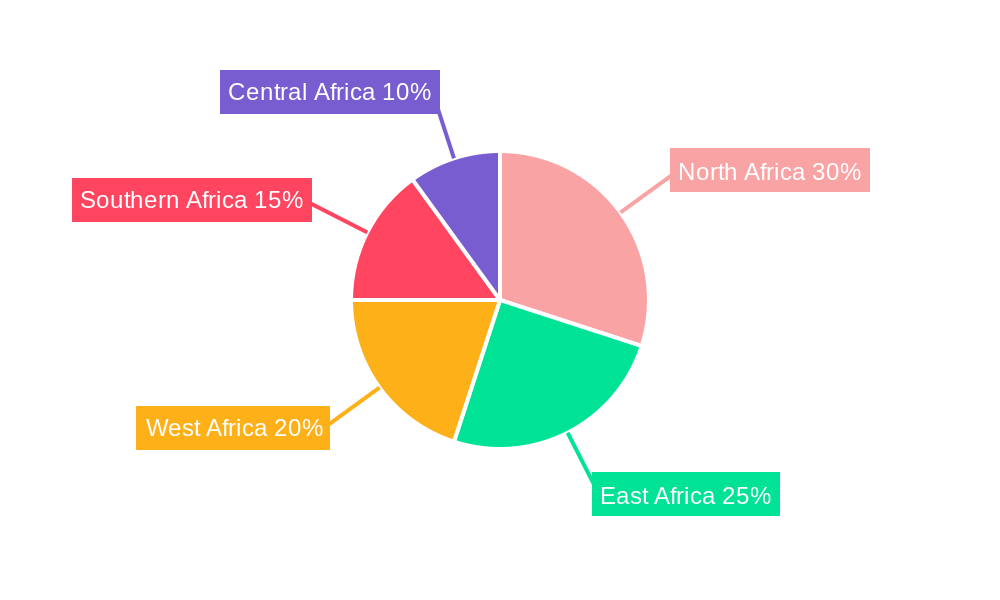

Leading Regions, Countries, or Segments in Africa Bitumen Market

This section identifies the leading regions, countries, and segments within the African bitumen market. We analyze factors contributing to their dominance, including investment trends, governmental support, and infrastructure development initiatives.

- Key Drivers:

- Robust Infrastructure Development: Significant investments in road networks across several African nations fuel high bitumen demand.

- Governmental Support: Favorable policies and incentives for infrastructure projects drive market expansion.

- Growing Urbanization: The rapid urbanization in several African cities is leading to increased construction activities and bitumen demand.

- Regional Economic Growth: The strong economic performance of specific regions supports increased investment in infrastructure.

The report provides a granular analysis of each leading region and country, highlighting market size, growth rate, and key characteristics.

Africa Bitumen Market Product Innovations

The African bitumen market is witnessing the introduction of innovative bitumen products with enhanced performance characteristics, such as modified bitumens and polymer-modified bitumens. These products offer improved durability, flexibility, and resistance to environmental factors. The adoption of these innovative products is gradually increasing, driven by the demand for higher quality and longer-lasting road infrastructure.

Propelling Factors for Africa Bitumen Market Growth

Several factors are propelling the growth of the Africa Bitumen Market. Increased governmental spending on infrastructure projects, notably road construction, is a primary driver. The burgeoning construction sector, fueled by urbanization and population growth, also significantly contributes. Furthermore, ongoing technological advancements in bitumen modification, leading to higher-performance products, stimulate market growth.

Obstacles in the Africa Bitumen Market Market

Despite promising growth prospects, challenges persist. Fluctuations in crude oil prices directly impact bitumen production costs, affecting pricing and profitability. Furthermore, logistical hurdles and infrastructure limitations in some regions can constrain supply chains. Inconsistent regulatory frameworks across various African nations also pose a challenge. The report quantifies the impact of these challenges on market growth.

Future Opportunities in Africa Bitumen Market

The future holds significant opportunities. Growing demand for sustainable and environmentally friendly bitumen solutions presents a niche market for manufacturers. Expanding into new geographical regions with developing infrastructure presents significant growth potential. Furthermore, technological innovations, such as the use of recycled materials in bitumen production, create lucrative opportunities.

Major Players in the Africa Bitumen Market Ecosystem

- Bouygues

- BP PLC (BP PLC)

- Exxon Mobil Corporation (ExxonMobil)

- Icopal ApS

- Indian Oil Corporation Ltd (Indian Oil Corporation)

- GOIL Company Limited

- KRATON CORPORATION (Kraton Corporation)

- RAHA Bitumen Inc

- Richmond Group

- Shell Plc (Shell)

- Tiger Bitumen

- Tekfalt Binders (Pty) Ltd

- Wabeco Petroleum Limited

- List Not Exhaustive

Key Developments in Africa Bitumen Market Industry

- March 2022: FFS Refiners and Rubis Asphalt South Africa entered a 12-month agreement for bitumen storage and handling, utilizing 4700 cubic meters of tank storage at FFS Refiners' Port of Cape Town facility. This significantly enhanced Rubis's logistical capabilities in the region.

Strategic Africa Bitumen Market Market Forecast

The Africa Bitumen Market is poised for robust growth over the forecast period, driven by sustained infrastructure investment, economic growth in several key regions, and the increasing adoption of high-performance bitumen products. This positive outlook is further bolstered by ongoing technological advancements and the emergence of new market segments. The report provides detailed forecasts for various market segments, offering valuable insights for strategic planning.

Africa Bitumen Market Segmentation

-

1. Product Type

- 1.1. Paving Grade

- 1.2. Hard Grade

- 1.3. Oxidized Grade

- 1.4. Bitumen Emulsions

- 1.5. Polymer Modified Bitumen

- 1.6. Other Pr

-

2. Application

- 2.1. Road Construction

- 2.2. Waterproofing

- 2.3. Adhesives

- 2.4. Other Applications (Coating and Canal Lining)

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. Algeria

- 3.4. Nigeria

- 3.5. Morocco

- 3.6. Rest of Africa

Africa Bitumen Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Algeria

- 4. Nigeria

- 5. Morocco

- 6. Rest of Africa

Africa Bitumen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Waterproofing Applications; Growing Roadways Network in Africa; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Waterproofing Applications; Growing Roadways Network in Africa; Other Drivers

- 3.4. Market Trends

- 3.4.1. Road Construction Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Africa Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Paving Grade

- 5.1.2. Hard Grade

- 5.1.3. Oxidized Grade

- 5.1.4. Bitumen Emulsions

- 5.1.5. Polymer Modified Bitumen

- 5.1.6. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Road Construction

- 5.2.2. Waterproofing

- 5.2.3. Adhesives

- 5.2.4. Other Applications (Coating and Canal Lining)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. Algeria

- 5.3.4. Nigeria

- 5.3.5. Morocco

- 5.3.6. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Algeria

- 5.4.4. Nigeria

- 5.4.5. Morocco

- 5.4.6. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Africa Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Paving Grade

- 6.1.2. Hard Grade

- 6.1.3. Oxidized Grade

- 6.1.4. Bitumen Emulsions

- 6.1.5. Polymer Modified Bitumen

- 6.1.6. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Road Construction

- 6.2.2. Waterproofing

- 6.2.3. Adhesives

- 6.2.4. Other Applications (Coating and Canal Lining)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. Algeria

- 6.3.4. Nigeria

- 6.3.5. Morocco

- 6.3.6. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Egypt Africa Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Paving Grade

- 7.1.2. Hard Grade

- 7.1.3. Oxidized Grade

- 7.1.4. Bitumen Emulsions

- 7.1.5. Polymer Modified Bitumen

- 7.1.6. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Road Construction

- 7.2.2. Waterproofing

- 7.2.3. Adhesives

- 7.2.4. Other Applications (Coating and Canal Lining)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. Algeria

- 7.3.4. Nigeria

- 7.3.5. Morocco

- 7.3.6. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Algeria Africa Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Paving Grade

- 8.1.2. Hard Grade

- 8.1.3. Oxidized Grade

- 8.1.4. Bitumen Emulsions

- 8.1.5. Polymer Modified Bitumen

- 8.1.6. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Road Construction

- 8.2.2. Waterproofing

- 8.2.3. Adhesives

- 8.2.4. Other Applications (Coating and Canal Lining)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. Algeria

- 8.3.4. Nigeria

- 8.3.5. Morocco

- 8.3.6. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Nigeria Africa Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Paving Grade

- 9.1.2. Hard Grade

- 9.1.3. Oxidized Grade

- 9.1.4. Bitumen Emulsions

- 9.1.5. Polymer Modified Bitumen

- 9.1.6. Other Pr

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Road Construction

- 9.2.2. Waterproofing

- 9.2.3. Adhesives

- 9.2.4. Other Applications (Coating and Canal Lining)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Egypt

- 9.3.3. Algeria

- 9.3.4. Nigeria

- 9.3.5. Morocco

- 9.3.6. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Morocco Africa Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Paving Grade

- 10.1.2. Hard Grade

- 10.1.3. Oxidized Grade

- 10.1.4. Bitumen Emulsions

- 10.1.5. Polymer Modified Bitumen

- 10.1.6. Other Pr

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Road Construction

- 10.2.2. Waterproofing

- 10.2.3. Adhesives

- 10.2.4. Other Applications (Coating and Canal Lining)

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. South Africa

- 10.3.2. Egypt

- 10.3.3. Algeria

- 10.3.4. Nigeria

- 10.3.5. Morocco

- 10.3.6. Rest of Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Africa Africa Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Paving Grade

- 11.1.2. Hard Grade

- 11.1.3. Oxidized Grade

- 11.1.4. Bitumen Emulsions

- 11.1.5. Polymer Modified Bitumen

- 11.1.6. Other Pr

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Road Construction

- 11.2.2. Waterproofing

- 11.2.3. Adhesives

- 11.2.4. Other Applications (Coating and Canal Lining)

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. South Africa

- 11.3.2. Egypt

- 11.3.3. Algeria

- 11.3.4. Nigeria

- 11.3.5. Morocco

- 11.3.6. Rest of Africa

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Bouygues

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 BP PLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Exxon Mobil Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Icopal ApS

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Indian Oil Corporation Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 GOIL Company Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 KRATON CORPORATION

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 RAHA Bitumen Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Richmond Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Shell Plc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Tiger Bitumen

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Tekfalt Binders (Pty) Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Wabeco Petroleum Limited*List Not Exhaustive

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Bouygues

List of Figures

- Figure 1: Global Africa Bitumen Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: South Africa Africa Bitumen Market Revenue (Million), by Product Type 2024 & 2032

- Figure 3: South Africa Africa Bitumen Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 4: South Africa Africa Bitumen Market Revenue (Million), by Application 2024 & 2032

- Figure 5: South Africa Africa Bitumen Market Revenue Share (%), by Application 2024 & 2032

- Figure 6: South Africa Africa Bitumen Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: South Africa Africa Bitumen Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: South Africa Africa Bitumen Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South Africa Africa Bitumen Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Egypt Africa Bitumen Market Revenue (Million), by Product Type 2024 & 2032

- Figure 11: Egypt Africa Bitumen Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: Egypt Africa Bitumen Market Revenue (Million), by Application 2024 & 2032

- Figure 13: Egypt Africa Bitumen Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: Egypt Africa Bitumen Market Revenue (Million), by Geography 2024 & 2032

- Figure 15: Egypt Africa Bitumen Market Revenue Share (%), by Geography 2024 & 2032

- Figure 16: Egypt Africa Bitumen Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Egypt Africa Bitumen Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Algeria Africa Bitumen Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Algeria Africa Bitumen Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Algeria Africa Bitumen Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Algeria Africa Bitumen Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Algeria Africa Bitumen Market Revenue (Million), by Geography 2024 & 2032

- Figure 23: Algeria Africa Bitumen Market Revenue Share (%), by Geography 2024 & 2032

- Figure 24: Algeria Africa Bitumen Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Algeria Africa Bitumen Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Nigeria Africa Bitumen Market Revenue (Million), by Product Type 2024 & 2032

- Figure 27: Nigeria Africa Bitumen Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 28: Nigeria Africa Bitumen Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Nigeria Africa Bitumen Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Nigeria Africa Bitumen Market Revenue (Million), by Geography 2024 & 2032

- Figure 31: Nigeria Africa Bitumen Market Revenue Share (%), by Geography 2024 & 2032

- Figure 32: Nigeria Africa Bitumen Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Nigeria Africa Bitumen Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Morocco Africa Bitumen Market Revenue (Million), by Product Type 2024 & 2032

- Figure 35: Morocco Africa Bitumen Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 36: Morocco Africa Bitumen Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Morocco Africa Bitumen Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Morocco Africa Bitumen Market Revenue (Million), by Geography 2024 & 2032

- Figure 39: Morocco Africa Bitumen Market Revenue Share (%), by Geography 2024 & 2032

- Figure 40: Morocco Africa Bitumen Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Morocco Africa Bitumen Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Rest of Africa Africa Bitumen Market Revenue (Million), by Product Type 2024 & 2032

- Figure 43: Rest of Africa Africa Bitumen Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 44: Rest of Africa Africa Bitumen Market Revenue (Million), by Application 2024 & 2032

- Figure 45: Rest of Africa Africa Bitumen Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: Rest of Africa Africa Bitumen Market Revenue (Million), by Geography 2024 & 2032

- Figure 47: Rest of Africa Africa Bitumen Market Revenue Share (%), by Geography 2024 & 2032

- Figure 48: Rest of Africa Africa Bitumen Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Rest of Africa Africa Bitumen Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Africa Bitumen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Africa Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Africa Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Africa Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global Africa Bitumen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Africa Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global Africa Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global Africa Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global Africa Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Africa Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Global Africa Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Global Africa Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global Africa Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Africa Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Global Africa Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Africa Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global Africa Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Africa Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Africa Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Africa Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global Africa Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Africa Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Global Africa Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Africa Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global Africa Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Africa Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Global Africa Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Africa Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Global Africa Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Bitumen Market ?

The projected CAGR is approximately 4.41%.

2. Which companies are prominent players in the Africa Bitumen Market ?

Key companies in the market include Bouygues, BP PLC, Exxon Mobil Corporation, Icopal ApS, Indian Oil Corporation Ltd, GOIL Company Limited, KRATON CORPORATION, RAHA Bitumen Inc, Richmond Group, Shell Plc, Tiger Bitumen, Tekfalt Binders (Pty) Ltd, Wabeco Petroleum Limited*List Not Exhaustive.

3. What are the main segments of the Africa Bitumen Market ?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Waterproofing Applications; Growing Roadways Network in Africa; Other Drivers.

6. What are the notable trends driving market growth?

Road Construction Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Demand for Waterproofing Applications; Growing Roadways Network in Africa; Other Drivers.

8. Can you provide examples of recent developments in the market?

March 2022: FFS Refiners and Rubis Asphalt South Africa reached an agreement wherein FFS Refiners will provide Rubis with reliable and safe bitumen storage and handling under a 12-month agreement, which includes the rental of 4700 cubic meters of tank storage at FFS Refiners' facility in the Port of Cape Town.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Bitumen Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Bitumen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Bitumen Market ?

To stay informed about further developments, trends, and reports in the Africa Bitumen Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence