Key Insights

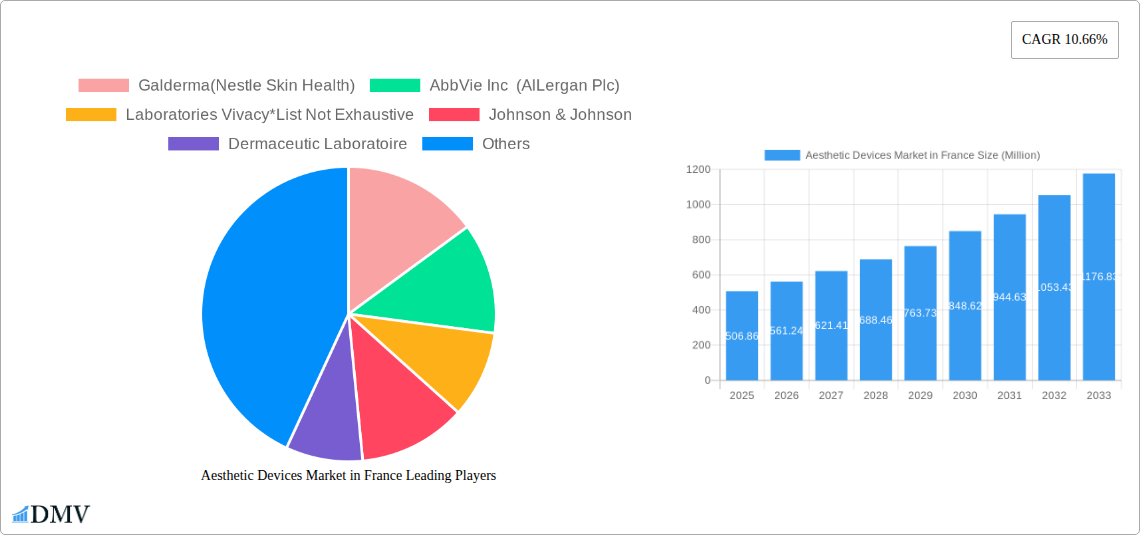

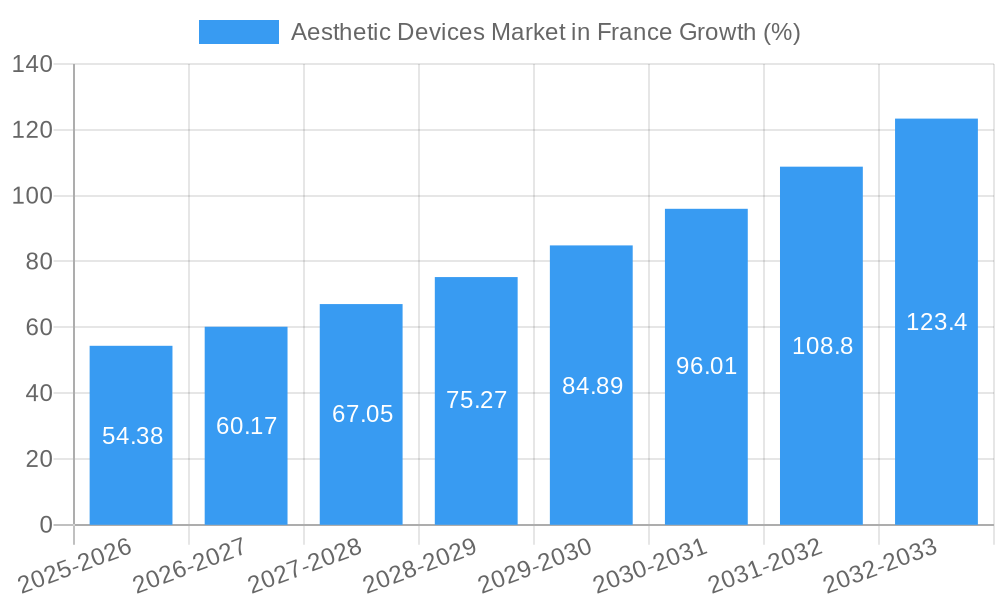

The French aesthetic devices market, valued at €506.86 million in 2025, is projected to experience robust growth, driven by increasing disposable incomes, rising awareness of non-invasive cosmetic procedures, and a growing preference for minimally-invasive treatments among the population. The market's Compound Annual Growth Rate (CAGR) of 10.66% from 2019 to 2024 suggests a significant upward trajectory, indicating strong consumer demand and market potential. Key drivers include the increasing popularity of botulinum toxin and dermal fillers, fueled by effective marketing campaigns and celebrity endorsements. Technological advancements leading to improved efficacy and safety profiles of devices further bolster this growth. The segment comprising aesthetic clinics is expected to dominate the market due to higher accessibility, specialized expertise, and comprehensive treatment packages offered. However, regulatory hurdles and concerns about the potential long-term side effects of some treatments could pose a challenge to this growth. The competitive landscape is marked by established players like Galderma, AbbVie (Allergan), and Johnson & Johnson, along with emerging companies vying for market share, leading to intense competition and innovation.

The forecast period (2025-2033) anticipates continued expansion, fueled by ongoing technological improvements, increasing consumer confidence, and the entrance of newer players with innovative products and services. While the "Other Products" segment (including chemical peels and microdermabrasion) contributes significantly, the market is heavily reliant on the performance of botulinum toxin and dermal fillers. Maintaining consumer trust and addressing safety concerns will be crucial for sustained market growth. The market's success will depend upon effective marketing and education initiatives to alleviate anxieties regarding procedure safety and cost effectiveness while simultaneously focusing on high-quality, safe, and effective treatments. Expansion into underserved regions and strategic collaborations between established players and emerging companies could further unlock market potential. Hospitals, though a smaller segment compared to aesthetic clinics, are expected to witness gradual growth owing to increased integration of aesthetic procedures within broader healthcare settings.

Aesthetic Devices Market in France: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Aesthetic Devices Market in France, offering a comprehensive overview of market size, trends, growth drivers, challenges, and future opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for stakeholders including manufacturers, distributors, investors, and regulatory bodies seeking a deep understanding of this dynamic market. The market is segmented by product (Botulinum Toxin, Dermal Filler, Non-absorbable Dermal Filler, Chemical Peel, Microdermabrasion, Other Products) and end-user (Aesthetic Clinics, Hospitals, Other End Users). Key players such as Galderma (Nestlé Skin Health), AbbVie Inc (Allergan Plc), and Laboratories Vivacy are analyzed, providing a thorough competitive landscape. The report projects a market value of xx Million by 2033.

Aesthetic Devices Market in France Market Composition & Trends

The French aesthetic devices market exhibits a moderately concentrated landscape, with several major players holding significant market share. Galderma (Nestlé Skin Health), AbbVie Inc (Allergan Plc), and Laboratories Vivacy are among the leading companies, although the exact market share distribution varies across product segments. Innovation in this market is driven by advancements in minimally invasive procedures, the development of longer-lasting fillers, and the rise of personalized treatments. The regulatory landscape, overseen by the French National Agency for Medicines and Health Products Safety (ANSM), plays a crucial role in approving new products and ensuring patient safety. Substitute products, such as non-invasive cosmetic procedures and alternative therapies, pose some competition. The market sees a significant proportion of end-users comprising aesthetic clinics, followed by hospitals and other end-users. Mergers and acquisitions (M&A) activity is moderate, with deal values varying depending on the size and strategic importance of the target company. Recent M&A activities have focused on strengthening product portfolios and expanding market reach. For example, a recent acquisition in xx could potentially increase the market concentration to a higher xx%.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Innovation Catalysts: Minimally invasive procedures, longer-lasting fillers, personalized treatments.

- Regulatory Landscape: Driven by ANSM regulations focused on safety and efficacy.

- Substitute Products: Non-invasive procedures, alternative therapies.

- End-User Profile: Dominated by aesthetic clinics, followed by hospitals and others.

- M&A Activities: Moderate activity, deal values varying considerably.

Aesthetic Devices Market in France Industry Evolution

The French aesthetic devices market has witnessed consistent growth over the historical period (2019-2024), driven by increasing consumer awareness of aesthetic procedures, rising disposable incomes, and an aging population. Technological advancements, particularly in the development of hyaluronic acid-based fillers and refined botulinum toxin formulations, have significantly improved treatment efficacy and safety. Consumer demand is shifting towards less invasive procedures with faster recovery times, driving innovation in areas like micro-needling and chemical peels. The market is also seeing a growth in demand for natural-looking results, pushing manufacturers to develop products that provide subtle enhancements. The average annual growth rate (AAGR) during the historical period was estimated at xx%, with a projected growth rate of xx% during the forecast period (2025-2033). Adoption rates for minimally invasive procedures are rising steadily, with xx% market penetration in 2024 projected to reach xx% by 2033.

Leading Regions, Countries, or Segments in Aesthetic Devices Market in France

While a national market, regional variations in adoption rates exist due to factors like population density and accessibility to clinics. Paris and other major metropolitan areas generally exhibit higher adoption rates.

By Product:

- Dermal Fillers: This segment holds the largest market share, driven by increasing demand for facial volumization and wrinkle correction.

- Botulinum Toxin: This segment shows strong growth due to the established efficacy and broad acceptance of botulinum toxin injections for wrinkle reduction.

- Non-absorbable Dermal Fillers: This segment experiences moderate growth due to long-term results, but concerns regarding safety and reversibility limit wider adoption.

By End User:

- Aesthetic Clinics: This segment dominates the market, benefiting from specialized equipment and expertise.

- Hospitals: Hospital-based procedures account for a smaller but significant share, often involving more complex cases.

Key Drivers:

- High disposable incomes: Fueling demand for aesthetic treatments.

- Aging population: Increasing the pool of potential customers.

- Technological advancements: Leading to safer and more effective products.

- Growing awareness: Educating consumers about the benefits of aesthetic procedures.

- Regulatory support: Facilitating market growth through approvals and guidelines.

Aesthetic Devices Market in France Product Innovations

Recent product innovations include the introduction of next-generation hyaluronic acid fillers with improved biocompatibility and longevity, alongside innovative botulinum toxin formulations offering tailored treatment options and reduced side effects. We're seeing an increased focus on combination therapies that integrate different technologies for more comprehensive aesthetic results. The incorporation of digital technologies into treatments (e.g., 3D imaging for pre-treatment planning) enhances precision and patient experience. These innovations contribute to the market's dynamic growth by offering more effective and safer solutions.

Propelling Factors for Aesthetic Devices Market in France Growth

Technological advancements, rising disposable incomes, and increasing awareness about aesthetic treatments significantly propel the market's growth. The aging population also presents a significant opportunity. Supportive regulatory frameworks that ensure product safety and efficacy contribute to market stability and growth. The trend towards minimally invasive procedures further enhances market expansion.

Obstacles in the Aesthetic Devices Market in France Market

Regulatory hurdles and stringent approval processes can slow down product launches. Supply chain disruptions, especially concerning raw materials, can impact production and cost. Intense competition among established players and emerging companies creates price pressure, affecting profitability. Safety concerns associated with certain procedures can also limit market expansion. For example, xx% of the market experienced delays in xx due to supply chain disruptions in xx.

Future Opportunities in Aesthetic Devices Market in France

Emerging opportunities lie in the expansion of personalized treatments, leveraging advancements in genomics and proteomics to tailor aesthetic procedures to individual needs. The integration of AI and machine learning in treatment planning and outcome prediction will be crucial. Focus on non-invasive treatments like micro-needling and radiofrequency therapy will offer increased market penetration. The continued development of bio-compatible materials for fillers and other devices will address safety and efficacy concerns.

Major Players in the Aesthetic Devices Market in France Ecosystem

- Galderma (Nestlé Skin Health)

- AbbVie Inc (Allergan Plc)

- Laboratories Vivacy

- Johnson & Johnson

- Dermaceutic Laboratoire

- Bioxis Pharmaceuticals

- Laboratoires Filorga

- Merz Pharma GmbH & Co KGaA

- Sinclair Pharma PLC

- Teoxane Laboratories

- Ipsen Pharma

Key Developments in Aesthetic Devices Market in France Industry

- June 2021: Galderma announced the European approval of Alluzience®, a ready-to-use neuromodulator. This launch expanded treatment options and strengthened Galderma's market position.

- January 2022: The EU's Heads of Medicines Agencies issued a positive opinion on Hugel's Letybo, a botulinum toxin product. This approval introduced a new competitor into the market, increasing competition and potentially lowering prices.

Strategic Aesthetic Devices Market in France Market Forecast

The French aesthetic devices market is poised for continued growth, driven by technological innovations, a growing demand for minimally invasive procedures, and an expanding consumer base. The market will likely consolidate further, with larger players acquiring smaller companies to gain a competitive edge. The focus on personalized treatments and digital technologies will redefine the market, creating new avenues for expansion and growth. The projected market value of xx Million by 2033 reflects the substantial growth potential of this dynamic sector.

Aesthetic Devices Market in France Segmentation

-

1. Product

- 1.1. Botulinum Toxin

-

1.2. Dermal Filler

- 1.2.1. Absorbable Dermal Filler

- 1.2.2. Non-absorbable Dermal Filler

- 1.3. Chemical Peel

- 1.4. Microdermabrasion

- 1.5. Other Products

-

2. End User

- 2.1. Aesthetic Clinics

- 2.2. Hospitals

- 2.3. Other End Users

Aesthetic Devices Market in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aesthetic Devices Market in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness and Adoption of Non- and Minimally-Invasive Aesthetic Procedures; Availability of Technologically Advanced & User-friendly Products

- 3.3. Market Restrains

- 3.3.1. Stringent Safety Regulations for Aesthetic Procedures; Risk of Side Effects

- 3.4. Market Trends

- 3.4.1. Dermal Filler is Expected to Have a Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aesthetic Devices Market in France Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Botulinum Toxin

- 5.1.2. Dermal Filler

- 5.1.2.1. Absorbable Dermal Filler

- 5.1.2.2. Non-absorbable Dermal Filler

- 5.1.3. Chemical Peel

- 5.1.4. Microdermabrasion

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Aesthetic Clinics

- 5.2.2. Hospitals

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Aesthetic Devices Market in France Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Botulinum Toxin

- 6.1.2. Dermal Filler

- 6.1.2.1. Absorbable Dermal Filler

- 6.1.2.2. Non-absorbable Dermal Filler

- 6.1.3. Chemical Peel

- 6.1.4. Microdermabrasion

- 6.1.5. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Aesthetic Clinics

- 6.2.2. Hospitals

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Aesthetic Devices Market in France Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Botulinum Toxin

- 7.1.2. Dermal Filler

- 7.1.2.1. Absorbable Dermal Filler

- 7.1.2.2. Non-absorbable Dermal Filler

- 7.1.3. Chemical Peel

- 7.1.4. Microdermabrasion

- 7.1.5. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Aesthetic Clinics

- 7.2.2. Hospitals

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Aesthetic Devices Market in France Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Botulinum Toxin

- 8.1.2. Dermal Filler

- 8.1.2.1. Absorbable Dermal Filler

- 8.1.2.2. Non-absorbable Dermal Filler

- 8.1.3. Chemical Peel

- 8.1.4. Microdermabrasion

- 8.1.5. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Aesthetic Clinics

- 8.2.2. Hospitals

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Aesthetic Devices Market in France Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Botulinum Toxin

- 9.1.2. Dermal Filler

- 9.1.2.1. Absorbable Dermal Filler

- 9.1.2.2. Non-absorbable Dermal Filler

- 9.1.3. Chemical Peel

- 9.1.4. Microdermabrasion

- 9.1.5. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Aesthetic Clinics

- 9.2.2. Hospitals

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Aesthetic Devices Market in France Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Botulinum Toxin

- 10.1.2. Dermal Filler

- 10.1.2.1. Absorbable Dermal Filler

- 10.1.2.2. Non-absorbable Dermal Filler

- 10.1.3. Chemical Peel

- 10.1.4. Microdermabrasion

- 10.1.5. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Aesthetic Clinics

- 10.2.2. Hospitals

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Galderma(Nestle Skin Health)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AbbVie Inc (AlLergan Plc)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Laboratories Vivacy*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Johnson & Johnson

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dermaceutic Laboratoire

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bioxis Pharmaceuticals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Laboratoires Filorga

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Merz Pharma GmbH & Co KGaA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sinclair Pharma PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Teoxane Laboratories

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ipsen Pharma

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Galderma(Nestle Skin Health)

List of Figures

- Figure 1: Global Aesthetic Devices Market in France Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: France Aesthetic Devices Market in France Revenue (Million), by Country 2024 & 2032

- Figure 3: France Aesthetic Devices Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Aesthetic Devices Market in France Revenue (Million), by Product 2024 & 2032

- Figure 5: North America Aesthetic Devices Market in France Revenue Share (%), by Product 2024 & 2032

- Figure 6: North America Aesthetic Devices Market in France Revenue (Million), by End User 2024 & 2032

- Figure 7: North America Aesthetic Devices Market in France Revenue Share (%), by End User 2024 & 2032

- Figure 8: North America Aesthetic Devices Market in France Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Aesthetic Devices Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Aesthetic Devices Market in France Revenue (Million), by Product 2024 & 2032

- Figure 11: South America Aesthetic Devices Market in France Revenue Share (%), by Product 2024 & 2032

- Figure 12: South America Aesthetic Devices Market in France Revenue (Million), by End User 2024 & 2032

- Figure 13: South America Aesthetic Devices Market in France Revenue Share (%), by End User 2024 & 2032

- Figure 14: South America Aesthetic Devices Market in France Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Aesthetic Devices Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Aesthetic Devices Market in France Revenue (Million), by Product 2024 & 2032

- Figure 17: Europe Aesthetic Devices Market in France Revenue Share (%), by Product 2024 & 2032

- Figure 18: Europe Aesthetic Devices Market in France Revenue (Million), by End User 2024 & 2032

- Figure 19: Europe Aesthetic Devices Market in France Revenue Share (%), by End User 2024 & 2032

- Figure 20: Europe Aesthetic Devices Market in France Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Aesthetic Devices Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Aesthetic Devices Market in France Revenue (Million), by Product 2024 & 2032

- Figure 23: Middle East & Africa Aesthetic Devices Market in France Revenue Share (%), by Product 2024 & 2032

- Figure 24: Middle East & Africa Aesthetic Devices Market in France Revenue (Million), by End User 2024 & 2032

- Figure 25: Middle East & Africa Aesthetic Devices Market in France Revenue Share (%), by End User 2024 & 2032

- Figure 26: Middle East & Africa Aesthetic Devices Market in France Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Aesthetic Devices Market in France Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Aesthetic Devices Market in France Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific Aesthetic Devices Market in France Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific Aesthetic Devices Market in France Revenue (Million), by End User 2024 & 2032

- Figure 31: Asia Pacific Aesthetic Devices Market in France Revenue Share (%), by End User 2024 & 2032

- Figure 32: Asia Pacific Aesthetic Devices Market in France Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Aesthetic Devices Market in France Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aesthetic Devices Market in France Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Aesthetic Devices Market in France Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2019 & 2032

- Table 13: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2019 & 2032

- Table 31: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Aesthetic Devices Market in France Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Aesthetic Devices Market in France Revenue Million Forecast, by End User 2019 & 2032

- Table 41: Global Aesthetic Devices Market in France Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Aesthetic Devices Market in France Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aesthetic Devices Market in France?

The projected CAGR is approximately 10.66%.

2. Which companies are prominent players in the Aesthetic Devices Market in France?

Key companies in the market include Galderma(Nestle Skin Health), AbbVie Inc (AlLergan Plc), Laboratories Vivacy*List Not Exhaustive, Johnson & Johnson, Dermaceutic Laboratoire, Bioxis Pharmaceuticals, Laboratoires Filorga, Merz Pharma GmbH & Co KGaA, Sinclair Pharma PLC, Teoxane Laboratories, Ipsen Pharma.

3. What are the main segments of the Aesthetic Devices Market in France?

The market segments include Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 506.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness and Adoption of Non- and Minimally-Invasive Aesthetic Procedures; Availability of Technologically Advanced & User-friendly Products.

6. What are the notable trends driving market growth?

Dermal Filler is Expected to Have a Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Safety Regulations for Aesthetic Procedures; Risk of Side Effects.

8. Can you provide examples of recent developments in the market?

January 2022: The European Union's (EU's) Heads of Medicines Agencies (HMA) issued a positive opinion on the approval of Hugel's Letybo, a product containing botulinum toxin (BTX) for the treatment of wrinkles on the forehead.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aesthetic Devices Market in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aesthetic Devices Market in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aesthetic Devices Market in France?

To stay informed about further developments, trends, and reports in the Aesthetic Devices Market in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence