Key Insights

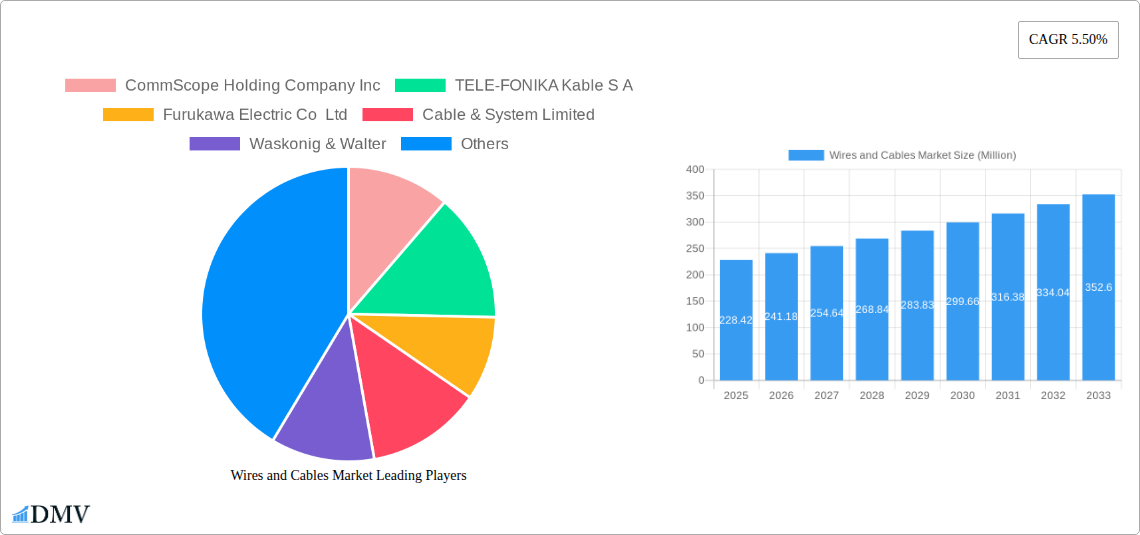

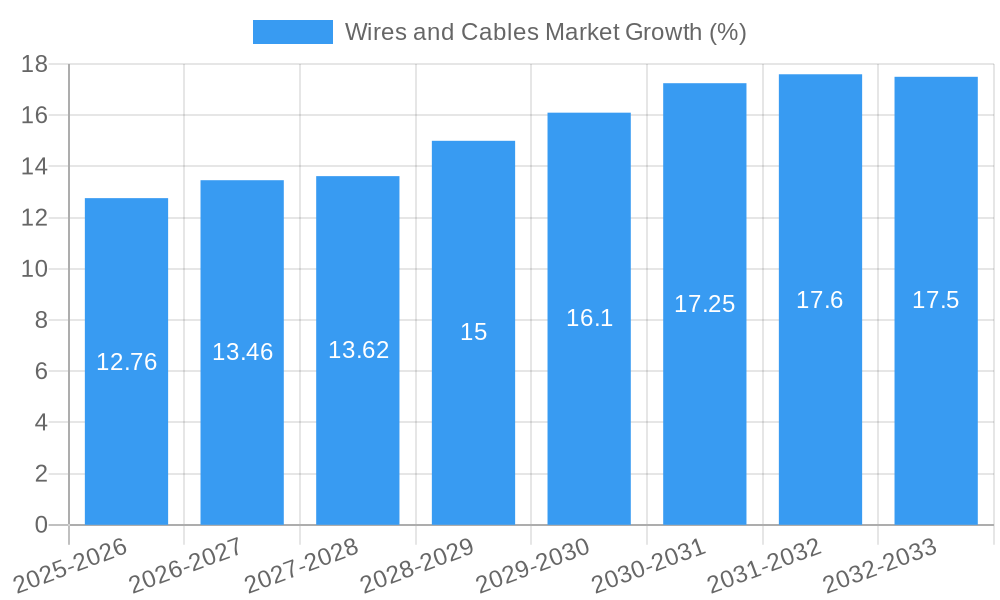

The global wires and cables market, valued at $228.42 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.50% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning construction sector, encompassing both residential and commercial projects globally, necessitates extensive wiring and cabling infrastructure. Simultaneously, the rapid advancement of telecommunications and IT networks, coupled with the increasing demand for high-speed internet and data transmission, significantly boosts the demand for fiber optic and signal cables. The power infrastructure sector, including renewable energy projects and electric vehicle adoption, further contributes to market growth. Technological advancements, such as the development of lighter, more efficient, and durable cable materials, are also contributing factors. Furthermore, stringent government regulations aimed at improving safety and reliability within electrical infrastructure are driving adoption of high-quality cables. Market segmentation reveals that power cables and fiber optic cables constitute significant portions of the market share, reflecting the high demand in the construction and telecommunication sectors.

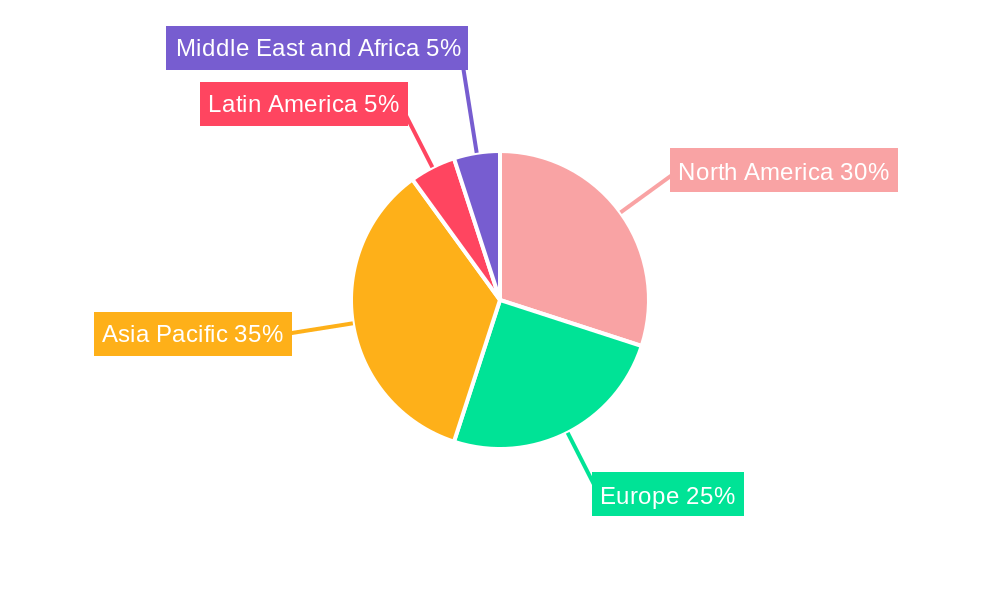

However, challenges remain. Fluctuations in raw material prices, particularly copper and aluminum, can impact profitability. Additionally, intense competition among numerous established players and emerging market entrants necessitates constant innovation and cost-optimization strategies to maintain market share. Nevertheless, the long-term outlook for the wires and cables market remains positive, driven by consistent growth in key end-user verticals and ongoing technological advancements. Geographical analysis suggests a strong presence in North America and Asia Pacific regions, with further expansion potential in developing economies experiencing rapid infrastructure development. Specific growth rates within these regions and segments will depend on factors like economic conditions, technological innovation, and governmental policies.

Wires and Cables Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the global Wires and Cables Market, offering a detailed analysis of market trends, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report projects robust market expansion, exceeding xx Million by 2033, driven by technological advancements and increasing demand across diverse sectors. This comprehensive analysis is essential for stakeholders seeking strategic insights and investment opportunities within this dynamic market.

Wires and Cables Market Market Composition & Trends

The Wires and Cables Market is characterized by a moderately consolidated structure, with several major players holding significant market share. The top 10 companies, including CommScope Holding Company Inc, TELE-FONIKA Kable S A, Furukawa Electric Co Ltd, and Prysmian S p A, collectively account for an estimated xx% of the global market in 2025. However, the presence of numerous smaller players fosters competition and innovation.

- Market Share Distribution (2025): Top 10 players: xx%; Others: xx%

- Market Concentration: Moderately Consolidated (Herfindahl-Hirschman Index: xx)

- Innovation Catalysts: Advancements in materials science (e.g., high-temperature superconductors), miniaturization technologies, and the rise of smart cables.

- Regulatory Landscape: Stringent safety and environmental regulations influence material selection and manufacturing processes. Variations in standards across different regions add complexity.

- Substitute Products: Wireless technologies pose a partial threat, particularly in certain applications. However, the inherent advantages of wired connections (reliability, speed) limit substitution.

- End-User Profiles: Diverse end-user segments, including construction, telecommunications, power infrastructure, and automotive, drive market growth.

- M&A Activities: The market has witnessed several significant mergers and acquisitions in recent years, with deal values exceeding xx Million in the past five years. These activities are primarily driven by expanding market share and gaining access to new technologies.

Wires and Cables Market Industry Evolution

The Wires and Cables Market has experienced steady growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is projected to accelerate in the forecast period (2025-2033), reaching a CAGR of xx%, driven by several factors. Technological advancements, such as the development of high-bandwidth fiber optic cables and the integration of smart sensors within cables, are significantly enhancing performance and opening new application areas. The increasing adoption of 5G and data centers fuels demand for high-performance cables. Furthermore, the expanding infrastructure development globally, particularly in emerging economies, significantly contributes to market expansion. The rising demand for renewable energy infrastructure also plays a pivotal role. Consumer demand shifts towards higher-quality, more durable, and environmentally friendly cables, impacting product development and material sourcing.

Leading Regions, Countries, or Segments in Wires and Cables Market

Dominant Regions: North America and Europe currently hold the largest market share, driven by strong infrastructure development and technological advancements. However, Asia-Pacific is experiencing rapid growth due to substantial investments in telecommunications and power infrastructure.

Dominant Segments:

- By Cable Type: Fiber optic cables are experiencing the fastest growth, driven by the expansion of high-speed data networks. Power cables continue to hold a significant share due to the sustained demand for electricity.

- By End-user Vertical: The telecommunications sector is a major driver of market growth, followed by construction and power infrastructure.

Key Drivers:

- Investment Trends: Significant investments in infrastructure development (5G networks, renewable energy projects) are propelling market growth.

- Regulatory Support: Government initiatives promoting energy efficiency and digital infrastructure development are creating favorable market conditions.

- Technological Advancements: Innovation in materials, manufacturing processes, and cable design continuously enhance product performance and expand applications.

The dominance of certain regions and segments is influenced by factors such as economic growth, regulatory environments, and technological advancements. North America's established telecommunications infrastructure and high technological adoption rates contribute to its strong market position. Similarly, Asia-Pacific's rapid infrastructure development and economic expansion fuel its high growth potential.

Wires and Cables Market Product Innovations

Recent innovations focus on enhancing data transmission speeds, improving energy efficiency, and increasing cable durability. The development of chip-embedded active electrical cables, as seen in MaxLinear's partnership with JPC Connection, exemplifies this trend. These advancements provide significant advantages in data centers and other high-bandwidth applications. The introduction of innovative materials, such as advanced polymers and high-temperature superconductors, further improves cable performance and extends their lifespan. These innovations cater to the growing demand for reliable, high-speed, and energy-efficient cable solutions across various sectors.

Propelling Factors for Wires and Cables Market Growth

Several factors fuel the growth of the Wires and Cables Market. Technological advancements, particularly in fiber optics and high-speed data transmission, are at the forefront. The global expansion of 5G networks and the rise of data centers dramatically increase demand for high-performance cables. Economic growth, especially in emerging markets, drives increased infrastructure investment, boosting cable demand. Government regulations promoting renewable energy and energy efficiency incentivize the adoption of advanced cable technologies, further stimulating market expansion.

Obstacles in the Wires and Cables Market Market

Despite significant growth potential, several challenges hinder the market's expansion. Regulatory hurdles and varying international standards create complexities in manufacturing and distribution. Supply chain disruptions, particularly concerning raw materials, can impact production and pricing. Intense competition among established players and the emergence of new entrants create price pressures and limit profit margins. Fluctuations in raw material costs also pose a challenge, impacting overall profitability.

Future Opportunities in Wires and Cables Market

The Wires and Cables Market presents numerous promising opportunities. The burgeoning Internet of Things (IoT) and smart city initiatives will drive demand for specialized cables with embedded sensors and data transmission capabilities. Expanding renewable energy projects, such as wind farms and solar power plants, necessitate the use of high-voltage cables. The continuous development of more efficient and sustainable cable materials will unlock new applications and enhance market appeal. Furthermore, penetration into untapped markets in developing economies presents significant potential for growth.

Major Players in the Wires and Cables Market Ecosystem

- CommScope Holding Company Inc

- TELE-FONIKA Kable S A

- Furukawa Electric Co Ltd

- Cable & System Limited

- Waskonig & Walter

- British Cables Company (Wilms Group)

- TE Connectivity

- Southwire Company LLC

- Amphenol Corporation

- Leoni AG

- Belden Incorporated

- Hengton Optic-Electric

- Prysmian S p A

- NKT A/S

- Shanghai Shenghua Group

- Nexans

- Fujikura Limited

- Corning Incorporated

Key Developments in Wires and Cables Market Industry

- May 2023: MaxLinear, Inc. partnered with JPC Connection to manufacture active electrical cables using MaxLinear's 5nm Keystone PAM4 DSP, significantly boosting data transfer speeds in hyperscale data centers.

- May 2023: LS cable and systems completed an HVDC submarine cable factory in Korea, strengthening its position in the submarine cable market.

Strategic Wires and Cables Market Market Forecast

The Wires and Cables Market is poised for continued growth, driven by technological innovation, expanding infrastructure development, and the increasing demand for high-performance cable solutions. The market's future potential hinges on continued investments in 5G networks, data centers, and renewable energy infrastructure. Technological advancements, such as the development of highly efficient and sustainable cables, will further shape market dynamics and create new opportunities for growth. The increasing focus on energy efficiency and environmentally friendly materials will also play a crucial role in shaping the future of the Wires and Cables Market.

Wires and Cables Market Segmentation

-

1. Cable Type

- 1.1. Low Voltage Energy

- 1.2. Power Cable

- 1.3. Fiber Optic Cable

- 1.4. Signal and Control Cable

- 1.5. Other Cable Types

-

2. End-user Vertical

- 2.1. Construction (Residential & Commercial)

- 2.2. Telecommunications (IT & Telecom)

- 2.3. Power Infrastructure (Energy & Power, Automotive)

- 2.4. Others End-user Verticals

Wires and Cables Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Wires and Cables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand from the Construction Sector; Ongoing Deployment of Smart Grid Infrastructure; Growing Adoption in the Telecommunications Industry

- 3.3. Market Restrains

- 3.3.1. Negative Statistics Due to the Regulatory Risks and Technological Changes

- 3.4. Market Trends

- 3.4.1. Fiber Optic Cable to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Low Voltage Energy

- 5.1.2. Power Cable

- 5.1.3. Fiber Optic Cable

- 5.1.4. Signal and Control Cable

- 5.1.5. Other Cable Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Construction (Residential & Commercial)

- 5.2.2. Telecommunications (IT & Telecom)

- 5.2.3. Power Infrastructure (Energy & Power, Automotive)

- 5.2.4. Others End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. North America Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 6.1.1. Low Voltage Energy

- 6.1.2. Power Cable

- 6.1.3. Fiber Optic Cable

- 6.1.4. Signal and Control Cable

- 6.1.5. Other Cable Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Construction (Residential & Commercial)

- 6.2.2. Telecommunications (IT & Telecom)

- 6.2.3. Power Infrastructure (Energy & Power, Automotive)

- 6.2.4. Others End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 7. Europe Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 7.1.1. Low Voltage Energy

- 7.1.2. Power Cable

- 7.1.3. Fiber Optic Cable

- 7.1.4. Signal and Control Cable

- 7.1.5. Other Cable Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Construction (Residential & Commercial)

- 7.2.2. Telecommunications (IT & Telecom)

- 7.2.3. Power Infrastructure (Energy & Power, Automotive)

- 7.2.4. Others End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 8. Asia Pacific Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 8.1.1. Low Voltage Energy

- 8.1.2. Power Cable

- 8.1.3. Fiber Optic Cable

- 8.1.4. Signal and Control Cable

- 8.1.5. Other Cable Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Construction (Residential & Commercial)

- 8.2.2. Telecommunications (IT & Telecom)

- 8.2.3. Power Infrastructure (Energy & Power, Automotive)

- 8.2.4. Others End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 9. Latin America Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 9.1.1. Low Voltage Energy

- 9.1.2. Power Cable

- 9.1.3. Fiber Optic Cable

- 9.1.4. Signal and Control Cable

- 9.1.5. Other Cable Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Construction (Residential & Commercial)

- 9.2.2. Telecommunications (IT & Telecom)

- 9.2.3. Power Infrastructure (Energy & Power, Automotive)

- 9.2.4. Others End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 10. Middle East and Africa Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Cable Type

- 10.1.1. Low Voltage Energy

- 10.1.2. Power Cable

- 10.1.3. Fiber Optic Cable

- 10.1.4. Signal and Control Cable

- 10.1.5. Other Cable Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Construction (Residential & Commercial)

- 10.2.2. Telecommunications (IT & Telecom)

- 10.2.3. Power Infrastructure (Energy & Power, Automotive)

- 10.2.4. Others End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Cable Type

- 11. North America Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Wires and Cables Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 CommScope Holding Company Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 TELE-FONIKA Kable S A

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Furukawa Electric Co Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Cable & System Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Waskonig & Walter

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 British Cables Company (Wilms Group)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 TE Connectivity

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Southwire Company LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Amphenol Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Leoni AG

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Belden Incorporated

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Hengton Optic-Electric*List Not Exhaustive

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Prysmian S p A

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 NKT A/S

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Shanghai Shenghua Group

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Nexans

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 Fujikura Limited

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.18 Corning Incorporated

- 16.2.18.1. Overview

- 16.2.18.2. Products

- 16.2.18.3. SWOT Analysis

- 16.2.18.4. Recent Developments

- 16.2.18.5. Financials (Based on Availability)

- 16.2.1 CommScope Holding Company Inc

List of Figures

- Figure 1: Global Wires and Cables Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Wires and Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 13: North America Wires and Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 14: North America Wires and Cables Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: North America Wires and Cables Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: North America Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Wires and Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 19: Europe Wires and Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 20: Europe Wires and Cables Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 21: Europe Wires and Cables Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 22: Europe Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Wires and Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 25: Asia Pacific Wires and Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 26: Asia Pacific Wires and Cables Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 27: Asia Pacific Wires and Cables Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 28: Asia Pacific Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Wires and Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 31: Latin America Wires and Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 32: Latin America Wires and Cables Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Latin America Wires and Cables Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Latin America Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Wires and Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 37: Middle East and Africa Wires and Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 38: Middle East and Africa Wires and Cables Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 39: Middle East and Africa Wires and Cables Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 40: Middle East and Africa Wires and Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Wires and Cables Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wires and Cables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Wires and Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 3: Global Wires and Cables Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global Wires and Cables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Wires and Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 23: Global Wires and Cables Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 24: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Wires and Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 28: Global Wires and Cables Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Wires and Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 35: Global Wires and Cables Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 36: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: China Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: India Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Asia Pacific Wires and Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Wires and Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 42: Global Wires and Cables Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 43: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Wires and Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 45: Global Wires and Cables Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 46: Global Wires and Cables Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wires and Cables Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Wires and Cables Market?

Key companies in the market include CommScope Holding Company Inc, TELE-FONIKA Kable S A, Furukawa Electric Co Ltd, Cable & System Limited, Waskonig & Walter, British Cables Company (Wilms Group), TE Connectivity, Southwire Company LLC, Amphenol Corporation, Leoni AG, Belden Incorporated, Hengton Optic-Electric*List Not Exhaustive, Prysmian S p A, NKT A/S, Shanghai Shenghua Group, Nexans, Fujikura Limited, Corning Incorporated.

3. What are the main segments of the Wires and Cables Market?

The market segments include Cable Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 228.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand from the Construction Sector; Ongoing Deployment of Smart Grid Infrastructure; Growing Adoption in the Telecommunications Industry.

6. What are the notable trends driving market growth?

Fiber Optic Cable to Witness Major Growth.

7. Are there any restraints impacting market growth?

Negative Statistics Due to the Regulatory Risks and Technological Changes.

8. Can you provide examples of recent developments in the market?

May 2023: MaxLinear, Inc., a provider of hyper-scale data center connectivity solutions, partnered with JPC Connection to manufacture active electrical cables using MaxLinear's5nm Keystone PAM4 DSP. Chip-embedded cables provide maximum data transfer speeds in hyperscale data centers. MaxLinear's5nm PAM4 DSPs will power JPC Connectivity's new 800G active electrical cables, which leverage the benefits of 5nm CMOS technology to address the critical needs for low-power, highly integrated, high-performance interconnect solutions in next-generation hyper-scale cloud networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wires and Cables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wires and Cables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wires and Cables Market?

To stay informed about further developments, trends, and reports in the Wires and Cables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence