Key Insights

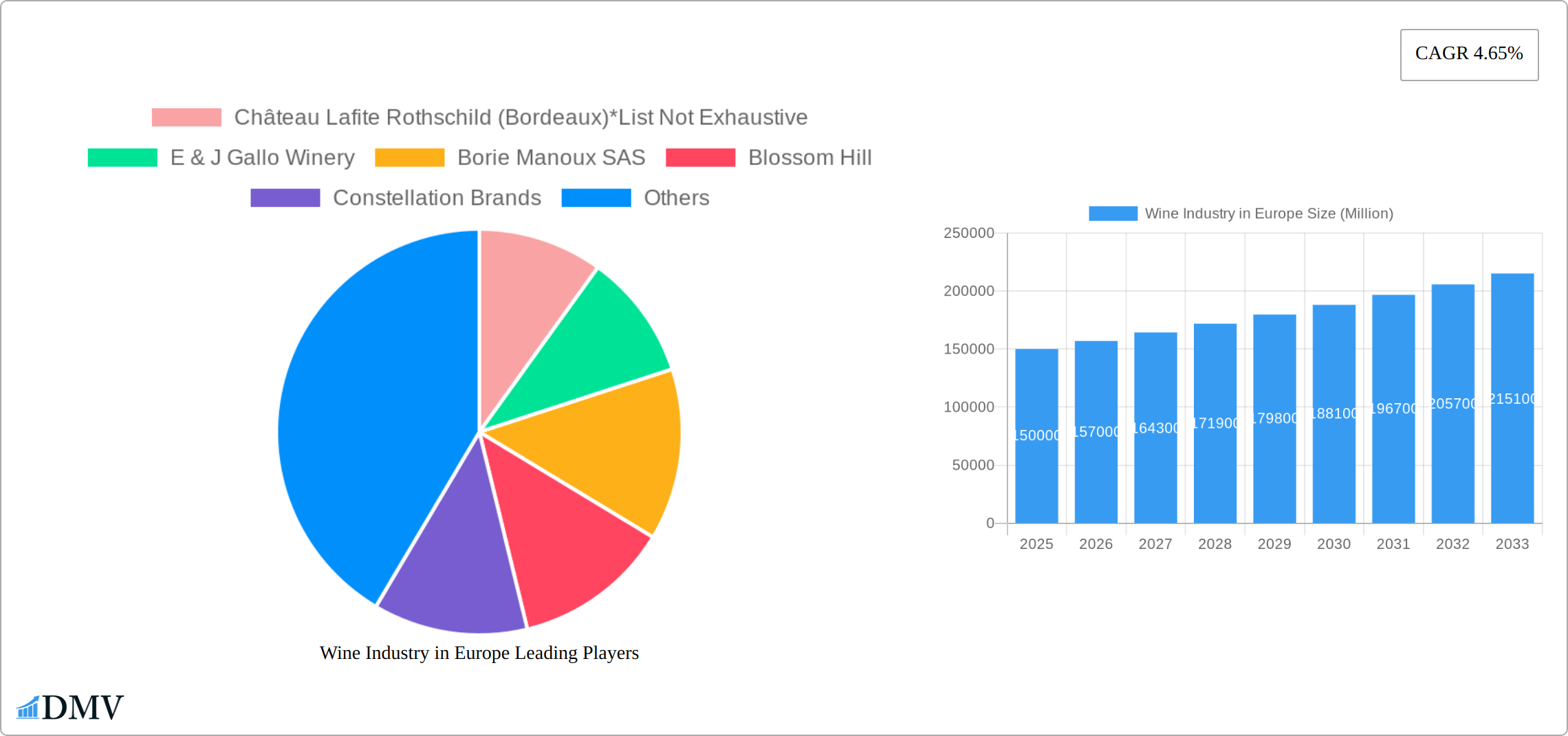

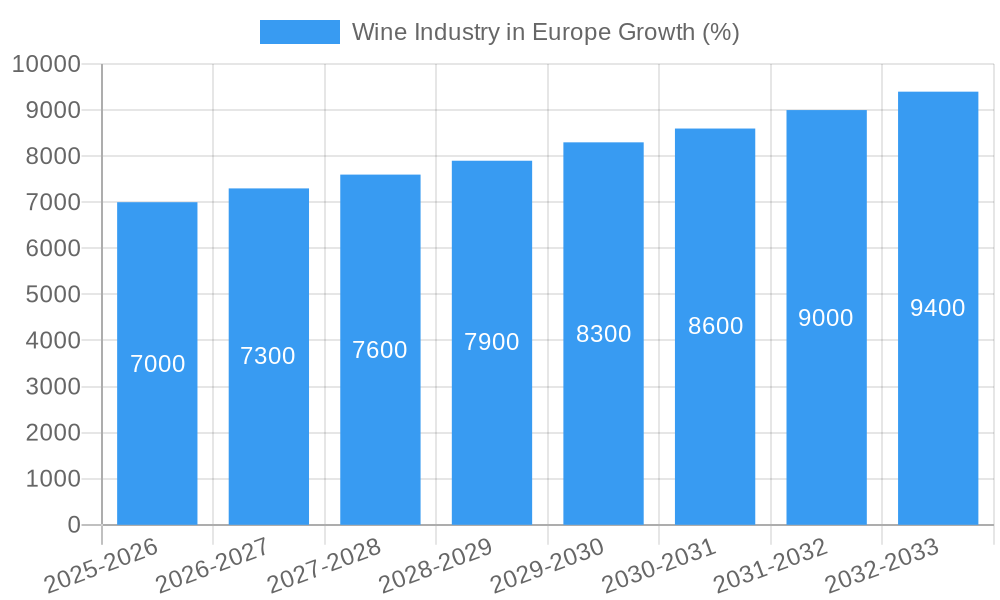

The European wine market, a significant global player, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.65% between 2025 and 2033. This expansion is driven by several key factors. Increasing disposable incomes across several European nations, particularly within the burgeoning middle class, fuel greater spending on premium and specialty wines. Furthermore, evolving consumer preferences are shifting towards healthier lifestyles, with wine often perceived as a moderate alcoholic beverage choice compared to spirits. The rise of wine tourism and an appreciation for regional wine varietals further enhance market dynamism. Strong export markets, particularly within Asia and North America, also contribute to market growth. However, challenges exist. Fluctuating grape harvests due to climate change pose a significant risk to production stability and pricing. Intense competition among established wineries and the emergence of new craft producers requires strategic marketing and differentiation to maintain market share. Regulatory changes regarding alcohol consumption and labeling also influence the market landscape. Segment-wise, the premium wine category (including red, rosé, and white wines) is expected to lead growth, driven by consumer demand for higher-quality products. The off-trade channel (supermarkets, wine shops) maintains a larger share than the on-trade (restaurants, bars), though both channels are likely to witness expansion. Still wines dominate the product type segment, although the sparkling wine category displays promising growth potential, driven by millennial and Gen Z consumers.

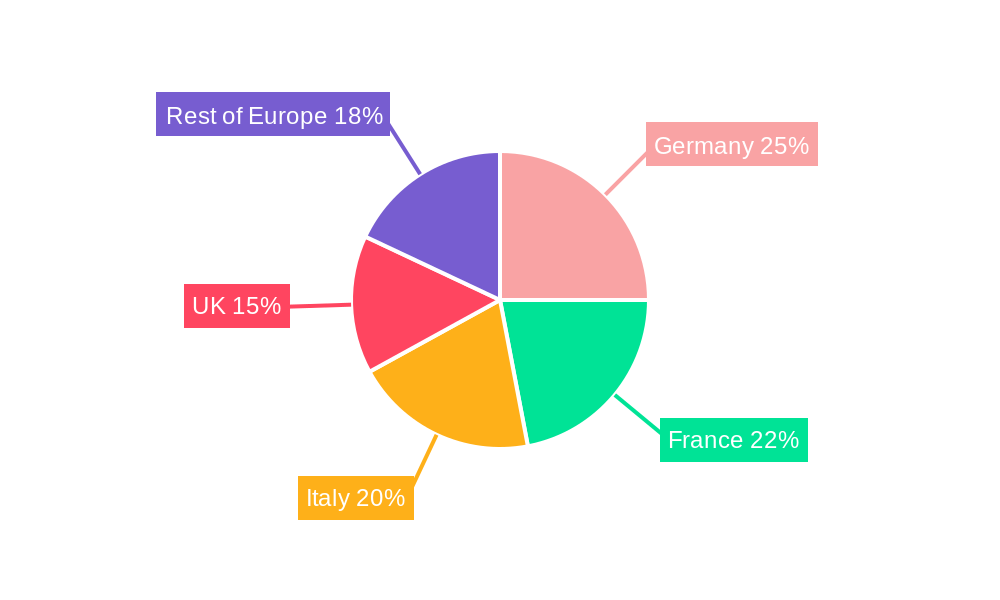

The competitive landscape is characterized by a mix of large multinational corporations and smaller, boutique wineries. Established players like E&J Gallo Winery and Constellation Brands leverage their global distribution networks and brand recognition. Simultaneously, smaller, regional wineries benefit from the growing demand for locally sourced and artisanal wines. This necessitates a flexible strategy for both large and smaller companies. The German, French, Italian, and UK markets represent the largest segments within Europe, but other countries, such as Sweden and the Netherlands, are exhibiting increasing consumption rates. A detailed analysis across all segments (color, distribution channel, and product type) indicates a considerable market opportunity for strategically positioned wineries to capitalize on the prevailing trends and mitigate potential risks. Market segmentation analysis and tailored product offerings are critical for success.

Wine Industry in Europe: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the European wine industry, covering market trends, leading players, and future opportunities. With a comprehensive study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for stakeholders seeking to navigate this dynamic market. The forecast period extends from 2025 to 2033, building upon the historical period of 2019-2024.

Wine Industry in Europe Market Composition & Trends

The European wine market, valued at €xx Million in 2024, exhibits a complex interplay of factors influencing its growth trajectory. Market concentration is moderate, with a few major players like E & J Gallo Winery and Pernod Ricard SA commanding significant shares, while numerous smaller wineries contribute to the overall landscape. Innovation is driven by consumer demand for premiumization, organic wines, and sustainable practices, prompting investment in new technologies and production methods. The regulatory landscape, varying across countries, plays a crucial role. Substitute products like beer and spirits exert competitive pressure, while the rising popularity of ready-to-drink (RTD) wine poses a further challenge. End-user profiles are diversifying, encompassing a broad spectrum from young adults to established wine connoisseurs. Mergers and acquisitions (M&A) activity is substantial, reflecting consolidation and brand expansion, with total M&A deal values exceeding €xx Million in recent years.

- Market Share Distribution (2024): E & J Gallo Winery: xx%; Pernod Ricard SA: xx%; Other Players: xx%

- M&A Deal Value (2019-2024): €xx Million

- Key M&A Activities: E. & J. Gallo Winery's acquisition of over 30 brands from Constellation Brands (2021).

Wine Industry in Europe Industry Evolution

The European wine industry has witnessed significant evolution over the past decade. Market growth, while exhibiting fluctuations, has largely followed an upward trend, driven primarily by increased disposable incomes in emerging markets and the growing preference for premium wines. Technological advancements in viticulture, winemaking, and packaging have enhanced efficiency and quality. Automation in vineyards, precision fermentation techniques, and innovative packaging solutions, such as bag-in-box and alternative closures, are transforming the industry. Shifting consumer demands toward organic, biodynamic, and sustainable wines are also shaping production methods. Furthermore, evolving consumer preferences towards specific varietals and wine styles have affected production choices, with trends in Rosé and sparkling wine contributing to market dynamism. The industry has faced challenges such as climate change, impacting yields and quality, and rising input costs affecting profitability. However, these obstacles are countered by increasing investment in research and development, focusing on adapting to climatic changes and improving yields. The market is expected to witness a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), reaching a value of €xx Million by 2033.

Leading Regions, Countries, or Segments in Wine Industry in Europe

France, Italy, and Spain remain the leading forces in European wine production and export, each contributing significantly to the global market. However, the landscape is dynamic, with other regions experiencing notable growth and shifts in consumer preferences reshaping the industry.

- By Color: Red wine continues its dominance, though the popularity of white and rosé wines remains strong, particularly in specific markets and among younger demographics. The "Other Wines" category, encompassing innovative blends, fruit-infused wines, and other novelties, is showing promising growth, driven by experimentation and consumer interest in unique flavor profiles.

- By Distribution Channel: While the off-trade (retail) sector maintains the largest market share, the on-trade (restaurants and bars) is experiencing a robust recovery following the pandemic, indicating a resurgence in hospitality and social consumption. E-commerce and direct-to-consumer sales are also steadily gaining traction, creating new avenues for distribution and brand engagement.

- By Product Type: Still wine remains the cornerstone of the European wine market. However, sparkling wine continues its impressive growth trajectory, fueled by rising demand for premium and celebratory beverages, particularly in key export markets. The increasing popularity of organic, biodynamic, and naturally produced wines also contributes to this market segment's dynamism.

Key Drivers:

- France's enduring legacy: France maintains its leading position due to a combination of strong brand recognition built over centuries, historical prestige, a remarkably diverse terroir capable of producing a vast array of wines, and significant investments in research and development to maintain quality and innovation.

- Italy's regional specialization: Italy leverages its regional strengths through a focus on high-quality production, well-established appellation systems that protect and promote regional identities, and the thriving wine tourism sector that connects consumers directly with the source.

- Spain's cost-effectiveness and quality push: Spain's high production volumes, particularly in the bulk wine segment, provide a cost-competitive advantage in certain markets. However, a simultaneous focus on producing high-quality, branded wines is positioning Spain to capture a larger share of the premium market.

- The burgeoning market for sustainable and organic wines: Growing consumer awareness of environmental and social responsibility is driving significant demand for organically and sustainably produced wines. This trend is further fueled by increasingly stringent regulations and certifications that provide consumers with greater transparency and confidence in product claims.

- Evolving Consumer Preferences: Health-conscious choices, increased interest in specific varietals, and exploration of diverse flavor profiles are creating opportunities for niche producers and innovative approaches to winemaking.

Wine Industry in Europe Product Innovations

Recent innovations include the use of alternative closures to reduce cork taint and enhance sustainability. Furthermore, the rise of organic, biodynamic, and low-intervention winemaking techniques satisfies the growing demand for natural and healthier beverages. Advances in packaging, including lighter-weight bottles and eco-friendly alternatives, enhance sustainability and reduce transportation costs. The use of technology for precision viticulture and winemaking allows producers to optimize processes and improve quality. The introduction of new wine styles and formats caters to evolving consumer preferences.

Propelling Factors for Wine Industry in Europe Growth

Technological advancements are improving yields and efficiency, while favorable economic conditions in many European countries boost consumer spending on premium beverages. Furthermore, supportive regulatory frameworks in some regions encourage investment and innovation. Increased tourism and the growing popularity of wine tourism, along with a rising middle class in developing markets, also contributes to market expansion.

Obstacles in the Wine Industry in Europe Market

Climate change poses a significant threat, impacting vineyard yields and quality. Supply chain disruptions due to geopolitical events or logistical challenges can increase production costs. Intense competition from both established players and new entrants puts pressure on margins. Stricter regulations regarding labeling and marketing increase compliance costs.

Future Opportunities in Wine Industry in Europe

Expanding into new markets (especially within Europe), particularly in countries with emerging middle classes, represents significant growth potential. The rising popularity of organic and biodynamic wines present opportunities for producers who embrace sustainable practices. Technological innovations in winemaking and packaging offer scope for enhanced efficiency and premiumization.

Major Players in the Wine Industry in Europe Ecosystem

- Château Lafite Rothschild (Bordeaux)

- E & J Gallo Winery

- Borie Manoux SAS

- Blossom Hill

- Constellation Brands

- Pernod Ricard SA (Brancott)

- Financière Pinault SCA (Groupe Artemis SA)

- Treasury Wine Estates (Wolf Blass)

- Louis Roederer

- Castel Group (Baron de Lestac)

Key Developments in Wine Industry in Europe Industry

- July 2022: Pernod Ricard launches a European pilot program for digital labeling across its wine and spirits portfolio.

- August 2021: Pernod Ricard UK launches "Cafayate and Leaps & Bounds," a new range of Australian wines.

- January 2021: E. & J. Gallo Winery completes the acquisition of over 30 wine brands from Constellation Brands.

Strategic Wine Industry in Europe Market Forecast

The European wine market is poised for continued growth, driven by favorable consumer trends, technological advancements, and the ongoing expansion of premium and sustainable wine segments. The market's future hinges on navigating challenges posed by climate change, geopolitical instability, and competition. However, innovation and adaptation will be crucial to unlocking the substantial market potential in the coming years. The expected CAGR of xx% points toward a robust and expanding market with significant opportunities for established and new players alike.

Wine Industry in Europe Segmentation

-

1. Product Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Other Product Types

-

2. Color

- 2.1. Red Wine

- 2.2. Rose Wine

- 2.3. White Wine

- 2.4. Other Wines

-

3. Distribution Channel

- 3.1. On-trade

-

3.2. Off-trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Specialty Stores

- 3.2.3. Online Retail Stores

- 3.2.4. Other Distribution Channels

Wine Industry in Europe Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. France

- 4. Germany

- 5. Italy

- 6. Rest of Europe

Wine Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Large Vineyard Area is Likely to Drive the Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Color

- 5.2.1. Red Wine

- 5.2.2. Rose Wine

- 5.2.3. White Wine

- 5.2.4. Other Wines

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade

- 5.3.2. Off-trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Specialty Stores

- 5.3.2.3. Online Retail Stores

- 5.3.2.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Germany

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Spain Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Still Wine

- 6.1.2. Sparkling Wine

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Color

- 6.2.1. Red Wine

- 6.2.2. Rose Wine

- 6.2.3. White Wine

- 6.2.4. Other Wines

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. On-trade

- 6.3.2. Off-trade

- 6.3.2.1. Supermarkets/Hypermarkets

- 6.3.2.2. Specialty Stores

- 6.3.2.3. Online Retail Stores

- 6.3.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Still Wine

- 7.1.2. Sparkling Wine

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Color

- 7.2.1. Red Wine

- 7.2.2. Rose Wine

- 7.2.3. White Wine

- 7.2.4. Other Wines

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. On-trade

- 7.3.2. Off-trade

- 7.3.2.1. Supermarkets/Hypermarkets

- 7.3.2.2. Specialty Stores

- 7.3.2.3. Online Retail Stores

- 7.3.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Still Wine

- 8.1.2. Sparkling Wine

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Color

- 8.2.1. Red Wine

- 8.2.2. Rose Wine

- 8.2.3. White Wine

- 8.2.4. Other Wines

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. On-trade

- 8.3.2. Off-trade

- 8.3.2.1. Supermarkets/Hypermarkets

- 8.3.2.2. Specialty Stores

- 8.3.2.3. Online Retail Stores

- 8.3.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Germany Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Still Wine

- 9.1.2. Sparkling Wine

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Color

- 9.2.1. Red Wine

- 9.2.2. Rose Wine

- 9.2.3. White Wine

- 9.2.4. Other Wines

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. On-trade

- 9.3.2. Off-trade

- 9.3.2.1. Supermarkets/Hypermarkets

- 9.3.2.2. Specialty Stores

- 9.3.2.3. Online Retail Stores

- 9.3.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Still Wine

- 10.1.2. Sparkling Wine

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Color

- 10.2.1. Red Wine

- 10.2.2. Rose Wine

- 10.2.3. White Wine

- 10.2.4. Other Wines

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. On-trade

- 10.3.2. Off-trade

- 10.3.2.1. Supermarkets/Hypermarkets

- 10.3.2.2. Specialty Stores

- 10.3.2.3. Online Retail Stores

- 10.3.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Still Wine

- 11.1.2. Sparkling Wine

- 11.1.3. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Color

- 11.2.1. Red Wine

- 11.2.2. Rose Wine

- 11.2.3. White Wine

- 11.2.4. Other Wines

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. On-trade

- 11.3.2. Off-trade

- 11.3.2.1. Supermarkets/Hypermarkets

- 11.3.2.2. Specialty Stores

- 11.3.2.3. Online Retail Stores

- 11.3.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Germany Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 13. France Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 14. Italy Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Château Lafite Rothschild (Bordeaux)*List Not Exhaustive

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 E & J Gallo Winery

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Borie Manoux SAS

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Blossom Hill

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Constellation Brands

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Pernod Ricard SA (Brancott)

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Financière Pinault SCA (Groupe Artemis SA)

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Treasury Wine Estates (Wolf Blass)

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Louis Roederer

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Castel Group (Baron de Lestac)

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Château Lafite Rothschild (Bordeaux)*List Not Exhaustive

List of Figures

- Figure 1: Wine Industry in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Wine Industry in Europe Share (%) by Company 2024

List of Tables

- Table 1: Wine Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 4: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Wine Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 16: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 20: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 24: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 28: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 32: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 36: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wine Industry in Europe?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the Wine Industry in Europe?

Key companies in the market include Château Lafite Rothschild (Bordeaux)*List Not Exhaustive, E & J Gallo Winery, Borie Manoux SAS, Blossom Hill, Constellation Brands, Pernod Ricard SA (Brancott), Financière Pinault SCA (Groupe Artemis SA), Treasury Wine Estates (Wolf Blass), Louis Roederer, Castel Group (Baron de Lestac).

3. What are the main segments of the Wine Industry in Europe?

The market segments include Product Type, Color, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Large Vineyard Area is Likely to Drive the Market in the Region.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

Pernod Ricard has announced the launch of a digital labeling project that will cover its entire portfolio, including wine and spirits. The project, under which every bottle of Pernod Ricard's products carries its QR code on the back label, is being implemented to provide consumers with more transparency on ingredient and health information. According to Pernod Richard, a European pilot program for the digital label solution will begin in July 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wine Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wine Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wine Industry in Europe?

To stay informed about further developments, trends, and reports in the Wine Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence