Key Insights

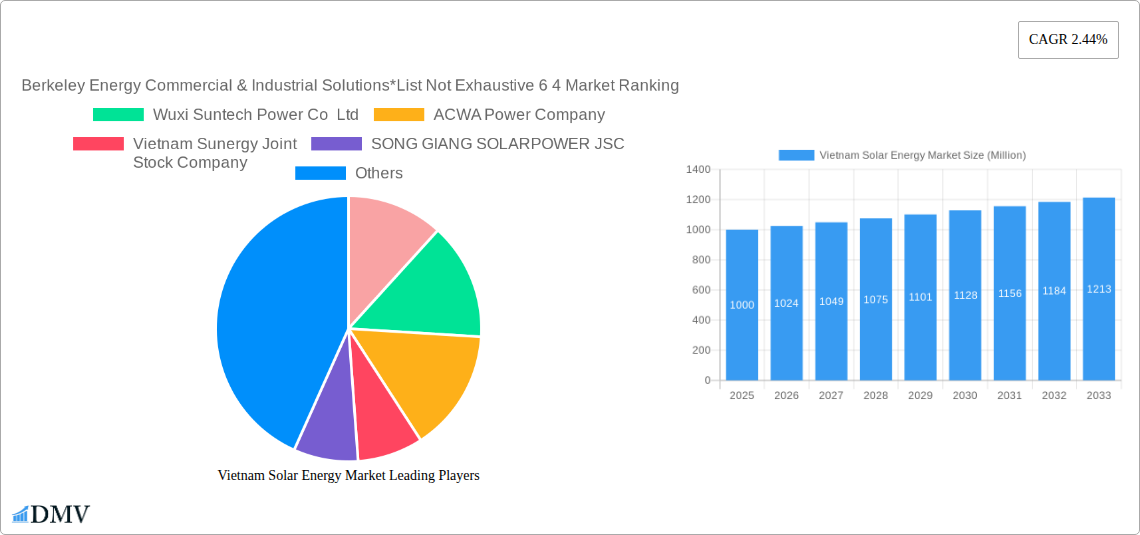

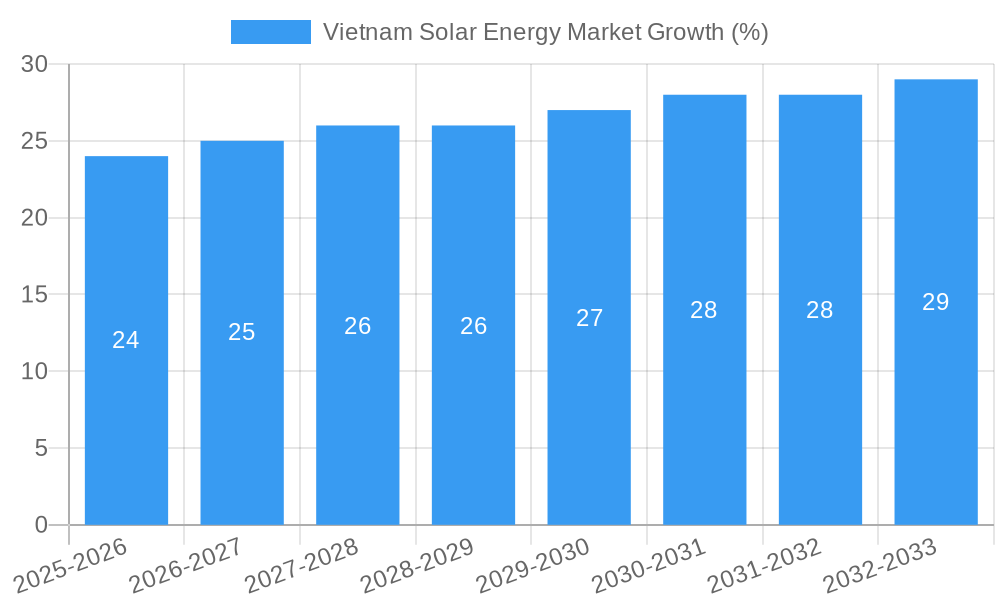

The Vietnam solar energy market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by the government's ambitious renewable energy targets, increasing energy demand, and decreasing solar panel costs. The 2.44% CAGR suggests a consistent, albeit moderate, expansion over the forecast period (2025-2033). Key market segments include Solar Photovoltaic (PV) and Concentrated Solar Power (CSP), with PV likely dominating due to its established technology and lower upfront costs. While government support acts as a significant driver, challenges such as land acquisition for large-scale projects and grid integration issues could potentially restrain market growth. The competitive landscape is dynamic, featuring both international players like Sharp Energy Solutions and ACWA Power, alongside domestic companies such as SONG GIANG SOLARPOWER JSC and Vivaan Solar Private Limited. The focus is likely shifting towards large-scale solar farms to meet the nation's energy needs effectively. Successful implementation of government policies and addressing infrastructural limitations will be crucial for unlocking the full potential of Vietnam's solar energy sector. The market is expected to see significant growth in the coming years, spurred on by a continued focus on sustainability and renewable energy independence. Further research into specific project developments and their impact on the market's trajectory is needed for detailed forecasting.

The historical period (2019-2024) likely saw a period of market establishment and initial growth. The base year of 2025 provides a solid foundation for projecting future growth based on the provided CAGR. The forecast period of 2025-2033 allows for assessing long-term market trends and potential investment opportunities. A detailed understanding of the regional distribution of solar energy projects within Vietnam is crucial for a comprehensive market analysis. While the provided data points to overall market growth, it is recommended to perform a deeper dive into the specific sub-segments within PV and CSP to understand the dynamics within each segment and refine market projections. The competitive landscape suggests potential opportunities for partnerships and technological advancements within the Vietnamese solar sector.

Vietnam Solar Energy Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Vietnam solar energy market, encompassing historical performance (2019-2024), current status (Base Year: 2025), and future projections (2025-2033). Discover key trends, growth drivers, challenges, and opportunities within this rapidly expanding sector, with a focus on market size (in Millions), key players, and technological advancements. This report is essential for stakeholders seeking to understand the intricacies of the Vietnamese solar energy landscape and capitalize on its immense potential.

Vietnam Solar Energy Market Composition & Trends

This section delves into the competitive dynamics, technological innovations, regulatory framework, and market forces shaping the Vietnam solar energy market. We analyze market concentration, revealing the market share distribution among key players. Furthermore, we examine the impact of mergers and acquisitions (M&A) activities, including deal values (in Millions), on market consolidation and growth. The analysis encompasses end-user profiles, identifying key demand segments and their evolving needs. Finally, we assess the influence of substitute products and the regulatory landscape in shaping market trajectories.

- Market Concentration: A detailed analysis of market share distribution amongst leading players, revealing the level of competition and dominance. xx% of the market is held by the top 5 players.

- Innovation Catalysts: Examination of factors driving technological advancements, including R&D investments and government incentives.

- Regulatory Landscape: Assessment of existing policies and their impact on market growth, including feed-in tariffs and renewable energy targets.

- Substitute Products: Analysis of alternative energy sources and their potential to impact solar energy adoption.

- End-User Profiles: Identification of key consumer segments driving demand for solar energy solutions, including residential, commercial, and industrial sectors.

- M&A Activities: Review of recent mergers and acquisitions, including deal values (in Millions USD) and their strategic implications. For example, SP Group's acquisition of 100 MWp of solar assets in 2023 represents a significant investment.

Vietnam Solar Energy Market Industry Evolution

This section meticulously traces the evolution of the Vietnam solar energy market, highlighting growth trajectories, technological leaps, and shifts in consumer preferences from 2019 to 2033. We present detailed data points, including compound annual growth rates (CAGRs) for different market segments. The analysis considers the adoption rates of various solar technologies and their impact on market dynamics. Furthermore, we examine the interplay of technological advancements, changing consumer demands, and government policies in driving market growth. The analysis includes projections for the forecast period (2025-2033) considering predicted growth rates in Millions USD. Expected growth rate for the forecast period (2025-2033) is xx%.

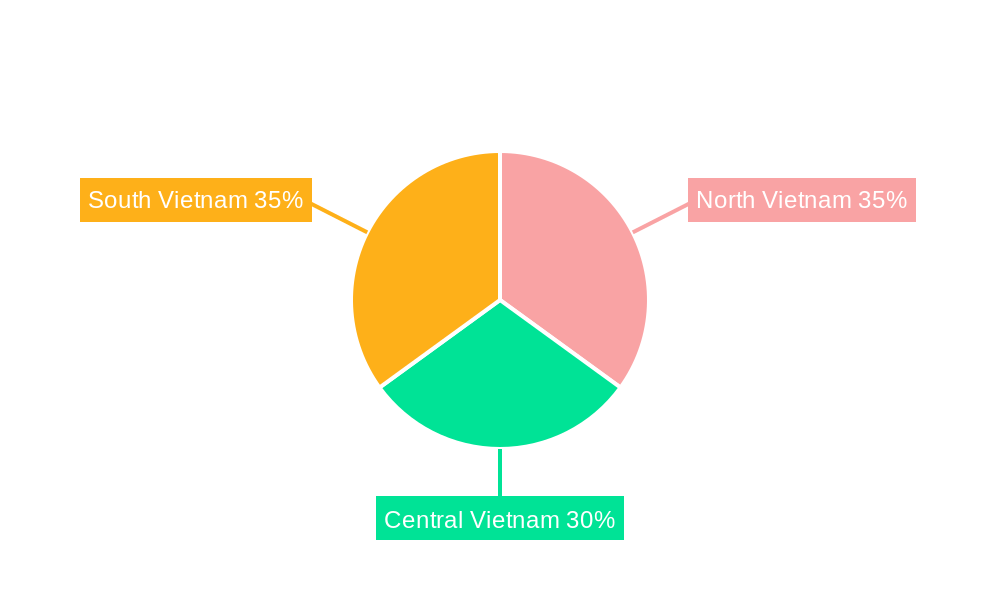

Leading Regions, Countries, or Segments in Vietnam Solar Energy Market

This section identifies the dominant segments within the Vietnam solar energy market, focusing on technology (Solar Photovoltaic (PV) and Concentrated Solar Power (CSP)). We provide in-depth analysis of the factors contributing to their dominance, including investment trends, regulatory support, and market drivers.

- Dominant Technology: Solar Photovoltaic (PV) is projected to dominate the market, accounting for xx% of total capacity by 2033.

- Key Drivers for PV Dominance:

- Lower Costs: Decreasing PV panel costs have made it a more economically viable option.

- Technological Advancements: Efficiency improvements in PV technology are driving higher energy yields.

- Government Support: Government policies and incentives are promoting the adoption of PV technology.

- Concentrated Solar Power (CSP): While CSP holds a smaller market share currently, opportunities exist for growth in specific regions due to high solar irradiance levels.

- Regional Variations: Analysis of regional differences in solar resource availability, regulatory frameworks, and investment activity influencing market growth.

Vietnam Solar Energy Market Product Innovations

This section highlights recent product innovations, emphasizing unique selling propositions (USPs) and technological breakthroughs that are transforming the Vietnamese solar energy market. This includes advancements in PV panel efficiency, energy storage solutions, and smart grid integration technologies, along with their corresponding performance metrics. The section also explores emerging applications of solar energy in diverse sectors such as residential, commercial, and industrial.

Propelling Factors for Vietnam Solar Energy Market Growth

Several factors are propelling the growth of the Vietnam solar energy market. These include:

- Government Policies: The Vietnamese government's commitment to renewable energy targets, coupled with favorable policies and incentives, is a key driver of growth.

- Decreasing Costs: The falling cost of solar PV technology makes it a more accessible and cost-effective energy source.

- Growing Energy Demand: Vietnam's rapidly growing economy and increasing energy demand are pushing the need for renewable energy solutions.

Obstacles in the Vietnam Solar Energy Market

Despite significant growth potential, several obstacles hinder the expansion of the Vietnam solar energy market:

- Grid Infrastructure: Limitations in grid infrastructure capacity can impede the integration of large-scale solar projects.

- Land Availability: Securing suitable land for large-scale solar farms can be challenging.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of solar components.

Future Opportunities in Vietnam Solar Energy Market

The future of the Vietnam solar energy market is bright. Emerging opportunities include:

- Floating Solar Farms: Utilizing water bodies for solar installations offers an alternative to land-based projects.

- Agrivoltaics: Integrating solar panel systems into agricultural lands maximizes land use efficiency.

- Energy Storage: Growth in energy storage solutions can enhance solar energy reliability.

Major Players in the Vietnam Solar Energy Market Ecosystem

- Berkeley Energy Commercial & Industrial Solutions

- Wuxi Suntech Power Co Ltd

- ACWA Power Company

- Vietnam Sunergy Joint Stock Company

- SONG GIANG SOLARPOWER JSC

- B Grimm Power Public Co Ltd

- Vivaan Solar Private Limited

- Sharp Energy Solutions Corporation

- TATA POWER SOLAR SYSTEMS LTD

Key Developments in Vietnam Solar Energy Market Industry

- June 2023: AD Green commences production at its 500 MW solar panel factory in Thai Binh, aiming for a 3 GW capacity within a year. This significantly boosts domestic solar panel production.

- March 2023: SP Group invests in 100 MWp of solar power farm assets in Phu Yen province, signifying increased foreign investment in Vietnam's solar sector.

Strategic Vietnam Solar Energy Market Forecast

The Vietnam solar energy market is poised for significant growth in the coming years. Continued government support, falling technology costs, and increasing energy demand will drive market expansion. Opportunities in large-scale solar projects, energy storage, and innovative applications like agrivoltaics will further contribute to market growth, with projections exceeding xx Million USD by 2033.

Vietnam Solar Energy Market Segmentation

-

1. Technology

- 1.1. Solar Photovoltaic (PV)

- 1.2. Concentrated Solar Power (CSP)

Vietnam Solar Energy Market Segmentation By Geography

- 1. Vietnam

Vietnam Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in the Renewable Energy Industry4.; Increasing Electricity Demand in Major Provinces

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. The Solar Photovoltaic (PV) Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Berkeley Energy Commercial & Industrial Solutions*List Not Exhaustive 6 4 Market Ranking Analysi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wuxi Suntech Power Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ACWA Power Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vietnam Sunergy Joint

Stock Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SONG GIANG SOLARPOWER JSC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 B Grimm Power Public Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vivaan Solar Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sharp Energy Solutions Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TATA POWER SOLAR SYSTEMS LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Berkeley Energy Commercial & Industrial Solutions*List Not Exhaustive 6 4 Market Ranking Analysi

List of Figures

- Figure 1: Vietnam Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Solar Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Vietnam Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Vietnam Solar Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 5: Vietnam Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Solar Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Vietnam Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Vietnam Solar Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Vietnam Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 10: Vietnam Solar Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 11: Vietnam Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Vietnam Solar Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Solar Energy Market?

The projected CAGR is approximately 2.44%.

2. Which companies are prominent players in the Vietnam Solar Energy Market?

Key companies in the market include Berkeley Energy Commercial & Industrial Solutions*List Not Exhaustive 6 4 Market Ranking Analysi, Wuxi Suntech Power Co Ltd, ACWA Power Company, Vietnam Sunergy Joint Stock Company, SONG GIANG SOLARPOWER JSC, B Grimm Power Public Co Ltd, Vivaan Solar Private Limited, Sharp Energy Solutions Corporation, TATA POWER SOLAR SYSTEMS LTD.

3. What are the main segments of the Vietnam Solar Energy Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in the Renewable Energy Industry4.; Increasing Electricity Demand in Major Provinces.

6. What are the notable trends driving market growth?

The Solar Photovoltaic (PV) Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

June 2023: AD Green, a Vietnamese solar panel producer, started production at its new Thai Binh factory. The project was launched with a capacity of 500 MW and was expected to expand to 3 GW within a year. The fully functioning facility distributes its 540 W monocrystalline solar panels to domestic and international customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Solar Energy Market?

To stay informed about further developments, trends, and reports in the Vietnam Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence