Key Insights

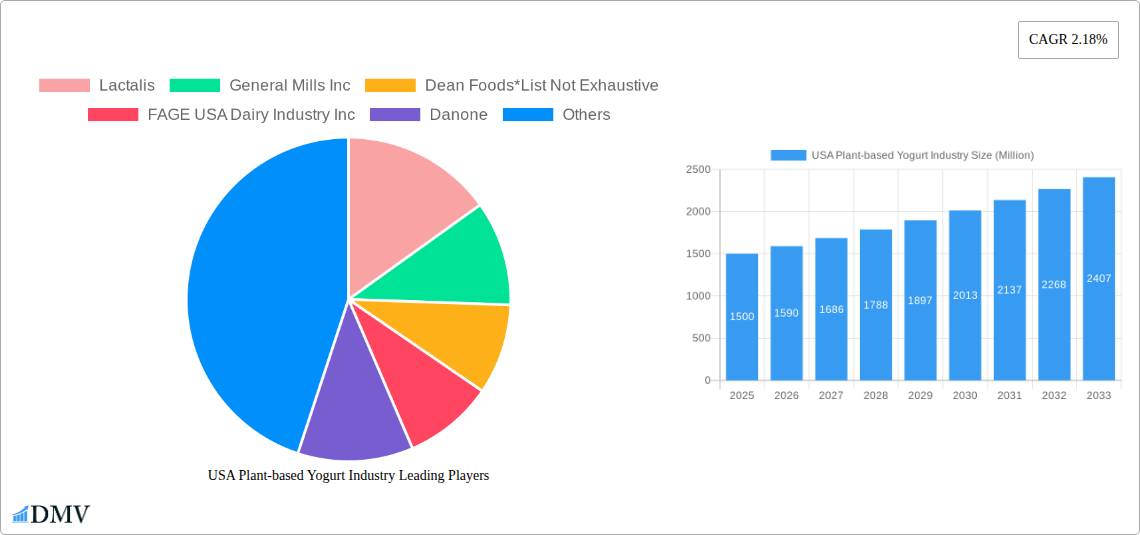

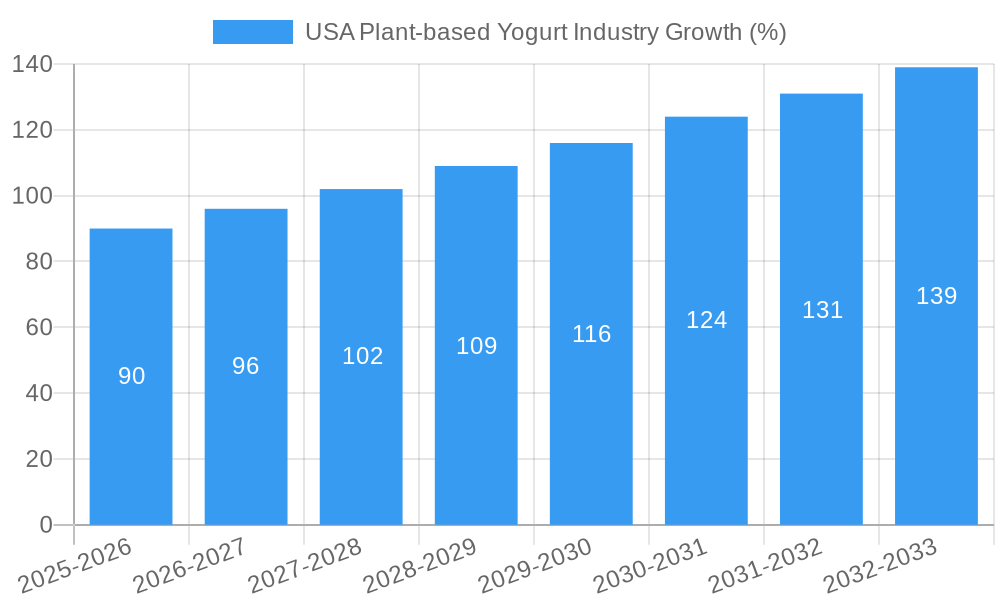

The US plant-based yogurt market, a dynamic segment within the broader yogurt industry, exhibits promising growth potential. While precise market size figures for plant-based yogurt specifically are absent from the provided data, we can infer its substantial contribution based on the overall yogurt market's size and the accelerating consumer preference for plant-based alternatives. Considering the overall yogurt market's CAGR of 2.18% and the surging popularity of vegan and dairy-free options, the plant-based segment likely experiences a significantly higher growth rate, potentially exceeding 5-7% annually. Key drivers include the rising awareness of health benefits associated with plant-based diets, increasing demand for dairy-free alternatives due to lactose intolerance and allergies, and a growing focus on sustainability and ethical sourcing. The market is segmented by product type (plain vs. flavored), distribution channels (supermarkets, convenience stores, online retail), and plant-based sources (almond, soy, coconut, oat, etc.). Major players like Danone, Chobani, and Hain Celestial Group are actively expanding their plant-based offerings, while smaller specialized brands are also gaining traction. Challenges include maintaining product consistency and taste comparable to dairy yogurt, managing ingredient costs, and addressing consumer perceptions regarding flavor and texture.

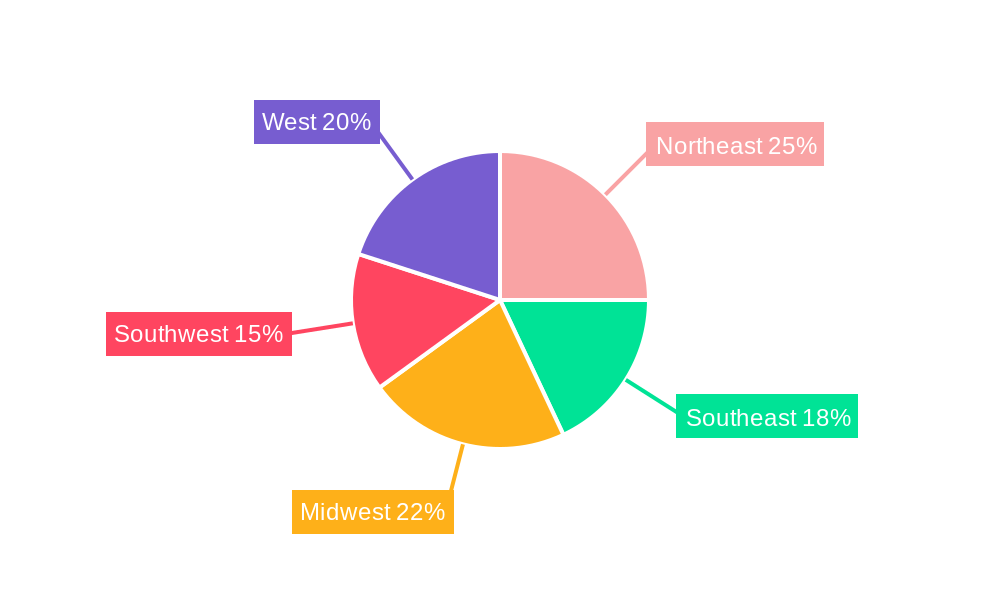

The regional distribution across the US is likely uneven, with higher consumption in regions known for health-conscious populations and strong retail infrastructure, such as the Northeast and West Coast. The forecast period (2025-2033) suggests continued market expansion, driven by product innovation, improved manufacturing techniques, and sustained consumer demand. Understanding these dynamics is critical for companies seeking to capitalize on the significant opportunities within the burgeoning US plant-based yogurt market. Growth will depend on successful product differentiation, effective marketing strategies targeting specific consumer segments, and robust supply chain management to meet rising demand. Future research should focus on quantifying the market size specifically for plant-based yogurt, disaggregating the data by specific plant-based sources, and analyzing the competitive landscape in greater detail.

USA Plant-Based Yogurt Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the USA plant-based yogurt industry, encompassing market size, segmentation, competitive landscape, and future growth projections. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for stakeholders seeking to understand the dynamics of this rapidly evolving market and make informed strategic decisions. The report leverages extensive primary and secondary research to offer actionable insights for industry participants. The total market value is predicted to reach xx Million by 2033.

USA Plant-based Yogurt Industry Market Composition & Trends

This section delves into the intricate structure of the USA plant-based yogurt market, examining key aspects influencing its evolution. We analyze market concentration, revealing the dominant players and their respective market shares. Innovation catalysts, including technological advancements and consumer preferences, are thoroughly investigated. The regulatory landscape, including labeling requirements and food safety regulations, is also explored. The influence of substitute products, such as plant-based milk alternatives, and the evolving end-user profiles are assessed. Finally, we examine the mergers and acquisitions (M&A) activity, providing insights into deal values and strategic implications.

- Market Share Distribution: (Provide data on market share distribution among key players. For example, Chobani holds xx%, Danone holds xx%, etc. If data is unavailable, use predicted values.)

- M&A Activity: (Detail significant M&A transactions, including deal values and rationale. Example: In 2022, a hypothetical acquisition of a smaller plant-based yogurt company by a larger player resulted in a $xx Million deal.)

- Regulatory Landscape: (Summarize key regulations impacting the industry, e.g., labeling requirements for plant-based products)

- Innovation Catalysts: (Describe key innovations driving growth, such as new flavors, functional ingredients, and sustainable packaging)

USA Plant-based Yogurt Industry Industry Evolution

This section provides a detailed historical and future analysis of the USA plant-based yogurt industry's evolution. We examine market growth trajectories, both historically (2019-2024) and in the forecast period (2025-2033), incorporating detailed data points like compound annual growth rates (CAGR). The report also explores technological advancements influencing production processes and product innovation, as well as the shifting consumer demands driving the market's evolution. Factors such as increasing health consciousness, the growing popularity of veganism, and changing dietary preferences are thoroughly analyzed.

(Provide a paragraph of 600 words analyzing the above points, including relevant data points like growth rates and adoption metrics for plant-based yogurt. Include examples of technological advancements and the impact of changing consumer demand.)

Leading Regions, Countries, or Segments in USA Plant-based Yogurt Industry

This section identifies the leading regions, countries, and segments within the USA plant-based yogurt market. It analyzes dominance factors across various categories (Dairy-Based Yogurt, Non-dairy Yogurt), product types (Plain Yogurt, Flavored Yogurt), and distribution channels (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Other Channels).

Key Drivers:

- Supermarkets/Hypermarkets: High volume sales, established distribution networks.

- Online Retail: Growing e-commerce penetration, convenience for consumers.

- Flavored Yogurt: Consumer preference for diverse taste profiles.

- Non-dairy Yogurt: Rising vegan and health-conscious population.

(Provide 600 words of in-depth analysis explaining why these segments are dominant, including analysis of investment trends and regulatory support.)

USA Plant-based Yogurt Industry Product Innovations

This section highlights recent product innovations in the USA plant-based yogurt industry. We analyze new product launches, improved formulations, and innovative packaging solutions, emphasizing their unique selling propositions and technological advancements. Examples include the introduction of novel flavor profiles, functional ingredients enhancing health benefits, and sustainable packaging options minimizing environmental impact. (Provide 100-150 words describing product innovations, highlighting their unique selling propositions and technological advancements.)

Propelling Factors for USA Plant-based Yogurt Industry Growth

Several key factors drive the growth of the USA plant-based yogurt industry. These include increasing consumer demand for healthier and more sustainable food choices, coupled with technological advancements in production processes and innovative product development. Favorable regulatory environments supporting the plant-based food sector also play a crucial role. (Provide 150 words explaining these drivers with specific examples).

Obstacles in the USA Plant-based Yogurt Industry Market

Despite its growth potential, the USA plant-based yogurt market faces various obstacles. These include intense competition from established dairy yogurt brands, challenges in replicating the texture and taste of traditional yogurt, and fluctuations in raw material prices. Supply chain disruptions and regulatory hurdles related to labeling and ingredient sourcing can also impede market expansion. (Provide 150 words explaining these obstacles and their quantifiable impact.)

Future Opportunities in USA Plant-based Yogurt Industry

The future of the USA plant-based yogurt industry presents exciting opportunities for growth. Emerging markets, such as specialized health food stores and online marketplaces, offer significant potential. Technological advancements in production processes, along with the development of innovative flavor profiles and functional ingredients, will further fuel market expansion. Furthermore, tapping into emerging consumer trends, such as personalized nutrition and sustainability, will create new avenues for growth. (Provide 150 words explaining these opportunities.)

Major Players in the USA Plant-based Yogurt Industry Ecosystem

- Lactalis

- General Mills Inc

- Dean Foods

- FAGE USA Dairy Industry Inc

- Danone

- Anderson Erickson Dairy

- Dairy Farmers of America Inc

- Chobani LLC

- Tillamook County Creamery Association

- Hain Celestial Group

Key Developments in USA Plant-based Yogurt Industry Industry

- June 2022: The chewy candy company HI-CHEW partnered with Menchie's Frozen Yogurt in North America to launch a limited edition HI-CHEW™ Rainbow Sherbet Flavor frozen yogurt. This collaboration expanded Menchie's product line and leveraged HI-CHEW's brand recognition.

- June 2022: Yogurtland introduced two new limited-time summer flavors: strawberry mango sorbet and passion fruit mango tart, expanding its product offerings and appealing to seasonal consumer preferences. Their online-exclusive sales strategy broadened reach.

- June 2022: Danone North America launched Activia+ Multi-Benefit Probiotic Yogurt Drinks, adding a new functional product to their portfolio and capitalizing on the growing demand for gut health products.

Strategic USA Plant-based Yogurt Industry Market Forecast

The USA plant-based yogurt market is poised for substantial growth over the forecast period (2025-2033). This positive outlook is driven by the confluence of several factors, including rising consumer demand for healthier alternatives, innovative product launches, and the increasing adoption of plant-based diets. Continued technological advancements and expansion into new distribution channels will further contribute to market expansion, creating significant opportunities for industry participants. (Provide 150 words summarizing growth catalysts and future market potential.)

USA Plant-based Yogurt Industry Segmentation

-

1. Category

- 1.1. Dairy-Based Yogurt

- 1.2. Non-dairy Yogurt

-

2. Product Type

- 2.1. Plain Yogurt

- 2.2. Flavored Yogurt

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Specialty Stores

- 3.4. Online Retail

- 3.5. Other Channels

USA Plant-based Yogurt Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Plant-based Yogurt Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood

- 3.3. Market Restrains

- 3.3.1. Rising Concern About Quality and Safety Standards of Canned Tuna

- 3.4. Market Trends

- 3.4.1. Growing Digestive Heath Concerns Heating up Demand for Probiotic Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Dairy-Based Yogurt

- 5.1.2. Non-dairy Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plain Yogurt

- 5.2.2. Flavored Yogurt

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Retail

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. North America USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Dairy-Based Yogurt

- 6.1.2. Non-dairy Yogurt

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Plain Yogurt

- 6.2.2. Flavored Yogurt

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Convenience Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online Retail

- 6.3.5. Other Channels

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. South America USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Dairy-Based Yogurt

- 7.1.2. Non-dairy Yogurt

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Plain Yogurt

- 7.2.2. Flavored Yogurt

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Convenience Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online Retail

- 7.3.5. Other Channels

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Europe USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Dairy-Based Yogurt

- 8.1.2. Non-dairy Yogurt

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Plain Yogurt

- 8.2.2. Flavored Yogurt

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Convenience Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online Retail

- 8.3.5. Other Channels

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Middle East & Africa USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Dairy-Based Yogurt

- 9.1.2. Non-dairy Yogurt

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Plain Yogurt

- 9.2.2. Flavored Yogurt

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Convenience Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online Retail

- 9.3.5. Other Channels

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Asia Pacific USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Category

- 10.1.1. Dairy-Based Yogurt

- 10.1.2. Non-dairy Yogurt

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Plain Yogurt

- 10.2.2. Flavored Yogurt

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Convenience Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online Retail

- 10.3.5. Other Channels

- 10.1. Market Analysis, Insights and Forecast - by Category

- 11. Northeast USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 12. Southeast USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 13. Midwest USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southwest USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 15. West USA Plant-based Yogurt Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Lactalis

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 General Mills Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Dean Foods*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 FAGE USA Dairy Industry Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Danone

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Anderson Erickson Dairy

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Dairy Farmers of America Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Chobani LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Tillamook County Creamery Association

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Hain Celestial Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Lactalis

List of Figures

- Figure 1: Global USA Plant-based Yogurt Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states USA Plant-based Yogurt Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United states USA Plant-based Yogurt Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America USA Plant-based Yogurt Industry Revenue (Million), by Category 2024 & 2032

- Figure 5: North America USA Plant-based Yogurt Industry Revenue Share (%), by Category 2024 & 2032

- Figure 6: North America USA Plant-based Yogurt Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 7: North America USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 8: North America USA Plant-based Yogurt Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: North America USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: North America USA Plant-based Yogurt Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America USA Plant-based Yogurt Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America USA Plant-based Yogurt Industry Revenue (Million), by Category 2024 & 2032

- Figure 13: South America USA Plant-based Yogurt Industry Revenue Share (%), by Category 2024 & 2032

- Figure 14: South America USA Plant-based Yogurt Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 15: South America USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 16: South America USA Plant-based Yogurt Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: South America USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: South America USA Plant-based Yogurt Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America USA Plant-based Yogurt Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe USA Plant-based Yogurt Industry Revenue (Million), by Category 2024 & 2032

- Figure 21: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Category 2024 & 2032

- Figure 22: Europe USA Plant-based Yogurt Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Europe USA Plant-based Yogurt Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Europe USA Plant-based Yogurt Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe USA Plant-based Yogurt Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa USA Plant-based Yogurt Industry Revenue (Million), by Category 2024 & 2032

- Figure 29: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Category 2024 & 2032

- Figure 30: Middle East & Africa USA Plant-based Yogurt Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Middle East & Africa USA Plant-based Yogurt Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa USA Plant-based Yogurt Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa USA Plant-based Yogurt Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific USA Plant-based Yogurt Industry Revenue (Million), by Category 2024 & 2032

- Figure 37: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Category 2024 & 2032

- Figure 38: Asia Pacific USA Plant-based Yogurt Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 39: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 40: Asia Pacific USA Plant-based Yogurt Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific USA Plant-based Yogurt Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific USA Plant-based Yogurt Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 3: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northeast USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southeast USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Midwest USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southwest USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 13: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 20: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 21: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 27: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 40: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 41: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 50: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 51: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global USA Plant-based Yogurt Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific USA Plant-based Yogurt Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Plant-based Yogurt Industry?

The projected CAGR is approximately 2.18%.

2. Which companies are prominent players in the USA Plant-based Yogurt Industry?

Key companies in the market include Lactalis, General Mills Inc, Dean Foods*List Not Exhaustive, FAGE USA Dairy Industry Inc, Danone, Anderson Erickson Dairy, Dairy Farmers of America Inc, Chobani LLC, Tillamook County Creamery Association, Hain Celestial Group.

3. What are the main segments of the USA Plant-based Yogurt Industry?

The market segments include Category, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood.

6. What are the notable trends driving market growth?

Growing Digestive Heath Concerns Heating up Demand for Probiotic Products.

7. Are there any restraints impacting market growth?

Rising Concern About Quality and Safety Standards of Canned Tuna.

8. Can you provide examples of recent developments in the market?

In June 2022, The chewy candy company HI-CHEW partnered with Menchie's Frozen Yogurt in North America to launch a limited edition HI-CHEWTM Rainbow Sherbet Flavor frozen yogurt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Plant-based Yogurt Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Plant-based Yogurt Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Plant-based Yogurt Industry?

To stay informed about further developments, trends, and reports in the USA Plant-based Yogurt Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence