Key Insights

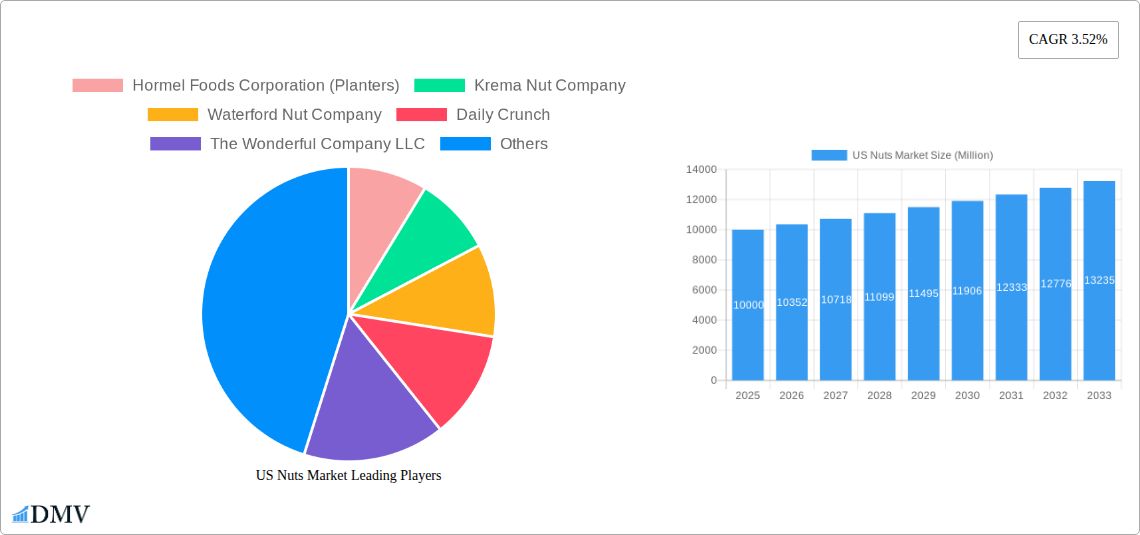

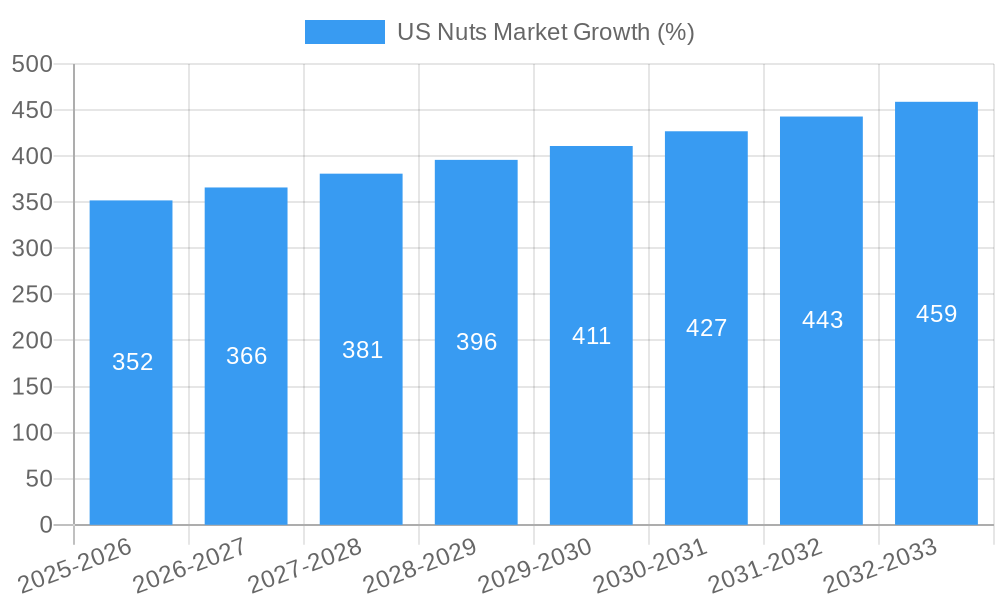

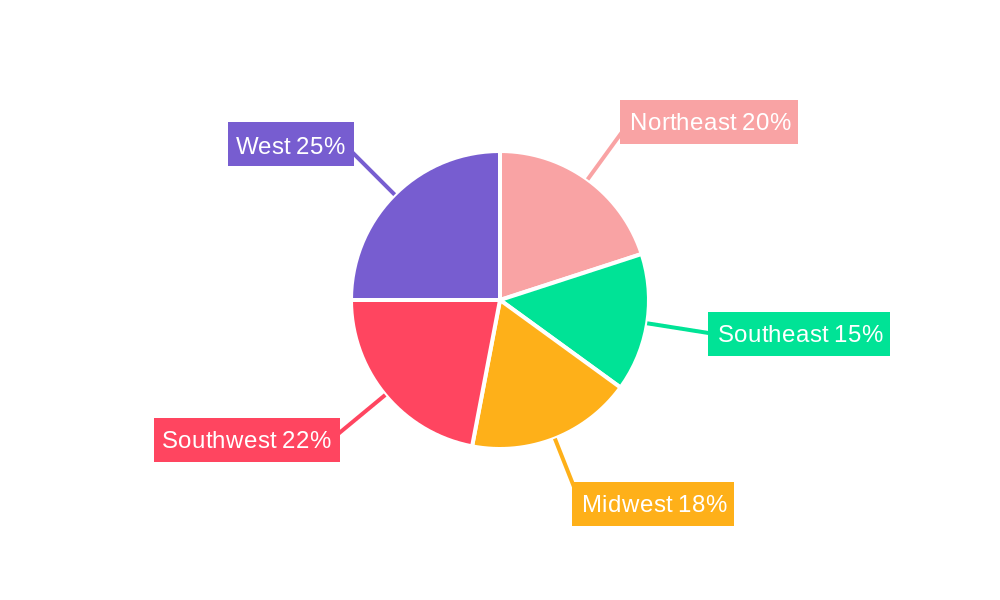

The US nuts market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.52% from 2025 to 2033. This growth is driven by several factors, including the increasing consumer awareness of the health benefits associated with nut consumption—rich in protein, fiber, and healthy fats—fueling demand for nutritious snacks and ingredients. The rising popularity of plant-based diets and the incorporation of nuts into various food products, from confectionery to baked goods, further contribute to market expansion. Consumer preference for convenient, ready-to-eat options is also driving growth within the off-trade distribution channel, as consumers seek healthy and portable snacks. However, price fluctuations in raw materials and potential supply chain disruptions due to factors like climate change pose challenges to consistent market growth. Furthermore, the increasing prevalence of nut allergies necessitates clear labeling and allergen management strategies within the industry. Segment-wise, almonds, walnuts, and cashews are expected to maintain significant market shares, driven by their versatile applications and consumer preference. The market is characterized by a mix of large multinational corporations and smaller regional players, each with their strategies to capture market share through product innovation, brand building, and targeted marketing. Geographical distribution shows varied consumption patterns across regions, with the West coast potentially exhibiting higher per capita consumption given its proximity to major nut-growing areas.

The forecast period (2025-2033) anticipates continued growth, although the pace may fluctuate slightly due to macroeconomic factors and consumer spending patterns. Innovation in nut-based products, such as nut butters, nut milks, and nut-based protein bars, is likely to remain a key driver of growth. Companies are also focusing on sustainable sourcing and environmentally friendly practices to meet growing consumer demand for ethical and responsible products. Competition is likely to intensify as companies strive to offer a diverse range of products catering to evolving consumer preferences, focusing on health, taste, and convenience. The expansion of e-commerce channels and direct-to-consumer models also offers opportunities for growth, with companies leveraging online platforms to reach wider audiences. Maintaining consistent quality and ensuring food safety remain paramount for success in this competitive market.

US Nuts Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the US nuts market, covering the period from 2019 to 2033. It delves into market dynamics, competitive landscapes, and future growth projections, offering invaluable insights for stakeholders across the value chain. With a base year of 2025 and an estimated year of 2025, the forecast period spans from 2025 to 2033, encompassing historical data from 2019 to 2024. The report quantifies market size in Millions for a clear understanding of market potential and growth trajectories. This comprehensive study is essential for businesses seeking to navigate the complexities and capitalize on the opportunities within this dynamic market.

US Nuts Market Composition & Trends

This section evaluates the US nuts market's structure, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user preferences, and merger & acquisition (M&A) activities. The market is characterized by a mix of large established players and smaller, specialized companies. The report details market share distribution among key players, revealing a moderately concentrated market with xx% controlled by the top five players in 2024.

- Market Concentration: High concentration in the almond and peanut segments, with greater fragmentation in other nut categories.

- Innovation Catalysts: Growing demand for healthier snacks fuels innovation in product formats, flavors, and processing methods (e.g., sprouted nuts, roasted nuts with unique flavor profiles).

- Regulatory Landscape: Regulations concerning labeling, food safety, and allergen information significantly impact market operations. The impact of the xx regulations on market growth is assessed in detail.

- Substitute Products: Competition from other snack food categories like seeds, dried fruits, and protein bars.

- End-User Profiles: The report segments consumers by demographics (age, income, lifestyle) and purchasing behavior to identify key target groups. The xx Million segment representing millennial consumers is a focus.

- M&A Activities: The report analyzes recent M&A deals, providing deal values where available, to assess their impact on market consolidation. In 2024, total M&A deal value was estimated at $xx Million.

US Nuts Market Industry Evolution

This section examines the historical and projected evolution of the US nuts market, focusing on market growth trajectories, technological advancements, and evolving consumer preferences. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), driven by increasing health consciousness and the versatility of nuts in various food applications. The report projects a xx% CAGR for the forecast period (2025-2033), influenced by factors such as increasing disposable incomes, expanding distribution channels, and the rise of e-commerce.

Technological advancements in nut processing, packaging, and preservation techniques are enhancing product quality, shelf life, and consumer convenience. The adoption rate of xx technology in nut processing increased by xx% between 2020 and 2024. Shifts in consumer preferences, including a preference for sustainably sourced nuts and minimally processed options, are also shaping market dynamics. The report analyzes these trends and their impact on market growth with detailed statistical data.

Leading Regions, Countries, or Segments in US Nuts Market

This section identifies the dominant regions, countries, and segments within the US nuts market, analyzing product type (almonds, peanuts, pistachios, walnuts, cashews, other nuts) and distribution channels (on-trade, off-trade).

Product Type: The almond segment dominates, holding a xx% market share in 2024, followed by peanuts at xx%. This dominance is driven by factors such as strong consumer demand, versatile applications (e.g., milk, butter, snacks), and consistent supply.

Distribution Channel: The off-trade channel (grocery stores, supermarkets, online retailers) represents the larger share of the market (xx%), while on-trade (restaurants, cafes, bars) accounts for the remaining xx%. The shift towards online grocery shopping has significantly impacted market distribution.

Key Drivers for Dominance:

- Almonds: High consumer demand fueled by health benefits (e.g., high protein, fiber) and culinary versatility. Investment in almond farming and processing technologies continues to drive production growth.

- Peanuts: Established consumer base, affordability, and ubiquitous availability across retail channels. Government support for peanut farming is also a factor.

- Off-Trade: Increased consumer preference for convenience and home consumption, supported by the rise of online grocery shopping.

US Nuts Market Product Innovations

The US nuts market showcases continuous innovation in product offerings, including the rise of sprouted nuts, organic nuts, flavored nuts, and nut-based ingredient products. Companies like Daily Crunch and Cibo Vita Inc. are at the forefront, introducing new product lines to cater to evolving consumer demands for healthier, convenient, and premium nut snacks. This includes unique flavor combinations and formats, such as the Cinnamon Java Sprouted Nut Medley and Nashville Hot Sprouted Almonds launched by Daily Crunch. These innovations are accompanied by advancements in packaging to enhance shelf life and product appeal.

Propelling Factors for US Nuts Market Growth

Several key factors fuel the growth of the US nuts market:

- Health and Wellness Trend: The rising awareness of the health benefits of nuts—rich in protein, fiber, and healthy fats—drives their inclusion in health-conscious diets.

- Growing Snacking Culture: Increased snacking frequency, particularly among younger generations, creates a robust demand for convenient and flavorful nut-based snacks.

- Technological Advancements: Innovation in processing techniques (e.g., roasting, flavoring, spouting) provides new product varieties and enhances product quality.

Obstacles in the US Nuts Market Market

Challenges in the US nuts market include:

- Supply Chain Disruptions: Weather patterns and global events can affect nut production and supply, leading to price fluctuations and potential shortages.

- Price Volatility: Fluctuations in raw material costs and global market conditions significantly impact nut pricing, affecting profitability for businesses.

- Competition: Intense competition from alternative snack options and from other nut producers requires continuous product innovation and marketing strategies to maintain market share.

Future Opportunities in US Nuts Market

Future opportunities arise from:

- Premiumization: Growing consumer demand for premium and specialized nut products, such as organic, exotic varieties, and functional nuts with added health benefits.

- Expansion into Novel Applications: Nuts' versatility extends to new food categories, including nut-based beverages, flours, and ingredients for confectionery, baking, and other food products.

- Sustainable Sourcing: Emphasis on sustainable farming practices and environmentally friendly packaging enhances brand appeal and attracts environmentally conscious consumers.

Major Players in the US Nuts Market Ecosystem

- Hormel Foods Corporation (Planters)

- Krema Nut Company

- Waterford Nut Company

- Daily Crunch

- The Wonderful Company LLC

- Tierra Farm Inc

- Blue Diamond Growers

- Farm Breeze International LLC

- Cibo Vita Inc

- John B Sanfilippo & Son Inc

- Mariani Nut Company

Key Developments in US Nuts Market Industry

- June 2022: Daily Crunch launched two new sprouted nut varieties at the Summer Fancy Food Show.

- June 2022: Planters (Hormel Foods) launched "Sweet & Spicy Dry Roasted Peanuts."

- January 2023: Cibo Vita Inc. announced the launch of new artisanal roasted nuts.

Strategic US Nuts Market Market Forecast

The US nuts market is poised for continued growth, driven by strong consumer demand, product innovation, and the expanding health and wellness market. The projected CAGR of xx% indicates significant growth potential during the forecast period, presenting attractive opportunities for businesses to expand their market share and invest in new product development. The increasing demand for convenience and the growth of e-commerce will continue to shape market dynamics, creating opportunities for businesses to adapt their strategies and expand their reach to consumers.

US Nuts Market Segmentation

-

1. Product Type

- 1.1. Almonds

- 1.2. Peanuts

- 1.3. Pistachios

- 1.4. Walnuts

- 1.5. Cashew

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Distribution Channels

US Nuts Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Nuts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. Surge in Demand For Healthy Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Almonds

- 5.1.2. Peanuts

- 5.1.3. Pistachios

- 5.1.4. Walnuts

- 5.1.5. Cashew

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Almonds

- 6.1.2. Peanuts

- 6.1.3. Pistachios

- 6.1.4. Walnuts

- 6.1.5. Cashew

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Online Retail Stores

- 6.2.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Almonds

- 7.1.2. Peanuts

- 7.1.3. Pistachios

- 7.1.4. Walnuts

- 7.1.5. Cashew

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Online Retail Stores

- 7.2.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Almonds

- 8.1.2. Peanuts

- 8.1.3. Pistachios

- 8.1.4. Walnuts

- 8.1.5. Cashew

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Online Retail Stores

- 8.2.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Almonds

- 9.1.2. Peanuts

- 9.1.3. Pistachios

- 9.1.4. Walnuts

- 9.1.5. Cashew

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Online Retail Stores

- 9.2.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Almonds

- 10.1.2. Peanuts

- 10.1.3. Pistachios

- 10.1.4. Walnuts

- 10.1.5. Cashew

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience Stores

- 10.2.2.3. Online Retail Stores

- 10.2.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Northeast US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 15. West US Nuts Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Hormel Foods Corporation (Planters)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Krema Nut Company

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Waterford Nut Company

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Daily Crunch

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 The Wonderful Company LLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Tierra Farm Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Blue Diamond Growers

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Farm Breeze International LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Cibo Vita Inc *List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 John B Sanfilippo & Son Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Mariani Nut Company

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Hormel Foods Corporation (Planters)

List of Figures

- Figure 1: Global US Nuts Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Nuts Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Nuts Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Nuts Market Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America US Nuts Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America US Nuts Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America US Nuts Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America US Nuts Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America US Nuts Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America US Nuts Market Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America US Nuts Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America US Nuts Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America US Nuts Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America US Nuts Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America US Nuts Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe US Nuts Market Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe US Nuts Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe US Nuts Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe US Nuts Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe US Nuts Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe US Nuts Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa US Nuts Market Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa US Nuts Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa US Nuts Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa US Nuts Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa US Nuts Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa US Nuts Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific US Nuts Market Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific US Nuts Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific US Nuts Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific US Nuts Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific US Nuts Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific US Nuts Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Nuts Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Nuts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global US Nuts Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global US Nuts Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global US Nuts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global US Nuts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Global US Nuts Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global US Nuts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global US Nuts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Global US Nuts Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global US Nuts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global US Nuts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: Global US Nuts Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Global US Nuts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global US Nuts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 36: Global US Nuts Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Global US Nuts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global US Nuts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 45: Global US Nuts Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 46: Global US Nuts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific US Nuts Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Nuts Market?

The projected CAGR is approximately 3.52%.

2. Which companies are prominent players in the US Nuts Market?

Key companies in the market include Hormel Foods Corporation (Planters), Krema Nut Company, Waterford Nut Company, Daily Crunch, The Wonderful Company LLC, Tierra Farm Inc, Blue Diamond Growers, Farm Breeze International LLC, Cibo Vita Inc *List Not Exhaustive, John B Sanfilippo & Son Inc, Mariani Nut Company.

3. What are the main segments of the US Nuts Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

Surge in Demand For Healthy Snacking.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

Jan 2023: Cibo Vita Inc.'s announced the launch of new artisanal roasted nuts innovations in the first quarter of 2023. Cibo Vita Inc. is the manufacturer of the Nature's Garden Powered by Plants brand of snack foods, which features over 2,000 SKUs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Nuts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Nuts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Nuts Market?

To stay informed about further developments, trends, and reports in the US Nuts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence