Key Insights

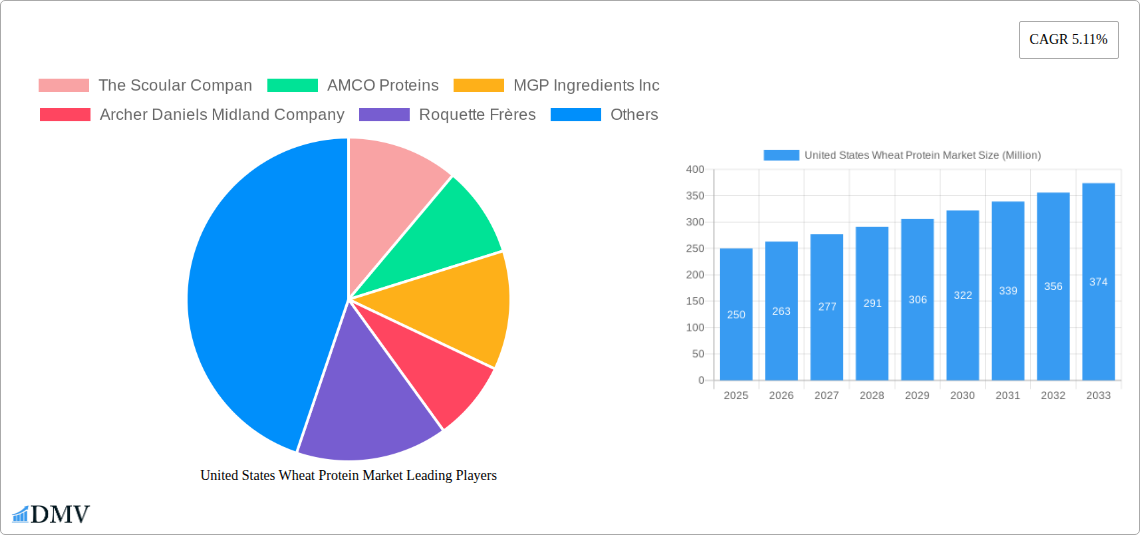

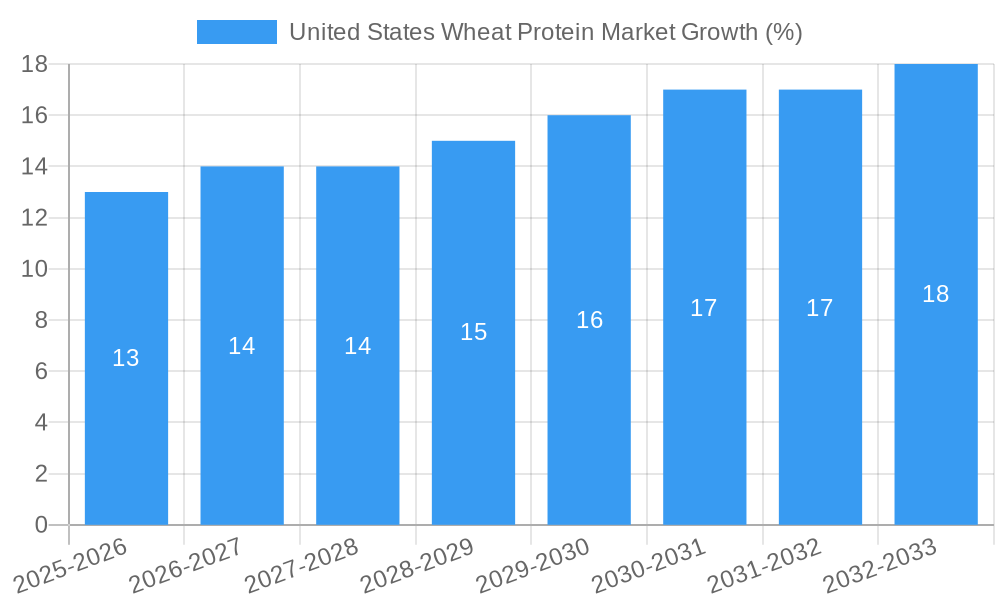

The United States wheat protein market is experiencing robust growth, driven by increasing consumer demand for plant-based protein alternatives and the functional benefits of wheat protein in food and animal feed applications. The market, valued at approximately $250 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.11% from 2025 to 2033. This growth is fueled by several key factors. The rising popularity of vegan and vegetarian diets is significantly boosting the demand for plant-based protein sources, with wheat protein emerging as a cost-effective and versatile option. Furthermore, the increasing awareness of the health benefits associated with wheat protein, such as improved satiety and enhanced gut health, is further driving market expansion. The food and beverage industry is a major consumer, utilizing wheat protein in various products like protein bars, bakery items, and beverages to enhance nutritional value and texture. The animal feed segment also contributes significantly, leveraging wheat protein's nutritional profile to improve animal health and productivity. Major players like The Scoular Company, AMCO Proteins, and MGP Ingredients are actively investing in research and development to improve wheat protein extraction and processing technologies, further contributing to market expansion.

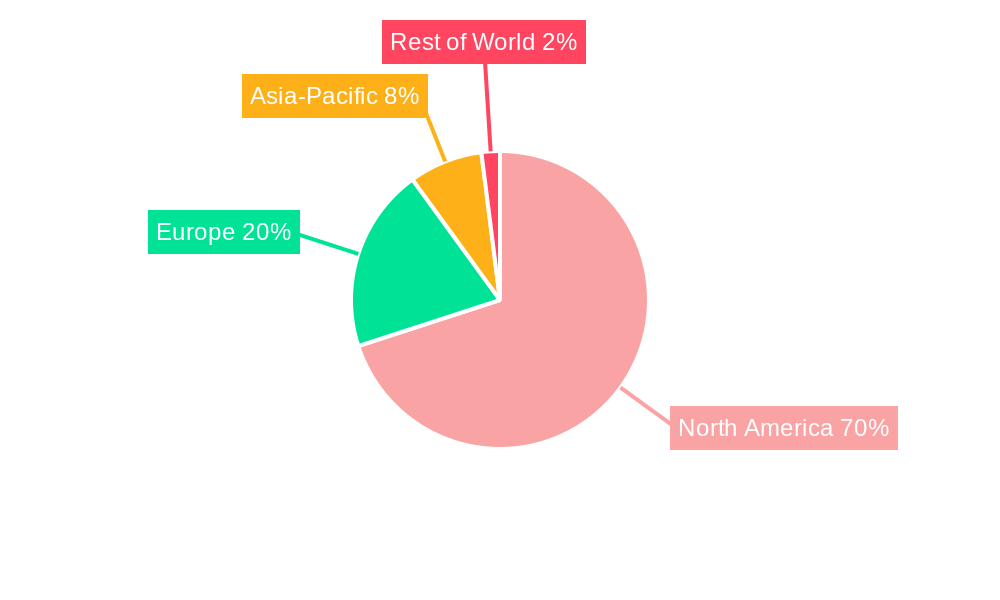

The market segmentation reveals that wheat protein concentrates hold the largest market share currently, owing to their cost-effectiveness. However, isolates and textured/hydrolyzed forms are witnessing faster growth due to their superior functional properties and suitability for specific applications. Geographic analysis indicates North America, particularly the United States, as the dominant market, driven by high consumer awareness, strong regulatory frameworks, and established production infrastructure. While challenges exist, such as price fluctuations in wheat and competition from other plant-based proteins like soy and pea protein, the overall market outlook for US wheat protein remains positive, with substantial growth potential in both established and emerging market segments. Further innovation in product development, coupled with targeted marketing campaigns highlighting the health and functional benefits of wheat protein, will be key to unlocking its full market potential in the coming years.

United States Wheat Protein Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic United States wheat protein market, offering a comprehensive analysis of market trends, competitive landscape, and future growth prospects. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this expanding market. The total market value in 2025 is estimated at USD xx Million and is projected to reach USD xx Million by 2033.

United States Wheat Protein Market Market Composition & Trends

This section examines the intricate structure of the US wheat protein market, evaluating its concentration, innovative drivers, regulatory environment, substitute products, and end-user profiles. We analyze mergers and acquisitions (M&A) activities, including deal values and their impact on market share distribution. The market is characterized by a moderate level of concentration, with key players vying for market dominance. Innovation is driven by the increasing demand for plant-based alternatives and the functional properties of wheat protein. The regulatory landscape, while generally supportive of food innovation, presents certain labeling and safety requirements. Competitive pressures stem from substitute proteins like soy and pea protein.

- Market Share Distribution (2025): Archer Daniels Midland Company (xx%), The Scoular Company (xx%), MGP Ingredients Inc. (xx%), Others (xx%). (Note: Specific percentages are unavailable; these are predicted values.)

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with an aggregate value of USD xx Million. Key drivers for M&A activity include expanding product portfolios and accessing new technologies.

United States Wheat Protein Market Industry Evolution

This in-depth analysis traces the evolutionary trajectory of the US wheat protein market, highlighting growth trajectories, technological breakthroughs, and evolving consumer preferences. The market has experienced robust growth, driven by the increasing demand for plant-based foods, functional foods, and animal feed ingredients. Technological advancements in wheat protein extraction and processing have led to higher quality and more functional ingredients. Consumer demand shifts toward healthier and more sustainable food choices further fuel market expansion. The CAGR from 2019 to 2024 is estimated at xx%, with projections indicating a CAGR of xx% between 2025 and 2033. Adoption of new technologies, such as advanced extrusion methods for creating textured wheat proteins, has been significant, increasing efficiency and product quality.

Leading Regions, Countries, or Segments in United States Wheat Protein Market

This section identifies the leading segments within the US wheat protein market across product type (Form Concentrates Isolates Textured/Hydrolyzed) and end-use applications (Animal Feed, Food and Beverages, Snacks).

Dominant Segment: Textured/Hydrolyzed wheat protein holds the largest market share, driven by its versatile applications in meat alternatives and other food products. The Food and Beverages segment exhibits the highest growth rate due to increasing demand for plant-based and protein-enriched products.

Key Drivers for Leading Segments:

- Textured/Hydrolyzed: Growing demand for plant-based meat alternatives, technological advancements in extrusion processes, and increasing health consciousness among consumers.

- Food and Beverages: Rising consumer demand for protein-rich products, increased focus on health and wellness, and the versatility of wheat protein in various food applications.

- Animal Feed: The growing demand for sustainable and cost-effective animal feed solutions is fueling the growth in this segment.

United States Wheat Protein Market Product Innovations

Recent innovations in wheat protein include the development of textured wheat proteins with improved functionality and texture. ADM's launch of Prolite® MeatTEX and Prolite® MeatXT exemplifies this trend, offering highly functional protein solutions enhancing the texture and density of meat alternatives. These advancements address the need for superior texture and functionality in plant-based meat analogs, driving increased market adoption.

Propelling Factors for United States Wheat Protein Market Growth

Several factors are propelling the growth of the US wheat protein market. Increased consumer awareness of the health benefits of plant-based proteins and growing demand for sustainable food sources are key drivers. Government initiatives promoting plant-based diets also contribute positively. Furthermore, technological advancements in processing and formulation are enabling the creation of wheat protein products with improved functionalities, expanding application possibilities.

Obstacles in the United States Wheat Protein Market Market

The market faces challenges, including price fluctuations in wheat and other raw materials, impacting profitability and supply chain stability. Competition from other plant-based protein sources, such as soy and pea protein, also presents a significant obstacle. Furthermore, the need for product standardization and quality control plays a role.

Future Opportunities in United States Wheat Protein Market

Significant growth opportunities lie in expanding applications in novel food products, such as ready-to-eat meals and snacks, as well as increasing penetration into the animal feed industry. Advancements in extraction and processing technologies could unlock further value and applications, and exploration of new market segments, like functional foods and beverages, holds significant promise.

Major Players in the United States Wheat Protein Market Ecosystem

- The Scoular Company

- AMCO Proteins

- MGP Ingredients Inc

- Archer Daniels Midland Company (ADM)

- Roquette Frères (Roquette)

- Kerry Group PLC (Kerry)

- Südzucker Group (Südzucker)

- A Costantino & C SpA

Key Developments in United States Wheat Protein Market Industry

- September 2020: ADM launched a range of textured wheat proteins, including Prolite® MeatTEX and Prolite® MeatXT, enhancing meat alternatives' texture and density.

- February 2022: MGP Ingredients announced a USD 16.7 Million extrusion plant in Kansas to produce its ProTerra line of texturized proteins, boosting production capacity to 10 Million pounds annually.

- May 2022: BENEO (a Südzucker subsidiary) acquired Meatless BV, expanding its texturizing solutions for meat and fish alternatives.

Strategic United States Wheat Protein Market Market Forecast

The US wheat protein market is poised for substantial growth driven by increasing consumer demand for plant-based alternatives and the rising adoption of sustainable food solutions. Innovation in wheat protein processing and applications will be key drivers of future expansion, with opportunities across food and beverage, animal feed, and other sectors creating substantial market potential.

United States Wheat Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.5. RTE/RTC Food Products

- 2.2.1.6. Snacks

-

2.2.1. By Sub End User

United States Wheat Protein Market Segmentation By Geography

- 1. United States

United States Wheat Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins

- 3.3. Market Restrains

- 3.3.1. Stringent government regulation of food labels/claims

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Wheat Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.5. RTE/RTC Food Products

- 5.2.2.1.6. Snacks

- 5.2.2.1. By Sub End User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United States United States Wheat Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada United States Wheat Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico United States Wheat Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America United States Wheat Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 The Scoular Compan

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 AMCO Proteins

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MGP Ingredients Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Archer Daniels Midland Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Roquette Frères

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kerry Group PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Südzucker Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 A Costantino & C SpA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 The Scoular Compan

List of Figures

- Figure 1: United States Wheat Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Wheat Protein Market Share (%) by Company 2024

List of Tables

- Table 1: United States Wheat Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Wheat Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: United States Wheat Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: United States Wheat Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Wheat Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States United States Wheat Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada United States Wheat Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico United States Wheat Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America United States Wheat Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Wheat Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 11: United States Wheat Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: United States Wheat Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Wheat Protein Market?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the United States Wheat Protein Market?

Key companies in the market include The Scoular Compan, AMCO Proteins, MGP Ingredients Inc, Archer Daniels Midland Company, Roquette Frères, Kerry Group PLC, Südzucker Group, A Costantino & C SpA.

3. What are the main segments of the United States Wheat Protein Market?

The market segments include Form, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent government regulation of food labels/claims.

8. Can you provide examples of recent developments in the market?

May 2022: BENEO, a subsidiary of Südzucker, has entered into a purchase agreement to acquire 100% of Meatless BV, a producer of functional ingredients. BENEO is expanding its existing product offering with the acquisition to offer an even broader range of texturizing solutions for meat and fish alternatives.February 2022: MGP Ingredients has announced the construction of a new extrusion plant in Kansas to manufacture its ProTerra line of texturized proteins. The USD 16.7 million facility will be located next to the company's Atchison site and will initially produce up to 10 million pounds of ProTerra per year. The new plant will assist MGP in meeting the rising demand for its ProTerra product line, which comprises pea and wheat protein ingredients used in applications such as plant-based meat substitutes.September 2020: ADM launched a range of textured wheat proteins that includes Prolite® MeatTEX textured wheat protein and Prolite® MeatXT non-textured wheat protein. These highly-functional protein solutions improve the texture and density of meat alternatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Wheat Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Wheat Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Wheat Protein Market?

To stay informed about further developments, trends, and reports in the United States Wheat Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence