Key Insights

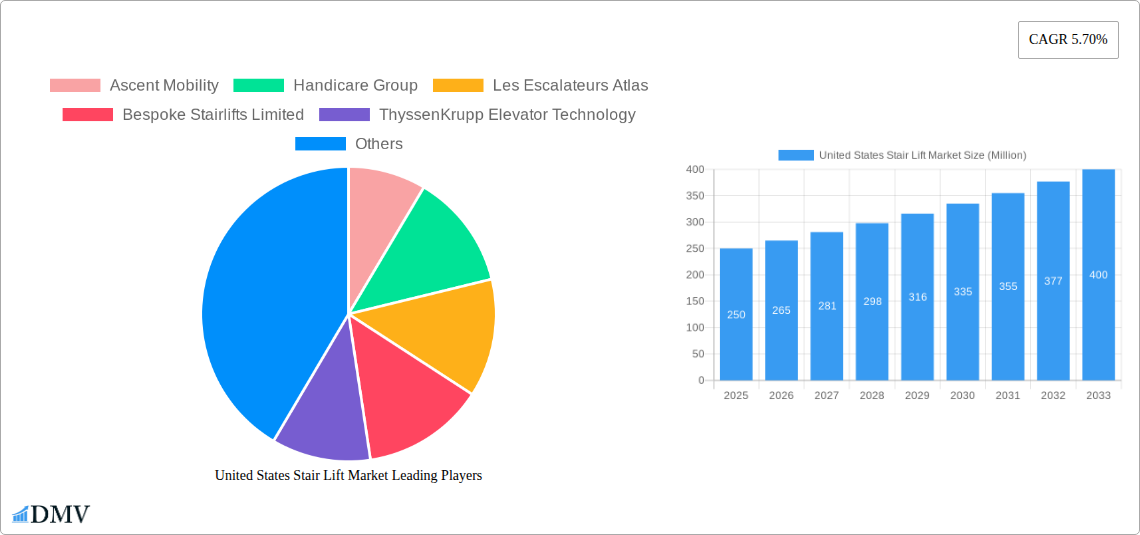

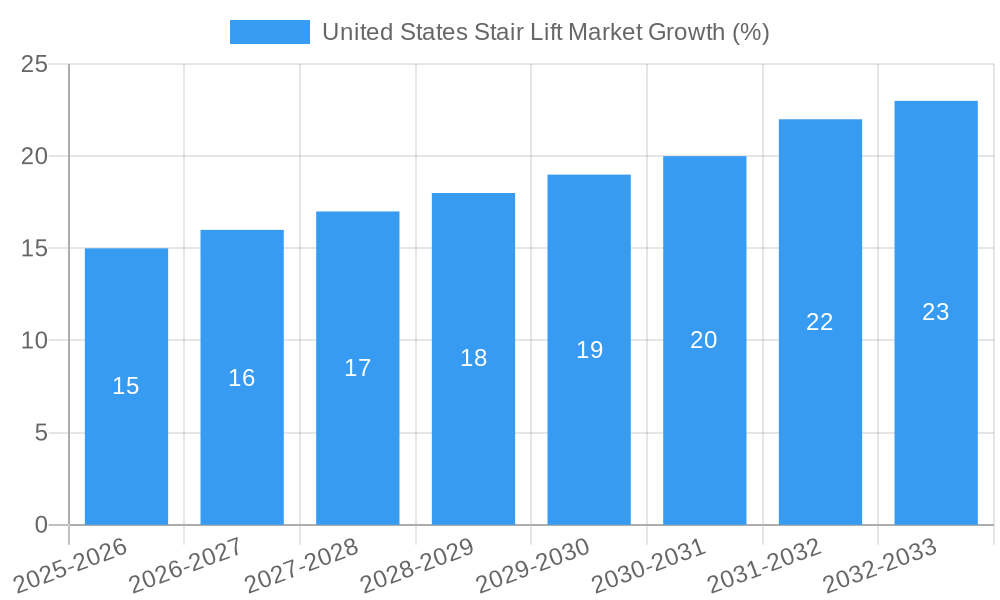

The United States stair lift market is experiencing robust growth, fueled by an aging population and increasing demand for accessibility solutions in residential and healthcare settings. The market, estimated at $XX million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.70% from 2025 to 2033. Several factors contribute to this upward trajectory. Firstly, the rising geriatric population in the US necessitates assistive devices like stair lifts to maintain independent living. Secondly, technological advancements are leading to more sophisticated, user-friendly, and aesthetically pleasing stair lift models, encouraging wider adoption. Furthermore, increasing awareness of disability rights and accessibility regulations is driving demand, particularly in public spaces and healthcare facilities. The market is segmented by rail orientation (straight, curved), user orientation (seated, standing, integrated), installation (indoor, outdoor), and application (residential, healthcare, others). The residential segment currently dominates, but the healthcare sector is witnessing significant growth due to the increasing number of elderly care facilities and hospitals. Competitive landscape includes both established players like ThyssenKrupp Elevator Technology and Acorn Stairlifts Inc., and smaller, specialized providers like Bespoke Stairlifts Limited, catering to niche market segments and offering customized solutions. While the market faces restraints such as high initial investment costs and potential maintenance expenses, these are outweighed by the significant benefits of improved mobility and independent living for a growing elderly population. The US market's prominence in technological advancements and healthcare infrastructure further bolsters its growth prospects.

The continued expansion of the US stair lift market is underpinned by several key trends. The growing popularity of smart home integration and remote monitoring capabilities in stair lifts is increasing their appeal among tech-savvy consumers. Focus on design and aesthetics is blurring the line between functionality and visual appeal, leading to greater acceptance in homes. Furthermore, innovative financing options and insurance coverage for stair lifts are increasing accessibility for a wider range of consumers. Geographical distribution reflects the higher concentration of the elderly population in specific regions, leading to market variations across states. Manufacturers are focusing on enhancing after-sales service and maintenance to address consumer concerns about long-term reliability and support. The market is also witnessing the emergence of innovative solutions like modular stair lifts and systems designed for curved staircases, addressing specific needs and architectural constraints. Overall, the US stair lift market is poised for sustained growth, driven by a confluence of demographic trends, technological innovations, and supportive policy environments.

United States Stair Lift Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States stair lift market, offering a comprehensive overview of its current state, future trajectory, and key players. From market sizing and segmentation to growth drivers and challenges, this report equips stakeholders with the crucial knowledge needed to navigate this dynamic sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

United States Stair Lift Market Composition & Trends

This section delves into the competitive landscape of the US stair lift market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activity. The market is moderately concentrated, with the top five players holding approximately xx% of the market share in 2025. Innovation is driven by the increasing demand for technologically advanced and user-friendly stair lifts, particularly in the residential sector. Regulatory changes focusing on accessibility and safety standards significantly impact market dynamics. The primary substitute is home elevators; however, stair lifts offer a cost-effective alternative for many. End-users predominantly include elderly individuals, people with disabilities, and healthcare facilities. M&A activities have been relatively moderate, with deal values averaging xx Million in recent years.

- Market Share Distribution (2025): Top 5 players - xx%; Others - xx%

- Average M&A Deal Value (2019-2024): xx Million

- Key Regulatory Bodies: [List relevant US regulatory bodies]

- Substitute Products: Home Elevators

United States Stair Lift Market Industry Evolution

The US stair lift market has witnessed consistent growth, driven by an aging population and increasing awareness of accessibility solutions. Technological advancements, such as improved safety features, quieter operation, and more aesthetically pleasing designs, have boosted market adoption. Consumer demand is shifting toward customized solutions and smart home integration capabilities. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is primarily attributed to increasing disposable incomes, rising healthcare expenditures, and government initiatives promoting accessibility. The adoption rate of stair lifts in residential settings is higher compared to healthcare facilities, although the latter is exhibiting significant growth potential.

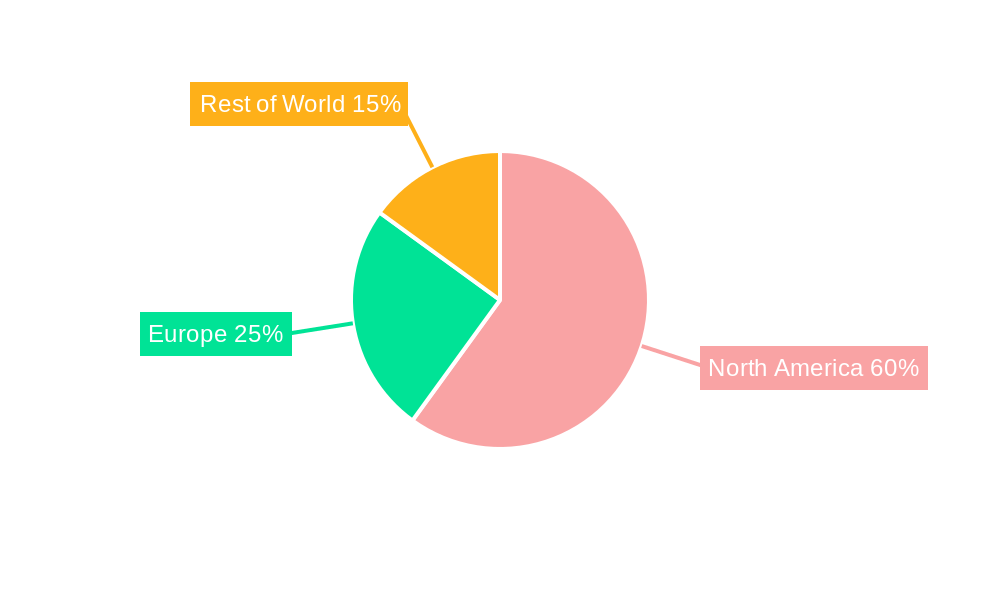

Leading Regions, Countries, or Segments in United States Stair Lift Market

The residential sector dominates the US stair lift market, accounting for approximately xx% of total revenue in 2025. Within the residential segment, straight rail stair lifts hold the largest market share due to their lower cost and ease of installation. However, the curved rail segment is experiencing faster growth owing to its adaptability to diverse home designs. Geographically, the Northeast and West Coast regions demonstrate high market penetration.

Key Drivers for Residential Segment Dominance:

- High elderly population density in specific regions.

- Growing awareness of home accessibility solutions.

- Increasing disposable incomes among the elderly.

Key Drivers for Curved Rail Segment Growth:

- Increasing demand for customized solutions to fit various home designs.

- Technological advancements making curved rail installation more efficient and cost-effective.

High Growth Regions: [List states/regions with specific growth rates]

United States Stair Lift Market Product Innovations

Recent innovations in stair lift technology focus on enhancing safety, comfort, and ease of use. Features such as automatic folding seats, improved weight capacities, and enhanced power systems are driving market growth. The introduction of smart home integration capabilities allows users to control their stair lift remotely and integrate it with other home automation systems. These advancements cater to a diverse range of user needs and preferences, promoting broader adoption.

Propelling Factors for United States Stair Lift Market Growth

The US stair lift market is propelled by several factors, including:

- Aging Population: The steadily growing elderly population significantly increases the demand for accessibility solutions.

- Increased Disposable Incomes: Rising disposable incomes allow more individuals to invest in home accessibility enhancements.

- Government Initiatives: Regulatory support and incentives for home modifications enhance market growth.

- Technological Advancements: Continuous innovation in design, safety, and features enhances user experience and adoption.

Obstacles in the United States Stair Lift Market

The market faces challenges such as:

- High Initial Costs: The relatively high initial investment can be a deterrent for some potential buyers.

- Space Constraints: Installation difficulties in homes with limited space can restrict market penetration.

- Competition from Substitute Products: Home elevators provide a compelling alternative, posing competition.

Future Opportunities in United States Stair Lift Market

Future opportunities include:

- Smart Home Integration: Growing demand for seamless integration of stairlifts into smart home ecosystems.

- Expansion into New Markets: Targeting untapped markets such as multi-family dwellings and commercial spaces.

- Development of Innovative Products: Continuous innovation in design and functionality to address diverse user needs.

Major Players in the United States Stair Lift Market Ecosystem

- Ascent Mobility

- Handicare Group

- Les Escalateurs Atlas

- Bespoke Stairlifts Limited

- ThyssenKrupp Elevator Technology

- Acme Home Elevator

- Acorn Stairlifts Inc

- Harmar

- Stannah Lifts Holdings Ltd

- Bruno Independent Living Aids Inc

- AmeriGlide Distributing 2019 Inc

Key Developments in United States Stair Lift Market Industry

- October 2021: Harmar Mobility's Highlander II Vertical Platform Lift (VPL) wins HME Business's 2021 New Product Award.

Strategic United States Stair Lift Market Forecast

The US stair lift market is poised for continued growth, driven by a confluence of factors including an aging population, rising disposable incomes, and ongoing technological advancements. The increasing adoption of smart home technology and the expansion into new market segments will further fuel market expansion. The market is projected to experience significant growth over the forecast period, presenting lucrative opportunities for existing and new market entrants.

United States Stair Lift Market Segmentation

-

1. Rail Orientation

- 1.1. Straight

- 1.2. Curved

-

2. User Orientation

- 2.1. Seated

- 2.2. Standing

- 2.3. Integrated

-

3. Installation

- 3.1. Indoor

- 3.2. Outdoor

-

4. Application

- 4.1. Residential

- 4.2. Healthcare

- 4.3. Others

United States Stair Lift Market Segmentation By Geography

- 1. United States

United States Stair Lift Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Old age and disability significantly propel the demand for stair lifts

- 3.3. Market Restrains

- 3.3.1. High installation cost and post installation services

- 3.4. Market Trends

- 3.4.1. Increasing Health Issues is Driving the Stair Lift Market in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Stair Lift Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rail Orientation

- 5.1.1. Straight

- 5.1.2. Curved

- 5.2. Market Analysis, Insights and Forecast - by User Orientation

- 5.2.1. Seated

- 5.2.2. Standing

- 5.2.3. Integrated

- 5.3. Market Analysis, Insights and Forecast - by Installation

- 5.3.1. Indoor

- 5.3.2. Outdoor

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Residential

- 5.4.2. Healthcare

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Rail Orientation

- 6. North America United States Stair Lift Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 7. Europe United States Stair Lift Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United kingdom

- 7.1.2 Germany

- 7.1.3 Rest of Europe

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 Ascent Mobility

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Handicare Group

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Les Escalateurs Atlas

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Bespoke Stairlifts Limited

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 ThyssenKrupp Elevator Technology

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Acme Home Elevator

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Acorn Stairlifts Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Harmar

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Stannah Lifts Holdings Ltd

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Bruno Independent Living Aids Inc

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 AmeriGlide Distributing 2019 Inc

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.1 Ascent Mobility

List of Figures

- Figure 1: United States Stair Lift Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Stair Lift Market Share (%) by Company 2024

List of Tables

- Table 1: United States Stair Lift Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Stair Lift Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United States Stair Lift Market Revenue Million Forecast, by Rail Orientation 2019 & 2032

- Table 4: United States Stair Lift Market Volume K Unit Forecast, by Rail Orientation 2019 & 2032

- Table 5: United States Stair Lift Market Revenue Million Forecast, by User Orientation 2019 & 2032

- Table 6: United States Stair Lift Market Volume K Unit Forecast, by User Orientation 2019 & 2032

- Table 7: United States Stair Lift Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 8: United States Stair Lift Market Volume K Unit Forecast, by Installation 2019 & 2032

- Table 9: United States Stair Lift Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: United States Stair Lift Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 11: United States Stair Lift Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: United States Stair Lift Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: United States Stair Lift Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Stair Lift Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United States United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Canada United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United States Stair Lift Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Stair Lift Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: United kingdom United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United kingdom United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Germany United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Germany United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe United States Stair Lift Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe United States Stair Lift Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: United States Stair Lift Market Revenue Million Forecast, by Rail Orientation 2019 & 2032

- Table 28: United States Stair Lift Market Volume K Unit Forecast, by Rail Orientation 2019 & 2032

- Table 29: United States Stair Lift Market Revenue Million Forecast, by User Orientation 2019 & 2032

- Table 30: United States Stair Lift Market Volume K Unit Forecast, by User Orientation 2019 & 2032

- Table 31: United States Stair Lift Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 32: United States Stair Lift Market Volume K Unit Forecast, by Installation 2019 & 2032

- Table 33: United States Stair Lift Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: United States Stair Lift Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 35: United States Stair Lift Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Stair Lift Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Stair Lift Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the United States Stair Lift Market?

Key companies in the market include Ascent Mobility, Handicare Group, Les Escalateurs Atlas, Bespoke Stairlifts Limited, ThyssenKrupp Elevator Technology, Acme Home Elevator, Acorn Stairlifts Inc, Harmar, Stannah Lifts Holdings Ltd, Bruno Independent Living Aids Inc, AmeriGlide Distributing 2019 Inc.

3. What are the main segments of the United States Stair Lift Market?

The market segments include Rail Orientation, User Orientation, Installation, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Old age and disability significantly propel the demand for stair lifts.

6. What are the notable trends driving market growth?

Increasing Health Issues is Driving the Stair Lift Market in United States.

7. Are there any restraints impacting market growth?

High installation cost and post installation services.

8. Can you provide examples of recent developments in the market?

October 2021 - Harmar Mobility's new product Vertical Platform Lift (VPL), the Highlander II, won HME Business's 2021 New Product Award competition. The New Product Award honors exceptional product development achievements by HME service providers and manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Stair Lift Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Stair Lift Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Stair Lift Market?

To stay informed about further developments, trends, and reports in the United States Stair Lift Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence