Key Insights

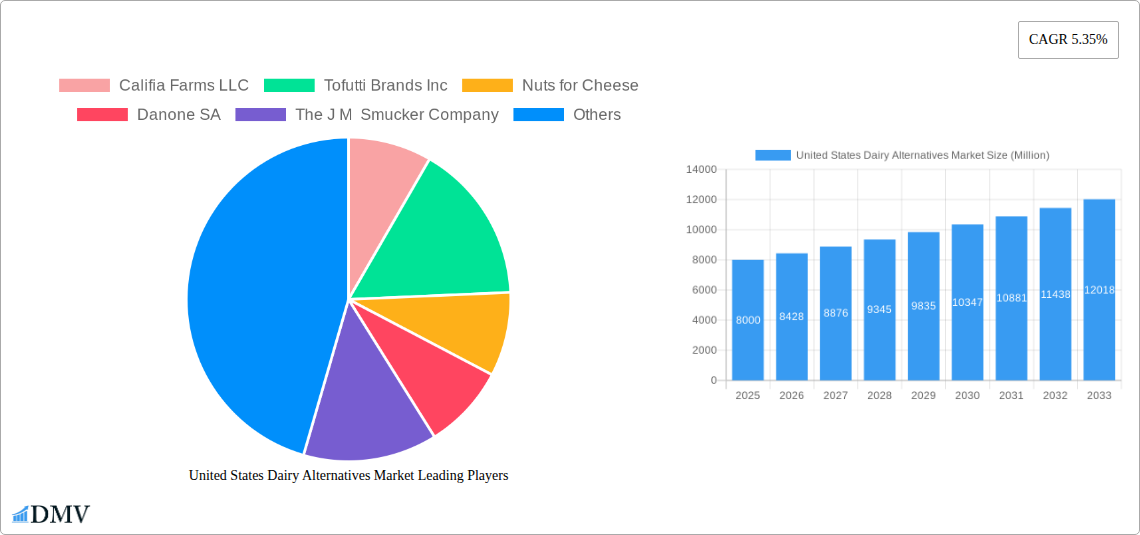

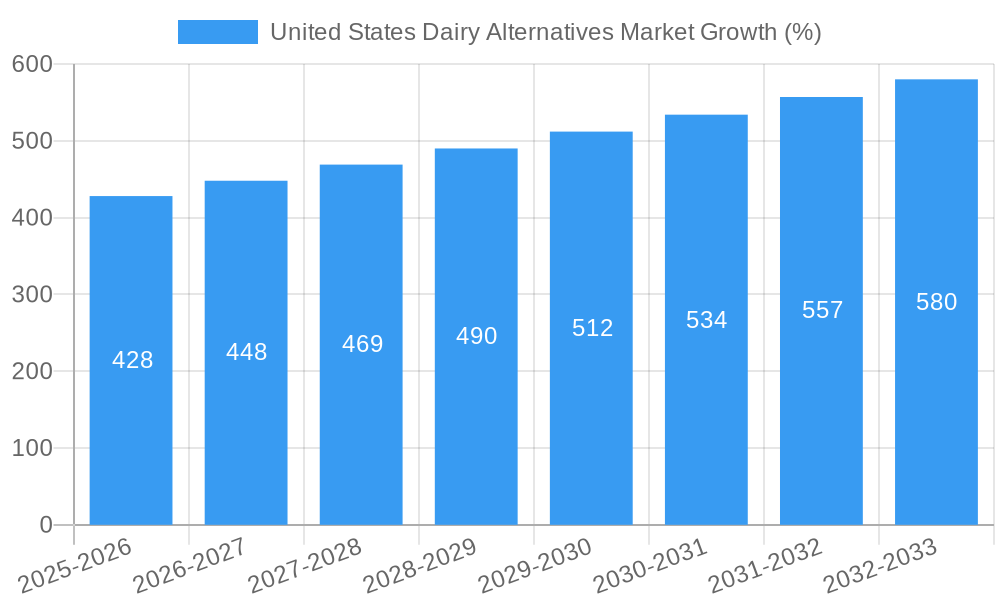

The United States dairy alternatives market, valued at approximately $8 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.35% from 2025 to 2033. This surge is driven primarily by increasing consumer awareness of health and wellness, coupled with rising demand for plant-based diets and a growing vegan and vegetarian population. The market's expansion is also fueled by advancements in product innovation, leading to dairy alternatives that closely mimic the taste and texture of traditional dairy products. Key product categories driving growth include non-dairy milk (almond, soy, oat), non-dairy cheese, and non-dairy ice cream, all catering to diverse consumer preferences and dietary needs. The off-trade distribution channel (grocery stores, supermarkets) dominates the market, although the on-trade sector (restaurants, cafes) is also experiencing gradual growth as plant-based options become more prevalent in food service establishments. Leading companies like Califia Farms, Oatly, and Danone are playing a significant role in shaping market dynamics through product diversification, strategic acquisitions, and robust marketing campaigns.

However, certain restraints exist. Price sensitivity remains a factor, as dairy alternatives can be more expensive than traditional dairy products. Furthermore, concerns about the environmental sustainability of certain plant-based ingredients and potential allergens could limit market penetration in specific segments. Nevertheless, ongoing research and development aimed at improving cost-effectiveness, reducing environmental impact, and enhancing product nutritional profiles is expected to mitigate these challenges. The market's future trajectory is highly promising, with continued growth anticipated across all segments, particularly driven by younger demographics increasingly embracing plant-based lifestyles and the expansion of retail availability. The increasing availability of dairy-free products across numerous channels and the burgeoning popularity of plant-based diets suggest a continued upward trend for the U.S. dairy alternatives market.

United States Dairy Alternatives Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning United States dairy alternatives market, offering a comprehensive overview of market trends, competitive dynamics, and future growth prospects. From the historical period (2019-2024) through the forecast period (2025-2033), with a base year of 2025 and estimated year of 2025, this report is an essential resource for stakeholders seeking to navigate this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

United States Dairy Alternatives Market Composition & Trends

This section delves into the intricate landscape of the US dairy alternatives market, examining key aspects driving its evolution. We analyze market concentration, revealing the market share distribution among major players like Califia Farms LLC, Danone SA, and Oatly Group AB. We explore the role of innovation, highlighting the emergence of new product categories and technological advancements, and assess the influence of regulatory landscapes and the presence of substitute products. Further, we examine end-user profiles, shedding light on evolving consumer preferences and demands. Finally, we analyze the impact of mergers and acquisitions (M&A) activities, including deals such as SunOpta Inc.'s acquisition of The Hain Celestial Group's brands, quantifying deal values and assessing their effect on market dynamics.

- Market Concentration: The US dairy alternatives market displays a [Describe concentration level: e.g., moderately concentrated] structure, with the top 5 players holding an estimated xx% market share in 2025.

- Innovation Catalysts: Growing consumer demand for plant-based alternatives, coupled with advancements in taste and texture technologies, fuels innovation.

- Regulatory Landscape: [Describe the regulatory environment, mentioning relevant agencies and regulations].

- Substitute Products: [Describe existing substitutes and their market impact].

- End-User Profiles: [Describe key end-user segments and their consumption patterns].

- M&A Activities: Significant M&A activity, such as the USD 33 Million acquisition of Dream® and WestSoy® by SunOpta, reshapes the competitive landscape and consolidates market power. The total M&A deal value for the period 2019-2024 is estimated at xx Million.

United States Dairy Alternatives Market Industry Evolution

This section provides a detailed analysis of the market's growth trajectory, technological advancements, and the evolving consumer preferences that shape its direction. We examine historical growth rates, projecting future trends based on macroeconomic factors, changing consumer preferences, and technological innovations impacting the production and distribution of dairy alternatives. We explore the adoption rates of new technologies and innovative product formulations, including plant-based proteins, and their impact on market share and consumer choices. We discuss the shifting consumer demographics and their influence on market demand for specific product categories like non-dairy milk, ice cream, and cheese. The analysis also examines the impact of industry-wide trends on the market size and value. Growth rates for key segments are examined, and the expected future market structure is discussed.

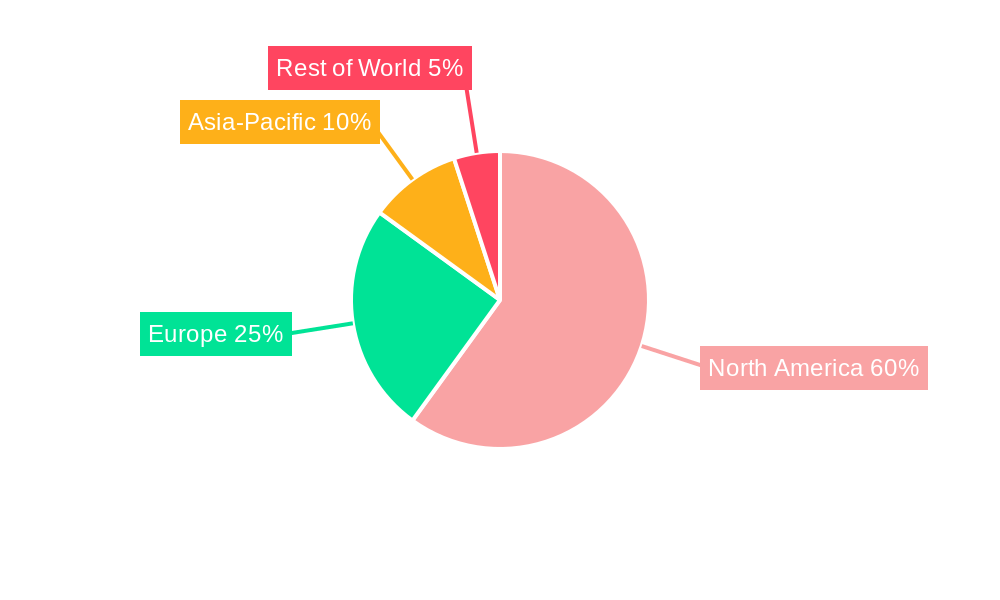

Leading Regions, Countries, or Segments in United States Dairy Alternatives Market

This section identifies the dominant regions, countries, and segments within the US dairy alternatives market. We analyze sales data and market share across different distribution channels (Off-Trade, On-Trade), focusing on the factors driving their success. We further dissect the leading product categories (Non-Dairy Milk, Non-Dairy Cheese, Non-Dairy Ice Cream, Non-Dairy Butter), outlining what makes them stand out.

- Distribution Channel Dominance: The Off-Trade channel (grocery stores, supermarkets) commands the largest market share, driven by [explain reasons, e.g., established distribution networks, consumer convenience].

- Leading Product Category: Non-Dairy Milk dominates the market, fueled by [explain factors like health consciousness, veganism, and lactose intolerance].

- Key Drivers:

- Investment Trends: Significant investments in research and development, plant expansion, and marketing drive the market.

- Regulatory Support: [Describe relevant regulatory support and its impact].

- Consumer Preferences: [Explain consumer preferences and their effect on market segmentation].

United States Dairy Alternatives Market Product Innovations

This section explores the wave of innovation shaping the dairy alternatives sector. We delve into the key product innovations, their unique selling propositions (USPs), technological advancements incorporated, and the performance metrics that differentiate them in the market. New product formulations, enhanced taste profiles, and sustainable production methods are analyzed. The impact of these innovations on market growth is also discussed, noting the increasing adoption rate of novel products that meet diverse consumer needs.

Propelling Factors for United States Dairy Alternatives Market Growth

The growth of the US dairy alternatives market is propelled by several key factors. The rising prevalence of lactose intolerance and the growing adoption of plant-based diets are significant drivers. Technological advancements, such as improved processing techniques that enhance the taste and texture of dairy alternatives, further contribute to market expansion. Furthermore, supportive regulations promoting sustainable and plant-based food production provide a favorable environment for growth. Increased consumer awareness of health and environmental benefits associated with dairy alternatives fuels demand.

Obstacles in the United States Dairy Alternatives Market Market

Despite significant growth potential, the market faces challenges. Supply chain disruptions, fluctuating raw material prices, and intense competition from established dairy players pose obstacles. Regulatory hurdles regarding labeling and ingredient sourcing can also impact market expansion. Moreover, maintaining product consistency and addressing concerns about taste and texture remain ongoing challenges for manufacturers.

Future Opportunities in United States Dairy Alternatives Market

The future of the US dairy alternatives market holds immense promise. Emerging opportunities lie in the expansion into new product categories, the development of innovative formulations tailored to specific dietary needs, and the exploration of novel plant-based ingredients. Technological advancements in precision fermentation and cellular agriculture offer exciting avenues for creating sustainable and cost-effective alternatives. Growing consumer demand for functional foods and personalized nutrition presents substantial growth potential.

Major Players in the United States Dairy Alternatives Market Ecosystem

- Califia Farms LLC

- Tofutti Brands Inc

- Nuts for Cheese

- Danone SA

- The J M Smucker Company

- Ripple Foods PBC

- Blue Diamond Growers

- Oatly Group AB

- Campbell Soup Company

- SunOpta Inc

- Miyoko's Creamery

Key Developments in United States Dairy Alternatives Market Industry

- August 2022: Califia Farms launched its Oat Barista Blend, expanding its barista blend offerings and strengthening its presence in the coffee shop segment.

- October 2022: SunOpta Inc. acquired The Hain Celestial Group Inc.'s Dream® and WestSoy® brands for USD 33 Million, significantly bolstering its portfolio and market position.

- October 2022: SunOpta completed the first phase of its USD 100 Million sterile alternative milk plant, enhancing its production capacity and reinforcing its commitment to sustainable practices.

Strategic United States Dairy Alternatives Market Market Forecast

The US dairy alternatives market is poised for sustained growth, driven by increasing consumer demand for plant-based options, technological advancements in product development, and favorable regulatory environments. The market's expansion into new segments, such as functional foods and personalized nutrition, along with the emergence of innovative production technologies, presents significant opportunities for future growth. The market is expected to witness substantial expansion across diverse product categories, resulting in a robust overall market value in the coming years.

United States Dairy Alternatives Market Segmentation

-

1. Category

- 1.1. Non-Dairy Butter

- 1.2. Non-Dairy Cheese

- 1.3. Non-Dairy Ice Cream

-

1.4. Non-Dairy Milk

-

1.4.1. By Product Type

- 1.4.1.1. Almond Milk

- 1.4.1.2. Cashew Milk

- 1.4.1.3. Coconut Milk

- 1.4.1.4. Hemp Milk

- 1.4.1.5. Oat Milk

- 1.4.1.6. Soy Milk

-

1.4.1. By Product Type

- 1.5. Non-Dairy Yogurt

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

United States Dairy Alternatives Market Segmentation By Geography

- 1. United States

United States Dairy Alternatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Dairy Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Non-Dairy Butter

- 5.1.2. Non-Dairy Cheese

- 5.1.3. Non-Dairy Ice Cream

- 5.1.4. Non-Dairy Milk

- 5.1.4.1. By Product Type

- 5.1.4.1.1. Almond Milk

- 5.1.4.1.2. Cashew Milk

- 5.1.4.1.3. Coconut Milk

- 5.1.4.1.4. Hemp Milk

- 5.1.4.1.5. Oat Milk

- 5.1.4.1.6. Soy Milk

- 5.1.4.1. By Product Type

- 5.1.5. Non-Dairy Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Califia Farms LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tofutti Brands Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nuts for Cheese

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Danone SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The J M Smucker Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ripple Foods PBC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Blue Diamond Growers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oatly Group AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Campbell Soup Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SunOpta Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Miyoko's Creamery

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Califia Farms LLC

List of Figures

- Figure 1: United States Dairy Alternatives Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Dairy Alternatives Market Share (%) by Company 2024

List of Tables

- Table 1: United States Dairy Alternatives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Dairy Alternatives Market Revenue Million Forecast, by Category 2019 & 2032

- Table 3: United States Dairy Alternatives Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: United States Dairy Alternatives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Dairy Alternatives Market Revenue Million Forecast, by Category 2019 & 2032

- Table 6: United States Dairy Alternatives Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: United States Dairy Alternatives Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Dairy Alternatives Market?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the United States Dairy Alternatives Market?

Key companies in the market include Califia Farms LLC, Tofutti Brands Inc, Nuts for Cheese, Danone SA, The J M Smucker Company, Ripple Foods PBC, Blue Diamond Growers, Oatly Group AB, Campbell Soup Company, SunOpta Inc, Miyoko's Creamery.

3. What are the main segments of the United States Dairy Alternatives Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: SunOpta Inc. announced the acquisition of The Hain Celestial Group Inc.'s Dream® and WestSoy® plant-based beverage brands for USD 33 million. The company may benefit from the acquired brands, thus boosting its growth in this competitively advantaged business.October 2022: SunOpta completed the first phase of the USD 100-million sterile alternative milk plant in Midlothian to manufacture sustainable milk and food products.August 2022: The addition of the new Oat Barista Blend to Califia Farms' already well-liked Original and Unsweetened Almondmilk Barista Blends demonstrated the company's commitment to quality coffee while bolstering its relationships with both old and new coffee shops.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Dairy Alternatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Dairy Alternatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Dairy Alternatives Market?

To stay informed about further developments, trends, and reports in the United States Dairy Alternatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence