Key Insights

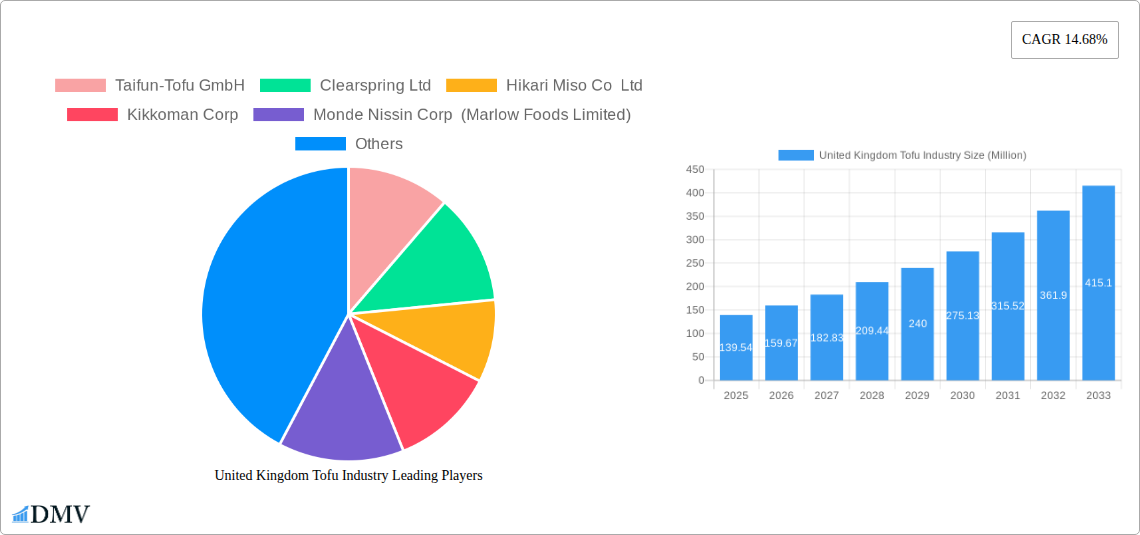

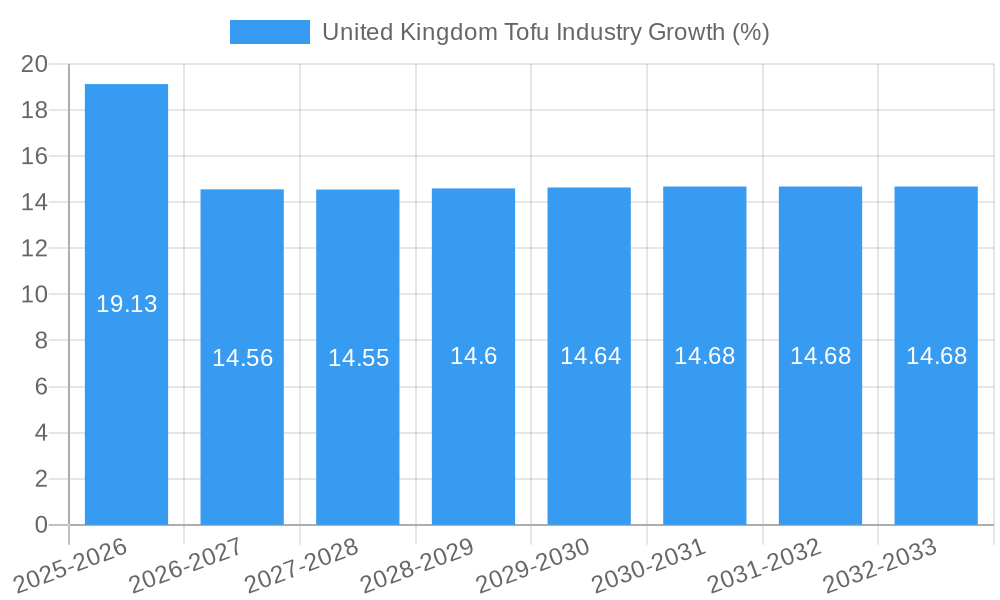

The United Kingdom tofu market, valued at £139.54 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.68% from 2025 to 2033. This surge is fueled by several key drivers. The rising popularity of veganism and vegetarianism within the UK, driven by health consciousness and environmental concerns, significantly boosts demand for plant-based protein sources like tofu. Furthermore, increasing awareness of tofu's versatility as a meat substitute in various culinary applications, from stir-fries to desserts, contributes to its widespread adoption. The expanding retail landscape, particularly the growth of online grocery stores and specialized health food retailers, facilitates easier access to tofu products for consumers. However, challenges remain, including potential price volatility tied to soy production costs and competition from other plant-based protein alternatives. Market segmentation reveals a strong presence across various distribution channels, with supermarkets/hypermarkets, convenience stores, and online retailers vying for market share. Key players like Taifun-Tofu GmbH, Clearspring Ltd, and Kikkoman Corp are strategically positioned to leverage these trends, while smaller companies and regional producers continue to contribute to market vibrancy.

The forecast period (2025-2033) anticipates continued market expansion, driven by innovation in tofu product offerings, such as flavored tofu, ready-to-eat meals, and organic options. Efforts by companies to enhance product quality, expand product lines, and cater to diverse consumer preferences will further influence growth. Marketing campaigns promoting the health benefits and sustainability aspects of tofu will also play a critical role. Competitive pressures will necessitate continuous improvement in product development, efficient supply chain management, and strategic pricing strategies. While the market faces certain restraints, the overarching trend points towards substantial growth and a strengthening position for tofu as a prominent plant-based protein within the UK food industry. Understanding these dynamic factors is essential for businesses operating within this expanding market.

United Kingdom Tofu Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the United Kingdom tofu industry, offering valuable insights for stakeholders seeking to understand market trends, competitive dynamics, and future growth potential. The study covers the period 2019-2033, with a focus on the estimated year 2025. The UK tofu market, valued at £xx Million in 2024, is projected to reach £xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United Kingdom Tofu Industry Market Composition & Trends

This section evaluates the UK tofu market's competitive landscape, innovation drivers, regulatory environment, substitute products, end-user preferences, and merger & acquisition (M&A) activity. The market is characterized by a mix of established international players and smaller, innovative UK-based brands. Market share distribution shows a fragmented landscape, with no single company dominating. However, key players such as Monde Nissin Corp (Marlow Foods Limited) and The Tofoo Co Ltd hold significant shares.

- Market Concentration: Moderately fragmented, with a few major players and numerous smaller brands.

- Innovation Catalysts: Growing consumer demand for plant-based protein, increasing health consciousness, and sustainability concerns.

- Regulatory Landscape: Favorable regulations promoting sustainable food production and labeling transparency.

- Substitute Products: Other plant-based protein sources (e.g., seitan, tempeh), meat alternatives.

- End-User Profiles: Vegans, vegetarians, flexitarians, health-conscious consumers, and those seeking diverse culinary options.

- M&A Activity: Moderate activity, with strategic acquisitions aimed at expanding product portfolios and market reach. Total M&A deal value over the historical period (2019-2024) is estimated at £xx Million.

United Kingdom Tofu Industry Industry Evolution

The UK tofu industry has witnessed significant growth driven by shifting consumer preferences and technological advancements. The historical period (2019-2024) saw a CAGR of xx%, fueled by increasing demand for plant-based alternatives and the introduction of innovative products. Technological advancements in soy processing and product formulation have led to improved texture, flavor, and shelf life. Consumer demand is shifting towards convenient, ready-to-eat options and products that cater to specific dietary needs (e.g., organic, non-GMO). This trend is expected to continue, driving further market expansion in the forecast period (2025-2033) with a projected CAGR of xx%. The adoption rate of plant-based alternatives among flexitarians and meat-reducers is a key indicator of market growth and shows a substantial increase of xx% during the historical period.

Leading Regions, Countries, or Segments in United Kingdom Tofu Industry

The supermarkets/hypermarkets segment dominates the UK tofu distribution channel, accounting for the largest market share due to its extensive reach and established supply chains.

- Key Drivers for Supermarkets/Hypermarkets Dominance:

- High consumer footfall and established distribution networks.

- Strong relationships with major tofu brands and suppliers.

- Increased focus on expanding plant-based food offerings.

- Significant investment in private-label tofu products.

- Convenience/Grocery Stores: This segment plays a significant role, particularly in local markets.

- Online Retail Stores: Experiencing steady growth, driven by convenience and e-commerce expansion.

- Other Distribution Channels: This includes food service establishments, specialty retailers, and direct-to-consumer sales. These segments are demonstrating an increasing growth rate, as more food service options are adapting their menus to include plant-based protein.

United Kingdom Tofu Industry Product Innovations

Recent years have witnessed a surge in tofu product innovation, focusing on enhanced taste, texture, and convenience. The launch of frozen tofu products like The Tofoo Co.'s "Tofoo Chunkies" and "Straight to Wok" has expanded accessibility and broadened consumer appeal. Furthermore, Cauldron Foods' introduction of Smoky BBQ and Hoisin tofu blocks showcases the trend toward flavorful and ready-to-cook options, reflecting market demands for ease and variety. These innovations leverage improved processing techniques and sustainable packaging solutions, demonstrating an emphasis on both product quality and environmental responsibility.

Propelling Factors for United Kingdom Tofu Industry Growth

The UK tofu industry's growth is propelled by several factors: the rising popularity of vegan and vegetarian diets, increasing awareness of the health benefits of plant-based protein, growing consumer demand for sustainable food products, and the consistent innovation in tofu product formats, textures, and flavors. Government initiatives promoting sustainable agriculture and plant-based food consumption further stimulate market expansion.

Obstacles in the United Kingdom Tofu Industry Market

Challenges include price volatility of soy (the primary ingredient), competition from other protein sources, and consumer perceptions of tofu’s taste and texture. Supply chain disruptions can also affect the availability and price of tofu, impacting market stability. While regulations are generally supportive, compliance costs and stringent labelling requirements can impact smaller producers.

Future Opportunities in United Kingdom Tofu Industry

Opportunities exist in expanding product lines, such as developing ready-meals, innovative culinary applications, and functional tofu-based foods (enriched with vitamins and minerals). Targeting new consumer segments with customized products (e.g., high-protein tofu for athletes) and leveraging online sales channels will be vital. Exploring novel soy sources and sustainable production methods can also enhance the industry's environmental credentials and appeal.

Major Players in the United Kingdom Tofu Industry Ecosystem

- Taifun-Tofu GmbH

- Clearspring Ltd

- Hikari Miso Co Ltd

- Kikkoman Corp

- Monde Nissin Corp (Marlow Foods Limited)

- House Foods Group Inc

- Associated British Foods (AB World Foods Limited)

- The Tofoo Co Ltd

- Morinaga Milk Industry Co Ltd

- Wilson International Frozen Foods (H K ) Limited (Tazaki Foods)

Key Developments in United Kingdom Tofu Industry Industry

- February 2021: The Tofoo Co. launched the UK's first frozen tofu product, Tofoo Chunkies.

- December 2021: The Tofoo Co. expanded its portfolio with the "Straight to Wok" frozen tofu range.

- April 2022: Cauldron Foods launched two new tofu products: Quick & Tasty Smoky BBQ Block and Hoisin Tofu.

Strategic United Kingdom Tofu Industry Market Forecast

The UK tofu market is poised for sustained growth, driven by strong consumer demand, product innovation, and favorable regulatory support. The increasing adoption of plant-based diets, health consciousness, and sustainability concerns will continue to fuel market expansion. The forecast period will witness a rise in innovative product formats, improved accessibility through diverse distribution channels, and a focus on sustainable and ethical production practices. These factors will contribute to significant market growth, with continued expansion of both established and emerging brands.

United Kingdom Tofu Industry Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience/Grocery Stores

- 1.3. Online Retail Stores

- 1.4. Other Distribution Channels

United Kingdom Tofu Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Tofu Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing consumer awareness about the health benefits of tofu

- 3.3. Market Restrains

- 3.3.1. Processing and Shelf Life Issues

- 3.4. Market Trends

- 3.4.1. Increased demand for organic and non-GMO tofu products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Tofu Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience/Grocery Stores

- 5.1.3. Online Retail Stores

- 5.1.4. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Taifun-Tofu GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clearspring Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hikari Miso Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kikkoman Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monde Nissin Corp (Marlow Foods Limited)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 House Foods Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Associated British Foods (AB World Foods Limited)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Tofoo Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Morinaga Milk Industry Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wilson International Frozen Foods (H K ) Limited (Tazaki Foods)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Taifun-Tofu GmbH

List of Figures

- Figure 1: United Kingdom Tofu Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Tofu Industry Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Tofu Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Tofu Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Tofu Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: United Kingdom Tofu Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 5: United Kingdom Tofu Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Tofu Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 7: United Kingdom Tofu Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Tofu Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Tofu Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 10: United Kingdom Tofu Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 11: United Kingdom Tofu Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Tofu Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Tofu Industry?

The projected CAGR is approximately 14.68%.

2. Which companies are prominent players in the United Kingdom Tofu Industry?

Key companies in the market include Taifun-Tofu GmbH, Clearspring Ltd, Hikari Miso Co Ltd, Kikkoman Corp, Monde Nissin Corp (Marlow Foods Limited), House Foods Group Inc, Associated British Foods (AB World Foods Limited)*List Not Exhaustive, The Tofoo Co Ltd, Morinaga Milk Industry Co Ltd, Wilson International Frozen Foods (H K ) Limited (Tazaki Foods).

3. What are the main segments of the United Kingdom Tofu Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing consumer awareness about the health benefits of tofu.

6. What are the notable trends driving market growth?

Increased demand for organic and non-GMO tofu products.

7. Are there any restraints impacting market growth?

Processing and Shelf Life Issues.

8. Can you provide examples of recent developments in the market?

April 2022: Cauldron Foods, a division of Marlow Foods Ltd, expanded its famous range with the addition of two new tofu products, namely Quick & Tasty Smoky BBQ Block and Hoisin Tofu. The new SKUs are created from sustainable soy and come in 100% recyclable packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Tofu Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Tofu Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Tofu Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Tofu Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence