Key Insights

The United Kingdom poultry meat market is experiencing robust growth, fueled by a rising population, increasing consumer demand for convenient and affordable protein sources, and evolving culinary trends incorporating poultry in diverse dishes. The market's Compound Annual Growth Rate (CAGR) of 26.40% from 2019 to 2024 suggests a significant expansion, indicating strong market potential. Key drivers include the affordability of poultry compared to other meat options, its versatility in culinary applications, and the growing preference for healthier, lean protein sources. The market segmentation reveals a dominance of the off-trade distribution channel, reflecting the widespread availability of poultry in supermarkets and retail outlets. While canned poultry holds a niche, fresh/chilled poultry remains the most popular form, indicating a focus on quality and freshness among consumers. Growth is likely further supported by innovations in processing techniques, leading to longer shelf life and enhanced product quality. Major players like 2 Sisters Food Group, Cranswick plc, and Gressingham Foods are key contributors to the market's growth, leveraging their established supply chains and brand recognition. However, challenges such as fluctuations in feed prices and increasing concerns regarding animal welfare and sustainable farming practices might pose some restraints to market expansion. Further segmentation data, while unavailable, could reveal nuanced insights into regional variations and consumer preferences within the UK.

The forecast period (2025-2033) promises continued expansion, driven by sustained consumer demand and potential export opportunities. Maintaining market share will depend on companies' ability to adapt to evolving consumer preferences, adopt sustainable practices, and respond effectively to potential supply chain disruptions. The market is projected to see a considerable increase in value, based on the substantial CAGR. Strategic investments in technology, sustainable farming practices, and brand building will be crucial for success in this dynamic and competitive market. This implies significant opportunities for both established players and new entrants. Effective marketing strategies targeting health-conscious consumers and highlighting the versatility and convenience of poultry meat are key to capturing a larger market share.

United Kingdom Poultry Meat Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United Kingdom poultry meat market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). It offers crucial insights into market dynamics, competitive landscapes, and future growth trajectories, equipping stakeholders with the knowledge to navigate this evolving sector. The market is projected to reach £XX Million by 2033, demonstrating substantial growth potential.

United Kingdom Poultry Meat Market Composition & Trends

This section delves into the intricate structure of the UK poultry meat market, examining key aspects influencing its current state and future direction. We analyze market concentration, revealing the market share distribution among key players like 2 Sisters Food Group, Cranswick plc, and Avara Foods Ltd. The report quantifies the level of market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) and the four-firm concentration ratio. We also explore the role of innovation, highlighting advancements in poultry processing technologies and sustainable packaging solutions. The regulatory landscape, encompassing food safety standards and environmental regulations, is thoroughly examined. Furthermore, we analyze the impact of substitute products, such as plant-based alternatives, on market demand. End-user consumption patterns—including retail, food service, and industrial applications—are profiled. Finally, a detailed analysis of mergers and acquisitions (M&A) activity, including deal values and their impact on market dynamics, is provided.

- Market Share Distribution: 2 Sisters Food Group holds an estimated xx% market share, followed by Cranswick plc at xx% and Avara Foods Ltd at xx%.

- M&A Activity: Analysis of M&A deals between 2019-2024, including deal values (in Millions). For example, the acquisition of Hemswell Coldstore by Gressingham Group in June 2023.

- Innovation Catalysts: Focus on advancements in automation, sustainable packaging, and disease prevention technologies.

- Regulatory Landscape: Detailed analysis of compliance costs and the impact of food safety and animal welfare regulations.

United Kingdom Poultry Meat Market Industry Evolution

The UK poultry meat market is a dynamic sector characterized by continuous evolution. This analysis meticulously charts its trajectory, encompassing growth patterns, technological innovations, and the ever-shifting preferences of consumers. We examine the market's Compound Annual Growth Rate (CAGR) across historical and projected periods, identifying periods of expansion and contraction, and offering insights into the underlying factors driving these trends. Technological advancements, such as automated processing systems and sophisticated traceability technologies, are critically assessed for their impact on production efficiency, product quality, and supply chain transparency. Furthermore, the report delves into evolving consumer demands, focusing on the increasing popularity of organic, free-range, and sustainably produced poultry. A detailed analysis of the adoption rates of these product types across various market segments is provided, revealing key demographic and psychographic drivers. The influence of broader societal factors, such as changing dietary habits, heightened health consciousness, ethical concerns, and economic conditions, on consumption patterns is also thoroughly explored.

Leading Regions, Countries, or Segments in United Kingdom Poultry Meat Market

This section identifies the key players and dominant segments within the UK poultry meat market. The analysis encompasses various product forms (fresh/chilled, frozen, processed, canned), distribution channels (off-trade, on-trade, food service), and specific poultry types (chicken, turkey, duck, etc.). We pinpoint the leading segments and provide a comprehensive explanation of their market dominance, considering factors such as consumer preferences, production efficiency, cost-effectiveness, marketing strategies, and overall supply chain management. The analysis includes:

Key Drivers for Dominance (using bullet points):

- Targeted investment trends in specific geographic regions or market segments.

- Governmental support, subsidies, and agricultural policies.

- Strategic infrastructure development, including cold storage facilities and logistics networks.

- Evolving consumer preferences and emerging trends (e.g., health and wellness, convenience, ethical sourcing).

- Competitive pricing strategies and market positioning.

- Innovation in product development and value-added offerings.

In-depth analysis (using paragraphs) of dominance factors: For example, a detailed examination of the high demand for fresh/chilled chicken in major supermarket chains, contributing significantly to the dominance of the off-trade segment, and how this is further influenced by factors like consumer purchasing behavior, promotional activities, and supermarket procurement strategies. Other examples will include analysis of the processed poultry segment and its growth drivers.

United Kingdom Poultry Meat Market Product Innovations

This section showcases recent product innovations, applications, and performance metrics within the UK poultry meat market. The discussion focuses on new product developments, such as value-added processed poultry products and ready-to-eat meals. We highlight the unique selling propositions (USPs) of these innovations, including improved convenience, enhanced taste profiles, and health benefits. The adoption of new technologies, such as modified atmosphere packaging (MAP) to extend shelf life, is also discussed.

Propelling Factors for United Kingdom Poultry Meat Market Growth

This section meticulously identifies and analyzes the key factors driving growth within the UK poultry meat market. These encompass technological advancements (automation, precision breeding, improved feed efficiency), economic factors (shifts in disposable incomes, consumer confidence, and food inflation), and supportive government policies (e.g., agricultural support schemes, food safety regulations). Specific examples are provided to illustrate the impact of these drivers on market expansion and trajectory. The analysis also considers potential challenges and risks that could impact future growth, such as geopolitical instability, supply chain disruptions, and disease outbreaks.

Obstacles in the United Kingdom Poultry Meat Market Market

This section discusses the barriers and restraints that could impede the growth of the UK poultry meat market. This includes: regulatory challenges (e.g., increasing compliance costs), supply chain disruptions (e.g., impacts of avian flu), and competitive pressures from imported poultry and plant-based alternatives. Quantifiable impacts of these challenges on market growth are presented.

Future Opportunities in United Kingdom Poultry Meat Market

This section highlights emerging opportunities for growth within the UK poultry meat market. This encompasses new market segments (e.g., increasing demand for premium and organic products), technological advancements (e.g., precision farming), and changing consumer trends (e.g., growing preference for healthy and sustainable food options).

Major Players in the United Kingdom Poultry Meat Market Ecosystem

- Copas Traditional Turkeys

- Wild Meat Company

- Lambert Dodard Chancereul (LDC) Group

- Salisbury Poultry (Midlands) Ltd

- Avara Foods Ltd

- Blackwells Farm

- 2 Sisters Food Group

- Cranswick plc

- Gressingham Foods

- JBS SA

- Donald Russell Ltd

- Danish Crown AmbA

Key Developments in United Kingdom Poultry Meat Market Industry

- June 2023: Gressingham Group's acquisition of Hemswell Coldstore significantly expands its cold storage capacity and enhances its distribution network, highlighting strategic investments in infrastructure to meet growing demand and improve supply chain resilience.

- May 2023: Avara Foods Ltd's announcement of the closure of its Abergavenny factory underscores the impact of significant inflationary pressures and fluctuating consumer demand on the industry, emphasizing the challenges faced by poultry producers in navigating economic volatility.

- May 2023: Cranswick Convenience Foods Milton Keynes' partnership with Graphic Packaging to adopt more sustainable, plant-based fibre packaging showcases the industry's increasing responsiveness to environmental concerns and the growing consumer preference for eco-friendly products.

- [Add other relevant recent developments with dates and brief descriptions]

Strategic United Kingdom Poultry Meat Market Market Forecast

The UK poultry meat market is poised for continued growth, driven by factors such as increasing consumer demand, technological advancements in processing and production, and the growing adoption of sustainable practices. Opportunities exist in value-added products, premium segments, and innovative packaging solutions. While challenges remain, such as inflationary pressures and supply chain volatility, the market’s inherent resilience and strong consumer demand suggest a positive outlook for the forecast period.

United Kingdom Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

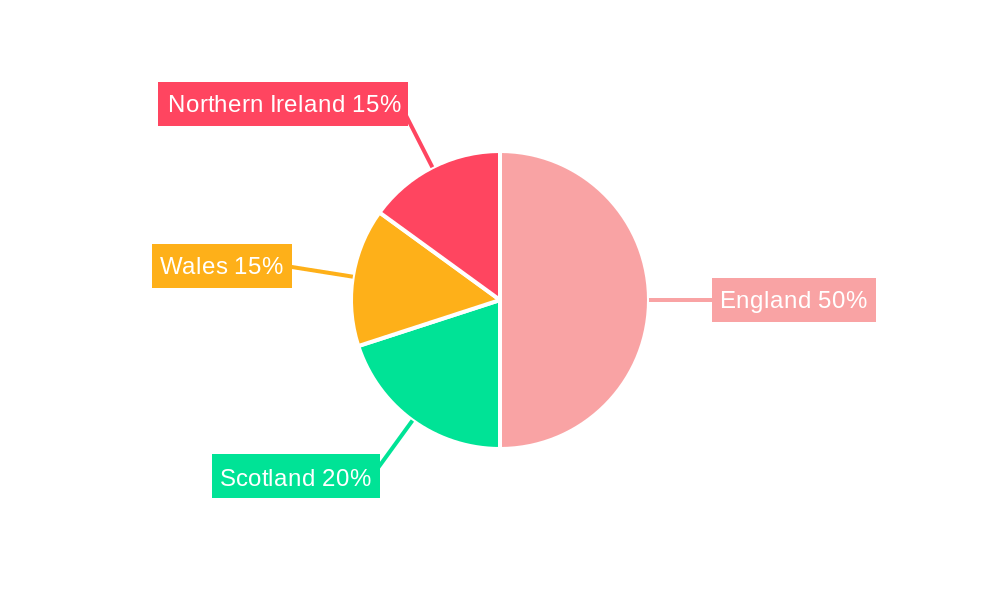

United Kingdom Poultry Meat Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Expansion of leading retail chains is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. UAE United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Saudi Arabia United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. South Africa United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of Middle East and Africa United Kingdom Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Copas Traditional Turkeys

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wild Meat Compan

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lambert Dodard Chancereul (LDC) Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Salisbury Poultry (Midlands) Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Avara Foods Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Blackwells Farm

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 2 Sisters Food Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cranswick plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Gressingham Foods

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 JBS SA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Donald Russell Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Danish Crown AmbA

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Copas Traditional Turkeys

List of Figures

- Figure 1: United Kingdom Poultry Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Poultry Meat Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: United Kingdom Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: United Kingdom Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Kingdom Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Poultry Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 14: United Kingdom Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: United Kingdom Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Poultry Meat Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the United Kingdom Poultry Meat Market?

Key companies in the market include Copas Traditional Turkeys, Wild Meat Compan, Lambert Dodard Chancereul (LDC) Group, Salisbury Poultry (Midlands) Ltd, Avara Foods Ltd, Blackwells Farm, 2 Sisters Food Group, Cranswick plc, Gressingham Foods, JBS SA, Donald Russell Ltd, Danish Crown AmbA.

3. What are the main segments of the United Kingdom Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Expansion of leading retail chains is driving the market.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

June 2023: Gressingham Group acquired a cold storage facility in Lincolnshire called Hemswell Coldstore. They are capable of housing 5000 pallets of frozen meat.May 2023: Avara Foods Ltd announced to shut its Abergavenny factory in Autumn 2023 attributed by significant inflationary pressure in fuel, commodities and labour, which has driven up pricing and significantly reduced demand for UK-produced turkey in the retail market.May 2023: Cranswick Convenience Foods Milton Keynes is working with fibre-based packaging supplier, Graphic Packaging, to move a range of cooked meats from plastic, into trays produced from PaperLite™ - a thermoformable packaging material which contains 90% plant-based fibre.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Poultry Meat Market?

To stay informed about further developments, trends, and reports in the United Kingdom Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence