Key Insights

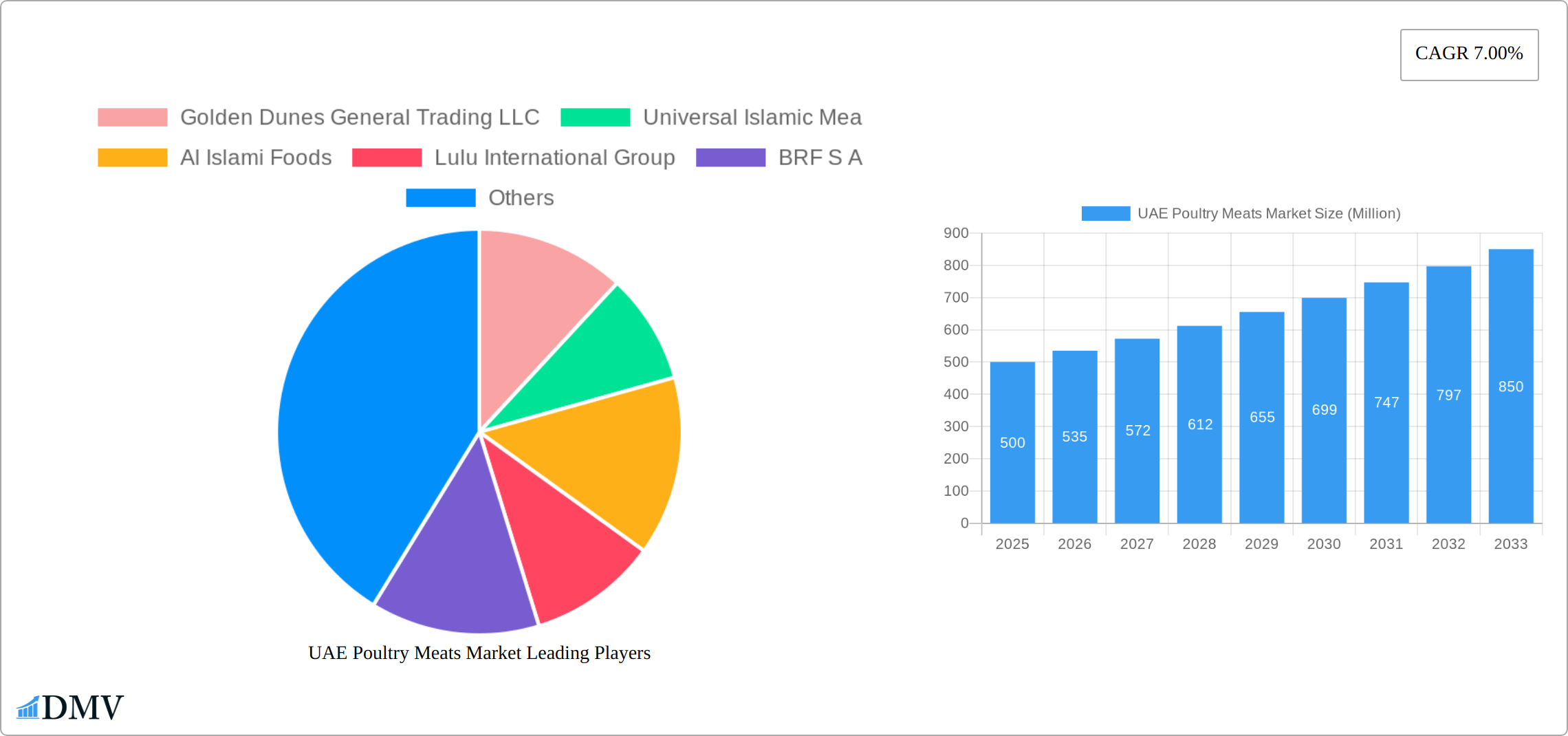

The UAE poultry meats market, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided 7% CAGR and market size "XX"), is projected to experience robust growth between 2025 and 2033. This expansion is fueled by several key drivers. The rising population, increasing urbanization, and a growing preference for convenient and affordable protein sources are significantly boosting demand. Furthermore, the UAE's thriving food service industry, encompassing restaurants, hotels, and catering services, creates substantial demand for poultry meat. Changing consumer lifestyles and increasing disposable incomes also contribute to higher consumption. However, the market faces certain restraints, primarily the fluctuating prices of poultry feed and potential supply chain disruptions. The market segmentation reveals a varied landscape. Canned poultry products cater to a segment seeking longer shelf life, while fresh/chilled poultry is favored for its perceived superior quality. Frozen poultry offers convenience and extended shelf life, with processed poultry products (e.g., sausages, nuggets) contributing to market growth due to their appeal to busy lifestyles. Distribution channels are divided between off-trade (supermarkets, hypermarkets) and on-trade (restaurants, hotels), each presenting distinct opportunities. Key players like Golden Dunes General Trading LLC, Al Islami Foods, and Lulu International Group are actively shaping the market dynamics through product innovation, strategic partnerships, and expansion efforts.

The competitive landscape is marked by a blend of both domestic and international players. Local producers benefit from geographical proximity and understanding of local consumer preferences, while international players bring in advanced processing technologies and established supply chains. Future growth will likely depend on factors such as successful navigation of fluctuating feed costs, proactive supply chain management, and adapting to evolving consumer preferences for healthier and sustainably produced poultry. Strategies focusing on product diversification, value-added products, and marketing campaigns highlighting quality and health benefits are anticipated to generate significant returns in the UAE's dynamic poultry meats market. The forecast period of 2025-2033 promises substantial opportunities for growth, with continued innovation and adaptation as essential factors in market success.

UAE Poultry Meats Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the UAE poultry meats market, offering valuable insights for stakeholders seeking to understand market dynamics, future trends, and investment opportunities. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines the market's composition, evolution, leading segments, and key players, providing crucial data for informed decision-making. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

UAE Poultry Meats Market Composition & Trends

The UAE poultry meats market exhibits a moderately concentrated structure, with key players like Al Islami Foods, Lulu International Group, and Tanmiah Food Company holding significant market share. Market share distribution fluctuates based on product type (fresh/chilled, frozen, processed, canned) and distribution channel (on-trade vs. off-trade). Innovation is driven by increasing consumer demand for value-added products, convenient formats, and health-conscious options. The regulatory landscape, including food safety standards and import regulations, significantly impacts market dynamics. Substitute products, such as red meat and plant-based alternatives, present competitive pressure. The market has seen a moderate level of M&A activity in recent years, with deal values ranging from xx Million to xx Million. End-users primarily comprise restaurants, food service providers, supermarkets, hypermarkets, and households.

- Market Concentration: Moderately concentrated, with top players holding xx% market share collectively.

- Innovation Catalysts: Growing consumer preference for convenience, health, and value-added products.

- Regulatory Landscape: Stringent food safety and import regulations influence market operations.

- Substitute Products: Red meat and plant-based alternatives pose a competitive threat.

- M&A Activity: Moderate level of mergers and acquisitions, with deal values ranging from xx Million to xx Million.

- End-User Profile: Restaurants, food service providers, supermarkets, hypermarkets, and households.

UAE Poultry Meats Market Industry Evolution

The UAE poultry meats market experienced robust growth between 2019 and 2024, fueled by a burgeoning population, rising disposable incomes, and evolving dietary preferences. This expansion was further propelled by technological advancements across poultry farming, processing, and packaging, leading to increased efficiency and superior product quality. Consumers increasingly prioritize healthier, sustainably sourced, and ethically produced poultry, driving demand for premium options. The market has witnessed a significant uptake of advanced technologies, including automated processing plants and improved cold chain logistics, ensuring product freshness and extending shelf life. While growth varied across segments, the fresh/chilled segment showcased the most significant expansion, achieving an impressive xx% growth rate during the period. Concurrently, the processed poultry segment also saw notable growth of xx%, driven by the convenience factor and the availability of diverse flavor profiles.

Leading Regions, Countries, or Segments in UAE Poultry Meats Market

The fresh/chilled segment maintains its dominance in the UAE poultry meats market, reflecting consumer preference for freshness and perceived higher quality. The off-trade channel (supermarkets and hypermarkets) commands a larger market share than the on-trade channel (restaurants and hotels). This dominance is attributable to several key factors:

Fresh/Chilled Segment:

- Strong consumer preference for freshness and superior quality.

- Extensive retail infrastructure facilitating efficient chilled product distribution.

- Significant investment in robust cold chain logistics to guarantee product integrity.

Off-Trade Channel:

- Elevated consumer purchasing power and a preference for home consumption.

- Readily available poultry products across a wide network of supermarkets and hypermarkets.

- The continuous expansion of organized retail formats.

Further analysis reveals significant regional variations in consumption patterns and market dynamics across the UAE.

UAE Poultry Meats Market Product Innovations

Recent innovations have centered on value-added products, such as marinated poultry, ready-to-cook meals, and organic options designed to cater to health-conscious consumers. Technological advancements in packaging, including modified atmosphere packaging (MAP) and vacuum sealing, contribute to extended shelf life and maintain optimal product quality. Successful products emphasize unique selling propositions centered on flavor, convenience, health benefits, and ethical sourcing. These innovations have demonstrably improved consumer perception, influenced purchase decisions, and positively impacted overall market growth.

Propelling Factors for UAE Poultry Meats Market Growth

Several factors fuel the UAE poultry meats market's growth:

- Rising Population and Disposable Incomes: Increased purchasing power enhances demand for protein-rich foods.

- Changing Dietary Habits: Growing preference for poultry as a healthier alternative to red meat.

- Government Initiatives: Support for sustainable agricultural practices and food security policies.

- Tourism: Influx of tourists boosts demand in the hospitality and food service sectors.

These factors collectively drive significant market expansion.

Obstacles in the UAE Poultry Meats Market Market

Several challenges hinder market growth, including:

- Fluctuations in Feed Prices: These directly impact production costs and overall profitability.

- Supply Chain Disruptions: Global events can lead to product shortages and price volatility.

- Stringent Regulations: Compliance with rigorous regulations can present significant costs and complexities for businesses.

- Intense Competition: The market faces stiff competition from both established players and new entrants.

Future Opportunities in UAE Poultry Meats Market

Promising future opportunities include:

- The Rise of E-commerce: Online grocery delivery platforms are expanding market access and reach.

- Premium and Specialty Products: The demand for organic, free-range, and halal-certified poultry continues to grow.

- Value-Added Products: Ready-to-cook meals and convenient formats cater to busy lifestyles.

- Sustainable Practices: Environmentally friendly farming methods and a reduced carbon footprint are becoming increasingly important consumer priorities.

Major Players in the UAE Poultry Meats Market Ecosystem

- Golden Dunes General Trading LLC

- Universal Islamic Mea

- Al Islami Foods

- Lulu International Group

- BRF S A

- The Savola Group

- Siniora Food Industries Company

- Al Ain Farms

- JBS SA

- Tanmiah Food Company

Key Developments in UAE Poultry Meats Market Industry

- November 2021: LuLu Hypermarket opened its 220th store in Shiab Al Ashkar, Al Ain, expanding its retail presence and poultry product distribution network.

- December 2021: LuLu Group launched a new poultry meat range, collaborating with leading manufacturers to broaden its product portfolio and enhance its market share.

- February 2022: Al Ain Farms launched a 2270 sq. m. facility in Abu Dhabi, significantly improving storage capacity and operational efficiency for its poultry products.

Strategic UAE Poultry Meats Market Market Forecast

The UAE poultry meats market is poised for sustained growth, driven by positive demographic trends, economic expansion, and evolving consumer preferences. Continued investment in infrastructure, technology, and sustainable practices will play a vital role in shaping future market dynamics. The forecast period (2025-2033) indicates strong growth potential, particularly in value-added products and convenient formats. The market's robust growth trajectory makes it an attractive investment destination for both established players and new entrants.

UAE Poultry Meats Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

UAE Poultry Meats Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Poultry Meats Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Expansion and acquisitions in UAE off-trade channels among online market players are promoting market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. North America UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Canned

- 6.1.2. Fresh / Chilled

- 6.1.3. Frozen

- 6.1.4. Processed

- 6.1.4.1. By Processed Types

- 6.1.4.1.1. Deli Meats

- 6.1.4.1.2. Marinated/ Tenders

- 6.1.4.1.3. Meatballs

- 6.1.4.1.4. Nuggets

- 6.1.4.1.5. Sausages

- 6.1.4.1.6. Other Processed Poultry

- 6.1.4.1. By Processed Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Off-Trade

- 6.2.1.1. Convenience Stores

- 6.2.1.2. Online Channel

- 6.2.1.3. Supermarkets and Hypermarkets

- 6.2.1.4. Others

- 6.2.2. On-Trade

- 6.2.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. South America UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Canned

- 7.1.2. Fresh / Chilled

- 7.1.3. Frozen

- 7.1.4. Processed

- 7.1.4.1. By Processed Types

- 7.1.4.1.1. Deli Meats

- 7.1.4.1.2. Marinated/ Tenders

- 7.1.4.1.3. Meatballs

- 7.1.4.1.4. Nuggets

- 7.1.4.1.5. Sausages

- 7.1.4.1.6. Other Processed Poultry

- 7.1.4.1. By Processed Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Off-Trade

- 7.2.1.1. Convenience Stores

- 7.2.1.2. Online Channel

- 7.2.1.3. Supermarkets and Hypermarkets

- 7.2.1.4. Others

- 7.2.2. On-Trade

- 7.2.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Europe UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Canned

- 8.1.2. Fresh / Chilled

- 8.1.3. Frozen

- 8.1.4. Processed

- 8.1.4.1. By Processed Types

- 8.1.4.1.1. Deli Meats

- 8.1.4.1.2. Marinated/ Tenders

- 8.1.4.1.3. Meatballs

- 8.1.4.1.4. Nuggets

- 8.1.4.1.5. Sausages

- 8.1.4.1.6. Other Processed Poultry

- 8.1.4.1. By Processed Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Off-Trade

- 8.2.1.1. Convenience Stores

- 8.2.1.2. Online Channel

- 8.2.1.3. Supermarkets and Hypermarkets

- 8.2.1.4. Others

- 8.2.2. On-Trade

- 8.2.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Middle East & Africa UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Canned

- 9.1.2. Fresh / Chilled

- 9.1.3. Frozen

- 9.1.4. Processed

- 9.1.4.1. By Processed Types

- 9.1.4.1.1. Deli Meats

- 9.1.4.1.2. Marinated/ Tenders

- 9.1.4.1.3. Meatballs

- 9.1.4.1.4. Nuggets

- 9.1.4.1.5. Sausages

- 9.1.4.1.6. Other Processed Poultry

- 9.1.4.1. By Processed Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Off-Trade

- 9.2.1.1. Convenience Stores

- 9.2.1.2. Online Channel

- 9.2.1.3. Supermarkets and Hypermarkets

- 9.2.1.4. Others

- 9.2.2. On-Trade

- 9.2.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Asia Pacific UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Canned

- 10.1.2. Fresh / Chilled

- 10.1.3. Frozen

- 10.1.4. Processed

- 10.1.4.1. By Processed Types

- 10.1.4.1.1. Deli Meats

- 10.1.4.1.2. Marinated/ Tenders

- 10.1.4.1.3. Meatballs

- 10.1.4.1.4. Nuggets

- 10.1.4.1.5. Sausages

- 10.1.4.1.6. Other Processed Poultry

- 10.1.4.1. By Processed Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Off-Trade

- 10.2.1.1. Convenience Stores

- 10.2.1.2. Online Channel

- 10.2.1.3. Supermarkets and Hypermarkets

- 10.2.1.4. Others

- 10.2.2. On-Trade

- 10.2.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. UAE UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 12. South Africa UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 13. Saudi Arabia UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of MEA UAE Poultry Meats Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Golden Dunes General Trading LLC

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Universal Islamic Mea

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Al Islami Foods

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Lulu International Group

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 BRF S A

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 The Savola Group

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Siniora Food Industries Company

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Al Ain Farms

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 JBS SA

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Tanmiah Food Company

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Golden Dunes General Trading LLC

List of Figures

- Figure 1: Global UAE Poultry Meats Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Middle East & Africa UAE Poultry Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Middle East & Africa UAE Poultry Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Poultry Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 5: North America UAE Poultry Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 6: North America UAE Poultry Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America UAE Poultry Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America UAE Poultry Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UAE Poultry Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UAE Poultry Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 11: South America UAE Poultry Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 12: South America UAE Poultry Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America UAE Poultry Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America UAE Poultry Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UAE Poultry Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UAE Poultry Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 17: Europe UAE Poultry Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 18: Europe UAE Poultry Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe UAE Poultry Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe UAE Poultry Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UAE Poultry Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UAE Poultry Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 23: Middle East & Africa UAE Poultry Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 24: Middle East & Africa UAE Poultry Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa UAE Poultry Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa UAE Poultry Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UAE Poultry Meats Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UAE Poultry Meats Market Revenue (Million), by Form 2024 & 2032

- Figure 29: Asia Pacific UAE Poultry Meats Market Revenue Share (%), by Form 2024 & 2032

- Figure 30: Asia Pacific UAE Poultry Meats Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific UAE Poultry Meats Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific UAE Poultry Meats Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UAE Poultry Meats Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Poultry Meats Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Poultry Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Global UAE Poultry Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global UAE Poultry Meats Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UAE Poultry Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UAE Poultry Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 11: Global UAE Poultry Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Global UAE Poultry Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global UAE Poultry Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 17: Global UAE Poultry Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Global UAE Poultry Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global UAE Poultry Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 23: Global UAE Poultry Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Global UAE Poultry Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global UAE Poultry Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 35: Global UAE Poultry Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Global UAE Poultry Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global UAE Poultry Meats Market Revenue Million Forecast, by Form 2019 & 2032

- Table 44: Global UAE Poultry Meats Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 45: Global UAE Poultry Meats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: ASEAN UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Oceania UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific UAE Poultry Meats Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Poultry Meats Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the UAE Poultry Meats Market?

Key companies in the market include Golden Dunes General Trading LLC, Universal Islamic Mea, Al Islami Foods, Lulu International Group, BRF S A, The Savola Group, Siniora Food Industries Company, Al Ain Farms, JBS SA, Tanmiah Food Company.

3. What are the main segments of the UAE Poultry Meats Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

Expansion and acquisitions in UAE off-trade channels among online market players are promoting market growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

February 2022: Al Ain Farms has announced the launch of its 2270 sq. m. facility in Abu Dhabi. Al Ain Farms has increased its storage capacity for handling products, including chicken, to enhance its operational efficiency.December 2021: LuLu Group launched its latest product categories, including the poultry meat range, in collaboration with world-class brands and leading manufacturers.November 2021: LuLu Hypermarket opened its 220th store in Shiab Al Ashkar, Al Ain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Poultry Meats Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Poultry Meats Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Poultry Meats Market?

To stay informed about further developments, trends, and reports in the UAE Poultry Meats Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence