Key Insights

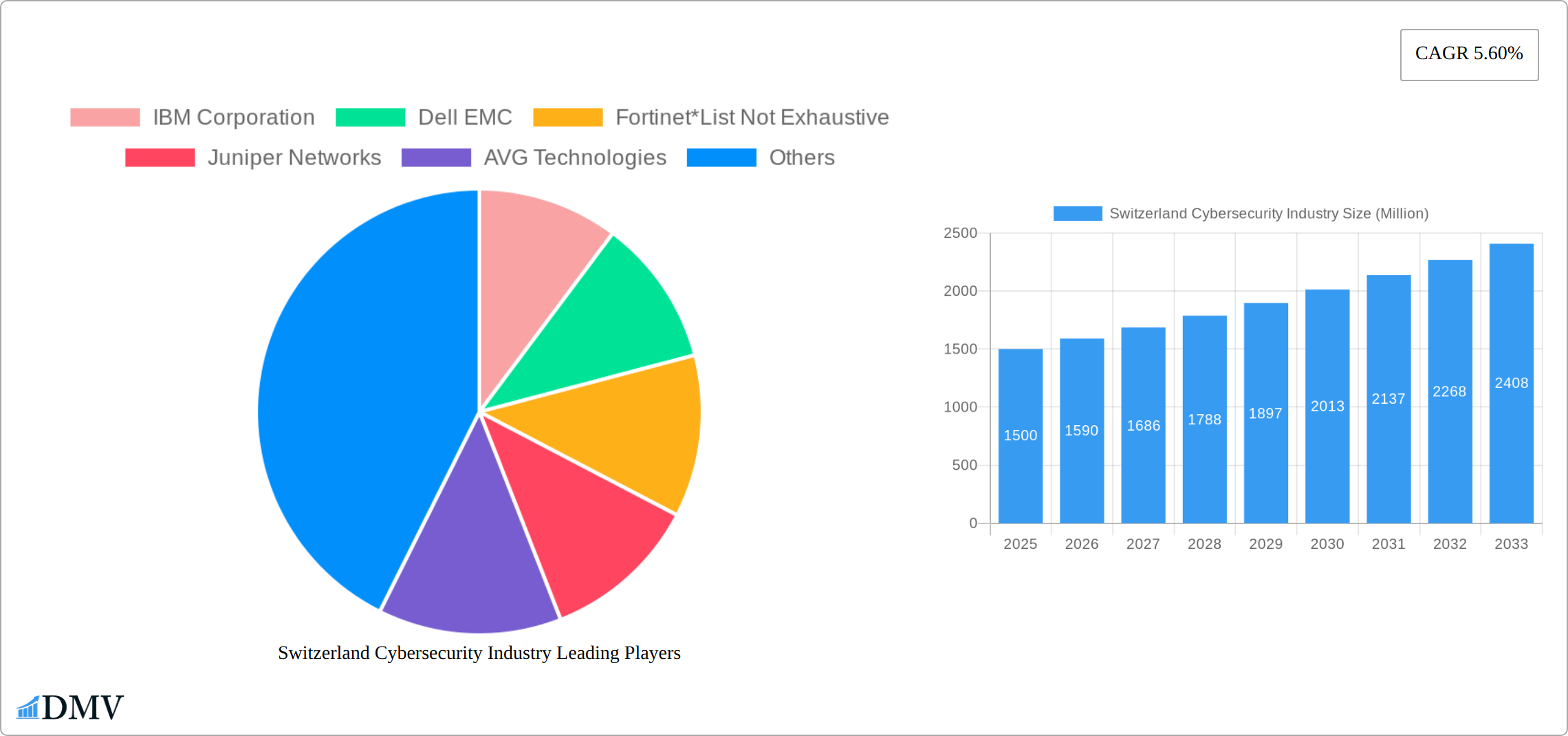

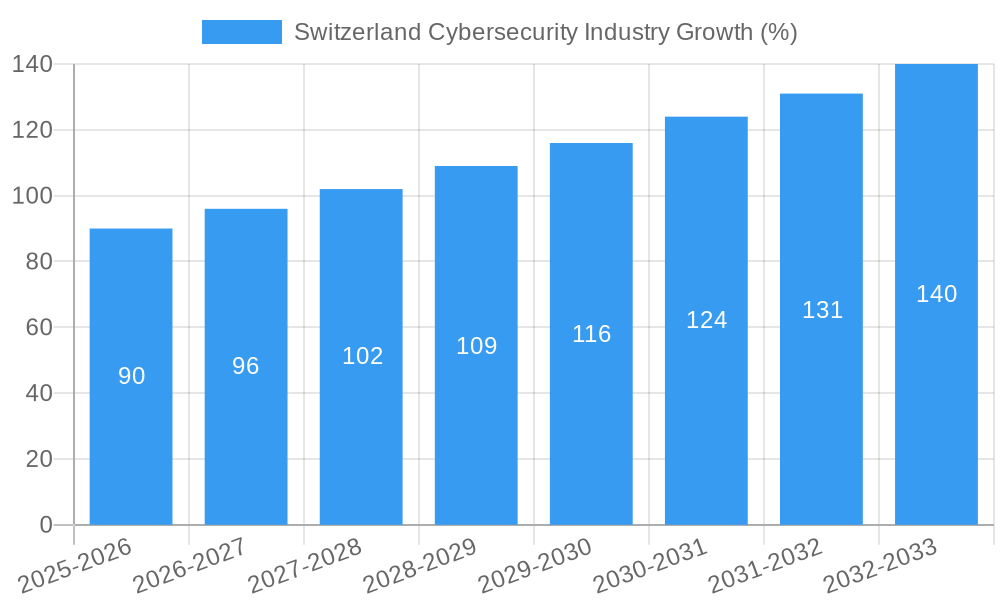

The Swiss cybersecurity market, valued at approximately CHF 1.5 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.6% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing digitalization across all sectors, particularly BFSI (Banking, Financial Services, and Insurance), healthcare, and government, necessitates heightened cybersecurity measures to protect sensitive data from escalating cyber threats. The rising prevalence of sophisticated ransomware attacks, data breaches, and phishing scams further intensifies the demand for advanced cybersecurity solutions. Furthermore, stringent data privacy regulations like GDPR and the Swiss Federal Act on Data Protection are compelling organizations to invest heavily in robust cybersecurity infrastructure and services to ensure compliance. The market is segmented by offering (security type and services), deployment (cloud and on-premise), and end-user (BFSI, healthcare, manufacturing, government & defense, IT & telecommunications, and others). The growth within the cloud-based segment is particularly significant, driven by its scalability, cost-effectiveness, and enhanced security features.

The Swiss cybersecurity landscape is characterized by a competitive market with both established global players like IBM, Dell EMC, Fortinet, Juniper Networks, and Cisco Systems, and specialized local providers. While the market presents significant opportunities, certain restraints exist. These include a skills gap in the cybersecurity workforce, high implementation costs associated with advanced security solutions, and the evolving nature of cyber threats requiring constant adaptation. However, these challenges are being actively addressed through government initiatives promoting cybersecurity education and collaboration between public and private sectors. Continued investment in research and development, along with the increasing adoption of artificial intelligence (AI) and machine learning (ML) for threat detection, are likely to shape the future of the Swiss cybersecurity market, ensuring its continued growth and resilience against emerging cyber risks.

Switzerland Cybersecurity Industry Market Composition & Trends

The Switzerland Cybersecurity Industry is witnessing significant evolution, driven by a concentrated market with key players like IBM Corporation, Cisco Systems, and McAfee holding substantial market shares. In 2025, IBM Corporation is projected to have a market share of approximately 20%, while Cisco Systems and McAfee are expected to hold around 15% each. The market is characterized by robust innovation catalysts, including advancements in artificial intelligence and machine learning, which are pivotal in developing advanced cybersecurity solutions. The regulatory landscape in Switzerland is stringent, with laws such as the Swiss Federal Data Protection Act enhancing the demand for secure solutions.

End-user profiles vary widely, with the BFSI sector leading in cybersecurity adoption due to its stringent regulatory requirements and high stakes in data security. Manufacturing and healthcare sectors are also increasingly investing in cybersecurity, with an estimated annual spend of xx Million each by 2025. The market has seen notable M&A activities, with deals valued at around 500 Million in the last year, aimed at consolidating capabilities and expanding market reach.

Market Share Distribution:

IBM Corporation: 20%

Cisco Systems: 15%

McAfee: 15%

Others: 50%

M&A Deal Values: Approximately 500 Million annually.

Switzerland Cybersecurity Industry Industry Evolution

The Switzerland Cybersecurity Industry has undergone significant evolution from 2019 to 2033, marked by steady market growth and technological advancements. The industry's growth rate has averaged around 8% annually, driven by increasing cyber threats and the need for robust security solutions. Technological advancements, particularly in cloud security and zero-trust frameworks, have revolutionized the market. The adoption of cloud-based cybersecurity solutions has seen a surge, with an estimated 30% of enterprises in Switzerland expected to fully transition to cloud-based security by 2033.

Consumer demands have shifted towards more integrated and user-friendly security solutions, prompting companies to focus on developing seamless and efficient products. The BFSI sector, for instance, has seen a 10% annual increase in cybersecurity spending due to heightened awareness of data breaches. Additionally, the government and defense sector's demand for advanced cybersecurity solutions has grown by 12% annually, driven by national security concerns and the need to protect critical infrastructure.

The industry's evolution is also influenced by regulatory changes, such as the implementation of the EU's General Data Protection Regulation (GDPR), which has indirectly impacted Swiss companies. This has led to a 15% increase in compliance-related cybersecurity investments. Overall, the industry's trajectory indicates a continued focus on innovation, with emerging technologies like blockchain and quantum computing poised to further transform the market landscape.

Leading Regions, Countries, or Segments in Switzerland Cybersecurity Industry

The Switzerland Cybersecurity Industry is dominated by key segments, with the BFSI sector leading due to its high demand for secure financial transactions and data protection. The BFSI sector's investment in cybersecurity is projected to reach xx Million by 2025, driven by regulatory requirements and the need to safeguard against financial cybercrimes.

- Key Drivers for BFSI Segment:

- Regulatory Compliance: Stringent data protection laws necessitate robust cybersecurity measures.

- High Stakes: Financial institutions face significant risks from cyberattacks, driving investment in security.

The cloud deployment segment is also a major player, with an expected market share of 40% by 2025. This dominance is attributed to the flexibility and scalability of cloud solutions, which are increasingly favored by businesses across various industries.

- Key Drivers for Cloud Deployment:

- Scalability: Cloud solutions offer scalable security options that can grow with business needs.

- Cost Efficiency: Reduced capital expenditure on hardware and infrastructure.

In-depth analysis reveals that the BFSI sector's dominance is also due to its early adoption of advanced security technologies. The sector's willingness to invest in cutting-edge solutions has fostered a competitive environment where cybersecurity companies continuously innovate to meet these demands. Similarly, the cloud deployment segment's growth is fueled by the ongoing digital transformation across Swiss industries, with a notable shift towards remote work and digital operations.

Switzerland Cybersecurity Industry Product Innovations

Innovations in the Switzerland Cybersecurity Industry are centered around advanced threat detection and prevention technologies. Companies are leveraging artificial intelligence to develop predictive security solutions that can anticipate and mitigate cyber threats before they materialize. For instance, IBM Corporation's AI-powered security platform has shown a 95% success rate in identifying potential breaches. These innovations are not only enhancing security but also improving user experience through seamless integration and real-time alerts.

Propelling Factors for Switzerland Cybersecurity Industry Growth

The growth of the Switzerland Cybersecurity Industry is propelled by several key factors. Technological advancements, such as the integration of AI and machine learning in security solutions, are driving demand for sophisticated cybersecurity products. Economically, the increasing digitalization of businesses across sectors like BFSI and healthcare is boosting the need for robust security measures. Regulatory influences, including stringent data protection laws, are compelling companies to invest heavily in cybersecurity to ensure compliance and protect sensitive data.

Obstacles in the Switzerland Cybersecurity Industry Market

The Switzerland Cybersecurity Industry faces several obstacles that could hinder growth. Regulatory challenges, such as the complexity of compliance with multiple international standards, can be a significant barrier. Supply chain disruptions, particularly in the wake of global events, have impacted the availability of critical hardware components, leading to delays in product development. Competitive pressures are intense, with companies like IBM and Cisco constantly innovating, which can make it difficult for smaller players to keep up. These factors collectively result in an estimated 5% annual reduction in market growth potential.

Future Opportunities in Switzerland Cybersecurity Industry

The Switzerland Cybersecurity Industry is poised for growth through several emerging opportunities. New markets in sectors like IoT and smart cities are opening up, requiring specialized cybersecurity solutions. Technological advancements in areas such as blockchain and quantum computing offer new avenues for secure data management and encryption. Additionally, consumer trends towards remote working and digital operations are driving demand for cloud-based security solutions, presenting significant growth potential for the industry.

Major Players in the Switzerland Cybersecurity Industry Ecosystem

- IBM Corporation

- Dell EMC

- Fortinet

- Juniper Networks

- AVG Technologies

- Oracle Corporation

- Cisco Systems

- McAfee

- Sophos Solutions

- Micro Focus

Key Developments in Switzerland Cybersecurity Industry Industry

- April 2022: Adnovum expanded into new sectors like zero-trust security, leveraging its identity and access management capabilities and Swiss heritage. This move is expected to enhance Adnovum's market position and cater to the growing demand for secure solutions in financial and government sectors.

- August 2022: Omada A/S, in partnership with Securix, was chosen by BKW, a major Swiss power provider, to enhance identity and access management. This development is significant as it addresses regulatory obligations and strengthens cybersecurity in the energy sector, potentially setting a precedent for other industries.

Strategic Switzerland Cybersecurity Industry Market Forecast

The Switzerland Cybersecurity Industry is set for robust growth, with a projected CAGR of 8% from 2025 to 2033. Future opportunities lie in emerging technologies like blockchain and quantum computing, which are expected to revolutionize data security. The increasing digitalization of businesses and the shift towards remote working will continue to drive demand for advanced cybersecurity solutions. The market's potential is further enhanced by the need for compliance with stringent data protection regulations, positioning Switzerland as a leader in cybersecurity innovation.

Switzerland Cybersecurity Industry Segmentation

-

1. Offering

- 1.1. Security Type

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

Switzerland Cybersecurity Industry Segmentation By Geography

- 1. Switzerland

Switzerland Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks

- 3.2.2 the evolution of MSSPs

- 3.2.3 and adoption of cloud-first strategy

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness

- 3.4. Market Trends

- 3.4.1. IT Sector will Observe a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dell EMC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fortinet*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Juniper Networks

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AVG Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oracle Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cisco Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 McAfee

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sophos Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Micro Focus

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Switzerland Cybersecurity Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Cybersecurity Industry Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Switzerland Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Switzerland Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Switzerland Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Switzerland Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Switzerland Cybersecurity Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 8: Switzerland Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 9: Switzerland Cybersecurity Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Switzerland Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Cybersecurity Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Switzerland Cybersecurity Industry?

Key companies in the market include IBM Corporation, Dell EMC, Fortinet*List Not Exhaustive, Juniper Networks, AVG Technologies, Oracle Corporation, Cisco Systems, McAfee, Sophos Solutions, Micro Focus.

3. What are the main segments of the Switzerland Cybersecurity Industry?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Digitalization and Scalable IT Infrastructure; Need to tackle risks from various trends such as third-party vendor risks. the evolution of MSSPs. and adoption of cloud-first strategy.

6. What are the notable trends driving market growth?

IT Sector will Observe a Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness.

8. Can you provide examples of recent developments in the market?

April 2022: Adnovum is a software firm expanding into new sectors and industries, such as zero-trust security, by utilizing its identity, access management capabilities, and Swiss history. Adnovum relies on its Swiss heritage as it expands and diversifies its business into new markets. With experience working with Swiss financial institutions and the Swiss government, which have some of the strictest quality and security requirements in the world, Adnovum has a history of satisfying these clients' needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the Switzerland Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence