Key Insights

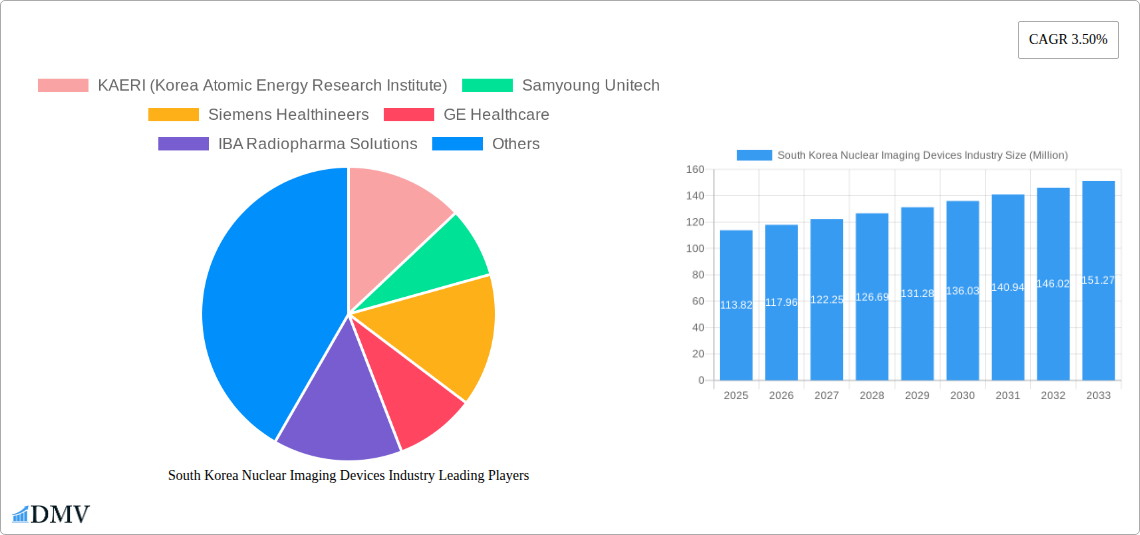

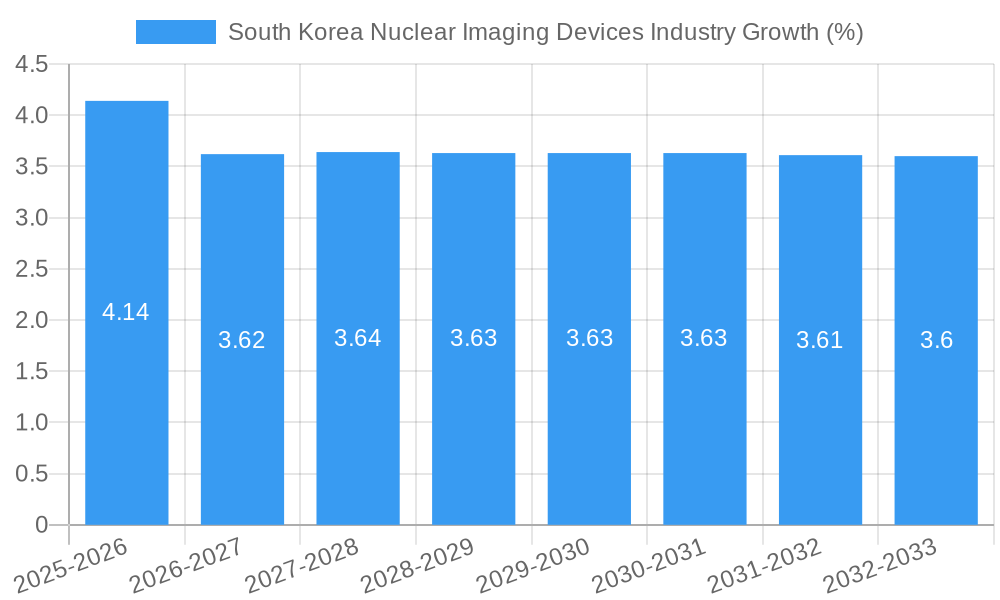

The South Korean nuclear imaging devices market, valued at $113.82 million in 2025, is projected to experience steady growth, driven by factors such as increasing prevalence of chronic diseases like cancer and cardiovascular ailments necessitating advanced diagnostic tools. The rising geriatric population further fuels demand for sophisticated imaging techniques to facilitate early and accurate diagnosis. Technological advancements in PET/CT scanners and radioisotope production, offering enhanced image resolution and reduced radiation exposure, are key market drivers. Government initiatives promoting healthcare infrastructure development and increasing healthcare expenditure contribute to market expansion. While the market faces restraints such as high equipment costs and stringent regulatory approvals, the overall outlook remains positive. Segment-wise, oncology applications dominate, followed by cardiology and orthopedics, with PET radioisotope segments exhibiting significant growth potential due to their crucial role in various diagnostic procedures. Key players like Siemens Healthineers, GE Healthcare, and domestic players like KAERI and Samyoung Unitech, are actively competing, driving innovation and market penetration. The forecast period (2025-2033) anticipates continued expansion, fueled by ongoing technological advancements and increasing healthcare awareness.

The 3.50% CAGR indicates a consistent, albeit moderate, growth trajectory. This rate is likely influenced by factors such as the relatively mature healthcare infrastructure in South Korea and the existing penetration of nuclear imaging technologies. However, ongoing technological innovation and the rising prevalence of chronic diseases suggest that this CAGR represents a conservative estimate, and that localized market segments may exhibit even higher growth rates. The competitive landscape characterized by both international and domestic players promotes healthy competition, leading to product innovation and competitive pricing, which should bolster market expansion throughout the forecast period. Focus on specific application segments, like oncology, will continue to drive growth and specialized market development.

South Korea Nuclear Imaging Devices Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the South Korea nuclear imaging devices industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive data analysis to present a clear picture of market trends, opportunities, and challenges. The market is segmented by product (Equipment, Radioisotope), application (Orthopedics, Thyroid, Cardiology, Oncology, Others), and key players, including domestic and international giants. The total market size is projected to reach xx Million by 2033.

South Korea Nuclear Imaging Devices Industry Market Composition & Trends

This section delves into the competitive landscape of the South Korean nuclear imaging devices market. We analyze market concentration, revealing the market share distribution amongst key players like Siemens Healthineers, GE Healthcare, and domestic companies such as KAERI (Korea Atomic Energy Research Institute), Samyoung Unitech, and Genoray. The report examines innovation drivers, including government funding initiatives and collaborations between research institutions and private companies. We assess the regulatory environment impacting market access and product approvals, identifying potential roadblocks and opportunities. Furthermore, the report analyzes substitute products and their impact on market share, profiling end-user segments (hospitals, clinics, research institutions) and their specific needs. Finally, we detail recent mergers and acquisitions (M&A) activities, including deal values and their influence on market dynamics. The total M&A deal value in the period 2019-2024 is estimated at xx Million.

- Market Concentration: High concentration with a few dominant players, but increasing participation from smaller, specialized firms.

- Innovation Catalysts: Government funding for R&D, collaborations between research institutes and industry.

- Regulatory Landscape: Stringent regulations, impacting approval timelines and market access.

- Substitute Products: Limited direct substitutes, but alternative diagnostic techniques pose indirect competition.

- End-User Profiles: Hospitals are the largest segment, followed by specialized clinics and research centers.

- M&A Activity: Moderate M&A activity, focusing on technology acquisition and market expansion.

South Korea Nuclear Imaging Devices Industry Industry Evolution

This section analyzes the evolution of the South Korean nuclear imaging devices industry from 2019 to 2024, projecting growth trajectories until 2033. We examine technological advancements, such as the introduction of advanced PET/CT systems and improved radioisotope production techniques. The report explores the impact of shifting consumer demands, including the growing preference for minimally invasive procedures and personalized medicine, on market growth. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Adoption rates of new technologies are analyzed, highlighting factors driving the transition from older technologies to advanced systems. The increasing prevalence of chronic diseases like cancer is a major driver of market growth. The focus on improving diagnostic accuracy and efficiency also fuels demand for advanced imaging devices. Specific data points, including detailed sales figures and market segmentation by technology type, will be included.

Leading Regions, Countries, or Segments in South Korea Nuclear Imaging Devices Industry

This section identifies the leading segments within the South Korean nuclear imaging devices market. Based on current market trends and future projections, the Oncology segment is expected to dominate, driven by increasing cancer incidence rates and advancements in cancer treatment.

Key Drivers:

- Oncology: High prevalence of cancer, demand for advanced diagnostic tools, and ongoing research and development in cancer imaging.

- Cardiology: Growing prevalence of cardiovascular diseases, driving demand for precise diagnostic tools.

- Equipment: Continued technological advancements and innovation in PET/CT and other nuclear imaging systems.

- Radioisotopes: Increasing demand for high-quality, reliable radioisotopes to power imaging systems.

Dominance Factors: The Oncology segment's dominance stems from the high prevalence of cancer in South Korea, the increasing demand for advanced diagnostic tools, and ongoing research and development in cancer imaging. Technological advancements and the availability of advanced imaging systems are also critical contributing factors.

South Korea Nuclear Imaging Devices Industry Product Innovations

Recent product innovations focus on improved image quality, faster scan times, and reduced radiation exposure. Advanced PET/CT systems offer superior resolution and improved diagnostic capabilities. New radioisotopes with longer half-lives and improved targeting capabilities are also enhancing the efficacy of nuclear imaging techniques. These innovations are increasing the accuracy and efficiency of diagnostic procedures, leading to better patient outcomes. Unique selling propositions include integrated software for image analysis and advanced data processing features, improving workflow efficiency.

Propelling Factors for South Korea Nuclear Imaging Devices Industry Growth

Several factors contribute to the growth of the South Korean nuclear imaging devices market. Technological advancements leading to more precise and efficient diagnostic tools are a key driver. Government initiatives supporting healthcare infrastructure development and R&D investments significantly impact market expansion. The rising prevalence of chronic diseases like cancer, cardiovascular diseases, and neurological disorders fuels the demand for advanced diagnostic solutions. Increased healthcare spending and an aging population further contribute to the market's growth trajectory.

Obstacles in the South Korea Nuclear Imaging Devices Industry Market

The South Korean nuclear imaging devices market faces several challenges. Stringent regulatory approvals can delay product launches and increase market entry barriers. The high cost of advanced imaging equipment can limit access for smaller clinics and hospitals. Competition from established international players also presents a significant challenge for domestic companies. Supply chain disruptions related to radioisotope production and equipment components can also impact market stability. These factors, combined with potential price pressures, could affect the market's overall growth.

Future Opportunities in South Korea Nuclear Imaging Devices Industry

Future opportunities lie in developing and adopting new imaging technologies, including molecular imaging techniques and advanced AI-driven image analysis. Expanding into new applications, like theranostics (combining diagnostics and therapy), presents significant potential. Increasing collaborations between research institutions, private companies, and the government could foster innovation and drive market expansion. Focusing on customized solutions tailored to specific clinical needs can also create new market segments.

Major Players in the South Korea Nuclear Imaging Devices Industry Ecosystem

- KAERI (Korea Atomic Energy Research Institute)

- Samyoung Unitech

- Siemens Healthineers

- GE Healthcare

- IBA Radiopharma Solutions

- DuChemBIO Co Ltd

- Genoray

- FutureChem

- KIRAMS (Korea Institute of Radiological & Medical Sciences)

- NuCare Inc

Key Developments in South Korea Nuclear Imaging Devices Industry Industry

- June 2022: The Society of Nuclear Medicine and Molecular Imaging (SNMMI) announced the creation of the Mars Shot Fund, an initiative to raise USD 100.0 Million to help pay for research into nuclear medicine, molecular imaging, and therapy. This significantly boosts R&D efforts.

- January 2022: Positron Corporation's strategic partnership with NeusoftMedical Systems for its PET/CT device signifies a notable market expansion strategy.

Strategic South Korea Nuclear Imaging Devices Industry Market Forecast

The South Korean nuclear imaging devices market is poised for robust growth driven by technological advancements, increasing healthcare spending, and a growing need for accurate diagnostic tools. The expanding application of nuclear imaging in various medical fields, combined with government initiatives promoting healthcare innovation, will contribute to continued market expansion. Opportunities exist for both domestic and international players to capitalize on this growth potential by focusing on innovation, strategic partnerships, and addressing unmet clinical needs.

South Korea Nuclear Imaging Devices Industry Segmentation

-

1. Product

-

1.1. Equipment

- 1.1.1. Single Photon Emission Computed Tomography (SPECT)

- 1.1.2. Positron-emission Tomography (PET)

-

1.2. Radioisotope

- 1.2.1. SPECT Radioisotopes

- 1.2.2. PET Radioisotopes

-

1.1. Equipment

-

2. Application

- 2.1. Orthopedics

- 2.2. Thyroid

- 2.3. Cardiology

- 2.4. Oncology

- 2.5. Others

South Korea Nuclear Imaging Devices Industry Segmentation By Geography

- 1. South Korea

South Korea Nuclear Imaging Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Prevalence of Cancer and Cardiac Disorders; Increase in Technological Advancements; Growth in Applications of Nuclear Medicine and Imaging

- 3.3. Market Restrains

- 3.3.1. High Cost of the Techniques; Short Half-life of Radiopharmaceuticals

- 3.4. Market Trends

- 3.4.1. Single Photon Emission Computed Tomography (SPECT) Segment is Expected to Witness Largest Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Nuclear Imaging Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Equipment

- 5.1.1.1. Single Photon Emission Computed Tomography (SPECT)

- 5.1.1.2. Positron-emission Tomography (PET)

- 5.1.2. Radioisotope

- 5.1.2.1. SPECT Radioisotopes

- 5.1.2.2. PET Radioisotopes

- 5.1.1. Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Orthopedics

- 5.2.2. Thyroid

- 5.2.3. Cardiology

- 5.2.4. Oncology

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 KAERI (Korea Atomic Energy Research Institute)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samyoung Unitech

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Healthineers

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GE Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IBA Radiopharma Solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DuChemBIO Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genoray

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FutureChem

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KIRAMS (Korea Institute of Radiological & Medical Sciences)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NuCare Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 KAERI (Korea Atomic Energy Research Institute)

List of Figures

- Figure 1: South Korea Nuclear Imaging Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Nuclear Imaging Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Nuclear Imaging Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Nuclear Imaging Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Korea Nuclear Imaging Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: South Korea Nuclear Imaging Devices Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: South Korea Nuclear Imaging Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: South Korea Nuclear Imaging Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: South Korea Nuclear Imaging Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Korea Nuclear Imaging Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: South Korea Nuclear Imaging Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South Korea Nuclear Imaging Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: South Korea Nuclear Imaging Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 12: South Korea Nuclear Imaging Devices Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 13: South Korea Nuclear Imaging Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: South Korea Nuclear Imaging Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 15: South Korea Nuclear Imaging Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South Korea Nuclear Imaging Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Nuclear Imaging Devices Industry?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the South Korea Nuclear Imaging Devices Industry?

Key companies in the market include KAERI (Korea Atomic Energy Research Institute), Samyoung Unitech, Siemens Healthineers, GE Healthcare, IBA Radiopharma Solutions, DuChemBIO Co Ltd, Genoray, FutureChem, KIRAMS (Korea Institute of Radiological & Medical Sciences), NuCare Inc.

3. What are the main segments of the South Korea Nuclear Imaging Devices Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Prevalence of Cancer and Cardiac Disorders; Increase in Technological Advancements; Growth in Applications of Nuclear Medicine and Imaging.

6. What are the notable trends driving market growth?

Single Photon Emission Computed Tomography (SPECT) Segment is Expected to Witness Largest Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of the Techniques; Short Half-life of Radiopharmaceuticals.

8. Can you provide examples of recent developments in the market?

In June 2022, the Society of Nuclear Medicine and Molecular Imaging (SNMMI) announced the creation of the Mars Shot Fund, an initiative to raise USD 100.0 million to help pay for research into nuclear medicine, molecular imaging, and therapy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Nuclear Imaging Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Nuclear Imaging Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Nuclear Imaging Devices Industry?

To stay informed about further developments, trends, and reports in the South Korea Nuclear Imaging Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence