Key Insights

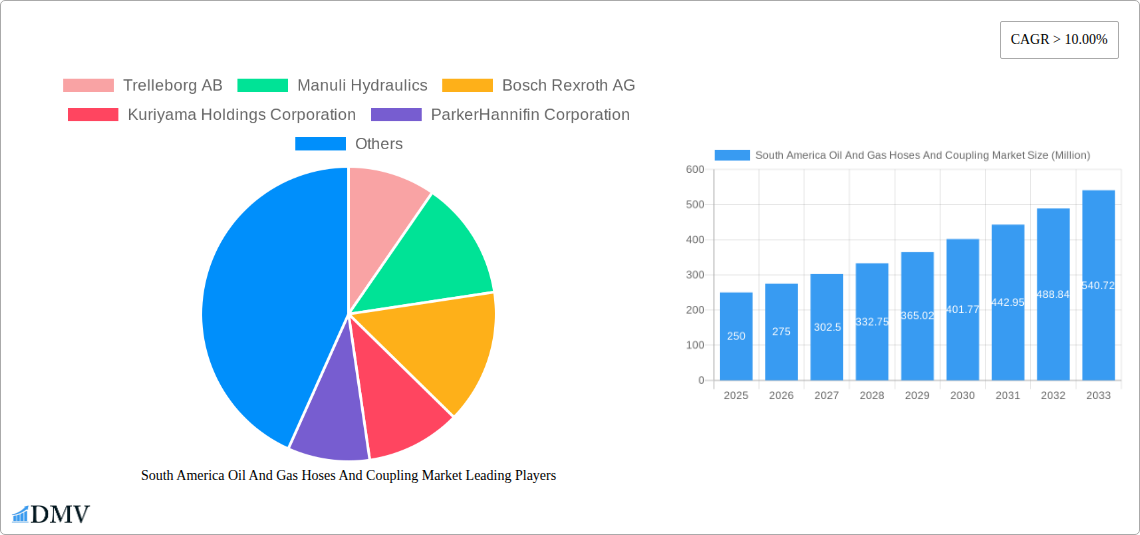

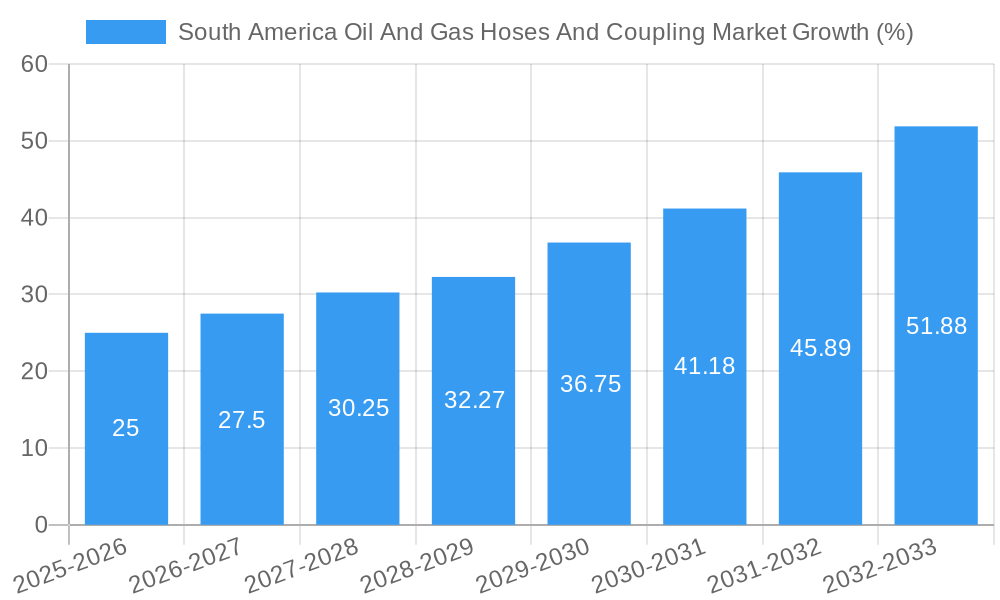

The South American oil and gas hoses and coupling market exhibits robust growth potential, driven by increasing oil and gas exploration and production activities across the region, particularly in Brazil and Argentina. The market's Compound Annual Growth Rate (CAGR) exceeding 10% from 2019 to 2024 indicates significant expansion. This growth is fueled by investments in upstream projects, including offshore drilling and pipeline infrastructure development, along with ongoing modernization efforts in midstream and downstream operations. The rising demand for efficient and reliable hose and coupling solutions, coupled with stringent safety regulations within the oil and gas sector, further stimulates market expansion. Key players such as Trelleborg AB, ParkerHannifin Corporation, and Continental AG are actively participating in this growth, leveraging their technological expertise and established distribution networks to cater to the specific needs of the South American market. Segment-wise, the upstream sector is expected to dominate the market due to its high capital expenditure on new projects, followed by midstream and downstream segments. However, fluctuating oil prices and economic uncertainties within the region present challenges to consistent market growth. The market size in 2025 is estimated at approximately $250 million (this is an estimation based on typical market sizes for regional niche industries and the provided CAGR; no actual data was provided). Further growth is anticipated through 2033, driven by ongoing investment in energy infrastructure and technological advancements within the industry.

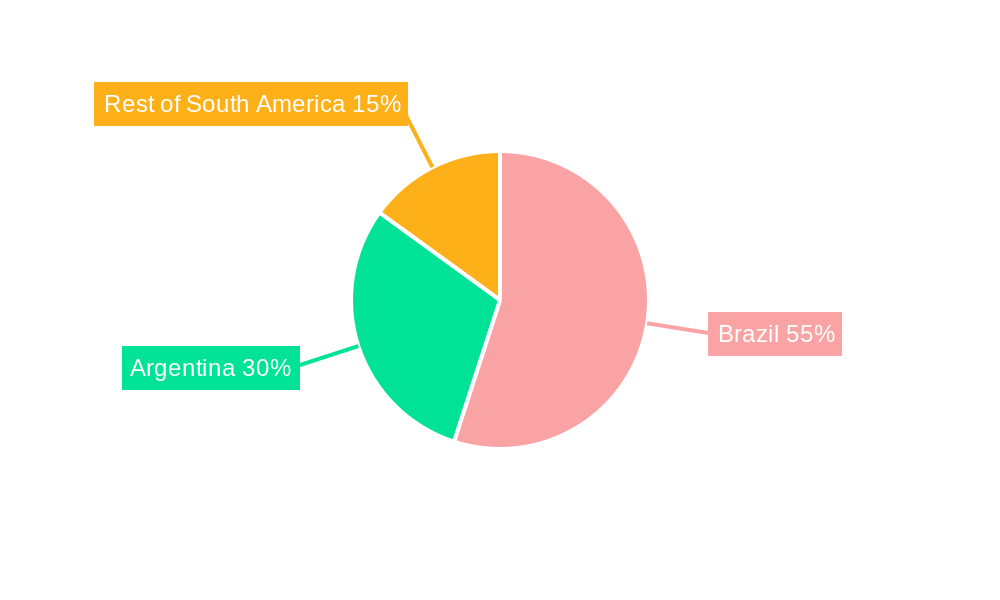

Brazil and Argentina constitute the primary markets within South America, contributing significantly to the overall market value. However, other countries within the region also present growth opportunities as exploration and production activities increase. Future market dynamics will be significantly influenced by government policies promoting energy independence, the adoption of advanced materials for hose and coupling manufacturing (improving durability and safety), and the increasing focus on sustainable practices within the oil and gas industry. The competitive landscape is characterized by both established international players and regional companies, resulting in a diverse and dynamic market. This necessitates manufacturers to focus on product innovation, operational efficiency, and strong customer relationships to maintain a competitive edge.

South America Oil and Gas Hoses and Coupling Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South America Oil and Gas Hoses and Coupling market, offering crucial insights for stakeholders seeking to navigate this dynamic sector. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this comprehensive study unveils market trends, growth drivers, challenges, and future opportunities. The report leverages extensive data analysis and expert insights to provide a clear picture of the market's current state and its projected trajectory. With a focus on key players like Trelleborg AB, Manuli Hydraulics, Bosch Rexroth AG, and others, this report is an essential resource for strategic decision-making. The market is expected to reach xx Million by 2033.

South America Oil and Gas Hoses and Coupling Market Market Composition & Trends

This section dissects the competitive landscape of the South America Oil and Gas Hoses and Coupling market, evaluating its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller players indicates a dynamic competitive environment.

Market Share Distribution: Trelleborg AB and ParkerHannifin Corporation are projected to hold the largest shares in 2025, estimated at xx% and xx% respectively. The remaining share is distributed among other key players and smaller regional companies.

Innovation Catalysts: Stringent safety regulations and the increasing demand for high-performance hoses drive innovation in materials, design, and manufacturing processes. The need for enhanced durability, flexibility, and resistance to extreme temperatures and pressures fuels R&D efforts.

Regulatory Landscape: Varying regulations across South American countries impact the market. Harmonization efforts and consistent enforcement of safety standards are vital for market growth.

Substitute Products: Although limited, alternative materials and technologies are emerging, posing a potential, albeit currently small, threat.

End-User Profiles: The market caters primarily to upstream, midstream, and downstream operations in the oil and gas industry, each exhibiting unique needs and preferences.

M&A Activities: While precise M&A deal values for the South American market are difficult to compile completely, observed activity indicates a trend towards consolidation, particularly among smaller companies seeking to gain scale and technological expertise. The total value of M&A deals within the past five years is estimated to be around xx Million.

South America Oil and Gas Hoses and Coupling Market Industry Evolution

The South America Oil and Gas Hoses and Coupling market has witnessed significant evolution, driven by technological advancements, fluctuating oil prices, and evolving industry demands. The market experienced a compound annual growth rate (CAGR) of xx% during the period 2019-2024. This growth is primarily attributed to increasing oil and gas exploration and production activities across the region, particularly in countries like Brazil and Argentina. Technological advancements, such as the adoption of lighter and more durable materials, and improved coupling technologies, have further enhanced market growth. However, periods of low oil prices have dampened market activity. Recent years have shown a shift towards more sustainable practices, leading to a greater demand for environmentally friendly hoses and couplings. Furthermore, the increasing emphasis on safety regulations has spurred the development of more robust and reliable products. Looking ahead, the market is poised for continued growth, albeit at a moderated pace compared to previous years, projected to maintain a CAGR of xx% during the forecast period (2025-2033). Increased investment in offshore oil and gas exploration, coupled with ongoing infrastructure development, is expected to be a primary driver. The adoption of advanced materials and intelligent technologies, such as remote monitoring systems, will also contribute to the market's expansion.

Leading Regions, Countries, or Segments in South America Oil and Gas Hoses and Coupling Market

Brazil dominates the South American Oil and Gas Hoses and Coupling market, driven by its substantial oil and gas reserves and extensive offshore exploration activities. The Upstream segment presents the largest share, followed by Downstream and Midstream.

Key Drivers for Brazil's Dominance:

- Significant Oil and Gas Reserves: Brazil possesses substantial proven reserves of both oil and natural gas, making it a significant producer and consumer of hoses and couplings.

- Extensive Offshore Exploration: A considerable portion of Brazil's oil and gas production comes from offshore fields, requiring specialized hoses and couplings capable of withstanding harsh marine environments.

- Government Investment: The Brazilian government has invested significantly in the oil and gas sector, fostering exploration and production activities.

- Robust Infrastructure: Brazil's relatively well-developed infrastructure provides support for the oil and gas industry's logistics and distribution networks.

Upstream Segment Dominance: The Upstream segment's dominance is due to the high demand for hoses and couplings in drilling operations, production facilities, and transportation of crude oil and natural gas. The increasing number of exploration and production projects in the region fuels this sector's growth.

South America Oil and Gas Hoses and Coupling Market Product Innovations

Recent innovations in the South American market focus on enhanced durability, lighter weight, and improved safety features. Materials like high-performance polymers and advanced elastomers are increasingly used to create hoses that withstand extreme temperatures and pressures, extending their lifespan and minimizing downtime. Improved coupling mechanisms ensure leak-free connections, minimizing environmental risks and enhancing operational efficiency. Moreover, the integration of smart technologies, like sensors for pressure and temperature monitoring, allows for real-time condition monitoring and predictive maintenance, optimizing operations and reducing maintenance costs. These innovations offer unique selling propositions like extended product lifespan, enhanced safety, and reduced operational costs, leading to increased adoption within the oil and gas industry.

Propelling Factors for South America Oil and Gas Hoses and Coupling Market Growth

Several factors contribute to the growth of the South American Oil and Gas Hoses and Coupling market. Firstly, rising oil and gas production activities across the region drive demand for specialized hoses and couplings. Secondly, growing investments in infrastructure development, particularly in offshore exploration, fuel market expansion. Thirdly, stringent safety regulations necessitate the adoption of high-quality, reliable products, boosting the demand for premium hoses and couplings. Finally, technological advancements, including the development of new materials and improved designs, contribute to market growth.

Obstacles in the South America Oil and Gas Hoses and Coupling Market Market

The South American Oil and Gas Hoses and Coupling market faces challenges, including fluctuating oil prices which directly impact investment decisions. Supply chain disruptions, particularly during periods of geopolitical instability, can lead to delays and increased costs. Intense competition, both from domestic and international players, also pressures profit margins. Furthermore, regulatory inconsistencies across different countries in South America can complicate operations and compliance.

Future Opportunities in South America Oil and Gas Hoses and Coupling Market

Future opportunities lie in tapping into the growing demand for environmentally friendly hoses and couplings. Expanding into new markets within South America, particularly in developing regions with burgeoning oil and gas exploration activities, presents significant potential. The adoption of advanced materials and innovative technologies, such as sensor integration for predictive maintenance, offers lucrative avenues for growth.

Major Players in the South America Oil and Gas Hoses and Coupling Market Ecosystem

- Trelleborg AB

- Manuli Hydraulics

- Bosch Rexroth AG

- Kuriyama Holdings Corporation

- ParkerHannifin Corporation

- Continental AG

- W W Grainger Inc

- Gates Corporation

- Jason Industrial Inc

- Eaton Corporation Plc

Key Developments in South America Oil and Gas Hoses and Coupling Market Industry

- September 2022: Enauta, a Brazilian oil and gas company, experienced a production interruption at the Atlanta field due to a hose problem, highlighting the critical role of reliable hose and coupling systems in maintaining operational efficiency and preventing production losses.

Strategic South America Oil and Gas Hoses and Coupling Market Market Forecast

The South American Oil and Gas Hoses and Coupling market is poised for continued growth, driven by ongoing exploration and production activities, infrastructure development, and increasing demand for high-performance hoses and couplings. The adoption of innovative materials and technologies, along with efforts towards sustainability, will shape the market's future trajectory. The market is expected to experience significant growth, driven by investments in new projects and the ongoing demand for reliable and efficient oil and gas transportation. Opportunities in offshore exploration and the adoption of advanced technologies will propel the market's expansion in the coming years.

South America Oil And Gas Hoses And Coupling Market Segmentation

-

1. Application

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Oil And Gas Hoses And Coupling Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Oil And Gas Hoses And Coupling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Midstream is Expected to Become a Significant Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Brazil South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Argentina South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Colombia South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of South America South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Brazil South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Oil And Gas Hoses And Coupling Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Trelleborg AB

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Manuli Hydraulics

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Bosch Rexroth AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Kuriyama Holdings Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ParkerHannifin Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Continental AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 W W Grainger Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Gates Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Jason Industrial Inc *List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Eaton Corporation Plc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Trelleborg AB

List of Figures

- Figure 1: South America Oil And Gas Hoses And Coupling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Oil And Gas Hoses And Coupling Market Share (%) by Company 2024

List of Tables

- Table 1: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 5: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 7: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Oil And Gas Hoses And Coupling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Oil And Gas Hoses And Coupling Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Oil And Gas Hoses And Coupling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Oil And Gas Hoses And Coupling Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Oil And Gas Hoses And Coupling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Oil And Gas Hoses And Coupling Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 19: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 21: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 23: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 31: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 33: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 37: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 39: South America Oil And Gas Hoses And Coupling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: South America Oil And Gas Hoses And Coupling Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Oil And Gas Hoses And Coupling Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the South America Oil And Gas Hoses And Coupling Market?

Key companies in the market include Trelleborg AB, Manuli Hydraulics, Bosch Rexroth AG, Kuriyama Holdings Corporation, ParkerHannifin Corporation, Continental AG, W W Grainger Inc, Gates Corporation, Jason Industrial Inc *List Not Exhaustive, Eaton Corporation Plc.

3. What are the main segments of the South America Oil And Gas Hoses And Coupling Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas.

6. What are the notable trends driving market growth?

Midstream is Expected to Become a Significant Segment.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

September 2022: Enauta, a Brazilian oil and gas company, resumed production through well 7-ATL-2HP-RJS at the Atlanta field in the Santos Basin offshore Brazil. Enauta resumed output from the field in August following a planned downtime. However, on August 26, it announced that a hose problem had preventively interrupted production in the field.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Oil And Gas Hoses And Coupling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Oil And Gas Hoses And Coupling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Oil And Gas Hoses And Coupling Market?

To stay informed about further developments, trends, and reports in the South America Oil And Gas Hoses And Coupling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence