Key Insights

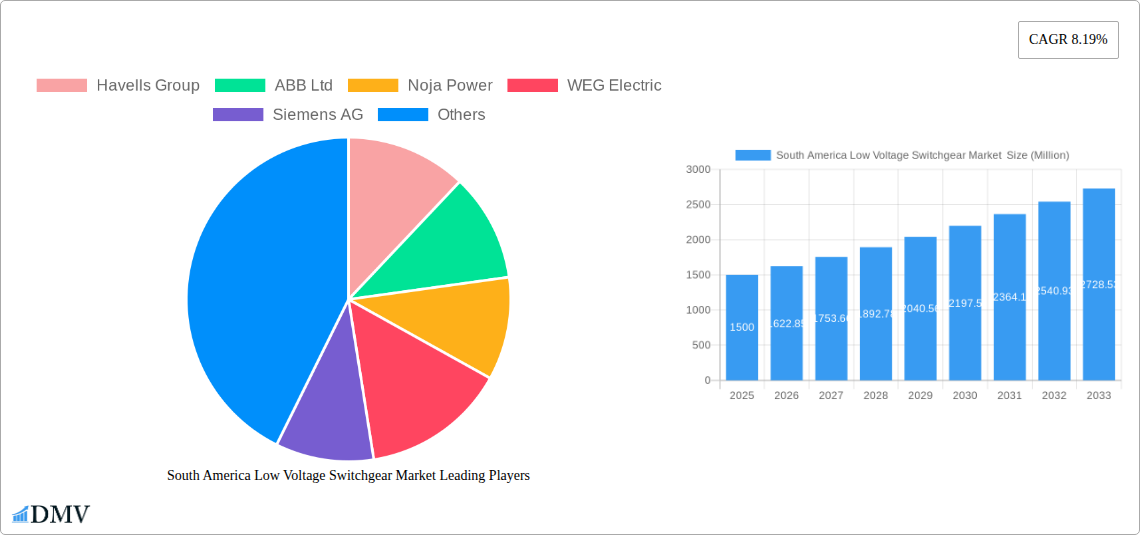

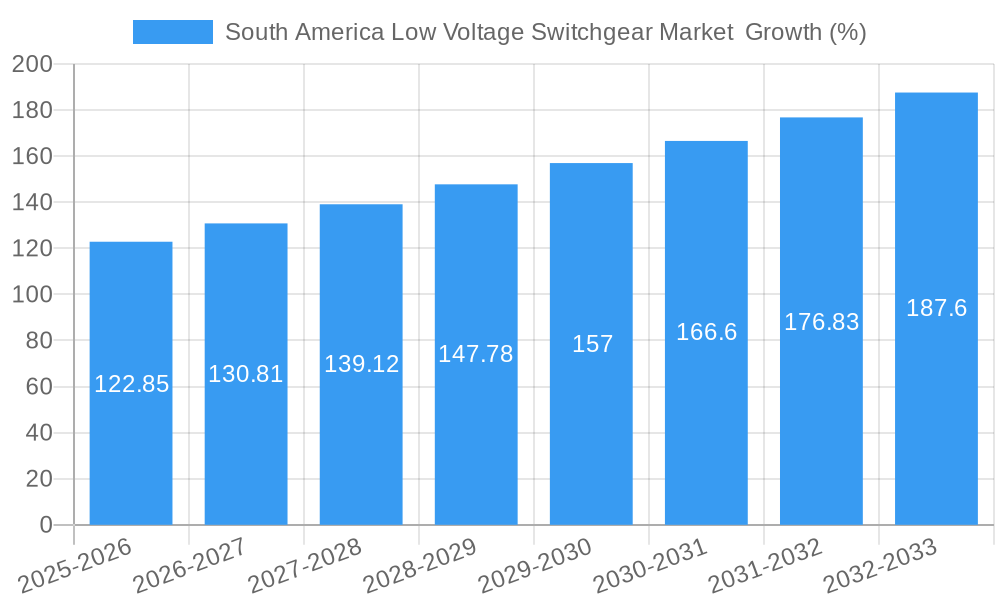

The South American low-voltage switchgear market, valued at $1.5 billion in 2025, is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.19% from 2025 to 2033. This growth is driven by several key factors. Firstly, significant investments in infrastructure development across Brazil and Argentina, fueled by expanding industrialization and urbanization, are creating a strong demand for reliable and efficient low-voltage switchgear solutions. Secondly, the increasing adoption of renewable energy sources, particularly solar and wind power, necessitates advanced switchgear technologies for seamless integration and grid stability, further bolstering market growth. Furthermore, stringent government regulations focusing on energy efficiency and safety standards are propelling the adoption of modern, technologically advanced switchgear systems. The market segmentation reveals that the substation and utility applications are the largest consumers, while outdoor installations dominate due to prevalent climatic conditions. Growth within the 250V-750V voltage rating segment is expected to outpace other segments due to its widespread usage in industrial and commercial settings. Leading players like ABB, Siemens, Schneider Electric, and Eaton, along with regional players like Havells and WEG, are actively competing in this dynamic market, investing in research and development to provide innovative and cost-effective solutions.

However, the market's growth trajectory is not without challenges. Economic fluctuations in South America, particularly susceptibility to inflation and currency devaluation, can influence investment decisions and hinder market expansion. Furthermore, the lack of skilled labor and technical expertise in some regions may limit the pace of installation and adoption of advanced switchgear technologies. Despite these restraints, the long-term outlook for the South American low-voltage switchgear market remains positive, fueled by continued infrastructure development, rising energy demands, and government initiatives promoting sustainable energy solutions. The market's diverse segmentation, coupled with the presence of established global and regional players, will create a competitive landscape fostering innovation and driving further growth.

South America Low Voltage Switchgear Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South America Low Voltage Switchgear Market, offering a comprehensive overview of market dynamics, growth drivers, challenges, and future opportunities. Covering the period from 2019 to 2033, with 2025 as the base year and forecast period extending to 2033, this report is an essential resource for stakeholders seeking to understand and capitalize on this evolving market. The market size is estimated to be xx Million in 2025.

South America Low Voltage Switchgear Market Composition & Trends

This section delves into the intricate structure of the South America Low Voltage Switchgear Market, examining its concentration, innovation drivers, regulatory environment, substitute products, and end-user profiles. We analyze mergers and acquisitions (M&A) activity, providing insights into market share distribution and deal values.

- Market Concentration: The market exhibits a moderately concentrated structure, with key players holding significant shares. Market share analysis reveals that the top five players account for approximately xx% of the overall market in 2025.

- Innovation Catalysts: Technological advancements, particularly in smart grid technologies and digitalization, are driving innovation within the low-voltage switchgear sector. The increasing adoption of IoT-enabled devices is shaping product development and improving operational efficiency.

- Regulatory Landscape: Government regulations focusing on grid modernization and energy efficiency are creating favorable conditions for market expansion. Stringent safety standards and environmental regulations also influence product design and manufacturing processes.

- Substitute Products: While direct substitutes are limited, alternative technologies such as solid-state circuit breakers are emerging, posing a potential challenge to traditional switchgear.

- End-User Profiles: The primary end-users are utilities, industrial facilities, commercial buildings, and residential sectors. The report provides a detailed breakdown of the market share held by each sector.

- M&A Activities: The past five years have witnessed xx M&A deals in the South American low-voltage switchgear market, with a total estimated value of xx Million. These deals have mainly focused on expanding market reach and enhancing technological capabilities.

South America Low Voltage Switchgear Market Industry Evolution

This section provides a deep dive into the evolutionary trajectory of the South American low-voltage switchgear market. We analyze market growth trajectories, technological advancements, and the changing demands of consumers. The historical period (2019-2024) reveals a Compound Annual Growth Rate (CAGR) of xx%, indicating robust market expansion. This growth is expected to continue during the forecast period (2025-2033) with a projected CAGR of xx%. The increased adoption of renewable energy sources, coupled with the modernization of aging infrastructure, is fueling this growth. Furthermore, evolving consumer preferences towards safer, more efficient, and environmentally friendly switchgear are driving demand for advanced technologies. The market is witnessing a significant shift towards digitally enabled switchgear, offering enhanced monitoring capabilities and predictive maintenance features. This adoption is driven by increased operational efficiency and reduced downtime, delivering significant cost savings for end-users. The integration of smart sensors and cloud-based platforms is accelerating this transformation, leading to the development of smarter, more responsive power distribution systems.

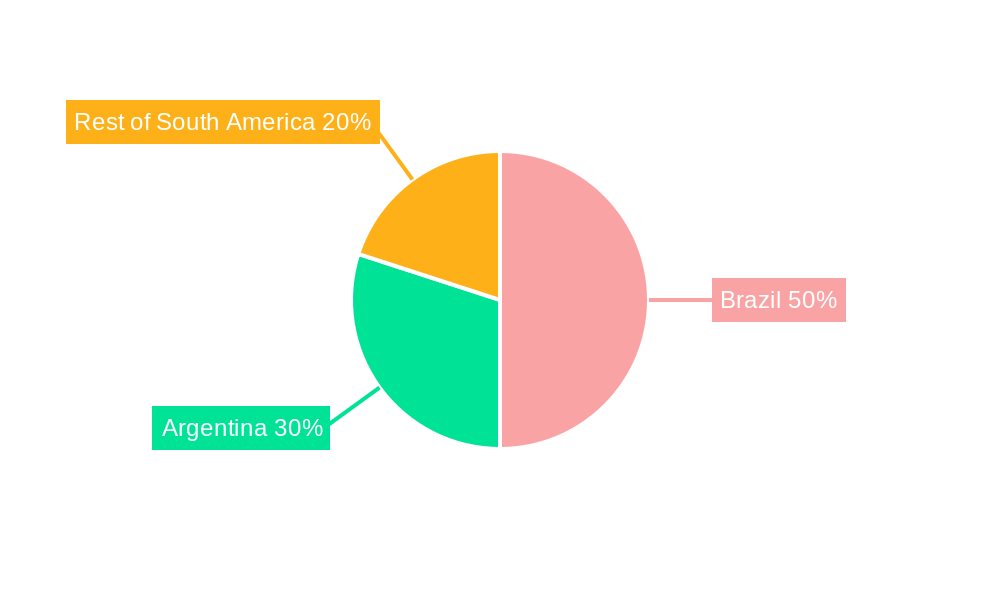

Leading Regions, Countries, or Segments in South America Low Voltage Switchgear Market

This section identifies the dominant regions, countries, and segments within the South American low-voltage switchgear market. Brazil holds the largest market share, driven by significant investments in infrastructure development and renewable energy projects.

- Dominant Region: Brazil

- Dominant Application: Utility and substation segments.

- Dominant Installation Type: Outdoor installations are more prevalent due to climate and landscape considerations.

- Dominant Voltage Rating: 250V - 750V segment represents a larger share of the market, catering to a wider range of applications.

Key Drivers:

- Significant government investments in infrastructure development projects like transmission lines and substations are boosting market growth.

- Stringent regulations mandating the use of modern and efficient switchgear in the renewable energy sector are shaping market dynamics.

- Increasing urbanization and industrialization lead to higher electricity demand, driving the need for upgraded power distribution networks.

Brazil's robust economic growth and extensive infrastructure development plans have created a substantial demand for low-voltage switchgear, particularly within the utility and industrial sectors. This dominance is expected to persist in the forecast period, propelled by ongoing investments in renewable energy sources and grid modernization initiatives.

South America Low Voltage Switchgear Market Product Innovations

Recent innovations in low-voltage switchgear include the integration of advanced sensors, improved arc flash protection systems, and the adoption of digital twin technology for enhanced monitoring and predictive maintenance. These advancements enhance safety, reliability, and efficiency, significantly improving the overall performance of power distribution systems. Unique selling propositions are centered around the improved safety features, longer lifespan, and reduced maintenance costs offered by these innovative products.

Propelling Factors for South America Low Voltage Switchgear Market Growth

Several factors are fueling the growth of the South America Low Voltage Switchgear Market. Increased investment in renewable energy projects, coupled with government initiatives aimed at improving power infrastructure, is driving demand for advanced switchgear solutions. Additionally, the increasing adoption of smart grid technologies and digitalization is further contributing to market expansion. Economic growth in several South American countries is generating demand for reliable and efficient power distribution, fueling this growth.

Obstacles in the South America Low Voltage Switchgear Market

Despite favorable market conditions, certain obstacles hinder growth. Supply chain disruptions due to global geopolitical uncertainties can impact the availability of raw materials and components, potentially leading to delays in project execution. Furthermore, competitive pressures from both domestic and international players create price competition, affecting overall profitability. Regulatory complexities and bureaucratic hurdles in some countries can also slow down the implementation of infrastructure projects. These obstacles can lead to a xx% reduction in market growth projections during certain periods.

Future Opportunities in South America Low Voltage Switchgear Market

The market presents significant opportunities for expansion. Emerging markets in smaller South American countries are ripe for development. The growing adoption of smart grid technologies and the integration of renewable energy sources present significant growth potentials. Increased focus on energy efficiency and safety regulations offers opportunities for innovative, high-performance switchgear solutions.

Major Players in the South America Low Voltage Switchgear Market Ecosystem

- Havells Group

- ABB Ltd

- Noja Power

- WEG Electric

- Siemens AG

- Schneider Electric

- Eaton Corporation Plc

- Toshiba Corp

- List Not Exhaustive

Key Developments in South America Low Voltage Switchgear Market Industry

- February 2023: Brazil's Mines and Energy Ministry (MME) recommended constructing an additional 6,000 km of transmission lines and eleven substations in Brazilian states such as Sao Paulo. This initiative significantly boosts the demand for low-voltage switchgear within Brazil's expanding power infrastructure.

- July 2022: Iberdrola's subsidiary Neoenergia secured a contract for one of thirteen power transmission projects offered by the Brazilian government. This project, involving a power transmission network between Minas Gerais and Sao Paulo states, and the construction of a 291km transmission line in Mato Grosso do Sul, represents a substantial injection of investment into the market and will drive demand for low-voltage switchgear for several years.

Strategic South America Low Voltage Switchgear Market Forecast

The South America Low Voltage Switchgear Market is poised for continued growth, driven by significant investments in infrastructure development, the increasing adoption of renewable energy sources, and government initiatives promoting grid modernization. The market’s strong fundamentals, coupled with ongoing technological advancements, indicate significant growth potential throughout the forecast period (2025-2033), with notable opportunities in emerging markets and the expanding renewable energy sector. This presents lucrative opportunities for both established players and new entrants to capture market share and contribute to the region's energy transition.

South America Low Voltage Switchgear Market Segmentation

-

1. Application

- 1.1. Substation

- 1.2. Distribution

- 1.3. Utility

-

2. Installation

- 2.1. Outdoor

- 2.2. Indoor

-

3. Voltage Rating

- 3.1. Less Than 250 V

- 3.2. 250 V - 750 V

- 3.3. 750 V - 1000 V

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Chile

- 4.4. Rest of South America

South America Low Voltage Switchgear Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Chile

- 4. Rest of South America

South America Low Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Several Government Plans for the Energy Transition in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Self-generated Renewable Power in the Residential and Commercial Sectors

- 3.4. Market Trends

- 3.4.1. Distribution Segments to dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Substation

- 5.1.2. Distribution

- 5.1.3. Utility

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Outdoor

- 5.2.2. Indoor

- 5.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 5.3.1. Less Than 250 V

- 5.3.2. 250 V - 750 V

- 5.3.3. 750 V - 1000 V

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Chile

- 5.4.4. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Chile

- 5.5.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Brazil South America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Substation

- 6.1.2. Distribution

- 6.1.3. Utility

- 6.2. Market Analysis, Insights and Forecast - by Installation

- 6.2.1. Outdoor

- 6.2.2. Indoor

- 6.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 6.3.1. Less Than 250 V

- 6.3.2. 250 V - 750 V

- 6.3.3. 750 V - 1000 V

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Chile

- 6.4.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Argentina South America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Substation

- 7.1.2. Distribution

- 7.1.3. Utility

- 7.2. Market Analysis, Insights and Forecast - by Installation

- 7.2.1. Outdoor

- 7.2.2. Indoor

- 7.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 7.3.1. Less Than 250 V

- 7.3.2. 250 V - 750 V

- 7.3.3. 750 V - 1000 V

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Chile

- 7.4.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Chile South America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Substation

- 8.1.2. Distribution

- 8.1.3. Utility

- 8.2. Market Analysis, Insights and Forecast - by Installation

- 8.2.1. Outdoor

- 8.2.2. Indoor

- 8.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 8.3.1. Less Than 250 V

- 8.3.2. 250 V - 750 V

- 8.3.3. 750 V - 1000 V

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Chile

- 8.4.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of South America South America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Substation

- 9.1.2. Distribution

- 9.1.3. Utility

- 9.2. Market Analysis, Insights and Forecast - by Installation

- 9.2.1. Outdoor

- 9.2.2. Indoor

- 9.3. Market Analysis, Insights and Forecast - by Voltage Rating

- 9.3.1. Less Than 250 V

- 9.3.2. 250 V - 750 V

- 9.3.3. 750 V - 1000 V

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Argentina

- 9.4.3. Chile

- 9.4.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Brazil South America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America Low Voltage Switchgear Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Havells Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Noja Power

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 WEG Electric

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Siemens AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Schneider Electric

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Eaton Corporation Plc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Toshiba Corp *List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Havells Group

List of Figures

- Figure 1: South America Low Voltage Switchgear Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Low Voltage Switchgear Market Share (%) by Company 2024

List of Tables

- Table 1: South America Low Voltage Switchgear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Low Voltage Switchgear Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: South America Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: South America Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2019 & 2032

- Table 5: South America Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: South America Low Voltage Switchgear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: South America Low Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil South America Low Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina South America Low Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of South America South America Low Voltage Switchgear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South America Low Voltage Switchgear Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South America Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 13: South America Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2019 & 2032

- Table 14: South America Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: South America Low Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South America Low Voltage Switchgear Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: South America Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 18: South America Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2019 & 2032

- Table 19: South America Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Low Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: South America Low Voltage Switchgear Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: South America Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 23: South America Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2019 & 2032

- Table 24: South America Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: South America Low Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Low Voltage Switchgear Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: South America Low Voltage Switchgear Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 28: South America Low Voltage Switchgear Market Revenue Million Forecast, by Voltage Rating 2019 & 2032

- Table 29: South America Low Voltage Switchgear Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: South America Low Voltage Switchgear Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Low Voltage Switchgear Market ?

The projected CAGR is approximately 8.19%.

2. Which companies are prominent players in the South America Low Voltage Switchgear Market ?

Key companies in the market include Havells Group, ABB Ltd, Noja Power, WEG Electric, Siemens AG, Schneider Electric, Eaton Corporation Plc, Toshiba Corp *List Not Exhaustive.

3. What are the main segments of the South America Low Voltage Switchgear Market ?

The market segments include Application, Installation, Voltage Rating, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.50 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Several Government Plans for the Energy Transition in the Region.

6. What are the notable trends driving market growth?

Distribution Segments to dominate the market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Self-generated Renewable Power in the Residential and Commercial Sectors.

8. Can you provide examples of recent developments in the market?

February 2023: Brazil's Mines and Energy Ministry (MME) recommended constructing an additional 6,000 km of transmission lines and eleven substations in Brazilian states such as Sao Pau

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Low Voltage Switchgear Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Low Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Low Voltage Switchgear Market ?

To stay informed about further developments, trends, and reports in the South America Low Voltage Switchgear Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence