Key Insights

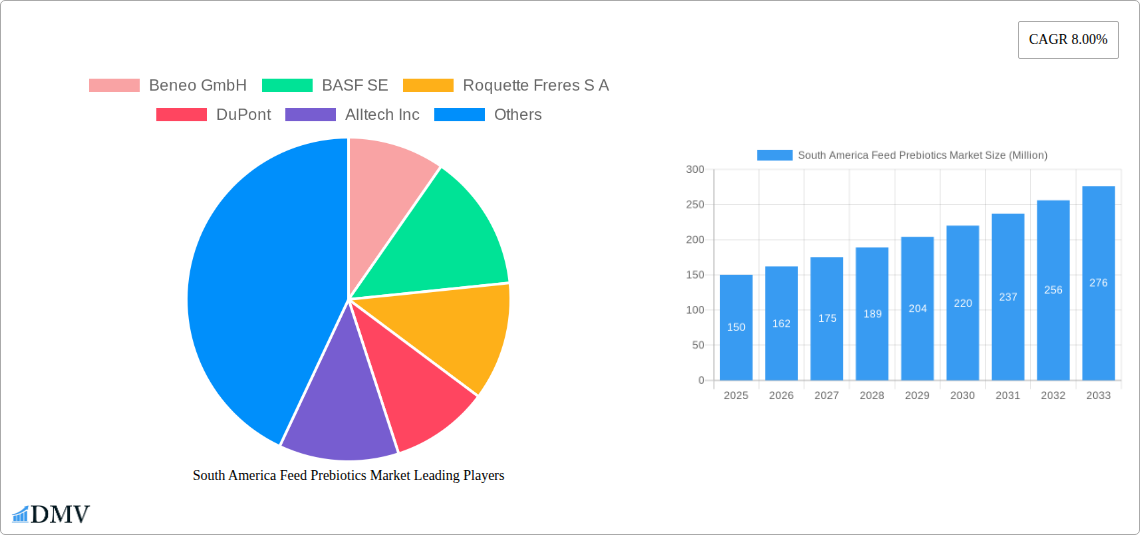

The South American feed prebiotics market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing demand for animal feed additives that enhance gut health, immunity, and overall animal productivity. The rising adoption of sustainable farming practices and the growing awareness of the benefits of prebiotics in improving animal feed efficiency are major catalysts. Within South America, Brazil and Argentina represent significant market segments, fueled by their substantial livestock populations and expanding aquaculture industries. The market's segmentation reveals a strong preference for prebiotics in ruminant and poultry feed, reflecting the dominant role these animal types play in the region's agricultural landscape. Inulin and fructo-oligosaccharides (FOS) are likely to be the most prominent types of prebiotics used, given their established efficacy and widespread availability. Competition among major players like Beneo GmbH, BASF SE, and Roquette Freres S A is expected to be intense, with companies focusing on product innovation and strategic partnerships to gain market share. Challenges such as price fluctuations in raw materials and the need for greater awareness among smaller farms could moderate growth.

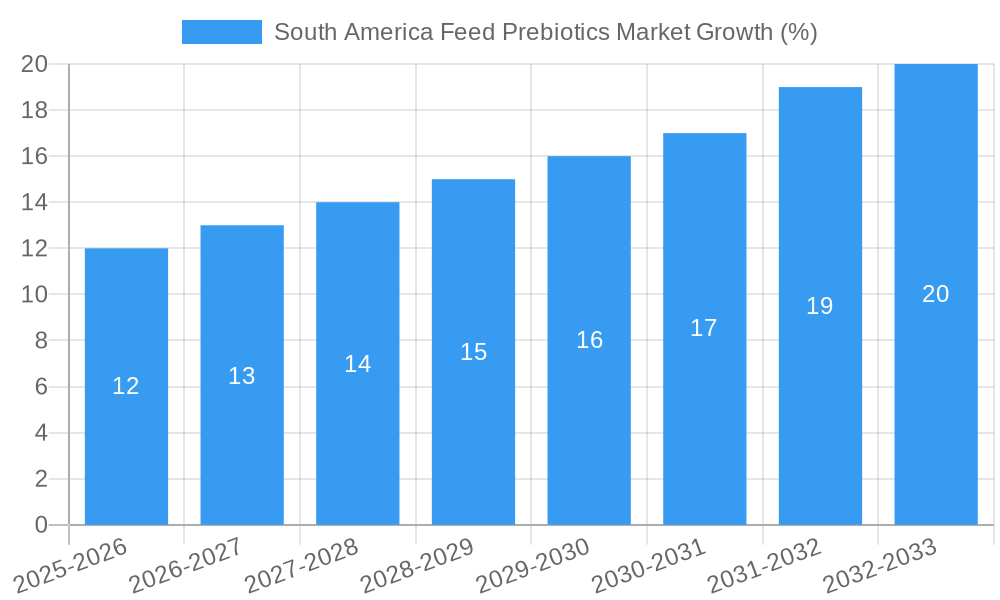

The forecast period (2025-2033) anticipates a consistent CAGR of 8.00%, indicating a substantial market expansion. This growth will be fueled by continuous advancements in prebiotic research leading to more effective and targeted products, coupled with increasing governmental support for sustainable agricultural practices in the region. Furthermore, the burgeoning middle class in South America is likely to increase the demand for high-quality animal protein, ultimately stimulating demand for feed prebiotics that enhance animal health and productivity. However, regulatory hurdles and potential economic fluctuations in certain South American countries could impact the market's trajectory. The “Other Animal Types” segment, which could encompass pets and other livestock, is likely to experience moderate growth, influenced by rising pet ownership and diversification of livestock farming.

South America Feed Prebiotics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South America Feed Prebiotics Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this research unveils crucial market dynamics, trends, and opportunities for stakeholders across the feed and animal nutrition industries. The market is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

South America Feed Prebiotics Market Composition & Trends

This section delves into the intricate structure of the South America Feed Prebiotics market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and M&A activities. We examine the market share distribution among key players, revealing the competitive landscape. The report also quantifies the value of significant M&A deals impacting the market during the historical period (2019-2024). For example, the xx% market share held by the top three players highlights the existing oligopolistic nature. Innovation in prebiotic formulations, driven by advancements in fermentation technologies and understanding of gut microbiome, is a key trend. Regulatory frameworks concerning feed additives and animal health influence market growth significantly. The presence of substitute products like antibiotics (though facing declining usage) presents competitive challenges. The report profiles end-users, focusing on their specific needs and purchasing behavior across different animal types. Finally, it details the impact of M&A activity on market consolidation and technological advancement, including deal values where available.

- Market Concentration: High, with top 3 players controlling xx% of the market in 2024.

- Innovation Catalysts: Advancements in fermentation technology and microbiome research.

- Regulatory Landscape: Varying regulations across South American countries impacting market access.

- Substitute Products: Antibiotics, probiotics.

- End-User Profiles: Detailed analysis of needs and purchasing behavior across different animal types (ruminants, poultry, swine, aquaculture).

- M&A Activity: xx number of deals valued at approximately xx Million during 2019-2024.

South America Feed Prebiotics Market Industry Evolution

This section traces the evolution of the South America Feed Prebiotics market from 2019 to 2024, examining growth trajectories, technological advancements, and shifts in consumer demands (specifically within the animal feed industry). The analysis explores the historical growth rate, pinpointing key inflection points and correlating them with technological innovations and changes in animal farming practices. The increasing awareness of animal gut health and the benefits of prebiotics as a sustainable alternative to antibiotics are key drivers. This section provides specific data points illustrating the adoption of various prebiotic types across different animal segments, revealing market preferences and trends impacting market growth. Factors such as increasing consumer demand for antibiotic-free animal products and the growing focus on sustainable animal agriculture are meticulously analyzed and correlated with market expansion. The impact of government initiatives promoting animal welfare and sustainable farming practices is also explored.

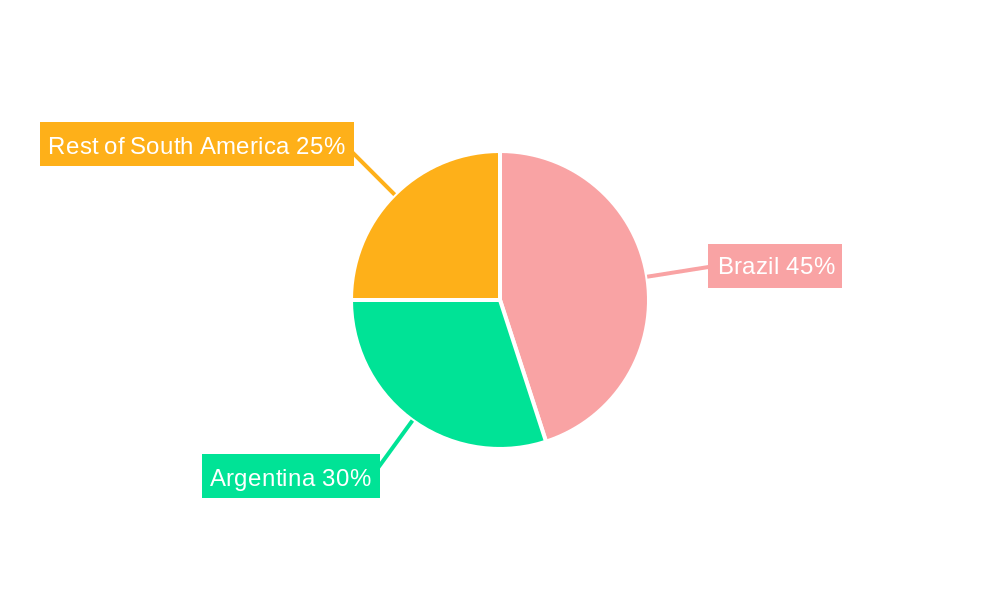

Leading Regions, Countries, or Segments in South America Feed Prebiotics Market

This section identifies the dominant regions, countries, and segments within the South American Feed Prebiotics market. Based on our analysis, Brazil emerges as the leading market, driven by its robust poultry and swine industries.

Dominant Segment: Poultry segment leads in terms of prebiotic consumption, followed by swine.

- Key Drivers for Brazil's Dominance:

- Large poultry and swine populations.

- Government support for sustainable agricultural practices.

- Significant investments in feed technology and innovation.

- Key Drivers for Poultry Segment Dominance:

- High demand for efficient poultry production.

- Focus on improving gut health and feed efficiency.

- Growing consumer demand for antibiotic-free poultry.

Other Significant Segments: Swine, ruminants, and aquaculture show promising growth potential, driven by factors like increasing awareness of animal health and sustainability concerns. In terms of prebiotic types, fructo-oligosaccharides (FOS) and inulin currently hold the largest market shares due to their cost-effectiveness and proven benefits.

South America Feed Prebiotics Market Product Innovations

Recent product innovations focus on enhanced prebiotic formulations with improved efficacy and targeted applications for specific animal species. This includes the development of prebiotic blends tailored to specific gut microbiomes and the incorporation of advanced delivery systems for improved nutrient bioavailability. These innovations enhance product performance metrics such as feed conversion ratio, animal growth rate, and disease resistance. Unique selling propositions center around superior efficacy, targeted species application, and sustainable production methods.

Propelling Factors for South America Feed Prebiotics Market Growth

Several factors are propelling the growth of the South America Feed Prebiotics Market. The increasing awareness of animal gut health and its impact on overall animal well-being is a primary driver. The growing consumer demand for antibiotic-free meat and poultry products is significantly boosting the adoption of prebiotics as sustainable alternatives. Furthermore, government initiatives promoting sustainable agricultural practices and advancements in prebiotic production technologies are accelerating market expansion.

Obstacles in the South America Feed Prebiotics Market

Despite significant growth potential, the South America Feed Prebiotics Market faces several challenges. Regulatory hurdles related to feed additive approvals and varying standards across different countries create complexity for market entry. Supply chain disruptions due to logistical constraints and raw material price fluctuations can affect product availability and costs. Furthermore, intense competition from existing players and the emergence of new entrants add pressure on pricing and profitability.

Future Opportunities in South America Feed Prebiotics Market

The South America Feed Prebiotics Market presents exciting opportunities for expansion. Untapped potential exists in emerging markets within the region. Advancements in prebiotic technology, such as the development of novel prebiotics and personalized prebiotic blends, will drive further growth. Furthermore, the increasing consumer demand for sustainable and ethical animal products creates a favorable environment for the adoption of prebiotics as a key component of animal feed.

Major Players in the South America Feed Prebiotics Market Ecosystem

- Beneo GmbH

- BASF SE

- Roquette Freres S A

- DuPont

- Alltech Inc

- Cosucra Groupe Warcoing SA

- Cargill Inc

- Tereos

- Adisseo

Key Developments in South America Feed Prebiotics Market Industry

- 2022 Q4: Launch of a new inulin-based prebiotic product by Roquette for poultry feed in Brazil.

- 2023 Q1: Acquisition of a small prebiotic producer in Argentina by Cargill.

- 2023 Q3: Regulatory approval for a novel prebiotic in Chile. (Further developments to be added based on available data)

Strategic South America Feed Prebiotics Market Forecast

The South America Feed Prebiotics market is poised for continued robust growth, driven by increasing consumer demand for high-quality animal products, advancements in prebiotic technology, and favorable regulatory changes. The expanding poultry and swine sectors will be key growth drivers. Further penetration into less developed markets, coupled with innovations in prebiotic formulations, will unlock significant market potential throughout the forecast period (2025-2033). The market is expected to witness further consolidation with potential mergers and acquisitions among key players.

South America Feed Prebiotics Market Segmentation

-

1. Type

- 1.1. Inulin

- 1.2. Fructo-Oligosaccharides

- 1.3. Galacto-Oligosaccharides

- 1.4. Other Types

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Animal Types

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Feed Prebiotics Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Prebiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Fish Consumption; Rise in Export-oriented Aquaculture

- 3.3. Market Restrains

- 3.3.1. Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets

- 3.4. Market Trends

- 3.4.1. Rising Feed production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Prebiotics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inulin

- 5.1.2. Fructo-Oligosaccharides

- 5.1.3. Galacto-Oligosaccharides

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Feed Prebiotics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inulin

- 6.1.2. Fructo-Oligosaccharides

- 6.1.3. Galacto-Oligosaccharides

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Feed Prebiotics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inulin

- 7.1.2. Fructo-Oligosaccharides

- 7.1.3. Galacto-Oligosaccharides

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Feed Prebiotics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inulin

- 8.1.2. Fructo-Oligosaccharides

- 8.1.3. Galacto-Oligosaccharides

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South America Feed Prebiotics Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Feed Prebiotics Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Feed Prebiotics Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Beneo GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 BASF SE

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Roquette Freres S A

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DuPont

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Alltech Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Cosucra Groupe Warcoing SA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cargill Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Tereos

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Adisseo

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Beneo GmbH

List of Figures

- Figure 1: South America Feed Prebiotics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Feed Prebiotics Market Share (%) by Company 2024

List of Tables

- Table 1: South America Feed Prebiotics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Feed Prebiotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Feed Prebiotics Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 4: South America Feed Prebiotics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Feed Prebiotics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Feed Prebiotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Feed Prebiotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Feed Prebiotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Feed Prebiotics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Feed Prebiotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Feed Prebiotics Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 12: South America Feed Prebiotics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Feed Prebiotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Feed Prebiotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Feed Prebiotics Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 16: South America Feed Prebiotics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Feed Prebiotics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Feed Prebiotics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Feed Prebiotics Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 20: South America Feed Prebiotics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Feed Prebiotics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Prebiotics Market?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the South America Feed Prebiotics Market?

Key companies in the market include Beneo GmbH, BASF SE, Roquette Freres S A, DuPont, Alltech Inc, Cosucra Groupe Warcoing SA, Cargill Inc, Tereos, Adisseo.

3. What are the main segments of the South America Feed Prebiotics Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Fish Consumption; Rise in Export-oriented Aquaculture.

6. What are the notable trends driving market growth?

Rising Feed production Drives the Market.

7. Are there any restraints impacting market growth?

Fluctuating Global Prices of Raw Materials; Increasing Disease Epidemics in Major Markets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Prebiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Prebiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Prebiotics Market?

To stay informed about further developments, trends, and reports in the South America Feed Prebiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence