Key Insights

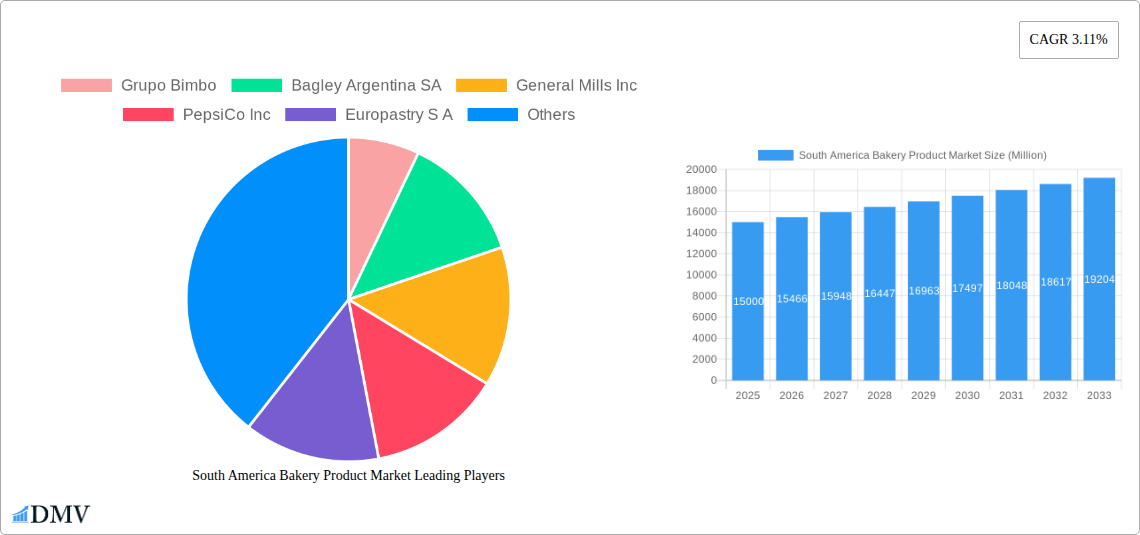

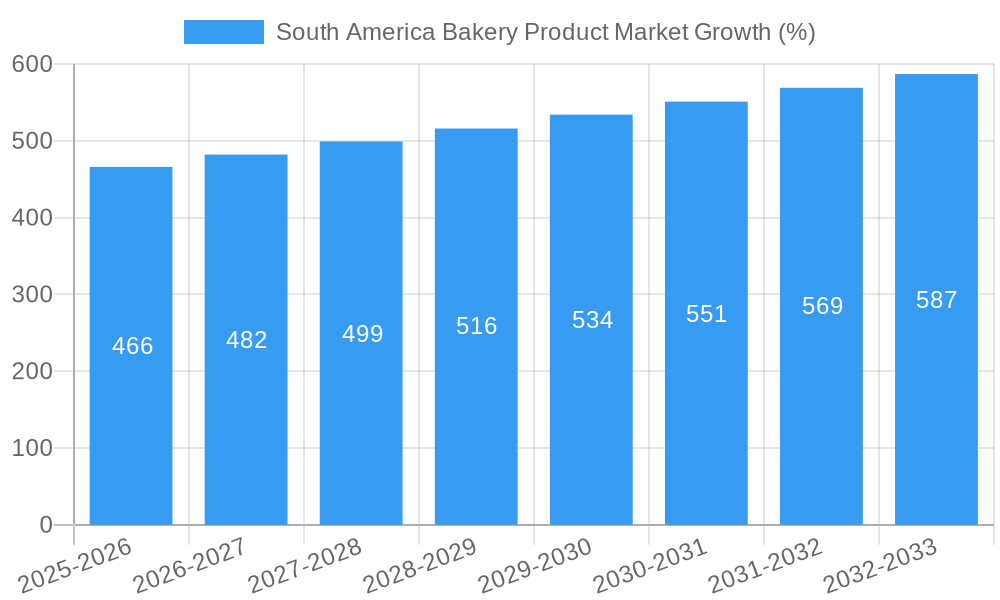

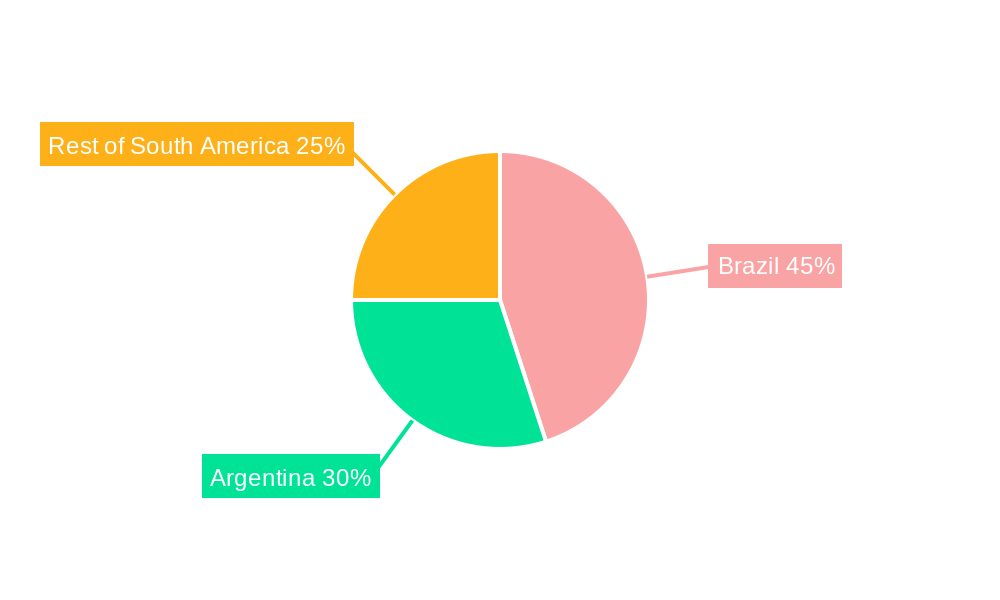

The South American bakery product market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for convenient and ready-to-eat food options. The market's Compound Annual Growth Rate (CAGR) of 3.11% from 2019 to 2024 indicates a consistent trajectory, expected to continue through 2033. Key product segments include cakes and pastries, biscuits and cookies, bread, and morning goods, with cakes and pastries likely holding the largest market share due to strong consumer demand for indulgent treats. Brazil and Argentina are the leading markets within South America, contributing significantly to the overall regional market size. The distribution landscape is diversified, encompassing supermarkets/hypermarkets, convenience stores, specialist bakeries, and a rapidly expanding online retail segment, which is expected to be a significant driver of future growth. While challenges such as fluctuating raw material prices and intense competition among established players like Grupo Bimbo, Mondelez International, and Bagley Argentina SA exist, the market’s inherent resilience and ongoing consumer preference for bakery items suggest sustained expansion in the forecast period.

The growth trajectory is expected to be influenced by several factors. The increasing popularity of healthier bakery options, such as whole-wheat bread and low-sugar pastries, presents significant opportunities for manufacturers. Innovation in product offerings, such as artisan breads and customized cakes, caters to evolving consumer preferences. Furthermore, strategic partnerships and acquisitions among key players are expected to reshape the market dynamics. While economic fluctuations in specific South American countries might pose temporary challenges, the overall long-term outlook remains positive, fueled by a burgeoning middle class and rising demand for convenient food solutions across diverse demographics. The market segmentation by product type and distribution channel offers valuable insights for strategic planning and investment decisions within the industry.

South America Bakery Product Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South America bakery product market, offering invaluable insights for stakeholders seeking to navigate this dynamic industry. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive landscapes, and future growth potential. The market is estimated to be valued at xx Million in 2025, demonstrating significant growth opportunities.

South America Bakery Product Market Composition & Trends

This section delves into the intricate structure of the South America bakery product market, examining key aspects influencing its trajectory. We analyze market concentration, revealing the market share distribution among leading players like Grupo Bimbo, Bagley Argentina SA, and Mondelez International. The report also explores the innovative forces driving product diversification, the evolving regulatory landscape impacting operations, and the presence of substitute products challenging market dominance. Furthermore, we assess the profiles of end-users, their evolving preferences, and the impact of mergers and acquisitions (M&A) activities. Significant M&A deals, valued at an estimated xx Million in the historical period, have reshaped the competitive landscape. The analysis includes:

- Market Concentration: A detailed breakdown of market share held by top players, illustrating the level of competition and dominance.

- Innovation Catalysts: An in-depth examination of technological advancements, consumer preferences, and regulatory influences driving innovation within the sector.

- Regulatory Landscape: Analysis of key regulations and their impact on market operations, including labeling requirements, food safety standards, and import/export regulations.

- Substitute Products: Identification of substitute products and their potential impact on market growth.

- End-User Profiles: A segmentation of end-users based on demographics, purchasing behavior, and consumption patterns.

- M&A Activities: A comprehensive overview of recent M&A activity, including deal values and their impact on market dynamics.

South America Bakery Product Market Industry Evolution

This section provides a comprehensive analysis of the South America bakery product market's evolution from 2019 to 2033. We examine market growth trajectories, detailing compound annual growth rates (CAGR) for each segment throughout the historical (2019-2024) and forecast (2025-2033) periods. We showcase technological advancements, such as automated production lines and improved packaging technologies, and their impact on efficiency and product quality. Furthermore, the report investigates shifting consumer demands, focusing on the increasing preference for healthier and more convenient options, the impact of changing lifestyles, and the growing influence of online retail channels. Specific data points regarding adoption rates of new technologies and changes in consumer preferences are included to illustrate the market's dynamic nature. The estimated CAGR for the forecast period is xx%.

Leading Regions, Countries, or Segments in South America Bakery Product Market

This section identifies the dominant regions, countries, and product segments within the South America bakery product market. We analyze factors contributing to the dominance of specific segments by Product Type (Cakes and Pastries, Biscuits & Cookies, Bread, Morning Goods, Pizza Crust, Others) and by Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retailers, Others).

By Product Type:

- Biscuits & Cookies: High demand driven by affordability and convenience, strong growth in xx and yy countries.

- Bread: Essential staple food with consistent demand across all regions. Growth driven by increased urbanization.

- Cakes & Pastries: Growing demand driven by special occasions and changing consumer preferences. High growth potential in xx.

By Distribution Channel:

- Supermarkets/Hypermarkets: Dominant channel, benefiting from broad reach and established infrastructure.

- Online Retailers: Rapid growth fueled by e-commerce adoption, particularly in urban areas.

Key Drivers:

- Significant investments in modernizing bakery infrastructure.

- Government support for small and medium-sized enterprises (SMEs) within the bakery sector.

- Growth of organized retail channels.

South America Bakery Product Market Product Innovations

Recent innovations in the South America bakery product market include the introduction of healthier options, such as whole-grain breads and low-sugar pastries. Manufacturers are also focusing on enhancing convenience with pre-portioned snacks and ready-to-bake products. Technological advancements such as improved automation and packaging technologies increase production efficiency and shelf life, leading to improved quality and reduced waste. Unique selling propositions emphasize fresh ingredients, locally sourced products, and ethical sourcing practices, catering to the evolving consumer preferences.

Propelling Factors for South America Bakery Product Market Growth

Several factors contribute to the South America bakery product market's growth. Rising disposable incomes coupled with changing lifestyles are driving increased demand for convenient and ready-to-eat food options. The burgeoning middle class fuels higher consumption of bakery products, particularly in urban areas. Government initiatives supporting small and medium-sized bakery businesses also contribute to market expansion. The adoption of advanced technologies further boosts efficiency and production capacity, pushing market growth.

Obstacles in the South America Bakery Product Market

Challenges in the South America bakery product market include fluctuations in raw material prices, particularly wheat and sugar, impacting production costs and profitability. Supply chain disruptions, particularly during periods of economic uncertainty, can also significantly impact market operations. Intense competition among established players and new entrants creates pressure on pricing and profitability. Furthermore, stringent food safety regulations and import/export procedures can create barriers to entry for new businesses. These obstacles are estimated to negatively impact the market growth by approximately xx% in the forecast period.

Future Opportunities in South America Bakery Product Market

The South America bakery product market presents promising future opportunities. Growing demand for healthier products creates openings for innovative offerings like organic and gluten-free options. The expansion of e-commerce platforms offers significant potential for online sales, reaching wider customer bases. The rising interest in artisanal and gourmet bakery products presents opportunities for niche players. Further growth is expected through market penetration in underserved rural areas.

Major Players in the South America Bakery Product Market Ecosystem

- Grupo Bimbo

- Bagley Argentina SA

- General Mills Inc

- PepsiCo Inc

- Europastry S A

- Associated British Foods PLC

- La Casa Alfajores

- Bakers Delight Holdings Limited

- Wickbold

- Mondelez International

Key Developments in South America Bakery Product Market Industry

- 2022-Q4: Grupo Bimbo launches a new line of gluten-free bread in Brazil.

- 2023-Q1: Bagley Argentina SA invests in a new automated production facility in Argentina.

- 2023-Q2: Mondelez International expands its distribution network in Colombia. (Further developments to be added)

Strategic South America Bakery Product Market Forecast

The South America bakery product market is poised for continued growth driven by rising disposable incomes, changing consumer preferences, and technological advancements. The increasing demand for convenience and health-conscious products will fuel innovation and expansion. The forecast period anticipates strong growth, particularly within the online retail channel and in emerging product categories. The market’s future trajectory is optimistic, with significant potential for both established players and new entrants.

South America Bakery Product Market Segmentation

-

1. Product Type

- 1.1. Cakes and Pastries

- 1.2. Biscuits & Cookies

- 1.3. Bread

- 1.4. Morning Goods

- 1.5. Pizza Crust

- 1.6. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retailers

- 2.5. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Bakery Product Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Bakery Product Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. Demand for Convenience Food Products Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Bakery Product Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cakes and Pastries

- 5.1.2. Biscuits & Cookies

- 5.1.3. Bread

- 5.1.4. Morning Goods

- 5.1.5. Pizza Crust

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retailers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Bakery Product Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cakes and Pastries

- 6.1.2. Biscuits & Cookies

- 6.1.3. Bread

- 6.1.4. Morning Goods

- 6.1.5. Pizza Crust

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Stores

- 6.2.4. Online Retailers

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Bakery Product Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cakes and Pastries

- 7.1.2. Biscuits & Cookies

- 7.1.3. Bread

- 7.1.4. Morning Goods

- 7.1.5. Pizza Crust

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Stores

- 7.2.4. Online Retailers

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Bakery Product Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cakes and Pastries

- 8.1.2. Biscuits & Cookies

- 8.1.3. Bread

- 8.1.4. Morning Goods

- 8.1.5. Pizza Crust

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Stores

- 8.2.4. Online Retailers

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Brazil South America Bakery Product Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Bakery Product Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Bakery Product Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Grupo Bimbo

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bagley Argentina SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 General Mills Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 PepsiCo Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Europastry S A

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Associated British Foods PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 La Casa Alfajores

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Bakers Delight Holdings Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Wickbold

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Group Bimbo*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Mondelez International

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Grupo Bimbo

List of Figures

- Figure 1: South America Bakery Product Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Bakery Product Market Share (%) by Company 2024

List of Tables

- Table 1: South America Bakery Product Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Bakery Product Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South America Bakery Product Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South America Bakery Product Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Bakery Product Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Bakery Product Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Bakery Product Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Bakery Product Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Bakery Product Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Bakery Product Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: South America Bakery Product Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: South America Bakery Product Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Bakery Product Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Bakery Product Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: South America Bakery Product Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: South America Bakery Product Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Bakery Product Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Bakery Product Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: South America Bakery Product Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: South America Bakery Product Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Bakery Product Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Bakery Product Market?

The projected CAGR is approximately 3.11%.

2. Which companies are prominent players in the South America Bakery Product Market?

Key companies in the market include Grupo Bimbo, Bagley Argentina SA, General Mills Inc, PepsiCo Inc, Europastry S A, Associated British Foods PLC, La Casa Alfajores, Bakers Delight Holdings Limited, Wickbold, Group Bimbo*List Not Exhaustive, Mondelez International.

3. What are the main segments of the South America Bakery Product Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

Demand for Convenience Food Products Drives the Market.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Bakery Product Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Bakery Product Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Bakery Product Market?

To stay informed about further developments, trends, and reports in the South America Bakery Product Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence