Key Insights

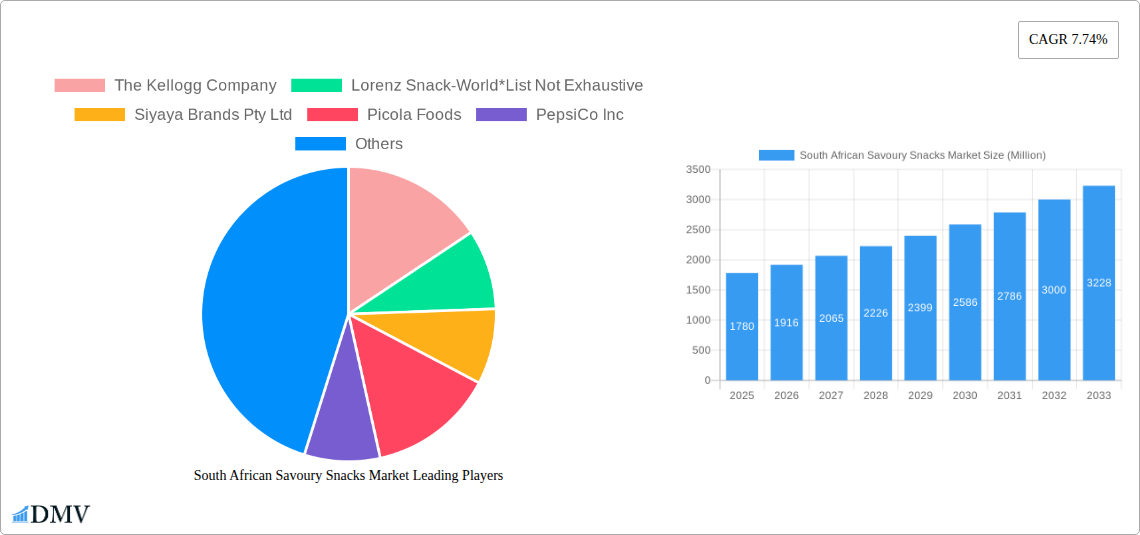

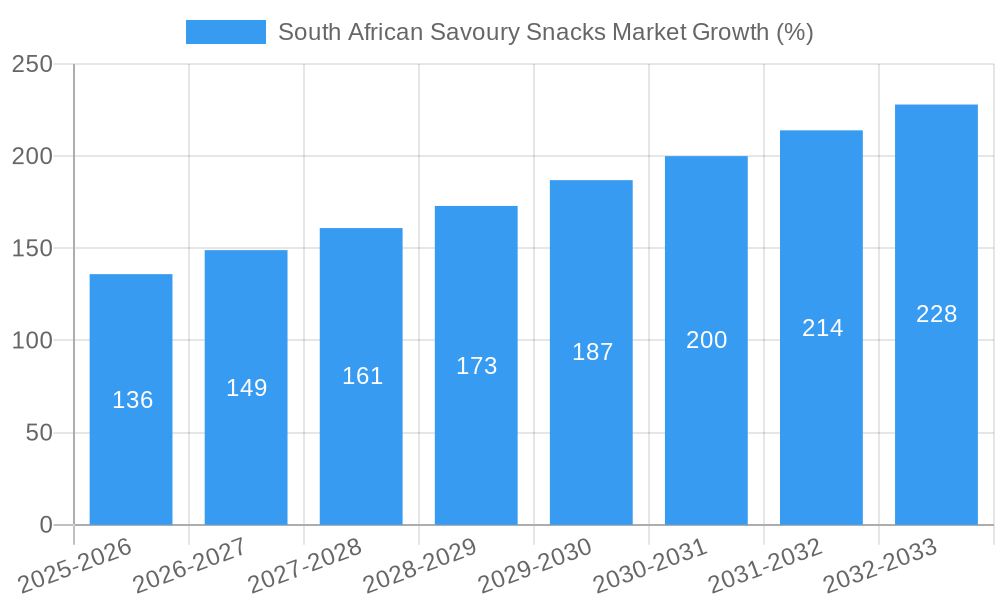

The South African savoury snacks market, valued at $1.78 billion in 2025, is projected to experience robust growth, driven by increasing disposable incomes, a young and growing population with a preference for convenient and on-the-go foods, and the rising popularity of healthier snack options. The market's Compound Annual Growth Rate (CAGR) of 7.74% from 2025 to 2033 indicates significant expansion potential. Key segments driving this growth include potato chips, which consistently hold a dominant market share due to their widespread appeal and affordability. Extruded snacks and meat snacks are also experiencing notable growth, fueled by innovation in flavors and textures, catering to evolving consumer preferences. The supermarket/hypermarket distribution channel remains the most significant, although online retail is experiencing rapid expansion, reflecting broader e-commerce growth trends within the country. Competitive dynamics are shaped by both established multinational corporations like PepsiCo and Kellogg's, and a growing number of local players catering to specific regional tastes and preferences. Challenges include fluctuating raw material prices, particularly for imported ingredients, and increasing health consciousness leading to demand for healthier, lower-sodium, and organic options. The market is likely to witness further consolidation as larger players seek to expand their market share through acquisitions and product diversification.

Looking ahead, the South African savoury snacks market is expected to see continued innovation, with an emphasis on healthier and more diverse product offerings. This will include increased focus on natural ingredients, reduced sugar and salt content, and the introduction of new and exciting flavor profiles. The growing middle class will further fuel market growth, alongside increased urbanization and a rise in snack consumption occasions outside the home. Successful players will need to adapt to changing consumer preferences, leverage e-commerce channels effectively, and manage supply chain costs to maintain profitability amidst fluctuating raw material prices. Expansion into underserved rural markets presents significant opportunity for growth, particularly for local brands capable of adapting their product offerings and distribution networks to meet the specific needs of these regions.

South African Savoury Snacks Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the South African savoury snacks market, offering a comprehensive overview of market dynamics, key players, and future growth projections. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033.

South African Savoury Snacks Market Composition & Trends

This section delves into the competitive landscape of the South African savoury snacks market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, consumer profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with key players such as The Kellogg Company and PepsiCo Inc. holding significant market share. However, smaller, local brands also contribute substantially, reflecting a diverse market landscape.

- Market Share Distribution (2024): The Kellogg Company (xx%), PepsiCo Inc. (xx%), AVI Limited (xx%), Lorenz Snack-World (xx%), Others (xx%). These figures are estimates based on available data.

- Innovation Catalysts: Growing consumer demand for healthier options and innovative flavors drives product diversification and improved nutritional profiles.

- Regulatory Landscape: Regulations concerning food safety, labeling, and advertising significantly influence market practices. Specific details on regulations are covered in the full report.

- Substitute Products: The market faces competition from other snack categories, including sweet snacks and fresh produce, influencing consumer choices.

- End-User Profiles: The target market is broad, ranging from children and young adults to families and older adults, with differing preferences impacting product development.

- M&A Activities (2019-2024): While specific deal values are not publicly available for all transactions, a notable increase in M&A activity was observed in the past five years with a total estimated value exceeding xx Million. This is a conservative estimate. The report provides a more detailed breakdown of M&A activity in the full report.

South African Savoury Snacks Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the South African savoury snacks market. The market has experienced steady growth over the past five years (2019-2024), driven by increasing disposable incomes, urbanization, and changing lifestyles. Technological advancements in processing, packaging, and distribution have further enhanced market expansion. Shifting consumer preferences towards healthier, more convenient, and ethically sourced snacks create ongoing opportunities.

The market witnessed an average annual growth rate (CAGR) of xx% between 2019 and 2024. We project a CAGR of xx% during the forecast period (2025-2033), indicating sustained market expansion. The adoption rate of innovative packaging technologies, such as recyclable materials and modified atmosphere packaging (MAP), is increasing steadily, with xx% of major players adopting these technologies by 2024. Changing consumer demands and the preference for healthier options continue to contribute to this growth.

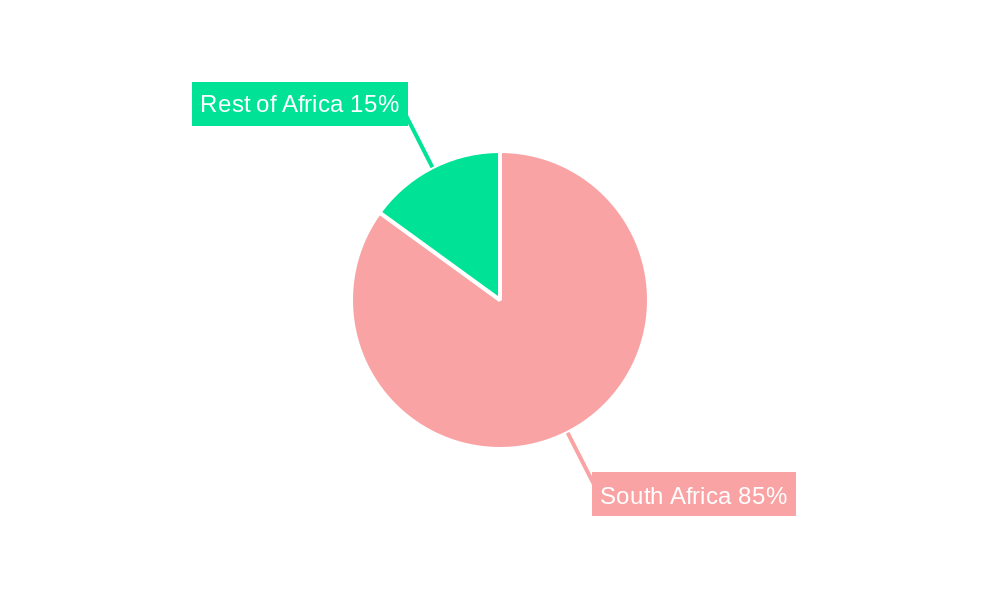

Leading Regions, Countries, or Segments in South African Savoury Snacks Market

This section highlights the dominant segments and regions within the South African savoury snacks market. While national-level data is more readily available, regional variations exist in consumption patterns.

By Product Type:

- Potato Chips: Remains the dominant segment due to its affordability and widespread popularity.

- Extruded Snacks: Growing steadily, driven by the introduction of new flavors and healthier options.

- Other Product Types: This category encompasses a diverse range of products, showing potential for future growth.

By Distribution Channel:

- Supermarkets/Hypermarkets: This channel dominates due to its wide reach and established distribution networks.

- Convenience Stores: Offers significant opportunities for impulse purchases, particularly for smaller snack packs.

- Online Retail Stores: Shows increasing potential, with growth expected due to increased online shopping.

Key Drivers:

- Investment Trends: Significant investments in production capacity expansion and technological upgrades drive market growth.

- Regulatory Support: Food safety regulations and quality standards are crucial for market stability and consumer confidence.

South African Savoury Snacks Market Product Innovations

The South African savoury snacks market is witnessing significant product innovation, driven by the rising demand for healthier options and unique flavor profiles. Companies are launching products with reduced fat, sodium, and sugar content. Simultaneously, innovative flavor combinations and the incorporation of locally sourced ingredients are becoming increasingly prevalent, catering to the diverse preferences of South African consumers. The use of sustainable packaging materials is also gaining traction, reflecting growing environmental consciousness among consumers and brands.

Propelling Factors for South African Savoury Snacks Market Growth

Several factors fuel the growth of the South African savoury snacks market. These include rising disposable incomes, leading to increased spending on discretionary items like snacks. The growing urban population, with its busy lifestyles, favors convenience foods, making snacks a popular choice. Technological advancements in food processing and packaging enhance product quality and shelf life. Furthermore, favorable government policies that support the food processing industry are also contributing to growth.

Obstacles in the South African Savoury Snacks Market Market

The South African savoury snacks market faces challenges, including volatile raw material prices impacting production costs. Supply chain disruptions also pose a threat. Furthermore, intense competition among established and emerging players creates pressure on profit margins and necessitates continuous innovation to maintain market share. Economic fluctuations and changing consumer preferences also present ongoing challenges.

Future Opportunities in South African Savoury Snacks Market

The South African savoury snacks market presents exciting future opportunities. The increasing health consciousness creates room for healthier snack options, like those with reduced sodium and added nutrients. Expansion into niche markets and exploring untapped regional opportunities offers potential for growth. Moreover, leveraging digital marketing and e-commerce platforms can enhance brand reach and expand sales.

Major Players in the South African Savoury Snacks Market Ecosystem

- The Kellogg Company

- Lorenz Snack-World

- Siyaya Brands Pty Ltd

- Picola Foods

- PepsiCo Inc

- Truda Foods (Pty) Ltd

- Super Snacks

- Messaris Snack Foods

- AVI Limited

- Frimax Foods (Pty) Ltd

Key Developments in South African Savoury Snacks Market Industry

- October 2023: Simba collaborated with Chef Benny to create their new Steakhouse Beef flavored chips.

- October 2023: Kaizer Chiefs launched its brand of potato chips.

- December 2023: Kellanova announced reduced plastic packaging for three of its snack brands.

Strategic South African Savoury Snacks Market Forecast

The South African savoury snacks market is poised for sustained growth, driven by favorable demographics, rising disposable incomes, and increasing demand for convenient and flavorful snacks. Opportunities lie in product innovation, particularly in healthier options and unique flavor profiles. Expanding distribution channels, especially online retail, will further drive market penetration. The market is expected to experience significant growth over the forecast period, making it an attractive sector for investment and expansion.

South African Savoury Snacks Market Segmentation

-

1. Product Type

- 1.1. Potato Chips

- 1.2. Extruded Snacks

- 1.3. Popcorn

- 1.4. Nuts, Seeds, and Trail Mixes

- 1.5. Meat Snacks

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

South African Savoury Snacks Market Segmentation By Geography

- 1. South Africa

South African Savoury Snacks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Convenient Snacking Options; Organic Snacking Options Gaining Prominence

- 3.3. Market Restrains

- 3.3.1. Inclination Toward Other Nutritional Food Products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Convenient Snacking Options

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South African Savoury Snacks Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Potato Chips

- 5.1.2. Extruded Snacks

- 5.1.3. Popcorn

- 5.1.4. Nuts, Seeds, and Trail Mixes

- 5.1.5. Meat Snacks

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa South African Savoury Snacks Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South African Savoury Snacks Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South African Savoury Snacks Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South African Savoury Snacks Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South African Savoury Snacks Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South African Savoury Snacks Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 The Kellogg Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Lorenz Snack-World*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Siyaya Brands Pty Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Picola Foods

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 PepsiCo Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Truda Foods (Pty) Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Super Snacks

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Messaris Snack Foods

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 AVI Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Frimax Foods (Pty) Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 The Kellogg Company

List of Figures

- Figure 1: South African Savoury Snacks Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South African Savoury Snacks Market Share (%) by Company 2024

List of Tables

- Table 1: South African Savoury Snacks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South African Savoury Snacks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South African Savoury Snacks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South African Savoury Snacks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South African Savoury Snacks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa South African Savoury Snacks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan South African Savoury Snacks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda South African Savoury Snacks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania South African Savoury Snacks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya South African Savoury Snacks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa South African Savoury Snacks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South African Savoury Snacks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: South African Savoury Snacks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: South African Savoury Snacks Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South African Savoury Snacks Market?

The projected CAGR is approximately 7.74%.

2. Which companies are prominent players in the South African Savoury Snacks Market?

Key companies in the market include The Kellogg Company, Lorenz Snack-World*List Not Exhaustive, Siyaya Brands Pty Ltd, Picola Foods, PepsiCo Inc, Truda Foods (Pty) Ltd, Super Snacks, Messaris Snack Foods, AVI Limited, Frimax Foods (Pty) Ltd.

3. What are the main segments of the South African Savoury Snacks Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Convenient Snacking Options; Organic Snacking Options Gaining Prominence.

6. What are the notable trends driving market growth?

Rising Demand for Convenient Snacking Options.

7. Are there any restraints impacting market growth?

Inclination Toward Other Nutritional Food Products.

8. Can you provide examples of recent developments in the market?

December 2023: Kellanova announced three of its snack brands, Cheez-It Snap'd, Cheez-It Puff'd, and Club Crisps, reduced the amount of plastic used in their packaging while maintaining the same amount of food in each package.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South African Savoury Snacks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South African Savoury Snacks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South African Savoury Snacks Market?

To stay informed about further developments, trends, and reports in the South African Savoury Snacks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence