Key Insights

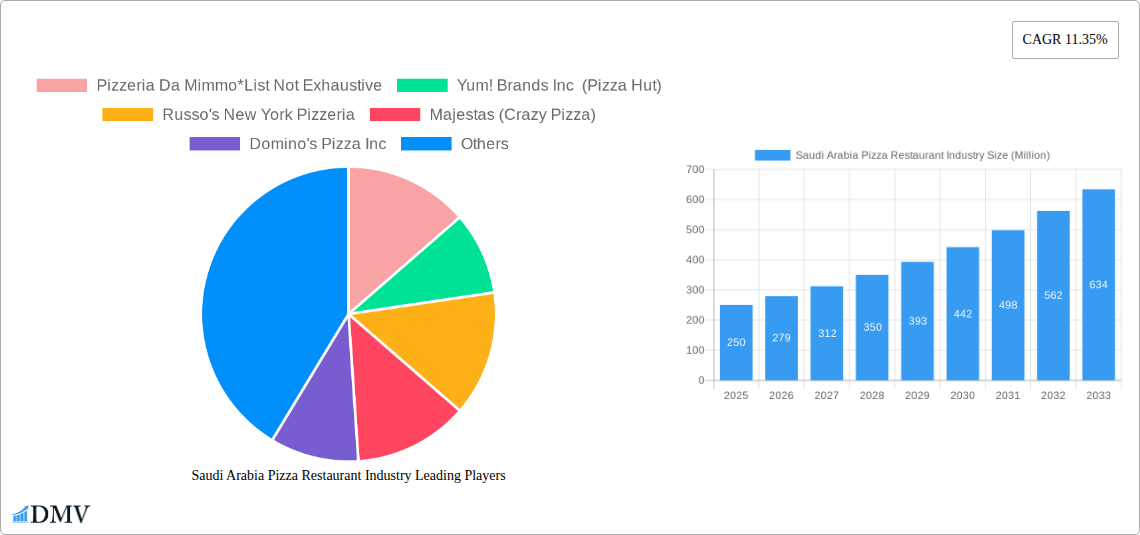

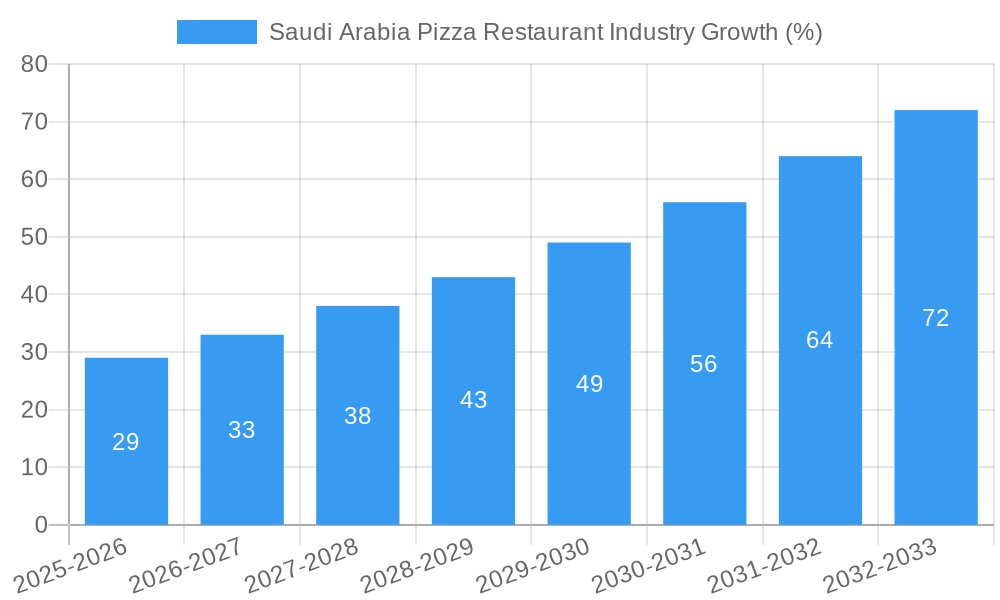

The Saudi Arabian pizza restaurant industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 11.35% from 2025 to 2033. This expansion is fueled by several key factors. The rising young population with increasing disposable incomes is a significant driver, leading to higher spending on food services, including convenient and popular options like pizza. Furthermore, the growing trend of casual dining and the increasing popularity of international cuisines are contributing to the market's positive trajectory. The sector is segmented into chained pizza outlets and independent pizza outlets, each catering to distinct customer preferences and price points. Major players like Pizza Hut, Domino's, and local brands like Pizzeria Da Mimmo are competing intensely, driving innovation in menu offerings and delivery services. The geographic spread across Saudi Arabia’s diverse regions—Central, Eastern, Western, and Southern—presents opportunities for both established chains and smaller, independent businesses to establish a foothold. However, challenges such as fluctuating food costs and intense competition could impact profitability. Despite these restraints, the overall outlook for the Saudi Arabian pizza market remains positive, indicating significant potential for growth and investment in the coming years.

The market size in 2025 is estimated to be around 250 million USD (This is an estimation, assuming a reasonable starting point given the CAGR). Using the 11.35% CAGR, the market's growth trajectory indicates significant future potential. This expansion is expected to continue due to favorable demographic trends, rising consumer spending, and the ongoing embrace of Western-style food culture within the Kingdom. Further growth is anticipated from strategic partnerships and expansions by multinational chains, alongside the emergence of innovative independent players leveraging local flavors and preferences. While competition remains a key challenge, successful brands will likely be those that effectively navigate fluctuating input costs while providing exceptional customer service and innovative menu options.

Saudi Arabia Pizza Restaurant Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Saudi Arabia pizza restaurant industry, offering a comprehensive overview of market trends, competitive dynamics, and future growth prospects. Spanning the period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this dynamic market. The report projects a market value of xx Million by 2033.

Saudi Arabia Pizza Restaurant Industry Market Composition & Trends

This section evaluates the Saudi Arabia pizza restaurant market's structure, examining market concentration, innovation drivers, regulatory influences, substitute products, consumer profiles, and mergers & acquisitions (M&A) activity. The market is characterized by a blend of international chains and independent outlets, resulting in a diverse competitive landscape.

Market Concentration: The market exhibits a moderate level of concentration, with leading players like Yum! Brands Inc (Pizza Hut) and Domino's Pizza Inc holding significant market share. However, independent pizza outlets contribute substantially, particularly in smaller cities. We estimate the combined market share of the top 5 players to be approximately 45% in 2025. This leaves significant opportunity for expansion and competition.

Innovation Catalysts: The industry is witnessing innovation in pizza varieties (e.g., gourmet pizzas with artisanal toppings), delivery technologies (e.g., online ordering and delivery apps), and restaurant formats (e.g., quick-service, casual dining). This is driven by evolving consumer preferences and the desire for enhanced customer experience.

Regulatory Landscape: The regulatory environment in Saudi Arabia influences food safety standards, licensing requirements, and operational procedures for restaurants. These regulations are expected to remain relatively stable during the forecast period, although potential updates related to food safety and hygiene are anticipated.

Substitute Products: Substitute products include other fast food options, home-cooked meals, and international cuisine. However, the convenience and affordability of pizza continue to drive demand.

End-User Profiles: The key end-user segments include families, young adults, and professionals. The growing young population and increasing disposable income contribute to higher demand.

M&A Activity: While data on precise M&A deal values is limited publicly, there has been notable activity, such as Yum! Brands' partnership with Americana Pizza to expand Pizza Hut's presence. The total M&A value for the period 2019-2024 is estimated at xx Million.

Saudi Arabia Pizza Restaurant Industry Industry Evolution

This section analyzes the historical and projected growth trajectory of the Saudi Arabia pizza restaurant industry, examining technological advancements and evolving consumer preferences that have shaped the market. The industry has experienced significant growth over the past five years (2019-2024), driven primarily by increasing urbanization, rising disposable incomes, and a growing preference for convenient and affordable dining options. We project a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. The increasing adoption of online ordering and delivery platforms has significantly influenced industry dynamics. Advancements in food technology are enabling the introduction of innovative pizza varieties and improved efficiency in restaurant operations. The shift in consumer preferences towards healthier options is also influencing menu innovation, with several chains offering vegetarian and healthier pizza options. The industry is witnessing a gradual shift towards premiumization, with an increasing number of consumers willing to pay for high-quality ingredients and a more upscale dining experience. This trend is driven by the rising disposable incomes and changing lifestyles within the Saudi population. The changing demographics, with a significant youth population, also contribute to the preference for casual dining and the adoption of modern technology in the sector.

Leading Regions, Countries, or Segments in Saudi Arabia Pizza Restaurant Industry

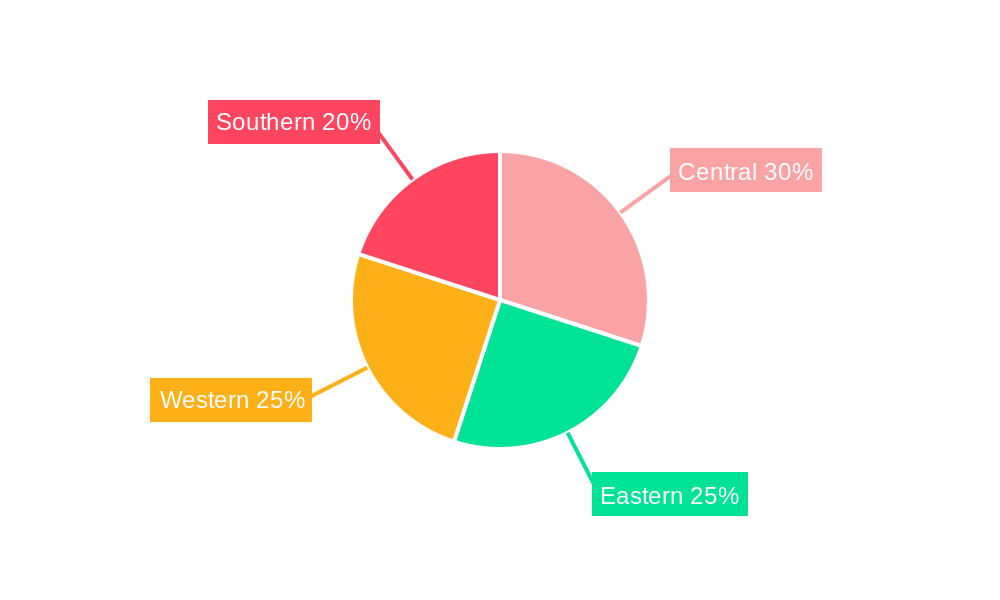

The Saudi Arabia pizza market is primarily driven by urban areas like Riyadh, Jeddah, and Dammam, exhibiting robust growth owing to high population density, higher disposable incomes, and significant concentration of retail and food services.

Key Drivers for Chained Pizza Outlets:

- High brand recognition and established customer loyalty

- Economies of scale in procurement and operations

- Extensive marketing and promotional capabilities

- Strategic locations in high-traffic areas

- Standardized product quality and service delivery

Key Drivers for Independent Pizza Outlets:

- Localized menus catering to specific tastes and preferences

- Competitive pricing strategies

- Flexible operational models suited to local conditions

- Potential for rapid expansion in underserved areas

- Building local brand recognition and community connections

Riyadh, as the capital, shows the highest concentration of both chained and independent pizza outlets, benefiting from significant population density, high consumer spending, and increased tourism. This dominance is further amplified by the presence of major shopping malls and entertainment centers, attracting a broad spectrum of customers.

Saudi Arabia Pizza Restaurant Industry Product Innovations

Recent innovations include gourmet pizzas with artisanal ingredients, healthier options (e.g., gluten-free crusts), and personalized pizza customization options through online platforms. The use of advanced ovens and food preparation technologies enhances efficiency and product quality. Unique selling propositions include faster delivery times, loyalty programs, and distinctive pizza flavors tailored to local preferences.

Propelling Factors for Saudi Arabia Pizza Restaurant Industry Growth

The industry's growth is propelled by rising disposable incomes, rapid urbanization, a young and growing population, and increasing demand for convenient food options. Government initiatives supporting the hospitality sector and the rising adoption of online food ordering platforms further contribute to market expansion.

Obstacles in the Saudi Arabia Pizza Restaurant Industry Market

Challenges include intense competition, fluctuating ingredient costs, stringent food safety regulations, and potential supply chain disruptions. The high cost of labor and real estate in prime locations presents operational challenges.

Future Opportunities in Saudi Arabia Pizza Restaurant Industry

Opportunities lie in expanding into underserved regions, introducing innovative menu options (e.g., healthier and more customizable pizzas), leveraging technology to enhance customer experience (e.g., AI-powered ordering systems), and expanding delivery networks to reach a wider customer base.

Major Players in the Saudi Arabia Pizza Restaurant Industry Ecosystem

- Yum! Brands Inc (Pizza Hut)

- Russo's New York Pizzeria

- Majestas (Crazy Pizza)

- Domino's Pizza Inc

- Pizza Era

- Little Caesar Enterprises Inc

- DAILY FOOD CO (Maestro Pizza)

- Sbarro LLC

- Rave Restaurant Group (Pizza Inn)

- Pizzeria Da Mimmo

Key Developments in Saudi Arabia Pizza Restaurant Industry Industry

- December 2022: Russo's New York Pizzeria opened in Riyadh, introducing a premium Italian-American dining experience.

- July 2022: Yum! Brands partnered with Americana Pizza to expand Pizza Hut's reach across Saudi Arabia, launching 30 new locations.

- June 2022: Majestas opened a second Crazy Pizza location in Riyadh, highlighting the growing demand for gourmet pizzas.

Strategic Saudi Arabia Pizza Restaurant Industry Market Forecast

The Saudi Arabia pizza market is poised for continued growth, driven by favorable demographics, economic expansion, and ongoing technological advancements. Opportunities for innovation and expansion remain substantial, especially in diversifying menu offerings, enhancing customer experience through technology, and penetrating new markets. The market is projected to witness a significant expansion in the coming years, with considerable potential for both established players and new entrants.

Saudi Arabia Pizza Restaurant Industry Segmentation

-

1. Category

- 1.1. Chained Pizza Outlets

- 1.2. Independent Pizza Outlets

Saudi Arabia Pizza Restaurant Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Pizza Restaurant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Strong Influence of Western Culture in the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Chained Pizza Outlets

- 5.1.2. Independent Pizza Outlets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Central Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Pizza Restaurant Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Pizzeria Da Mimmo*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Yum! Brands Inc (Pizza Hut)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Russo's New York Pizzeria

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Majestas (Crazy Pizza)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Domino's Pizza Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Pizza Era

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Little Caesar Enterprises Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DAILY FOOD CO (Maestro Pizza)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sbarro LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rave Restaurant Group (Pizza Inn)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Pizzeria Da Mimmo*List Not Exhaustive

List of Figures

- Figure 1: Saudi Arabia Pizza Restaurant Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Pizza Restaurant Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 3: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Pizza Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Pizza Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Pizza Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Pizza Restaurant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 10: Saudi Arabia Pizza Restaurant Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Pizza Restaurant Industry?

The projected CAGR is approximately 11.35%.

2. Which companies are prominent players in the Saudi Arabia Pizza Restaurant Industry?

Key companies in the market include Pizzeria Da Mimmo*List Not Exhaustive, Yum! Brands Inc (Pizza Hut), Russo's New York Pizzeria, Majestas (Crazy Pizza), Domino's Pizza Inc, Pizza Era, Little Caesar Enterprises Inc, DAILY FOOD CO (Maestro Pizza), Sbarro LLC, Rave Restaurant Group (Pizza Inn).

3. What are the main segments of the Saudi Arabia Pizza Restaurant Industry?

The market segments include Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Strong Influence of Western Culture in the Market..

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

In December 2022, United States-based Russo's New York Pizzeria & Italian Kitchen opened a new restaurant in Riyadh, Saudi Arabia. The products available in the restaurant include salads, burrata cheese cooked from fresh mozzarella, Italian soups, pasta as well as pizzas baked in brick ovens, calzones, and desserts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Pizza Restaurant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Pizza Restaurant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Pizza Restaurant Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Pizza Restaurant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence