Key Insights

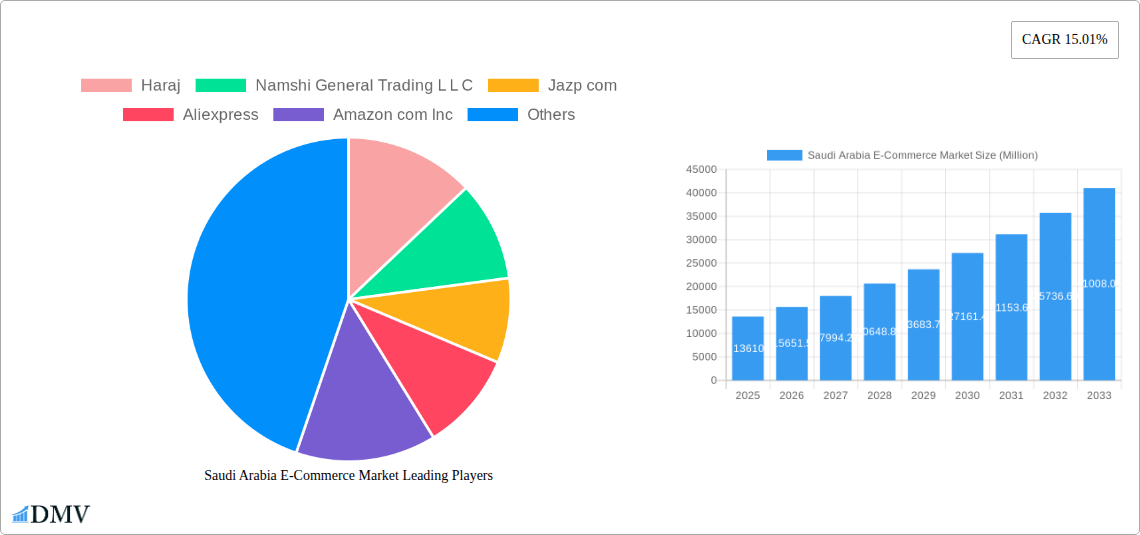

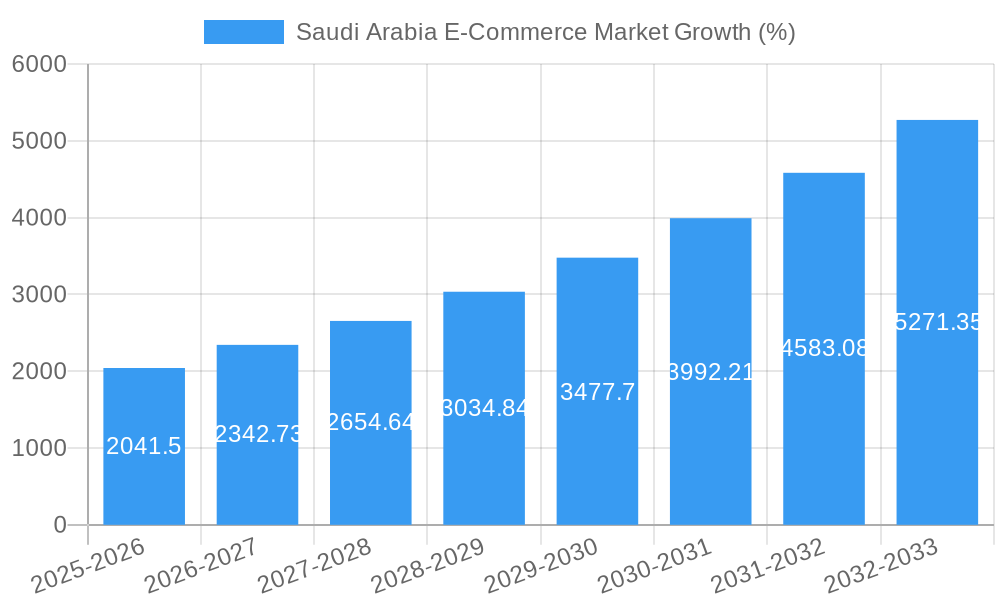

The Saudi Arabian e-commerce market is experiencing robust growth, projected to reach a market size of $13.61 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 15.01% from 2019 to 2033. This surge is driven by several factors. Increasing internet and smartphone penetration, coupled with a young and tech-savvy population, fuels a strong demand for online shopping convenience. Government initiatives promoting digital transformation and investments in digital infrastructure further bolster the market's expansion. The rising popularity of online payment gateways and improved logistics infrastructure, including reliable delivery services, significantly enhances consumer confidence and participation in e-commerce. Furthermore, the growth of social commerce and the introduction of innovative e-commerce models contribute to the overall market dynamism. Major players like Haraj, Namshi, and Noon are capitalizing on these trends, offering diverse product categories and competitive pricing to attract a large customer base. The market is segmented by product type (fashion & apparel, electronics, grocery, beauty & personal care, home décor & furniture, others) and end-user (individual consumers, businesses (B2B), government & institutions), offering various opportunities for market participants. The significant growth in the B2B segment reflects increasing adoption of e-procurement solutions by businesses.

The competitive landscape is characterized by both established international players like Amazon and Carrefour, and successful local e-commerce platforms. This combination fuels innovation and ensures diverse product offerings to cater to a broad range of consumer preferences and needs. While challenges such as addressing concerns around online security and logistics remain, the overall outlook for the Saudi Arabian e-commerce market is extremely positive, indicating significant potential for future growth and investment. The market's consistent expansion is expected to continue throughout the forecast period (2025-2033), underpinned by ongoing technological advancements, supportive government policies, and a growing appetite for online shopping amongst consumers. The high CAGR suggests a rapid pace of transformation within the Saudi Arabian retail landscape, presenting lucrative opportunities for both established players and new market entrants.

Saudi Arabia E-Commerce Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Saudi Arabia e-commerce market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the immense potential of this rapidly expanding sector. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024. The report uses Million as the unit for all values.

Saudi Arabia E-Commerce Market Composition & Trends

This section delves into the competitive landscape of the Saudi Arabian e-commerce market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and significant M&A activities. We analyze market share distribution amongst key players like Noon, Amazon, and others, and assess the impact of recent mergers and acquisitions, including the USD 335.2 Million acquisition of Namshi by Noon.

- Market Concentration: The Saudi Arabian e-commerce market shows a moderately concentrated structure, with a few dominant players holding significant market share. However, the market remains dynamic with ample opportunities for new entrants.

- Innovation Catalysts: Government initiatives promoting digital transformation and investments in digital infrastructure are major catalysts for innovation.

- Regulatory Landscape: Government regulations aimed at consumer protection and data privacy are shaping the market's evolution. Further analysis of these regulations and their implications are discussed.

- Substitute Products: Traditional retail channels still present competition, however, e-commerce's convenience and accessibility are steadily eroding its market share. We quantify this shift using relevant market data.

- End-User Profiles: The report segments the market based on consumer demographics and purchasing behavior, differentiating between individual consumers, businesses (B2B), and government institutions. The report analyzes the spending patterns, preferences and needs of each segment.

- M&A Activities: The USD 335.2 Million acquisition of Namshi by Noon in February 2023 exemplifies the significant M&A activity reshaping the market landscape. The report analyses xx more such transactions during 2019-2024, detailing their values and market implications. Total M&A value in the period 2019-2024 is estimated at xx Million USD.

Saudi Arabia E-Commerce Market Industry Evolution

This section analyzes the historical and projected growth of the Saudi Arabian e-commerce market, exploring the underlying factors driving its expansion. We examine the impact of technological advancements, such as improved logistics and mobile payment systems, and changing consumer preferences, including increased smartphone penetration and online shopping habits. Growth rates are projected to average xx% annually during the forecast period (2025-2033), based on historical data and anticipated market trends. The increasing adoption of e-commerce, particularly among younger demographics, is a key driver for market growth. Specific data points, including growth rates for different product segments, are provided. The report explores the influence of various factors, including infrastructure development and government initiatives, on market evolution.

Leading Regions, Countries, or Segments in Saudi Arabia E-Commerce Market

This section identifies the leading regions, countries, and segments within the Saudi Arabian e-commerce market. The analysis focuses on both product type (Fashion & Apparel, Electronics, Grocery, Beauty & Personal Care, Home Décor & Furniture, Others) and end-user segments (Individual Consumers, Businesses (B2B), Government & Institutions).

Dominant Segments: Fashion & Apparel and Electronics are projected to remain the leading product segments, driven by increasing consumer spending and demand. Grocery e-commerce is also rapidly growing.

Key Drivers for Dominance:

- Fashion & Apparel: Strong demand for international brands and increased online shopping among the younger generation.

- Electronics: High consumer electronics adoption rate in Saudi Arabia, fueled by increasing disposable incomes.

- Grocery: Convenience and time saving are driving increased adoption and government push for online grocery services.

- Individual Consumers: Majority of online purchases originate from individual consumers, driven by increasing internet penetration.

The report provides a detailed breakdown of market share and growth projections for each segment, highlighting the contributing factors behind their success.

Saudi Arabia E-Commerce Market Product Innovations

The Saudi Arabian e-commerce market is witnessing rapid product innovation, particularly in areas such as personalized recommendations, AI-powered chatbots for customer service, and improved logistics solutions including drone delivery and next-day shipping. These innovations enhance the user experience and drive market growth. The adoption of AR/VR technologies in e-commerce is also expected to increase, allowing consumers to virtually experience products before purchase. These innovations enhance the customer journey and contribute to increased market penetration. Market penetration of these technologies is estimated at xx% in 2025 and projected to reach xx% by 2033.

Propelling Factors for Saudi Arabia E-Commerce Market Growth

Several key factors are propelling the growth of the Saudi Arabian e-commerce market. These include increasing internet and smartphone penetration, rising disposable incomes, government initiatives promoting digital transformation (Vision 2030), and the expansion of logistics infrastructure. Furthermore, the development of secure and convenient online payment systems and the increasing popularity of online marketplaces are contributing to this growth. The adoption of innovative technologies further enhances the growth.

Obstacles in the Saudi Arabia E-Commerce Market

Despite its immense potential, the Saudi Arabian e-commerce market faces certain challenges. These include concerns regarding data security and privacy, the need for improved logistics infrastructure in certain regions, and the competition from traditional retail channels. Furthermore, the high cost of internet access in some areas and lack of financial inclusion for certain demographic segments can pose significant obstacles. These challenges currently impact xx% of online transactions.

Future Opportunities in Saudi Arabia E-Commerce Market

The Saudi Arabian e-commerce market presents significant future opportunities. The expansion of e-commerce into less penetrated regions, the adoption of new technologies such as blockchain for secure transactions, and the growth of niche market segments all offer lucrative prospects. The rising adoption of mobile commerce and the integration of social commerce platforms present further opportunities for growth.

Major Players in the Saudi Arabia E-Commerce Market Ecosystem

- Haraj

- Namshi General Trading L L C

- Jazp.com

- Aliexpress

- Amazon com Inc

- Carrefour

- eBay Inc

- Noon Ad Holdings Ltd (Noon E-Commerce)

Key Developments in Saudi Arabia E-Commerce Market Industry

- December 2022: Sideup, an e-commerce platform developer, received USD 1.2 Million in funding to expand its operations in Saudi Arabia.

- February 2023: Noon acquired Namshi for USD 335.2 Million, significantly expanding its fashion and lifestyle offerings. This acquisition is expected to further consolidate the market.

Strategic Saudi Arabia E-Commerce Market Forecast

The Saudi Arabian e-commerce market is poised for continued strong growth, driven by favorable demographic trends, increasing digital literacy, and supportive government policies. The expanding middle class, combined with further infrastructure improvements and technological advancements, will contribute to significant market expansion throughout the forecast period. The market is projected to reach xx Million USD by 2033.

Saudi Arabia E-Commerce Market Segmentation

-

1. Product Type

- 1.1. Fashion & Apparel

- 1.2. Electronics

- 1.3. Grocery

- 1.4. Beauty & Personal Care

- 1.5. Home Décor & Furniture

- 1.6. Others

-

2. End-User

- 2.1. Individual Consumers

- 2.2. Businesses (B2B)

- 2.3. Government & Institutions

Saudi Arabia E-Commerce Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia E-Commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector

- 3.2.2 including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Fashion and Apparel Segment is Expected to Grow Exponentially

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion & Apparel

- 5.1.2. Electronics

- 5.1.3. Grocery

- 5.1.4. Beauty & Personal Care

- 5.1.5. Home Décor & Furniture

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Individual Consumers

- 5.2.2. Businesses (B2B)

- 5.2.3. Government & Institutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. UAE Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Haraj

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Namshi General Trading L L C

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jazp com

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aliexpress

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Amazon com Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Carrefou

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 eBay Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Noon Ad Holdings Ltd (Noon E-Commerce)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Haraj

List of Figures

- Figure 1: Saudi Arabia E-Commerce Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia E-Commerce Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: UAE Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: UAE Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: South Africa Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Saudi Arabia Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Saudi Arabia Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of MEA Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of MEA Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 21: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 22: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 23: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-Commerce Market?

The projected CAGR is approximately 15.01%.

2. Which companies are prominent players in the Saudi Arabia E-Commerce Market?

Key companies in the market include Haraj, Namshi General Trading L L C, Jazp com, Aliexpress, Amazon com Inc, Carrefou, eBay Inc, Noon Ad Holdings Ltd (Noon E-Commerce).

3. What are the main segments of the Saudi Arabia E-Commerce Market?

The market segments include Product Type , End-User .

4. Can you provide details about the market size?

The market size is estimated to be USD 13.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector. including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers.

6. What are the notable trends driving market growth?

Fashion and Apparel Segment is Expected to Grow Exponentially.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

February 2023: The online fashion retailer Namshi, which operated primarily in Saudi Arabia, was acquired by the e-commerce company Noon for a total cash consideration of USD 335.2 million, and this addition of more fashion and lifestyle brands to Noon's digital offering of goods and services in the country

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-Commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-Commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-Commerce Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-Commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence