Key Insights

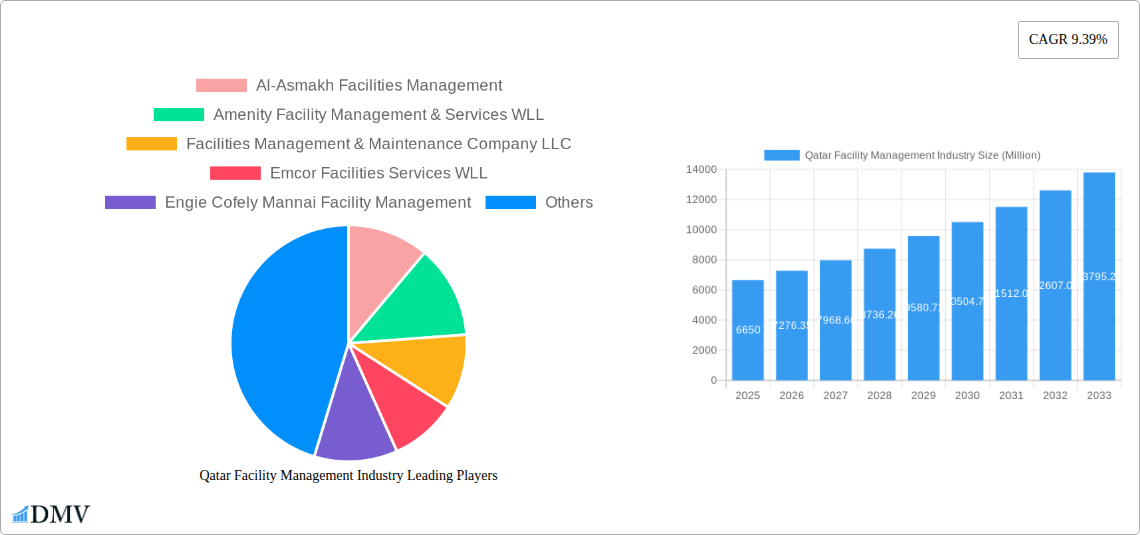

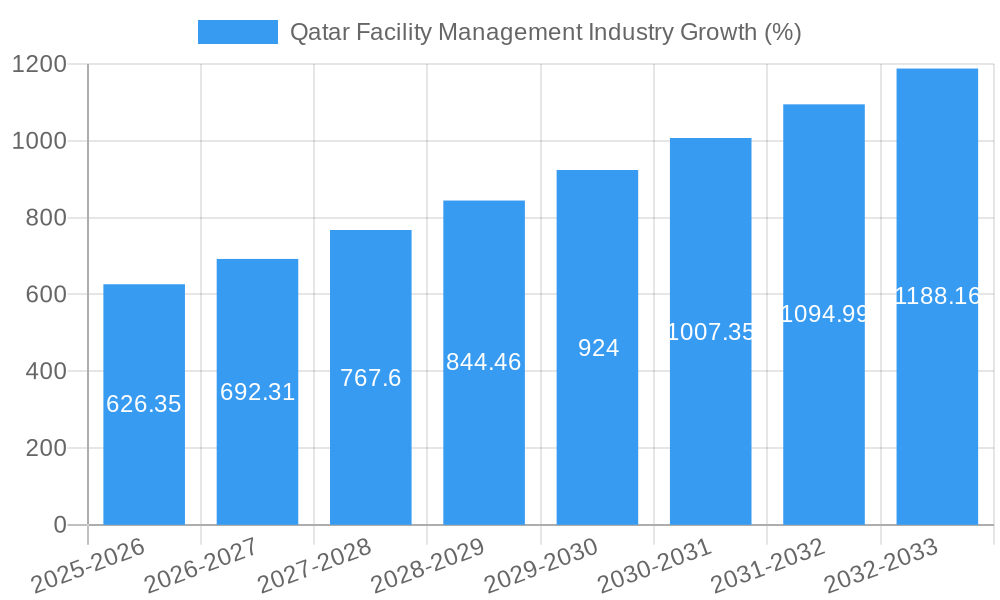

The Qatari facility management (FM) market, valued at $6.65 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 9.39% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Qatar's substantial investments in infrastructure development, particularly in preparation for and following the FIFA World Cup 2022, have created a surge in demand for FM services across commercial, institutional, and public infrastructure sectors. Secondly, the increasing adoption of smart building technologies and a focus on sustainable practices are driving the demand for sophisticated FM solutions, including energy-efficient building operations and integrated technology management. Finally, the growing awareness of the importance of workplace efficiency and employee well-being is encouraging businesses to outsource FM tasks, leading to the expansion of the outsourced FM segment. The market is segmented by type (in-house vs. outsourced), offering (hard FM – maintenance, repairs; soft FM – cleaning, security), and end-user (commercial, institutional, public/infrastructure, industrial). The outsourced FM segment is expected to witness faster growth due to its cost-effectiveness and access to specialized expertise. The growing commercial and infrastructure sectors are key contributors to overall market expansion. While potential restraints include economic fluctuations and global uncertainties, the strong underlying growth drivers are expected to sustain the market's upward trajectory.

The competitive landscape is marked by a mix of both international and local players, each offering a range of services to cater to the diverse needs of Qatari clients. The leading companies are strategically positioning themselves to capitalize on the market's growth by focusing on innovation, technological advancements, and expanding their service portfolios to offer integrated solutions. This includes incorporating sustainable practices and leveraging digital technologies to enhance efficiency and optimize resource allocation. The market's future growth hinges on continued infrastructure development, increased government initiatives promoting sustainable building practices, and the ongoing expansion of both the commercial and tourism sectors. The sustained growth trajectory is further supported by Qatar's long-term economic vision and its commitment to modernization and diversification.

Qatar Facility Management Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Qatar facility management industry, offering a comprehensive overview of its market dynamics, growth drivers, challenges, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this burgeoning market. The total market value in 2025 is estimated at xx Million USD.

Qatar Facility Management Industry Market Composition & Trends

The Qatar facility management market, valued at xx Million USD in 2025, exhibits a moderately concentrated landscape with several key players vying for market share. Innovation is driven by technological advancements, particularly in smart building technologies and sustainable practices. The regulatory environment, while generally supportive, presents certain compliance requirements impacting operational costs. Substitute products, such as in-house teams, compete with outsourced solutions. The end-user profile is diverse, encompassing commercial, institutional, public/infrastructure, and industrial sectors. M&A activity has been moderate, with deal values in the past five years averaging xx Million USD per transaction.

- Market Share Distribution: The top five players command approximately xx% of the market, with the remaining share distributed among numerous smaller firms.

- M&A Activity: A total of xx M&A deals were recorded between 2019 and 2024, representing a total value of approximately xx Million USD.

Qatar Facility Management Industry Industry Evolution

The Qatar facility management industry has experienced significant growth over the historical period (2019-2024), driven by increasing urbanization, infrastructure development, and a growing focus on operational efficiency across various sectors. The compound annual growth rate (CAGR) from 2019 to 2024 is estimated at xx%, fueled by heightened demand for outsourced facility management services and technological advancements such as Building Information Modeling (BIM) and Internet of Things (IoT) integration. Consumer demand is shifting towards sustainable and technologically advanced solutions, pushing the industry to innovate and adopt new practices. This trend is expected to continue, leading to a projected CAGR of xx% during the forecast period (2025-2033). The market is expected to reach xx Million USD by 2033. Adoption of smart building technologies is increasing, with approximately xx% of new commercial buildings incorporating such technologies by 2025.

Leading Regions, Countries, or Segments in Qatar Facility Management Industry

The commercial sector currently dominates the Qatar facility management market, followed by the public/infrastructure sector, driven by substantial investments in infrastructure projects related to the FIFA World Cup 2022 and beyond. Outsourced facility management is the leading segment by type, reflecting a growing preference for specialized expertise and cost optimization. Within offerings, Hard FM currently holds the largest share but Soft FM is experiencing rapid growth.

- Key Drivers for Commercial Sector Dominance: High concentration of commercial buildings, strong economic activity, and significant investments in modern infrastructure.

- Key Drivers for Outsourced FM Dominance: Cost efficiency, access to specialized expertise, and focus on core business operations.

- Key Drivers for Hard FM Dominance: Essential nature of services, including maintenance and repairs.

- Growth of Soft FM: Increasing focus on workplace experience, employee well-being and sustainability initiatives.

Qatar Facility Management Industry Product Innovations

Recent innovations focus on smart building technologies, integrating IoT sensors, AI-powered predictive maintenance, and data analytics platforms to enhance operational efficiency, reduce costs, and improve sustainability. These integrated solutions provide improved real-time monitoring, automated alerts, and data-driven insights to optimize energy consumption, resource management, and maintenance scheduling. This has led to the rise of new service offerings like facility performance dashboards and predictive maintenance programs providing significant cost savings and operational improvements.

Propelling Factors for Qatar Facility Management Industry Growth

Several factors are driving the growth of the Qatar facility management industry. Firstly, significant investments in infrastructure projects, particularly within the public and commercial sectors, are creating a high demand for facility management services. Secondly, technological advancements, such as IoT and AI, are enhancing operational efficiency and increasing cost savings. Finally, government regulations promoting sustainability and energy efficiency are driving the adoption of green building technologies and sustainable practices within the facility management sector.

Obstacles in the Qatar Facility Management Industry Market

The Qatar facility management market faces challenges such as intense competition among established and emerging players, potential supply chain disruptions impacting the availability and cost of materials and equipment, and regulatory complexities relating to compliance and licensing. Fluctuations in the global economy can also impact investment in infrastructure projects, thus affecting demand for facility management services. These factors can lead to a reduction in profit margins and potential delays in project completion for facility management firms.

Future Opportunities in Qatar Facility Management Industry

Future opportunities lie in expanding into new market segments, such as the healthcare and education sectors. The adoption of advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT) will create new service offerings and revenue streams. Furthermore, growing focus on sustainability and energy efficiency will drive demand for green facility management services. Finally, the expansion of smart city initiatives will present significant opportunities for integrated facility management solutions.

Major Players in the Qatar Facility Management Industry Ecosystem

- Al-Asmakh Facilities Management

- Amenity Facility Management & Services WLL

- Facilities Management & Maintenance Company LLC

- Emcor Facilities Services WLL

- Engie Cofely Mannai Facility Management

- G4S QATAR SPC

- Al Faisal Holdings (MMG Qatar)

- Sodexo Qatar Services

- Como Facility Management Services

- EFS Facilities Services

Key Developments in Qatar Facility Management Industry Industry

- March 2022: EDGNEX, a subsidiary of Damac Group, partnered with JLL for its facility management needs, signifying increased demand for outsourced services in the data center sector.

Strategic Qatar Facility Management Industry Market Forecast

The Qatar facility management market is poised for continued growth, driven by sustained infrastructure development, technological advancements, and increasing focus on operational efficiency and sustainability. The market's expansion into new segments and the adoption of innovative technologies will further contribute to its positive trajectory, presenting significant opportunities for existing and new market entrants. The forecast period is expected to witness strong growth, with a CAGR exceeding xx% leading to a market value of xx Million USD by 2033.

Qatar Facility Management Industry Segmentation

-

1. Offering Type

- 1.1. Hard FM

- 1.2. Soft FM

-

2. Type

- 2.1. In-house Facility Management

-

2.2. Outsourced Facility Management

- 2.2.1. Single FM

- 2.2.2. Bundled FM

- 2.2.3. Integrated FM

-

3. End User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End Users

Qatar Facility Management Industry Segmentation By Geography

- 1. Qatar

Qatar Facility Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Qatar as One of the Key Investment Destinations in the GCC; Growing Emphasis on the Outsourcing of Non-core Operations; Increase in Market Concentration Due to the Entry of Global Firms with Diversified Service Portfolios

- 3.3. Market Restrains

- 3.3.1. Regulatory & Legal Changes; Growing Presence of Global Firms Collaborating with Regional Entities Pose a Challenge for Local Firms

- 3.4. Market Trends

- 3.4.1. Public/ Infrastructure Sector Accounts for Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering Type

- 5.1.1. Hard FM

- 5.1.2. Soft FM

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. In-house Facility Management

- 5.2.2. Outsourced Facility Management

- 5.2.2.1. Single FM

- 5.2.2.2. Bundled FM

- 5.2.2.3. Integrated FM

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Offering Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Al-Asmakh Facilities Management

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amenity Facility Management & Services WLL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Facilities Management & Maintenance Company LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emcor Facilities Services WLL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Engie Cofely Mannai Facility Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 G4S QATAR SPC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al Faisal Holdings (MMG Qatar)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sodexo Qatar Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Como Facility Management Services

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EFS Facilities Services

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Al-Asmakh Facilities Management

List of Figures

- Figure 1: Qatar Facility Management Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Facility Management Industry Share (%) by Company 2024

List of Tables

- Table 1: Qatar Facility Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Facility Management Industry Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 3: Qatar Facility Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Qatar Facility Management Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Qatar Facility Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Qatar Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Qatar Facility Management Industry Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 8: Qatar Facility Management Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Qatar Facility Management Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Qatar Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Facility Management Industry?

The projected CAGR is approximately 9.39%.

2. Which companies are prominent players in the Qatar Facility Management Industry?

Key companies in the market include Al-Asmakh Facilities Management, Amenity Facility Management & Services WLL, Facilities Management & Maintenance Company LLC, Emcor Facilities Services WLL, Engie Cofely Mannai Facility Management, G4S QATAR SPC, Al Faisal Holdings (MMG Qatar), Sodexo Qatar Services, Como Facility Management Services, EFS Facilities Services.

3. What are the main segments of the Qatar Facility Management Industry?

The market segments include Offering Type, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Qatar as One of the Key Investment Destinations in the GCC; Growing Emphasis on the Outsourcing of Non-core Operations; Increase in Market Concentration Due to the Entry of Global Firms with Diversified Service Portfolios.

6. What are the notable trends driving market growth?

Public/ Infrastructure Sector Accounts for Significant Growth.

7. Are there any restraints impacting market growth?

Regulatory & Legal Changes; Growing Presence of Global Firms Collaborating with Regional Entities Pose a Challenge for Local Firms.

8. Can you provide examples of recent developments in the market?

March 2022: EDGNEX, a subsidiary of Damac Group, operating in Qatar has partnered with JLL for its facility management needs as it pursues the first phase of its strategy to deliver data center facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Facility Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Facility Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Facility Management Industry?

To stay informed about further developments, trends, and reports in the Qatar Facility Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence