Key Insights

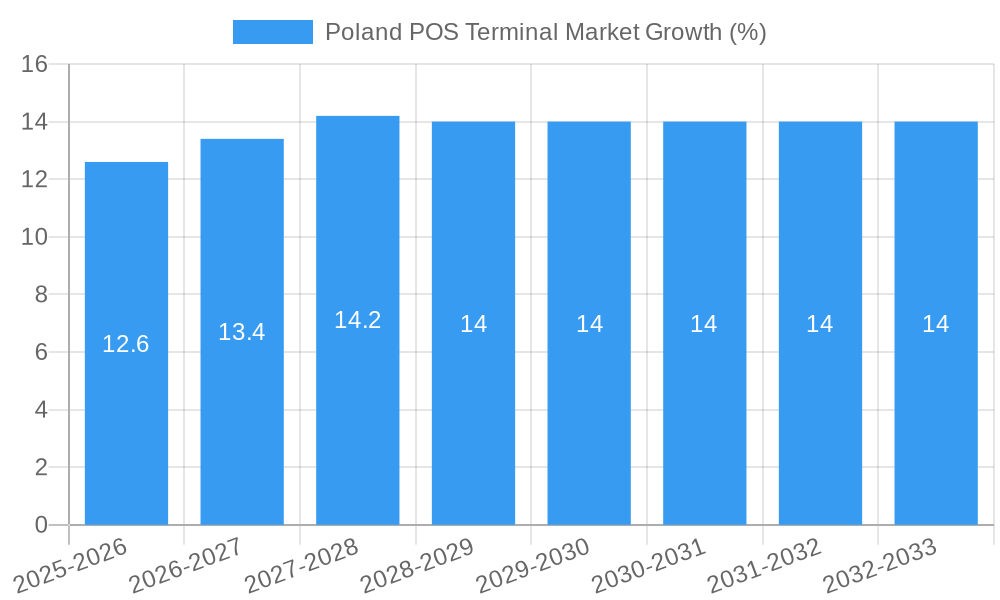

The Poland POS terminal market, valued at approximately €150 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.40% from 2025 to 2033. This growth is fueled by several key drivers. The increasing adoption of digital payment methods across retail, hospitality, and healthcare sectors is a primary factor. Furthermore, the rising demand for efficient and secure transaction processing solutions, coupled with government initiatives promoting digitalization, contributes significantly to market expansion. The market is segmented by type (fixed and mobile/portable POS systems) and end-user industry (retail, hospitality, healthcare, and others). The retail sector currently dominates, driven by the proliferation of small and medium-sized enterprises (SMEs) adopting POS systems for improved inventory management and sales tracking. The shift towards contactless payments and mobile POS solutions is a significant trend shaping the market. However, challenges remain, including the initial investment costs associated with implementing new systems and the need for robust cybersecurity measures to protect sensitive customer data. Competition is fierce, with established players like Ingenico Group (WorldLine), Verifone Payments BV, and PAX Technology vying for market share alongside emerging players. The mobile/portable POS segment is expected to witness faster growth compared to fixed systems due to its flexibility and suitability for various business models.

The Polish POS terminal market's trajectory indicates a promising future. The ongoing digitization of the economy and the increasing preference for cashless transactions are expected to sustain market growth. The continuous innovation in POS technology, including the integration of advanced features such as loyalty programs and analytics dashboards, will further enhance market appeal. While challenges related to infrastructure development and cybersecurity need to be addressed, the overall outlook for the Polish POS terminal market is positive. Future growth will likely be influenced by the adoption rates across various industry segments, the development of innovative payment solutions, and the evolving regulatory landscape. The market is expected to surpass €250 million by 2033 based on current growth projections.

Poland POS Terminal Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Poland POS terminal market, offering a comprehensive overview of market trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is estimated to be valued at xx Million in 2025.

Poland POS Terminal Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, substitute products, end-user profiles, and merger & acquisition (M&A) activities within the Polish POS terminal market. The market exhibits a moderately concentrated structure, with key players holding significant market share. However, the emergence of new technologies and agile fintech companies is fostering increased competition.

- Market Share Distribution: Ingenico Group (WorldLine) and Verifone Payments BV hold approximately xx% and xx% market share respectively in 2025, while other players like PAX Technology and Datecs Polska contribute significantly. Smaller players account for the remaining share.

- Innovation Catalysts: The increasing adoption of contactless payments, mobile POS systems, and integrated payment solutions is driving innovation. The push for improved security features and cloud-based solutions is further shaping the market.

- Regulatory Landscape: The Polish government's focus on promoting digital payments and financial inclusion influences market dynamics. Regulations concerning data security and payment processing are crucial considerations for market participants.

- Substitute Products: While traditional POS terminals remain dominant, the rise of mobile payment solutions and alternative payment methods represents a potential substitute.

- End-User Profiles: The retail, hospitality, and healthcare sectors are primary end-users, with varying POS terminal requirements based on their specific needs.

- M&A Activities: The historical period (2019-2024) witnessed xx M&A deals, with a total estimated value of xx Million. These activities reflect consolidation trends and efforts to expand market reach.

Poland POS Terminal Market Industry Evolution

The Polish POS terminal market has witnessed significant growth over the historical period (2019-2024), driven by increasing digitalization, expanding e-commerce, and rising consumer preference for contactless payments. The market is expected to maintain a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. Technological advancements, particularly the adoption of cloud-based POS systems and the integration of advanced analytics, are accelerating market expansion. Consumer demand for seamless and secure payment experiences is fueling the demand for innovative POS terminal solutions. The shift toward mobile and contactless payments is evident in the rising adoption rates of mobile POS systems, which are projected to account for xx% of the market by 2033.

Leading Regions, Countries, or Segments in Poland POS Terminal Market

The retail sector dominates the Polish POS terminal market, driven by strong e-commerce growth and the increasing adoption of advanced POS systems. Major cities such as Warsaw and Krakow show higher adoption rates than smaller towns due to higher concentration of businesses and consumer spending.

- Key Drivers for Retail Dominance: High consumer spending, government initiatives promoting e-commerce, and the need for efficient inventory management systems.

- Fixed Point-of-Sale Systems: Remain prevalent due to their reliability and established integration with existing business systems.

- Mobile/Portable Point-of-Sale Systems: Experience increasing adoption, particularly in the hospitality and retail sectors, driven by convenience and mobility.

The significant presence of large retail chains and the growing number of SMEs in Poland contribute to high demand for both fixed and mobile POS systems. Further expansion is anticipated in sectors like healthcare and others as digitalization efforts progress.

Poland POS Terminal Market Product Innovations

Recent product innovations include the integration of biometric authentication, improved data security features, and seamless integration with loyalty programs. The adoption of cloud-based platforms allows for remote management and real-time data analysis, enhancing operational efficiency. The introduction of NFC-enabled terminals supports contactless payments, catering to growing consumer demand for quick and convenient transactions.

Propelling Factors for Poland POS Terminal Market Growth

The Polish POS terminal market is propelled by several key factors: the rising adoption of digital payments, government initiatives promoting financial inclusion, and the increasing penetration of e-commerce. Technological advancements in POS systems, including the integration of advanced analytics and cloud-based solutions, also contribute significantly. Furthermore, a growing focus on enhanced security features and contactless payment options drives market growth.

Obstacles in the Poland POS Terminal Market

Challenges include the relatively high initial investment cost for businesses adopting advanced POS systems, potential supply chain disruptions, and intense competition amongst vendors. Regulatory changes and evolving data privacy concerns can impact market dynamics. The cybersecurity risks associated with digital transactions are another considerable obstacle.

Future Opportunities in Poland POS Terminal Market

Future opportunities lie in expanding into less penetrated market segments, leveraging emerging technologies such as Artificial Intelligence (AI) and Internet of Things (IoT) for enhanced customer experiences, and capitalizing on the increasing adoption of mobile and contactless payment solutions. Further growth is projected in integrating loyalty programs and enhanced data analytics capabilities in POS systems.

Major Players in the Poland POS Terminal Market Ecosystem

- Ingenico Group (WorldLine)

- Samsung Electronics Corporation Limited

- HP Development Company LP

- NEC Corporation

- Datecs Polska

- Spire Corp

- Newland Europe BV

- Verifone Payments BV

- PAX Technology

- Panasonic Corporation

Key Developments in Poland POS Terminal Market Industry

- April 2022: Glory announced the opening of a direct sales office in Warsaw, expanding its reach in the Polish retail market.

- April 2022: Credit Agricole in Poland adopted the SoftPos contactless payment acceptance system, boosting mobile payment adoption.

Strategic Poland POS Terminal Market Forecast

The Polish POS terminal market is poised for continued growth driven by increasing digitalization, expanding e-commerce, and government support for digital payments. The adoption of innovative solutions, such as integrated payment platforms and AI-powered analytics, will further propel market expansion, creating significant opportunities for businesses across the value chain. The market is projected to experience sustained growth, driven by robust consumer spending and ongoing technological advancements.

Poland POS Terminal Market Segmentation

-

1. Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-user Industries

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Others

Poland POS Terminal Market Segmentation By Geography

- 1. Poland

Poland POS Terminal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. Constant Fluctuations in Raw Material Supply

- 3.4. Market Trends

- 3.4.1. Strong adoption of Mobile Point-of-Sale System is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland POS Terminal Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ingenico Group(WorldLine)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Electronics Corportion Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HP Development Company LP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NEC Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Datecs Polska

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Spire Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Newland Europe BV*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Verifone Payments BV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PAX Technology

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ingenico Group(WorldLine)

List of Figures

- Figure 1: Poland POS Terminal Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland POS Terminal Market Share (%) by Company 2024

List of Tables

- Table 1: Poland POS Terminal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland POS Terminal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Poland POS Terminal Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 4: Poland POS Terminal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Poland POS Terminal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Poland POS Terminal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Poland POS Terminal Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 8: Poland POS Terminal Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland POS Terminal Market?

The projected CAGR is approximately 8.40%.

2. Which companies are prominent players in the Poland POS Terminal Market?

Key companies in the market include Ingenico Group(WorldLine), Samsung Electronics Corportion Limited, HP Development Company LP, NEC Corporation, Datecs Polska, Spire Corp, Newland Europe BV*List Not Exhaustive, Verifone Payments BV, PAX Technology, Panasonic Corporation.

3. What are the main segments of the Poland POS Terminal Market?

The market segments include Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Strong adoption of Mobile Point-of-Sale System is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Constant Fluctuations in Raw Material Supply.

8. Can you provide examples of recent developments in the market?

April 2022 - Glory announced the opening of a direct sales office in Warsaw as part of its ongoing growth. Glory Global Solutions (Poland) LLC will benefit from market expansion in Poland, particularly in the retail industry. Glory's tried-and-true point of sale and back office hardware and software solutions help merchants run more efficiently while enhancing the shopping experience for Polish customers in all retail segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland POS Terminal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland POS Terminal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland POS Terminal Market?

To stay informed about further developments, trends, and reports in the Poland POS Terminal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence