Key Insights

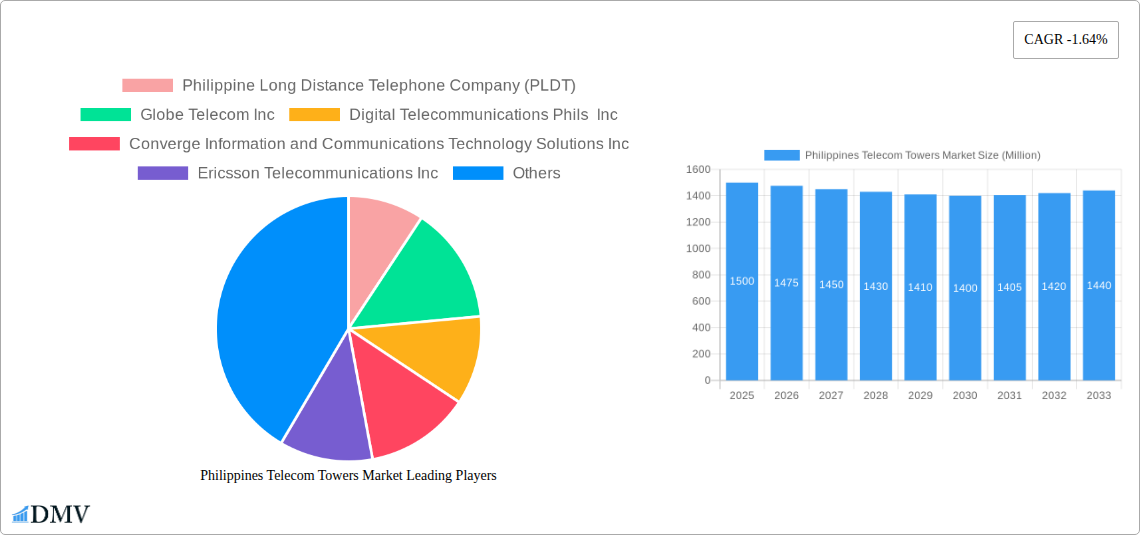

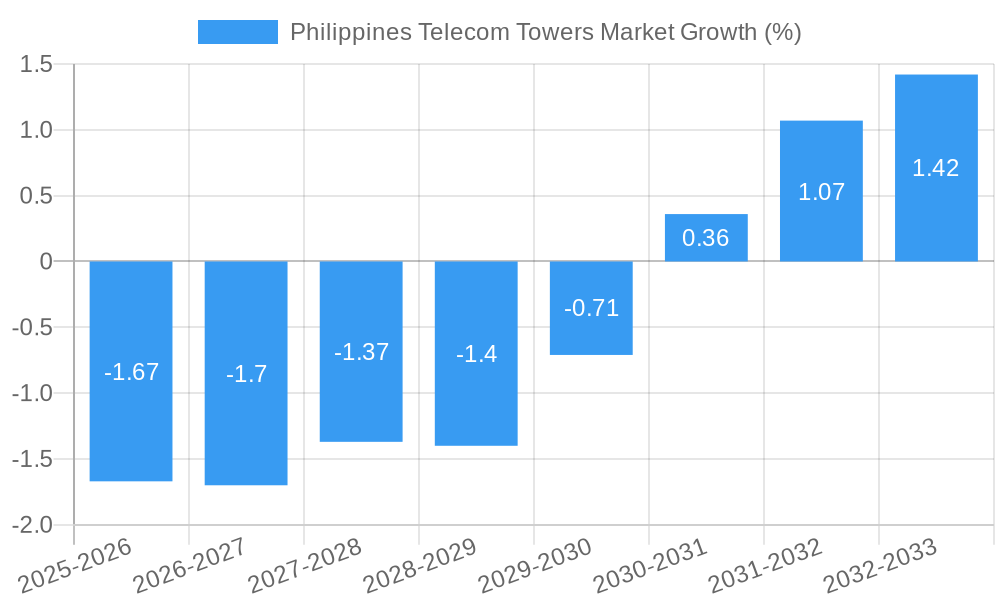

The Philippines Telecom Towers market, while exhibiting a negative CAGR of -1.64% between 2019 and 2024, presents a complex picture for the forecast period of 2025-2033. This slight contraction likely reflects market consolidation and increased efficiency in tower infrastructure utilization rather than an overall decline in demand. The market is driven by the expanding mobile data consumption in the Philippines, fueled by increasing smartphone penetration and the growing popularity of data-intensive applications. Government initiatives promoting digital infrastructure development also contribute positively, although regulatory hurdles and potential licensing complexities could act as restraints. The major players, including PLDT, Globe Telecom, and Converge ICT Solutions, are key in shaping the market landscape through infrastructure sharing agreements and strategic partnerships. Furthermore, the emergence of independent tower companies (ITCs) like Transcend Towers and Phil-Tower Consortium signifies a growing trend towards infrastructure-as-a-service (IaaS) models, driving further efficiency and competition.

Looking ahead, the market is poised for modest growth, albeit likely slower than the broader telecommunications sector. The ongoing rollout of 5G networks presents a significant opportunity, demanding increased tower density and potentially offsetting the negative CAGR observed in the past. However, the market will need to address challenges such as securing land permits for new tower installations and managing environmental concerns associated with infrastructure deployment. The segments within the market likely include macro towers, small cells, and rooftop towers, each with its own growth trajectory influenced by specific technological advancements and deployment strategies. The success of the market hinges on the ability of key players to navigate regulatory hurdles, effectively manage operational costs, and strategically leverage the growing demand for robust and reliable telecommunications infrastructure.

Philippines Telecom Towers Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Philippines Telecom Towers Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with 2025 as the base and estimated year, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting significant growth potential fueled by increasing mobile penetration, expanding 5G infrastructure, and substantial investments.

Philippines Telecom Towers Market Composition & Trends

This section delves into the competitive landscape of the Philippines telecom towers market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute technologies, end-user profiles, and merger and acquisition (M&A) activities. The market exhibits a moderately concentrated structure, with key players like PLDT, Globe Telecom, and Converge holding significant market share. However, the entry of new players and increased M&A activity indicates a shift towards a more dynamic competitive environment.

- Market Share Distribution (2024 Estimate): PLDT (xx%), Globe Telecom (xx%), Converge (xx%), Others (xx%). These figures are based on a combination of tower ownership and leasing agreements. Precise figures remain commercially sensitive.

- Innovation Catalysts: The push for 5G deployment, increasing demand for improved network coverage, and the adoption of innovative tower technologies are key drivers of market innovation.

- Regulatory Landscape: The current regulatory environment in the Philippines fosters competition, encouraging investment and infrastructure development within the telecom sector. However, evolving regulations and licensing requirements continue to shape market dynamics.

- Substitute Products: While traditional macro cell towers remain dominant, the market is witnessing the emergence of small cells and distributed antenna systems (DAS) as alternative solutions.

- End-User Profiles: The primary end-users are major telecom operators, including PLDT, Globe Telecom, and Converge, along with independent tower companies.

- M&A Activities: Recent years have witnessed several significant M&A deals, including KKR's planned USD 400 Million investment in the Philippine telecom tower sector (March 2024), reflecting the attractive investment potential. The total value of M&A transactions within the period 2019-2024 is estimated at xx Million.

Philippines Telecom Towers Market Industry Evolution

This section analyzes the Philippines Telecom Towers Market's growth trajectory, technological advancements, and evolving consumer demands from 2019 to 2024, and projects future trends through 2033. The market has demonstrated robust growth, driven by increasing mobile subscriptions and data consumption. The rapid expansion of 4G and the imminent rollout of 5G are major catalysts for tower infrastructure development. The increasing demand for higher data speeds and greater network capacity continues to drive investment in new tower infrastructure and upgrades to existing ones. We project a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, indicating sustained market expansion. This growth is underpinned by the expanding mobile subscriber base, continuous upgrading of network technologies, and increased demand for data services.

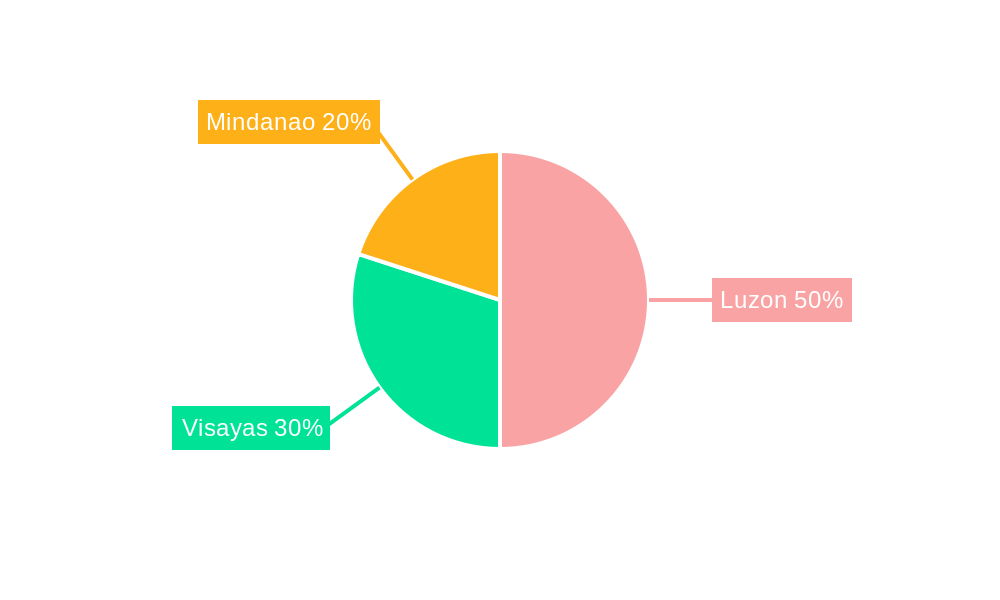

Leading Regions, Countries, or Segments in Philippines Telecom Towers Market

The National Capital Region (NCR) and key urban centers in Luzon and Visayas are currently the leading regions for telecom tower deployments in the Philippines. This is due to high population density, greater mobile penetration, and strong demand for high-speed data services.

- Key Drivers for NCR Dominance:

- High population density and mobile penetration.

- Significant investment by telecom operators in network infrastructure.

- Favorable regulatory environment supporting infrastructure development.

- Expansion into other regions: Growth is expected to expand to other regions as operators seek to increase their nationwide coverage, including those with promising digital infrastructures in Mindanao.

The dominance of NCR and major urban areas is expected to persist, although expansion into other regions, particularly those with increasing populations and economic activity, will likely accelerate during the forecast period.

Philippines Telecom Towers Market Product Innovations

Recent product innovations in the Philippines Telecom Towers market include the adoption of more energy-efficient tower designs, improved site acquisition and permitting procedures and the implementation of smart tower technologies that enhance network performance and maintenance efficiency. These innovations are aimed at optimizing operational costs, improving network coverage and reliability, and increasing capacity to meet the growing demand for wireless data services.

Propelling Factors for Philippines Telecom Towers Market Growth

The Philippines Telecom Towers Market's growth is driven by several key factors, including:

- Increasing Mobile Penetration: The number of mobile subscribers in the Philippines continues to rise, creating a sustained demand for network infrastructure.

- 5G Network Rollout: The deployment of 5G networks necessitates significant investment in new tower infrastructure and upgrades to existing sites.

- Government Support: The Philippine government's focus on improving digital infrastructure and expanding internet access creates a favorable environment for investment in the sector.

- Rise in Data Consumption: The growing demand for high-speed data services, particularly from streaming video and online gaming, fuels the need for enhanced network capacity.

Obstacles in the Philippines Telecom Towers Market

Several factors could hinder the growth of the Philippines Telecom Towers Market:

- Permitting and Regulatory Hurdles: The process of obtaining permits for tower construction and operation can be complex and time-consuming.

- Right-of-Way Issues: Securing access to land for tower construction can be challenging in densely populated areas.

- Competition: The increasing number of players in the market creates a more competitive landscape, potentially impacting profitability. The entry of new firms is creating a competitive pressure and could impact profitability.

- Economic Factors: Economic downturns could affect investment levels in telecom infrastructure.

Future Opportunities in Philippines Telecom Towers Market

Future opportunities within the Philippines Telecom Towers Market include:

- Expansion into Rural Areas: Extending network coverage to underserved rural areas represents a significant growth opportunity.

- Small Cell Deployments: The use of small cells and other distributed antenna systems (DAS) is expected to increase, creating demand for innovative deployment solutions.

- Tower Colocation: Tower colocation services will be a prominent feature within the market, reducing costs for telecom operators.

Major Players in the Philippines Telecom Towers Market Ecosystem

- Philippine Long Distance Telephone Company (PLDT)

- Globe Telecom Inc

- Digital Telecommunications Phils Inc

- Converge Information and Communications Technology Solutions Inc

- Ericsson Telecommunications Inc

- Radius Telecoms Inc

- N-Wave Technologies Philippines Inc

- Transcend Towers Infrastructure Inc

- Phil-Tower Consortium Inc

- Sky Cable Corporation

Key Developments in Philippines Telecom Towers Market Industry

- June 2024: Nokia partnered with Globe Telecom to deploy its Broadband Network Gateway (BNG) solution across key regions, enhancing broadband services. This strategic partnership modernizes Globe's infrastructure, improving the customer experience and boosting the demand for network capacity.

- March 2024: KKR & Co. announced a USD 400 Million investment to develop and acquire approximately 2,000 telecom towers, significantly boosting digital connectivity across the Philippines. This demonstrates significant private investment confidence in the growth of the telecom sector.

Strategic Philippines Telecom Towers Market Forecast

The Philippines Telecom Towers Market is poised for sustained growth throughout the forecast period (2025-2033), driven by the factors previously discussed. The ongoing expansion of 5G networks, increasing mobile penetration, and supportive government policies will create significant demand for tower infrastructure, thereby driving market expansion and attracting further investments. The market is expected to witness increased competition, technological advancements, and strategic partnerships, shaping its future landscape and solidifying its position as a key driver of technological and socioeconomic progress in the Philippines.

Philippines Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive Sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Philippines Telecom Towers Market Segmentation By Geography

- 1. Philippines

Philippines Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of -1.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G Deployment to Address the Increasing Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive Sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Philippine Long Distance Telephone Company (PLDT)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Globe Telecom Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Digital Telecommunications Phils Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Converge Information and Communications Technology Solutions Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ericsson Telecommunications Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Radius Telecoms Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 N-Wave Technologies Philippines Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Transcend Towers Infrastructure Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Phil-Tower Consortium Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sky Cable Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Philippine Long Distance Telephone Company (PLDT)

List of Figures

- Figure 1: Philippines Telecom Towers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Philippines Telecom Towers Market Share (%) by Company 2024

List of Tables

- Table 1: Philippines Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Philippines Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 3: Philippines Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: Philippines Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Philippines Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Philippines Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 7: Philippines Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 8: Philippines Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 9: Philippines Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Telecom Towers Market?

The projected CAGR is approximately -1.64%.

2. Which companies are prominent players in the Philippines Telecom Towers Market?

Key companies in the market include Philippine Long Distance Telephone Company (PLDT), Globe Telecom Inc, Digital Telecommunications Phils Inc, Converge Information and Communications Technology Solutions Inc, Ericsson Telecommunications Inc, Radius Telecoms Inc, N-Wave Technologies Philippines Inc, Transcend Towers Infrastructure Inc, Phil-Tower Consortium Inc, Sky Cable Corporatio.

3. What are the main segments of the Philippines Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G Deployment to Address the Increasing Market Demand.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas5.1.2 5G deployments are a major catalyst for growth in the cell-tower leasing environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

June 2024: Nokia partnered with Globe Telecom to roll out its Broadband Network Gateway (BNG) solution across pivotal regions in the Philippines. These regions encompass North Luzon, South Luzon, the National Capital Region, Visayas, and Mindanao. This initiative aims to modernize Globe Telecom's infrastructure, ensuring an enhanced broadband experience for its clientele. Upon implementation, Nokia's BNG solution will bolster Globe Telecom's residential wireline services, catering to both postpaid and prepaid broadband users. Central to Nokia's offering is the 7750 Service Router (SR), designated as the BNG platform. This platform is engineered to manage subscriber services, oversee bandwidth allocation, and enforce per-subscriber policy controls.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Philippines Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence