Key Insights

The Pakistan lithium-ion battery market is projected for substantial growth, driven by escalating adoption of electric vehicles (EVs), renewable energy storage systems, and the expanding consumer electronics sector. The market is expected to reach $134.8 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 23.3% from 2025 to 2033. This expansion is supported by government initiatives promoting renewable energy, a growing middle class fueling consumer electronics demand, and developing EV infrastructure. Key segments include consumer electronics, automotive (EVs, two-wheelers), and industrial applications (UPS systems, power tools). Despite challenges such as limited domestic manufacturing capacity and high import costs, favorable government policies and the increasing demand for energy storage solutions, particularly in a region facing power outages, ensure an optimistic outlook. Continued investment in battery technology and infrastructure will propel market expansion throughout the forecast period. Established players like Zhejiang Narada Power Source Co Ltd, Exide Pakistan Limited, Phoenix Battery Ltd, and Atlas Battery Limited indicate market maturity and contribute to growth.

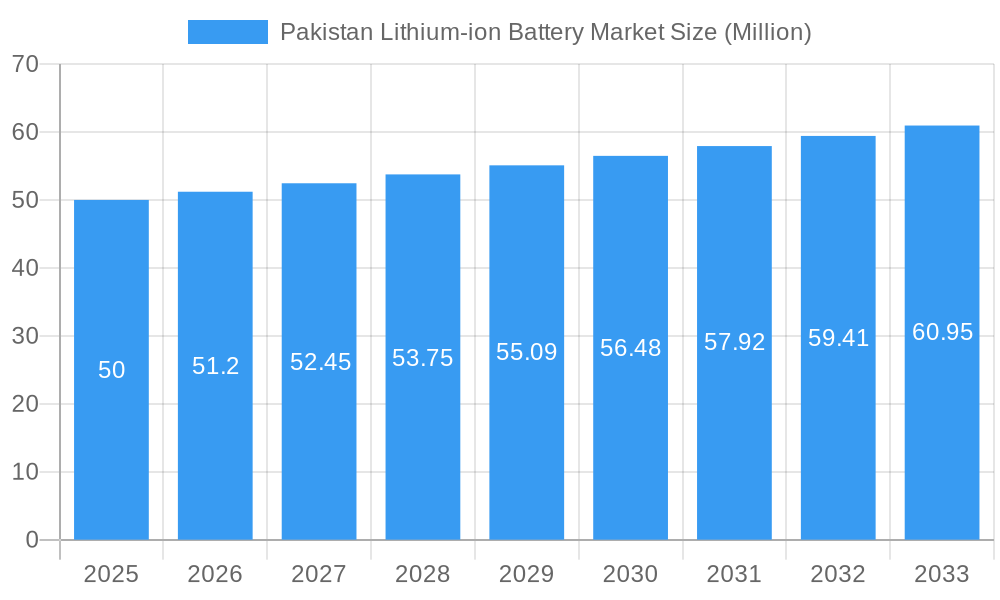

Pakistan Lithium-ion Battery Market Market Size (In Billion)

The forecast period (2025-2033) anticipates significant expansion within the Pakistan lithium-ion battery market, driven by increasing energy storage needs and the rapid development of the country's EV sector. Improved grid stability through energy storage solutions will also be a key driver. Sustained growth in the consumer electronics sector will further bolster demand for portable device batteries. However, substantial investment in local manufacturing to reduce import reliance and the development of a robust charging infrastructure for EVs are crucial for sustained growth. Government support, including subsidies, tax incentives, and infrastructure development, is essential for unlocking the market's full potential and positioning Pakistan as a significant player in the regional lithium-ion battery landscape.

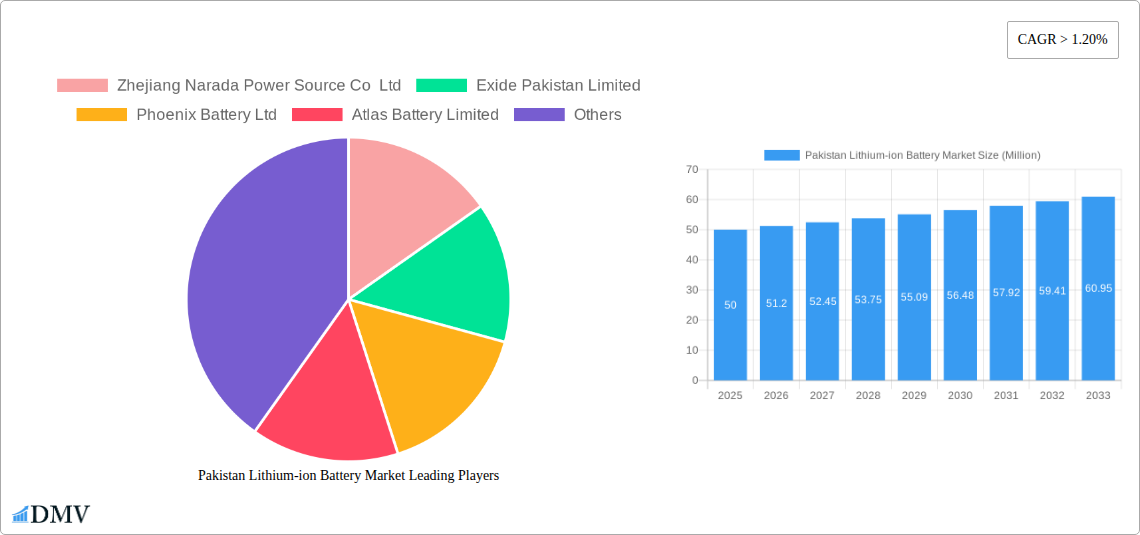

Pakistan Lithium-ion Battery Market Company Market Share

Pakistan Lithium-ion Battery Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Pakistan Lithium-ion Battery market, offering a comprehensive overview of its current state and future trajectory. With a meticulous study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this dynamic market. The report delves into key segments, including consumer electronics, automotive, industrial, and other applications, offering granular insights into market size, growth drivers, challenges, and future opportunities. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033.

Pakistan Lithium-ion Battery Market Market Composition & Trends

This section examines the competitive landscape of the Pakistan Lithium-ion Battery market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure, with key players like Zhejiang Narada Power Source Co Ltd, Exide Pakistan Limited, Phoenix Battery Ltd, and Atlas Battery Limited holding significant market share. However, the entry of new players and technological advancements are expected to increase competition in the coming years.

- Market Share Distribution (2025): Exide Pakistan Limited (XX%), Zhejiang Narada Power Source Co Ltd (XX%), Phoenix Battery Ltd (XX%), Atlas Battery Limited (XX%), Others (XX%).

- Innovation Catalysts: Growing demand for electric vehicles (EVs), increasing adoption of renewable energy sources, and government initiatives promoting energy storage solutions are major drivers of innovation.

- Regulatory Landscape: The government's focus on developing the EV sector and investments in energy storage infrastructure are creating a favorable regulatory environment.

- Substitute Products: Lead-acid batteries remain a significant competitor, but their limitations in terms of energy density and lifespan are pushing the adoption of lithium-ion batteries.

- End-User Profiles: The automotive, consumer electronics, and industrial sectors are the primary end-users of lithium-ion batteries in Pakistan.

- M&A Activities: While significant M&A activity is not yet prevalent, increased investment and market growth are likely to trigger consolidation in the coming years. The total value of M&A deals in the last 5 years is estimated at XX Million.

Pakistan Lithium-ion Battery Market Industry Evolution

This section meticulously analyzes the evolution of the Pakistan Lithium-ion Battery market, focusing on market growth trajectories, technological advancements, and evolving consumer preferences. The market has witnessed significant growth in recent years, driven by increasing demand for portable electronic devices, electric vehicles, and energy storage systems. Technological advancements have led to improved battery performance, longer lifespan, and reduced costs, further boosting market growth. Consumer demand for high-performance, reliable, and environmentally friendly batteries is also driving the market's expansion.

The market experienced a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024). Adoption rates for lithium-ion batteries in various applications are steadily increasing, with the automotive sector expected to witness particularly strong growth in the forecast period. The market is projected to achieve a CAGR of XX% between 2025 and 2033. This growth is fueled by government initiatives promoting EVs and energy storage, coupled with decreasing battery costs and improved technology.

Leading Regions, Countries, or Segments in Pakistan Lithium-ion Battery Market

The automotive segment is currently the leading application for lithium-ion batteries in Pakistan, driven by the government's push towards electric mobility and significant investments in EV infrastructure.

- Key Drivers for Automotive Segment Dominance:

- Government policies promoting EV adoption, including the August 2020 agreement with China for electric bus procurement and the USD 30 billion investment by Skywell Automobile.

- Increasing consumer demand for electric vehicles due to rising fuel prices and environmental concerns.

- Growing investments in charging infrastructure.

The industrial segment is also experiencing notable growth, driven by the increasing demand for energy storage solutions in various industrial applications. The consumer electronics segment remains a significant market, although growth is comparatively slower than the automotive segment due to maturity of the market and price sensitivity. Other applications, such as medical devices and power tools, are emerging and are expected to gain momentum as their applications expand.

Pakistan Lithium-ion Battery Market Product Innovations

Recent product innovations focus on improving energy density, cycle life, safety, and cost-effectiveness. Manufacturers are introducing advanced battery chemistries, such as lithium iron phosphate (LFP), and improved battery management systems (BMS) to enhance battery performance and reliability. These innovations are enhancing the overall appeal of lithium-ion batteries and further driving their adoption across various applications. Unique selling propositions often center around extended lifespan, rapid charging capabilities, and enhanced safety features.

Propelling Factors for Pakistan Lithium-ion Battery Market Growth

The growth of the Pakistan Lithium-ion Battery market is fueled by several key factors:

- Technological Advancements: Improvements in battery chemistry, cell design, and manufacturing processes are leading to higher energy density, longer lifespan, and reduced costs.

- Government Support: Government initiatives promoting electric mobility and renewable energy are creating a favorable environment for market expansion. The December 2018 ADB loan and grant agreement for the Jhimpir-I BESS project exemplifies this.

- Economic Growth: Rising disposable incomes and increasing urbanization are boosting demand for consumer electronics and electric vehicles.

Obstacles in the Pakistan Lithium-ion Battery Market Market

Despite the positive outlook, several factors hinder the growth of the Pakistan Lithium-ion Battery market:

- Regulatory Hurdles: While there is government support, navigating the regulatory landscape can be challenging, impacting the speed of market penetration.

- Supply Chain Disruptions: Dependence on imported raw materials and components can lead to supply chain vulnerabilities and price volatility.

- Competitive Pressures: Competition from established players and new entrants can put downward pressure on prices and profitability.

Future Opportunities in Pakistan Lithium-ion Battery Market

Significant opportunities exist for market expansion in the coming years:

- Growing EV Market: The continued expansion of the electric vehicle sector will drive substantial demand for lithium-ion batteries.

- Renewable Energy Integration: Increasing use of renewable energy sources will require efficient energy storage solutions, boosting demand for lithium-ion batteries.

- Emerging Applications: New applications in areas such as grid-scale energy storage, medical devices, and industrial automation will further propel market growth.

Major Players in the Pakistan Lithium-ion Battery Market Ecosystem

- Zhejiang Narada Power Source Co Ltd

- Exide Pakistan Limited (Exide Pakistan Limited)

- Phoenix Battery Ltd

- Atlas Battery Limited

Key Developments in Pakistan Lithium-ion Battery Market Industry

- August 2020: Pakistan signed an agreement with China to procure electric buses, triggering significant investment in the EV sector.

- December 2018: The Asian Development Bank (ADB) provided USD 284 million in funding for the construction of a large-scale Lithium-Ion Battery Energy Storage System (BESS) at Jhimpir-I Grid Station.

Strategic Pakistan Lithium-ion Battery Market Market Forecast

The Pakistan Lithium-ion Battery market is poised for significant growth in the coming years, driven by technological advancements, supportive government policies, and increasing demand from various sectors. The expanding EV market and the growing adoption of renewable energy will be key catalysts for market expansion. The market is expected to experience robust growth, exceeding XX Million by 2033, creating lucrative opportunities for both established and emerging players.

Pakistan Lithium-ion Battery Market Segmentation

-

1. Application

- 1.1. Consumer Electronics

- 1.2. Automotive

- 1.3. Industrial

- 1.4. Other Ap

Pakistan Lithium-ion Battery Market Segmentation By Geography

- 1. Pakistan

Pakistan Lithium-ion Battery Market Regional Market Share

Geographic Coverage of Pakistan Lithium-ion Battery Market

Pakistan Lithium-ion Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Growing Automotive Sector in the Country4.; The Low Cost of Lead and Lithium

- 3.3. Market Restrains

- 3.3.1. 4.; An Economic Slowdown and Increasing Government Debt

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Application to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Pakistan Lithium-ion Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Electronics

- 5.1.2. Automotive

- 5.1.3. Industrial

- 5.1.4. Other Ap

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zhejiang Narada Power Source Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Exide Pakistan Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Phoenix Battery Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Atlas Battery Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.1 Zhejiang Narada Power Source Co Ltd

List of Figures

- Figure 1: Pakistan Lithium-ion Battery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Pakistan Lithium-ion Battery Market Share (%) by Company 2025

List of Tables

- Table 1: Pakistan Lithium-ion Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Pakistan Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 3: Pakistan Lithium-ion Battery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Pakistan Lithium-ion Battery Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Pakistan Lithium-ion Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Pakistan Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 7: Pakistan Lithium-ion Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Pakistan Lithium-ion Battery Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pakistan Lithium-ion Battery Market?

The projected CAGR is approximately 23.3%.

2. Which companies are prominent players in the Pakistan Lithium-ion Battery Market?

Key companies in the market include Zhejiang Narada Power Source Co Ltd, Exide Pakistan Limited, Phoenix Battery Ltd, Atlas Battery Limited.

3. What are the main segments of the Pakistan Lithium-ion Battery Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Growing Automotive Sector in the Country4.; The Low Cost of Lead and Lithium.

6. What are the notable trends driving market growth?

Consumer Electronics Application to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; An Economic Slowdown and Increasing Government Debt.

8. Can you provide examples of recent developments in the market?

In August 2020, post the introduction of EV policy, Pakistan had signed an agreement with China to procure electric buses. Under the Strategic Alliance Agreement, Skywell Automobile is expected to set up an electric vehicles chain throughout Pakistan, with electric buses running in the first phase between Islamabad and Lahore. Further, Skywell is expected to make an investment of around USD 30 billion for setting up the EV chain in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pakistan Lithium-ion Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pakistan Lithium-ion Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pakistan Lithium-ion Battery Market?

To stay informed about further developments, trends, and reports in the Pakistan Lithium-ion Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence