Key Insights

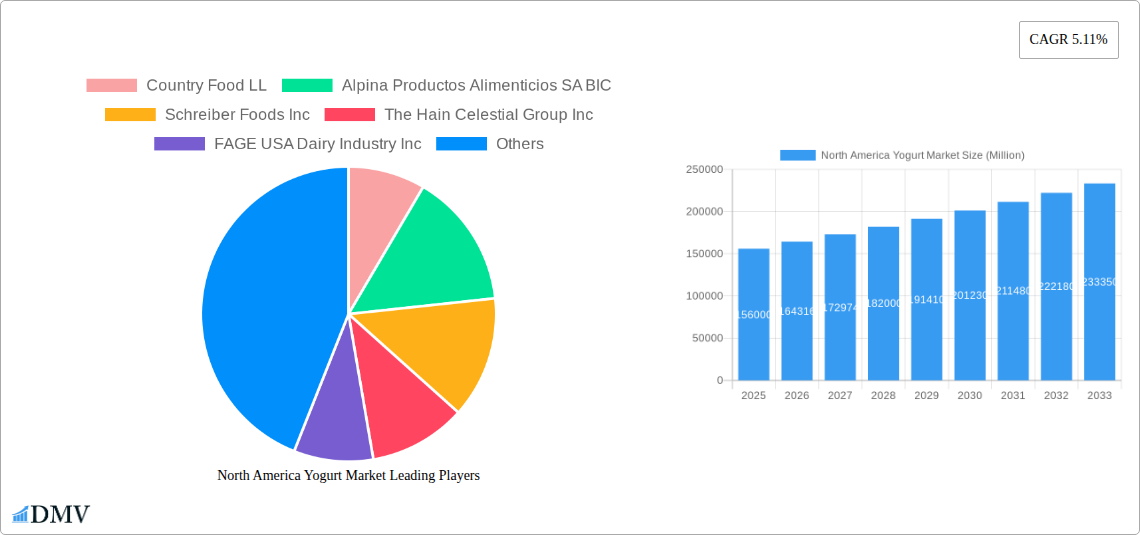

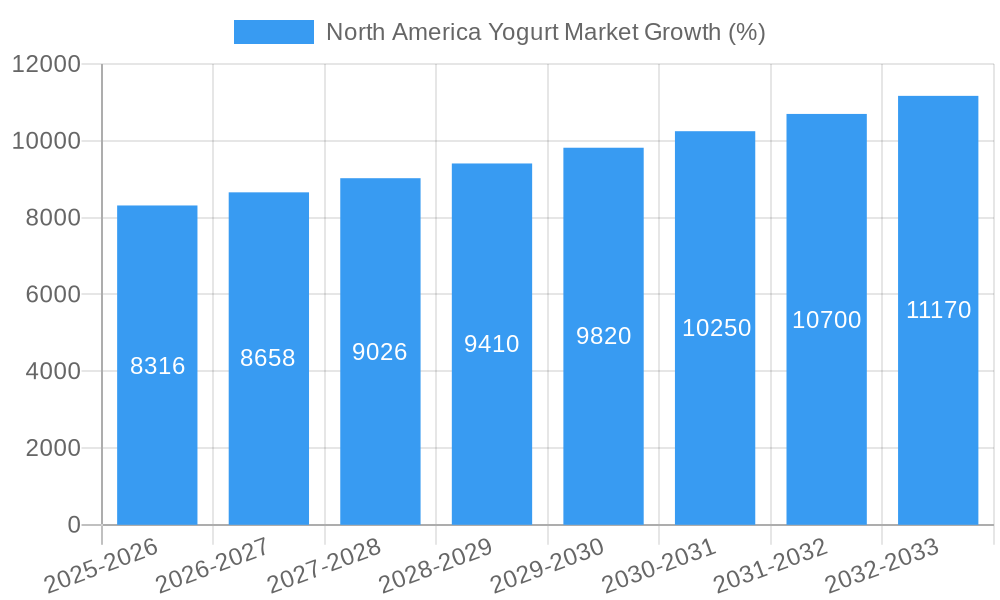

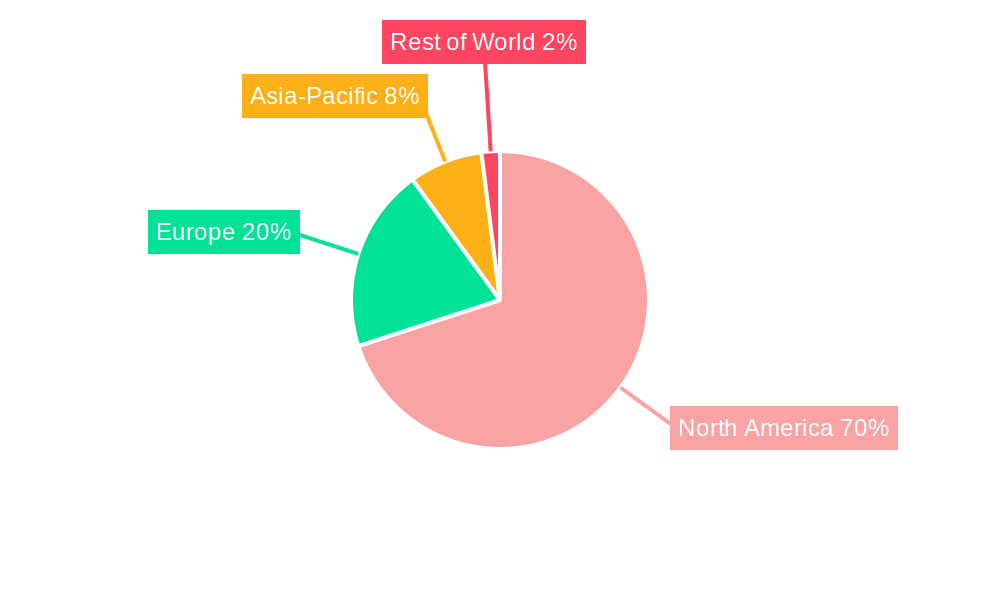

The North American yogurt market, valued at $156,000 million in 2025, is projected to experience robust growth, driven by increasing health consciousness among consumers and the rising popularity of yogurt as a healthy and convenient snack and meal option. The market's Compound Annual Growth Rate (CAGR) of 5.11% from 2019-2024 indicates a steady upward trajectory, expected to continue through 2033. Key growth drivers include the increasing demand for functional yogurts with added probiotics and nutrients, catering to health-conscious consumers seeking gut health benefits and enhanced nutritional value. Furthermore, the burgeoning popularity of Greek yogurt and innovative product variations, such as flavored and organic options, fuels market expansion. The convenience offered by ready-to-eat yogurt cups and the expanding availability through various distribution channels, including supermarkets, convenience stores, and foodservice establishments, contributes significantly to market growth. However, factors such as fluctuating milk prices and increasing competition from alternative healthy snacks could potentially restrain market growth. Within the market segmentation, flavored yogurts are expected to dominate due to their appealing taste profiles and diverse offerings, while the off-trade channel (supermarkets and grocery stores) will continue to be the primary distribution channel, reflecting consumer purchasing habits. The presence of established multinational players like Danone and Groupe Lactalis, alongside regional and smaller brands, creates a dynamic competitive landscape characterized by ongoing innovation and brand competition.

The United States, being the largest economy within North America, holds a dominant share of the regional market, largely attributed to high yogurt consumption rates and the presence of numerous established players. Canada and Mexico are also significant contributors to regional growth. The strategic focus of market players on product diversification, expanding distribution networks, and targeted marketing campaigns will influence future market trends. The projected growth in the North American yogurt market offers significant opportunities for businesses across the value chain, from raw material suppliers to retailers and foodservice providers. A deeper understanding of consumer preferences for specific flavors, functionalities, and packaging formats will be crucial for achieving sustained success in this competitive market. The incorporation of sustainable practices and eco-friendly packaging is also anticipated to become a more influential factor in consumer choice, impacting the market's trajectory in the years to come.

North America Yogurt Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America yogurt market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The report's meticulous analysis covers market size, segmentation, competitive landscape, and future growth projections, all quantified in Millions (USD).

North America Yogurt Market Composition & Trends

This section delves into the intricate composition of the North American yogurt market, analyzing its concentration, innovative drivers, regulatory environment, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market is characterized by a moderate level of concentration, with key players holding significant market share. The precise market share distribution for 2025 is estimated at: Danone SA (25%), Groupe Lactalis SA (18%), Schreiber Foods Inc (15%), The Hain Celestial Group Inc (12%), and others (30%). Innovation is primarily driven by the introduction of new flavors, functional benefits (e.g., probiotics), and sustainable packaging options. Regulatory landscapes, particularly concerning labeling and health claims, influence product formulations and marketing strategies. The primary substitute products include other dairy products (milk, cheese) and plant-based alternatives. The end-user profile is diverse, encompassing all age groups and demographics, with a notable focus on health-conscious consumers. M&A activity has been moderate in recent years, with deal values averaging approximately XX Million in the past five years.

- Market Concentration: Moderate, with a few dominant players.

- Innovation Catalysts: New flavors, functional benefits (probiotics), sustainable packaging.

- Regulatory Landscape: Significant influence on labeling and health claims.

- Substitute Products: Other dairy products, plant-based alternatives.

- End-User Profile: Diverse, with a focus on health-conscious consumers.

- M&A Activity: Moderate, with average deal values of approximately XX Million.

North America Yogurt Market Industry Evolution

The North America yogurt market has experienced consistent growth throughout the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is attributed to several factors, including increasing consumer awareness of yogurt's health benefits, the rise of convenient single-serve packaging, and the introduction of innovative product variations catering to diverse taste preferences. Technological advancements, such as improved fermentation processes and automated packaging systems, have enhanced efficiency and product quality. Consumer demand has shifted towards healthier options, with a growing preference for low-sugar, high-protein, and organic yogurts. The market is expected to maintain a healthy growth trajectory in the forecast period (2025-2033), driven by the increasing demand for convenient and nutritious snacks. The projected CAGR for the forecast period is estimated at xx%. The adoption rate of plant-based yogurt alternatives has also seen significant growth, particularly among consumers seeking vegan or lactose-free options. This segment alone is estimated to show a CAGR of xx% during the forecast period.

Leading Regions, Countries, or Segments in North America Yogurt Market

The Western region of North America dominates the yogurt market, driven by high consumer spending, a strong focus on health and wellness, and a robust retail infrastructure. California, in particular, stands out due to its large population, diverse consumer preferences, and a high concentration of innovative yogurt brands. Within product types, flavored yogurt holds a larger market share compared to unflavored yogurt, reflecting consumer preference for diverse and appealing taste profiles. In terms of distribution channels, off-trade channels (supermarkets, grocery stores, convenience stores) account for the majority of sales, reflecting the convenience and accessibility of these retail formats.

- Key Drivers for Western Region Dominance:

- High consumer spending

- Strong health and wellness focus

- Robust retail infrastructure

- Key Drivers for Flavored Yogurt Dominance:

- Diverse taste preferences

- Appealing product variations

- Key Drivers for Off-Trade Channel Dominance:

- Convenience and accessibility

- Wide distribution network

North America Yogurt Market Product Innovations

Recent innovations within the North American yogurt market showcase a focus on enhanced nutritional profiles, improved taste, and greater convenience. Reduced-sugar options, the addition of probiotics for gut health, and the use of natural sweeteners are prominent trends. The market also witnesses the rise of plant-based yogurt alternatives, catering to the growing vegan and lactose-intolerant population. These innovations are often supported by technological advancements, such as improved fermentation processes and high-pressure processing (HPP) for extended shelf life. Unique selling propositions often center on health benefits, taste, and convenience.

Propelling Factors for North America Yogurt Market Growth

Several factors are driving the growth of the North American yogurt market. Technological advancements in production and packaging enhance efficiency and product quality. The increasing health consciousness of consumers fuels the demand for healthier yogurt options, such as low-sugar and high-protein varieties. Furthermore, favorable regulatory environments and supportive government policies encourage innovation and market expansion. The rise in disposable incomes also contributes to increased consumer spending on premium yogurt products.

Obstacles in the North America Yogurt Market

The North America yogurt market faces challenges, including fluctuating raw material costs (milk prices) and potential supply chain disruptions. Intense competition among established brands and new entrants adds pressure on pricing and profit margins. Regulatory hurdles related to labeling, health claims, and food safety standards can add complexity and increase production costs. Changing consumer preferences and the rise of alternative snack options (e.g., plant-based yogurt, other healthy snacks) create continuous pressure on market share.

Future Opportunities in North America Yogurt Market

The North American yogurt market presents several future opportunities. The expanding market for functional yogurts with added probiotics and other health benefits offers significant potential. The growing demand for sustainable and ethically sourced yogurt creates opportunities for brands focused on environmental responsibility. Furthermore, the exploration of new flavors, formats, and distribution channels provides room for innovation and expansion. The market also sees opportunities in targeting specific demographics with tailored product offerings.

Major Players in the North America Yogurt Market Ecosystem

- Country Food LL

- Alpina Productos Alimenticios SA BIC

- Schreiber Foods Inc

- The Hain Celestial Group Inc

- FAGE USA Dairy Industry Inc

- Danone SA

- Johanna Foods Inc

- Groupe Lactalis SA

Key Developments in North America Yogurt Market Industry

- February 2023: Johanna Foods Inc. announced the construction plan for a 65,000-square-foot expansion of its yogurt manufacturing plant, aiming to double its production capacity. This expansion indicates a significant investment in increased production to meet growing market demand.

- June 2022: Danone North America partnered with White Plains, Boulder, and Colo, launching Activia+ Multi-Benefit Probiotic Yogurt Drinks. This partnership highlights the strategic collaboration to expand product offerings and market reach.

- March 2021: Siggi’s launched its newest line of reduced-sugar yogurt, containing 50% less sugar than leading Greek yogurt. This launch demonstrates a response to the rising consumer demand for healthier, low-sugar options.

Strategic North America Yogurt Market Forecast

The North America yogurt market is poised for continued growth, driven by factors such as increasing health awareness, rising disposable incomes, and the introduction of innovative product offerings. The focus on functional benefits, sustainable practices, and personalized nutrition will shape future market dynamics. Opportunities exist in expanding into niche markets, developing new product formats, and exploring innovative distribution channels. The market's future growth will be significantly influenced by consumer preferences, technological advancements, and evolving regulatory landscapes. The overall market potential remains strong, with significant opportunities for both established players and new entrants.

North America Yogurt Market Segmentation

-

1. Product Type

- 1.1. Flavored Yogurt

- 1.2. Unflavored Yogurt

-

2. Distribution Channel

-

2.1. Off-Trade

-

2.1.1. By Sub Distribution Channels

- 2.1.1.1. Convenience Stores

- 2.1.1.2. Online Retail

- 2.1.1.3. Specialist Retailers

- 2.1.1.4. Supermarkets and Hypermarkets

- 2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

-

2.1.1. By Sub Distribution Channels

- 2.2. On-Trade

-

2.1. Off-Trade

North America Yogurt Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Yogurt Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Yogurt Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Flavored Yogurt

- 5.1.2. Unflavored Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. By Sub Distribution Channels

- 5.2.1.1.1. Convenience Stores

- 5.2.1.1.2. Online Retail

- 5.2.1.1.3. Specialist Retailers

- 5.2.1.1.4. Supermarkets and Hypermarkets

- 5.2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.1.1. By Sub Distribution Channels

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Yogurt Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Yogurt Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Yogurt Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Yogurt Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Country Food LL

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alpina Productos Alimenticios SA BIC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Schreiber Foods Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Hain Celestial Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 FAGE USA Dairy Industry Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Danone SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Johanna Foods Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Groupe Lactalis SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Country Food LL

List of Figures

- Figure 1: North America Yogurt Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Yogurt Market Share (%) by Company 2024

List of Tables

- Table 1: North America Yogurt Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Yogurt Market Volume Liters Forecast, by Region 2019 & 2032

- Table 3: North America Yogurt Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: North America Yogurt Market Volume Liters Forecast, by Product Type 2019 & 2032

- Table 5: North America Yogurt Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: North America Yogurt Market Volume Liters Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America Yogurt Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Yogurt Market Volume Liters Forecast, by Region 2019 & 2032

- Table 9: North America Yogurt Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Yogurt Market Volume Liters Forecast, by Country 2019 & 2032

- Table 11: United States North America Yogurt Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Yogurt Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Yogurt Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Yogurt Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Yogurt Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Yogurt Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Yogurt Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Yogurt Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 19: North America Yogurt Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Yogurt Market Volume Liters Forecast, by Product Type 2019 & 2032

- Table 21: North America Yogurt Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: North America Yogurt Market Volume Liters Forecast, by Distribution Channel 2019 & 2032

- Table 23: North America Yogurt Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Yogurt Market Volume Liters Forecast, by Country 2019 & 2032

- Table 25: United States North America Yogurt Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Yogurt Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Yogurt Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Yogurt Market Volume (Liters) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Yogurt Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Yogurt Market Volume (Liters) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Yogurt Market?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the North America Yogurt Market?

Key companies in the market include Country Food LL, Alpina Productos Alimenticios SA BIC, Schreiber Foods Inc, The Hain Celestial Group Inc, FAGE USA Dairy Industry Inc, Danone SA, Johanna Foods Inc, Groupe Lactalis SA.

3. What are the main segments of the North America Yogurt Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 156000 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: Johanna Foods Inc. announced the construction plan for a 65,000-square-foot expansion of its yogurt manufacturing plant to double the production capacity.June 2022: Danone North America partnered with White Plains, Boulder, and Colo and launched Activia+ Multi-Benefit Probiotic Yogurt Drinks.March 2021: Siggi’s launched its newest line of reduced-sugar yogurt. The new offering contains 50% less sugar than the leading Greek yogurt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Yogurt Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Yogurt Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Yogurt Market?

To stay informed about further developments, trends, and reports in the North America Yogurt Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence