Key Insights

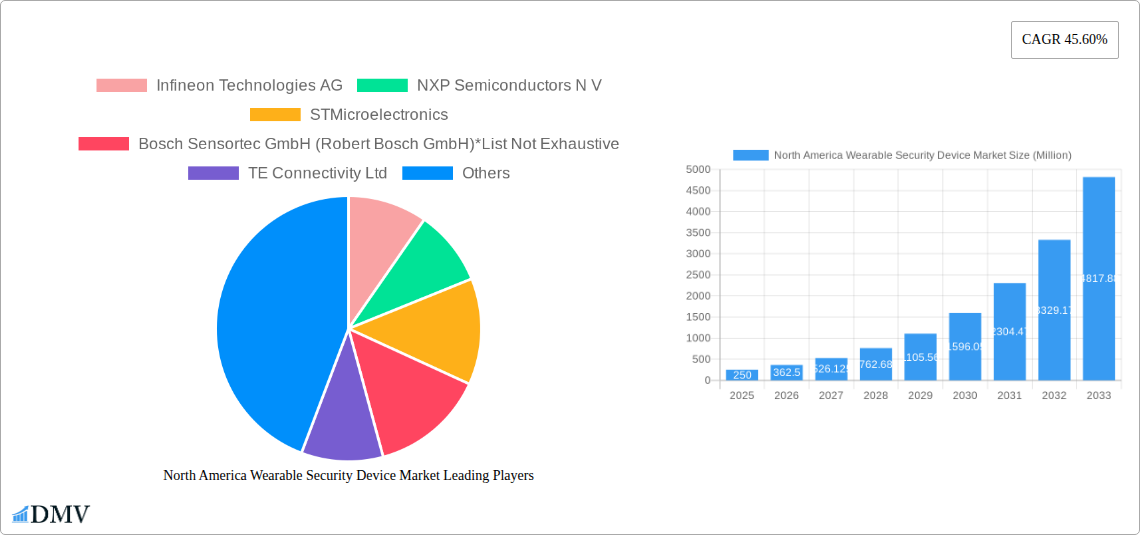

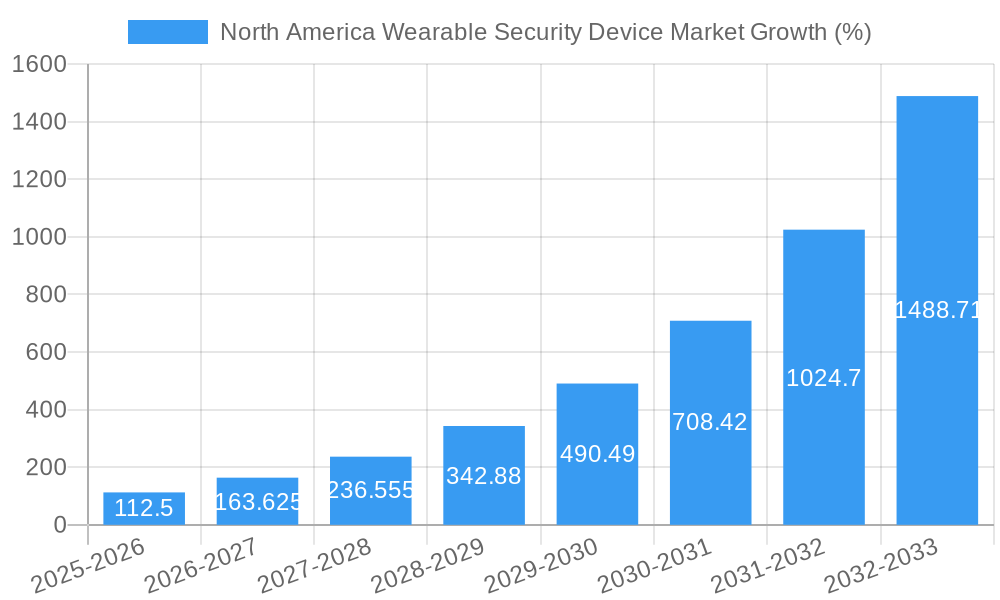

The North American wearable security device market is experiencing robust growth, driven by increasing concerns over personal safety and escalating demand for remote health monitoring solutions. The market, currently valued in the hundreds of millions (a precise figure requires additional data but can be reasonably estimated based on the global CAGR of 45.60% and considering North America's significant share of the global wearable technology market), is projected to maintain a high growth trajectory throughout the forecast period (2025-2033). This expansion is fueled by several key factors. Firstly, technological advancements in sensor technology, such as MEMS, motion, and health sensors, are enabling smaller, more accurate, and energy-efficient wearable devices capable of sophisticated security and health monitoring. Secondly, the rising adoption of smartwatches and fitness trackers, coupled with the integration of security features like GPS tracking and emergency alerts, is significantly broadening the market's appeal. Furthermore, the increasing prevalence of remote patient monitoring programs in healthcare and the growing adoption of wearable security solutions by law enforcement and security personnel contribute to this positive market outlook. The segmentations within the market further indicate strong growth potential. For instance, the health and wellness application segment is anticipated to lead market growth, driven by a rising aging population with increasing healthcare needs and a corresponding demand for convenient and continuous health monitoring.

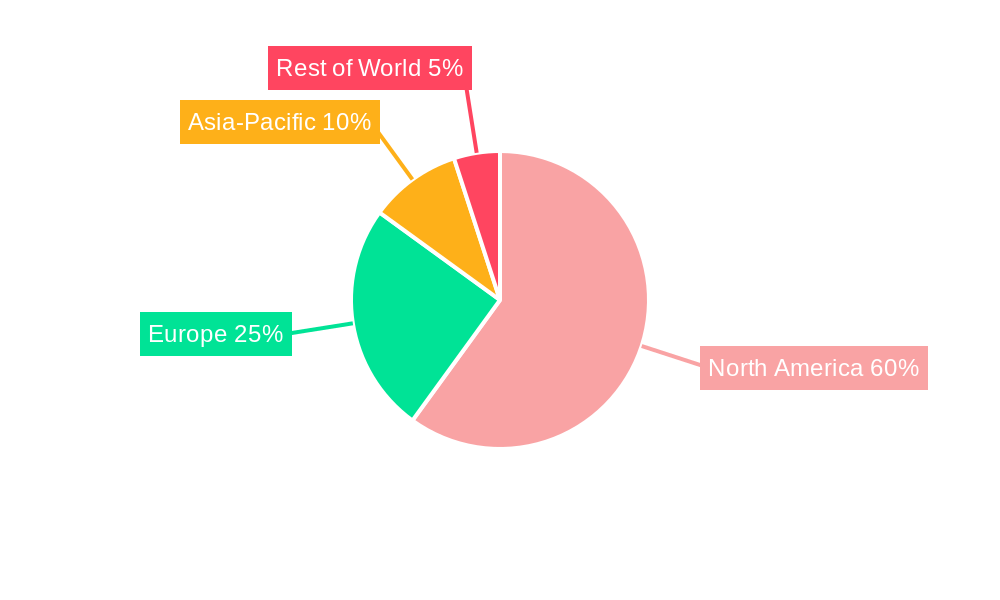

However, market growth may face some restraints. The high initial cost of advanced wearable security devices could limit their widespread adoption, particularly among budget-conscious consumers. Concerns regarding data privacy and security, coupled with potential regulatory hurdles concerning data collection and usage, represent other challenges. Nonetheless, the overarching trend is strongly positive, fueled by technological innovation, expanding applications, and increasing consumer awareness of personal safety and health monitoring benefits. The market is poised for significant expansion, driven by substantial investment in research and development and the ongoing development of more sophisticated and user-friendly wearable security solutions throughout North America. The United States, as the largest market in North America, will dominate the regional landscape due to its technologically advanced infrastructure and high consumer spending power on health and safety products. Canada also presents a significant market opportunity, fueled by increasing healthcare spending and the adoption of smart technologies.

North America Wearable Security Device Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America wearable security device market, offering invaluable insights for stakeholders across the industry value chain. Covering the period from 2019 to 2033, with a focus year of 2025, this report unveils the market's composition, evolution, key players, and future trajectory. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Wearable Security Device Market Composition & Trends

This section delves into the competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity within the North America wearable security device market. The market is moderately concentrated, with key players holding a combined market share of approximately xx%. Innovation is driven by advancements in sensor technology, miniaturization, and power efficiency. Stringent data privacy regulations are shaping market dynamics, while the emergence of alternative security solutions presents competitive pressures.

- Market Share Distribution (2024): Infineon Technologies AG (xx%), NXP Semiconductors N.V. (xx%), STMicroelectronics (xx%), Others (xx%)

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with an aggregate value of approximately xx Million. Deals primarily focused on expanding product portfolios and strengthening market presence.

- End-User Profiles: The market caters to diverse end-users, including law enforcement, healthcare providers, and individual consumers.

North America Wearable Security Device Market Industry Evolution

This section examines the historical (2019-2024) and projected (2025-2033) growth trajectories of the North America wearable security device market, highlighting technological advancements and evolving consumer preferences. The market experienced significant growth during the historical period, driven by increasing demand for personal safety and health monitoring devices. Technological advancements in sensor technology, connectivity, and data analytics are accelerating market expansion. The increasing adoption of wearable devices for fitness tracking, health monitoring, and fall detection is a key driver. The market is expected to maintain its strong growth momentum in the forecast period, fueled by the rising adoption of IoT-enabled devices and the increasing integration of advanced security features. The market witnessed a growth rate of xx% from 2019 to 2024, and is anticipated to grow at a rate of xx% from 2025 to 2033. Adoption rates are expected to increase by approximately xx% annually during the forecast period.

Leading Regions, Countries, or Segments in North America Wearable Security Device Market

The United States represents the largest market for wearable security devices in North America, driven by high technological adoption, strong consumer spending, and a well-established healthcare infrastructure. The wristwear segment holds the largest market share within the device category, propelled by the popularity of smartwatches and fitness trackers equipped with security features. The health and wellness application segment dominates the market, fueled by the rising prevalence of chronic diseases and the increasing demand for remote patient monitoring solutions.

Key Drivers (United States):

- High disposable income and technological savviness

- Strong regulatory support for telehealth and remote patient monitoring

- Significant investments in R&D in wearable technology.

Key Drivers (Wristwear Segment):

- Integration of advanced sensors and connectivity technologies

- Growing consumer preference for stylish and functional wearable devices.

Key Drivers (Health & Wellness Application):

- Increasing prevalence of chronic diseases necessitating continuous health monitoring

- Growing adoption of remote patient monitoring solutions and telehealth services.

North America Wearable Security Device Market Product Innovations

Recent product innovations in the wearable security device market focus on enhancing security features, improving user experience, and incorporating advanced analytics capabilities. Smartwatches and fitness trackers now integrate advanced features like GPS tracking, fall detection, and emergency SOS functionalities. The emergence of bio-metric sensors improves authentication and security protocols. These innovations are designed to provide enhanced personal safety and offer a more comprehensive user experience. Unique selling propositions include enhanced privacy features, longer battery life, and advanced data analytics.

Propelling Factors for North America Wearable Security Device Market Growth

Several factors are driving the growth of the North America wearable security device market. Technological advancements, such as the development of more accurate and miniaturized sensors, are key. Furthermore, increasing consumer awareness of personal safety and health monitoring, coupled with government initiatives promoting telehealth and remote patient monitoring, significantly contributes. Economic factors such as rising disposable incomes in North America also fuel demand.

Obstacles in the North America Wearable Security Device Market

The market faces certain challenges. Data privacy and security concerns remain significant obstacles, requiring robust security protocols and transparent data handling practices. Supply chain disruptions and the increasing cost of components can impact production and market expansion. Intense competition from established players and emerging startups puts pressure on pricing and profitability.

Future Opportunities in North America Wearable Security Device Market

Future opportunities lie in expanding into new market segments, such as industrial safety and elderly care. Advancements in artificial intelligence (AI) and machine learning (ML) will enhance predictive capabilities and offer personalized safety solutions. The integration of wearable devices with smart home systems will create a more integrated security ecosystem.

Major Players in the North America Wearable Security Device Market Ecosystem

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Analog Devices Inc

- Freescale Semiconductor Inc

- InvenSense Inc

- Panasonic Corporation

Key Developments in North America Wearable Security Device Market Industry

- September 2020: Apple launched the Apple Watch Series 6, integrating blood oxygen monitoring capabilities, boosting market interest in health-focused wearables with integrated security features.

- October 2020: The focus on augmented reality head-mounted displays for aviation highlights the growing integration of sensor technology in specialized security applications, potentially impacting future wearable security device designs.

Strategic North America Wearable Security Device Market Forecast

The North America wearable security device market is poised for robust growth, driven by ongoing technological innovation, increased consumer demand for personal safety and health monitoring, and supportive regulatory environments. The integration of AI and IoT will create new opportunities, while addressing data privacy concerns will be critical for sustained market expansion. The market is expected to experience significant growth, driven by the rising adoption of smart wearable devices with integrated security capabilities.

North America Wearable Security Device Market Segmentation

-

1. Type

- 1.1. Health Sensors

- 1.2. Environmental Sensors

- 1.3. MEMS Sensors

- 1.4. Motion Sensors

- 1.5. Others

-

2. Device

- 2.1. Wristwear

- 2.2. Bodywear & Footwear

- 2.3. Others

-

3. Application

- 3.1. Health & Wellness

- 3.2. Safety Monitoring

- 3.3. Home Rehabilitation

- 3.4. Others

North America Wearable Security Device Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Wearable Security Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 45.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid technological developments and miniaturization of sensors; Increasing applications in the industrial sector

- 3.3. Market Restrains

- 3.3.1. High initial costs for large scale implementation in industries

- 3.4. Market Trends

- 3.4.1. Increase in demand of wearable fitness devices is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Health Sensors

- 5.1.2. Environmental Sensors

- 5.1.3. MEMS Sensors

- 5.1.4. Motion Sensors

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Wristwear

- 5.2.2. Bodywear & Footwear

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Health & Wellness

- 5.3.2. Safety Monitoring

- 5.3.3. Home Rehabilitation

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Wearable Security Device Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semiconductors N V

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 STMicroelectronics

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 TE Connectivity Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Texas Instruments Incorporated

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Analog Devices Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Freescale Semiconductor Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 InvenSense Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: North America Wearable Security Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Wearable Security Device Market Share (%) by Company 2024

List of Tables

- Table 1: North America Wearable Security Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Wearable Security Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Wearable Security Device Market Revenue Million Forecast, by Device 2019 & 2032

- Table 4: North America Wearable Security Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: North America Wearable Security Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Wearable Security Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Wearable Security Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Wearable Security Device Market Revenue Million Forecast, by Device 2019 & 2032

- Table 13: North America Wearable Security Device Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: North America Wearable Security Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Wearable Security Device Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Wearable Security Device Market?

The projected CAGR is approximately 45.60%.

2. Which companies are prominent players in the North America Wearable Security Device Market?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors N V, STMicroelectronics, Bosch Sensortec GmbH (Robert Bosch GmbH)*List Not Exhaustive, TE Connectivity Ltd, Texas Instruments Incorporated, Analog Devices Inc, Freescale Semiconductor Inc, InvenSense Inc, Panasonic Corporation.

3. What are the main segments of the North America Wearable Security Device Market?

The market segments include Type, Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid technological developments and miniaturization of sensors; Increasing applications in the industrial sector.

6. What are the notable trends driving market growth?

Increase in demand of wearable fitness devices is driving the market.

7. Are there any restraints impacting market growth?

High initial costs for large scale implementation in industries.

8. Can you provide examples of recent developments in the market?

September 2020: Apple launched the Apple watch series 6, which is the latest smartwatch that enables blood oxygen monitoring and measures oxygen saturation in the blood for a better understanding of fitness and wellness.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Wearable Security Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Wearable Security Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Wearable Security Device Market?

To stay informed about further developments, trends, and reports in the North America Wearable Security Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence