Key Insights

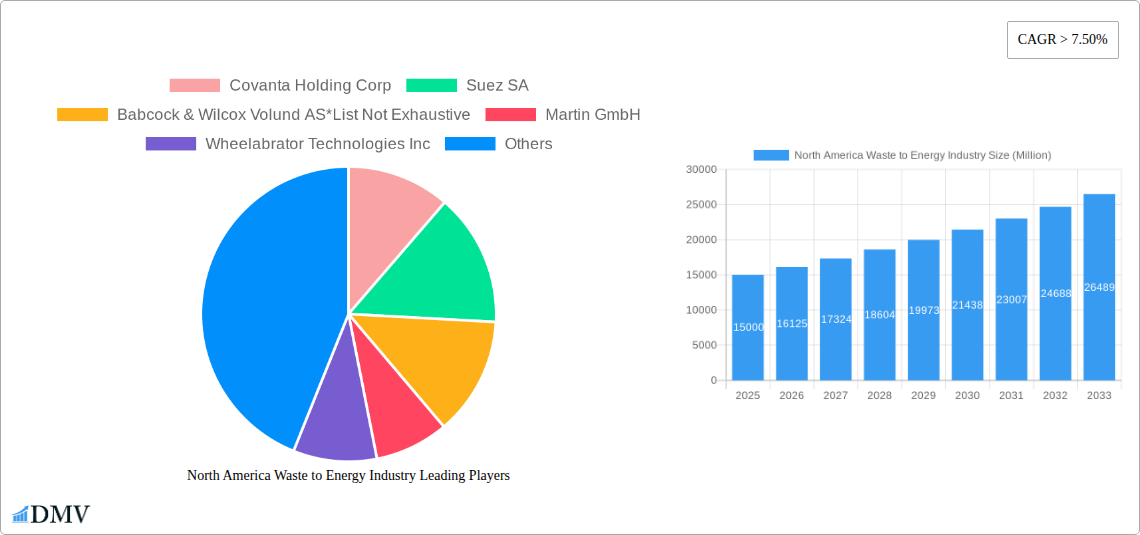

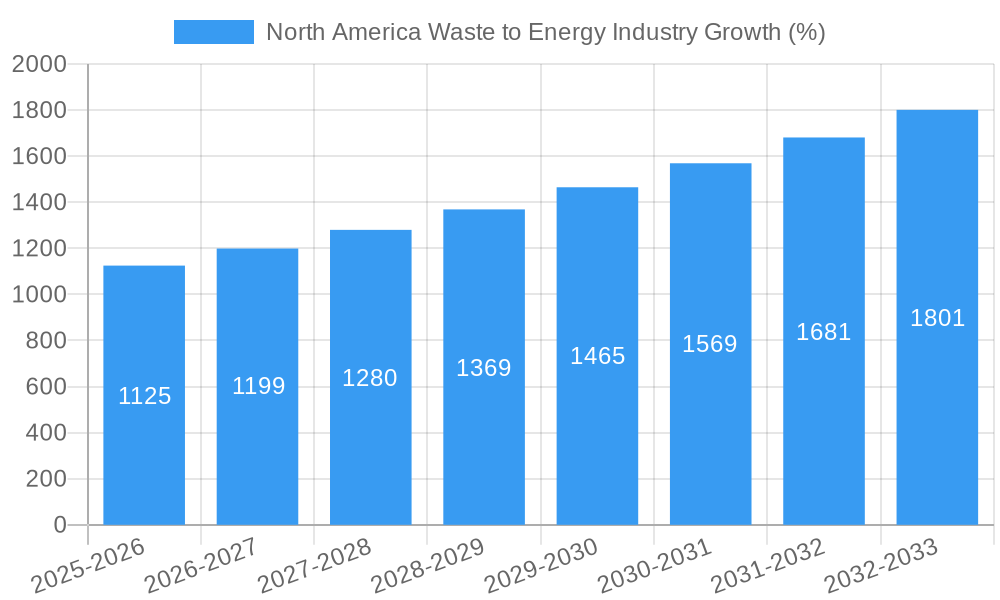

The North American waste-to-energy (WtE) market, currently valued at approximately $XX million (estimated based on provided CAGR and market size), is experiencing robust growth, projected to exceed a CAGR of 7.5% from 2025 to 2033. This expansion is fueled by several key drivers. Stringent environmental regulations aimed at reducing landfill waste and promoting sustainable waste management practices are creating significant demand for WtE solutions. Furthermore, the increasing scarcity of landfill space and rising disposal costs are incentivizing municipalities and industries to adopt WtE technologies. Technological advancements in areas like gasification and anaerobic digestion are improving efficiency and reducing emissions, further boosting market adoption. The market is segmented by technology, encompassing physical, thermal, and biological methods, each contributing uniquely to the overall growth. Leading players like Covanta Holding Corp, Suez SA, and Waste Management Inc are actively shaping the market landscape through technological innovations, strategic partnerships, and project expansions. The focus on renewable energy generation through WtE is further amplified by government incentives and policies supporting green initiatives.

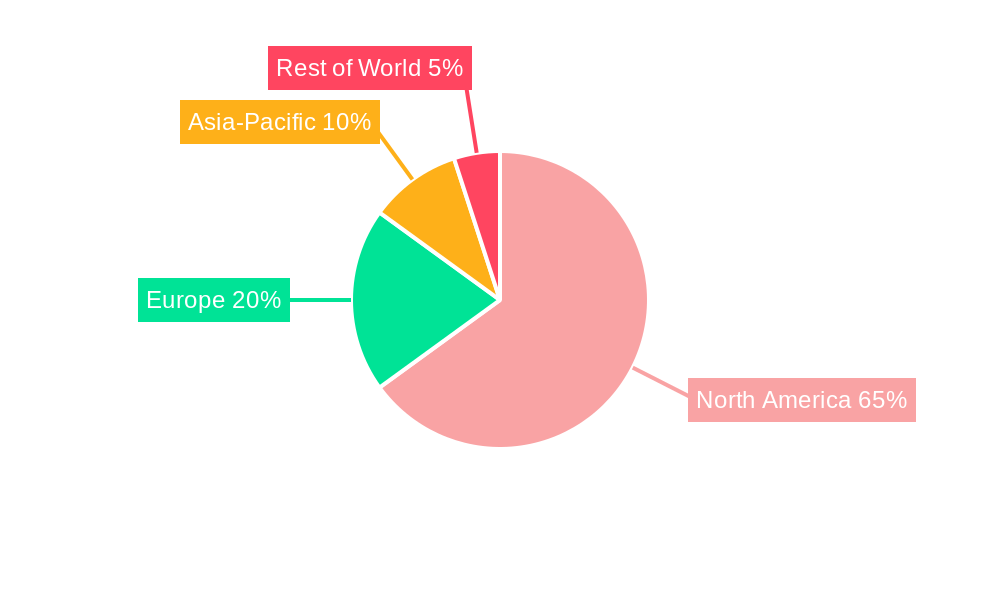

Within North America, the United States, Canada, and Mexico represent significant market segments. The US market, being the largest, is driven by high waste generation coupled with increasing environmental awareness. Canada’s focus on sustainable waste management practices contributes significantly to the regional growth, while Mexico is witnessing increasing investments in WtE infrastructure to address its waste management challenges. However, challenges remain, including the high capital costs associated with WtE facility development, the need for robust regulatory frameworks to ensure efficient and environmentally sound operations, and public perception concerns surrounding the potential environmental impacts of certain WtE technologies. Overcoming these challenges through continued technological innovation, transparent communication, and supportive regulatory environments will be critical to unlocking the full potential of the North American WtE market.

North America Waste to Energy Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America waste-to-energy industry, offering invaluable data and forecasts for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, technological advancements, and key players shaping the future of waste management and renewable energy generation. The total market size is projected to reach xx Million by 2033.

North America Waste to Energy Industry Market Composition & Trends

This section delves into the competitive landscape of the North America waste-to-energy market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. We explore the market share distribution among key players like Covanta Holding Corp, Suez SA, Babcock & Wilcox Volund AS, Martin GmbH, Wheelabrator Technologies Inc, Veolia Environnement SA, Waste Management Inc, Mitsubishi Heavy Industries Ltd, Enerkem Inc., and Green Conversion Systems (GCS), revealing insights into market dominance and competitive strategies. The report analyzes M&A activities, providing insights into deal values and their impact on market consolidation. A detailed analysis of regulatory landscapes and their influence on industry growth is included, along with an examination of substitute products and their potential impact on market share. The report also segments the market by end-user, profiling key industries and their waste generation patterns. Estimated market concentration is xx%, with significant M&A deal values exceeding xx Million in the last five years.

- Market Share Distribution: Detailed breakdown of market share by leading companies (percentage values estimated based on available data).

- M&A Activity: Analysis of key mergers and acquisitions, including deal values and strategic implications.

- Regulatory Landscape: Comprehensive overview of environmental regulations and their impact on industry growth.

- Substitute Products: Assessment of alternative waste management technologies and their competitive threats.

- End-User Profiles: Analysis of waste generation patterns across various industries (e.g., municipal, industrial).

North America Waste to Energy Industry Evolution

This section presents a detailed analysis of the North America waste-to-energy market's historical performance (2019-2024) and projected future growth (2025-2033). It explores the driving forces behind market expansion, including technological advancements in thermal, physical, and biological waste-to-energy technologies. We examine shifting consumer preferences for sustainable waste management solutions and their influence on market demand. The report incorporates detailed data points, including compound annual growth rates (CAGRs) for specific segments and adoption rates of new technologies. The analysis considers factors such as government policies, technological breakthroughs, and evolving environmental concerns. The market is projected to grow at a CAGR of xx% during the forecast period, driven by increasing environmental concerns and government support for renewable energy initiatives.

Leading Regions, Countries, or Segments in North America Waste to Energy Industry

This section identifies the leading regions, countries, and technology segments within the North America waste-to-energy market. We examine the factors contributing to their dominance, such as investment trends, regulatory support, and technological advancements. The analysis will focus on the three main technology segments: Physical Technology, Thermal Technology, and Biological Technology, highlighting the leading segment and providing a deeper understanding of the key drivers of its growth.

Key Drivers (Bullet Points):

- Investment trends in each technology segment (e.g., venture capital, government funding).

- Regulatory support and incentives for each technology.

- Technological advancements and innovations.

- Market size and growth potential of each region/segment.

Dominance Factors (Paragraphs): In-depth analysis of the factors contributing to the leading segment's market position, including technological advantages, cost-effectiveness, and regulatory support. Specific examples of successful projects or policy initiatives will be included.

North America Waste to Energy Industry Product Innovations

This section highlights the latest product innovations in the North America waste-to-energy industry. We showcase new technologies and applications, focusing on unique selling propositions (USPs) and their performance metrics. Examples include advancements in gasification, pyrolysis, and anaerobic digestion, and the integration of AI and machine learning for process optimization. Innovations leading to improved energy efficiency and reduced environmental impact will be emphasized.

Propelling Factors for North America Waste to Energy Industry Growth

Several factors are driving the growth of the North America waste-to-energy industry. These include increasing environmental regulations aimed at reducing landfill waste, growing concerns about climate change and the need for renewable energy sources, and government incentives and subsidies promoting the adoption of waste-to-energy technologies. Technological advancements leading to higher efficiency and lower operating costs further accelerate market growth. The rising cost of landfill disposal also incentivizes the adoption of waste-to-energy solutions.

Obstacles in the North America Waste to Energy Industry Market

Despite the positive growth trajectory, the North America waste-to-energy market faces certain challenges. These include stringent environmental regulations and permitting processes, which can lead to delays and increased project costs. The high capital investment required for building waste-to-energy plants can pose a barrier to entry for smaller players. Competition from other waste management technologies and potential supply chain disruptions also influence the market's growth rate. Public perception and concerns about potential environmental risks, such as air emissions, represent further obstacles.

Future Opportunities in North America Waste to Energy Industry

The future of the North America waste-to-energy industry holds significant opportunities. The development and adoption of advanced technologies, such as advanced gasification and pyrolysis, offer the potential for improved energy efficiency and reduced environmental impact. The integration of waste-to-energy facilities with other renewable energy sources, such as solar and wind, creates synergistic opportunities. Exploring new feedstocks, including agricultural residues and plastic waste, will broaden the market's potential. Government support for renewable energy and stricter environmental regulations will create significant opportunities for growth and investment in the waste-to-energy sector.

Major Players in the North America Waste to Energy Industry Ecosystem

- Covanta Holding Corp

- Suez SA

- Babcock & Wilcox Volund AS

- Martin GmbH

- Wheelabrator Technologies Inc

- Veolia Environnement SA

- Waste Management Inc

- Mitsubishi Heavy Industries Ltd

- Enerkem Inc.

- Green Conversion Systems (GCS)

Key Developments in North America Waste to Energy Industry Industry

October 2022: Kore Infrastructure announced the successful one-year demonstration of its waste-to-energy modular system in Los Angeles, California. This modular system produces 100% renewable energy from organic waste using a closed-loop, carbon-negative process, demonstrating a significant advancement in waste-to-energy technology and highlighting the potential for decentralized waste-to-energy solutions.

October 2022: The Washington State Department of Commerce announced USD 850,000 in grants to four projects supporting beneficial uses for industrial waste. This initiative demonstrates growing government support for innovative waste management solutions and encourages further research and development in the sector.

Strategic North America Waste to Energy Industry Market Forecast

The North America waste-to-energy market is poised for substantial growth driven by increasing environmental regulations, rising landfill costs, and technological advancements. The focus on renewable energy and carbon reduction will continue to fuel demand for waste-to-energy solutions. Opportunities exist in expanding the adoption of advanced technologies, developing innovative waste-to-energy solutions for diverse feedstocks, and creating integrated waste management systems. The market's future growth is expected to be significant, driven by the factors mentioned above, resulting in a substantial increase in market size and investment in the sector.

North America Waste to Energy Industry Segmentation

-

1. Technology

- 1.1. Physical Technology

- 1.2. Thermal Technology

- 1.3. Biological Technology

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Waste to Energy Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Waste to Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternate Energy Sources

- 3.4. Market Trends

- 3.4.1. Thermal Based Waste to Energy Conversion to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Physical Technology

- 5.1.2. Thermal Technology

- 5.1.3. Biological Technology

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Physical Technology

- 6.1.2. Thermal Technology

- 6.1.3. Biological Technology

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Physical Technology

- 7.1.2. Thermal Technology

- 7.1.3. Biological Technology

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of North America North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Physical Technology

- 8.1.2. Thermal Technology

- 8.1.3. Biological Technology

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. United States North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Waste to Energy Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Covanta Holding Corp

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Suez SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Babcock & Wilcox Volund AS*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Martin GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Wheelabrator Technologies Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Veolia Environnement SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Waste Management Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mitsubishi Heavy Industries Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Enerkem Inc.

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Green Conversion Systems (GCS)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Covanta Holding Corp

List of Figures

- Figure 1: North America Waste to Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Waste to Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Waste to Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Waste to Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: North America Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Waste to Energy Industry Volume Gigawatt Forecast, by Technology 2019 & 2032

- Table 5: North America Waste to Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Waste to Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: North America Waste to Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Waste to Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: North America Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Waste to Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: United States North America Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Waste to Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Waste to Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Waste to Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Waste to Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Waste to Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: North America Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: North America Waste to Energy Industry Volume Gigawatt Forecast, by Technology 2019 & 2032

- Table 21: North America Waste to Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Waste to Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 23: North America Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Waste to Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 25: North America Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 26: North America Waste to Energy Industry Volume Gigawatt Forecast, by Technology 2019 & 2032

- Table 27: North America Waste to Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Waste to Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 29: North America Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Waste to Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 31: North America Waste to Energy Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 32: North America Waste to Energy Industry Volume Gigawatt Forecast, by Technology 2019 & 2032

- Table 33: North America Waste to Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Waste to Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 35: North America Waste to Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Waste to Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Waste to Energy Industry?

The projected CAGR is approximately > 7.50%.

2. Which companies are prominent players in the North America Waste to Energy Industry?

Key companies in the market include Covanta Holding Corp, Suez SA, Babcock & Wilcox Volund AS*List Not Exhaustive, Martin GmbH, Wheelabrator Technologies Inc, Veolia Environnement SA, Waste Management Inc, Mitsubishi Heavy Industries Ltd, Enerkem Inc. , Green Conversion Systems (GCS).

3. What are the main segments of the North America Waste to Energy Industry?

The market segments include Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Thermal Based Waste to Energy Conversion to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternate Energy Sources.

8. Can you provide examples of recent developments in the market?

October 2022: Kore Infrastructure announced the successful one-year demonstration of its waste-to-energy modular system in Los Angeles, California. The company's technology can produce 100% renewable energy from organic waste using a closed-loop, carbon-negative process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Waste to Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Waste to Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Waste to Energy Industry?

To stay informed about further developments, trends, and reports in the North America Waste to Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence