Key Insights

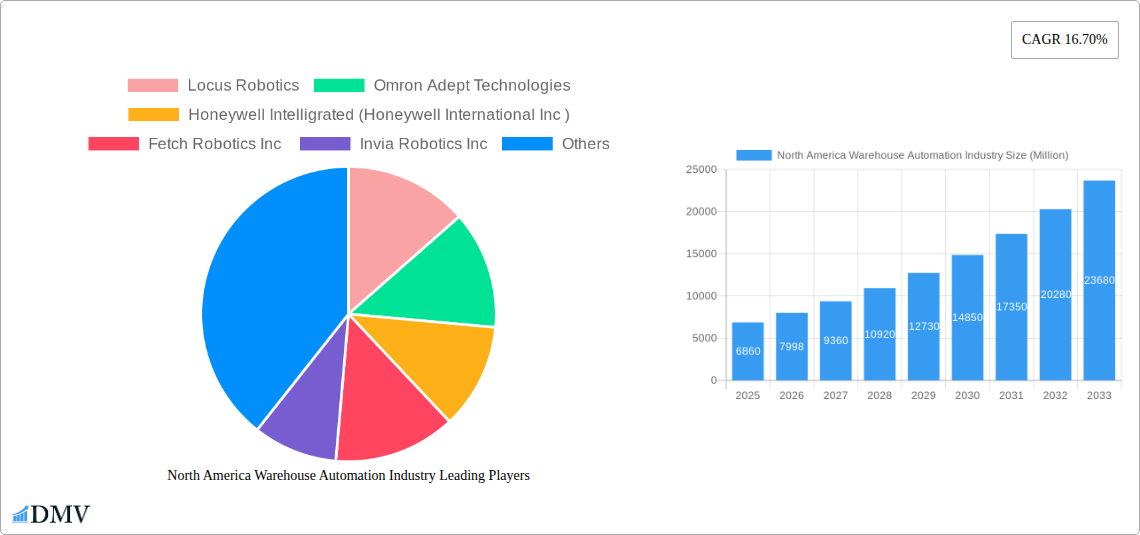

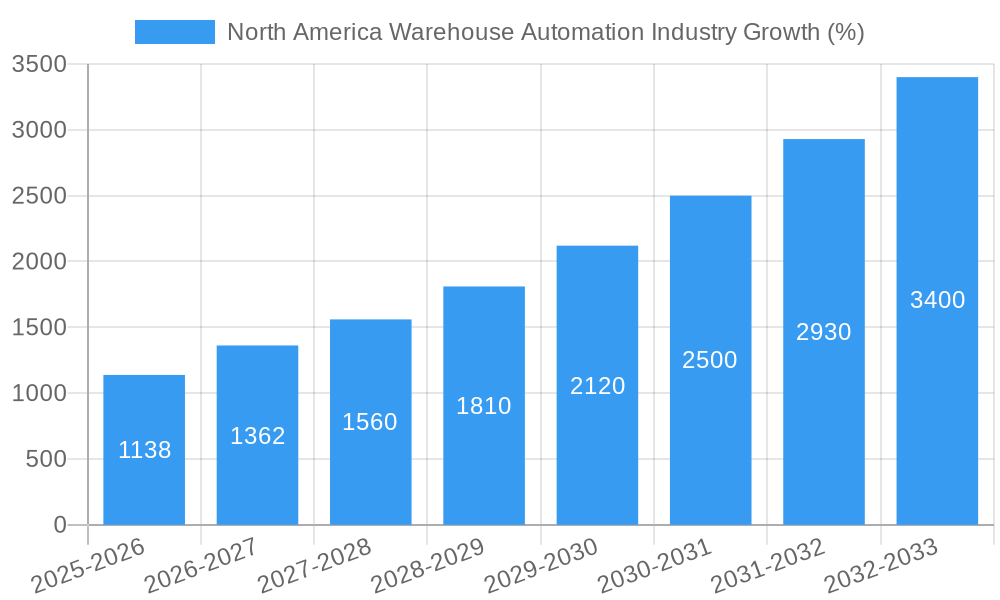

The North American warehouse automation market, valued at approximately $6.86 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 16.70% from 2025 to 2033. This surge is driven by several key factors. E-commerce continues its exponential rise, demanding faster and more efficient order fulfillment. Labor shortages and rising labor costs incentivize businesses to automate warehouse operations, improving productivity and reducing operational expenses. Furthermore, advancements in robotics, AI-powered software, and warehouse management systems (WMS) are making automation more accessible and cost-effective for businesses of all sizes. The integration of these technologies streamlines processes, reduces errors, and optimizes space utilization within warehouses, leading to significant return on investment. Key segments within this market include hardware (robotics, conveyors, etc.), software (WMS, warehouse execution systems – WES), and services (maintenance, integration). The end-user industries driving this growth are e-commerce focused sectors like food and beverage, post and parcel, groceries, general merchandise, and apparel, along with the manufacturing sector.

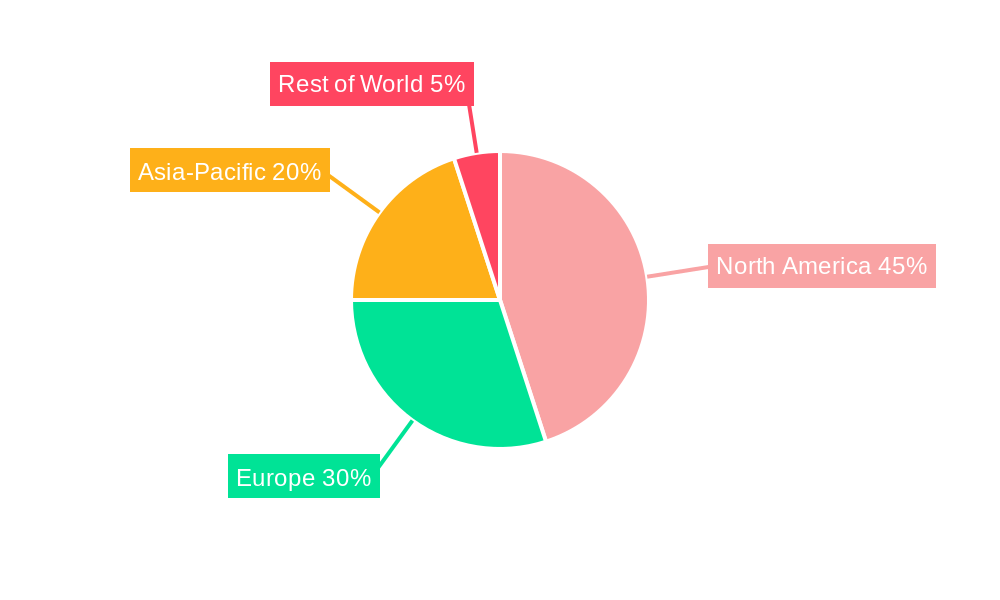

North America dominates the market due to early adoption of automation technologies, robust infrastructure, and a strong presence of major players like Locus Robotics, Honeywell Intelligrated, and Dematic. However, the market faces some challenges. High initial investment costs for automation can be a barrier to entry for smaller businesses. Furthermore, the need for skilled labor to implement and maintain these systems presents a potential bottleneck. Despite these challenges, the long-term outlook remains positive, with ongoing technological advancements and increasing demand expected to fuel sustained growth in the coming years. The market's evolution will likely see greater integration of artificial intelligence and machine learning capabilities in warehouse automation solutions, leading to even more efficient and flexible operations.

North America Warehouse Automation Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America warehouse automation industry, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers critical data and forecasts to guide strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting substantial growth driven by technological advancements, e-commerce expansion, and labor shortages.

North America Warehouse Automation Industry Market Composition & Trends

The North American warehouse automation market is experiencing significant transformation, driven by the increasing adoption of automated systems to enhance efficiency and productivity. Market concentration is moderate, with several key players holding substantial market share, but a fragmented landscape exists, particularly amongst smaller specialized vendors. Innovation is largely technology-driven, focusing on AI-powered robotics, advanced software solutions (Warehouse Management Systems – WMS, Warehouse Execution Systems – WES), and the integration of IoT devices. The regulatory landscape is evolving, with increasing focus on data security and worker safety regulations impacting technology implementation and cost. Substitute products are limited; however, the industry faces challenges from optimizing existing manual processes. M&A activity is robust, with strategic acquisitions driving market consolidation and technological advancement. Deal values exceeding xx Million are common.

- Market Share Distribution (2024): Top 5 players account for approximately xx% of the market.

- M&A Activity (2019-2024): Total deal value exceeding xx Million, with an average deal size of xx Million.

- Key M&A Trends: Focus on integrating software and robotics capabilities, expanding geographic reach, and enhancing service offerings.

North America Warehouse Automation Industry Industry Evolution

The North America warehouse automation industry has witnessed exponential growth, fueled by the rising demand for faster and more efficient order fulfillment. From 2019 to 2024, the market exhibited a Compound Annual Growth Rate (CAGR) of xx%, driven by the increasing adoption of automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and advanced warehouse management systems (WMS). Technological advancements, particularly in artificial intelligence (AI) and machine learning (ML), are enabling more sophisticated automation solutions capable of handling complex tasks. This includes advancements in piece-picking robotics, improving accuracy and speed. Shifting consumer demands for faster delivery times and personalized experiences are further accelerating the adoption of warehouse automation technologies. The adoption rate of AMR's is projected to reach xx% by 2033, while the market for WMS software is expected to reach xx Million by 2028.

Leading Regions, Countries, or Segments in North America Warehouse Automation Industry

The Northeast and West Coast regions are leading the North America warehouse automation market, driven by high e-commerce penetration and the concentration of major logistics hubs. Within segments:

- By Component: Hardware (particularly robotics) dominates the market, followed by software (WMS and WES). Services are also a significant segment, encompassing value-added services like integration and maintenance.

- By End-user Industry: The e-commerce, food and beverage, and post and parcel industries are leading adopters.

Key Drivers:

- High labor costs and shortages: Automation is crucial for mitigating labor costs and overcoming staffing challenges.

- Increased e-commerce demand: The need for faster and more efficient order fulfillment drives automation adoption.

- Government incentives and regulatory support: Initiatives promoting automation adoption are boosting market growth.

North America Warehouse Automation Industry Product Innovations

Recent innovations include advancements in AI-powered piece-picking robots capable of handling a wider range of items, autonomous mobile robots (AMRs) with improved navigation and obstacle avoidance capabilities, and cloud-based warehouse management systems (WMS) offering enhanced scalability and flexibility. These innovations are driving improved accuracy, efficiency, and cost-effectiveness in warehouse operations. Key features include improved dexterity and handling of irregular-shaped objects in piece-picking robots, and enhanced integration capabilities for seamless data exchange between systems.

Propelling Factors for North America Warehouse Automation Industry Growth

Technological advancements, particularly in AI, robotics, and IoT, are pivotal in driving market growth. Economic factors like rising labor costs and the need for increased efficiency are also major contributors. Regulatory support and incentives promoting automation adoption further accelerate the market expansion. The increasing adoption of cloud-based solutions and the integration of these solutions into existing warehouse management systems, alongside the growing demand from e-commerce, create a favorable environment for growth.

Obstacles in the North America Warehouse Automation Industry Market

High initial investment costs can be a barrier for smaller companies. Supply chain disruptions, particularly in the semiconductor industry, impact the availability of critical components. Intense competition amongst vendors can result in price pressure, impacting profitability. Integration complexities and the need for skilled labor to implement and maintain automated systems also pose challenges.

Future Opportunities in North America Warehouse Automation Industry

Expansion into new markets (e.g., cold chain logistics), the adoption of collaborative robots (cobots) for human-robot collaboration, and the integration of augmented reality (AR) and virtual reality (VR) technologies for improved warehouse operations present significant opportunities. Developing specialized solutions for niche industries, expanding into rural areas, and focusing on sustainable solutions will also shape future growth.

Major Players in the North America Warehouse Automation Industry Ecosystem

- Locus Robotics

- Omron Adept Technologies

- Honeywell Intelligrated (Honeywell International Inc)

- Fetch Robotics Inc

- Invia Robotics Inc

- Dematic Group

- KUKA AG

- Daifuku Co Ltd

- Oracle Corporation

- One Network Enterprises Inc

Key Developments in North America Warehouse Automation Industry Industry

- March 2022: Honeywell announced a strategic partnership with OTTO Motors, expanding AMR capabilities in North American warehouses.

- March 2022: Addverb Technologies partnered with Numina Group, expanding the reach of its mobile robots in the North American market.

Strategic North America Warehouse Automation Industry Market Forecast

The North America warehouse automation market is poised for sustained growth, driven by continued technological advancements, increasing e-commerce adoption, and ongoing labor shortages. Emerging trends like the rise of autonomous mobile robots (AMRs), the adoption of AI-powered solutions, and growing demand for flexible and scalable automation solutions are expected to shape the market trajectory in the coming years. The market is expected to witness significant expansion, presenting significant opportunities for both established players and new entrants.

North America Warehouse Automation Industry Segmentation

-

1. Component

-

1.1. Hardware

- 1.1.1. Mobile Robots (AGV, AMR)

- 1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 1.1.3. Automated Conveyor & Sorting Systems

- 1.1.4. De-palletizing/Palletizing Systems

- 1.1.5. Automatic Identification and Data Collection

- 1.1.6. Piece Picking Robots

- 1.2. Software

- 1.3. Services (Value Added Services, Maintenance, etc.)

-

1.1. Hardware

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Post and Parcel

- 2.3. Groceries

- 2.4. General Merchandise

- 2.5. Apparel

- 2.6. Manufacturing

- 2.7. Other End-User Industries

North America Warehouse Automation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Warehouse Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the e-commerce industry and SKUs proliferation.; Increase in technology innovations and availbility

- 3.3. Market Restrains

- 3.3.1. Optimizing Battery Life of Hearable Device

- 3.4. Market Trends

- 3.4.1. Increased Adoption of Robotics In The Warehouses Is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Mobile Robots (AGV, AMR)

- 5.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.1.3. Automated Conveyor & Sorting Systems

- 5.1.1.4. De-palletizing/Palletizing Systems

- 5.1.1.5. Automatic Identification and Data Collection

- 5.1.1.6. Piece Picking Robots

- 5.1.2. Software

- 5.1.3. Services (Value Added Services, Maintenance, etc.)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Post and Parcel

- 5.2.3. Groceries

- 5.2.4. General Merchandise

- 5.2.5. Apparel

- 5.2.6. Manufacturing

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. United States North America Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Warehouse Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Locus Robotics

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Omron Adept Technologies

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell Intelligrated (Honeywell International Inc )

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fetch Robotics Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Invia Robotics Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Dematic Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 KUKA AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Daifuku Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Oracle Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 One Network Enterprises Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Locus Robotics

List of Figures

- Figure 1: North America Warehouse Automation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Warehouse Automation Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Warehouse Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: North America Warehouse Automation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: North America Warehouse Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Warehouse Automation Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 11: North America Warehouse Automation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: North America Warehouse Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Warehouse Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Warehouse Automation Industry?

The projected CAGR is approximately 16.70%.

2. Which companies are prominent players in the North America Warehouse Automation Industry?

Key companies in the market include Locus Robotics, Omron Adept Technologies, Honeywell Intelligrated (Honeywell International Inc ), Fetch Robotics Inc , Invia Robotics Inc, Dematic Group, KUKA AG, Daifuku Co Ltd, Oracle Corporation, One Network Enterprises Inc.

3. What are the main segments of the North America Warehouse Automation Industry?

The market segments include Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the e-commerce industry and SKUs proliferation.; Increase in technology innovations and availbility.

6. What are the notable trends driving market growth?

Increased Adoption of Robotics In The Warehouses Is Driving The Market.

7. Are there any restraints impacting market growth?

Optimizing Battery Life of Hearable Device.

8. Can you provide examples of recent developments in the market?

March 2022 - Honeywell announced a strategic partnership with OTTO Motors, a division of Clearpath Robotics, giving warehouses and distribution centers throughout North America an automated option to handle some of the most labor-intensive roles in an increasingly scarce job market. The collaboration enables the company's customers to increase efficiency, reduce errors and improve safety by deploying OTTO's autonomous mobile robots (AMRs) in their facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Warehouse Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Warehouse Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Warehouse Automation Industry?

To stay informed about further developments, trends, and reports in the North America Warehouse Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence