Key Insights

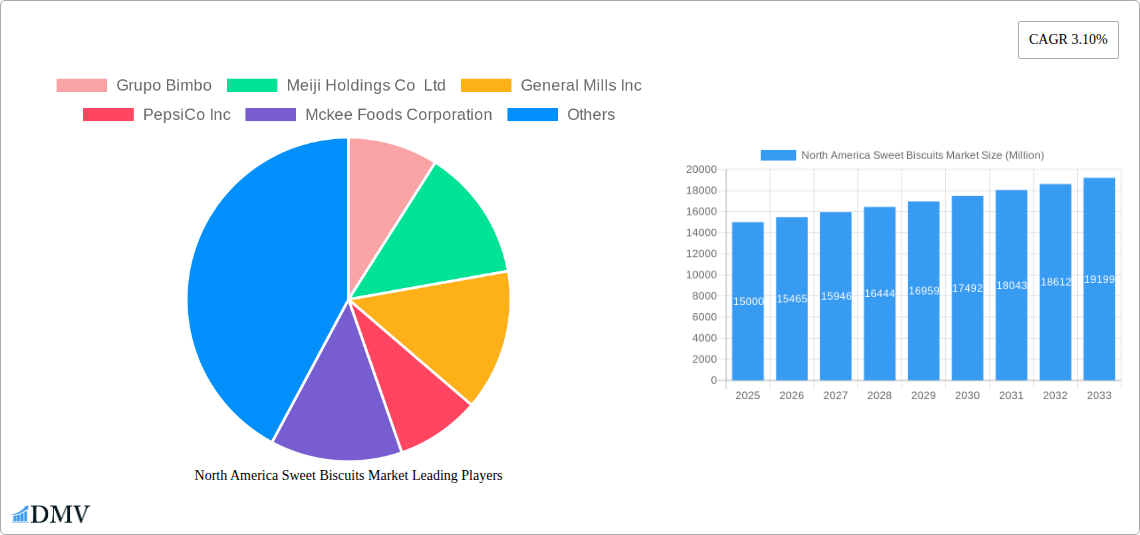

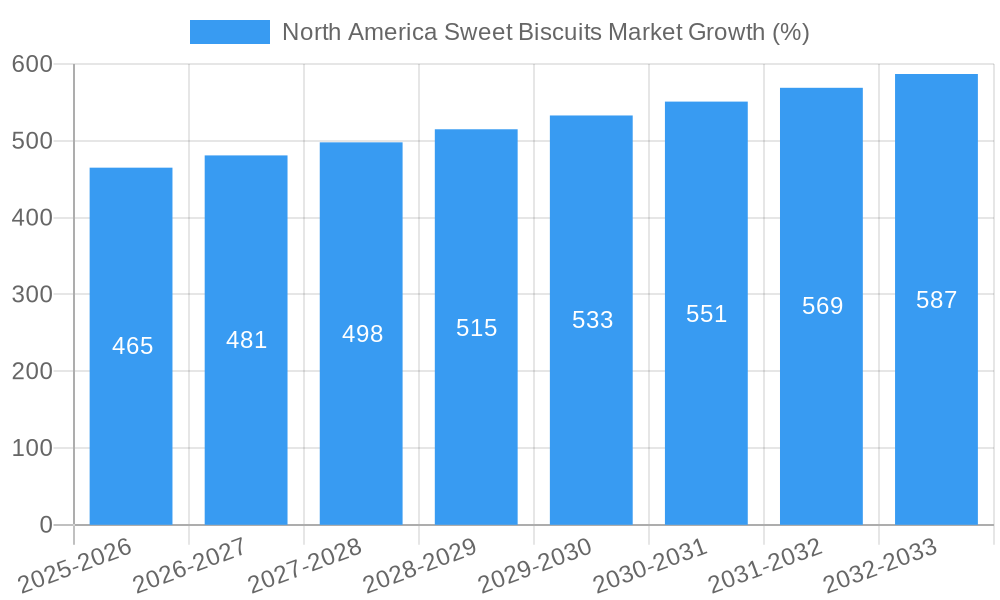

The North American sweet biscuits market, valued at approximately $15 billion in 2025, is projected to experience steady growth, driven by increasing consumer demand for convenient and indulgent snacks. This growth, estimated at a Compound Annual Growth Rate (CAGR) of 3.10% from 2025 to 2033, is fueled by several key factors. The rising popularity of on-the-go snacking, coupled with the increasing disposable incomes in the region, significantly contributes to market expansion. Furthermore, innovative product launches, such as gluten-free and organic options, cater to evolving consumer preferences for healthier alternatives. The market is segmented by product type (chocolate-coated, cookies, filled, plain, sandwich, and other sweet biscuits) and distribution channel (supermarkets/hypermarkets, convenience stores, online retail, and others). Supermarkets and hypermarkets currently dominate distribution, but online retail channels are showing significant growth potential, driven by the increasing adoption of e-commerce. Major players like Grupo Bimbo, Mondelez International, and General Mills are constantly innovating and expanding their product lines to maintain their market share, facing competition from regional and specialty brands.

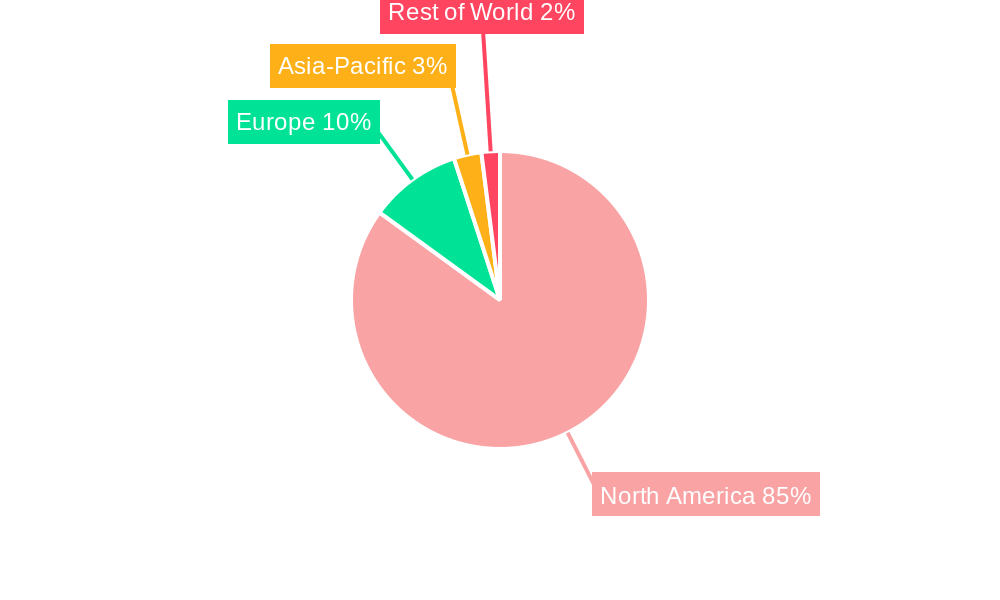

Despite the positive outlook, certain challenges exist. Fluctuations in raw material prices, particularly sugar and wheat, could impact profitability. Additionally, growing health consciousness among consumers might curb demand for high-sugar products, necessitating the development of healthier alternatives to sustain market growth. Competitive pressures from established players and emerging brands necessitate constant innovation and efficient supply chain management. The segment of filled biscuits and chocolate-coated biscuits is projected to be particularly strong owing to its appeal to a broad consumer base. The geographic distribution sees a dominance from the US, followed by Canada and Mexico. Further market penetration strategies by major brands in the less saturated markets of Canada and Mexico will also fuel growth in the North American region.

North America Sweet Biscuits Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the North America sweet biscuits market, offering a comprehensive overview of market trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market size is projected to reach xx Million by 2033.

North America Sweet Biscuits Market Composition & Trends

The North America sweet biscuits market is characterized by a moderately concentrated landscape, with key players such as Grupo Bimbo, Mondelez International, and General Mills Inc. holding significant market share. The exact distribution is complex and varies by segment. However, we estimate that the top 5 players hold approximately xx% of the market share in 2025, while the remaining xx% is distributed among numerous smaller players and regional brands. Innovation is a key driver, with companies continuously introducing new flavors, formats, and healthier options to cater to evolving consumer preferences. The regulatory landscape, including food safety and labeling regulations, significantly impacts market operations. Substitute products, such as cakes, pastries, and other snacks, present competitive pressures. The market encompasses diverse end-users, including households, food service establishments, and retailers. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values averaging xx Million per transaction in 2024. This trend is expected to continue as larger players seek to expand their market reach and product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation: Focus on new flavors, healthier options, and convenient formats.

- Regulatory Landscape: Significant impact from food safety and labeling regulations.

- Substitute Products: Competition from cakes, pastries, and other snacks.

- End-Users: Households, food service, and retail outlets.

- M&A Activity: Moderate, with average deal values of xx Million in 2024.

North America Sweet Biscuits Market Industry Evolution

The North America sweet biscuits market has witnessed steady growth over the historical period (2019-2024), driven by increasing consumer demand for convenient and indulgent snacks. The market experienced a compound annual growth rate (CAGR) of xx% during this period. Technological advancements in production and packaging have enhanced efficiency and extended shelf life. Consumer preferences are shifting towards healthier options, with a growing demand for products with reduced sugar, fat, and artificial ingredients. This has led to an increased focus on clean-label products and the adoption of natural ingredients by many manufacturers. The rise of online retail channels has also significantly impacted the distribution landscape, providing new avenues for sales and reaching a wider customer base. The market is expected to continue its growth trajectory in the forecast period (2025-2033), with a projected CAGR of xx%. This growth will be fueled by factors such as increasing disposable incomes, changing lifestyles, and the continued innovation in product development. The adoption rate of online retail channels is expected to grow by xx% annually during the forecast period.

Leading Regions, Countries, or Segments in North America Sweet Biscuits Market

The United States dominates the North America sweet biscuits market, accounting for the largest market share, followed by Canada and Mexico. Within product types, cookies and chocolate-coated biscuits hold the largest market share due to high consumer preference. The supermarkets/hypermarkets distribution channel commands the largest share, followed by convenience stores, reflecting the widespread availability and accessibility of these products.

- Key Drivers (US): High consumer spending on snacks, strong retail infrastructure, and established market presence of major players.

- Key Drivers (Cookies & Chocolate-Coated Biscuits): Strong consumer preference for these established product categories.

- Key Drivers (Supermarkets/Hypermarkets): High consumer footfall, established supply chains, and wide product assortment.

- Dominance Factors: Established consumer preferences, strong distribution networks, and large presence of multinational corporations.

North America Sweet Biscuits Market Product Innovations

Recent product innovations in the North America sweet biscuits market include the introduction of mini-sized biscuits, gluten-free options, and functional biscuits enriched with vitamins and minerals. These innovations aim to cater to changing consumer preferences for convenience, health, and variety. The emphasis is on clean-label ingredients, natural flavors, and innovative packaging formats to enhance the consumer experience. Key performance metrics for new product launches include sales growth, market share gains, and consumer feedback.

Propelling Factors for North America Sweet Biscuits Market Growth

Several factors propel the growth of the North America sweet biscuits market. These include increasing disposable incomes among consumers, leading to higher spending on convenient and indulgent snacks; evolving lifestyles and busy schedules, resulting in increased demand for ready-to-eat foods; and technological advancements in production and packaging, enabling efficient manufacturing and extended shelf life. Additionally, favorable government regulations and consumer preference for specific flavors (e.g., the increasing popularity of chocolate and other international flavors) further stimulate market expansion.

Obstacles in the North America Sweet Biscuits Market Market

The North America sweet biscuits market faces several challenges. These include increasing health consciousness among consumers, leading to a preference for healthier options and putting pressure on manufacturers to reformulate their products; fluctuating prices of raw materials, impacting production costs and profit margins; and intense competition from established players and new entrants, creating a challenging market environment. Supply chain disruptions, particularly evident in recent years, also create significant obstacles for consistent production and distribution.

Future Opportunities in North America Sweet Biscuits Market

Future opportunities in the North America sweet biscuits market lie in the growing demand for specialized products such as organic, vegan, and keto-friendly biscuits; the expansion into new markets and distribution channels, including online retail and direct-to-consumer channels; and the development of innovative packaging solutions, enhancing product shelf life and appeal. Leveraging consumer trends towards convenient, on-the-go snacks and exploring global flavor profiles will also create additional opportunities for market growth.

Major Players in the North America Sweet Biscuits Market Ecosystem

- Grupo Bimbo

- Meiji Holdings Co Ltd

- General Mills Inc

- PepsiCo Inc

- McKee Foods Corporation

- Ferrero Group

- Girl Scouts of the USA

- Campbell Soup Company

- Sweet Nutrition

- Mondelez International

Key Developments in North America Sweet Biscuits Market Industry

- June 2021: General Mills' Pillsbury launched Mini Sweet Biscuits in four flavors.

- January 2022: Girl Scouts of the USA partnered with DoorDash for hybrid online/offline sales.

- February 2022: Carl Brandt, Inc. launched Kambly Swiss Biscuits in four new items in the US.

Strategic North America Sweet Biscuits Market Forecast

The North America sweet biscuits market is poised for continued growth, driven by factors such as rising disposable incomes, changing consumer preferences, and ongoing product innovation. The market's future potential is significant, with opportunities arising from the expanding health-conscious segment, the growth of online retail channels, and the introduction of new flavors and formats to cater to evolving tastes. This presents attractive prospects for established players and new entrants alike, leading to a dynamic and competitive market landscape.

North America Sweet Biscuits Market Segmentation

-

1. Product Type

- 1.1. Chocolate-coated Biscuits

- 1.2. Cookies

- 1.3. Filled Biscuits

- 1.4. Plain Biscuits

- 1.5. Sandwich Biscuits

- 1.6. Other Sweet Biscuits

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Sweet Biscuits Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Sweet Biscuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Freeze-Drying Technology

- 3.4. Market Trends

- 3.4.1. Increased Innovations in Sweet Biscusts

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Chocolate-coated Biscuits

- 5.1.2. Cookies

- 5.1.3. Filled Biscuits

- 5.1.4. Plain Biscuits

- 5.1.5. Sandwich Biscuits

- 5.1.6. Other Sweet Biscuits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Chocolate-coated Biscuits

- 6.1.2. Cookies

- 6.1.3. Filled Biscuits

- 6.1.4. Plain Biscuits

- 6.1.5. Sandwich Biscuits

- 6.1.6. Other Sweet Biscuits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Chocolate-coated Biscuits

- 7.1.2. Cookies

- 7.1.3. Filled Biscuits

- 7.1.4. Plain Biscuits

- 7.1.5. Sandwich Biscuits

- 7.1.6. Other Sweet Biscuits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Chocolate-coated Biscuits

- 8.1.2. Cookies

- 8.1.3. Filled Biscuits

- 8.1.4. Plain Biscuits

- 8.1.5. Sandwich Biscuits

- 8.1.6. Other Sweet Biscuits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Chocolate-coated Biscuits

- 9.1.2. Cookies

- 9.1.3. Filled Biscuits

- 9.1.4. Plain Biscuits

- 9.1.5. Sandwich Biscuits

- 9.1.6. Other Sweet Biscuits

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North America Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Grupo Bimbo

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Meiji Holdings Co Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 General Mills Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 PepsiCo Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Mckee Foods Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Ferrero Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Girl Scouts of the USA

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Campbell Soup Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sweet Nutrition*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Mondelez International

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Grupo Bimbo

List of Figures

- Figure 1: North America Sweet Biscuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Sweet Biscuits Market Share (%) by Company 2024

List of Tables

- Table 1: North America Sweet Biscuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Sweet Biscuits Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Sweet Biscuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Sweet Biscuits Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: North America Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Sweet Biscuits Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North America Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: North America Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Sweet Biscuits Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: North America Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Sweet Biscuits Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: North America Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sweet Biscuits Market?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the North America Sweet Biscuits Market?

Key companies in the market include Grupo Bimbo, Meiji Holdings Co Ltd, General Mills Inc, PepsiCo Inc, Mckee Foods Corporation, Ferrero Group, Girl Scouts of the USA, Campbell Soup Company, Sweet Nutrition*List Not Exhaustive, Mondelez International.

3. What are the main segments of the North America Sweet Biscuits Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products.

6. What are the notable trends driving market growth?

Increased Innovations in Sweet Biscusts.

7. Are there any restraints impacting market growth?

High Cost Associated with the Freeze-Drying Technology.

8. Can you provide examples of recent developments in the market?

In February 2022, Carl Brandt, Inc. launched Kambly Swiss Biscuits in four new items in the United States which include Matterhorn Swiss Biscuits, Chocolate Bretzeli Swiss Biscuits, Bretzeli Tin Gold, and the Primavera Gift Box. The company claims that the Kambly's line of indulgent Swiss biscuits is made with the finest all-natural, clean-label ingredients for a sustainable world.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sweet Biscuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sweet Biscuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sweet Biscuits Market?

To stay informed about further developments, trends, and reports in the North America Sweet Biscuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence