Key Insights

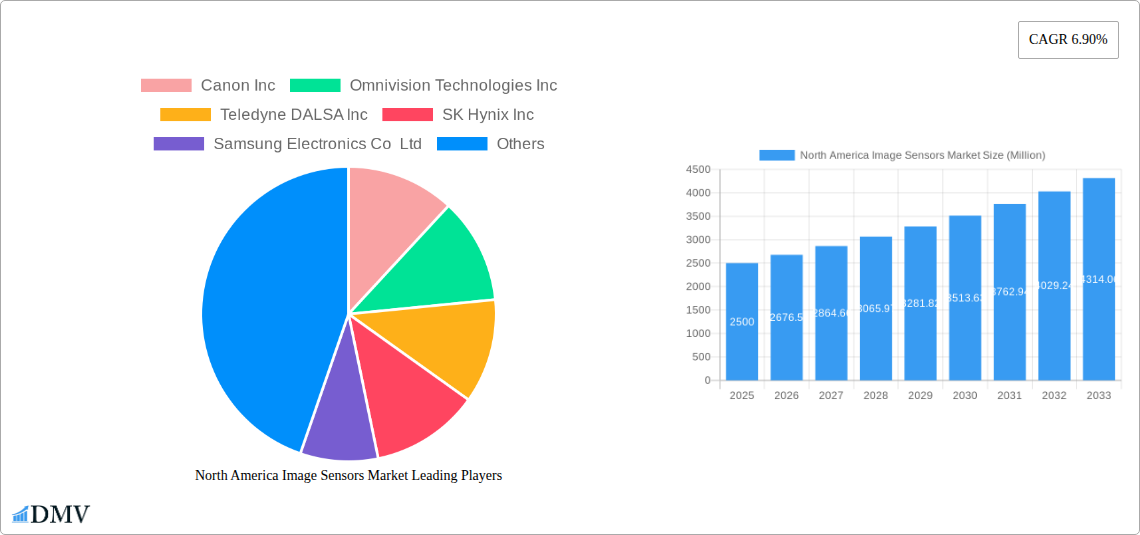

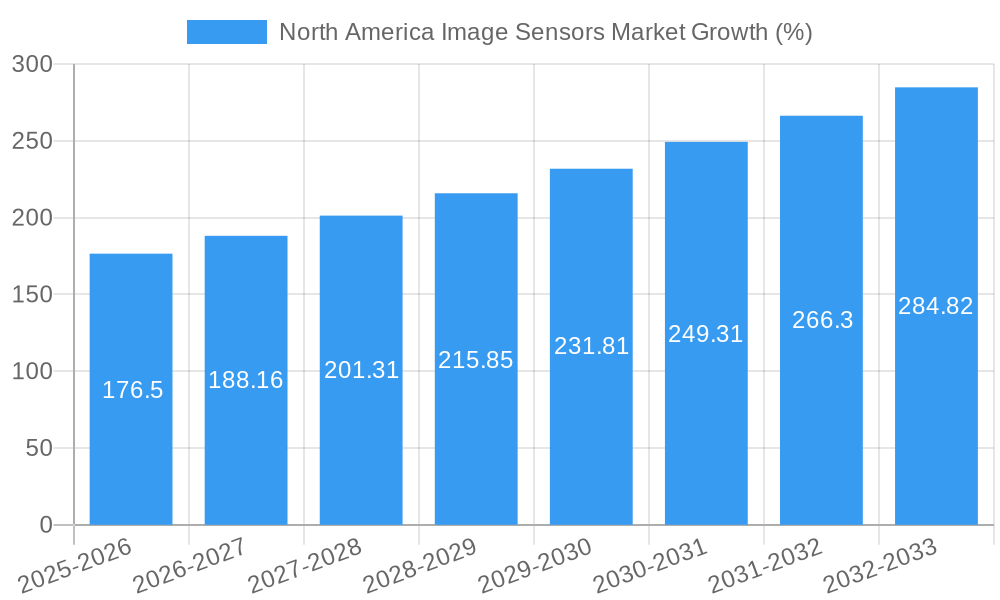

The North America image sensor market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.90% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of image sensors across diverse end-user industries, including consumer electronics (smartphones, cameras), healthcare (medical imaging), automotive (advanced driver-assistance systems, autonomous vehicles), and security and surveillance (CCTV, video analytics), is a significant driver. Technological advancements leading to higher resolution, improved sensitivity, and reduced power consumption in CMOS and CCD image sensors are further stimulating market growth. The strong presence of major image sensor manufacturers like Canon, Sony, and Samsung in North America, coupled with significant investments in research and development, contributes to this positive outlook. While data for specific regional breakdowns within North America (e.g., precise market share of the United States versus Canada) is not provided, it is reasonable to assume the United States holds the largest market share due to its large economy and high technological adoption rates.

However, certain market restraints could potentially moderate growth. These might include the cyclical nature of the electronics industry, potential supply chain disruptions impacting sensor production, and the emergence of competing technologies. Nevertheless, the overall market trajectory remains positive, with a foreseeable increase in demand for higher-performance image sensors across diverse applications, ensuring continued market expansion throughout the forecast period. The strong presence of both established players and innovative startups within North America positions the region for continued leadership in this dynamic market. The increasing integration of image sensors into IoT devices and the expansion of AI-powered image processing are expected to further propel market expansion in the coming years.

North America Image Sensors Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America image sensors market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. Spanning the period from 2019 to 2033 (historical period: 2019-2024; base year: 2025; forecast period: 2025-2033), the report leverages rigorous research methodologies to project a market valued at xx Million by 2033. This in-depth study covers key market segments, leading players, emerging trends, and future growth opportunities within the United States and Canada.

North America Image Sensors Market Composition & Trends

This section delves into the competitive dynamics of the North America image sensors market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity.

Market Concentration: The North American image sensor market exhibits a moderately concentrated landscape, with key players holding significant market share. Precise market share distribution among leading companies like Canon Inc, Sony Corporation, and Samsung Electronics Co Ltd. will be detailed in the full report. We will quantify the top 5 players' combined market share. We predict that the market will experience increased competition from new entrants and disruptive technologies in the forecast period.

Innovation Catalysts: Continuous advancements in CMOS technology, particularly in resolution, sensitivity, and dynamic range, are driving market growth. The increasing demand for high-quality imaging in diverse applications fuels innovation.

Regulatory Landscape: Government regulations concerning data privacy and safety standards in automotive and healthcare applications influence market dynamics. The full report will examine specific regulations and their impacts.

Substitute Products: While limited, alternative technologies like LiDAR are emerging and potentially impacting the market share of image sensors in specific applications, such as autonomous driving.

End-User Profiles: The report provides a detailed breakdown of end-user industries, including consumer electronics, automotive, healthcare, industrial automation, and security & surveillance, outlining their specific needs and preferences.

M&A Activities: The report will analyze significant M&A activities within the North American image sensor industry from 2019 to 2024, including deal values and strategic implications. We anticipate xx Million in total M&A deal value during this period.

North America Image Sensors Market Industry Evolution

This section traces the evolution of the North American image sensor market, examining growth trajectories, technological progress, and shifts in consumer demand. We will analyze the historical growth rates of the CMOS and CCD segments, along with adoption rates across key end-user industries. The market witnessed a CAGR of xx% from 2019 to 2024 and is projected to grow at a CAGR of xx% during the forecast period. This growth is primarily driven by the increasing demand for high-resolution imaging in consumer electronics, automotive, and security applications. Detailed analyses of specific technological advancements, including improvements in pixel size, low-light performance, and high-dynamic range (HDR), will be provided along with examples. The shift towards higher megapixel counts and the integration of advanced image processing capabilities are significant factors shaping market trends. Moreover, the report will analyze the impact of changing consumer preferences, such as the rising demand for smaller, more energy-efficient image sensors, on market growth.

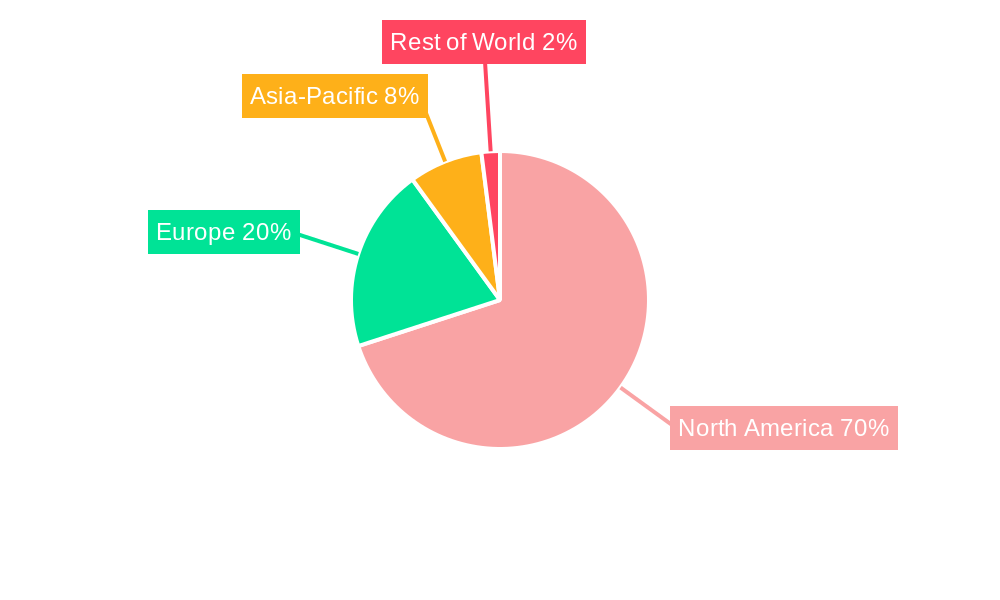

Leading Regions, Countries, or Segments in North America Image Sensors Market

This section pinpoints the dominant regions, countries, and segments within the North American image sensor market. The analysis will focus on the United States and Canada, examining their unique market characteristics and growth drivers.

- Dominant Region/Country: The United States currently holds the largest market share, driven by a strong presence of key players and high demand across multiple sectors.

Key Drivers for U.S. Dominance:

- High investments in R&D and technological advancements.

- Strong presence of major consumer electronics and automotive manufacturers.

- Favorable regulatory environment encouraging innovation.

Canada Market Analysis:

While smaller than the US market, Canada shows significant growth potential fueled by government investments in advanced technologies and the presence of key industry players in sectors like aerospace and defense.

Dominant Segments: The CMOS segment overwhelmingly dominates the market due to superior performance and cost-effectiveness compared to CCD technology. Within end-user industries, the consumer electronics and automotive segments are currently the largest contributors to market revenue. Detailed market share data for each segment will be provided in the full report. The rapid expansion of the automotive sector, particularly autonomous driving and advanced driver-assistance systems (ADAS), is a major growth catalyst. Similarly, the healthcare sector demonstrates strong growth prospects due to increasing adoption of medical imaging technologies.

North America Image Sensors Market Product Innovations

Recent innovations in image sensors include advancements in back-illuminated (BSI) technology, which improves light sensitivity and low-light performance. Higher pixel counts and the incorporation of advanced image processing capabilities like HDR are also significantly enhancing image quality. The development of specialized sensors for specific applications, such as NIR sensors for automotive in-cabin monitoring, reflects a key trend in product innovation. These innovations are driving the adoption of image sensors in various high-growth markets.

Propelling Factors for North America Image Sensors Market Growth

Several factors are driving the expansion of the North America image sensor market. Technological advancements, such as the development of higher-resolution, more sensitive sensors, are key drivers. Growing demand from diverse end-user industries, including automotive (ADAS and autonomous driving), healthcare (medical imaging), and security and surveillance (CCTV and facial recognition), is significantly boosting market growth. Favorable government policies and incentives promoting the development and adoption of advanced imaging technologies in key sectors also play a crucial role. The increasing penetration of smartphones and other consumer electronics equipped with advanced camera systems further contributes to market expansion.

Obstacles in the North America Image Sensors Market

The North American image sensor market faces certain challenges, including the intensifying competition from global manufacturers, leading to price pressures. Supply chain disruptions, particularly concerning semiconductor components, can impact production and availability. Stringent regulatory requirements and standards related to data privacy and security in certain applications can present hurdles for market players.

Future Opportunities in North America Image Sensors Market

Future growth opportunities lie in the increasing adoption of image sensors in emerging sectors like robotics, augmented reality (AR), and virtual reality (VR). The development of specialized sensors for specific applications, such as hyperspectral imaging and 3D sensing, holds significant potential. The expansion into new markets and applications, coupled with continuous advancements in sensor technology, will drive future growth.

Major Players in the North America Image Sensors Market Ecosystem

- Canon Inc

- Omnivision Technologies Inc

- Teledyne DALSA Inc

- SK Hynix Inc

- Samsung Electronics Co Ltd

- Aptina Imaging Corporation

- STMicroelectronics N V

- ON Semiconductor Corporation

- CMOSIS N V

- Panasonic Corporation

- Sony Corporation

Key Developments in North America Image Sensors Market Industry

- July 2021: Samsung released the ISOCELL Auto 4AC automotive image sensor, expanding its presence beyond the mobile sector.

- January 2022: OMNIVISION Technologies, Inc. announced the OX05B1S, a 5MP RGB-IR BSI global shutter sensor for automotive in-cabin monitoring systems.

Strategic North America Image Sensors Market Forecast

The North American image sensor market is poised for robust growth, driven by technological advancements, increasing demand from diverse end-user industries, and the emergence of new applications. The market's future prospects are bright, with significant opportunities in areas such as automotive, healthcare, and industrial automation. The continued development of high-performance, cost-effective image sensors will fuel market expansion. The predicted growth rate ensures a promising future for investors and businesses in this sector.

North America Image Sensors Market Segmentation

-

1. Type

- 1.1. CMOS

- 1.2. CCD

-

2. End-User Industry

- 2.1. Consumer Electronics

- 2.2. Healthcare

- 2.3. Industrial

- 2.4. Automotive and Transportation

- 2.5. Aerospace and Defense

- 2.6. Other End-user Industries

North America Image Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Image Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand in Automotive Sector; Low-Cost Availability of CMOS Image Sensors Deployed in Electronic Devices; Demand for Gesture Recognition/Control in Various Applications

- 3.3. Market Restrains

- 3.3.1. Space and Battery Consumption issues; High Manufacturing Costs and Increased Market Competition

- 3.4. Market Trends

- 3.4.1. CMOS Image Sensor in Smartphone and Other Products to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Image Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. CMOS

- 5.1.2. CCD

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Healthcare

- 5.2.3. Industrial

- 5.2.4. Automotive and Transportation

- 5.2.5. Aerospace and Defense

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Image Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Image Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Image Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Image Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Canon Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Omnivision Technologies Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Teledyne DALSA Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SK Hynix Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Samsung Electronics Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aptina Imaging Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 STMicroelectronics N V

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ON Semiconductor Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CMOSIS N V

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Panasonic Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sony Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Canon Inc

List of Figures

- Figure 1: North America Image Sensors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Image Sensors Market Share (%) by Company 2024

List of Tables

- Table 1: North America Image Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Image Sensors Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Image Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Image Sensors Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: North America Image Sensors Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: North America Image Sensors Market Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 7: North America Image Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Image Sensors Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Image Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Image Sensors Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Image Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Image Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Image Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Image Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Image Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Image Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Image Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Image Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Image Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Image Sensors Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 21: North America Image Sensors Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 22: North America Image Sensors Market Volume K Unit Forecast, by End-User Industry 2019 & 2032

- Table 23: North America Image Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Image Sensors Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States North America Image Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Image Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Image Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Image Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Image Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Image Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Image Sensors Market?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the North America Image Sensors Market?

Key companies in the market include Canon Inc, Omnivision Technologies Inc, Teledyne DALSA Inc, SK Hynix Inc , Samsung Electronics Co Ltd, Aptina Imaging Corporation, STMicroelectronics N V, ON Semiconductor Corporation, CMOSIS N V, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the North America Image Sensors Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand in Automotive Sector; Low-Cost Availability of CMOS Image Sensors Deployed in Electronic Devices; Demand for Gesture Recognition/Control in Various Applications.

6. What are the notable trends driving market growth?

CMOS Image Sensor in Smartphone and Other Products to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Space and Battery Consumption issues; High Manufacturing Costs and Increased Market Competition.

8. Can you provide examples of recent developments in the market?

January 2022 - OMNIVISION Technologies, Inc. announced the next addition to its pioneering Nyxel near-infrared (NIR) technology family. The OX05B1S is the first 5 megapixels (MP) RGB-IR BSI global shutter sensor for in-cabin monitoring systems (IMS) in the automotive industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Image Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Image Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Image Sensors Market?

To stay informed about further developments, trends, and reports in the North America Image Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence