Key Insights

The North American hydropower market, encompassing large and small hydropower plants, pumped storage facilities, and other related technologies, is experiencing steady growth. Driven by increasing demand for renewable energy sources, stringent environmental regulations aimed at reducing carbon emissions, and government incentives promoting clean energy development, the market is poised for expansion throughout the forecast period (2025-2033). While the precise market size for 2025 isn't explicitly stated, considering a CAGR exceeding 1% and a value unit of millions, a reasonable estimation places the 2025 market size in the range of $20-30 billion, reflecting the significant investment and operational activity within the sector. Key market segments include large-scale hydropower projects, which continue to dominate due to their established infrastructure and high energy output, along with the burgeoning small hydropower segment, driven by advancements in technology and the feasibility of decentralized energy generation. Pumped storage hydropower, crucial for grid stability and balancing intermittent renewable energy sources like solar and wind, is also experiencing growth. Growth is further supported by continuous technological innovation focused on improving efficiency and reducing environmental impact.

However, the market faces certain restraints. These include the significant upfront capital investment required for hydropower projects, complex permitting processes and regulatory hurdles, as well as environmental concerns related to dam construction and potential impacts on aquatic ecosystems. Geographical limitations in suitable locations for hydropower development also present challenges. Despite these constraints, the long-term outlook for the North American hydropower market remains positive, driven by increasing governmental support, technological progress addressing environmental concerns, and a sustained push towards a decarbonized energy future. Major players like BC Hydro, Duke Energy, and General Electric are actively involved in project development and technological innovation, reinforcing the market's dynamism and growth trajectory. The continued focus on grid modernization and the integration of renewable energy sources will further stimulate demand for hydropower's reliable and clean energy generation capabilities.

North America Hydropower Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America hydropower market, encompassing market size, growth drivers, challenges, and future opportunities. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving dynamics of this crucial energy sector. The report meticulously examines various segments, including large hydropower, small hydropower, pumped storage, and other types, offering a granular view of the market's composition and future trajectory. Projected market value for 2025 is estimated at $XX Million.

North America Hydropower Market Composition & Trends

The North American hydropower market exhibits a moderately concentrated landscape, with key players such as BC Hydro & Power Authority, Hydro-Québec, and Duke Energy Corporation holding significant market share. However, the market also features numerous smaller independent power producers (IPPs) and regional utilities. Innovation in areas like pumped storage hydropower (PSH) and advanced turbine technology is driving market growth, alongside supportive regulatory frameworks in several regions. Substitute products like solar and wind power exert competitive pressure, but hydropower maintains a significant advantage due to its reliability and baseload capacity. End-users are primarily electricity utilities and industrial consumers seeking clean and sustainable energy sources. Recent years have witnessed notable M&A activity, with deal values exceeding $XX Million in some instances.

- Market Share Distribution: BC Hydro & Power Authority (xx%), Hydro-Québec (xx%), Duke Energy Corporation (xx%), Others (xx%).

- M&A Activity: A total of xx M&A deals were recorded during the historical period (2019-2024), with the average deal value amounting to $XX Million. Most transactions involved smaller hydropower assets.

- Regulatory Landscape: Varies significantly across North American jurisdictions, with some regions exhibiting more supportive policies than others.

- Innovation Catalysts: Advancements in turbine technology, PSH advancements, and digitalization are driving efficiency and cost reductions.

North America Hydropower Market Industry Evolution

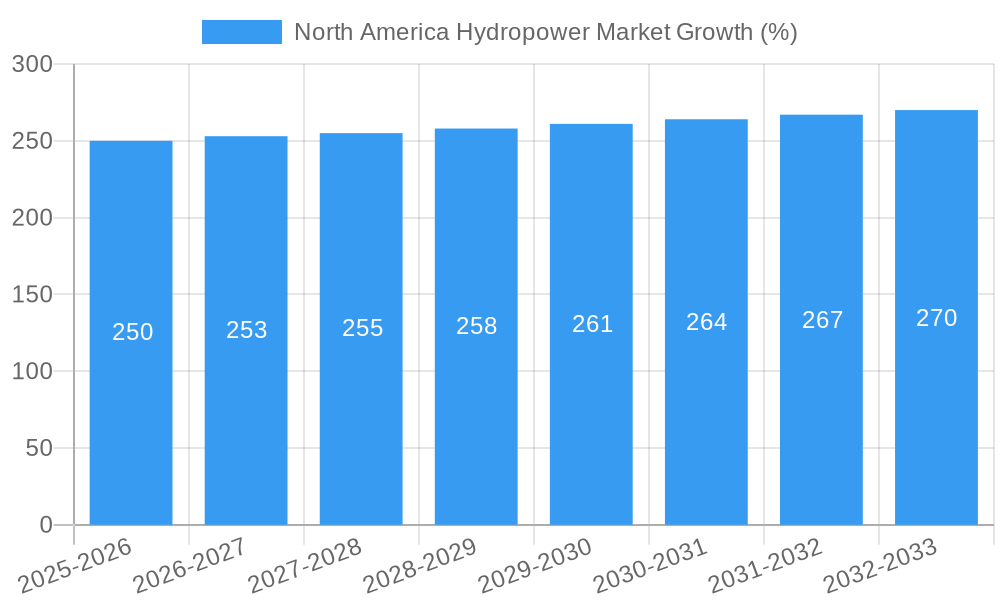

The North American hydropower market has experienced steady growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is primarily driven by increasing demand for renewable energy, supportive government policies aimed at reducing carbon emissions, and the inherent reliability of hydropower as a baseload power source. Technological advancements, such as the development of more efficient turbines and improved grid integration capabilities, have further propelled market expansion. Shifting consumer preferences towards environmentally friendly energy sources also provide a significant boost. The forecast period (2025-2033) is expected to see continued growth, albeit at a potentially moderated pace due to factors such as environmental concerns and the increasing penetration of intermittent renewable energy sources. The projected CAGR for the forecast period is estimated at xx%, resulting in an estimated market value of $XX Million by 2033.

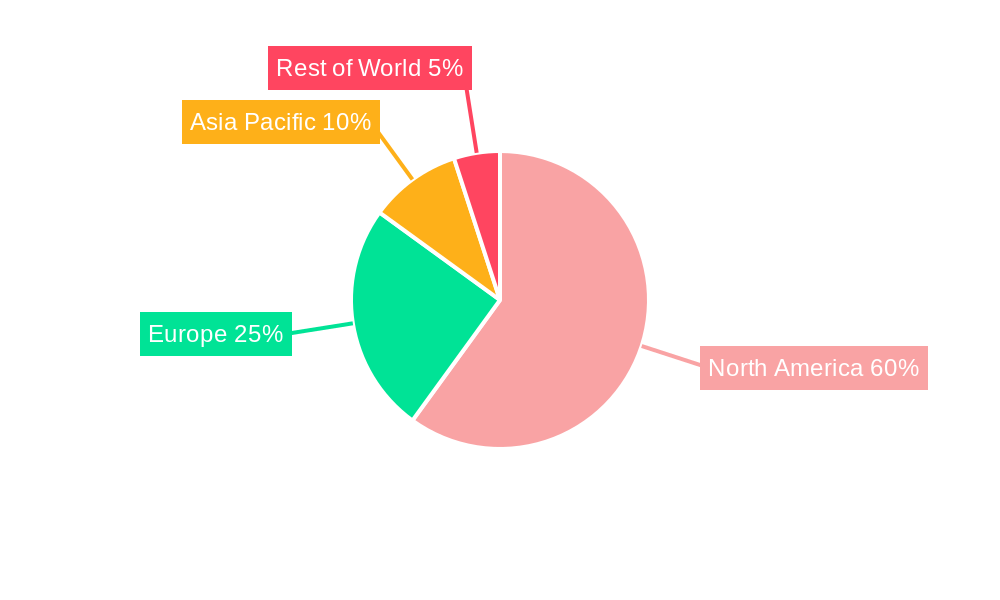

Leading Regions, Countries, or Segments in North America Hydropower Market

The Canadian Provinces and states in the Pacific Northwest regions of the United States (Washington, Oregon, Idaho, California) are currently the dominant regions within the North American hydropower market. Pumped Storage Hydropower (PSH) represents a rapidly growing segment, driven by its ability to address intermittency issues associated with variable renewable energy sources.

Key Drivers for Leading Regions:

- Significant existing hydropower infrastructure.

- Abundant water resources.

- Supportive government policies and investment incentives.

- High electricity demand.

Key Drivers for Pumped Storage Hydropower (PSH):

- Growing need for grid stability and flexibility.

- Increasing penetration of renewable energy sources (solar, wind).

- Government support for energy storage technologies.

- Relatively lower environmental impact compared to other storage solutions.

The dominance of these regions and segments is largely attributed to a combination of factors: substantial existing infrastructure, favorable regulatory environments, significant water resources, and strong investment in new projects. This segment is poised for considerable expansion as the importance of grid balancing and energy storage grows.

North America Hydropower Market Product Innovations

Recent innovations in hydropower technology focus on increased efficiency, reduced environmental impact, and improved grid integration. This includes advancements in turbine design, digital control systems, and the development of innovative pumped storage technologies. These improvements lead to higher energy output, lower operating costs, and enhanced grid reliability. The unique selling propositions emphasize sustainability, reliability, and grid stabilization capabilities. These innovations directly translate into higher performance metrics in terms of energy yield and operational efficiency.

Propelling Factors for North America Hydropower Market Growth

Several key factors fuel the growth of the North American hydropower market:

- Increasing Demand for Renewable Energy: Government regulations to reduce carbon emissions and public awareness of climate change are driving demand for sustainable energy options, making hydropower an attractive choice.

- Technological Advancements: Continuous improvements in turbine design, grid integration techniques, and energy storage solutions enhance efficiency and cost-effectiveness.

- Government Support and Incentives: Subsidies, tax breaks, and supportive policies encourage investment in new hydropower projects and upgrades to existing infrastructure.

Obstacles in the North America Hydropower Market

Several obstacles hinder the growth of the North American hydropower market:

- Environmental Concerns: Concerns about the environmental impact of dam construction on aquatic ecosystems and wildlife remain a significant barrier.

- Regulatory Hurdles: Complex permitting processes and regulatory frameworks can significantly delay or impede the development of new projects.

- High Capital Costs: The high upfront investment required for hydropower projects can present a significant barrier for developers.

Future Opportunities in North America Hydropower Market

Future growth opportunities for the North American hydropower market include:

- Modernization and Upgrades: Retrofitting existing hydropower facilities with advanced technologies to enhance efficiency and output represents a substantial opportunity.

- Expansion of Pumped Hydro Storage: This technology is critical to grid stabilization and will witness increased investment as the adoption of renewable energy sources intensifies.

- Exploring New Hydropower Sites: Harnessing the potential of smaller rivers and remote locations offers a pathway for sustainable expansion.

Major Players in the North America Hydropower Market Ecosystem

- BC Hydro & Power Authority

- Absaroka Energy LLC

- Georgia Power Company

- Toshiba Corporation

- Hydro-Québec

- Duke Energy Corporation

- Ontario Power Generation Inc

- General Electric Company

- Andritz AG

Key Developments in North America Hydropower Market Industry

- June 2022: Stantec initiated a study commissioned by WaterPower Canada to assess the potential for pumped storage hydropower across Canada. This signals increased interest and investment in PSH technologies to support grid stability and address the intermittency issues of renewables.

- May 2022: The United States Department of Energy provided approximately USD 8 Million in funding to improve the flexibility of the US hydropower fleet and enhance grid reliability. This highlights government support for modernizing existing infrastructure and optimizing operational efficiency.

Strategic North America Hydropower Market Forecast

The North American hydropower market is poised for sustained growth driven by increasing demand for renewable energy, government support, and technological advancements. The focus on pumped storage hydropower, coupled with modernization efforts in existing plants, will contribute to this growth. The forecast period (2025-2033) is expected to witness significant investment in new projects and upgrades, expanding the market's capacity and contribution to the North American energy mix. This strategic positioning emphasizes the long-term potential of hydropower as a cornerstone of clean and reliable energy production.

North America Hydropower Market Segmentation

-

1. Type

- 1.1. Large Hydropower

- 1.2. Small Hydropower

- 1.3. Pumped Storage

- 1.4. Other Types

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Hydropower Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Hydropower Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Pumped Storage to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Large Hydropower

- 5.1.2. Small Hydropower

- 5.1.3. Pumped Storage

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Large Hydropower

- 6.1.2. Small Hydropower

- 6.1.3. Pumped Storage

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Large Hydropower

- 7.1.2. Small Hydropower

- 7.1.3. Pumped Storage

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Large Hydropower

- 8.1.2. Small Hydropower

- 8.1.3. Pumped Storage

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Hydropower Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 BC Hydro & Power Authority

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Absaroka Energy LLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Georgia Power Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Toshiba Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hydro-Québec

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Duke Energy Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ontario Power Generation Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 General Electric Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Andritz AG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 BC Hydro & Power Authority

List of Figures

- Figure 1: North America Hydropower Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Hydropower Market Share (%) by Company 2024

List of Tables

- Table 1: North America Hydropower Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Hydropower Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: North America Hydropower Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Hydropower Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 5: North America Hydropower Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Hydropower Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: North America Hydropower Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Hydropower Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: North America Hydropower Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Hydropower Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: United States North America Hydropower Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Hydropower Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Hydropower Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Hydropower Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Hydropower Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Hydropower Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Hydropower Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Hydropower Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: North America Hydropower Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Hydropower Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 21: North America Hydropower Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Hydropower Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 23: North America Hydropower Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Hydropower Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 25: North America Hydropower Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: North America Hydropower Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 27: North America Hydropower Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Hydropower Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 29: North America Hydropower Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Hydropower Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 31: North America Hydropower Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: North America Hydropower Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 33: North America Hydropower Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Hydropower Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 35: North America Hydropower Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Hydropower Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hydropower Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the North America Hydropower Market?

Key companies in the market include BC Hydro & Power Authority, Absaroka Energy LLC, Georgia Power Company, Toshiba Corporation, Hydro-Québec, Duke Energy Corporation, Ontario Power Generation Inc, General Electric Company, Andritz AG.

3. What are the main segments of the North America Hydropower Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Pumped Storage to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

June 2022: Stantec announced that WaterPower Canada had commissioned it to assess the potential for pumped storage hydropower across Canada. Stantec and its partners, the Australian National University, CEATI, and Power Advisory, will study the strategic value of pumped storage hydropower (PSH) facilities to help WaterPower Canada and the hydropower industry as a whole.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hydropower Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hydropower Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hydropower Market?

To stay informed about further developments, trends, and reports in the North America Hydropower Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence