Key Insights

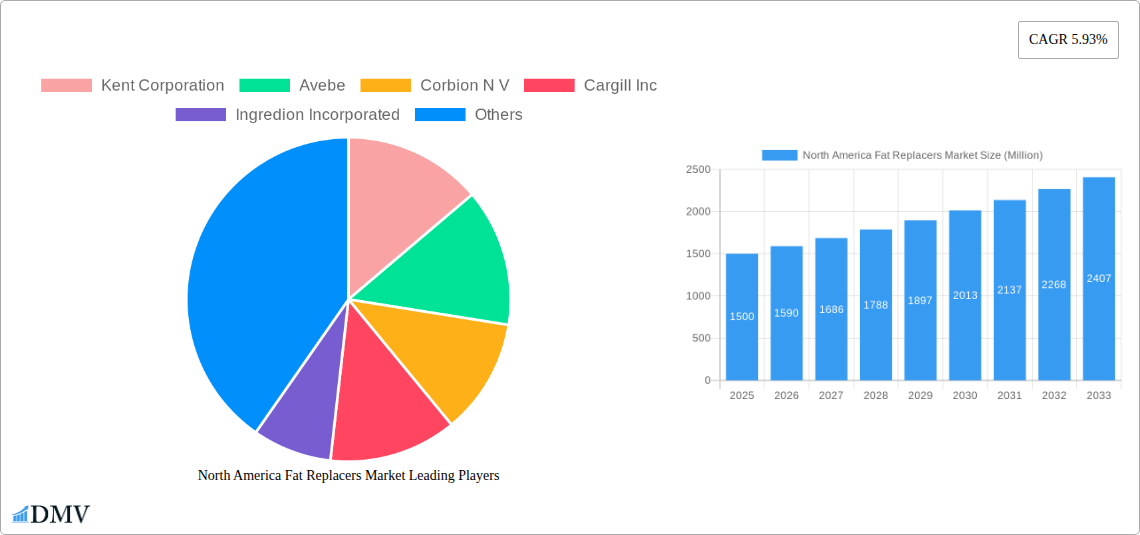

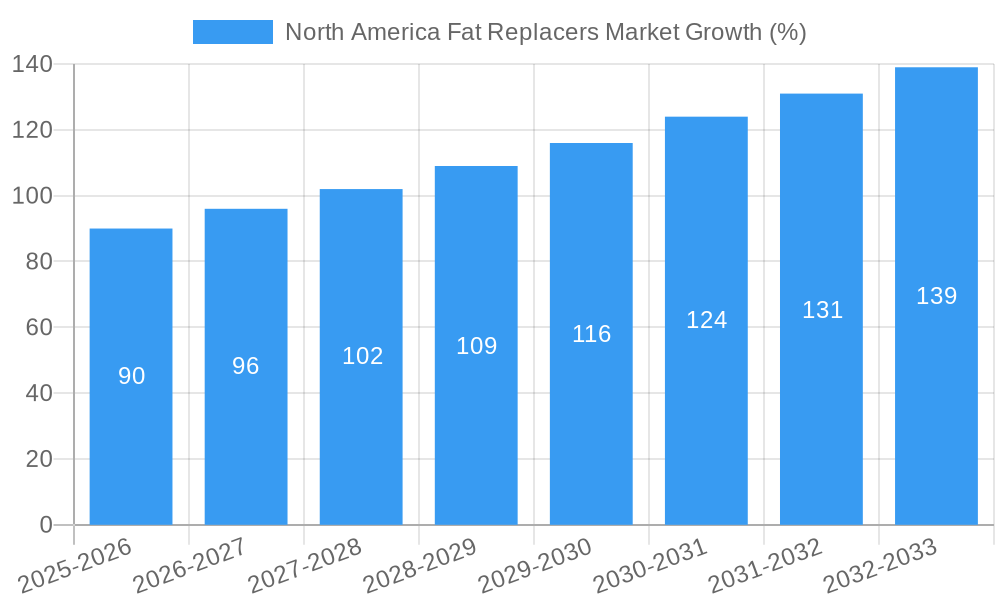

The North American fat replacers market, valued at approximately $1.5 billion in 2025, is projected to experience robust growth, driven by increasing consumer demand for healthier food options and the rising prevalence of obesity and related health concerns. The market's compound annual growth rate (CAGR) of 5.93% from 2025 to 2033 indicates a significant expansion, reaching an estimated value exceeding $2.5 billion by 2033. Key growth drivers include the burgeoning popularity of low-fat and reduced-fat food products across various categories, including bakery and confectionery, beverages, and processed meats. The increasing adoption of plant-based alternatives and the development of innovative fat replacers with improved functionalities are further propelling market expansion. Within the market segmentation, carbohydrate-based and protein-based fat replacers are anticipated to maintain a substantial share due to their functional properties and widespread applicability. However, the market faces certain restraints, such as the potential aftertaste associated with some fat replacers and consumer perceptions regarding the nutritional value of these alternatives. Continued innovation focused on addressing these challenges and creating more palatable and nutritionally enhanced products is critical for sustained market growth.

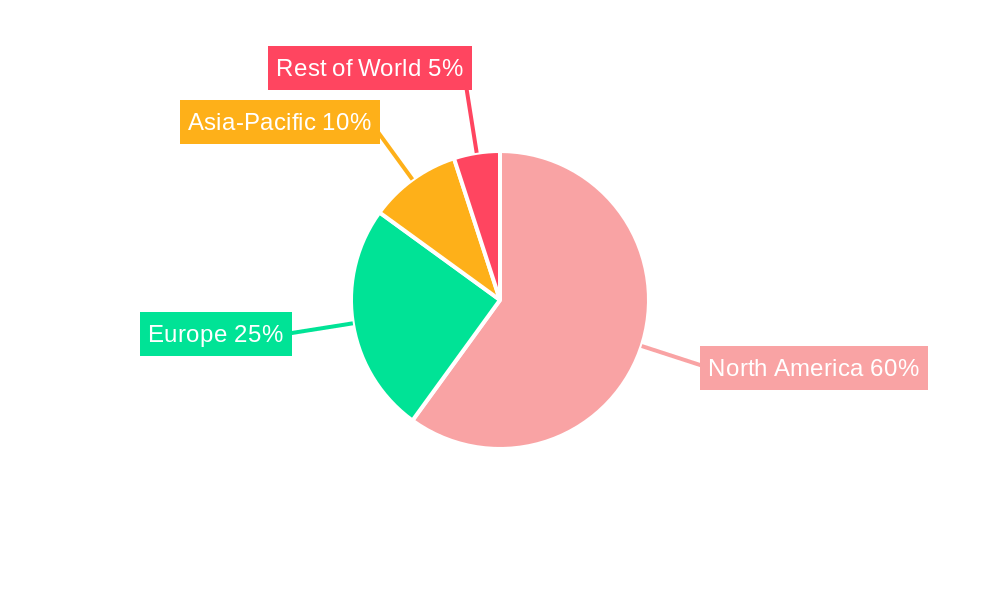

The North American market is segmented geographically, with the United States holding the largest market share, followed by Canada and Mexico. Major players like Cargill, Ingredion, and Tate & Lyle are actively involved in research and development, driving innovation in fat replacer technology. The market is characterized by a high level of competition, with companies focusing on product diversification, strategic partnerships, and mergers and acquisitions to enhance their market positions. Future growth will likely be influenced by evolving consumer preferences, stricter food labeling regulations, and advancements in fat replacer technology, including the development of more sustainable and cost-effective solutions. The rising demand for clean label products, free from artificial ingredients, will also play a significant role in shaping market trends in the coming years.

North America Fat Replacers Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America fat replacers market, offering valuable insights for stakeholders across the value chain. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this comprehensive study unveils the market's dynamics, growth drivers, and future potential. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period. Key players such as Kent Corporation, Avebe, Corbion N V, Cargill Inc, Ingredion Incorporated, Tate & Lyle PLC, CP Kelco U S Inc, and others are shaping the competitive landscape.

North America Fat Replacers Market Composition & Trends

This section meticulously examines the market's structure, identifying key trends and influential factors. We delve into market concentration, analyzing the market share distribution among leading players and assessing the level of competition. Furthermore, the report explores the role of innovation in driving market growth, highlighting recent technological advancements and their impact on product development. The regulatory landscape, including relevant health and safety standards, is also scrutinized. Analysis of substitute products and their market penetration is included, alongside an in-depth profile of end-users across various sectors. Finally, significant mergers and acquisitions (M&A) activities within the industry are examined, evaluating their impact on market dynamics and deal values (estimated at xx Million in total during the study period).

- Market Concentration: Highly fragmented with the top 5 players holding approximately xx% of the market share in 2024.

- Innovation Catalysts: Growing demand for healthier food options and technological advancements in fat replacer formulations.

- Regulatory Landscape: Stringent regulations regarding food safety and labeling are influencing product development and market entry.

- Substitute Products: Increased competition from alternative ingredients like plant-based proteins and fibers.

- End-User Profiles: Dominated by the food and beverage industry, specifically bakery and confectionery, beverages, and processed meat segments.

- M&A Activities: Significant M&A activity observed in the past five years, with an average deal value of xx Million.

North America Fat Replacers Market Industry Evolution

This section traces the evolution of the North America fat replacers market, charting its growth trajectory and identifying key milestones. We analyze the market's growth rate over the historical period, noting periods of expansion and contraction. Technological advancements, such as the development of novel fat replacers with improved functionalities, are examined in detail. Shifting consumer preferences towards healthier and more convenient food products are analyzed, assessing their impact on market demand. Specific data points, such as the adoption rate of novel fat replacers in different food applications, are provided. The impact of macroeconomic factors, including economic growth and changes in consumer spending patterns, are discussed. The influence of evolving consumer demands for clean label and natural ingredients is also discussed.

Leading Regions, Countries, or Segments in North America Fat Replacers Market

This section identifies the dominant regions, countries, and market segments within the North America fat replacers market. We provide a detailed analysis of the leading segments based on type (Carbohydrate-Based, Protein-Based, Lipid-Based), application (Bakery and Confectionery, Beverages, Processed Meat, Convenience Food, Others), and source (Plant, Animal). The factors driving the dominance of these segments are explored, including investment trends, regulatory support, and consumer preferences.

Dominant Segment: The Carbohydrate-Based segment is projected to maintain its leading position throughout the forecast period driven by cost-effectiveness and wide applicability. The Bakery and Confectionery application segment is expected to show the highest growth rate. Plant-based sources are projected to dominate the source segment.

Key Drivers for Dominant Segments:

- Bakery and Confectionery: Growing demand for low-fat and healthier baked goods.

- Carbohydrate-Based: Cost-effectiveness and functional properties.

- Plant-Based: Growing consumer preference for natural and sustainable ingredients.

North America Fat Replacers Market Product Innovations

Recent innovations in fat replacers have focused on improving functionalities such as texture, taste, and stability. Advancements in formulation technology have led to the development of fat replacers that better mimic the sensory properties of traditional fats. Novel fat replacers with enhanced health benefits, such as reduced cholesterol or improved gut health, are gaining traction. These innovations are driving growth in specific application segments and catering to the growing demand for healthier food products.

Propelling Factors for North America Fat Replacers Market Growth

The North America fat replacers market is propelled by several factors. The rising health consciousness among consumers is a significant driver, fueling demand for low-fat and healthier food options. The increasing prevalence of obesity and related health issues further enhances this trend. Government regulations promoting healthier food choices also contribute to market expansion. Technological advancements leading to better-performing fat replacers with improved sensory attributes further stimulate market growth.

Obstacles in the North America Fat Replacers Market

Despite the positive growth outlook, the North America fat replacers market faces certain challenges. Stringent regulatory requirements for food additives can increase the cost and time required for product development and approval. Supply chain disruptions can affect the availability and price of raw materials, impacting production costs. Intense competition from established players and new entrants adds pressure on profit margins. These obstacles need to be carefully addressed to sustain market growth.

Future Opportunities in North America Fat Replacers Market

The North America fat replacers market presents several future opportunities. The growing demand for clean-label products is opening avenues for new fat replacers derived from natural sources. The development of fat replacers with functional health benefits, such as prebiotic or probiotic properties, is another promising area. Expansion into new food applications and geographical markets further presents significant growth potential.

Major Players in the North America Fat Replacers Market Ecosystem

- Kent Corporation

- Avebe

- Corbion N V

- Cargill Inc

- Ingredion Incorporated

- Tate & Lyle PLC

- CP Kelco U S Inc

Key Developments in North America Fat Replacers Market Industry

- 2022-Q4: Cargill Inc. launched a new line of plant-based fat replacers.

- 2023-Q1: Ingredion Incorporated announced a strategic partnership to expand its distribution network.

- 2023-Q3: Avebe acquired a smaller competitor, expanding its market share. (Further developments need to be added based on available information)

Strategic North America Fat Replacers Market Forecast

The North America fat replacers market is poised for continued growth, driven by the increasing demand for healthier and more convenient food options. Innovations in fat replacer technology, coupled with expanding applications in diverse food sectors, are expected to fuel market expansion. Emerging trends like the preference for clean-label products and functional ingredients will shape the market's future trajectory. The market's robust growth potential makes it an attractive investment opportunity for stakeholders.

North America Fat Replacers Market Segmentation

-

1. Source

- 1.1. Plant

- 1.2. Animal

-

2. Type

- 2.1. Carbohydrate-Based

- 2.2. Protein-Based

- 2.3. Lipid-Based

-

3. Application

- 3.1. Bakery and Confectionery

- 3.2. Beverages

- 3.3. Processed Meat

- 3.4. Convenience Food

- 3.5. Others

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Fat Replacers Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Fat Replacers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Increased Application in Bakery and Confectionery

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fat Replacers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Plant

- 5.1.2. Animal

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Carbohydrate-Based

- 5.2.2. Protein-Based

- 5.2.3. Lipid-Based

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bakery and Confectionery

- 5.3.2. Beverages

- 5.3.3. Processed Meat

- 5.3.4. Convenience Food

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. United States North America Fat Replacers Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Plant

- 6.1.2. Animal

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Carbohydrate-Based

- 6.2.2. Protein-Based

- 6.2.3. Lipid-Based

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bakery and Confectionery

- 6.3.2. Beverages

- 6.3.3. Processed Meat

- 6.3.4. Convenience Food

- 6.3.5. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Canada North America Fat Replacers Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Plant

- 7.1.2. Animal

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Carbohydrate-Based

- 7.2.2. Protein-Based

- 7.2.3. Lipid-Based

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bakery and Confectionery

- 7.3.2. Beverages

- 7.3.3. Processed Meat

- 7.3.4. Convenience Food

- 7.3.5. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Mexico North America Fat Replacers Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Plant

- 8.1.2. Animal

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Carbohydrate-Based

- 8.2.2. Protein-Based

- 8.2.3. Lipid-Based

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Bakery and Confectionery

- 8.3.2. Beverages

- 8.3.3. Processed Meat

- 8.3.4. Convenience Food

- 8.3.5. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Rest of North America North America Fat Replacers Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Plant

- 9.1.2. Animal

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Carbohydrate-Based

- 9.2.2. Protein-Based

- 9.2.3. Lipid-Based

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Bakery and Confectionery

- 9.3.2. Beverages

- 9.3.3. Processed Meat

- 9.3.4. Convenience Food

- 9.3.5. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. United States North America Fat Replacers Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Fat Replacers Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Fat Replacers Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Fat Replacers Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Kent Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Avebe

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Corbion N V

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Cargill Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Ingredion Incorporated

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Tate & Lyle PLC*List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 CP Kelco U S Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.1 Kent Corporation

List of Figures

- Figure 1: North America Fat Replacers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Fat Replacers Market Share (%) by Company 2024

List of Tables

- Table 1: North America Fat Replacers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Fat Replacers Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: North America Fat Replacers Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Fat Replacers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: North America Fat Replacers Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Fat Replacers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Fat Replacers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Fat Replacers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Fat Replacers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Fat Replacers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Fat Replacers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Fat Replacers Market Revenue Million Forecast, by Source 2019 & 2032

- Table 13: North America Fat Replacers Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: North America Fat Replacers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: North America Fat Replacers Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America Fat Replacers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America Fat Replacers Market Revenue Million Forecast, by Source 2019 & 2032

- Table 18: North America Fat Replacers Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: North America Fat Replacers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: North America Fat Replacers Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America Fat Replacers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America Fat Replacers Market Revenue Million Forecast, by Source 2019 & 2032

- Table 23: North America Fat Replacers Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: North America Fat Replacers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: North America Fat Replacers Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Fat Replacers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: North America Fat Replacers Market Revenue Million Forecast, by Source 2019 & 2032

- Table 28: North America Fat Replacers Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: North America Fat Replacers Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: North America Fat Replacers Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: North America Fat Replacers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fat Replacers Market?

The projected CAGR is approximately 5.93%.

2. Which companies are prominent players in the North America Fat Replacers Market?

Key companies in the market include Kent Corporation, Avebe, Corbion N V, Cargill Inc, Ingredion Incorporated, Tate & Lyle PLC*List Not Exhaustive, CP Kelco U S Inc.

3. What are the main segments of the North America Fat Replacers Market?

The market segments include Source, Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Increased Application in Bakery and Confectionery.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fat Replacers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fat Replacers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fat Replacers Market?

To stay informed about further developments, trends, and reports in the North America Fat Replacers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence