Key Insights

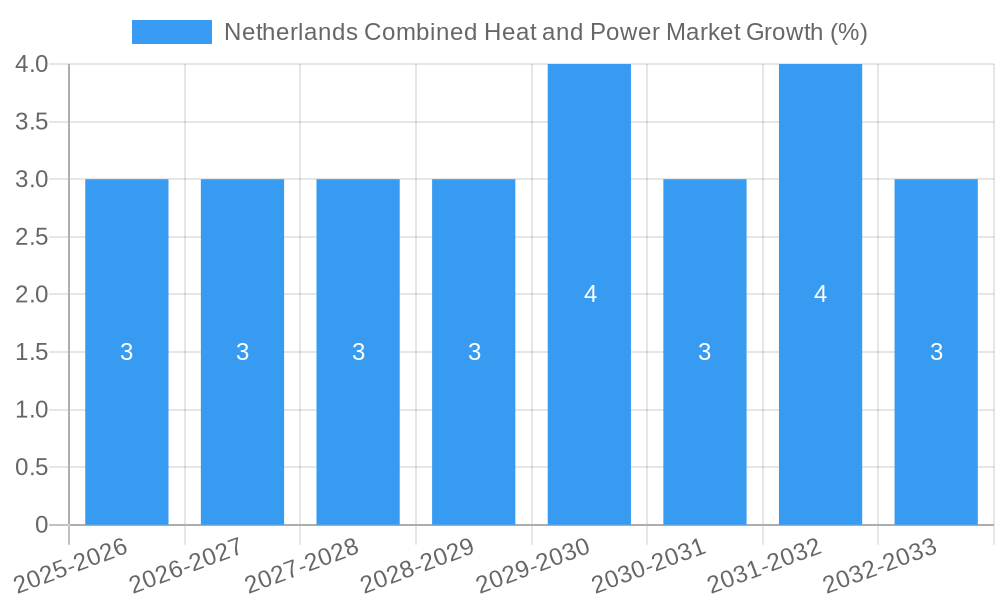

The Netherlands Combined Heat and Power (CHP) market, valued at approximately €250 million in 2025, is projected to experience moderate growth over the forecast period (2025-2033). A CAGR of 1.34% indicates a steady, albeit not explosive, expansion. This growth is driven primarily by increasing energy efficiency regulations within the residential and commercial sectors, coupled with a growing awareness of the environmental benefits of CHP systems. The shift towards renewable energy sources, particularly biogas and biomass, is another key driver, offering sustainable alternatives to traditional natural gas-powered CHP units. However, market restraints include the high initial investment costs associated with CHP technology, which can deter smaller businesses and homeowners. Furthermore, the existing well-developed infrastructure for separate heat and power generation presents a competitive challenge to wider CHP adoption. The market is segmented by application (residential, commercial, industrial, and utility) and fuel type (natural gas, renewable energy sources, and other fuel types). The residential segment is expected to see consistent growth, fueled by government incentives and increasing consumer demand for energy-efficient solutions. The commercial and industrial sectors are anticipated to exhibit slightly slower growth, driven by larger-scale projects and associated longer decision-making cycles. Major players like ABB, Viessmann, and Siemens are actively competing in this market, constantly innovating to improve efficiency and reduce costs.

The Netherlands' commitment to sustainability targets will significantly influence the future trajectory of the CHP market. The increasing emphasis on decarbonization is likely to accelerate the adoption of renewable energy-based CHP systems. Technological advancements, such as improved energy storage solutions integrated with CHP units, will also play a crucial role in enhancing market appeal. However, overcoming the initial investment barrier remains a significant challenge requiring ongoing government support and industry collaboration to unlock the full potential of CHP in the Netherlands. Further research into grid integration and optimized energy management strategies for CHP systems is essential to ensure efficient and reliable energy supply.

Netherlands Combined Heat and Power Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Netherlands Combined Heat and Power (CHP) market, offering a detailed examination of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report incorporates meticulous data analysis, incorporating both historical (2019-2024) and forecast (2025-2033) periods. The market size is expected to reach xx Million by 2033.

Netherlands Combined Heat and Power Market Composition & Trends

This section delves into the intricate composition of the Netherlands CHP market, examining its competitive landscape, innovation drivers, regulatory framework, and market dynamics. We analyze market concentration, revealing the market share distribution amongst key players like ABB Ltd, Viessmann Werke GmbH & Co KG, Senertec Kraft-Warme-Energiesysteme GmbH (Senertec), Microgen Engine Corporation Holding B V, Siemens AG, Caterpillar Inc, Centrica PLC, General Electric Company, BDR Thermea Group BV, and Capstone Turbine Corporation. The report also assesses the impact of M&A activities, quantifying deal values where possible and exploring their influence on market structure. Furthermore, we analyze substitute products, end-user profiles across residential, commercial, industrial, and utility sectors, and the evolving regulatory landscape shaping market behavior.

- Market Concentration: The Netherlands CHP market exhibits a [Describe level of concentration - e.g., moderately concentrated] market structure. [Insert data on market share distribution amongst top 5 players, if available. Otherwise, use estimated percentages].

- Innovation Catalysts: [Discuss key technological advancements and their impact on market innovation, e.g., advancements in renewable energy integration].

- Regulatory Landscape: [Analyze the impact of relevant regulations and policies on market growth and investment].

- Substitute Products: [Discuss alternative energy solutions and their competitive impact].

- End-User Profiles: [Provide a breakdown of CHP adoption across residential, commercial, industrial, and utility sectors].

- M&A Activities: [Analyze completed and pending M&A deals, including deal values where available. If data is limited, mention the general trend of M&A activity in the sector].

Netherlands Combined Heat and Power Market Industry Evolution

This section charts the evolutionary journey of the Netherlands CHP market, tracing its growth trajectory, technological advancements, and shifts in consumer preferences. We examine the historical market growth rate from 2019 to 2024, projecting future growth rates for the forecast period (2025-2033). Specific data points on growth rates and adoption metrics for different fuel types and applications will be presented. Analysis includes the impact of technological advancements such as improved efficiency and the integration of renewable energy sources. The increasing emphasis on sustainability and energy efficiency will be a key focus. This section will also analyze evolving consumer demands and their impact on market trends. [Insert detailed paragraphs based on the above points, including specific data on growth rates, adoption metrics, etc. Include information on the increasing use of renewable energy sources in the CHP market].

Leading Regions, Countries, or Segments in Netherlands Combined Heat and Power Market

This section identifies the dominant regions, countries, or segments within the Netherlands CHP market based on application (Residential, Commercial, Industrial, Utility), fuel type (Natural Gas, Renewable Energy Sources, Other Fuel Types), and geographic location. We will delve deep into the factors driving the dominance of specific segments.

- Dominant Segment: [Identify the dominant segment – e.g., Industrial or a specific fuel type].

- Key Drivers for Dominant Segment:

- Investment Trends: [Explain investment patterns in the dominant segment].

- Regulatory Support: [Discuss government policies and incentives supporting the dominant segment].

- Technological Advancements: [Highlight technological factors contributing to the segment’s dominance].

- Market Size and Growth: [Provide data illustrating the size and growth of the dominant segment].

[Include detailed paragraphs providing in-depth analysis of the factors contributing to the dominance of the identified segment. Support analysis with market data and relevant examples].

Netherlands Combined Heat and Power Market Product Innovations

The Netherlands CHP market is witnessing significant product innovations, focusing on enhanced efficiency, reduced emissions, and greater integration of renewable energy sources. New CHP systems incorporating advanced control systems, improved heat recovery mechanisms, and flexible fuel capabilities are emerging. These innovations are driven by stringent environmental regulations and the increasing demand for sustainable energy solutions. The focus on improving the overall efficiency and reducing operational costs is a crucial driver. [Insert details about specific product innovations, highlighting unique selling propositions and performance metrics].

Propelling Factors for Netherlands Combined Heat and Power Market Growth

Several factors are driving the growth of the Netherlands CHP market. Technological advancements in CHP technology, leading to increased efficiency and reduced emissions, are key. Government policies and incentives promoting renewable energy integration and energy efficiency also play a crucial role. Economic factors such as rising energy prices and the need for energy security are influencing market growth. [Include examples to support the points and quantify their impact wherever possible].

Obstacles in the Netherlands Combined Heat and Power Market

Despite the growth potential, the Netherlands CHP market faces challenges. Regulatory hurdles, including complex permitting processes and evolving environmental regulations, can hinder market expansion. Supply chain disruptions can affect the availability and cost of components. Competition from other energy sources and technological advancements in other sectors pose a competitive pressure. [Provide specific examples and quantify impacts wherever possible].

Future Opportunities in Netherlands Combined Heat and Power Market

The future of the Netherlands CHP market holds significant opportunities. Expansion into new market segments, particularly in the residential sector, presents potential for growth. Advancements in renewable energy integration offer prospects for more sustainable and cost-effective CHP systems. Emerging consumer trends towards sustainability and energy efficiency are creating new opportunities. [Include specific examples and identify potential market segments].

Major Players in the Netherlands Combined Heat and Power Market Ecosystem

- ABB Ltd

- Viessmann Werke GmbH & Co KG

- Senertec Kraft-Warme-Energiesysteme GmbH (Senertec)

- Microgen Engine Corporation Holding B V

- Siemens AG

- Caterpillar Inc

- Centrica PLC

- General Electric Company

- BDR Thermea Group BV

- Capstone Turbine Corporation

Key Developments in Netherlands Combined Heat and Power Market Industry

- H1 2024: Renewable energy sources surpassed fossil fuels in electricity generation in the Netherlands for the first time. Renewables produced 32.3 billion kilowatt-hours, representing 53% of total electricity output. Wind power was a significant contributor to this increase. This shift significantly impacts the CHP market, increasing the demand for CHP systems that integrate renewable energy sources.

- [Add other key developments with year/month and their impact on market dynamics].

Strategic Netherlands Combined Heat and Power Market Forecast

The Netherlands CHP market is poised for significant growth driven by increasing energy demand, stringent environmental regulations promoting renewable energy integration, and government incentives. The continued focus on improving energy efficiency and reducing carbon emissions will further drive market expansion. The forecast period will witness notable growth driven by the factors mentioned above. This growth will be particularly strong in the [mention specific segments]. [Summarize future opportunities and market potential].

Netherlands Combined Heat and Power Market Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial and Utility

-

2. Fuel Type

- 2.1. Natural Gas

- 2.2. Renewable Energy Sources

- 2.3. Other Fuel Types

Netherlands Combined Heat and Power Market Segmentation By Geography

- 1. Netherlands

Netherlands Combined Heat and Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.34% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Industries such as chemicals

- 3.2.2 paper

- 3.2.3 and pulp require reliable and efficient power solutions

- 3.2.4 making CHP systems an attractive option. The chemical sector

- 3.2.5 in particular

- 3.2.6 is expected to continue driving demand for natural gas-based CHP due to its established infrastructure and logistics.

- 3.3. Market Restrains

- 3.3.1 The increasing share of renewable energy sources

- 3.3.2 such as wind and solar

- 3.3.3 presents challenges for integrating CHP systems into the grid. The variability of renewable energy can affect the efficiency and operation of CHP plants

- 3.4. Market Trends

- 3.4.1 Natural gas has traditionally been the primary fuel for CHP systems in the Netherlands

- 3.4.2 accounting for over 70% of fuel usage. This trend is expected to continue

- 3.4.3 driven by the chemical sector's substantial demand for CHP

- 3.4.4 which benefits from natural gas's efficiency and environmental compatibility.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Combined Heat and Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial and Utility

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Natural Gas

- 5.2.2. Renewable Energy Sources

- 5.2.3. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Viessmann Werke GmbH & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Senertec Kraft-Warme-Energiesysteme Gmbh (Senertec)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Microgen Engine Corporation Holding B V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Centrica PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BDR Thermea Group BV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Capstone Turbine Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Netherlands Combined Heat and Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Combined Heat and Power Market Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Combined Heat and Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Combined Heat and Power Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Netherlands Combined Heat and Power Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Netherlands Combined Heat and Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Netherlands Combined Heat and Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Netherlands Combined Heat and Power Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Netherlands Combined Heat and Power Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 8: Netherlands Combined Heat and Power Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Combined Heat and Power Market?

The projected CAGR is approximately 1.34%.

2. Which companies are prominent players in the Netherlands Combined Heat and Power Market?

Key companies in the market include ABB Ltd, Viessmann Werke GmbH & Co KG, Senertec Kraft-Warme-Energiesysteme Gmbh (Senertec), Microgen Engine Corporation Holding B V, Siemens AG, Caterpillar Inc, Centrica PLC, General Electric Company, BDR Thermea Group BV, Capstone Turbine Corporation.

3. What are the main segments of the Netherlands Combined Heat and Power Market?

The market segments include Application, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Industries such as chemicals. paper. and pulp require reliable and efficient power solutions. making CHP systems an attractive option. The chemical sector. in particular. is expected to continue driving demand for natural gas-based CHP due to its established infrastructure and logistics..

6. What are the notable trends driving market growth?

Natural gas has traditionally been the primary fuel for CHP systems in the Netherlands. accounting for over 70% of fuel usage. This trend is expected to continue. driven by the chemical sector's substantial demand for CHP. which benefits from natural gas's efficiency and environmental compatibility..

7. Are there any restraints impacting market growth?

The increasing share of renewable energy sources. such as wind and solar. presents challenges for integrating CHP systems into the grid. The variability of renewable energy can affect the efficiency and operation of CHP plants.

8. Can you provide examples of recent developments in the market?

In the first half of 2024, renewable energy sources generated more electricity than fossil fuels in the Netherlands for the first time. Renewables produced 32.3 billion kilowatt-hours, accounting for 53% of the total electricity output, with wind power significantly contributing to this increase.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Combined Heat and Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Combined Heat and Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Combined Heat and Power Market?

To stay informed about further developments, trends, and reports in the Netherlands Combined Heat and Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence